The Debt Collection Software Market size was valued at USD 4.25 Billion in 2023 and the total Debt Collection Software revenue is expected to grow at a CAGR of 10.2 % from 2024 to 2030, reaching nearly USD 8.39 Billion by 2030. Debt collection software, a subset of financial management software, is used to streamline debt recovery processes, providing a comprehensive view of debt collection activities and interactions between debtors and creditors. Increasing demand for efficient debt recovery solutions across industries driving the growth of Debt Collection Software Market. Amid economic uncertainties, businesses are increasingly adopting automated debt collection software to streamline operations and reduce errors. The growing use of digital payment methods and non-performing assets is driving Debt Collection Software market demand, while the incorporation of technologies such as AI and ML allows for predictive analytics, improving debtor behavior prediction and optimizing resource allocation.To know about the Research Methodology:-Request Free Sample Report The Debt Collection Software Market is witnessing dynamic innovation from industry leaders such as Experian, FICO, and Nucleus Software, as they strive to reinforce their market presence. Experian's CrossCore platform stands out with its advanced identity verification and debt collection capabilities, while FICO's Debt Manager leverages AI to tailor strategies. Nucleus Software adds value by enhancing its suite with digital collections features. Debt collection software plays a pivotal role in addressing industry challenges by automating tasks, boosting recovery rates, and centralizing data. Moreover, it offers analytical insights, improves customer relations, ensures compliance, and delivers substantial ROI. Automation streamlines processes, allowing businesses to focus on strategic initiatives and achieve faster resolutions with higher recovery rates. The expanding Debt Collection Software Market is adapting to meet the growing challenges of late payments and economic uncertainties. With innovative AI and ML-powered solutions, businesses are empowered to navigate financial obstacles with confidence and resilience, driving efficiency and efficacy in debt recovery processes.

Debt Collection Software Market Dynamics:

Increased Non-Performing Assets (NPAs) boosting the Debt Collection Software Market Debt collection software offers significant advantages for businesses navigating accounts receivable management within the broader financial management software which driving the growth of Debt Collection Software Market. This strategic move streamlines processes, enhances recovery efforts, and safeguards sensitive customer data, nurturing stronger customer relationships and elevating financial reporting capabilities. The typical return on investment (ROI) of automated debt collection solutions is remarkable, with potential reductions in debt collection costs by up to 65% and accelerated processes up to 8 times, alongside significant productivity growth in debt recovery teams by 3-4 times. Debt Collection Software Market End users experience a sevenfold increase in debtor response rates, over 40% reduction in Days Sales Outstanding (DSO), and a 20% decrease in bad debt, highlighting the efficiency and effectiveness of debt collection software. These benefits are further accentuated by key features such as automation, optimized collection processes, data consolidation, and insightful analytics, which drive efficiency and improve overall performance in the Debt Collection Software Market. Ensuring security and regulatory compliance is important in the Debt Collection Software Market. Software solutions integrate robust measures such as encryption technology and authentication protocols to protect sensitive data and uphold adherence to evolving regulations, fostering trust among customers. The escalating demand for debt collection software stems from various drivers, including digital transformation across industries, heightened regulatory requirements, the surge in non-performing assets (NPAs), and the incorporation of artificial intelligence (AI) and machine learning (ML) algorithms. The uptake of cloud-based solutions, emphasis on data security, and strategic collaborations are boosting Debt Collection Software market growth. The complexity of legal and regulatory frameworks acts as a barrier, hampering the growth of the market. The difficulty of establishing contact with customers, who often evade communication attempts, impeding debt recovery efforts and hindering the growth of Debt Collection Software Market. The market contends with low debt recovery rates, indicative of inefficiencies within the collection process. Advanced solutions incorporating digital outreach methods and automated reminders are essential in accelerating debt recovery and improving overall financial health for companies. Navigating the complex legal and regulatory landscape poses considerable challenges for debt collection software providers. Compliance with stringent regulations such as the Fair Debt Collection Practices Act (FDCPA) demands meticulous attention to detail and adherence to guidelines to avoid legal repercussions. The debt collection software market facing a range of challenges stemming from economic fluctuations, intense competition, pricing pressures, reputation vulnerabilities, and cultural and language barriers. Amidst economic uncertainties, providers like Cogent Road adopt flexible pricing strategies to weather downturns effectively. Addressing the diverse global market demands, TransUnion's provision of multilingual support showcases a strategic response to cultural and language barriers. Despite these hurdles, companies endeavour to distinguish themselves, sustain profitability, and uphold standards of compliance, data security, and operational efficiency within a fiercely competitive and ever-evolving market environment.Debt Collection Software Market Segment Analysis:

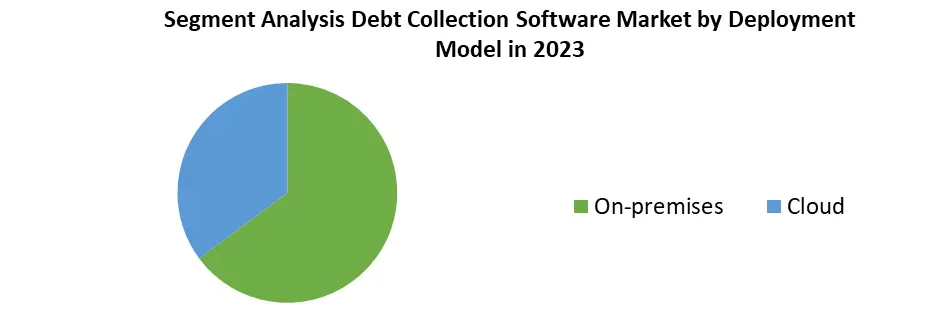

Based on Deployment Model, On-premises solutions dominated the Debt Collection Software Market in 2023, it offers greater control and customization, making them favored by large enterprises with stringent data security requirements and existing IT infrastructure. These solutions are often preferred in industries such as finance and healthcare, where data sensitivity and regulatory compliance are paramount. Cloud-based debt collection software has witnessed rapid adoption due to its scalability, accessibility, and lower initial costs. Small and medium-sized businesses, as well as newer entrants into the market, find cloud-based solutions more attractive, as they eliminate the need for extensive hardware investment and offer flexibility in terms of remote access and rapid deployment. Additionally, cloud solutions facilitate seamless integration with other cloud-based systems, enabling efficient data sharing and collaboration across platforms.

Debt Collection Software Market Regional Insights:

Asia Pacific Dominated the Debt Collection Software Market Asia Pacific region dominated the Debt Collection Software Market in 2023, as the debt collection landscape in China has seen a notable shift in recent years, driven by technology-driven approaches aimed at enhancing efficiency and compliance. With a focus on minimizing bad debts and automating collection processes, the market is poised for growth, driven by increasing demand from end-user industries. As China's financial sector expands and evolves, vendors offering innovative debt collection solutions are expected to gain traction, providing efficient and secure collection processes. In India, the debt collection software market has experienced significant growth, driven by the presence of global vendors, technological advancements, and rising bad loans. Challenges within the economic landscape have led to operational inefficiencies, prompting banks and NBFCs to adopt debt collection software to streamline processes. Post-pandemic, there has been a rapid uptake of technology in the debt collection industry, driven by increasing demand for credit and the need for seamless customer experiences. Expanding beyond China and India, the Asia-Pacific region presents substantial growth opportunities for the debt collection software market. Countries like Australia, Japan, South Korea, and New Zealand are witnessing increasing digitization and a growing demand for automated debt collection across various sectors. With both regional and global vendors vying for market share, the focus remains on minimizing bad loans and improving collection efficiency to meet the evolving needs of end-user industries.Debt Collection Software Market Scope: Inquire before buying

Global Debt Collection Software Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 4.25 Bn. Forecast Period 2024 to 2030 CAGR: 10.2% Market Size in 2030: US $ 8.39 Bn. Segments Covered: by Component Software Services by Deployment Mode On-premises Cloud by Organization Size Large enterprises Small and Medium Sized Enterprises by End-Use Industry Banks Collection agencies Finance companies Consumer goods and retail Telecom and utilities Healthcare Others Debt Collection Software Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Debt Collection Software Market Key Players:

Major Contributors in the Debt Collection Software Service Providing: 1. FICO (Fair Isaac Corporation), San Jose, California, USA 2. Experian, Dublin, Ireland 3. TransUnion, Chicago, Illinois, USA 4. Nortridge Software, Lake Forest, California, USA 5. Temenos, Geneva, Switzerland 6. Coface, Paris, France 7. CGI (Collections360), Montreal, Quebec, Canada 8. Quantrax Corporation, Miami, Florida, USA 9. TietoEVRY, Espoo, Finland 10. Chetu Inc., Plantation, Florida, USA 11. Ontario Systems, Muncie, Indiana, USA 12. Pegasystems Inc., Cambridge, Massachusetts, USA 13. Latitude Software, Jacksonville, Florida, USA 14. Indus Software Technologies, Bangalore, Karnataka, India 15. Intellect Design Arena, Chennai, Tamil Nadu, India 16. Katabat, Wilmington, Delaware, USA 17. D2r-Collect, Rennes, France 18. CSS Impact, Chicago, Illinois, USA 19. Applied Innovation Inc., Moline, Illinois, USA 20. Cforia Software, Westlake Village, California, USA FAQs: 1] Which region is expected to hold the highest share in the Global Market? Ans. Asia Pacific region is expected to hold the highest share in the Market. 2] What is the market size of the Global Market by 2030? Ans. The market size of the Debt Collection Software Market by 2030 is expected to reach US$ 8.39 Billion. 3] What is the forecast period for the Global Market? Ans. The forecast period for the Debt Collection Software Market is 2024-2030. 4] What was the market size of the Global Market in 2023? Ans. The market size of the Market in 2023 was valued at US$ 4.25 Billion.

1. Debt Collection Software Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Debt Collection Software Market: Dynamics 2.1. Debt Collection Software Market Trends by Region 2.1.1. North America Debt Collection Software Market Trends 2.1.2. Europe Debt Collection Software Market Trends 2.1.3. Asia Pacific Debt Collection Software Market Trends 2.1.4. Middle East and Africa Debt Collection Software Market Trends 2.1.5. South America Debt Collection Software Market Trends 2.2. Debt Collection Software Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Debt Collection Software Market Drivers 2.2.1.2. North America Debt Collection Software Market Restraints 2.2.1.3. North America Debt Collection Software Market Opportunities 2.2.1.4. North America Debt Collection Software Market Challenges 2.2.2. Europe 2.2.2.1. Europe Debt Collection Software Market Drivers 2.2.2.2. Europe Debt Collection Software Market Restraints 2.2.2.3. Europe Debt Collection Software Market Opportunities 2.2.2.4. Europe Debt Collection Software Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Debt Collection Software Market Drivers 2.2.3.2. Asia Pacific Debt Collection Software Market Restraints 2.2.3.3. Asia Pacific Debt Collection Software Market Opportunities 2.2.3.4. Asia Pacific Debt Collection Software Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Debt Collection Software Market Drivers 2.2.4.2. Middle East and Africa Debt Collection Software Market Restraints 2.2.4.3. Middle East and Africa Debt Collection Software Market Opportunities 2.2.4.4. Middle East and Africa Debt Collection Software Market Challenges 2.2.5. South America 2.2.5.1. South America Debt Collection Software Market Drivers 2.2.5.2. South America Debt Collection Software Market Restraints 2.2.5.3. South America Debt Collection Software Market Opportunities 2.2.5.4. South America Debt Collection Software Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Debt Collection Software Industry 2.8. Analysis of Government Schemes and Initiatives For Debt Collection Software Industry 2.9. Debt Collection Software Market Trade Analysis 2.10. The Global Pandemic Impact on Debt Collection Software Market 3. Debt Collection Software Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Debt Collection Software Market Size and Forecast, by Component (2023-2030) 3.1.1. Software 3.1.2. Services 3.2. Debt Collection Software Market Size and Forecast, by Deployment Mode (2023-2030) 3.2.1. On-premises 3.2.2. Cloud 3.3. Debt Collection Software Market Size and Forecast, by Organization Size (2023-2030) 3.3.1. Large enterprises 3.3.2. Small and Medium Sized Enterprises 3.4. Debt Collection Software Market Size and Forecast, by End Use Industry (2023-2030) 3.4.1. Banks 3.4.2. Collection agencies 3.4.3. Finance companies 3.4.4. Consumer goods and retail 3.4.5. Telecom and utilities 3.4.6. Healthcare 3.4.7. Others 3.5. Debt Collection Software Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Debt Collection Software Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Debt Collection Software Market Size and Forecast, by Component (2023-2030) 4.1.1. Software 4.1.2. Services 4.2. North America Debt Collection Software Market Size and Forecast, by Deployment Mode (2023-2030) 4.2.1. On-premises 4.2.2. Cloud 4.3. North America Debt Collection Software Market Size and Forecast, by Organization Size (2023-2030) 4.3.1. Large enterprises 4.3.2. Small and Medium Sized Enterprises 4.4. North America Debt Collection Software Market Size and Forecast, by End Use Industry (2023-2030) 4.4.1. Banks 4.4.2. Collection agencies 4.4.3. Finance companies 4.4.4. Consumer goods and retail 4.4.5. Telecom and utilities 4.4.6. Healthcare 4.4.7. Others 4.5. North America Debt Collection Software Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Debt Collection Software Market Size and Forecast, by Component (2023-2030) 4.5.1.1.1. Software 4.5.1.1.2. Services 4.5.1.2. United States Debt Collection Software Market Size and Forecast, by Deployment Mode (2023-2030) 4.5.1.2.1. On-premises 4.5.1.2.2. Cloud 4.5.1.3. United States Debt Collection Software Market Size and Forecast, by Organization Size (2023-2030) 4.5.1.3.1. Large enterprises 4.5.1.3.2. Small and Medium Sized Enterprises 4.5.1.4. United States Debt Collection Software Market Size and Forecast, by End Use Industry (2023-2030) 4.5.1.4.1. Banks 4.5.1.4.2. Collection agencies 4.5.1.4.3. Finance companies 4.5.1.4.4. Consumer goods and retail 4.5.1.4.5. Telecom and utilities 4.5.1.4.6. Healthcare 4.5.1.4.7. Others 4.5.2. Canada 4.5.2.1. Canada Debt Collection Software Market Size and Forecast, by Component (2023-2030) 4.5.2.1.1. Software 4.5.2.1.2. Services 4.5.2.2. Canada Debt Collection Software Market Size and Forecast, by Deployment Mode (2023-2030) 4.5.2.2.1. On-premises 4.5.2.2.2. Cloud 4.5.2.3. Canada Debt Collection Software Market Size and Forecast, by Organization Size (2023-2030) 4.5.2.3.1. Large enterprises 4.5.2.3.2. Small and Medium Sized Enterprises 4.5.2.4. Canada Debt Collection Software Market Size and Forecast, by End Use Industry (2023-2030) 4.5.2.4.1. Banks 4.5.2.4.2. Collection agencies 4.5.2.4.3. Finance companies 4.5.2.4.4. Consumer goods and retail 4.5.2.4.5. Telecom and utilities 4.5.2.4.6. Healthcare 4.5.2.4.7. Others 4.5.3. Mexico 4.5.3.1. Mexico Debt Collection Software Market Size and Forecast, by Component (2023-2030) 4.5.3.1.1. Software 4.5.3.1.2. Services 4.5.3.2. Mexico Debt Collection Software Market Size and Forecast, by Deployment Mode (2023-2030) 4.5.3.2.1. On-premises 4.5.3.2.2. Cloud 4.5.3.3. Mexico Debt Collection Software Market Size and Forecast, by Organization Size (2023-2030) 4.5.3.3.1. Large enterprises 4.5.3.3.2. Small and Medium Sized Enterprises 4.5.3.4. Mexico Debt Collection Software Market Size and Forecast, by End Use Industry (2023-2030) 4.5.3.4.1. Banks 4.5.3.4.2. Collection agencies 4.5.3.4.3. Finance companies 4.5.3.4.4. Consumer goods and retail 4.5.3.4.5. Telecom and utilities 4.5.3.4.6. Healthcare 4.5.3.4.7. Others 5. Europe Debt Collection Software Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Debt Collection Software Market Size and Forecast, by Component (2023-2030) 5.2. Europe Debt Collection Software Market Size and Forecast, by Deployment Mode (2023-2030) 5.3. Europe Debt Collection Software Market Size and Forecast, by Organization Size (2023-2030) 5.4. Europe Debt Collection Software Market Size and Forecast, by End Use Industry (2023-2030) 5.5. Europe Debt Collection Software Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Debt Collection Software Market Size and Forecast, by Component (2023-2030) 5.5.1.2. United Kingdom Debt Collection Software Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.1.3. United Kingdom Debt Collection Software Market Size and Forecast, by Organization Size (2023-2030) 5.5.1.4. United Kingdom Debt Collection Software Market Size and Forecast, by End Use Industry (2023-2030) 5.5.2. France 5.5.2.1. France Debt Collection Software Market Size and Forecast, by Component (2023-2030) 5.5.2.2. France Debt Collection Software Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.2.3. France Debt Collection Software Market Size and Forecast, by Organization Size (2023-2030) 5.5.2.4. France Debt Collection Software Market Size and Forecast, by End Use Industry (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Debt Collection Software Market Size and Forecast, by Component (2023-2030) 5.5.3.2. Germany Debt Collection Software Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.3.3. Germany Debt Collection Software Market Size and Forecast, by Organization Size (2023-2030) 5.5.3.4. Germany Debt Collection Software Market Size and Forecast, by End Use Industry (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Debt Collection Software Market Size and Forecast, by Component (2023-2030) 5.5.4.2. Italy Debt Collection Software Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.4.3. Italy Debt Collection Software Market Size and Forecast, by Organization Size (2023-2030) 5.5.4.4. Italy Debt Collection Software Market Size and Forecast, by End Use Industry (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Debt Collection Software Market Size and Forecast, by Component (2023-2030) 5.5.5.2. Spain Debt Collection Software Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.5.3. Spain Debt Collection Software Market Size and Forecast, by Organization Size (2023-2030) 5.5.5.4. Spain Debt Collection Software Market Size and Forecast, by End Use Industry (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Debt Collection Software Market Size and Forecast, by Component (2023-2030) 5.5.6.2. Sweden Debt Collection Software Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.6.3. Sweden Debt Collection Software Market Size and Forecast, by Organization Size (2023-2030) 5.5.6.4. Sweden Debt Collection Software Market Size and Forecast, by End Use Industry (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Debt Collection Software Market Size and Forecast, by Component (2023-2030) 5.5.7.2. Austria Debt Collection Software Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.7.3. Austria Debt Collection Software Market Size and Forecast, by Organization Size (2023-2030) 5.5.7.4. Austria Debt Collection Software Market Size and Forecast, by End Use Industry (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Debt Collection Software Market Size and Forecast, by Component (2023-2030) 5.5.8.2. Rest of Europe Debt Collection Software Market Size and Forecast, by Deployment Mode (2023-2030) 5.5.8.3. Rest of Europe Debt Collection Software Market Size and Forecast, by Organization Size (2023-2030) 5.5.8.4. Rest of Europe Debt Collection Software Market Size and Forecast, by End Use Industry (2023-2030) 6. Asia Pacific Debt Collection Software Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Debt Collection Software Market Size and Forecast, by Component (2023-2030) 6.2. Asia Pacific Debt Collection Software Market Size and Forecast, by Deployment Mode (2023-2030) 6.3. Asia Pacific Debt Collection Software Market Size and Forecast, by Organization Size (2023-2030) 6.4. Asia Pacific Debt Collection Software Market Size and Forecast, by End Use Industry (2023-2030) 6.5. Asia Pacific Debt Collection Software Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Debt Collection Software Market Size and Forecast, by Component (2023-2030) 6.5.1.2. China Debt Collection Software Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.1.3. China Debt Collection Software Market Size and Forecast, by Organization Size (2023-2030) 6.5.1.4. China Debt Collection Software Market Size and Forecast, by End Use Industry (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Debt Collection Software Market Size and Forecast, by Component (2023-2030) 6.5.2.2. S Korea Debt Collection Software Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.2.3. S Korea Debt Collection Software Market Size and Forecast, by Organization Size (2023-2030) 6.5.2.4. S Korea Debt Collection Software Market Size and Forecast, by End Use Industry (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Debt Collection Software Market Size and Forecast, by Component (2023-2030) 6.5.3.2. Japan Debt Collection Software Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.3.3. Japan Debt Collection Software Market Size and Forecast, by Organization Size (2023-2030) 6.5.3.4. Japan Debt Collection Software Market Size and Forecast, by End Use Industry (2023-2030) 6.5.4. India 6.5.4.1. India Debt Collection Software Market Size and Forecast, by Component (2023-2030) 6.5.4.2. India Debt Collection Software Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.4.3. India Debt Collection Software Market Size and Forecast, by Organization Size (2023-2030) 6.5.4.4. India Debt Collection Software Market Size and Forecast, by End Use Industry (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Debt Collection Software Market Size and Forecast, by Component (2023-2030) 6.5.5.2. Australia Debt Collection Software Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.5.3. Australia Debt Collection Software Market Size and Forecast, by Organization Size (2023-2030) 6.5.5.4. Australia Debt Collection Software Market Size and Forecast, by End Use Industry (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Debt Collection Software Market Size and Forecast, by Component (2023-2030) 6.5.6.2. Indonesia Debt Collection Software Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.6.3. Indonesia Debt Collection Software Market Size and Forecast, by Organization Size (2023-2030) 6.5.6.4. Indonesia Debt Collection Software Market Size and Forecast, by End Use Industry (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Debt Collection Software Market Size and Forecast, by Component (2023-2030) 6.5.7.2. Malaysia Debt Collection Software Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.7.3. Malaysia Debt Collection Software Market Size and Forecast, by Organization Size (2023-2030) 6.5.7.4. Malaysia Debt Collection Software Market Size and Forecast, by End Use Industry (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Debt Collection Software Market Size and Forecast, by Component (2023-2030) 6.5.8.2. Vietnam Debt Collection Software Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.8.3. Vietnam Debt Collection Software Market Size and Forecast, by Organization Size (2023-2030) 6.5.8.4. Vietnam Debt Collection Software Market Size and Forecast, by End Use Industry (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Debt Collection Software Market Size and Forecast, by Component (2023-2030) 6.5.9.2. Taiwan Debt Collection Software Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.9.3. Taiwan Debt Collection Software Market Size and Forecast, by Organization Size (2023-2030) 6.5.9.4. Taiwan Debt Collection Software Market Size and Forecast, by End Use Industry (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Debt Collection Software Market Size and Forecast, by Component (2023-2030) 6.5.10.2. Rest of Asia Pacific Debt Collection Software Market Size and Forecast, by Deployment Mode (2023-2030) 6.5.10.3. Rest of Asia Pacific Debt Collection Software Market Size and Forecast, by Organization Size (2023-2030) 6.5.10.4. Rest of Asia Pacific Debt Collection Software Market Size and Forecast, by End Use Industry (2023-2030) 7. Middle East and Africa Debt Collection Software Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Debt Collection Software Market Size and Forecast, by Component (2023-2030) 7.2. Middle East and Africa Debt Collection Software Market Size and Forecast, by Deployment Mode (2023-2030) 7.3. Middle East and Africa Debt Collection Software Market Size and Forecast, by Organization Size (2023-2030) 7.4. Middle East and Africa Debt Collection Software Market Size and Forecast, by End Use Industry (2023-2030) 7.5. Middle East and Africa Debt Collection Software Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Debt Collection Software Market Size and Forecast, by Component (2023-2030) 7.5.1.2. South Africa Debt Collection Software Market Size and Forecast, by Deployment Mode (2023-2030) 7.5.1.3. South Africa Debt Collection Software Market Size and Forecast, by Organization Size (2023-2030) 7.5.1.4. South Africa Debt Collection Software Market Size and Forecast, by End Use Industry (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Debt Collection Software Market Size and Forecast, by Component (2023-2030) 7.5.2.2. GCC Debt Collection Software Market Size and Forecast, by Deployment Mode (2023-2030) 7.5.2.3. GCC Debt Collection Software Market Size and Forecast, by Organization Size (2023-2030) 7.5.2.4. GCC Debt Collection Software Market Size and Forecast, by End Use Industry (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Debt Collection Software Market Size and Forecast, by Component (2023-2030) 7.5.3.2. Nigeria Debt Collection Software Market Size and Forecast, by Deployment Mode (2023-2030) 7.5.3.3. Nigeria Debt Collection Software Market Size and Forecast, by Organization Size (2023-2030) 7.5.3.4. Nigeria Debt Collection Software Market Size and Forecast, by End Use Industry (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Debt Collection Software Market Size and Forecast, by Component (2023-2030) 7.5.4.2. Rest of ME&A Debt Collection Software Market Size and Forecast, by Deployment Mode (2023-2030) 7.5.4.3. Rest of ME&A Debt Collection Software Market Size and Forecast, by Organization Size (2023-2030) 7.5.4.4. Rest of ME&A Debt Collection Software Market Size and Forecast, by End Use Industry (2023-2030) 8. South America Debt Collection Software Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Debt Collection Software Market Size and Forecast, by Component (2023-2030) 8.2. South America Debt Collection Software Market Size and Forecast, by Deployment Mode (2023-2030) 8.3. South America Debt Collection Software Market Size and Forecast, by Organization Size(2023-2030) 8.4. South America Debt Collection Software Market Size and Forecast, by End Use Industry (2023-2030) 8.5. South America Debt Collection Software Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Debt Collection Software Market Size and Forecast, by Component (2023-2030) 8.5.1.2. Brazil Debt Collection Software Market Size and Forecast, by Deployment Mode (2023-2030) 8.5.1.3. Brazil Debt Collection Software Market Size and Forecast, by Organization Size (2023-2030) 8.5.1.4. Brazil Debt Collection Software Market Size and Forecast, by End Use Industry (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Debt Collection Software Market Size and Forecast, by Component (2023-2030) 8.5.2.2. Argentina Debt Collection Software Market Size and Forecast, by Deployment Mode (2023-2030) 8.5.2.3. Argentina Debt Collection Software Market Size and Forecast, by Organization Size (2023-2030) 8.5.2.4. Argentina Debt Collection Software Market Size and Forecast, by End Use Industry (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Debt Collection Software Market Size and Forecast, by Component (2023-2030) 8.5.3.2. Rest Of South America Debt Collection Software Market Size and Forecast, by Deployment Mode (2023-2030) 8.5.3.3. Rest Of South America Debt Collection Software Market Size and Forecast, by Organization Size (2023-2030) 8.5.3.4. Rest Of South America Debt Collection Software Market Size and Forecast, by End Use Industry (2023-2030) 9. Global Debt Collection Software Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Debt Collection Software Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. FICO (Fair Isaac Corporation), San Jose, California, USA 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Experian, Dublin, Ireland 10.3. TransUnion, Chicago, Illinois, USA 10.4. Nortridge Software, Lake Forest, California, USA 10.5. Temenos, Geneva, Switzerland 10.6. Coface, Paris, France 10.7. CGI (Collections360), Montreal, Quebec, Canada 10.8. Quantrax Corporation, Miami, Florida, USA 10.9. TietoEVRY, Espoo, Finland 10.10. Chetu Inc., Plantation, Florida, USA 10.11. Ontario Systems, Muncie, Indiana, USA 10.12. Pegasystems Inc., Cambridge, Massachusetts, USA 10.13. Latitude Software, Jacksonville, Florida, USA 10.14. Indus Software Technologies, Bangalore, Karnataka, India 10.15. Intellect Design Arena, Chennai, Tamil Nadu, India 10.16. Katabat, Wilmington, Delaware, USA 10.17. D2r-Collect, Rennes, France 10.18. CSS Impact, Chicago, Illinois, USA 10.19. Applied Innovation Inc., Moline, Illinois, USA 10.20. Cforia Software, Westlake Village, California, USA 11. Key Findings 12. Industry Recommendations 13. Debt Collection Software Market: Research Methodology 14. Terms and Glossary