Data Center Transformation Market was valued at US$ 7.94 Bn in 2022. Global Data Center Transformation Market size is expected to grow at a CAGR of 13.5 % through the forecast period.Data Center Transformation Market Overview:

A data centre is a physical location where businesses keep their most important data and applications. A data center's layout is built on a network of computers and storage facilities that enable the supply of shared applications and data. The main elements of a data centre design include routers, switches, firewalls, storage devices, servers, and application delivery controllers. Data centre safety is crucial for the design of data centres as these components manage and store important company data and applications. Data centre components need significant infrastructures to support the center's hardware and software. These consist of backup generators, external network connections, ventilation, cooling systems, and continuous power supply (UPS).To know about the Research Methodology:-Request Free Sample Report The report provides the detailed information about the data center transformation market by Service Type (Consolidation Service Types, Optimization Service Types, Automation Service Types, Infrastructure Management Service Types), by tier type (Tier 1, Tier 2, Tier 3, Tier 4), by End-Use (IT & Telecom, BFSI, Healthcare, Energy, Manufacturing, Government, Others). 2022 is considered as a base year to forecast the market from 2023 to 2029. 2020’s market size is estimated on real numbers and outputs of the key players and major players across the globe. Past five years' trends are considered while forecasting the market through 2029. 2020 is a year of exception and analysis, especially with the impact of lockdown by region. COVID-19 Impact: As businesses try to expedite their digital transformation initiatives in order to remain viable and domestic customers have started living an ever-greater portion of their lives online, the market has noticed a large need for increase in data centre capacity. Due to the COVID-19 pandemic, the datacenter environment is constantly changing, and IT workers need to deal with a range of problems, such as ensuring security from hackers and managing a wide range of complicated workloads. Due to COVID-19, companies of all sizes, but particularly smaller ones, became aware of the costs associated with maintaining on-premise servers and began migrating to the cloud. Huge cloud servers and infrastructure have resulted from this. In the forecast period, it is expected to generate profitable prospects for the market for data centre transformation.

Data Center Transformation Market Dynamics:

Market Drivers: The market is driven by a variety of reasons, including increasing data centre traffic and rising investments in data centre technologies. Additionally, the need for data centres transformation is being fueled by the widely growing usage of cutting-edge technologies like big data analytics, cloud computing, and the internet of things across various companies as part of their digital transformation plan. Additionally, the market is growing as a result of an increase in demand for improved data centre efficiency brought on by the growth of the number of data centres and their growing dependability. The key element driving the expansion of the global data centre industry is the increasing significance of e-commerce databases. Data centres are used by e-commerce businesses to store and transmit these data sets for a variety of organizational tasks like branding, promotions, etc. Through the acquisition of e-commerce data, online retailers monitor all the many components of their e-commerce, such as analytics or customer information. It is also expected that rising digital transformation in emerging nations fuels data centre market growth. As a result, emerging economies like China and India are significantly contributing to the growth of the market for data centres. Since technology is advancing, effective data centres and related solutions are being created throughout this phase of digital transformation. Market Restraints: The market's growth is hampered by a lack of skilled workers and issues with regulatory and portability compliance. Customer control over the management of utilities, physical security, building maintenance, and other physical components is not available because colos are handled by a different entity. Location is beyond control, provider fully administers their data centres using the public cloud, taking care of equipment maintenance and upgrades. As a result, all these factors are hampering the growth of the data center transformation market. Market Opportunities: As more organizations switch to SaaS-based products and the number of connected devices rises swiftly, data centre traffic is growing. Customers utilize popular services like social networking, streaming video, and Internet search more frequently. On the other side, business users are embracing enterprise resource planning (ERP), analytics, collaboration, and other digital enterprise technologies. The reasons given boost the data centre transformation industry, which in turn creates new demands for data centres. Competative Landscape: There are a lot of competitors in the market for data centre transformation. To make the integration of software for businesses simple and user-friendly, the players are investing in research and development operations. The players are utilizing cutting-edge tactics to increase their market growth. In the end, these actions help the market for data centre transformation to grow. The path of growth for the data centre transformation market as a whole includes strategic collaborations. To increase their market presence, the players are concentrating on entering into mergers, acquisitions, joint ventures, and partnerships. Cisco Systems, IBM Corporation, Microsoft Corporation, Schneider Electric SE, and Dell EMC are a few well-established companies in the data centre transformation market.Data Center Transformation Market Segment Analysis:

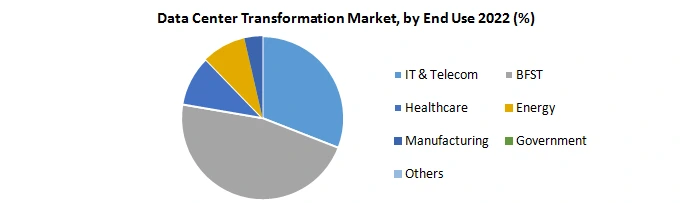

Based on Service Type, The Automation service segment is expected to grow at the highest CAGR during the forecast period. With the most recent developments in the fields of AI, IoT, and data analytics, digital transformation has gained traction in the automobile industry over the past 20 years. The automation services in the data center transformation market provides benefits such as , developing new services or enterprises with digital capabilities, customer-focused product design, improvement of supply chains, being more productive (i.e. decreasing operational costs), and enhancing quality management.Based on Tier Type, the tier 4 segment is expected to grow with the highest CAGR during the forecast period. The tier 4 infrastructures have a high level of acceptance for data centre transformation solutions because of their complexity. There is a considerable demand for transformation services that help data centres in tier 4 to optimise their operations because these facilities have the most complicated and redundant components. Tier 4 data centres have extraordinarily complex infrastructures since they have several active power and cooling routes. There is a considerable demand for effective IT transformation services since the operators have difficulties in updating and improving these infrastructures. This fuels market growth. Based on End-Use, the IT & Telecom segment is expected to grow with the highest CAGR during the forecast period. The requirement for reliable IT infrastructures that handle the soaring amounts of data increase as a result of the developing IT and telecom infrastructure. The amount of data gathered has sharply increased as internet-enabled devices become more widely used by the population. More individuals use digital services as 5G technology becomes available and guarantees fast data streaming speeds. This has prompted telecom and IT service providers to employ cutting-edge solutions for the effective transit and storage of data. Data centre transformation market value will be boosted by IT and telecom companies' focus on modernising their current data centres.

Data Center Transformation Market Regional Insights:

The North America region dominated the market with xx % share in 2021. The North America region is expected to witness significant growth at a CAGR of xx% through the forecast period. The majority of the cloud and internet data centres are located in the North American continent, according to CNNIC. This large percentage is a result of the fact that many significant companies have their headquarters in the North America. The demand for data centres across a range of end-user industries, including IT, BFSI, retail, and healthcare, is also largely driven by North America. The federal government's Data Center Optimization Initiative (DCOI) principally aims to encourage data centre stakeholders to consolidate the underperforming infrastructure, optimise current facilities, realise cost savings, and make the switch to a more effective infrastructure. The objective of the report is to present a comprehensive analysis of the Global Data Center Transformation Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Data Center Transformation Market dynamic, and structure by analyzing the market segments and projecting the Data Center Transformation Market size. Clear representation of competitive analysis of key players by Vehicle type, price, financial position, product portfolio, growth strategies, and regional presence in the Data Center Transformation Market make the report investor’s guide.Data Center Transformation Market Scope: Inquire before buying

Global Data Center Transformation Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2021: US$ 7.94 Bn. Forecast Period 2023 to 2029 CAGR: 13.5% Market Size in 2029: US$ 19.28 Bn. Segments Covered: by Service Type Automation Service Types Optimization Service Types Consolidation Service Types Infrastructure Management Service Types by Tier Type Tier 1 Tier 2 Tier 3 Tier 4 by End-Use IT & Telecom BFSI Healthcare Energy Manufacturing Government Others Data Center Transformation Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Data Center Transformation Market Key Players

1. Micro Focus (UK) 2. Dell EMC (US) 3. IBM (US) 4. Atos (France) 5. Cisco Systems (US) 6. DynTek (US) 7. Schneider Electric (France) 8. NTT Communications (Japan) 9. Microsoft (US) 10.Bytes Technology Group (South Africa) 11.Tech Mahindra (India) 12.HCL Technologies (India) 13.Performance Technologies (Greece) 14.Rahi Systems (US) 15.Inknowtech (India) 16.GreenPages (US) 17.General Datatech (US) 18.Mindteck (India) 19.Accenture (Ireland) 20.Wipro (India) 21.SoftChoice (Canada) 22.Hitachi (Japan) 23.Cognizant (US) 24.NetApp (US) 25.Insight Enterprise (US). Frequently Asked Questions: 1] What segments are covered in the Global Data Center Transformation Market report? Ans. The segments covered in the Data Center Transformation Market report are based on Service Type, Tier Type and End-User. 2] Which region is expected to hold the highest share in the Global Data Center Transformation Market? Ans. The North America region is expected to hold the highest share in the Data Center Transformation Market. 3] What is the market size of the Global Data Center Transformation Market by 2029? Ans. The market size of the Data Center Transformation Market by 2029 is expected to reach US$ 19.28 Bn. 4] What is the forecast period for the Global Data Center Transformation Market? Ans. The forecast period for the Data Center Transformation Market is 2023-2029. 5] What was the market size of the Global Data Center Transformation Market in 2022? Ans. The market size of the Data Center Transformation Market in 2022 was valued at US$ 7.94 Bn.

1. Data Center Transformation Market: Research Methodology 2. Data Center Transformation Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Data Center Transformation Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Data Center Transformation Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Data Center Transformation Market Segmentation 4.1 Data Center Transformation Market, by Service Type (2022-2029) • Consolidation Services • Optimization Services • Automation Services • Infrastructure Management Services 4.2 Data Center Transformation Market, by Tier Type (2022-2029) • Tier 1 • Tier 2 • Tier 3 • Tier 4 4.3 Data Center Transformation Market, by End-Use (2022-2029) • IT & Telecom • BFSI • Healthcare • Energy • Manufacturing • Government • Others 5. North America Almond Flour Market (2022-2029) 5.1 North America Almond Flour Market, by Service Type (2022-2029) • Consolidation Services • Optimization Services • Automation Services • Infrastructure Management Services 5.2 North America Almond Flour Market, by Tier Type (2022-2029) • Tier 1 • Tier 2 • Tier 3 • Tier 4 5.3 North America Almond Flour Market, by End-Use (2022-2029) • IT & Telecom • BFSI • Healthcare • Energy • Manufacturing • Government • Others 5.4 North America Almond Flour Market, by Country (2022-2029) • United States • Canada • Mexico 6. Europe Almond Flour Market (2022-2029) 6.1. European Almond Flour Market, by Service Type (2022-2029) 6.2. European Almond Flour Market, by Tier Type (2022-2029) 6.3. European Almond Flour Market, by End-Use (2022-2029) 6.4. European Almond Flour Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Almond Flour Market (2022-2029) 7.1. Asia Pacific Almond Flour Market, by Service Type (2022-2029) 7.2. Asia Pacific Almond Flour Market, by Tier Type (2022-2029) 7.3. Asia Pacific Almond Flour Market, by End-Use (2022-2029) 7.4. Asia Pacific Almond Flour Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Almond Flour Market (2022-2029) 8.1 Middle East and Africa Almond Flour Market, by Service Type (2022-2029) 8.2. Middle East and Africa Almond Flour Market, by Tier Type (2022-2029) 8.3. Middle East and Africa Almond Flour Market, by End-Use (2022-2029) 8.4. Middle East and Africa Almond Flour Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Almond Flour Market (2022-2029) 9.1. South America Almond Flour Market, by Service Type (2022-2029) 9.2. South America Almond Flour Market, by Tier Type (2022-2029) 9.3. South America Almond Flour Market, by End-Use (2022-2029) 9.4 South America Almond Flour Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. Micro Focus (UK). 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Dell EMC (US) 10.3.IBM (US) 10.4. Atos (France) 10.5. Cisco Systems (US) 10.6. DynTek (US) 10.7. Schneider Electric (France) 10.8.NTT Communications (Japan) 10.9. Microsoft (US) 10.10. Bytes Technology Group (South Africa) 10.11. Tech Mahindra (India) 10.12.HCL Technologies (India) 10.13. Performance Technologies (Greece) 10.14. Rahi Systems (US) 10.15. Inknowtech (India) 10.16. GreenPages (US) 10.17. General Datatech (US) 10.18. Mindteck (India) 10.19. Accenture (Ireland) 10.20. Wipro (India) 10.21. SoftChoice (Canada) 10.22. Hitachi (Japan) 10.23. Cognizant (US) 10.24. NetApp (US) 10.25. Insight Enterprise (US).