The Digital TV SoC Market size was valued at USD 9.68 Billion in 2022 and the total Digital TV SoC Market is expected to grow at a CAGR of 12.60 % from 2023 to 2029, reaching nearly USD 22.24 Billion.Digital TV SoC Definition:

A Digital TV SoC (System-on-a-Chip) is a specialized type of microchip that is designed specifically for use in digital television devices. It integrates various functions that are required for the digital TV to work, including the video and audio processing, as well as the connectivity interfaces. Digital TV SoCs can support various video and audio codecs, as well as multiple broadcast standards such as ATSC (North America), DVB (Europe), and ISDB (Japan and South America). They also support advanced features such as 4K and HDR video, advanced audio processing, and smart TV functionalities.Overview:

Digital TV SoCs are components in modern digital TVs, and they play a significant role in providing high-quality digital content and a seamless viewing experience to users. The digital TV SoC (System-on-Chip) market growth is driven by high demand for digital television across the globe. Digital TV SoCs are integrated circuits, which combines multiple components and functions of a digital TV into a single chip like video and audio decoding, graphics processing, and networking capabilities. Regionally, Asia Pacific held the dominant position because of high adoption rate of digital television and the presence of several key manufacturers in the region. North America and Europe are also significant markets for digital TV SoCs, which is driven by the growing trend of smart homes and connected devices.To know about the Research Methodology :- Request Free Sample Report

Digital TV SoC Market Competitive Landscapes:

The digital TV System-on-Chip (SoC) market is highly competitive and is dominated by a few major players. Broadcom is one of the leading players in the digital TV SoC market. The company offers a wide range of digital TV SoCs, including satellite, cable, and terrestrial products. MediaTek is another major player in the digital TV SoC market. The company offers a range of SoCs for digital TV applications, including satellite, cable, and terrestrial solutions. Qualcomm is a leading provider of SoCs for digital TV applications. The company offers a range of solutions for cable, satellite, and terrestrial applications. STMicroelectronics is a major player in the digital TV SoC market. The company offers a range of SoCs for digital TV applications, including solutions for cable, satellite, and terrestrial applications. Other notable players in the market include Amlogic, Inc., Marvell Display Technology Group Ltd., and NXP Semiconductors N.V. These companies also offer a range of SoCs for digital TV applications, including solutions for cable, satellite, and terrestrial applications. Business Key Opportunities for Digital TV SoC Key Players: The digital TV SoC market is a highly competitive market, and the success of companies in the market depends on various factors like product innovation, Display Technology advancements, partnerships, and strategic collaborations. Some of the business strategies that companies in the digital TV SoC industry can use to succeed in the market Product Innovation: Companies in the digital TV SoC market are expected to differentiate themselves by offering innovative products that meet the changing needs of customers. For instance, companies can focus on developing SoCs with enhanced features such as better picture quality, support for high dynamic range (HDR), and advanced audio codecs. Diversification: Diversifying the product portfolio is a viable strategy for companies in the digital TV SoC market. Companies can expand their product offerings to include SoCs for different applications such as smart TVs, set-top boxes, and streaming devices. The strategy is expected to help companies to address different market segments and expand their customer base. Strategic Partnerships and Collaborations: Companies in the digital TV SoC can form strategic partnerships and collaborations with other companies to expand their reach and market share. For instance, companies can partner with TV manufacturers to integrate their SoCs into their TVs or collaborate with content providers to offer integrated solutions that provide a seamless user experience. Cost Optimization: Cost optimization is an important strategy for companies in the digital TV SoC market. Companies can optimize their costs by using advanced manufacturing technologies, reducing production costs, and improving supply chain management. Customer Engagement: Engaging with customers is important for companies in the digital TV SoC industry. Companies can engage with customers through various channels such as social media, customer service, and online forums. This can help companies to understand customer needs and preferences and develop products that meet their requirements.Digital TV SoC Market Dynamics:

Transition from analog to digital TV is expected to drive the Market With the transition from analog to digital TV, the demand for digital TV SoCs has increased significantly. Digital TV SoCs provide better video and audio quality, and they support various features such as interactive TV, multi-language support, and electronic program guides. Digital TV offers many benefits over analog TV, including higher picture quality, better sound, and more channels. As a result, many countries have been transitioning from analog to digital TV in recent years. This transition requires new digital TV infrastructure, including digital TV receivers, set-top boxes, and other devices that can decode and display digital TV signals. Additionally, the rise of streaming services and over-the-top (OTT) content delivery are expected to contribute to the growth of the Digital TV SoC market. The streaming services require specialized SoCs to handle the processing and decoding of digital video streams that drive the demand for SoCs. The transition from analog to digital TV is a significant advancement in television Display Technology, that providing viewers with higher-quality, more reliable broadcasts and allowing broadcasters to make more efficient use of the available radio spectrum. Growing demand for high-definition (HD) and ultra-high-definition (UHD) content: Drive the need for Digital TV SoC The demand for high-definition and ultra-high-definition content is increasing significantly in recent years, and digital TV SoCs are required to support HD formats. As more consumers purchase HD and UHD TVs, the demand for digital TV SoCs is increasing. The demand for high-definition (HD) and ultra-high-definition (UHD) content is increasing rapidly because of advancements in display Display Technology and improvements in internet speeds. Consumers are increasingly expecting to view high-quality content on their devices, whether it be through streaming services, cable or satellite TV, or Blu-ray discs. The growing demand for HD and UHD content has led to an increase in production of such content, with streaming services like Netflix and Amazon Prime investing heavily in producing original programming in UHD, which is expected led to an increase in demand for high-speed internet and larger data plans, as streaming UHD content requires a significant amount of bandwidth. The demand for HD and UHD content is expected to grow as display Display Technology continues to improve and consumers seek a more immersive viewing experience.Increase in smart TV adoption: One of the Key Drivers for market Growth With the growth of the internet and connected devices, smart TV adoption has increased significantly. Digital TV SoCs are required to power these smart TVs, which provide users with access to internet-based content and services. Smart TVs have become more widely available and affordable over the years, making them a viable option for many households. Smart TVs offer a wide range of features and functionality and allow users to stream content from various online services, browse the web, and even use voice commands to control their TV. Everything can be accessed through a single device, which makes for a more seamless and convenient viewing experience. Many smart TVs can be integrated with other smart devices, such as home assistants and smart speakers, which adds another layer of convenience and functionality are expected to drive the Smart TV adoption. An increase in disposable income is one of the factors that drive the market growth. Digital TV SoCs are specialized integrated circuits that are used in digital TVs to provide advanced functionalities such as high-definition video decoding, multimedia playback, and internet connectivity. As disposable income increases, consumers are expected to upgrade their home entertainment systems, that lead to an increased demand for digital TVs. Additionally, consumers are expected to purchase digital TVs with advanced features, that require more sophisticated digital TV SoCs. High disposable income is also driving the growth of the global digital content industry, like streaming services that also increase the demand for digital TV SoCs. Digital TV SoC Market challenges The Digital TV SoC (System-on-a-Chip) market faces several challenges that can impact its growth and profitability. The digital TV SoC market is highly competitive, with many players offering similar products. The competition is expected to result in price pressures and reduced profit margins for manufacturers. The digital TV industry is rapidly evolving, with new technological advancements. Keeping up with these advancements requires significant investment in research and development, that can be a challenge for some manufacturers. The cost of developing and manufacturing digital TV SoCs is high. There are different digital TV standards and specifications, such as ATSC, DVB, and ISDB, that make it challenging for manufacturers to create SoCs. Digital TV SoCs is expected to be vulnerable to piracy and security threats like hacking and theft of intellectual property. Manufacturers need to invest in robust security measures to prevent these threats. Digital TV SoCs need to comply with various regulations and standards set by different countries and regions. Compliance can be costly and time-consuming, that affect manufacturers' ability to introduce products to the market quickly.

Digital TV SoC Market Segment Analysis:

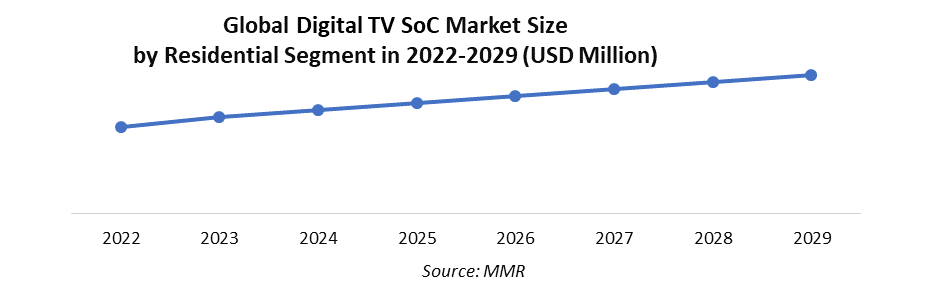

Digital TV SoC is a highly integrated electronic component that combines various functions like processing, memory, and interfaces into a single chip. It is widely used in digital televisions and set-top boxes to enable digital signal processing, audio and video decoding, and content streaming. The commercial segment includes digital signage, displays, and public display systems used in retail stores, airports, hotels, and other public places. Digital TV SoCs in commercial segment is designed to provide high-quality visuals, low power consumption, and ease of use. The healthcare segment includes medical displays used in hospitals, clinics, and other healthcare facilities. Digital TV SoCs in this segment is designed to meet stringent regulations, such as DICOM (Digital Imaging and Communications in Medicine), and provide high-quality images for medical professionals. The automotive segment includes digital displays and infotainment systems used in cars, buses, and other vehicles. Digital TV SoCs offer features like touch screens, GPS navigation, and Bluetooth connectivity, making them popular among car manufacturers. The residential segment held the dominant position and is projected to continue its dominance during the forecast period. The residential segment is the largest application segment for digital TV SoCs. It includes digital TV sets, set-top boxes, and media players used in homes. Digital TV SoCs in this segment offer features such as high-definition (HD) video playback, multimedia streaming, and internet connectivity, making them popular among consumers. The Digital TV SoC (System-on-Chip) market is segmented by the type of display Display Technology used in the television. The main types of display technologies used in modern televisions are LCD, LED, OLED, and QLED. LCD (Liquid Crystal Display) is a type of display Display Technology that uses a backlight to illuminate an array of pixels. The backlight can be either fluorescent or LED-based. LCD TVs are known for their affordability and wide availability, and they are commonly used in budget and mid-range televisions. OLED (Organic Light-Emitting Diode) TVs are a type of display Display Technology that doesn't require a backlight. Instead, each pixel emits its own light, allowing for perfect blacks and infinite contrast. OLED TVs are known for their exceptional image quality and color accuracy, but they are more expensive than both LCD and LED TVs. QLED (Quantum-dot Light-Emitting Diode) TVs are a type of LED TV that uses quantum dots to enhance color accuracy and brightness. QLED TVs are known for their vibrant colors and high peak brightness, and they are generally less expensive than OLED TVs. According to the research, the LCD (Liquid Crystal Display) segment dominated the Digital TV SoC (System on Chip) market in terms of market share. LCD TVs have been the most popular type of TV for many years because of their affordability and widespread availability.Digital TV SoC Market Regional Insights:

North America is one of the largest markets for digital TV SoCs because of the presence of a large number of major technology players in the region. The United States is a major contributor to the growth Digital TV SoC Market. The high adoption rate of digital TVs and the increasing demand for high-definition and ultra-high-definition TVs are expected to boost the market growth. The European digital TV SoC market is also witnessing significant growth due to the increasing demand for digital TVs, especially in countries like Germany, France, and the United Kingdom. The growth in this region is also driven by the increasing adoption of smart TVs that require advanced SoCs to provide seamless and high-quality streaming services. On the other hand, The Asia-Pacific region is one of the fastest-growing markets for digital TV SoCs, with countries like China, India, and Japan leading the way. The increasing disposable income of consumers, coupled with the growing demand for high-quality video content that led to the growth of this market in the region. The Latin American digital TV SoC market is also witnessing significant growth due to the increasing adoption of digital TVs in countries like Brazil and Mexico. The growth in this region is also driven by the increasing penetration of the internet and the growing demand for streaming services. Asia Pacific: Emerging market for Digital TV SoC The APAC (Asia-Pacific) digital TV SoCs (System-on-a-Chip) market is a dynamic and rapidly evolving industry, the market growth is driven by the growing demand for high-quality multimedia content and the increasing adoption of smart TVs and internet-connected devices. China is the largest market for digital TV SoCs in the APAC region, with a significant share of the market. The country has a large number of television households and is a major manufacturing hub for electronic devices, which has contributed to the growth of the digital TV SoCs market. Other major markets in the APAC region include Japan, South Korea, India, and Southeast Asian countries such as Indonesia, Vietnam, and Thailand. The key players in the APAC digital TV SoCs market include MediaTek, Broadcom, MStar Semiconductor, Novatek Microelectronics, and Realtek Semiconductor. These companies are focusing on product innovation and technological advancements to gain a competitive edge in the market. Digital TV SoC demand in India the demand for digital TV SoCs (System-on-Chip) in India is expected to grow because of the country's ongoing transition from analog to digital TV broadcasting. The transformation is driven by the Indian government's initiative to digitize the country's cable TV infrastructure that created a growing market for digital TV STBs (set-top boxes) and digital TV SoCs. In addition to the government's efforts, the increasing adoption of smart TVs and the growing popularity of OTT (over-the-top) video streaming services such as Netflix, Amazon Prime Video, and Disney+ Hotstar have also contributed to the demand for digital TV SoCs in India. SoCs enable advanced features like high-definition video decoding, smart TV functionality, and support for OTT content. Several companies such as MediaTek, Broadcom, and Amlogic have been providing digital TV SoCs to the Indian market.

Digital TV SoC Market Scope: Inquiry Before Buying

Digital TV SoC Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: USD 9.68 Bn Forecast Period 2023 to 2029 CAGR: 12.60% Market Size in 2029: USD 22.24 Bn Segments Covered: by End User 1.Residential 2.Commercial 3.Others by Display Technology 1.LCD 2.LED 3.OLED 4.QLED Digital TV SoC Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Digital TV SoC Market Key Players:

1.Broadcom Inc. 2. MediaTek Inc. 3.Intel Corporation 4.Qualcomm Technologies, Inc. 5.Samsung Electronics Co. Ltd. 6.STMicroelectronics N.V. 7.Texas Instruments Incorporated 8.Novatek Microelectronics Corp. 9.MStar Semiconductor, Inc. 10. LG Electronics Inc 11.Sigma Designs 12.HiSilicon 13. Transtec Semiconductor AG 14.ViXS Systems Inc 15.Zoran Corporation 16. Silicon Laboratories Inc 17.NXP Semiconductors 18. Realtek Semiconductor Corporation. FAQs: 1] What segments are covered in the Global Digital TV SoC Market report? Ans. The segments covered in the Digital TV SoC report are based on End User, Display Technology and Region. 2] Which region is expected to hold the highest share in the Global Digital TV SoC Market during the forecast period? Ans. The Asia Pacific region is expected to hold the highest share of the Digital TV SoC Market during the forecast period. 3] What is the market size of the Global Digital TV SoC by 2029? Ans. The market size of the Digital TV SoC by 2029 is expected to reach US$ 22.24 Bn. 4] What is the forecast period for the Global Digital TV SoC Market? Ans. The forecast period for the Digital TV SoC Market is 2023-2029. 5] What was the market size of the Global Digital TV SoC in 2022? Ans. The market size of the Digital TV SoC in 2021 was valued at US$ 9.68 Bn.

1. Digital TV SoC Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Digital TV SoC Market: Dynamics 2.1. Digital TV SoC Market Trends by Region 2.1.1. North America Digital TV SoC Market Trends 2.1.2. Europe Digital TV SoC Market Trends 2.1.3. Asia Pacific Digital TV SoC Market Trends 2.1.4. Middle East and Africa Digital TV SoC Market Trends 2.1.5. South America Digital TV SoC Market Trends 2.2. Digital TV SoC Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Digital TV SoC Market Drivers 2.2.1.2. North America Digital TV SoC Market Restraints 2.2.1.3. North America Digital TV SoC Market Opportunities 2.2.1.4. North America Digital TV SoC Market Challenges 2.2.2. Europe 2.2.2.1. Europe Digital TV SoC Market Drivers 2.2.2.2. Europe Digital TV SoC Market Restraints 2.2.2.3. Europe Digital TV SoC Market Opportunities 2.2.2.4. Europe Digital TV SoC Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Digital TV SoC Market Drivers 2.2.3.2. Asia Pacific Digital TV SoC Market Restraints 2.2.3.3. Asia Pacific Digital TV SoC Market Opportunities 2.2.3.4. Asia Pacific Digital TV SoC Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Digital TV SoC Market Drivers 2.2.4.2. Middle East and Africa Digital TV SoC Market Restraints 2.2.4.3. Middle East and Africa Digital TV SoC Market Opportunities 2.2.4.4. Middle East and Africa Digital TV SoC Market Challenges 2.2.5. South America 2.2.5.1. South America Digital TV SoC Market Drivers 2.2.5.2. South America Digital TV SoC Market Restraints 2.2.5.3. South America Digital TV SoC Market Opportunities 2.2.5.4. South America Digital TV SoC Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Digital TV SoC Industry 2.8. Analysis of Government Schemes and Initiatives For Digital TV SoC Industry 2.9. Digital TV SoC Market Trade Analysis 2.10. The Global Pandemic Impact on Digital TV SoC Market 3. Digital TV SoC Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Digital TV SoC Market Size and Forecast, by End User (2022-2029) 3.1.1. Residential 3.1.2. Commercial 3.1.3. Others 3.2. Digital TV SoC Market Size and Forecast, by Display Technology (2022-2029) 3.2.1. LCD 3.2.2. LED 3.2.3. OLED 3.2.4. QLED 3.3. Digital TV SoC Market Size and Forecast, by Region (2022-2029) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Digital TV SoC Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Digital TV SoC Market Size and Forecast, by End User (2022-2029) 4.1.1. Residential 4.1.2. Commercial 4.1.3. Others 4.2. North America Digital TV SoC Market Size and Forecast, by Display Technology (2022-2029) 4.2.1. LCD 4.2.2. LED 4.2.3. OLED 4.2.4. QLED 4.3. North America Digital TV SoC Market Size and Forecast, by Country (2022-2029) 4.3.1. United States 4.3.1.1. United States Digital TV SoC Market Size and Forecast, by End User (2022-2029) 4.3.1.1.1. Residential 4.3.1.1.2. Commercial 4.3.1.1.3. Others 4.3.1.2. United States Digital TV SoC Market Size and Forecast, by Display Technology (2022-2029) 4.3.1.2.1. LCD 4.3.1.2.2. LED 4.3.1.2.3. OLED 4.3.1.2.4. QLED 4.7.2. Canada 4.3.2.1. Canada Digital TV SoC Market Size and Forecast, by End User (2022-2029) 4.3.2.1.1. Residential 4.3.2.1.2. Commercial 4.3.2.1.3. Others 4.3.2.2. Canada Digital TV SoC Market Size and Forecast, by Display Technology (2022-2029) 4.3.2.2.1. LCD 4.3.2.2.2. LED 4.3.2.2.3. OLED 4.3.2.2.4. QLED 4.7.3. Mexico 4.3.3.1. Mexico Digital TV SoC Market Size and Forecast, by End User (2022-2029) 4.3.3.1.1. Residential 4.3.3.1.2. Commercial 4.3.3.1.3. Others 4.3.3.2. Mexico Digital TV SoC Market Size and Forecast, by Display Technology (2022-2029) 4.3.3.2.1. LCD 4.3.3.2.2. LED 4.3.3.2.3. OLED 4.3.3.2.4. QLED 5. Europe Digital TV SoC Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Digital TV SoC Market Size and Forecast, by End User (2022-2029) 5.2. Europe Digital TV SoC Market Size and Forecast, by Display Technology (2022-2029) 5.3. Europe Digital TV SoC Market Size and Forecast, by Country (2022-2029) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Digital TV SoC Market Size and Forecast, by End User (2022-2029) 5.3.1.2. United Kingdom Digital TV SoC Market Size and Forecast, by Display Technology (2022-2029) 5.3.2. France 5.3.2.1. France Digital TV SoC Market Size and Forecast, by End User (2022-2029) 5.3.2.2. France Digital TV SoC Market Size and Forecast, by Display Technology (2022-2029) 5.3.3. Germany 5.3.3.1. Germany Digital TV SoC Market Size and Forecast, by End User (2022-2029) 5.3.3.2. Germany Digital TV SoC Market Size and Forecast, by Display Technology (2022-2029) 5.3.4. Italy 5.3.4.1. Italy Digital TV SoC Market Size and Forecast, by End User (2022-2029) 5.3.4.2. Italy Digital TV SoC Market Size and Forecast, by Display Technology (2022-2029) 5.3.5. Spain 5.3.5.1. Spain Digital TV SoC Market Size and Forecast, by End User (2022-2029) 5.3.5.2. Spain Digital TV SoC Market Size and Forecast, by Display Technology (2022-2029) 5.3.6. Sweden 5.3.6.1. Sweden Digital TV SoC Market Size and Forecast, by End User (2022-2029) 5.3.6.2. Sweden Digital TV SoC Market Size and Forecast, by Display Technology (2022-2029) 5.3.7. Austria 5.3.7.1. Austria Digital TV SoC Market Size and Forecast, by End User (2022-2029) 5.3.7.2. Austria Digital TV SoC Market Size and Forecast, by Display Technology (2022-2029) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Digital TV SoC Market Size and Forecast, by End User (2022-2029) 5.3.8.2. Rest of Europe Digital TV SoC Market Size and Forecast, by Display Technology (2022-2029) 6. Asia Pacific Digital TV SoC Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Digital TV SoC Market Size and Forecast, by End User (2022-2029) 6.2. Asia Pacific Digital TV SoC Market Size and Forecast, by Display Technology (2022-2029) 6.7. Asia Pacific Digital TV SoC Market Size and Forecast, by Country (2022-2029) 6.3.1. China 6.3.1.1. China Digital TV SoC Market Size and Forecast, by End User (2022-2029) 6.3.1.2. China Digital TV SoC Market Size and Forecast, by Display Technology (2022-2029) 6.3.2. S Korea 6.3.2.1. S Korea Digital TV SoC Market Size and Forecast, by End User (2022-2029) 6.3.2.2. S Korea Digital TV SoC Market Size and Forecast, by Display Technology (2022-2029) 6.3.3. Japan 6.3.3.1. Japan Digital TV SoC Market Size and Forecast, by End User (2022-2029) 6.3.3.2. Japan Digital TV SoC Market Size and Forecast, by Display Technology (2022-2029) 6.3.4. India 6.3.4.1. India Digital TV SoC Market Size and Forecast, by End User (2022-2029) 6.3.4.2. India Digital TV SoC Market Size and Forecast, by Display Technology (2022-2029) 6.3.5. Australia 6.3.5.1. Australia Digital TV SoC Market Size and Forecast, by End User (2022-2029) 6.3.5.2. Australia Digital TV SoC Market Size and Forecast, by Display Technology (2022-2029) 6.3.6. Indonesia 6.3.6.1. Indonesia Digital TV SoC Market Size and Forecast, by End User (2022-2029) 6.3.6.2. Indonesia Digital TV SoC Market Size and Forecast, by Display Technology (2022-2029) 6.3.7. Malaysia 6.3.7.1. Malaysia Digital TV SoC Market Size and Forecast, by End User (2022-2029) 6.3.7.2. Malaysia Digital TV SoC Market Size and Forecast, by Display Technology (2022-2029) 6.3.8. Vietnam 6.3.8.1. Vietnam Digital TV SoC Market Size and Forecast, by End User (2022-2029) 6.3.8.2. Vietnam Digital TV SoC Market Size and Forecast, by Display Technology (2022-2029) 6.3.9. Taiwan 6.3.9.1. Taiwan Digital TV SoC Market Size and Forecast, by End User (2022-2029) 6.3.9.2. Taiwan Digital TV SoC Market Size and Forecast, by Display Technology (2022-2029) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Digital TV SoC Market Size and Forecast, by End User (2022-2029) 6.3.10.2. Rest of Asia Pacific Digital TV SoC Market Size and Forecast, by Display Technology (2022-2029) 7. Middle East and Africa Digital TV SoC Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Digital TV SoC Market Size and Forecast, by End User (2022-2029) 7.2. Middle East and Africa Digital TV SoC Market Size and Forecast, by Display Technology (2022-2029) 7.7. Middle East and Africa Digital TV SoC Market Size and Forecast, by Country (2022-2029) 7.7.1. South Africa 7.3.1.1. South Africa Digital TV SoC Market Size and Forecast, by End User (2022-2029) 7.3.1.2. South Africa Digital TV SoC Market Size and Forecast, by Display Technology (2022-2029) 7.7.2. GCC 7.3.2.1. GCC Digital TV SoC Market Size and Forecast, by End User (2022-2029) 7.3.2.2. GCC Digital TV SoC Market Size and Forecast, by Display Technology (2022-2029) 7.7.3. Nigeria 7.3.3.1. Nigeria Digital TV SoC Market Size and Forecast, by End User (2022-2029) 7.3.3.2. Nigeria Digital TV SoC Market Size and Forecast, by Display Technology (2022-2029) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Digital TV SoC Market Size and Forecast, by End User (2022-2029) 7.3.4.2. Rest of ME&A Digital TV SoC Market Size and Forecast, by Display Technology (2022-2029) 8. South America Digital TV SoC Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Digital TV SoC Market Size and Forecast, by End User (2022-2029) 8.2. South America Digital TV SoC Market Size and Forecast, by Display Technology (2022-2029) 8.7. South America Digital TV SoC Market Size and Forecast, by Country (2022-2029) 8.3.1. Brazil 8.3.1.1. Brazil Digital TV SoC Market Size and Forecast, by End User (2022-2029) 8.3.1.2. Brazil Digital TV SoC Market Size and Forecast, by Display Technology (2022-2029) 8.3.2. Argentina 8.3.2.1. Argentina Digital TV SoC Market Size and Forecast, by End User (2022-2029) 8.3.2.2. Argentina Digital TV SoC Market Size and Forecast, by Display Technology (2022-2029) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Digital TV SoC Market Size and Forecast, by End User (2022-2029) 8.3.3.2. Rest Of South America Digital TV SoC Market Size and Forecast, by Display Technology (2022-2029) 9. Global Digital TV SoC Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Digital TV SoC Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Broadcom Inc. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. MediaTek Inc. 10.3. Intel Corporation 10.4. Qualcomm Technologies, Inc. 10.5. Samsung Electronics Co. Ltd. 10.6. STMicroelectronics N.V. 10.7. Texas Instruments Incorporated 10.8. Novatek Microelectronics Corp. 10.9. MStar Semiconductor, Inc. 10.10. LG Electronics Inc 10.11. Sigma Designs 10.12. HiSilicon 10.13. Transtec Semiconductor AG 10.14. ViXS Systems Inc 10.15. Zoran Corporation 10.16. Silicon Laboratories Inc 10.17. NXP Semiconductors 10.18. Realtek Semiconductor Corporation. 11. Key Findings 12. Industry Recommendations 13. Digital TV SoC Market: Research Methodology 14. Terms and Glossary