The DNA Data Storage Market size was valued at USD 43.76 Million in 2023 and the total DNA Data Storage Market revenue is expected to grow at a CAGR of 85.4 % from 2024 to 2030, reaching nearly USD 3295 Million. DNA data storage is a revolutionary method that encodes digital information into the nucleotide sequences of DNA molecules. This cutting-edge technology leverages the inherent properties of DNA, such as its high density, long-term stability, and potential for immense data storage capacity. The process involves synthesizing DNA molecules with encoded information and storing them either in biological cells (in vivo) or in vitro. Retrieving the stored data requires selectively reading specific DNA sequences using advanced sequencing instruments. The DNA data storage market is experiencing unprecedented growth, driven by its potential to address the escalating demands for big data storage. As of the latest MMR analysis, the DNA data storage market is projected to grow USD 3295 million by 2030, showing a substantial compound annual growth rate (CAGR). Major players in this dynamic market include Illumina, Inc., Microsoft, Iridia, Inc., Twist Bioscience, and Catalog. These companies contribute to shaping the landscape of DNA data storage through innovations and strategic initiatives. The growth in technological advancements and an increasing recognition of DNA's potential for long-term, high-density data storage. Advancements in soft-decision decoding techniques have mitigated the challenges posed by high error rates, making DNA data storage more reliable. Biomemory, a startup, has introduced DNA cards for consumers, offering a tangible and accessible DNA data storage solution. Innovative approaches like the use of a 'biological camera' for encoding and storing data within living cells show the diverse strategies driving DNA Data Storage Market growth. The unparalleled storage capacity of DNA, environmental sustainability, and the flexibility of in vivo and in vitro storage options position DNA data storage as a promising solution. Biomemory's commitment to sustainability aligns with the growing need for eco-friendly data storage solutions. The surge in global data creation, estimated to reach 175 ZB by 2025, further drives the quest for alternative storage solutions, creating opportunities for DNA data storage. The DNA Data Storage also benefits from the forecasted growth of the global datasphere, reaching unprecedented levels. The advancements in nanophotonics-enabled optical storage techniques, addressing challenges and contributing to the continuous evolution of storage capabilities in DNA Data Storage market.To know about the Research Methodology :- Request Free Sample Report

DNA Data Storage Market Dynamics:

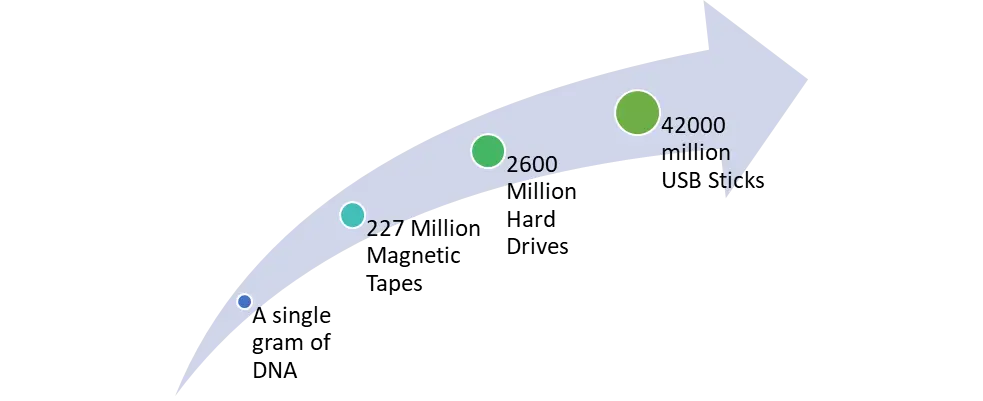

Advancements in Soft-Decision Decoding driving DNA Data Storage market growth: Recent breakthroughs DNA Data Storage market in soft-decision decoding significantly enhance error correction capabilities in DNA digital storage, overcoming challenges related to high error rates during synthesis, replication, storage, and sequencing. Biomemory introduces DNA cards for consumers, offering a tangible DNA data storage solution. Priced at $1,000, each card promises a minimum lifespan of 150 years and signifies a step towards making DNA storage accessible to the public. Researchers at NUS CDE pioneered a 'biological camera,' leveraging living cells to encode and store data directly within DNA. This groundbreaking approach represents a new paradigm in information storage, potentially disrupting the data storage industry. DNA's exceptional storage capacity becomes a driving force. One gram of DNA holds 215 petabytes of data, providing immense potential for addressing the growing demand for big data storage. Biomemory's commitment to environmental sustainability aligns with the growing need for eco-friendly data storage solutions. DNA's longevity and low maintenance costs contribute to a greener approach to DNA Data Storage Market. The surge in global data creation, estimated to reach 175 ZB by 2025, drives the quest for alternative storage solutions. DNA's stability and durability position it as a viable option amidst the challenges posed by conventional data storage methods. With the global data warehouse forecast to grow exponentially, the DNA data storage market emerges as a potential solution to address the increasing demand for efficient and high-capacity storage solutions. DNA digital storage provides flexibility with options for in vivo and in vitro storage. This versatility caters to diverse storage needs and preferences in different applications. DNA data storage offers a cost-effective solution to long-term data storage needs. Its potential to last millions of years makes it an attractive option for archival purposes, reducing the need for frequent data migrations and updates. Derrick's soft-decision decoding technique not only enhances error correction but also achieves a balance between correction overhead and storage density. This technological innovation contributes to the continuous evolution of DNA data storage market capabilities. Financial Investment Boosts DNA-Based Computation: CATALOG's recent $35 million Series B funding, led by Hanwha Impact, accelerates the development of a computing platform utilizing synthetic DNA. This positions DNA-based computation for complex queries in industries like finance, manufacturing, and research, showing a trend toward increased investment in DNA data storage market. CATALOG's technology of encapsulating data in DNA within tiny glass spheres presents an innovative approach to preserving information. Recognized with the European Inventor Award, this trend highlights the growing importance of novel techniques, like DNA encapsulation, for long-term data storage and durability. Digital Bedrock joining the DNA Data Storage Alliance signifies a trend of collaboration among diverse stakeholders. The Alliance, formed by industry leaders like Illumina, Microsoft, Twist Bioscience, and Western Digital, emphasizes the importance of creating an interoperable storage ecosystem based on DNA, showcasing a shift towards industry-wide cooperation. The DNA Data Storage Market Alliance's focus on DNA as an eco-friendly solution indicates a trend toward environmentally sustainable data storage. As organizations like Digital Bedrock contribute to developing interoperability standards, the industry is recognizing the potential of DNA storage to address the explosive growth of data in an eco-friendly manner. The DNA Data Storage Alliance's mission includes public education and awareness raising, indicating a trend towards promoting understanding and acceptance of DNA as a viable data storage medium. This emphasis on education is crucial for fostering the broader adoption of DNA data storage technologies.Low Speed in Data writing and Reading is the major challenge for the market: One major challenge in DNA data storage market is the current intrinsic low speed of data writing and reading. For instance, chemical DNA synthesis, a common method of data writing, is time-consuming, hindering the efficient storage and retrieval of information. The high cost per byte stored poses a significant challenge. Despite DNA's potential for high-density storage, the economic viability is impacted by the expenses associated with chemical DNA synthesis and sequencing processes. Current storage methods, including DNA data storage, need to address energy consumption concerns. Although DNA's archival storage has low power requirements, overall energy consumption throughout the entire storage process remains a consideration. While DNA boasts a theoretical data density of 6 bits per 1 nm of polymer, practical implementations face challenges in achieving such densities. The actual data density achieved is lower due to various factors, impacting the overall efficiency of DNA data storage market. Although DNA is stable for thousands of years under suitable conditions, ensuring long-term stability and low maintenance costs for large-scale DNA data storage systems remains a challenge. The need for consistent and reliable preservation adds complexity to the operational aspects of DNA-based storage solutions.

Chart: The Future of DNA Data Storage

DNA Data Storage Market Segment Analysis:

Based on Deployment, The DNA Data Storage market, segmented by Deployment into Cloud and On-Premise solutions, exhibits a dynamic landscape shaped by technological advancements and industry demands. Cloud deployment dominates the DNA Data Storage market, driven by its scalability, accessibility, and cost-effectiveness. Major players, including Illumina, Microsoft, and Twist Bioscience, have embraced cloud solutions, leveraging the flexibility it offers for managing vast amounts of genetic data efficiently. The On-Premise segment remains relevant, particularly in contexts where data privacy and security concerns dictate a more localized storage approach. The cloud segment's dominance stems from its ability to accommodate the growing demands of big data storage, enabling seamless collaboration and accessibility as technological innovations continue, Cloud deployment is expected to maintain its dominance, with projections indicating substantial growth, reaching USD 3348 million by 2030. Applications of cloud-based DNA data storage span various industries, from healthcare to research, fostering widespread adoption. On the other hand, On-Premise solutions find prominence in sectors prioritizing stringent control over data management. The market's evolution hinges on balancing the advantages of cloud scalability with on-premise security measures. While cloud deployment currently dominates the DNA Data Storage market, both segments are integral, catering to diverse needs within an ever-expanding landscape of genetic data storage.

DNA Data Storage Market Regional Insights:

The DNA Data Storage market is experiencing significant growth globally. North America stands out as the dominant region in the market. The presence of key players such as Illumina, Inc., Microsoft, and Twist Bioscience in the region has propelled North America to the forefront of DNA Data Storage innovation and adoption. These companies are at the forefront of developing cutting-edge technologies, fostering research, and driving DNA Data Storage growth. For instance, Illumina, Inc., a major player in the DNA Data Storage market, has been instrumental in advancing sequencing technologies. North America currently dominates the DNA Data Storage market, while the Asia Pacific region emerges as a promising contender for substantial growth. With a burgeoning biotechnology sector and increasing investments in research and development, Asia Pacific is poised to witness rapid market growth. For instance, China-based BGI Shenzhen and Berry Genomics are actively contributing to the market's growth in the region. Their endeavors in developing innovative DNA data storage solutions reflect the region's commitment to technological advancement. Europe, with companies like Thermo Fisher Scientific and Siemens playing a pivotal role, maintains a strong position in the DNA Data Storage industry. Thermo Fisher Scientific, Siemens, and Eurofins Scientific are key players dominating the European DNA Data Storage market. Their focus on research and development, strategic partnerships, and market growth initiatives contribute to the region's market influence. Europe is expected to experience steady growth, driven by advancements in DNA data storage technologies. The dynamics of the DNA Data Storage market highlight a global landscape where different regions contribute to overall growth, reflecting the industry's collaborative and evolving nature.

Sector Organization Primary Effort Private Microsoft R&D with the eventual goal of a proto-commercial DNA data storage system Private Semiconductor Research Corporation R&D in advanced alternative data storage solutions Private Catalog Commercialization of DNA data storage technology Private Iridia Commercialization of DNA data storage technology Public NSF, IARPA, DARPA, NIH Funding support to key players in the DNA data storage field Academia University of Washington Research that is pushing towards increasing the volume of information stored in DNA Academia Harvard University R&D of DNA synthesis technology and novel mechanisms of encoding and retrieving information from DNA Academia ETH Zurich Research on storing varying types of files in DNA DNA Data Storage Market Competitive Landscape

In recent breakthroughs, Biomemory launched DNA Cards, making DNA data storage accessible to the public, promising a minimum lifespan of 150 years. Catalog secured $35 million in Series B funding, advancing DNA-based computation systems. NUS CDE pioneered a 'biological camera' for encoding data directly within DNA, presenting a paradigm shift. Additionally, the DNA Data Storage Alliance, joined by Digital Bedrock, focuses on creating interoperable standards. These innovations address the pressing need for sustainable, high-capacity data storage solutions amid the explosive growth of global data. Biomemory's consumer-friendly DNA Cards and advancements in DNA computation contribute significantly to shaping the future of data storage. On December 4, 2023, Biomemory introduced DNA Cards, a groundbreaking leap in data storage technology. These credit card-sized marvels offer one kilobyte of text data storage each, making DNA data storage accessible to the public for the first time. Developed by Biomemory, DNA Cards provide a sustainable alternative to traditional silicon chips, utilizing molecular computing. With a minimum lifespan of 150 years, they set a new standard for data longevity. In a world producing and consuming 100 trillion gigabytes annually, Biomemory addresses the urgency for innovative storage solutions, offering a more energy-efficient and space-saving approach amidst growing concerns about environmental impact. On June 23, 2022, SNIA declared a significant advancement in the storage industry, initiating technical work and standards development for the interoperability of DNA Data Storage solutions. The DNA Data Storage Alliance established in 2020 by Illumina, Inc., Microsoft, Twist Bioscience Corporation, and Western Digital, joins SNIA as a Technology Affiliate. This collaboration leverages SNIA's 25 years of open standards development experience to accelerate the creation of an interoperable ecosystem for DNA-based data storage solutions under the SNIA IP Policy structure. On May 30, 2022, MoleculArXiv's exploratory Priority Research Programme and Equipment (PEPR), led by CNRS, launched with a 20 million euro budget over 7 years. The initiative aims to pioneer innovative data storage devices utilizing molecular media, including DNA and artificial polymers. With global data estimated to reach 175 zettabytes by 2025, traditional storage methods have become inadequate. Addressing this, the program explores chemically synthesized DNA as a sustainable and energy-efficient solution, countering the challenges posed by growing data quantities and environmental concerns in conventional data centers.DNA Data Storage Market Scope: Inquiry Before Buying

DNA Data Storage Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 43.76 Mn. Forecast Period 2024 to 2030 CAGR: 85.4% Market Size in 2030: US $ 3295 Mn. Segments Covered: by Deployment Cloud On-Premise by Sequencing Platform Next-Generation Sequencing Nanopore Sequencing by Synthesis Platform Chemical-Column Based Chemical-Microchip Based Enzymatic by End-User Banking Financial Services & Insurance Government & Defense Healthcare & Pharma Media & Entertainment Other DNA Data Storage Market, by region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)DNA Data Storage Market Key Players:

North America: 1. Illumina Inc. (California, United States) 2. Microsoft Corp. (Washington, United States) 3. Seagate Technology (North America) 4. Brooks Life Sciences (Massachusetts, United States) 5. Genewiz (A Brooks Life Sciences Company) (New Jersey, United States) Europe: 6. Thermo Fisher Scientific (Europe) 7. Siemens AG (Munich, Germany) 8. Eurofins Scientific (Luxembourg) 9. Catalog Technologies Inc. (Europe) 10. Cegat Gmbh (Tübingen, Germany) Asia Pacific: 11. Bgi Shenzhen (Shenzhen, China) 12. Genewiz (A Brooks Life Sciences Company) (Beijing, China) 13. Berry Genomics Co. Ltd. (Beijing, China) 14. Helixworks Technologies Ltd. (Dhenzhen, China) 15. Loop Genomics (Element Biosciences) (Japan) Middle East Africa: 16. Eurofins Scientific 17. Cegat Gmbh South America: 18. Genomika (A Brooks Life Sciences Company) 19. Catalog Technologies Inc.FAQs:

1. What are the growth drivers for the DNA Data Storage Market? Ans. Advancements in Soft-Decision Decoding driving market growth expected to be the major driver for the DNA Data Storage Market. 2. What are the major Opportunity for the DNA Data Storage Market growth? Ans. Financial Investment Boosts DNA-Based Computation is the major opportunity for the DNA Data Storage market. 3. Which country is expected to lead the global DNA Data Storage Market during the forecast period? Ans. North America is expected to lead the DNA Data Storage Market during the forecast period. 4. What is the projected market size and growth rate of the DNA Data Storage Market? Ans. The DNA Data Storage Market size was valued at USD 43.76 Million in 2023 and the total DNA Data Storage Market revenue is expected to grow at a CAGR of 85.4 % from 2024 to 2030, reaching nearly USD 3295 Million. 5. What segments are covered in the DNA Data Storage Market report? Ans. The segments covered in the DNA Data Storage Market report are by Deployment, Sequencing Platform, Synthesis Platform, End User, and Region.

1. DNA Data Storage Market: Research Methodology 2. DNA Data Storage Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. DNA Data Storage Market: Dynamics 3.1 DNA Data Storage Market Trends by Region 3.1.1 North America DNA Data Storage Market Trends 3.1.2 Europe DNA Data Storage Market Trends 3.1.3 Asia Pacific DNA Data Storage Market Trends 3.1.4 Middle East and Africa DNA Data Storage Market Trends 3.1.5 South America DNA Data Storage Market Trends 3.2 DNA Data Storage Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America DNA Data Storage Market Drivers 3.2.1.2 North America DNA Data Storage Market Restraints 3.2.1.3 North America DNA Data Storage Market Opportunities 3.2.1.4 North America DNA Data Storage Market Challenges 3.2.2 Europe 3.2.2.1 Europe DNA Data Storage Market Drivers 3.2.2.2 Europe DNA Data Storage Market Restraints 3.2.2.3 Europe DNA Data Storage Market Opportunities 3.2.2.4 Europe DNA Data Storage Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific DNA Data Storage Market Drivers 3.2.3.2 Asia Pacific DNA Data Storage Market Restraints 3.2.3.3 Asia Pacific DNA Data Storage Market Opportunities 3.2.3.4 Asia Pacific DNA Data Storage Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa DNA Data Storage Market Drivers 3.2.4.2 Middle East and Africa DNA Data Storage Market Restraints 3.2.4.3 Middle East and Africa DNA Data Storage Market Opportunities 3.2.4.4 Middle East and Africa DNA Data Storage Market Challenges 3.2.5 South America 3.2.5.1 South America DNA Data Storage Market Drivers 3.2.5.2 South America DNA Data Storage Market Restraints 3.2.5.3 South America DNA Data Storage Market Opportunities 3.2.5.4 South America DNA Data Storage Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 By Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 North America 3.6.2 Europe 3.6.3 Asia Pacific 3.6.4 Middle East and Africa 3.6.5 South America 3.7 Analysis of Government Schemes and Initiatives For the DNA Data Storage Industry 3.8 The Global Pandemic and Redefining of The DNA Data Storage Industry Landscape 4. Global DNA Data Storage Market: Global Market Size and Forecast by Segmentation (By Value) (2023-2030) 4.1 Global DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 4.1.1 Cloud 4.1.2 On-Premise 4.2 Global DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030) 4.2.1 Next-Generation Sequencing 4.2.2 Nanopore Sequencing 4.3 Global DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 4.3.1 Chemical-Column Based 4.3.2 Chemical-Microchip Based 4.3.3 Enzymatic 4.4 Global DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 4.4.1 Banking 4.4.2 Financial Services & Insurance 4.4.3 Government & Defense 4.4.4 Healthcare & Pharma 4.4.5 Media & Entertainment 4.4.6 Other 4.5 Global DNA Data Storage Market Size and Forecast, by Region (2023-2030) 4.5.1 North America 4.5.2 Europe 4.5.3 Asia Pacific 4.5.4 Middle East and Africa 4.5.5 South America 5. North America DNA Data Storage Market Size and Forecast by Segmentation (By Value) (2023-2030) 5.1 North America DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 5.1.1 Cloud 5.1.2 On-Premise 5.2 North America DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030) 5.2.1 Next-Generation Sequencing 5.2.2 Nanopore Sequencing 5.3 North America DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 5.3.1 Chemical-Column Based 5.3.2 Chemical-Microchip Based 5.3.3 Enzymatic 5.4 North America DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 5.4.1 Banking 5.4.2 Financial Services & Insurance 5.4.3 Government & Defense 5.4.4 Healthcare & Pharma 5.4.5 Media & Entertainment 5.4.6 Other 5.5 North America DNA Data Storage Market Size and Forecast, by Country (2023-2030) 5.5.1 United States 5.5.1.1 United States DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 5.5.1.1.1 Cloud 5.5.1.1.2 On-Premise 5.5.1.2 United States DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030) 5.5.1.2.1 Next-Generation Sequencing 5.5.1.2.2 Nanopore Sequencing 5.5.1.3 United States DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 5.5.1.3.1 Chemical-Column Based 5.5.1.3.2 Chemical-Microchip Based 5.5.1.3.3 Enzymatic 5.5.1.4 United States DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 5.5.1.4.1 Banking 5.5.1.4.2 Financial Services & Insurance 5.5.1.4.3 Government & Defense 5.5.1.4.4 Healthcare & Pharma 5.5.1.4.5 Media & Entertainment 5.5.1.4.6 Other 5.5.2 Canada 5.5.2.1 Canada DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 5.5.2.1.1 Cloud 5.5.2.1.2 On-Premise 5.5.2.2 Canada DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030) 5.5.2.2.1 Next-Generation Sequencing 5.5.2.2.2 Nanopore Sequencing 5.5.2.3 Canada DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 5.5.2.3.1 Chemical-Column Based 5.5.2.3.2 Chemical-Microchip Based 5.5.2.3.3 Enzymatic 5.5.2.4 Canada DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 5.5.2.4.1 Banking 5.5.2.4.2 Financial Services & Insurance 5.5.2.4.3 Government & Defense 5.5.2.4.4 Healthcare & Pharma 5.5.2.4.5 Media & Entertainment 5.5.2.4.6 Other 5.5.3 Mexico 5.5.3.1 Mexico DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 5.5.3.1.1 Cloud 5.5.3.1.2 On-Premise 5.5.3.2 Mexico DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030) 5.5.3.2.1 Next-Generation Sequencing 5.5.3.2.2 Nanopore Sequencing 5.5.3.3 Mexico DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 5.5.3.3.1 Chemical-Column Based 5.5.3.3.2 Chemical-Microchip Based 5.5.3.3.3 Enzymatic 5.5.3.4 Mexico DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 5.5.3.4.1 Banking 5.5.3.4.2 Financial Services & Insurance 5.5.3.4.3 Government & Defense 5.5.3.4.4 Healthcare & Pharma 5.5.3.4.5 Media & Entertainment 5.5.3.4.6 Other 6. Europe DNA Data Storage Market Size and Forecast by Segmentation (By Value) (2023-2030) 6.1 Europe DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 6.2 Europe DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030) 6.3 Europe DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 6.4 Europe DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 6.5 Europe DNA Data Storage Market Size and Forecast, by Country (2023-2030) 6.5.1 United Kingdom 6.5.1.1 United Kingdom DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 6.5.1.2 United Kingdom DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030) 6.5.1.3 United Kingdom DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 6.5.1.4 United Kingdom DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 6.5.2 France 6.5.2.1 France DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 6.5.2.2 France DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030) 6.5.2.3 France DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 6.5.2.4 France DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 6.5.3 Germany 6.5.3.1 Germany DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 6.5.3.2 Germany DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030) 6.5.3.3 Germany DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 6.5.3.4 Germany DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 6.5.4 Italy 6.5.4.1 Italy DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 6.5.4.2 Italy DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030) 6.5.4.3 Italy DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 6.5.4.4 Italy DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 6.5.5 Spain 6.5.5.1 Spain DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 6.5.5.2 Spain DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030) 6.5.5.3 Spain DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 6.5.5.4 Spain DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 6.5.6 Sweden 6.5.6.1 Sweden DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 6.5.6.2 Sweden DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030) 6.5.6.3 Sweden DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 6.5.6.4 Sweden DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 6.5.7 Austria 6.5.7.1 Austria DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 6.5.7.2 Austria DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030) 6.5.7.3 Austria DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 6.5.7.4 Austria DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 6.5.8 Rest of Europe 6.5.8.1 Rest of Europe DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 6.5.8.2 Rest of Europe DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030). 6.5.8.3 Rest of Europe DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 6.5.8.4 Rest of Europe DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 7. Asia Pacific DNA Data Storage Market Size and Forecast by Segmentation (By Value) (2023-2030) 7.1 Asia Pacific DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 7.2 Asia Pacific DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030) 7.3 Asia Pacific DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 7.4 Asia Pacific DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 7.5 Asia Pacific DNA Data Storage Market Size and Forecast, by Country (2023-2030) 7.5.1 China 7.5.1.1 China DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 7.5.1.2 China DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030) 7.5.1.3 China DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 7.5.1.4 China DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 7.5.2 South Korea 7.5.2.1 S Korea DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 7.5.2.2 S Korea DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030) 7.5.2.3 S Korea DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 7.5.2.4 S Korea DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 7.5.3 Japan 7.5.3.1 Japan DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 7.5.3.2 Japan DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030) 7.5.3.3 Japan DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 7.5.3.4 Japan DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 7.5.4 India 7.5.4.1 India DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 7.5.4.2 India DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030) 7.5.4.3 India DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 7.5.4.4 India DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 7.5.5 Australia 7.5.5.1 Australia DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 7.5.5.2 Australia DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030) 7.5.5.3 Australia DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 7.5.5.4 Australia DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 7.5.6 Indonesia 7.5.6.1 Indonesia DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 7.5.6.2 Indonesia DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030) 7.5.6.3 Indonesia DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 7.5.6.4 Indonesia DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 7.5.7 Malaysia 7.5.7.1 Malaysia DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 7.5.7.2 Malaysia DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030) 7.5.7.3 Malaysia DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 7.5.7.4 Malaysia DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 7.5.8 Vietnam 7.5.8.1 Vietnam DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 7.5.8.2 Vietnam DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030) 7.5.8.3 Vietnam DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 7.5.8.4 Vietnam DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 7.5.9 Taiwan 7.5.9.1 Taiwan DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 7.5.9.2 Taiwan DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030) 7.5.9.3 Taiwan DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 7.5.9.4 Taiwan DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 7.5.10 Bangladesh 7.5.10.1 Bangladesh DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 7.5.10.2 Bangladesh DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030) 7.5.10.3 Bangladesh DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 7.5.10.4 Bangladesh DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 7.5.11 Pakistan 7.5.11.1 Pakistan DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 7.5.11.2 Pakistan DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030) 7.5.11.3 Pakistan DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 7.5.11.4 Pakistan DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 7.5.12 Rest of Asia Pacific 7.5.12.1 Rest of Asia Pacific DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 7.5.12.2 Rest of Asia Pacific DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030) 7.5.12.3 Rest of Asia Pacific DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 7.5.12.4 Rest of Asia Pacific DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 8. Middle East and Africa DNA Data Storage Market Size and Forecast by Segmentation (By Value) (2023-2030) 8.1 Middle East and Africa DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 8.2 Middle East and Africa DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030) 8.3 Middle East and Africa DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 8.4 Middle East and Africa DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 8.5 Middle East and Africa DNA Data Storage Market Size and Forecast, by Country (2023-2030) 8.5.1 South Africa 8.5.1.1 South Africa DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 8.5.1.2 South Africa DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030) 8.5.1.3 South Africa DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 8.5.1.4 South Africa DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 8.5.2 GCC 8.5.2.1 GCC DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 8.5.2.2 GCC DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030) 8.5.2.3 GCC DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 8.5.2.4 GCC DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 8.5.3 Egypt 8.5.3.1 Egypt DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 8.5.3.2 Egypt DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030) 8.5.3.3 Egypt DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 8.5.3.4 Egypt DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 8.5.4 Nigeria 8.5.4.1 Nigeria DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 8.5.4.2 Nigeria DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030) 8.5.4.3 Nigeria DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 8.5.4.4 Nigeria DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 8.5.5 Rest of ME&A 8.5.5.1 Rest of ME&A DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 8.5.5.2 Rest of ME&A DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030) 8.5.5.3 Rest of ME&A DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 8.5.5.4 Rest of ME&A DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 9. South America DNA Data Storage Market Size and Forecast by Segmentation (By Value) (2023-2030) 9.1 South America DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 9.2 South America DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030) 9.3 South America DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 9.4 South America DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 9.5 South America DNA Data Storage Market Size and Forecast, by Country (2023-2030) 9.5.1 Brazil 9.5.1.1 Brazil DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 9.5.1.2 Brazil DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030) 9.5.1.3 Brazil DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 9.5.1.4 Brazil DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 9.5.2 Argentina 9.5.2.1 Argentina DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 9.5.2.2 Argentina DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030) 9.5.2.3 Argentina DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 9.5.2.4 Argentina DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 9.5.3 Rest Of South America 9.5.3.1 Rest Of South America DNA Data Storage Market Size and Forecast, by Deployment (2023-2030) 9.5.3.2 Rest Of South America DNA Data Storage Market Size and Forecast, by Sequencing Platform (2023-2030) 9.5.3.3 Rest Of South America DNA Data Storage Market Size and Forecast, by Synthesis Platform (2023-2030) 9.5.3.4 Rest Of South America DNA Data Storage Market Size and Forecast, by End Use (2023-2030) 10. Global DNA Data Storage Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Business Segment 10.3.3 End User Segment 10.3.4 Revenue (2023) 10.3.5 Manufacturing Locations 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Leading DNA Data Storage Global Companies, by market capitalization 10.6 Market Structure 10.6.1 Market Leaders 10.6.2 Market Followers 10.6.3 Emerging Players 10.7 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Illumina Inc 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2 Microsoft Corp. (Washington, United States) 11.3 Seagate Technology (North America) 11.4 Brooks Life Sciences (Massachusetts, United States) 11.5 Genewiz (A Brooks Life Sciences Company) (New Jersey, United States) 11.6 Thermo Fisher Scientific (Europe) 11.7 Siemens AG (Munich, Germany) 11.8 Catalog Technologies Inc. (Europe) 11.9 Bgi Shenzhen (Shenzhen, China) 11.10 Berry Genomics Co. Ltd. (Beijing, China) 11.11 Helixworks Technologies Ltd. (Dhenzhen, China) 11.12 Loop Genomics (Element Biosciences) (Japan) 11.13 Eurofins Scientific 11.14 Cegat Gmbh 11.15 Genomika 12. Key Findings and Analyst Recommendations 13. Terms and Glossary