The Global Dulse Palmaria Market size was valued at USD 330.20 Million in 2022 and the total Dulse/Palmaria revenue is expected to grow at a CAGR of 9.3% from 2023 to 2029, reaching nearly USD 615.34 Million. Algae, mostly known as seaweeds, are an important element of global aquaculture. The cultivation of algae, when measured by its weight when wet, made up approximately 30 percent of the total global aquaculture production of 120 million tonnes in 2019. Among the various species groups in aquaculture, red seaweeds (Rhodophyta) and brown seaweeds (Phaeophyceae) ranked as the second and third largest, respectively. Dulse is a red seaweed harvested in the cool waters along the Atlantic coast of North America and also along the shores of Ireland and Norway. Its fronds grow in tidal areas on rocks, shells, and the larger, longer, brown seaweeds. Dulse can be eaten raw, roasted, fried, dried, or as a thickening agent for soups. Dulse belongs to the Palmariaceae family and is also called dillisk. the Dulse is a tremendous source of phytochemicals and minerals and a superior source of iodine. Thus it is also included in superfoods. Seaweeds have a wide range of applications in both the food and non-food sectors, serving as versatile resources. They find use as food additives, animal feed, pharmaceutical ingredients, nutraceuticals, cosmetics, textiles, biofertilizers/biostimulants, bio-packaging materials, and even as a potential source for biofuel production, among other purposes. These factors are expected to contribute to the dulse/palmaria market growth during the forecast period. however, the awareness and understanding of seaweed's contributions to these products are often confined to the seaweed industry and the scientific community. Their potential benefits and applications remain relatively unknown to the general public and industries outside of the seaweed-related sectors. With their various social, environmental, and economic contribution and benefits, the potential contributions of seaweeds to multiple Sustainable Development Goals (SDGs) have been recognized, for example, in a “Seaweed Manifesto”. Seaweeds are witnessing a rapid surge of popularity across various sectors, driven by their potential as a sustainable and nutritious food source to meet the requirements of a growing global population. Additionally, there is a growing awareness of the ecosystem services provided by seaweeds, especially their ability to mitigate greenhouse gas emissions. This increased attention highlights the importance of seaweeds in addressing food security and environmental challenges. This factor further benefits the global Dulse/palmaria market growth.To know about the Research Methodology :- Request Free Sample Report

Dulse Palmaria Market Dynamics:

Increasing adoption of seaweed in the diet as a potential source of nutrition While the typical go-to products often include the likes of meat for protein or citrus fruits for vitamin C, many people are now switching to edible sea vegetables to help improve their health and well-being by adding more whole foods. Red seaweed is widely recognized for its significant protein content. Palmaria palmata (Dulse) is a red seaweed that is expected to be a potential protein source in the human diet. Palmaria palmata contains high levels of proteins, around 30%, found in their fronds. Beta carotene, a form of Vitamin A is also found in Dulse/plumeria, a compound that has been shown to significantly reduce the risk of cataracts and macular deterioration. It is also a rich source of potassium as well as it is rich in macro- and micronutrients, including fiber, and antioxidants. Vitamin A, a fat-soluble antioxidant, also helps to protect the cornea, and the surface of the eye, and is a component of rhodopsin – a protein in the eye that boosts vision in low-light conditions. Dulse is rich in fiber, mainly soluble fiber, a soft and sticky substance that absorbs water to form a gel-like substance inside the digestive system. It helps to soften the stool so it can slide through the GI tract more easily, binding to substances like cholesterol and sugar, thus preventing or slowing their absorption into the blood. Soluble fiber further help to regulate blood sugar levels in the human body and protect against cardiac disease. Along with its notable antioxidant and nutrient content, dulse is well-loved for its taste, which has been likened to that of bacon. The rising geriatric population, changing lifestyles, and increasing innovations in food cuisines are some of the factors demanding extra nutritional foods in a regular diet to keep the body healthy. Thus, these factors are expected to benefit the Dulse/palmaria market growth during the forecast period. The protein content of some algae compared with Palmaria palmata:Growing use of dulse to increase the thyroid level in the human body Dulse is extremely rich in iodine, with a 30g serving to provide 110 percent of the RDI for this important compound. As a result of continuous soil depletion, sea vegetables, including Dulse, have surpassed land vegetables in terms of iodine content. Iodine plays a crucial part in thyroid function. It is an integral component of thyroid hormones (T3 and T4) in the human body. These hormones are involved in regulating metabolism and weight by facilitating the breakdown of fat for energy and heat production in every cell of the body. They directly influence the body's "base metabolic rate," impacting the efficiency of various organ systems and essential processes like the absorption and conversion of food into usable energy. Iodine is literally "food for the thyroid". Iodine also displaces dangerous "halides" such as; fluoride, bromide, and chlorine in the thyroid. It is antioxidant, encourages appropriate hormone balance, protects from radiation, and kills bacteria and fungi. When the thyroid is compromised in the body, symptoms can include unexplained weight loss/gain, fatigue, hair loss, and dry skin. Thus, the demand for dulse is significantly increased in recent years to maintain the thyroid level in the human body, eventually driving the dulse/palmaria market growth. Increasing food safety concerns Food safety concerns have been a primary issue deterring the consumption of aquatic foods. This factor is expected to pose a major challenge to the dulse/palmaria market growth during the forecast period. The consumption of wild and cultivated seaweeds and microalgae could also contribute to exposure to certain food safety hazards (e.g. heavy metals or microcystin contaminations) or incur health risks from excessive intake of certain elements (e.g. iodine). Several factors affect the presence of food safety hazards in seaweeds and microalgae. These include the specific species or strain of seaweed or microalgae, their physiological characteristics, the season in which they are harvested, the location of harvest, the method of harvesting employed, and the treatments applied during the post-harvest phase. All of these factors are expected to significantly impact the safety of seaweed and microalgae products intended for consumption. Concerns and uncertainties over the safety of algae products pose a great challenge to the promotion of their consumption in new markets where food safety guidelines or regulations tend to be stringent for precautionary purposes.

Dulse Palmaria Market Segment Analysis:

Based on the form, the Powder segment followed by the Flakes segment is expected to generate the highest revenue share in the global dulse/palmaria market during the forecast period. Dulse Flakes and Dulse Powder are wonderful food ingredients full of superfood properties. Thus, increasing adoption of flakes and powder in dietary supplements supports the segment growth during the forecast period. Demand for healthy and tasty aquatic food has been the primary driving force behind the kelp boom in Eastern Asia, primarily China and the Republic of Korea. The boom has been sustained or reinforced along the way by other market forces, such as the demand for brown seaweed extracts (iodine, alginate, mannitol, fucoidan, etc.) and the demand for fresh seaweeds to feed abalone. Nutritious, eco-friendly, and versatile algae have great potential in a variety of food and non-food applications, yet the potential may not turn into immediate market demand because of a variety of constraints, such as low consumer exposure or preference, high production costs, market competition, and stringent regulations.Regional Insights:

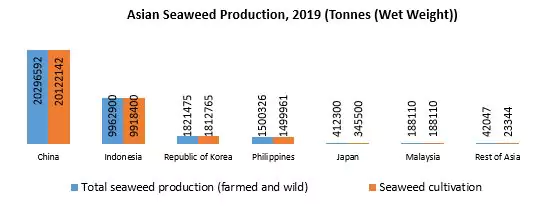

Dulse/palmaria, red seaweeds, however, are not well known in many parts of the world, as their production is mostly concentrated in Eastern and South-eastern Asia. Thus, eastern and south-eastern Asia is expected to offer lucrative growth opportunities for the dulse/palmaria market players during the forecast period. On the demand side, while in Eastern Asia seaweeds have become widely and frequently consumed human foods, in other parts of the world seaweeds are largely niche or novel foods, mostly eaten in some coastal communities as traditional foods or by a relatively small number of consumers for various purposes, which could be dietary (e.g. as exotic foods from Oriental cuisine), nutritional (e.g. supplementing micronutrients), environmental (e.g. as products with a low environmental footprint) and/or social (e.g. plant-based diets for animal welfare). These regions are further expected to generate the highest revenue share throughout the forecast period. There is a strong regional imbalance observed during the market study in seaweed production across the world. In 2019, seaweed production in Asia (99.1% from cultivation) contributed 97.4% of total global production, and seven of the top ten seaweed-producing countries were from Eastern or South-eastern Asia. The Americas and Europe contributed, respectively, 1.4 percent and 0.8 percent of world seaweed production in 2019. Seaweed production in these two regions was primarily fulfilled by wild collection, and cultivation only accounted for 4.7 percent and 3.9 percent of total seaweed production, respectively. In contrast, cultivation was the main source of seaweed production in Africa (81.3 percent) and Oceania (85.3 percent), although their contribution to world seaweed production was only 0.4 percent and 0.05 percent, respectively. Global seaweed production, 2019:Coastal communities in many countries have cultural traditions of eating seaweeds. Dulse has become a common food in Eastern Asia and is widely and frequently consumed as soup ingredients, salads, sushi wraps, and snacks, among others. They have been introduced in other countries as part of Asian cuisine and have gained increasing global popularity. Many seaweeds are delicious foodstuffs when ready and eaten properly, and they can be adapted to or integrated into modern culinary and dietary habits. As a result, the increasing adoption of dulse in regular cuisine is expected to drive the demand for dulse, thereby driving the dulse/palamaria market growth during the forecast period.

Dulse Palmaria Market Scope: Inquire before buying

Dulse Palmaria Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: USD 330.20 Million Forecast Period 2023 to 2029 CAGR: 9.3 % Market Size in 2029: USD 615.34 Million Segments Covered: by Form 1. Powder 2. Flakes 3. Liquid by End Use 1. Food & Beverages 1.1 Bakery & Confectionary 1.2 Snacks & Savory 1.3 Meat & Seafood 1.4 Salads, Sauces, & Dressings 1.5 Processed Meal 1.6 Others 2. Nutraceuticals 3. Retail/Household 4. Animal Feed 5. Cosmetics & Personal Care 6. Others by Distribution Channel 1 Business to Business 2 Business to Consumer 2.1 Hypermarkets/Supermarkets 2.2 Convenience Stores 2.3 Specialty Stores 2.4 Online Retail Dulse/Palmaria Market by Region:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players:

1 Bernard Jensen Products (United States) 2 Eden Foods, Inc. (United States) 3 Mendocino Sea Vegetable Company (United States) 4 Z-Company (United States) 5 VitaminSea Seaweed (United States) 6 Celtic Sea Spice Co. (Ireland) 7 Atlantic Holdfast Seaweed Company (United States) 8 Cascadia Seaweed (Canada) 9 Maine Fresh Sea Farm (United States) 10 Acadian Seaplants Limited (Canada) 11 Maine Coast Sea Vegetables (United States) 12 Ocean Harvest Technology (Ireland) 13 Mara Seaweed (United Kingdom) 14 Seagreens® (United Kingdom) 15 AlgAran Seaweed Products (Ireland) 16 Wild Irish Seaweeds (Ireland) 17 Seaflora Skincare (Canada) 18 Atlantic Sea Farms (United States) 19 The Cornish Seaweed Company (United Kingdom) FAQs: 1. What are the growth drivers for the Dulse/Palmaria market? Ans. The increasing adoption of dulse across various end-use industries is expected to be the major driver for the Dulse/Palmaria market. 2. What is the major restraint for the Dulse/Palmaria market growth? Ans. Increasing food safety concerns are expected to be the major restraining factor for the Dulse/Palmaria market growth. 3. Which region is expected to lead the global Dulse/Palmaria market during the forecast period? Ans. Asia Pacific is expected to lead the global Dulse/Palmaria market during the forecast period. 4. What is the projected market size & growth rate of the Dulse/Palmaria Market? Ans. The Global Dulse/Palmaria Market size was valued at USD 330.20 Million in 2022 and the total Dulse/Palmaria revenue is expected to grow at a CAGR of 9.3% from 2023 to 2029, reaching nearly USD 615.34 Million. 5. What segments are covered in the Dulse/Palmaria Market report? Ans. The segments covered in the Dulse/Palmaria market report are Form, End-use, Distribution Channel, and Region.

1. Dulse/Palmaria Market: Research Methodology 2. Dulse/Palmaria Market: Executive Summary 3. Dulse/Palmaria Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Dulse/Palmaria Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 4.10. COVID-19 Impact on the Global Dulse/Palmaria Market 5. Dulse/Palmaria Market Size and Forecast by Segments (by Value USD and Volume Units) 5.1. Dulse/Palmaria Market Size and Forecast, by Form (2022-2029) 5.1.1. Powder 5.1.2. Flakes 5.1.3. Liquid 5.2. Dulse/Palmaria Market Size and Forecast, by End Use (2022-2029) 5.2.1. Food & Beverages 5.2.1.1. Bakery & Confectionary 5.2.1.2. Snacks & Savory 5.2.1.3. Meat & Seafood 5.2.1.4. Salads, Sauces, & Dressings 5.2.1.5. Processed Meal 5.2.1.6. Others 5.2.2. Nutraceuticals 5.2.3. Retail/Household 5.2.4. Animal Feed 5.2.5. Cosmetics & Personal Care 5.2.6. Others 5.3. Dulse/Palmaria Market Size and Forecast, by Distribution Channel (2022-2029) 5.3.1. Business to Business 5.3.2. Business to Consumer 5.3.2.1. Hypermarkets/Supermarkets 5.3.2.2. Convenience Stores 5.3.2.3. Specialty Stores 5.3.2.4. Online Retail 5.4. Dulse/Palmaria Market Size and Forecast, by Region (2022-2029) 5.4.1. North America 5.4.2. Europe 5.4.3. Asia Pacific 5.4.4. Middle East and Africa 5.4.5. South America 6. North America Dulse/Palmaria Market Size and Forecast (by Value USD and Volume Units) 6.1. North America Dulse/Palmaria Market Size and Forecast, by Form (2022-2029) 6.1.1. Powder 6.1.2. Flakes 6.1.3. Liquid 6.2. North America Dulse/Palmaria Market Size and Forecast, by End Use (2022-2029) 6.2.1. Food & Beverages 6.2.1.1. Bakery & Confectionary 6.2.1.2. Snacks & Savory 6.2.1.3. Meat & Seafood 6.2.1.4. Salads, Sauces, & Dressings 6.2.1.5. Processed Meal 6.2.1.6. Others 6.2.2. Nutraceuticals 6.2.3. Retail/Household 6.2.4. Animal Feed 6.2.5. Cosmetics & Personal Care 6.2.6. Others 6.3. North America Dulse/Palmaria Market Size and Forecast, by Distribution Channel (2022-2029) 6.3.1. Business to Business 6.3.2. Business to Consumer 6.3.2.1. Hypermarkets/Supermarkets 6.3.2.2. Convenience Stores 6.3.2.3. Specialty Stores 6.3.2.4. Online Retail 6.4. North America Dulse/Palmaria Market Size and Forecast, by Country (2022-2029) 6.4.1. United States 6.4.2. Canada 6.4.3. Mexico 7. Europe Dulse/Palmaria Market Size and Forecast (by Value USD and Volume Units) 7.1. Europe Dulse/Palmaria Market Size and Forecast, by Form (2022-2029) 7.1.1. Powder 7.1.2. Flakes 7.1.3. Liquid 7.2. Europe Dulse/Palmaria Market Size and Forecast, by End Use (2022-2029) 7.2.1. Food & Beverages 7.2.1.1. Bakery & Confectionary 7.2.1.2. Snacks & Savory 7.2.1.3. Meat & Seafood 7.2.1.4. Salads, Sauces, & Dressings 7.2.1.5. Processed Meal 7.2.1.6. Others 7.2.2. Nutraceuticals 7.2.3. Retail/Household 7.2.4. Animal Feed 7.2.5. Cosmetics & Personal Care 7.2.6. Others 7.3. Europe Dulse/Palmaria Market Size and Forecast, by Distribution Channel (2022-2029) 7.3.1. Business to Business 7.3.2. Business to Consumer 7.3.2.1. Hypermarkets/Supermarkets 7.3.2.2. Convenience Stores 7.3.2.3. Specialty Stores 7.3.2.4. Online Retail 7.4. Europe Dulse/Palmaria Market Size and Forecast, by Country (2022-2029) 7.4.1. UK 7.4.2. France 7.4.3. Germany 7.4.4. Italy 7.4.5. Spain 7.4.6. Sweden 7.4.7. Austria 7.4.8. Rest of Europe 8. Asia Pacific Dulse/Palmaria Market Size and Forecast (by Value USD and Volume Units) 8.1. Asia Pacific Dulse/Palmaria Market Size and Forecast, by Form (2022-2029) 8.1.1. Powder 8.1.2. Flakes 8.1.3. Liquid 8.2. Asia Pacific Dulse/Palmaria Market Size and Forecast, by End Use (2022-2029) 8.2.1. Food & Beverages 8.2.1.1. Bakery & Confectionary 8.2.1.2. Snacks & Savory 8.2.1.3. Meat & Seafood 8.2.1.4. Salads, Sauces, & Dressings 8.2.1.5. Processed Meal 8.2.1.6. Others 8.2.2. Nutraceuticals 8.2.3. Retail/Household 8.2.4. Animal Feed 8.2.5. Cosmetics & Personal Care 8.2.6. Others 8.3. Asia Pacific Dulse/Palmaria Market Size and Forecast, by Distribution Channel (2022-2029) 8.3.1. Business to Business 8.3.2. Business to Consumer 8.3.2.1. Hypermarkets/Supermarkets 8.3.2.2. Convenience Stores 8.3.2.3. Specialty Stores 8.3.2.4. Online Retail 8.4. Asia Pacific Dulse/Palmaria Market Size and Forecast, by Country (2022-2029) 8.4.1. China 8.4.2. S Korea 8.4.3. Japan 8.4.4. India 8.4.5. Australia 8.4.6. Indonesia 8.4.7. Malaysia 8.4.8. Vietnam 8.4.9. Taiwan 8.4.10. Bangladesh 8.4.11. Pakistan 8.4.12. Rest of Asia Pacific 9. Middle East and Africa Dulse/Palmaria Market Size and Forecast (by Value USD and Volume Units) 9.1. Middle East and Africa Dulse/Palmaria Market Size and Forecast, by Form (2022-2029) 9.1.1. Powder 9.1.2. Flakes 9.1.3. Liquid 9.2. Middle East and Africa Dulse/Palmaria Market Size and Forecast, by End Use (2022-2029) 9.2.1. Food & Beverages 9.2.1.1. Bakery & Confectionary 9.2.1.2. Snacks & Savory 9.2.1.3. Meat & Seafood 9.2.1.4. Salads, Sauces, & Dressings 9.2.1.5. Processed Meal 9.2.1.6. Others 9.2.2. Nutraceuticals 9.2.3. Retail/Household 9.2.4. Animal Feed 9.2.5. Cosmetics & Personal Care 9.2.6. Others 9.3. Middle East and Africa Dulse/Palmaria Market Size and Forecast, by Distribution Channel (2022-2029) 9.3.1. Business to Business 9.3.2. Business to Consumer 9.3.2.1. Hypermarkets/Supermarkets 9.3.2.2. Convenience Stores 9.3.2.3. Specialty Stores 9.3.2.4. Online Retail 9.4. Middle East and Africa Dulse/Palmaria Market Size and Forecast, by Country (2022-2029) 9.4.1. South Africa 9.4.2. GCC 9.4.3. Egypt 9.4.4. Nigeria 9.4.5. Rest of ME&A 10. South America Dulse/Palmaria Market Size and Forecast (by Value USD and Volume Units) 10.1. South America Dulse/Palmaria Market Size and Forecast, by Form (2022-2029) 10.1.1. Powder 10.1.2. Flakes 10.1.3. Liquid 10.2. South America Dulse/Palmaria Market Size and Forecast, by End Use (2022-2029) 10.2.1. Food & Beverages 10.2.1.1. Bakery & Confectionary 10.2.1.2. Snacks & Savory 10.2.1.3. Meat & Seafood 10.2.1.4. Salads, Sauces, & Dressings 10.2.1.5. Processed Meal 10.2.1.6. Others 10.2.2. Nutraceuticals 10.2.3. Retail/Household 10.2.4. Animal Feed 10.2.5. Cosmetics & Personal Care 10.2.6. Others 10.3. South America Dulse/Palmaria Market Size and Forecast, by Distribution Channel (2022-2029) 10.3.1. Business to Business 10.3.2. Business to Consumer 10.3.2.1. Hypermarkets/Supermarkets 10.3.2.2. Convenience Stores 10.3.2.3. Specialty Stores 10.3.2.4. Online Retail 10.4. South America Dulse/Palmaria Market Size and Forecast, by Country (2022-2029) 10.4.1. Brazil 10.4.2. Argentina 10.4.3. Rest of South America 11. Company Profile: Key players 11.1. Bernard Jensen Products (United States) 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Eden Foods, Inc. (United States) 11.3. Mendocino Sea Vegetable Company (United States) 11.4. Z-Company (United States) 11.5. VitaminSea Seaweed (United States) 11.6. Celtic Sea Spice Co. (Ireland) 11.7. Atlantic Holdfast Seaweed Company (United States) 11.8. Cascadia Seaweed (Canada) 11.9. Maine Fresh Sea Farm (United States) 11.10. Acadian Seaplants Limited (Canada) 11.11. Maine Coast Sea Vegetables (United States) 11.12. Ocean Harvest Technology (Ireland) 11.13. Mara Seaweed (United Kingdom) 11.14. Seagreens® (United Kingdom) 11.15. AlgAran Seaweed Products (Ireland) 11.16. Wild Irish Seaweeds (Ireland) 11.17. Seaflora Skincare (Canada) 11.18. Atlantic Sea Farms (United States) 11.19. The Cornish Seaweed Company (United Kingdom) 12. Key Findings 13. Industry Recommendation