Global Cryptocurrency Market size was valued at USD 2.10 Bn in 2022 and Cosmetic Serum revenue is expected to reach USD 4.88 Bn by 2029, at a CAGR of 12.8 % over the forecast period.Cryptocurrency Market Overview

Cryptocurrency is a digital or virtual currency that employs cryptography for security, making counterfeiting or double-spending nearly impossible. These currencies primarily operate on decentralized networks utilizing blockchain technology—an enforced distributed ledger maintained by a diverse network of computers. One key characteristic of cryptocurrencies is their typical lack of issuance by a central authority, theoretically safeguarding them against government interference or manipulation. The cryptocurrency market is not without challenges. Price volatility, security concerns, and regulatory uncertainties continue to be areas of focus. Ongoing advancements in technology, increased adoption, and growing interest from institutional investors specify a maturing market. Government regulations play a crucial role in shaping the Cryptocurrency Market landscape. While some countries embrace and regulate cryptocurrencies, others impose restrictions or outright bans. Regulatory developments significantly impact market sentiment and influence the adoption and development of blockchain and cryptocurrency projects.To know about the Research Methodology :- Request Free Sample Report The cryptocurrency market scope covers a comprehensive analysis of the dynamic and evolving landscape, offering insights into current trends and prospects. The report by Maximize Market Research provides the adoption of blockchain technology across various industries beyond finance, including healthcare, supply chain, and real estate.

Cryptocurrency Market Dynamics

Decentralized Finance (DeFi) Evolution to drive the Cryptocurrency Market growth The rise of decentralized finance (DeFi) has been a transformative driver. DeFi platforms offer traditional financial services such as lending, borrowing, and trading without intermediaries. This innovation has attracted users seeking financial inclusivity and higher yields, contributing to the overall Cryptocurrency Market growth. The broader acceptance and adoption of cryptocurrencies as a means of payment by businesses and merchants have contributed to increased mainstream use. This growing acceptance facilitates the integration of cryptocurrencies into everyday financial transactions. Cryptocurrencies provide a more efficient and cost-effective alternative for global remittances and cross-border payments. The speed and reduced fees associated with cryptocurrency transactions appeal to individuals and businesses engaged in international transfers. Ongoing technological advancements and innovation within the cryptocurrency space drive the Cryptocurrency market evolution. This includes improvements in scalability, interoperability, and the development of new consensus mechanisms, enhancing the overall functionality and appeal of cryptocurrencies with rise in revenue. The scarcity of certain cryptocurrencies, particularly Bitcoin with its capped supply of 21 million coins, creates a sense of digital scarcity. Bitcoin's halving events, occurring approximately every four years, further reduce the rate at which new coins are generated, reinforcing its scarcity narrative and potentially impacting its price. Public perception and sentiment regarding the overall potential and utility of Cryptocurrencies influence Cryptocurrency Industry dynamics. Cryptocurrency Market Restraints and Challenges: Regulatory Uncertainty to restraint the Cryptocurrency Market growth The cryptocurrency market is the lack of clear and consistent regulatory frameworks across different jurisdictions. Varying regulatory approaches create uncertainty for market participants and limit broader institutional adoption. Security remains a critical challenge in the cryptocurrency space. While blockchain technology provides inherent security features, the risk of hacking, fraud, and cyber-attacks on exchanges and wallets poses a significant threat to user assets and Cryptocurrency market stability. Scalability is a persistent challenge for many blockchain networks. As the number of users and transactions increases, some blockchains face limitations in processing speed and capacity, leading to congestion and higher fees. Despite growing recognition, some individuals and institutions still perceive cryptocurrencies as lacking intrinsic value. Overcoming this perception challenge is essential for widespread adoption and acceptance as a legitimate asset class. Cryptocurrency and blockchain technology is complex for the average user. Improving user education and enhancing the overall user experience are critical challenges. This includes addressing issues related to wallet management, key security, and general understanding of blockchain technology. Implementing technological upgrades and protocol changes within blockchain networks is challenge, leading to potential network splits (hard forks) and disagreements among developers and stakeholders. These events create uncertainty and impact market dynamics.Cryptocurrency Market Segment Analysis

Based on Component, the market is segmented into Hardware and Software. Software Segment is expected to hold the largest Cryptocurrency Market share over the forecast period. The software segment in the cryptocurrency market includes a wide range of applications and programs that play crucial roles in facilitating, managing, and securing various aspects of the digital asset ecosystem. This segment is diverse, covering everything from blockchain protocols and cryptocurrency wallets to trading platforms and smart contracts. For proof-of-work cryptocurrencies like Bitcoin, mining software is essential. Miners use specialized software to connect their hardware to the network, participate in the consensus process, and attempt to solve complex mathematical puzzles to add new blocks to the blockchain. Examples include CGMiner and BFGMiner. Mining software is crucial for coordinating the mining process and connecting hardware to the network. Mining pools often provide their mining software. Additionally, individuals use various mining software options compatible with different hardware configurations. The software segment includes mining algorithms, connectivity protocols, and user interfaces for miners. Based on Type, the market is segmented into Litecoin, Bitcoin, Dogecoin, Monero, Cardano, Ripple, Tether, and Others. Bitcoin segment dominated the market in 2022 and is expected to hold the largest Cryptocurrency Market share over the forecast period. Bitcoin has a capped supply of 21 million coins. Approximately every four years, a halving event occurs, reducing the rate at which new bitcoins are generated. This scarcity mechanism contributes to the narrative of Bitcoin as "digital gold". BIPs are proposals for changes or improvements to the Bitcoin protocol. They are discussed and implemented through a decentralized governance process, and successful BIPs can lead to protocol upgrades. The decentralized nature of its development allows anyone to contribute to its improvement and evolution, which is expected to boost the Cryptocurrency Market growth. Based on End-Use, the market is segmented into Trading, E-Commerce & Retail, Peer-to-Peer Payment, and Remittance. The trading segment dominated the market in 2022 and is expected to hold the largest Cryptocurrency Market share over the forecast period. The trading segment in the cryptocurrency market rises due to the buying and selling of digital assets on various platforms, known as cryptocurrency exchanges. This segment is vital for price discovery, liquidity, and overall Cryptocurrency Market dynamics. Cryptocurrency exchanges act as online marketplaces where users can trade digital assets. Exchanges facilitate the matching of buyers and sellers, enabling the exchange of one cryptocurrency for another or fiat currency. Trading platforms provide user interfaces for placing orders, monitoring price charts, and accessing market data. These interfaces vary in complexity, catering to both beginners and experienced traders. Some exchanges offer derivatives trading, allowing users to trade contracts that derive their value from an underlying cryptocurrency price. This enables speculation on price movements without owning the actual asset.

Cryptocurrency Market Regional Insight

Growing Blockchain Adoption to boost the Cryptocurrency Market growth The Asia Pacific region has shown increasing interest in adopting blockchain technology beyond cryptocurrenciesThe entry of institutional investors, including banks, asset managers, and corporations, brings additional legitimacy and capital to the Cryptocurrency industry. Several countries in the Asia Pacific region are actively exploring or developing Central Bank Digital Currencies. These initiatives have a significant impact on the broader cryptocurrency market, influencing adoption and regulatory approaches. The Asia Pacific region has a large and tech-savvy population, particularly in countries such as China, South Korea, and Japan. This population's interest and familiarity with digital technologies contribute to increased cryptocurrency adoption. Several countries in the Asia Pacific region are actively exploring or developing Central Bank Digital Currencies. These initiatives have a significant impact on the broader cryptocurrency market, influencing adoption and regulatory approaches. Fintech innovation, including cryptocurrency-related services, is on the rise in the Asia Pacific. Startups and established financial institutions are developing new products and services that leverage blockchain and digital assets, driving Cryptocurrency market growth. Cryptocurrency Market Competitive Landscape Cryptocurrency companies offering blockchain infrastructure, development tools, and solutions compete to become preferred providers for projects and businesses. Examples include Chainlink in the oracle space and ConsenSys providing blockchain development tools. Blockchain platforms such as Ethereum, Binance Smart Chain, and Solana compete to host decentralized applications (DApps) and smart contracts. Each platform aims to provide scalability, security, and developer-friendly environments. Mining pools, where miners combine computational power to increase chances of solving blocks, compete to attract participants.Hardware manufacturers such as Bitmain and MicroBT produce mining equipment, creating competition for technological efficiency. Companies providing regulatory compliance solutions for the cryptocurrency industry compete to offer tools that assist exchanges and other businesses in adhering to evolving regulatory frameworks. Compliance is a critical aspect of Cryptocurrency Market participation. Websites, forums, and platforms providing cryptocurrency education and market information compete to be authoritative sources for market insights, news, and analysis. Competing in this space involves delivering accurate and timely information to users.

Cryptocurrency Market Report Scope : Inquire Before Buying

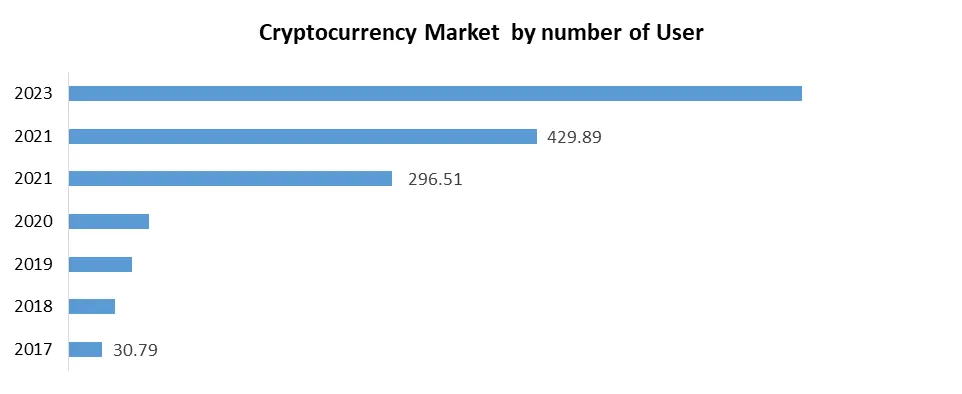

Global Cryptocurrency Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 2.10 Bn. Forecast Period 2023 to 2029 CAGR: 12.8% Market Size in 2029: US $ 4.88 Bn. Segments Covered: by Component Hardware FPGA ASIC GPU Software Mining Software Exchange Software Wallet Payment by Type Litecoin Bitcoin Dogecoin Monero Cardano Ripple Tether Others by End Use Trading E-Commerce & Retail Peer-to-Peer Payment Remittance Cryptocurrency Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Cryptocurrency Key Players

1. Binance 2. Kraken 3. Bitfinex 4. Gemini 5. Bitstamp 6. Coinbase 7. HTX 8. OKEx 9. eToro 10. BitPay 11. Celsius Network 12. Cardano 13. ByBit 14. Polkadot 15. Uniswap Frequently Asked Questions: 1. What challenges does the cryptocurrency market face? Ans: The cryptocurrency market faces challenges such as price volatility, security concerns, regulatory uncertainties, and scalability issues. These factors impact market dynamics and user confidence. 2. How does decentralized finance (DeFi) contribute to market growth? Ans: DeFi platforms offer traditional financial services without intermediaries, attracting users seeking inclusivity and higher yields. This innovation contributes significantly to the overall growth of the cryptocurrency market. 3. How is the Asia Pacific region contributing to blockchain adoption? Ans: The Asia Pacific region, particularly countries like China, South Korea, and Japan, is actively exploring or developing Central Bank Digital Currencies. This, coupled with the tech-savvy population, fosters increased adoption of blockchain technology beyond cryptocurrencies in industries like finance, supply chain, healthcare, and logistics. 4. What is the significance of the Asia Pacific region in cryptocurrency adoption? Ans: The Asia Pacific region shows increasing interest in adopting blockchain technology. The large and tech-savvy population, along with growing institutional interest, contributes to increased cryptocurrency adoption in the region. 5. What hinders cryptocurrency market growth according to the information? Ans: Regulatory uncertainty, security challenges, scalability issues, and the perception of cryptocurrencies lacking intrinsic value are identified as hindrances to market growth.

1. Cryptocurrency Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Cryptocurrency Market: Dynamics 2.1. Cryptocurrency Market Trends by Region 2.1.1. Global Cryptocurrency Market Trends 2.1.2. North America Cryptocurrency Market Trends 2.1.3. Europe Cryptocurrency Market Trends 2.1.4. Asia Pacific Cryptocurrency Market Trends 2.1.5. Middle East and Africa Cryptocurrency Market Trends 2.1.6. South America Cryptocurrency Market Trends 2.2. Cryptocurrency Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Cryptocurrency Market Drivers 2.2.1.2. North America Cryptocurrency Market Restraints 2.2.1.3. North America Cryptocurrency Market Opportunities 2.2.1.4. North America Cryptocurrency Market Challenges 2.2.2. Europe 2.2.2.1. Europe Cryptocurrency Market Drivers 2.2.2.2. Europe Cryptocurrency Market Restraints 2.2.2.3. Europe Cryptocurrency Market Opportunities 2.2.2.4. Europe Cryptocurrency Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Cryptocurrency Market Drivers 2.2.3.2. Asia Pacific Cryptocurrency Market Restraints 2.2.3.3. Asia Pacific Cryptocurrency Market Opportunities 2.2.3.4. Asia Pacific Cryptocurrency Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Cryptocurrency Market Drivers 2.2.4.2. Middle East and Africa Cryptocurrency Market Restraints 2.2.4.3. Middle East and Africa Cryptocurrency Market Opportunities 2.2.4.4. Middle East and Africa Cryptocurrency Market Challenges 2.2.5. South America 2.2.5.1. South America Cryptocurrency Market Drivers 2.2.5.2. South America Cryptocurrency Market Restraints 2.2.5.3. South America Cryptocurrency Market Opportunities 2.2.5.4. South America Cryptocurrency Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Regulatory Landscape by Region 2.6.1. Global 2.6.2. North America 2.6.3. Europe 2.6.4. Asia Pacific 2.6.5. Middle East and Africa 2.6.6. South America 2.7. Key Opinion Leader Analysis For Cryptocurrency Industry 2.8. The Global Pandemic Impact on Cryptocurrency Market 2.9. Cryptocurrency Technology Price Trend Analysis (2021-22) 3. Cryptocurrency Market: Global Market Size and Forecast by Segmentation (by Value) (2022-2029) 3.1. Cryptocurrency Market Size and Forecast, by Component (2022-2029) 3.1.1. Hardware 3.1.1.1. FPGA 3.1.1.2. ASIC 3.1.1.3. GPU 3.1.2. Software 3.1.2.1. Mining Software 3.1.2.2. Exchange Software 3.1.2.3. Wallet 3.1.2.4. Payment 3.2. Cryptocurrency Market Size and Forecast, by Type (2022-2029) 3.2.1. Litecoin 3.2.2. Bitcoin 3.2.3. Dogecoin 3.2.4. Monero 3.2.5. Cardano 3.2.6. Ripple 3.2.7. Tether 3.2.8. Others 3.3. Cryptocurrency Market Size and Forecast, by End Use (2022-2029) 3.3.1. Trading 3.3.2. E-Commerce & Retail 3.3.3. Peer-to-Peer Payment 3.3.4. Remittance 3.4. Cryptocurrency Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Cryptocurrency Market Size and Forecast by Segmentation (by Value) (2022-2029) 4.1. North America Cryptocurrency Market Size and Forecast, by Component (2022-2029) 4.1.1. Hardware 4.1.1.1. FPGA 4.1.1.2. ASIC 4.1.1.3. GPU 4.1.2. Software 4.1.2.1. Mining Software 4.1.2.2. Exchange Software 4.1.2.3. Wallet 4.1.2.4. Payment 4.2. North America Cryptocurrency Market Size and Forecast, by Type (2022-2029) 4.2.1. Litecoin 4.2.2. Bitcoin 4.2.3. Dogecoin 4.2.4. Monero 4.2.5. Cardano 4.2.6. Ripple 4.2.7. Tether 4.2.8. Others 4.3. North America Cryptocurrency Market Size and Forecast, by End Use (2022-2029) 4.3.1. Trading 4.3.2. E-Commerce & Retail 4.3.3. Peer-to-Peer Payment 4.3.4. Remittance 4.4. North America Cryptocurrency Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Cryptocurrency Market Size and Forecast, by Component (2022-2029) 1.1.1. Hardware 1.1.1.1. FPGA 1.1.1.2. ASIC 1.1.1.3. GPU 1.1.2. Software 1.1.2.1. Mining Software 1.1.2.2. Exchange Software 1.1.2.3. Wallet 1.1.2.4. Payment 1.1.2.5. United States Cryptocurrency Market Size and Forecast, by Type (2022-2029) 1.1.2.5.1. Litecoin 1.1.2.5.2. Bitcoin 1.1.2.5.3. Dogecoin 1.1.2.5.4. Monero 1.1.2.5.5. Cardano 1.1.2.5.6. Ripple 1.1.2.5.7. Tether 1.1.2.5.8. Others 1.1.2.6. United States Cryptocurrency Market Size and Forecast, by End Use (2022-2029) 1.1.2.6.1. Trading 1.1.2.6.2. E-Commerce & Retail 1.1.2.6.3. Peer-to-Peer Payment 1.1.2.6.4. Remittance 1.1.3. Canada 1.1.3.1. Canada Cryptocurrency Market Size and Forecast, by Component (2022-2029) 1.1.4. Hardware 1.1.4.1. FPGA 1.1.4.2. ASIC 1.1.4.3. GPU 1.1.5. Software 1.1.5.1. Mining Software 1.1.5.2. Exchange Software 1.1.5.3. Wallet 1.1.5.4. Payment 1.1.5.5. Canada Cryptocurrency Market Size and Forecast, by Type (2022-2029) 1.1.5.5.1. Litecoin 1.1.5.5.2. Bitcoin 1.1.5.5.3. Dogecoin 1.1.5.5.4. Monero 1.1.5.5.5. Cardano 1.1.5.5.6. Ripple 1.1.5.5.7. Tether 1.1.5.5.8. Others 1.1.5.6. Canada Cryptocurrency Market Size and Forecast, by End Use (2022-2029) 1.1.5.6.1. Trading 1.1.5.6.2. E-Commerce & Retail 1.1.5.6.3. Peer-to-Peer Payment 1.1.5.6.4. Remittance 1.1.6. Mexico 1.1.6.1. Mexico Cryptocurrency Market Size and Forecast, by Component (2022-2029) 1.1.7. Hardware 1.1.7.1. FPGA 1.1.7.2. ASIC 1.1.7.3. GPU 1.1.8. Software 1.1.8.1. Mining Software 1.1.8.2. Exchange Software 1.1.8.3. Wallet 1.1.8.4. Payment 1.1.8.4.1. 1.1.8.5. Mexico Cryptocurrency Market Size and Forecast, by Type (2022-2029) 1.1.8.5.1. Litecoin 1.1.8.5.2. Bitcoin 1.1.8.5.3. Dogecoin 1.1.8.5.4. Monero 1.1.8.5.5. Cardano 1.1.8.5.6. Ripple 1.1.8.5.7. Tether 1.1.8.5.8. Others 1.1.8.6. Mexico Cryptocurrency Market Size and Forecast, by End Use (2022-2029) 1.1.8.6.1. Trading 1.1.8.6.2. E-Commerce & Retail 1.1.8.6.3. Peer-to-Peer Payment 1.1.8.6.4. Remittance 2. Europe Cryptocurrency Market Size and Forecast by Segmentation (by Value) (2022-2029) 2.1. Europe Cryptocurrency Market Size and Forecast, by Component (2022-2029) 2.2. Europe Cryptocurrency Market Size and Forecast, by Type (2022-2029) 2.3. Europe Cryptocurrency Market Size and Forecast, by End Use (2022-2029) 2.4. Europe Cryptocurrency Market Size and Forecast, by Country (2022-2029) 2.4.1. United Kingdom 2.4.1.1. United Kingdom Cryptocurrency Market Size and Forecast, by Component (2022-2029) 2.4.1.2. United Kingdom Cryptocurrency Market Size and Forecast, by Type (2022-2029) 2.4.1.3. United Kingdom Cryptocurrency Market Size and Forecast, by End Use (2022-2029) 2.4.2. France 2.4.2.1. France Cryptocurrency Market Size and Forecast, by Component (2022-2029) 2.4.2.2. France Cryptocurrency Market Size and Forecast, by Type (2022-2029) 2.4.2.3. France Cryptocurrency Market Size and Forecast, by End Use (2022-2029) 2.4.3. Germany 2.4.3.1. Germany Cryptocurrency Market Size and Forecast, by Component (2022-2029) 2.4.3.2. Germany Cryptocurrency Market Size and Forecast, by Type (2022-2029) 2.4.3.3. Germany Cryptocurrency Market Size and Forecast, by End Use (2022-2029) 2.4.4. Italy 2.4.4.1. Italy Cryptocurrency Market Size and Forecast, by Component (2022-2029) 2.4.4.2. Italy Cryptocurrency Market Size and Forecast, by Type (2022-2029) 2.4.4.3. Italy Cryptocurrency Market Size and Forecast, by End Use (2022-2029) 2.4.5. Spain 2.4.5.1. Spain Cryptocurrency Market Size and Forecast, by Component (2022-2029) 2.4.5.2. Spain Cryptocurrency Market Size and Forecast, by Type (2022-2029) 2.4.5.3. Spain Cryptocurrency Market Size and Forecast, by End Use (2022-2029) 2.4.6. Sweden 2.4.6.1. Sweden Cryptocurrency Market Size and Forecast, by Component (2022-2029) 2.4.6.2. Sweden Cryptocurrency Market Size and Forecast, by Type (2022-2029) 2.4.6.3. Sweden Cryptocurrency Market Size and Forecast, by End Use (2022-2029) 2.4.7. Austria 2.4.7.1. Austria Cryptocurrency Market Size and Forecast, by Component (2022-2029) 2.4.7.2. Austria Cryptocurrency Market Size and Forecast, by Type (2022-2029) 2.4.7.3. Austria Cryptocurrency Market Size and Forecast, by End Use (2022-2029) 2.4.8. Rest of Europe 2.4.8.1. Rest of Europe Cryptocurrency Market Size and Forecast, by Component (2022-2029) 2.4.8.2. Rest of Europe Cryptocurrency Market Size and Forecast, by Type (2022-2029) 2.4.8.3. Rest of Europe Cryptocurrency Market Size and Forecast, by End Use (2022-2029) 3. Asia Pacific Cryptocurrency Market Size and Forecast by Segmentation (by Value) (2022-2029) 3.1. Asia Pacific Cryptocurrency Market Size and Forecast, by Component (2022-2029) 3.2. Asia Pacific Cryptocurrency Market Size and Forecast, by Type (2022-2029) 3.3. Asia Pacific Cryptocurrency Market Size and Forecast, by End Use (2022-2029) 3.4. Asia Pacific Cryptocurrency Market Size and Forecast, by Country (2022-2029) 3.4.1. China 3.4.1.1. China Cryptocurrency Market Size and Forecast, by Component (2022-2029) 3.4.1.2. China Cryptocurrency Market Size and Forecast, by Type (2022-2029) 3.4.1.3. China Cryptocurrency Market Size and Forecast, by End Use (2022-2029) 3.4.2. S Korea 3.4.2.1. S Korea Cryptocurrency Market Size and Forecast, by Component (2022-2029) 3.4.2.2. S Korea Cryptocurrency Market Size and Forecast, by Type (2022-2029) 3.4.2.3. S Korea Cryptocurrency Market Size and Forecast, by End Use (2022-2029) 3.4.3. Japan 3.4.3.1. Japan Cryptocurrency Market Size and Forecast, by Component (2022-2029) 3.4.3.2. Japan Cryptocurrency Market Size and Forecast, by Type (2022-2029) 3.4.3.3. Japan Cryptocurrency Market Size and Forecast, by End Use (2022-2029) 3.4.4. India 3.4.4.1. India Cryptocurrency Market Size and Forecast, by Component (2022-2029) 3.4.4.2. India Cryptocurrency Market Size and Forecast, by Type (2022-2029) 3.4.4.3. India Cryptocurrency Market Size and Forecast, by End Use (2022-2029) 3.4.5. Australia 3.4.5.1. Australia Cryptocurrency Market Size and Forecast, by Component (2022-2029) 3.4.5.2. Australia Cryptocurrency Market Size and Forecast, by Type (2022-2029) 3.4.5.3. Australia Cryptocurrency Market Size and Forecast, by End Use (2022-2029) 3.4.6. Indonesia 3.4.6.1. Indonesia Cryptocurrency Market Size and Forecast, by Component (2022-2029) 3.4.6.2. Indonesia Cryptocurrency Market Size and Forecast, by Type (2022-2029) 3.4.6.3. Indonesia Cryptocurrency Market Size and Forecast, by End Use (2022-2029) 3.4.7. Malaysia 3.4.7.1. Malaysia Cryptocurrency Market Size and Forecast, by Component (2022-2029) 3.4.7.2. Malaysia Cryptocurrency Market Size and Forecast, by Type (2022-2029) 3.4.7.3. Malaysia Cryptocurrency Market Size and Forecast, by End Use (2022-2029) 3.4.8. Vietnam 3.4.8.1. Vietnam Cryptocurrency Market Size and Forecast, by Component (2022-2029) 3.4.8.2. Vietnam Cryptocurrency Market Size and Forecast, by Type (2022-2029) 3.4.8.3. Vietnam Cryptocurrency Market Size and Forecast, by End Use (2022-2029) 3.4.9. Taiwan 3.4.9.1. Taiwan Cryptocurrency Market Size and Forecast, by Component (2022-2029) 3.4.9.2. Taiwan Cryptocurrency Market Size and Forecast, by Type (2022-2029) 3.4.9.3. Taiwan Cryptocurrency Market Size and Forecast, by End Use (2022-2029) 3.4.10. Rest of Asia Pacific 3.4.10.1. Rest of Asia Pacific Cryptocurrency Market Size and Forecast, by Component (2022-2029) 3.4.10.2. Rest of Asia Pacific Cryptocurrency Market Size and Forecast, by Type (2022-2029) 3.4.10.3. Rest of Asia Pacific Cryptocurrency Market Size and Forecast, by End Use (2022-2029) 4. Middle East and Africa Cryptocurrency Market Size and Forecast by Segmentation (by Value) (2022-2029 4.1. Middle East and Africa Cryptocurrency Market Size and Forecast, by Component (2022-2029) 4.2. Middle East and Africa Cryptocurrency Market Size and Forecast, by Type (2022-2029) 4.3. Middle East and Africa Cryptocurrency Market Size and Forecast, by End Use (2022-2029) 4.4. Middle East and Africa Cryptocurrency Market Size and Forecast, by Country (2022-2029) 4.4.1. South Africa 4.4.1.1. South Africa Cryptocurrency Market Size and Forecast, by Component (2022-2029) 4.4.1.2. South Africa Cryptocurrency Market Size and Forecast, by Type (2022-2029) 4.4.1.3. South Africa Cryptocurrency Market Size and Forecast, by End Use (2022-2029) 4.4.2. GCC 4.4.2.1. GCC Cryptocurrency Market Size and Forecast, by Component (2022-2029) 4.4.2.2. GCC Cryptocurrency Market Size and Forecast, by Type (2022-2029) 4.4.2.3. GCC Cryptocurrency Market Size and Forecast, by End Use (2022-2029) 4.4.3. Nigeria 4.4.3.1. Nigeria Cryptocurrency Market Size and Forecast, by Component (2022-2029) 4.4.3.2. Nigeria Cryptocurrency Market Size and Forecast, by Type (2022-2029) 4.4.3.3. Nigeria Cryptocurrency Market Size and Forecast, by End Use (2022-2029) 4.4.4. Rest of ME&A 4.4.4.1. Rest of ME&A Cryptocurrency Market Size and Forecast, by Component (2022-2029) 4.4.4.2. Rest of ME&A Cryptocurrency Market Size and Forecast, by Type (2022-2029) 4.4.4.3. Rest of ME&A Cryptocurrency Market Size and Forecast, by End Use (2022-2029) 5. South America Cryptocurrency Market Size and Forecast by Segmentation (by Value) (2022-2029 5.1. South America Cryptocurrency Market Size and Forecast, by Component (2022-2029) 5.2. South America Cryptocurrency Market Size and Forecast, by Type (2022-2029) 5.3. South America Cryptocurrency Market Size and Forecast, by End Use (2022-2029) 5.4. South America Cryptocurrency Market Size and Forecast, by Country (2022-2029) 5.4.1. Brazil 5.4.1.1. Brazil Cryptocurrency Market Size and Forecast, by Component (2022-2029) 5.4.1.2. Brazil Cryptocurrency Market Size and Forecast, by Type (2022-2029) 5.4.1.3. Brazil Cryptocurrency Market Size and Forecast, by End Use (2022-2029) 5.4.2. Argentina 5.4.2.1. Argentina Cryptocurrency Market Size and Forecast, by Component (2022-2029) 5.4.2.2. Argentina Cryptocurrency Market Size and Forecast, by Type (2022-2029) 5.4.2.3. Argentina Cryptocurrency Market Size and Forecast, by End Use (2022-2029) 5.4.3. Rest Of South America 5.4.3.1. Rest Of South America Cryptocurrency Market Size and Forecast, by Component (2022-2029) 5.4.3.2. Rest Of South America Cryptocurrency Market Size and Forecast, by Type (2022-2029) 5.4.3.3. Rest Of South America Cryptocurrency Market Size and Forecast, by End Use (2022-2029) 6. Global Cryptocurrency Market: Competitive Landscape 6.1. MMR Competition Matrix 6.2. Competitive Landscape 6.3. Key Players Benchmarking 6.3.1. Company Name 6.3.2. Product Segment 6.3.3. End Use Segment 6.3.4. Revenue (2022) 6.3.5. Company Locations 6.4. Market Analysis by Organized Players vs. Unorganized Players 6.4.1. Organized Players 6.4.2. Unorganized Players 6.5. Leading Cryptocurrency Market Companies, by market capitalization 6.6. Market Structure 6.6.1. Market Leaders 6.6.2. Market Followers 6.6.3. Emerging Players 6.7. Mergers and Acquisitions Details 7. Company Profile: Key Players 7.1. Binance 7.1.1. Company Overview 7.1.2. Business Portfolio 7.1.3. Financial Overview 7.1.4. SWOT Analysis 7.1.5. Strategic Analysis 7.1.6. Recent Developments 7.2. Kraken 7.3. Bitfinex 7.4. Gemini 7.5. Bitstamp 7.6. Coinbase 7.7. HTX 7.8. OKEx 7.9. eToro 7.10. BitPay 7.11. Celsius Network 7.12. Cardano 7.13. ByBit 7.14. Polkadot 7.15. Uniswap 8. Key Findings 9. Industry Recommendations 10. Cryptocurrency Market: Research Methodology 11. Terms and Glossary