Cyber Security in BFSI Market was valued at USD 47.39 Billion in 2022, and it is expected to reach USD 195.06 Billion by 2029, exhibiting a CAGR of 22.4 % during the forecast period (2023-2029).Cyber Security in BFSI Market Overview and Dynamics:

The BFSI (Banking, Financial Services, and Insurance) sector have aggressively transformed themselves & leveraged technology to meet the developing requirements of their customers. From keeping paper records to providing a range of digital services including online shopping, premium payments, etc. While the customer experience and financial results of this digital transformation have improved, the BFSI sector's security worries have also grown. The industry is the target of various attacks that aim to steal money and harm the reputation of the brand, including phishing attacks, denial-of-service attacks, spear-phishing, ransomware, malware attacks, etc. To prevent these attacks, governments and regulatory agencies all over the world have placed a strong emphasis on technology and stringent security standards.To know about the Research Methodology :- Request Free Sample Report Global cybercrime costs will reach $6 trillion in 2022 according to Cybersecurity Ventures. The Cyber Security in BFSI Market has seen a digital redesign in its varied operations and processes as a result of the epidemic. As a result, the banks and payment businesses have become the preferred target of the limitless hordes of extremely knowledgeable and technologically advanced cyber miscreants who employ the most recent technologies. Cyber Security in BFSI Market: Current Cybersecurity Scenario in Banks The BFSI industry experienced nearly 26% of these cybersecurity incidents, compared to the Software and Technology Services (7%), Healthcare (11%) and Retail (6%).

The volume of cyber-attacks is rapidly rising, demonstrating how crucial cybersecurity is today for banks. Cyber-attacks can be exceedingly expensive to deal with, especially for tiny financial institutions and credit unions that lack the resources to survive. These financial firms might also have their reputations severely damaged. Financial institutions are vulnerable to a variety of cyberthreats that can be mitigated by employing strong cybersecurity measures. Rising Number of Cyber Data Breaches: The BFSI industry is one of the critical organization segments that suffers numerous data breaches and cyber-attacks, because of the large customer base that the industry serves and the financial data that is at stake. The demand for such solutions is expected to increase because financial service firms have been four times more vulnerable to cyberattacks than businesses in other sectors. Growing economies offer BFSI safety a lot of room to grow and diversify its products. Additionally, it is expected that the increasing availability of the internet in the Cyber Security in BFSI Market and the utilisation of digitalized systems via the internet would present growth opportunities. The adoption of connected devices that allow for convenient and secure financial transactions is being sparked by the increasing internet penetration in developing countries, which is encouraging the banking, financial services, and insurance security market to implement threat management systems for protecting payment gateways.

Cyber Security in BFSI Market Trends:

Innovative Blockchain Systems: Most financial institution has a centralised system to house its massive customer database and transaction records. This centralised data is vulnerable to hacking attacks, corruption, and theft. Blockchain technology may offer a decentralised, tamper-proof answer for the cyber security in BFSI market security concerns. Records in blockchain-based decentralised ledgers cannot be altered since they are immutable. The network enables an append-only ledger of records that are added to the chain and stores each transaction as historical data. This makes it simpler and safer to transmit information among the various parties involved by keeping customer information and transaction records on a decentralised network. Regulatory Technologies: The digital revolution has given people many comforts, eases of conducting business, and conveniences, however it has also introduced certain potential hazards like data breaches, cyber intrusions, and fraudulent transactions. Because of this, governments have been forced to impose stricter controls on the financial sector, and the cost of doing so has been rising daily. Regulatory technologies, often known as Regtech, were developed to address the problems driven on by a technology-driven economy. Regtech offers to assist financial institutions with the time-consuming duty of monitoring the massive volume of financial transactions that take place online and discovering any problems or irregularities. A collection of businesses known as "regtech" supports the financial services sector by utilising cutting-edge technology like artificial intelligence (AI), machine learning, and big data to not only minimise regulatory risks but also compliance costs and boost client confidence. AI-Powered Cybersecurity: Thousands of events take place in any large financial services company every second, which is often where cybercriminals try to breach security and launch an attack. This is where artificial intelligence (AI) can be useful in preventing cybercrime by spotting patterns of behaviour that would indicate something unusual is happening. Nearly three-quarters of firms are utilising or testing AI for the goal of identifying and thwarting cybersecurity threats. Financial institutions are increasingly coming to the conclusion that AI-powered cybersecurity offers the best value when it comes to managing large amounts of information and transactions. Current Trends in Cybersecurity In The Financial Services Sector: A significant trend we see for the future is the use of artificial intelligence to avoid fraud. Based on the results of an investigation, fraud detection AI systems analyse company and customer data to identify client risks and weaknesses. Another aspect is the increasing reliability of block chain systems, which contain security features that make system hacking more challenging. Zero-trust adoption has also elevated in importance among companies. This methodology can locate valuable resources and information on a network while also securing data beyond the scope of current cybersecurity measures. BFSI organisations are increasingly switching to superior cloud management software solutions to carry out their digital transformation strategy and embrace cloud-based tools and services.Cyber Security in BFSI Market Threats:

Ransomware: For many years, ransomware has been a significant problem among the different cybersecurity concerns. A type of cybercrime known as ransomware encrypts files, locks out users, and then demands money in exchange for access to the system. Social engineering, in which people are tricked into divulging vital information and credentials, is one issue. A common attack that falls into this category is phishing. Given that ransomware has affected 90% of banking institutions in the last year, it poses a severe threat to them. In addition to posing a threat to bank cybersecurity, ransomware also threatens cryptocurrencies. Cryptocurrencies give attackers a chance to get into trading systems and steal money because of their decentralised nature.Credential Fabrication: Credential-stuffing attacks are one of the most common reasons for data breaches because 65% of users reuse the same password across several (and possibly all) accounts. The opportunity for cybercriminals to exploit credential stuffing grows as more credentials are made public as a result of breaches; at the moment, there are literally billions of compromised credentials available on the dark web.

Cyber Security in BFSI Market Segment Analysis:

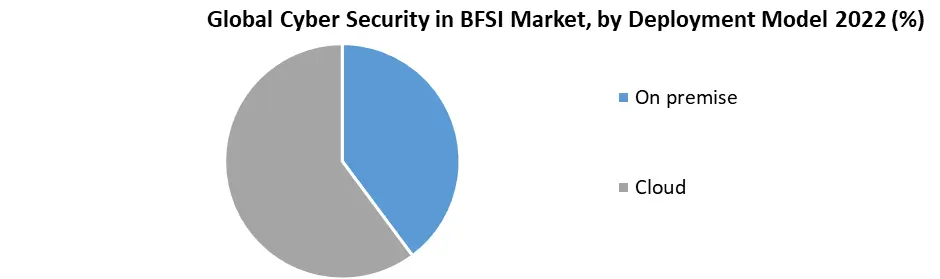

Component Segment Overview, solution segment is estimated to account for over 58% of the total market share in 2022. This growth is attributed to increase in need for security and management services to increase banking operations. On the flip side, the services segment is projected to witness the fastest CAGR of 23% during forecast period, thanks to the rise in the demand for data breach detection service to detect the cloud data breach in the Cyber Security in BFSI Market. Deployment Model Segment Overview, cloud segment is projected to maintain dominance in terms of revenue and witness the fastest CAGR of 22.8% from 2023 to 2029. This growth is driven by the increase in need for scalable and agile solutions to track and provide data access to cloud users, as well as the rising use of mobile devices. However, the on-premise segment held the largest market share in 2022, thanks to the increased need for securing critical data in on-premise data centres from cyberattacks & monitor the influx of data within the organization.

Cyber Security in BFSI Market Regional Insights:

Geographically, in 2022, North America commanded the largest share of the Cyber Security in BFSI Market globally. Owing to the region's reliance on digital payments, North America, and specifically the United States, is one of the greatest markets for BFSI security. Because of various government initiatives in the country that demand the need for stronger security solutions, the region is also expected to have significant growth. The BFSI industry in the USA has seen a considerable uptake of cybersecurity platforms. Leading financial institutions across the country, including Citi Bank, JP Morgan Chase, and Bank of America, have put sophisticated cybersecurity systems in place to provide round-the-clock defence against cybercriminals. Financial organisations are now more likely to use threat management systems to safeguard their digital assets and consumer data as a result of digitization. Payment information, bank account information, and credit or debit card information are examples of sensitive consumer information. The number of breaches recorded in the United States climbed by 10% in 2022, from 2,645 to 2,932, accounting for 12.5% of all data breaches, according to the 2022 Year-ended Security report. Because there is so much sensitive data in the banking sector, especially in banks using SWIFT architecture, it is a top target for hackers. Asia-Pacific region is expected to hold the largest growth rate during 2022 to 2029 thanks to the growing adoption of advanced banking solutions in Japan, India, China, and Australia. The regional market is also being driven by the increased digitalization of BFSI companies to offer online financial services. Financial organisations are now more likely to use threat management systems to safeguard their digital assets and consumer data as a result of digitization. Payment information, bank account information, and credit or debit card information are examples of sensitive consumer information. Customers in the area are now able to pay for meals, transportation, and recreational activities online thanks to the arrival of fintech services. The increasing use of mobile payments in developing countries like China and India has further compelled banks to implement a strong threat management system to prevent financial data breaches. The region's adoption of BFSI security solutions has been prompted by the growing need to secure data from hackers.Cyber Security in BFSI Market Competitive Landscape:

The competitive landscape section in the Cyber Security in BFSI Market offers a deep dive into the profiles of the leading companies operating in the global market landscape. It offers captivating insights on the key developments, differential strategies, and other crucial aspects about the key players having a stronghold in the Cyber Security in BFSI Market. Such as, In June 2022, McAfee and Visa announced a new agreement via which Visa financial institution partners in North America and EMEA would be able to provide Visa Business cardholders with award-winning internet security. Holders of Visa Business cards get access to McAfee subscription services that offer mobile VPN, protect devices from malware and other online hazards, provide browser and firewall protection, and protect sensitive data sent over email. The objective of the Cyber Security in BFSI Market report is to give a comprehensive analysis of the integration of Cyber Security in BFSI Sector across the Five Main Region like North America, Europe, Asia Pacific, Middle East and Africa and South America. The report has presented the current status of the banking and financial industry with the forecasted market size and trends. The report covers dynamic aspects of the various industry with a dedicated study of key players that include market leaders, followers, and new entrants. The reports also help in understanding the Cyber Security in BFSI Market dynamic, structure by analysing the market segments and projecting the Cyber Security in BFSI Market size. Clear representation of competitive analysis of key players by segment type and regional presence in the Cyber Security in BFSI Market make the report investor’s guide.Scope of the Cyber Security in BFSI Market Report: Inquiry Before Buying

Cyber Security in BFSI Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US 47.39 Bn. Forecast Period 2023 to 2029 CAGR: 22.4 % Market Size in 2029: US 195.54 Bn. Segments Covered: by Componentt 1. Solution 2. Services by Deployment Model 1. On premise 2. Cloud by Enterprise Size 1. Large Enterprise 2. SMEs Cyber Security in BFSI Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Cyber Security in BFSI Market, Key Players are:

1. Cisco Systems (US) 2.IBM Corporation (US) 3. Microsoft Corporation (US) 4. DXC Technology (US) 5. FireEye Inc.(US) 6. Broadcom Inc. (US) 7. MacAfee Inc. (US) 8. SAS Institute Inc. (US) 9. ThreatMetrix (US) 10. Symantec (US) 11. Fortinet(US) 12. Proofpoint (US) 13. CyberArk(US) 14. Palo Alto Networks (US) 15. BAE Systems plc (UK) 16. Check Point Software Technologies (Israel) 17. Trend Micro Inc. (Japan) Frequently Asked Questions: 1] What segments are covered in the Global Cyber Security in BFSI Market report? Ans. The segments covered in the Cyber Security in BFSI Market report are based on Component, Deployment Model, and Enterprise Size. 2] Which region is expected to hold the highest share in the Global Cyber Security in BFSI Market? Ans. APAC region is expected to hold the highest share in the Cyber Security in BFSI Market. 3] What is the market size of the Global Cyber Security in BFSI Market by 2029? Ans. The market size of the Cyber Security in BFSI Market by 2029 is expected to reach USD 195.06 Bn. 4] What is the forecast period for the Global Cyber Security in BFSI Market? Ans. The forecast period for the Cyber Security in BFSI Market is 2023-2029. 5] What was the market size of the Global Cyber Security in BFSI Market in 2022? Ans. The market size of the Cyber Security in BFSI Market in 2022 was valued at USD 47.39 Bn.

1. Cyber Security in BFSI Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Cyber Security in BFSI Market: Dynamics 2.1. Cyber Security in BFSI Market Trends by Region 2.1.1. North America Cyber Security in BFSI Market Trends 2.1.2. Europe Cyber Security in BFSI Market Trends 2.1.3. Asia Pacific Cyber Security in BFSI Market Trends 2.1.4. Middle East and Africa Cyber Security in BFSI Market Trends 2.1.5. South America Cyber Security in BFSI Market Trends 2.2. Cyber Security in BFSI Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Cyber Security in BFSI Market Drivers 2.2.1.2. North America Cyber Security in BFSI Market Restraints 2.2.1.3. North America Cyber Security in BFSI Market Opportunities 2.2.1.4. North America Cyber Security in BFSI Market Challenges 2.2.2. Europe 2.2.2.1. Europe Cyber Security in BFSI Market Drivers 2.2.2.2. Europe Cyber Security in BFSI Market Restraints 2.2.2.3. Europe Cyber Security in BFSI Market Opportunities 2.2.2.4. Europe Cyber Security in BFSI Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Cyber Security in BFSI Market Drivers 2.2.3.2. Asia Pacific Cyber Security in BFSI Market Restraints 2.2.3.3. Asia Pacific Cyber Security in BFSI Market Opportunities 2.2.3.4. Asia Pacific Cyber Security in BFSI Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Cyber Security in BFSI Market Drivers 2.2.4.2. Middle East and Africa Cyber Security in BFSI Market Restraints 2.2.4.3. Middle East and Africa Cyber Security in BFSI Market Opportunities 2.2.4.4. Middle East and Africa Cyber Security in BFSI Market Challenges 2.2.5. South America 2.2.5.1. South America Cyber Security in BFSI Market Drivers 2.2.5.2. South America Cyber Security in BFSI Market Restraints 2.2.5.3. South America Cyber Security in BFSI Market Opportunities 2.2.5.4. South America Cyber Security in BFSI Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Cyber Security in BFSI Industry 2.8. Analysis of Government Schemes and Initiatives For Cyber Security in BFSI Industry 2.9. Cyber Security in BFSI Market Trade Analysis 2.10. The Global Pandemic Impact on Cyber Security in BFSI Market 3. Cyber Security in BFSI Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Cyber Security in BFSI Market Size and Forecast, by Componentt (2022-2029) 3.1.1. Solution 3.1.2. Services 3.2. Cyber Security in BFSI Market Size and Forecast, by Deployment Model (2022-2029) 3.2.1. On premise 3.2.2. Cloud 3.3. Cyber Security in BFSI Market Size and Forecast, by Enterprise Size (2022-2029) 3.3.1. Large Enterprise 3.3.2. SMEs 3.4. Cyber Security in BFSI Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Cyber Security in BFSI Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Cyber Security in BFSI Market Size and Forecast, by Componentt (2022-2029) 4.1.1. Solution 4.1.2. Services 4.2. North America Cyber Security in BFSI Market Size and Forecast, by Deployment Model (2022-2029) 4.2.1. On premise 4.2.2. Cloud 4.3. North America Cyber Security in BFSI Market Size and Forecast, by Enterprise Size (2022-2029) 4.3.1. Large Enterprise 4.3.2. SMEs 4.4. North America Cyber Security in BFSI Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Cyber Security in BFSI Market Size and Forecast, by Componentt (2022-2029) 4.4.1.1.1. Solution 4.4.1.1.2. Services 4.4.1.2. United States Cyber Security in BFSI Market Size and Forecast, by Deployment Model (2022-2029) 4.4.1.2.1. On premise 4.4.1.2.2. Cloud 4.4.1.3. United States Cyber Security in BFSI Market Size and Forecast, by Enterprise Size (2022-2029) 4.4.1.3.1. Large Enterprise 4.4.1.3.2. SMEs 4.4.2. Canada 4.4.2.1. Canada Cyber Security in BFSI Market Size and Forecast, by Componentt (2022-2029) 4.4.2.1.1. Solution 4.4.2.1.2. Services 4.4.2.2. Canada Cyber Security in BFSI Market Size and Forecast, by Deployment Model (2022-2029) 4.4.2.2.1. On premise 4.4.2.2.2. Cloud 4.4.2.3. Canada Cyber Security in BFSI Market Size and Forecast, by Enterprise Size (2022-2029) 4.4.2.3.1. Large Enterprise 4.4.2.3.2. SMEs 4.4.3. Mexico 4.4.3.1. Mexico Cyber Security in BFSI Market Size and Forecast, by Componentt (2022-2029) 4.4.3.1.1. Solution 4.4.3.1.2. Services 4.4.3.2. Mexico Cyber Security in BFSI Market Size and Forecast, by Deployment Model (2022-2029) 4.4.3.2.1. On premise 4.4.3.2.2. Cloud 4.4.3.3. Mexico Cyber Security in BFSI Market Size and Forecast, by Enterprise Size (2022-2029) 4.4.3.3.1. Large Enterprise 4.4.3.3.2. SMEs 5. Europe Cyber Security in BFSI Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Cyber Security in BFSI Market Size and Forecast, by Componentt (2022-2029) 5.2. Europe Cyber Security in BFSI Market Size and Forecast, by Deployment Model (2022-2029) 5.3. Europe Cyber Security in BFSI Market Size and Forecast, by Enterprise Size (2022-2029) 5.4. Europe Cyber Security in BFSI Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Cyber Security in BFSI Market Size and Forecast, by Componentt (2022-2029) 5.4.1.2. United Kingdom Cyber Security in BFSI Market Size and Forecast, by Deployment Model (2022-2029) 5.4.1.3. United Kingdom Cyber Security in BFSI Market Size and Forecast, by Enterprise Size(2022-2029) 5.4.2. France 5.4.2.1. France Cyber Security in BFSI Market Size and Forecast, by Componentt (2022-2029) 5.4.2.2. France Cyber Security in BFSI Market Size and Forecast, by Deployment Model (2022-2029) 5.4.2.3. France Cyber Security in BFSI Market Size and Forecast, by Enterprise Size(2022-2029) 5.4.3. Germany 5.4.3.1. Germany Cyber Security in BFSI Market Size and Forecast, by Componentt (2022-2029) 5.4.3.2. Germany Cyber Security in BFSI Market Size and Forecast, by Deployment Model (2022-2029) 5.4.3.3. Germany Cyber Security in BFSI Market Size and Forecast, by Enterprise Size (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Cyber Security in BFSI Market Size and Forecast, by Componentt (2022-2029) 5.4.4.2. Italy Cyber Security in BFSI Market Size and Forecast, by Deployment Model (2022-2029) 5.4.4.3. Italy Cyber Security in BFSI Market Size and Forecast, by Enterprise Size(2022-2029) 5.4.5. Spain 5.4.5.1. Spain Cyber Security in BFSI Market Size and Forecast, by Componentt (2022-2029) 5.4.5.2. Spain Cyber Security in BFSI Market Size and Forecast, by Deployment Model (2022-2029) 5.4.5.3. Spain Cyber Security in BFSI Market Size and Forecast, by Enterprise Size (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Cyber Security in BFSI Market Size and Forecast, by Componentt (2022-2029) 5.4.6.2. Sweden Cyber Security in BFSI Market Size and Forecast, by Deployment Model (2022-2029) 5.4.6.3. Sweden Cyber Security in BFSI Market Size and Forecast, by Enterprise Size (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Cyber Security in BFSI Market Size and Forecast, by Componentt (2022-2029) 5.4.7.2. Austria Cyber Security in BFSI Market Size and Forecast, by Deployment Model (2022-2029) 5.4.7.3. Austria Cyber Security in BFSI Market Size and Forecast, by Enterprise Size (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Cyber Security in BFSI Market Size and Forecast, by Componentt (2022-2029) 5.4.8.2. Rest of Europe Cyber Security in BFSI Market Size and Forecast, by Deployment Model (2022-2029) 5.4.8.3. Rest of Europe Cyber Security in BFSI Market Size and Forecast, by Enterprise Size (2022-2029) 6. Asia Pacific Cyber Security in BFSI Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Cyber Security in BFSI Market Size and Forecast, by Componentt (2022-2029) 6.2. Asia Pacific Cyber Security in BFSI Market Size and Forecast, by Deployment Model (2022-2029) 6.3. Asia Pacific Cyber Security in BFSI Market Size and Forecast, by Enterprise Size (2022-2029) 6.4. Asia Pacific Cyber Security in BFSI Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Cyber Security in BFSI Market Size and Forecast, by Componentt (2022-2029) 6.4.1.2. China Cyber Security in BFSI Market Size and Forecast, by Deployment Model (2022-2029) 6.4.1.3. China Cyber Security in BFSI Market Size and Forecast, by Enterprise Size (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Cyber Security in BFSI Market Size and Forecast, by Componentt (2022-2029) 6.4.2.2. S Korea Cyber Security in BFSI Market Size and Forecast, by Deployment Model (2022-2029) 6.4.2.3. S Korea Cyber Security in BFSI Market Size and Forecast, by Enterprise Size (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Cyber Security in BFSI Market Size and Forecast, by Componentt (2022-2029) 6.4.3.2. Japan Cyber Security in BFSI Market Size and Forecast, by Deployment Model (2022-2029) 6.4.3.3. Japan Cyber Security in BFSI Market Size and Forecast, by Enterprise Size (2022-2029) 6.4.4. India 6.4.4.1. India Cyber Security in BFSI Market Size and Forecast, by Componentt (2022-2029) 6.4.4.2. India Cyber Security in BFSI Market Size and Forecast, by Deployment Model (2022-2029) 6.4.4.3. India Cyber Security in BFSI Market Size and Forecast, by Enterprise Size (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Cyber Security in BFSI Market Size and Forecast, by Componentt (2022-2029) 6.4.5.2. Australia Cyber Security in BFSI Market Size and Forecast, by Deployment Model (2022-2029) 6.4.5.3. Australia Cyber Security in BFSI Market Size and Forecast, by Enterprise Size (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Cyber Security in BFSI Market Size and Forecast, by Componentt (2022-2029) 6.4.6.2. Indonesia Cyber Security in BFSI Market Size and Forecast, by Deployment Model (2022-2029) 6.4.6.3. Indonesia Cyber Security in BFSI Market Size and Forecast, by Enterprise Size (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Cyber Security in BFSI Market Size and Forecast, by Componentt (2022-2029) 6.4.7.2. Malaysia Cyber Security in BFSI Market Size and Forecast, by Deployment Model (2022-2029) 6.4.7.3. Malaysia Cyber Security in BFSI Market Size and Forecast, by Enterprise Size (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Cyber Security in BFSI Market Size and Forecast, by Componentt (2022-2029) 6.4.8.2. Vietnam Cyber Security in BFSI Market Size and Forecast, by Deployment Model (2022-2029) 6.4.8.3. Vietnam Cyber Security in BFSI Market Size and Forecast, by Enterprise Size(2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Cyber Security in BFSI Market Size and Forecast, by Componentt (2022-2029) 6.4.9.2. Taiwan Cyber Security in BFSI Market Size and Forecast, by Deployment Model (2022-2029) 6.4.9.3. Taiwan Cyber Security in BFSI Market Size and Forecast, by Enterprise Size (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Cyber Security in BFSI Market Size and Forecast, by Componentt (2022-2029) 6.4.10.2. Rest of Asia Pacific Cyber Security in BFSI Market Size and Forecast, by Deployment Model (2022-2029) 6.4.10.3. Rest of Asia Pacific Cyber Security in BFSI Market Size and Forecast, by Enterprise Size (2022-2029) 7. Middle East and Africa Cyber Security in BFSI Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Cyber Security in BFSI Market Size and Forecast, by Componentt (2022-2029) 7.2. Middle East and Africa Cyber Security in BFSI Market Size and Forecast, by Deployment Model (2022-2029) 7.3. Middle East and Africa Cyber Security in BFSI Market Size and Forecast, by Enterprise Size (2022-2029) 7.4. Middle East and Africa Cyber Security in BFSI Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Cyber Security in BFSI Market Size and Forecast, by Componentt (2022-2029) 7.4.1.2. South Africa Cyber Security in BFSI Market Size and Forecast, by Deployment Model (2022-2029) 7.4.1.3. South Africa Cyber Security in BFSI Market Size and Forecast, by Enterprise Size (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Cyber Security in BFSI Market Size and Forecast, by Componentt (2022-2029) 7.4.2.2. GCC Cyber Security in BFSI Market Size and Forecast, by Deployment Model (2022-2029) 7.4.2.3. GCC Cyber Security in BFSI Market Size and Forecast, by Enterprise Size (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Cyber Security in BFSI Market Size and Forecast, by Componentt (2022-2029) 7.4.3.2. Nigeria Cyber Security in BFSI Market Size and Forecast, by Deployment Model (2022-2029) 7.4.3.3. Nigeria Cyber Security in BFSI Market Size and Forecast, by Enterprise Size (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Cyber Security in BFSI Market Size and Forecast, by Componentt (2022-2029) 7.4.4.2. Rest of ME&A Cyber Security in BFSI Market Size and Forecast, by Deployment Model (2022-2029) 7.4.4.3. Rest of ME&A Cyber Security in BFSI Market Size and Forecast, by Enterprise Size (2022-2029) 8. South America Cyber Security in BFSI Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Cyber Security in BFSI Market Size and Forecast, by Componentt (2022-2029) 8.2. South America Cyber Security in BFSI Market Size and Forecast, by Deployment Model (2022-2029) 8.3. South America Cyber Security in BFSI Market Size and Forecast, by Enterprise Size(2022-2029) 8.4. South America Cyber Security in BFSI Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Cyber Security in BFSI Market Size and Forecast, by Componentt (2022-2029) 8.4.1.2. Brazil Cyber Security in BFSI Market Size and Forecast, by Deployment Model (2022-2029) 8.4.1.3. Brazil Cyber Security in BFSI Market Size and Forecast, by Enterprise Size (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Cyber Security in BFSI Market Size and Forecast, by Componentt (2022-2029) 8.4.2.2. Argentina Cyber Security in BFSI Market Size and Forecast, by Deployment Model (2022-2029) 8.4.2.3. Argentina Cyber Security in BFSI Market Size and Forecast, by Enterprise Size (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Cyber Security in BFSI Market Size and Forecast, by Componentt (2022-2029) 8.4.3.2. Rest Of South America Cyber Security in BFSI Market Size and Forecast, by Deployment Model (2022-2029) 8.4.3.3. Rest Of South America Cyber Security in BFSI Market Size and Forecast, by Enterprise Size (2022-2029) 9. Global Cyber Security in BFSI Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Cyber Security in BFSI Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Cisco Systems (US) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. IBM Corporation (US) 10.3. Microsoft Corporation (US) 10.4. DXC Technology (US) 10.5. FireEye Inc.(US) 10.6. Broadcom Inc. (US) 10.7. MacAfee Inc. (US) 10.8. SAS Institute Inc. (US) 10.9. ThreatMetrix (US) 10.10. Symantec (US) 10.11. Fortinet(US) 10.12. Proofpoint (US) 10.13. CyberArk(US) 10.14. Palo Alto Networks (US) 10.15. BAE Systems plc (UK) 10.16. Check Point Software Technologies (Israel) 10.17. Trend Micro Inc. (Japan) 11. Key Findings 12. Industry Recommendations 13. Cyber Security in BFSI Market: Research Methodology 14. Terms and Glossary