The Dry Mix Mortar Market is estimated to increase at a CAGR of 5.96% between 2023 and 2030 from USD 322.46 Million in 2024 to USD 431.88 Million by 2030. Dry mix mortar, sometimes known as dry mortar, is a pre-mixed combination of cement, sand, and additives that is used as a building material with the addition of water. This ready-to-use combination has multiple benefits, including improved workability, higher durability, and increased productivity, making it a popular choice in various construction applications.To know about the Research Methodology :- Request Free Sample Report The dry mix mortar market has grown significantly in recent years, owing to increased demand for efficient and cost-effective building solutions. The market's expansion may be ascribed to increased urbanisation, infrastructural development, and the growing demand for environmentally friendly and sustainable construction practices. Furthermore, the rising tendency to rebuild and redesign existing structures has increased demand for dry mix mortar. One significant advantage of dry mix mortar is its capacity to maintain uniform quality and remove on-site variability, increasing construction efficiency and lowering personnel costs. Furthermore, its quick setting time and muscular bond strength lead to shorter building cycles, allowing projects to be completed on schedule. These considerations have accelerated dry-mix mortar use in the residential, commercial, and industrial sectors. As a result of the substantial expansion of the construction sector in countries such as China and India, Asia Pacific has emerged as a significant market for dry mix mortar. The Middle East and Africa area has also seen significant market growth due to large-scale infrastructure projects and urban development efforts. Furthermore, the growing use of dry mix mortar in Europe and North America, notably for energy-efficient building practices, has boosted market development. This report includes market analysis, forecasts, industry segmentation and competitive analysis of top dry mix mortar manufacturers. This report also emphasises sustainability, innovation and consumer preferences, offering a global outlook with trends, drivers, challenges and opportunities. It will help industry stakeholders (manufacturers, distributors, retailers, investors) make informed decisions and capitalise on dry mix mortar market opportunities.

Dry Mix Mortar Market Dynamics:

Market Drivers: Increasing Construction Activities: The global construction industry has been witnessing steady growth, fueled by population growth, urbanization, and government initiatives to develop infrastructure. Dry mix mortars are extensively used in construction projects for their advantages such as improved workability, reduced construction time, and consistent quality. For instance, in 2023, the Indian government announced the "Housing for All" initiative, which aims to construct affordable houses for all citizens by 2023. This initiative is expected to drive the demand for dry-mix mortars in the country. Advantages over Traditional Wet Mortar Mixes: Dry mix mortars offer several advantages over wet mortar mixes, such as better workability, improved strength, reduced wastage, and enhanced durability. These benefits have led to an increased adoption of dry-mix mortars in various construction applications. For example, according to a report by Global Market Insights, the global dry mix mortar market size was valued at over USD 40 Million in 2020. In the upcoming years, these dry-mix mortars are anticipated to fuel market growth. Market Restraints: Lack of Awareness and Skilled Workforce: The adoption of dry mix mortars requires adequate knowledge and training among construction professionals. However, in some regions, there is a lack of awareness regarding the benefits and application techniques of dry mix mortars. Additionally, a shortage of skilled labor for handling and applying dry mix mortars can pose a challenge to the market growth. Initiatives by governments and companies to provide training and education programs can help overcome these challenges. For instance, in 2021, the Construction Industry Development Board (CIDB) in Malaysia initiated a training program to enhance the skills of construction workers in handling dry mix mortars. Price Volatility of Raw Materials: The prices of raw materials used in the production of dry mix mortars, such as cement and sand, are subject to market fluctuations. This volatility can impact the profitability of dry mix mortar manufacturers and influence the overall market growth. To mitigate this challenge, companies are focusing on developing alternative materials or exploring innovative sourcing strategies. For instance, in 2021, a major dry mix mortar manufacturer announced the use of recycled materials as a substitute for traditional raw materials, reducing costs and promoting sustainability. These factors are anticipated to hamper the dry mix mortar market growth. Market Opportunities: Growing Demand for Sustainable Construction: With increasing environmental concerns, there is a growing demand for sustainable construction practices. Dry mix mortars offer opportunities for sustainable construction due to reduced waste generation and the potential for incorporating eco-friendly additives. For example, the European Union's Horizon 2020 program supports research and development activities in the construction industry, including the development of sustainable building materials such as dry-mix mortars. Technological Advancements: Continuous research and development efforts have led to technological advancements in the dry mix mortar industry. Companies are investing in innovative additives, binders, and production processes to improve the performance and quality of dry-mix mortar products. For instance, a major dry mix mortar manufacturer introduced a self-leveling dry mix mortar with enhanced flow properties and self-compacting characteristics, enabling easier and more efficient application. These factors are predicted to boost the dry mix mortar market opportunity. Market Challenges: Lack of Standardization: The dry mix mortar market lacks standardized testing methods and quality control measures, which can lead to variations in product performance and quality. The absence of a unified standard can pose challenges for manufacturers, contractors, and end-users. Initiatives by industry associations and regulatory bodies to establish standardized guidelines and testing protocols can address this challenge. For example, the ASTM International committee is actively developing standards for dry mix mortars to ensure consistent quality across the industry. Intense Market Competition: The dry mix mortar market is highly competitive, with numerous players operating globally and regionally. Intense competition can result in price wars, reducing profit margins for manufacturers. To stay competitive, companies are focusing on product differentiation, technological advancements, and strategic partnerships. For instance, in 2023, a leading dry mix mortar manufacturer announced a strategic collaboration with a technology company to develop smart mortar solutions that offer enhanced performance and monitoring capabilities.Dry Mix Mortar Market Segmentation:

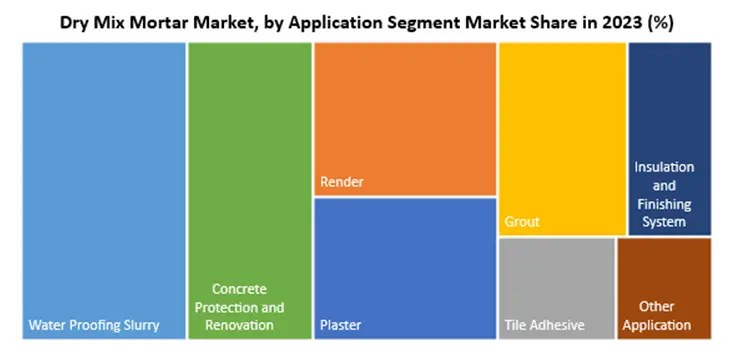

The Dry Mix Mortar Market is characterized by diverse applications that cater to the multifaceted needs of the construction industry. In the realm of applications, formulations for plastering find prominence in both interior and exterior wall finishes, contributing to a seamless and durable surface. Rendering applications, on the other hand, offer protective and decorative coatings for walls and structures, enhancing aesthetic appeal and longevity. The market also witnesses a surge in demand for efficient tile adhesive formulations, facilitating quick and robust tile installations in various settings. Grouting applications focus on filling gaps and ensuring structural stability, finding applications in infrastructure and renovation projects. Waterproofing slurries play a crucial role in surface protection, preventing water penetration and adding to structural resilience. Concrete protection and renovation formulations enhance the durability of concrete structures, particularly relevant in maintenance and industrial settings. Additionally, insulation and finishing systems contribute to energy efficiency and visual appeal in both residential and commercial constructions. The market's adaptability is further evident in emerging applications, reflecting continuous innovation to meet evolving construction needs. Moving to end-user industries, dry mix mortar plays a pivotal role in non-residential settings, spanning commercial, infrastructure, and industrial/institutional projects. In commercial construction, the formulations cater to various applications like plastering, rendering, and flooring, ensuring efficient project completion. Infrastructure projects leverage dry mix mortar for grouting, concrete protection, and waterproofing, emphasizing the longevity and resilience of critical structures. Industrial and institutional constructions benefit from tailored solutions, incorporating dry mix mortar for insulation, flooring, and concrete protection to meet specific sector requirements. Furthermore, the market embraces emerging non-residential end-user industries, showcasing its adaptability and versatility to cater to unique construction needs. Overall, the Dry Mix Mortar Market thrives on its ability to provide tailored solutions for a myriad of applications, positioning itself as an indispensable component in contemporary construction practices.

Dry Mix Mortar Regional Analysis:

The regional analysis of the dry mix mortar market provides valuable insights into the market's performance and growth potential across different regions. Various factors influence the demand for dry-mixed mortar, including construction activities, infrastructure development, government initiatives, and economic conditions. For instance, North America and Europe have well-established construction industries and stringent building regulations, driving the demand for high-quality dry mix mortar. The Asia Pacific region, with its rapid urbanization and infrastructure investments, offers significant growth opportunities for the market. Latin America, the Middle East & Africa regions are witnessing increasing construction activities, creating a favourable environment for dry mix mortar adoption. Understanding regional variations in market dynamics, preferences, and growth drivers is crucial for market participants to develop targeted strategies and tap into the immense potential of each region. Dry Mix Mortar Industry, Competitive Landscape The dry-mix mortar sector is highly competitive, with several regional and worldwide companies. Product quality, innovation, price tactics, distribution networks, and customer relationships drive market rivalry. Key market participants prioritize R&D operations to provide new formulations and meet various client demands. Companies also aggressively pursue partnerships, collaborations, mergers, and acquisitions to increase their market share and obtain core competency. Manufacturers are emphasizing the development of ecologically friendly dry mix mortar products as part of a trend towards sustainability and eco-friendly practices in the industry. Market players aim to differentiate themselves through efficient supply chain management, effective marketing tactics, and excellent customer service to preserve their market position in this highly competitive business.Dry Mix Mortar Market Scope: Inquire before buying

Global Dry Mix Mortar Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 322.46 Mn. Forecast Period 2024 to 2030 CAGR: 5.96% Market Size in 2030: US $ 431.88 Mn. Segments Covered: by Application Plaster Render Tile Adhesive Grout Water Proofing Slurry Concrete Protection and Renovation Insulation and Finishing System Other Application by End User Industry Residential Non-residential Commercial Infrastructure Industrial/Institutional Other Non-residential End-User Industries Dry Mix Mortar Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argetina and Rest of South America)Dry Mix Mortar Key Players

The following Dry Mix Mortar Companies are the key players in the market and are selected based on criteria for further evaluation. The strategies followed by the companies to sustain and grow in the market are discussed in detail in the report. 1. aint-Gobain Weber 2. Sika AG 3. Ardex Group 4. BASF SE 5. LafargeHolcim Ltd. 6. CEMEX S.A.B. de C.V. 7. Mapei S.p.A. 8. Dow Chemical Company 9. Henkel AG & Co. KGaA 10. Parex Group 11. Bostik SA 12. Rk Drymix Mortar Co., Ltd. 13. Laticrete International, Inc. 14. Quick-mix Gruppe GmbH & Co. KG 15. Dico Fix AD 16. Adhesive Technologies India Pvt. Ltd. 17. Knauf Gips KG 18. Caparol Group 19. HeidelbergCement AG 20. Akzo Nobel N.V. 21. Pidilite Industries Limited 22. Promat International NV/SA 23. Quick-Mix Holding GmbH 24. Sakrete 25. Asian Paints Limited FAQs 1. How big is the Dry Mix Mortar Market? Ans: Dry Mix Mortar Market was valued at USD 322.46 Million in 2023. 2. What is the growth rate of the Dry Mix Mortar Market? Ans: The CAGR of the Dry Mix Mortar Market is 5.96%. 3. What are the segments of the Dry Mix Mortar Market? Ans: There are primarily 4 segments – Type, Application, End-user and Geography for the Dry Mix Mortar Market 4. Which region has the highest market share in the Dry Mix Mortar Market sector? Ans: North America has the highest market share in the Dry Mix Mortar Market sector. 5. Is it profitable to invest in the Dry Mix Mortar Market? Ans: There is a fair growth rate in this market and there are various factors to be analyzed like the driving forces and opportunities of the market which have been discussed extensively in Maximize’s full report. That would help in understanding the profitability of the market

1. Dry Mix Mortar Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Dry Mix Mortar Market: Dynamics 2.1. Dry Mix Mortar Market Trends by Region 2.1.1. North America Dry Mix Mortar Market Trends 2.1.2. Europe Dry Mix Mortar Market Trends 2.1.3. Asia Pacific Dry Mix Mortar Market Trends 2.1.4. Middle East and Africa Dry Mix Mortar Market Trends 2.1.5. South America Dry Mix Mortar Market Trends 2.2. Dry Mix Mortar Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Dry Mix Mortar Market Drivers 2.2.1.2. North America Dry Mix Mortar Market Restraints 2.2.1.3. North America Dry Mix Mortar Market Opportunities 2.2.1.4. North America Dry Mix Mortar Market Challenges 2.2.2. Europe 2.2.2.1. Europe Dry Mix Mortar Market Drivers 2.2.2.2. Europe Dry Mix Mortar Market Restraints 2.2.2.3. Europe Dry Mix Mortar Market Opportunities 2.2.2.4. Europe Dry Mix Mortar Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Dry Mix Mortar Market Drivers 2.2.3.2. Asia Pacific Dry Mix Mortar Market Restraints 2.2.3.3. Asia Pacific Dry Mix Mortar Market Opportunities 2.2.3.4. Asia Pacific Dry Mix Mortar Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Dry Mix Mortar Market Drivers 2.2.4.2. Middle East and Africa Dry Mix Mortar Market Restraints 2.2.4.3. Middle East and Africa Dry Mix Mortar Market Opportunities 2.2.4.4. Middle East and Africa Dry Mix Mortar Market Challenges 2.2.5. South America 2.2.5.1. South America Dry Mix Mortar Market Drivers 2.2.5.2. South America Dry Mix Mortar Market Restraints 2.2.5.3. South America Dry Mix Mortar Market Opportunities 2.2.5.4. South America Dry Mix Mortar Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Dry Mix Mortar Industry 2.8. Analysis of Government Schemes and Initiatives For Dry Mix Mortar Industry 2.9. Dry Mix Mortar Market Trade Analysis 2.10. The Global Pandemic Impact on Dry Mix Mortar Market 3. Dry Mix Mortar Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Dry Mix Mortar Market Size and Forecast, by Application (2023-2030) 3.1.1. Plaster 3.1.2. Render 3.1.3. Tile Adhesive 3.1.4. Grout 3.1.5. Water Proofing Slurry 3.1.6. Concrete Protection and Renovation 3.1.7. Insulation and Finishing System 3.1.8. Other Application 3.2. Dry Mix Mortar Market Size and Forecast, by End Use Industry (2023-2030) 3.2.1. Residential 3.2.2. Non-residential 3.3. Dry Mix Mortar Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Dry Mix Mortar Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Dry Mix Mortar Market Size and Forecast, by Application (2023-2030) 4.1.1. Plaster 4.1.2. Render 4.1.3. Tile Adhesive 4.1.4. Grout 4.1.5. Water Proofing Slurry 4.1.6. Concrete Protection and Renovation 4.1.7. Insulation and Finishing System 4.1.8. Other Application 4.2. North America Dry Mix Mortar Market Size and Forecast, by End Use Industry (2023-2030) 4.2.1. Residential 4.2.2. Non-residential 4.3. North America Dry Mix Mortar Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Dry Mix Mortar Market Size and Forecast, by Application (2023-2030) 4.3.1.1.1. Plaster 4.3.1.1.2. Render 4.3.1.1.3. Tile Adhesive 4.3.1.1.4. Grout 4.3.1.1.5. Water Proofing Slurry 4.3.1.1.6. Concrete Protection and Renovation 4.3.1.1.7. Insulation and Finishing System 4.3.1.1.8. Other Application 4.3.1.2. United States Dry Mix Mortar Market Size and Forecast, by End Use Industry (2023-2030) 4.3.1.2.1. Residential 4.3.1.2.2. Non-residential 4.3.2. Canada 4.3.2.1. Canada Dry Mix Mortar Market Size and Forecast, by Application (2023-2030) 4.3.2.1.1. Plaster 4.3.2.1.2. Render 4.3.2.1.3. Tile Adhesive 4.3.2.1.4. Grout 4.3.2.1.5. Water Proofing Slurry 4.3.2.1.6. Concrete Protection and Renovation 4.3.2.1.7. Insulation and Finishing System 4.3.2.1.8. Other Application 4.3.2.2. Canada Dry Mix Mortar Market Size and Forecast, by End Use Industry (2023-2030) 4.3.2.2.1. Residential 4.3.2.2.2. Non-residential 4.3.3. Mexico 4.3.3.1. Mexico Dry Mix Mortar Market Size and Forecast, by Application (2023-2030) 4.3.3.1.1. Plaster 4.3.3.1.2. Render 4.3.3.1.3. Tile Adhesive 4.3.3.1.4. Grout 4.3.3.1.5. Water Proofing Slurry 4.3.3.1.6. Concrete Protection and Renovation 4.3.3.1.7. Insulation and Finishing System 4.3.3.1.8. Other Application 4.3.3.2. Mexico Dry Mix Mortar Market Size and Forecast, by End Use Industry (2023-2030) 4.3.3.2.1. Residential 4.3.3.2.2. Non-residential 5. Europe Dry Mix Mortar Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Dry Mix Mortar Market Size and Forecast, by Application (2023-2030) 5.2. Europe Dry Mix Mortar Market Size and Forecast, by End Use Industry (2023-2030) 5.3. Europe Dry Mix Mortar Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Dry Mix Mortar Market Size and Forecast, by Application (2023-2030) 5.3.1.2. United Kingdom Dry Mix Mortar Market Size and Forecast, by End Use Industry (2023-2030) 5.3.2. France 5.3.2.1. France Dry Mix Mortar Market Size and Forecast, by Application (2023-2030) 5.3.2.2. France Dry Mix Mortar Market Size and Forecast, by End Use Industry (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Dry Mix Mortar Market Size and Forecast, by Application (2023-2030) 5.3.3.2. Germany Dry Mix Mortar Market Size and Forecast, by End Use Industry (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Dry Mix Mortar Market Size and Forecast, by Application (2023-2030) 5.3.4.2. Italy Dry Mix Mortar Market Size and Forecast, by End Use Industry (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Dry Mix Mortar Market Size and Forecast, by Application (2023-2030) 5.3.5.2. Spain Dry Mix Mortar Market Size and Forecast, by End Use Industry (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Dry Mix Mortar Market Size and Forecast, by Application (2023-2030) 5.3.6.2. Sweden Dry Mix Mortar Market Size and Forecast, by End Use Industry (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Dry Mix Mortar Market Size and Forecast, by Application (2023-2030) 5.3.7.2. Austria Dry Mix Mortar Market Size and Forecast, by End Use Industry (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Dry Mix Mortar Market Size and Forecast, by Application (2023-2030) 5.3.8.2. Rest of Europe Dry Mix Mortar Market Size and Forecast, by End Use Industry (2023-2030) 6. Asia Pacific Dry Mix Mortar Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Dry Mix Mortar Market Size and Forecast, by Application (2023-2030) 6.2. Asia Pacific Dry Mix Mortar Market Size and Forecast, by End Use Industry (2023-2030) 6.3. Asia Pacific Dry Mix Mortar Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Dry Mix Mortar Market Size and Forecast, by Application (2023-2030) 6.3.1.2. China Dry Mix Mortar Market Size and Forecast, by End Use Industry (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Dry Mix Mortar Market Size and Forecast, by Application (2023-2030) 6.3.2.2. S Korea Dry Mix Mortar Market Size and Forecast, by End Use Industry (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Dry Mix Mortar Market Size and Forecast, by Application (2023-2030) 6.3.3.2. Japan Dry Mix Mortar Market Size and Forecast, by End Use Industry (2023-2030) 6.3.4. India 6.3.4.1. India Dry Mix Mortar Market Size and Forecast, by Application (2023-2030) 6.3.4.2. India Dry Mix Mortar Market Size and Forecast, by End Use Industry (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Dry Mix Mortar Market Size and Forecast, by Application (2023-2030) 6.3.5.2. Australia Dry Mix Mortar Market Size and Forecast, by End Use Industry (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Dry Mix Mortar Market Size and Forecast, by Application (2023-2030) 6.3.6.2. Indonesia Dry Mix Mortar Market Size and Forecast, by End Use Industry (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Dry Mix Mortar Market Size and Forecast, by Application (2023-2030) 6.3.7.2. Malaysia Dry Mix Mortar Market Size and Forecast, by End Use Industry (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Dry Mix Mortar Market Size and Forecast, by Application (2023-2030) 6.3.8.2. Vietnam Dry Mix Mortar Market Size and Forecast, by End Use Industry (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Dry Mix Mortar Market Size and Forecast, by Application (2023-2030) 6.3.9.2. Taiwan Dry Mix Mortar Market Size and Forecast, by End Use Industry (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Dry Mix Mortar Market Size and Forecast, by Application (2023-2030) 6.3.10.2. Rest of Asia Pacific Dry Mix Mortar Market Size and Forecast, by End Use Industry (2023-2030) 7. Middle East and Africa Dry Mix Mortar Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Dry Mix Mortar Market Size and Forecast, by Application (2023-2030) 7.2. Middle East and Africa Dry Mix Mortar Market Size and Forecast, by End Use Industry (2023-2030) 7.3. Middle East and Africa Dry Mix Mortar Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Dry Mix Mortar Market Size and Forecast, by Application (2023-2030) 7.3.1.2. South Africa Dry Mix Mortar Market Size and Forecast, by End Use Industry (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Dry Mix Mortar Market Size and Forecast, by Application (2023-2030) 7.3.2.2. GCC Dry Mix Mortar Market Size and Forecast, by End Use Industry (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Dry Mix Mortar Market Size and Forecast, by Application (2023-2030) 7.3.3.2. Nigeria Dry Mix Mortar Market Size and Forecast, by End Use Industry (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Dry Mix Mortar Market Size and Forecast, by Application (2023-2030) 7.3.4.2. Rest of ME&A Dry Mix Mortar Market Size and Forecast, by End Use Industry (2023-2030) 8. South America Dry Mix Mortar Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Dry Mix Mortar Market Size and Forecast, by Application (2023-2030) 8.2. South America Dry Mix Mortar Market Size and Forecast, by End Use Industry (2023-2030) 8.3. South America Dry Mix Mortar Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Dry Mix Mortar Market Size and Forecast, by Application (2023-2030) 8.3.1.2. Brazil Dry Mix Mortar Market Size and Forecast, by End Use Industry (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Dry Mix Mortar Market Size and Forecast, by Application (2023-2030) 8.3.2.2. Argentina Dry Mix Mortar Market Size and Forecast, by End Use Industry (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Dry Mix Mortar Market Size and Forecast, by Application (2023-2030) 8.3.3.2. Rest Of South America Dry Mix Mortar Market Size and Forecast, by End Use Industry (2023-2030) 9. Global Dry Mix Mortar Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Dry Mix Mortar Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Saint-Gobain Weber 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Sika AG 10.3. Ardex Group 10.4. BASF SE 10.5. LafargeHolcim Ltd. 10.6. CEMEX S.A.B. de C.V. 10.7. Mapei S.p.A. 10.8. Dow Chemical Company 10.9. Henkel AG & Co. KGaA 10.10. Parex Group 10.11. Bostik SA 10.12. Rk Drymix Mortar Co., Ltd. 10.13. Laticrete International, Inc. 10.14. Quick-mix Gruppe GmbH & Co. KG 10.15. Dico Fix AD 10.16. Adhesive Technologies India Pvt. Ltd. 10.17. Knauf Gips KG 10.18. Caparol Group 10.19. HeidelbergCement AG 10.20. Akzo Nobel N.V. 10.21. Pidilite Industries Limited 10.22. Promat International NV/SA 10.23. Quick-Mix Holding GmbH 10.24. Sakrete 11. Key Findings 12. Industry Recommendations 13. Dry Mix Mortar Market: Research Methodology 14. Terms and Glossary