Global Dark Store Market size was valued at USD 42.13 Mn. in 2022 and the total Dark Store revenue is expected to grow by 38.7 % from 2023 to 2029, reaching nearly USD 416 Mn.Dark Store Market Overview:

A dark store, also known as a dark supermarket, or dotcom center, pertains to a retail establishment or distribution center specifically designed for online shopping purposes, has seen substantial growth in recent years due to the rising popularity of online shopping and the need for efficient last-mile delivery solutions. These specialized warehouses are dedicated to fulfilling online orders, improving order fulfillment processes, reducing delivery times, and enhancing customer satisfaction across various industries like groceries, electronics, and apparel. The concept gained prominence during the COVID-19 pandemic as lockdowns and restrictions drove a surge in online shopping, leading consumers to rely on dark stores for fast delivery and convenient experiences. The e-commerce sector experienced a significant boost during the pandemic, with a 43% increase in e-commerce reported by the U.S. Census Bureau. Dark stores played a crucial role in delivering groceries and essential items, streamlining order fulfillment and shipping processes. Well-known supermarket chains globally have been exploring dark store models, with sizes varying from large-scale warehouses equipped with specialized equipment to smaller locations spanning 10,000 to 20,000 square feet. These stores operate in different formats, resembling traditional retail spaces with aisles and shelves but without promotional displays or resembling warehouses with varying degrees of automation. The demand for home delivery, particularly during the pandemic, has significantly contributed to the success of dark stores, offering fast and contactless delivery suitable for groceries and essentials. Major players in the dark store market include industry are Amazon, Walmart, Instacart, and Ocado, who have made significant advancements in e-commerce, logistics, and technology to optimize order fulfillment capabilities and enhance customer experiences. Overall, the dark store market has emerged as a disruptive force in the retail industry, meeting the growing demand for e-commerce and same-day delivery services while providing retailers with the tools to optimize operations and exceed customer expectations. Dark Store Market Scope and Research Methodology The Dark Store Market report is a withal representation of innovation, policy support, increased competition, and environmental concerns by global and local players holding Dark Store Market in different countries. The report covered Market structure by comparative analysis of key players, and market followers, which makes this report insightful to the Renewable Energy Policy outlook. The Dark Store Market report aims to outlook the market size based on segments, regional distribution and industry competition. The bottom-up approach has been used to estimate and forecast market size and market growth. The report provides a detailed examination of the key players in the dark store industry, including revenue. The report covers the global, regional and local level analysis of the Dark Store Market with the factors restraining, driving and challenging the market growth during the forecast period.To know about the Research Methodology :- Request Free Sample Report

Dark Store Market Dynamics:

Dark Store Market Drivers Growing Popularity of Online Shopping Drives the Market Growth One of the key market drivers for dark stores is the increasing penetration of e-commerce. The growing popularity of online shopping has led to higher order volumes, creating a need for efficient order fulfillment solutions such as dark stores. Additionally, rapid urbanization and changing consumer preferences contribute to the demand for dark stores. Urban consumers, with their busy lifestyles, seek convenience and fast delivery options, making dark stores an ideal solution. The strategic placement of dark stores in urban areas enables retailers to offer enhanced last-mile delivery, resulting in improved customer satisfaction. The Impact of the COVID-19 pandemic has accelerated the shift towards online shopping, driving the adoption of dark store models to meet the surge in demand and ensure business continuity. The pandemic has also highlighted the need for quick and contact-free shopping experiences, which dark stores provide. They offer the convenience of online shopping with the advantage of fast product delivery while maintaining safety and social distancing measures. Dark stores also help retailers manage inventory control effectively, particularly within the same geographic region. With their customer-free warehouses, dark stores allow for better inventory management to handle larger order volumes. The benefits of quick shopping, faster delivery, broader reach, and improved inventory control contribute to the market drive for dark stores. Dark Store Market Restraint Higher Transportation Costs Hinders the Market Growth A significant restraint faced by the dark store market is the challenge of managing perishable products. Perishability poses various challenges, including the need to keep expired products separate, prevent liquid leaks, and ensure airtight containers remain sealed during delivery. The location of the dark store is also crucial in ensuring orderly product placement and easy accessibility. Longer home delivery routes and the requirement to bring click-and-collect purchases back to the shops, incurring additional handling expenses, result in significantly higher transportation costs for retailers. The dark store market faces the constraint of high initial investment. The establishment of dark stores requires substantial capital investment in infrastructure, automation technologies, and inventory management systems, which may deter some retailers from entering the market. Operational complexities are another restraint, as operating dark stores necessitates efficient inventory management, streamlined order processing, and optimized workforce allocation, which can be complex and resource-intensive. Additionally, the limited scalability of dark stores is a challenge, as their smaller size compared to traditional retail stores restricts their capacity to handle large order volumes during peak periods. Regulatory constraints also come into play, as dark stores must adhere to local regulations and zoning laws, which may impose limitations on their establishment or location. The management of perishable products, high initial investment, operational complexities, limited scalability, and regulatory constraints act as restraints in the dark store market. Dark Store Market Opportunity Partnerships and Collaborations in the Dark Store Market Offer Significant Partnerships and collaborations in the dark store market offer significant opportunities for growth and success. By teaming up with other companies, dark stores can capitalize on their respective strengths, expand their market reach, and enhance their service offerings. Collaborations enable dark stores to overcome challenges, tap into new customer segments, and foster competitiveness in the market. One area of opportunity lies in partnerships between traditional retailers and technology companies. Traditional retailers can collaborate with e-commerce platforms, order management system providers, or automation technology specialists to optimize their operations and bolster their online presence. For instance, a supermarket chain could partner with a logistics technology provider to streamline order fulfillment, inventory management, and last-mile delivery. This collaboration empowers the supermarket chain to leverage advanced technology solutions and provide efficient and convenient online shopping experiences to their customers. Collaboration between dark stores and third-party delivery providers offers promising growth opportunity to market. Dark stores can join forces with established delivery service companies such as Instacart or Door Dash to expand their delivery capabilities and reach a wider customer base. Such partnerships allow dark stores to tap into the existing infrastructure and expertise of delivery providers, ensuring swift and reliable deliveries. By teaming up with third-party delivery companies, dark stores can enhance their logistics capabilities without the need for substantial investments in their own delivery fleet. These partnerships and collaborations in the dark store market create avenues for innovation, market expansion, and operational efficiency. By leveraging the strengths and resources of each partner, companies can forge synergies that drive growth and elevate the overall customer experience in the online retail landscape.Dark Store Market Segment Analysis:

Based on delivery option, The Home Delivery segment dominated the market in 2022 and is expected to continue its dominance during the forecast period as it is very convenient option for users. Curbside Pickup allows customers to conveniently collect their orders from designated parking spaces, where store representatives bring the purchases directly to their vehicles without the need to leave the car. In-Store Pickup is another option available within many dark stores, providing customers with a dedicated pickup location near the front entrance. Home Delivery, on the other hand, offers a rapid, easy, and contactless delivery option, particularly beneficial for customers seeking essential items. The COVID-19 pandemic has significantly influenced consumer behavior, leading many individuals to prioritize personal safety and space. Online grocery shopping has gained popularity, with customers preferring contactless methods such as curbside pickup and home delivery. Among the various distribution channels, curbside pickup highly growing segment in the market, accounting for approximately 40% of the market share in 2022. This option ensures that customers can retrieve their orders conveniently while remaining protected during the ongoing pandemic and beyond, offering a suitable solution for their grocery needs.Based on Service Type, the dark store market is segmented into Business-to-Business (B2B) and Business-to-Consumer (B2C) categories. In the B2B segment, dark stores cater to other businesses by providing them with efficient order fulfillment solutions. This includes supplying inventory to retailers, wholesalers, and even restaurants or cafes that may require a steady and timely supply of products. Dark stores offer B2B customers the advantage of streamlined operations, optimized inventory management, and reliable delivery services, enabling them to meet the demands of their own customers effectively. On the other hand, the B2C segment focuses on serving individual consumers directly. Dark stores offer online platforms or mobile applications where consumers can browse and select products, and then have them delivered to their doorstep or choose the option of curbside pickup. This segment has witnessed significant growth, particularly during the COVID-19 pandemic, as more consumers turned to online shopping for convenience and safety. Dark stores in the B2C segment provide consumers with a wide range of products, quick delivery options, and enhanced shopping experiences. By targeting both B2B and B2C segments, dark stores are able to diversify their customer base and capture opportunities in both the business and consumer markets, offering tailored solutions to meet the unique requirements of each segment.

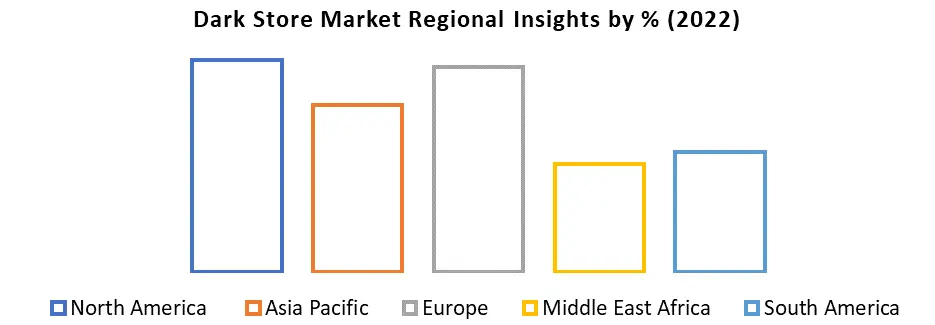

Dark Store Market Regional Insights:

North America and Europe dominate the market, driven by their well-established e-commerce ecosystems and the presence of major players like Amazon and Walmart. The dark store market displays regional variations influenced by factors such as e-commerce adoption, consumer behavior, and logistics infrastructure. The COVID-19 pandemic has accelerated the demand for dark stores in North America, with supermarket chains like Kroger and Albertsons expanding their online operations to meet the surge in online orders. In Europe, countries such as the U.K., Germany, and France have witnessed a rapid shift towards online grocery shopping, leading to the establishment of numerous dark stores. Ocado, a UK-based online grocery retailer, stands as an example of innovation in this region, leveraging automated dark stores for efficient order fulfillment. Asia Pacific holds significant growth potential, driven by expanding urban populations, increasing disposable incomes, and growing internet penetration. China, Japan, and India have experienced a significant rise in online shopping and changing consumer preferences, prompting companies like JD.com to set up dark stores for same-day delivery. South America and the Middle East are also witnessing the emergence of dark stores as online shopping gains traction, with companies like MercadoLibre investing in dark store infrastructure to enhance order fulfillment and expand their market reach. As the global market continues to evolve, regional developments in the dark store industry will play a crucial role in shaping its future.

Competitive Landscape:

The dark store market is highly competitive, with established players and startups vying for market share. Key players in the market include industry giants Amazon, Walmart, Instacart, and Ocado, as well as Kroger. These companies are actively expanding their dark store networks, investing in automation technologies, and enhancing their delivery capabilities to stay ahead of the competition. Amazon, known globally for its e-commerce dominance, has been a frontrunner in the dark store market with its Amazon Fresh and Amazon Prime Now services. The company has made significant investments in dark store infrastructure and automation to streamline operations and offer efficient deliveries. While Walmart, a major retail chain on a global scale, has also embraced the dark store concept. It is expanding its grocery delivery services and leveraging dark stores to optimize order fulfillment and reduce delivery times. These players, along with other market players, are constantly innovating to enhance the customer experience and maintain their market position. The competition in the dark store market is fierce, driving continuous advancements in technology, logistics, and operational efficiency. As the market evolves, we can expect to see further competition and strategic moves from both established players and emerging startups seeking to establish their presence in this rapidly growing sector.Dark Store Market Scope: Inquire before buying

Global Dark Store Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 42.13 Mn. Forecast Period 2023 to 2029 CAGR: 38.7 % Market Size in 2029: US $ 416 Mn. Segments Covered: by Product B2B B2C by Product Apparel Electronics Food Grocery Household Goods Pharmacy by Delivery Options Curbside Pickup Home Delivery In-Store Pickup by Operational Scale Small Independent Stores Larger Chains Or Franchises Dark Store Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Dark Store Market Key Players

1. Albertsons 2. Amazon.com, Inc. 3. Auchan 4. DoorDash 5. Dunzo Daily 6. Flipkart 7. FreshDirect 8. Grab 9. Instacart 10. JD.com 11. Kroger 12. Ocado 13. Ola Foods 14. Swiggy 15. Target Brands, Inc 16. Tesco 17. Uber 18. Walmart, Inc. 19. Wolt Frequently Asked Questions: 1] What segments are covered in the Global Dark Store Market report? Ans. The segments covered in the Dark Store Market report are based on Service Type, Product, Delivery Options, Operational Scale, and Region. 2] Which region is expected to hold the highest share of the Global Dark Store Market? Ans. The North America region is expected to hold the highest share of the Dark Store Market. 3] What is the market size of the Global Dark Store Market by 2029? Ans. The market size of the Dark Store Market by 2029 is expected to reach US$ 416 Mn. 4] What is the forecast period for the Global Dark Store Market? Ans. The forecast period for the Dark Store Market is 2022-2029. 5] What was the market size of the Global Dark Store Market in 2022? Ans. The market size of the Dark Store Market in 2022 was valued at US$ 42.13 Mn.

Table of Content: 1. Dark Store Market: Research Methodology 2. Dark Store Market: Executive Summary 3. Dark Store Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Dark Store Market: Dynamics 4.1. Market Trends by region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Dark Store Market: Segmentation (by Value USD and Volume Units) 5.1. Dark Store Market, by Service Type (2022-2029) 5.1.1. B2B 5.1.2. B2C 5.2. Dark Store Market, by Product (2022-2029) 5.2.1. Apparel 5.2.2. Electronics 5.2.3. Food 5.2.4. Grocery 5.2.5. Household Goods 5.2.6. Pharmacy 5.3. Dark Store Market, by Delivery Options (2022-2029) 5.3.1. Curbside Pickup 5.3.2. Home Delivery 5.3.3. In-Store Pickup 5.4. Dark Store Market, by Operational Scale (2022-2029) 5.4.1. Small Independent Stores 5.4.2. Larger Chains or Franchises 5.5. Dark Store Market, by region (2022-2029) 5.5.1. North America 5.5.2. Europe 5.5.3. Asia Pacific 5.5.4. Middle East and Africa 5.5.5. South America 6. North America Dark Store Market (by Value USD and Volume Units) 6.1. North America Dark Store Market, by Service Type (2022-2029) 6.1.1. B2B 6.1.2. B2C 6.2. North America Dark Store Market, by Product (2022-2029) 6.2.1. Apparel 6.2.2. Electronics 6.2.3. Food 6.2.4. Grocery 6.2.5. Household Goods 6.2.6. Pharmacy 6.3. North America Dark Store Market, by Delivery Options (2022-2029) 6.3.1. Curbside Pickup 6.3.2. Home Delivery 6.3.3. In-Store Pickup 6.4. North America Dark Store Market, by Operational Scale (2022-2029) 6.4.1. Small Independent Stores 6.4.2. Larger Chains Or Franchises 6.5. North America Dark Store Market, by Country (2022-2029) 6.5.1. United States 6.5.2. Canada 6.5.3. Mexico 7. Europe Dark Store Market (by Value USD and Volume Units) 7.1. Europe Dark Store Market, by Type (2022-2029) 7.2. Europe Dark Store Market, by Length (2022-2029) 7.3. Europe Dark Store Market, by Gauge (2022-2029) 7.4. Europe Dark Store Market, by End-Users (2022-2029) 7.5. Europe Dark Store Market, by Country (2022-2029) 7.5.1. UK 7.5.2. France 7.5.3. Germany 7.5.4. Italy 7.5.5. Spain 7.5.6. Sweden 7.5.7. Austria 7.5.8. Rest of Europe 8. Asia Pacific Dark Store Market (by Value USD and Volume Units) 8.1. Asia Pacific Dark Store Market, by Type (2022-2029) 8.2. Asia Pacific Dark Store Market, by Length (2022-2029) 8.3. Asia Pacific Dark Store Market, by Gauge (2022-2029) 8.4. Asia Pacific Dark Store Market, by End-Users (2022-2029) 8.5. Asia Pacific Dark Store Market, by Country (2022-2029) 8.5.1. China 8.5.2. S Korea 8.5.3. Japan 8.5.4. India 8.5.5. Australia 8.5.6. Indonesia 8.5.7. Malaysia 8.5.8. Vietnam 8.5.9. Taiwan 8.5.10. Bangladesh 8.5.11. Pakistan 8.5.12. Rest of Asia Pacific 9. Middle East and Africa Dark Store Market (by Value USD and Volume Units) 9.1. Middle East and Africa Dark Store Market, by Type (2022-2029) 9.2. Middle East and Africa Dark Store Market, by Length (2022-2029) 9.3. Middle East and Africa Dark Store Market, by Gauge (2022-2029) 9.4. Middle East and Africa Dark Store Market, by End-Users (2022-2029) 9.5. Middle East and Africa Dark Store Market, by Country (2022-2029) 9.5.1. South Africa 9.5.2. GCC 9.5.3. Egypt 9.5.4. Nigeria 9.5.5. Rest of ME&A 10. South America Dark Store Market (by Value USD and Volume Units) 10.1. South America Dark Store Market, by Type (2022-2029) 10.2. South America Dark Store Market, by Length (2022-2029) 10.3. South America Dark Store Market, by Gauge (2022-2029) 10.4. South America Dark Store Market, by End-Users (2022-2029) 10.5. South America Dark Store Market, by Country (2022-2029) 10.5.1. Brazil 10.5.2. Argentina 10.5.3. Rest of South America 11. Company Profile: Key players 11.1. Albertsons 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Amazon.com, Inc. 11.3. Auchan 11.4. DoorDash 11.5. Dunzo Daily 11.6. Flipkart 11.7. FreshDirect 11.8. Grab 11.9. Instacart 11.10. JD.com 11.11. Kroger 11.12. Ocado 11.13. Ola Foods 11.14. Swiggy 11.15. Target Brands, Inc 11.16. Tesco 11.17. Uber 11.18. Walmart, Inc. 11.19. Wolt 12. Key Findings 13. Length Recommendation