The Global Crocetin Esters Market size was valued at USD 385.6 Thousand in 2022 and is expected to reach USD 572.19 Thousand by 2029, at a CAGR of 5.8 %Overview of the Global Crocetin Esters Market

Crocetin Ester is a carotenoid component found in saffron and gardenia flowers. It has acquired popularity due to its possible health advantages, which include antioxidant and anti-inflammatory characteristics. Crocetin esters are crocetin derivatives employed in various applications, including the pharmaceutical, nutraceutical, and cosmetic sectors. Crocetin Esters are frequently marketed as a natural cure for a variety of health concerns, including cardiovascular health, mental disorders, and anti-aging properties. As a result, the nutraceutical and dietary supplement businesses might be interested in using crocetin esters in their products. The graphical representation and structural exclusive information showed the dominating region of the Global Crocetin Esters Market. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Global Crocetin Esters Market.To know about the Research Methodology :- Request Free Sample Report

Crocetin Esters Market Dynamics

Growing Consumer Awareness and Demand for Natural and Functional Components are the growth drivers of Crocetin Esters Market The Crocetin Esters market is currently experiencing a surge in consumer awareness concerning the potential health benefits of crocetin esters and saffron. These compounds are increasingly acknowledged for their role as antioxidants with health-promoting properties, aligning seamlessly with the surging consumer demand for natural and plant-based ingredients in their dietary supplements. Consumers are actively seeking out natural and functional ingredients for their food, beverages, and dietary supplements. Crocetin esters are gaining recognition as natural alternatives to synthetic additives and colorants, thereby propelling their demand and adoption across a spectrum of products. The market is being positively impacted by the increasing consumer expenditure on premium and health-related products. This is particularly evident in emerging economies with expanding middle-class populations. The unique flavor and color attributes of saffron and crocetin esters are highly appealing to consumers, making them sought-after additions to gourmet foods, teas, desserts, and beverages. High Cost of Saffron and Geographical Limitations restraints the crocetin esters market Saffron, the primary source of crocetin esters, is renowned as one of the world's most expensive spices. The labour-intensive process of harvesting saffron threads from the Crocus sativus flower significantly contributes to its high cost, acting as a substantial barrier to entry for organizations interested in producing crocetin esters. Saffron cultivation is geographically confined to specific regions characterized by precise climatic and soil conditions. Consequently, the supply and pricing of saffron are susceptible to fluctuations, posing a challenge for businesses seeking to secure a consistent and cost-effective source of saffron. The Crocetin Esters market can be fragmented with numerous small producers and suppliers, complicating the process of consumers finding reliable sources and ensuring consistent product quality. Additionally, in certain cases, synthetic alternatives may prove more cost-effective, leading to limited adoption of Crocetin Esters. Adulteration Concerns:** The saffron industry is plagued by issues of adulteration, where lower-quality saffron is mixed with genuine saffron to increase volume and reduce costs. This jeopardizes the purity and quality of saffron-based products, thereby impacting manufacturers' reputations and product quality. Saffron cultivation heavily depends on seasonal and weather factors, such as droughts and heavy rains, which can significantly affect saffron yields and quality. Consequently, supply fluctuations and price volatility pose potential challenges in the market. Positioning as Premium Ingredients and Geographical Market Expansion creating opportunities for crocetin esters market An enticing opportunity lies in positioning Crocetin Esters and saffron-derived products as premium and gourmet ingredients in culinary and beverage applications. This strategy targets consumers seeking unique and luxurious experiences. Investment in consumer education to raise awareness about crocetin esters, their natural origins, and potential health benefits can stimulate demand. Emphasizing sustainable and ethical saffron sourcing practices resonates with socially conscious consumers, furthering the market's growth. Exploration of untapped markets where saffron and crocetin esters are less commonly used, coupled with collaborations with food, beverage, and cosmetic companies to create customized formulations, can meet the unique demands of various product and market segments. Collaboration with research institutions and universities to conduct additional studies on the health benefits and applications of crocetin esters is vital for market expansion. Promoting crocetin esters as natural, minimally processed ingredients in various product categories aligns with the clean label movement and appeals to health-conscious consumers.Crocetin Esters Market Segment Analysis

Application: Crocetin esters, renowned for their potential health benefits, are prominently featured in dietary supplements designed to address specific health concerns, including cognitive function, ocular health, and antioxidant support. The dietary supplements segment plays a pivotal role in the Crocetin Esters market, appealing to health-conscious consumers actively seeking natural solutions to enhance their overall well-being and demonstrating the growth potential of Crocetin Supplements. Crocetin esters, with their intrinsic antioxidant and anti-inflammatory attributes, have made a notable impact on the cosmetics and skincare industries. These chemical compounds are recognized for their potential to enhance skin health and address a range of aging-related concerns, showcasing the Health Benefits of Crocetin Esters. The cosmetics and skincare segment holds substantial importance within the Crocetin Esters market, responding to the growing consumer demand for products featuring natural and effective ingredients, illustrating the market's growth. Crocetin esters find application as natural colorants and flavor enhancers in the food and beverage sectors, enhancing the visual appeal and taste of a diverse array of products. This growth is indicative of the expanding Crocetin Esters Market, driven by consumer preference for natural and enticing ingredients. The food and beverage industry derives significant benefits from the incorporation of crocetin esters, aligning with the consumer demand for natural and appealing ingredients, contributing to Market Growth. Ongoing research efforts explore the potential pharmaceutical applications of crocetin esters, aiming to develop medications for pressing health concerns, including cancer, neurological diseases, and cardiovascular disorders, indicating Research and Development opportunities for crocetin esters. The pharmaceutical segment stands as a promising frontier for crocetin esters, positioning them as key contributors to the creation of innovative drugs aimed at tackling prevalent health issues, showcasing potential for Market Growth. Form: Crocetin esters are predominantly available in powder form, a versatile and widely employed format. This form finds applications across diverse industries, including functional foods, beverages, medicines, and cosmetics, emphasizing the significance of Crocetin Esters Extraction Techniques. Powdered crocetin esters hold a fundamental and adaptable role, serving as the cornerstone of their utility across a wide range of products and applications, reflecting the importance of Crocetin Esters in various forms. Liquid crocetin esters find usage in applications demanding a more concentrated form of the compound, notably within pharmaceuticals and specific cosmetic products. This format highlights the potential for Research and Development to create specialized formulations. Liquid crocetin esters are indispensable in applications requiring higher concentrations, ensuring their efficacy in specialized areas and showcasing the adaptability of Crocetin Esters in different forms. Crocetin esters are efficiently administered in the form of capsules, offering a convenient and controlled delivery method, illustrating their significance in Crocetin Supplements. Capsules provide a user-friendly and controlled delivery mechanism for crocetin esters, amplifying their utilization in supplements and pharmaceutical applications, emphasizing their role in Crocetin Supplements. Crocetin esters find their place in diverse alternative forms, including tablets, gels, and creams, each addressing specific requirements in the market. These alternative forms emphasize the adaptability of Crocetin Esters. These alternative forms of crocetin esters cater to an array of applications and consumer preferences, allowing for versatility across various industries, highlighting their adaptability in the market.Crocetin Esters Market Regional Analysis

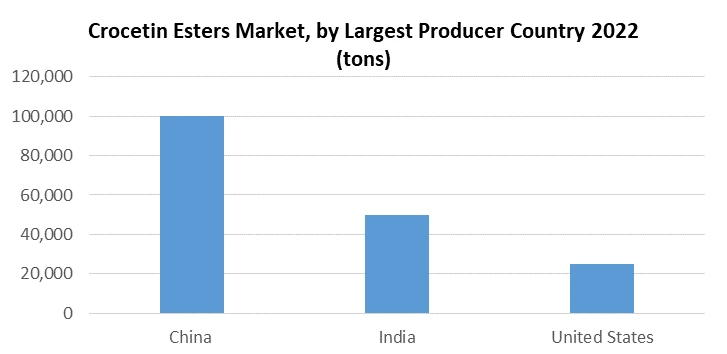

The analysis of the Crocetin Esters Market underscores the Asia-Pacific region as a prominent contender for substantial growth within the crocetin esters market, and this trend is expected to persist and potentially intensify in the forthcoming years. A key driver behind this burgeoning crocetin esters industry in the Asia-Pacific region is the significant cultivation and production of saffron. The geography has a rich history of saffron farming in nations such as Iran, India, and China, all of which are located within the Asia-Pacific region. These countries, owing to favourable climatic conditions and extensive experience in saffron cultivation, play pivotal roles in the global saffron industry. As crocetin esters are derived from saffron, the region benefits from an abundant supply of raw materials, enabling robust local manufacturing of products based on crocetin esters. In the year 2022, Europe is projected to account for over 31% of the global crocetin esters market. This prominence can be attributed to the increasing demand for natural food colors and flavorings, especially in major nations like Germany, the United Kingdom, France, and Italy. The Asia-Pacific region stands as the second-largest market for Crocetin Esters, with the highest Compound Annual Growth Rate (CAGR) anticipated throughout the forecast period. This accelerated growth can be attributed to the region's growing demand for functional foods and beverages, coupled with an increasing awareness of the health benefits associated with antioxidants. North America holds the third-largest market share for Crocetin Esters, and the market within this region is expected to demonstrate consistent expansion during the forecast period. This growth is fuelled by the rising demand for natural and herbal products. Crocetin Esters have smaller market shares in South America, the Middle East, and Africa. Nevertheless, both these markets are poised for rapid growth during the projection period due to the escalating preference for natural products.

Crocetin Esters Market Competitive Landscape

Givaudan and Novozymes, both renowned leaders in their respective industries, are delighted to announce the establishment of a strategic research partnership focused on creating innovative ingredients and technologies for their customers. The collaboration will entail joint efforts in researching and developing sustainable solutions, with a specific emphasis on the food and cleaning sectors. This exciting partnership aligns seamlessly with Novozymes' updated strategy, "Better Business with Biology," and Givaudan's strategic goals for 2025, aimed at expanding its product offerings to consumer brands through innovative and sustainable solutions. Givaudan, a pioneer in the industry, leads the way with its substantial investment in research and development, global consumer insights, and its ability to craft emotional signatures and memorable food experiences for consumer brands. Givaudan is thrilled to unveil a strategic partnership with Synthite, aimed at pioneering exclusive and innovative natural fragrance ingredients for its Fragrance business. The collaboration will revolve around intensive research and development efforts to create exceptional floral and spicy natural ingredients, including jasmine, tuberose, ginger, and cardamom. These distinctive natural components will enrich Givaudan's palette of ingredients, empowering perfumers to craft the winning fragrances of tomorrow. Sabinsa Corporation has entered into a significant sales and marketing agreement with Tempo Canada, marking a pivotal milestone in the distribution of specialized, standardized botanical extracts and cosmeceuticals from Sabinsa within the personal care and healthcare industries in Canada. This partnership encompasses Sabinsa's wide array of nutritional ingredients and integrated services. The collaboration signifies an essential stride towards further developing and commercializing Sabinsa's product portfolio in the Canadian market. The core objective of this partnership is to harness the respective strengths of both companies to deliver safe and effective unique products that align with the needs of customers and consumers.Global Crocetin Esters Market Scope: Inquire before buying

Global Crocetin Esters Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 385.6 Thousand Forecast Period 2023 to 2029 CAGR: 5.8 % Market Size in 2029: US $ 572.19 Thousand Segments Covered: by Application Dietary Supplements Cosmetics and Skincare Food and Beverages Pharmaceuticals by Form Powder Form Liquid Form Capsules Others Crocetin Esters Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players of the Crocetin Esters Market

1. Sabinsa Corporation 2. Givaudan 3. Evonik Industries 4. Sami Labs 5. Phytochem India 6. Flavex Naturextrakte GmbH 7. Pharos Nutraceuticals 8. Safrante Global Company S.L. 9. Valensa International 10. Hijos de Eustaquio Abadía S.L. 11. Sigma-Aldrich (now part of Merck Group) 12. Organic Herb Inc. 13. Takasago International Corporation 14. Merck KGaA 15. Himalaya Wellness Company 16. Lionel Hitchen (Essential Oils) Ltd. 17. Loyal Super Fabrics 18. Taj Agro International 19. Exir International 20. California Botanicals Frequently Asked Questions and Answers about Crocetin Esters Market 1. What are crocetin esters? Ans: Crocetin esters are a group of natural compounds derived from saffron (Crocus sativus), a flowering plant. Crocetin esters are formed when the carotenoid crocetin is esterified with various fatty acids. 2. What are the applications of crocetin esters? Ans: Crocetin esters have a wide range of applications in the food, pharmaceutical, and nutraceutical industries. They are used as natural food colors and flavorings, as well as dietary supplements and functional food ingredients. 3. What is the global crocetin esters market size? Ans: The global crocetin esters market is expected to reach USD 572.19 Thousand by 2029, growing at a CAGR of 5.8% from 2022 to 2029. 4. What are the major drivers of the crocetin esters market? Ans: The major drivers of the crocetin esters market include increasing demand for natural food colors and flavorings, growing awareness of the health benefits of crocetin esters, and increasing demand for herbal medicines and functional foods. 5. Who are the major players in the crocetin esters market? Ans: The major players in the crocetin esters market include Chengdu Biopurify, Chengdu Gelipu Biotechnology Co., Ltd., Tokyo Chemical Industry Co., Ltd., Amadis Chemical Company Limited, Hunan Jiahang Pharmaceutical Technology Co., Ltd., Cayman Chemical, and Biosynth.

1. Crocetin Esters Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Crocetin Esters Market: Dynamics 2.1. Crocetin Esters Market Trends by Region 2.1.1. Global Crocetin Esters Market Trends 2.1.2. North America Crocetin Esters Market Trends 2.1.3. Europe Crocetin Esters Market Trends 2.1.4. Asia Pacific Crocetin Esters Market Trends 2.1.5. Middle East and Africa Crocetin Esters Market Trends 2.1.6. South America Crocetin Esters Market Trends 2.2. Crocetin Esters Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Crocetin Esters Market Drivers 2.2.1.2. North America Crocetin Esters Market Restraints 2.2.1.3. North America Crocetin Esters Market Opportunities 2.2.1.4. North America Crocetin Esters Market Challenges 2.2.2. Europe 2.2.2.1. Europe Crocetin Esters Market Drivers 2.2.2.2. Europe Crocetin Esters Market Restraints 2.2.2.3. Europe Crocetin Esters Market Opportunities 2.2.2.4. Europe Crocetin Esters Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Crocetin Esters Market Drivers 2.2.3.2. Asia Pacific Crocetin Esters Market Restraints 2.2.3.3. Asia Pacific Crocetin Esters Market Opportunities 2.2.3.4. Asia Pacific Crocetin Esters Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Crocetin Esters Market Drivers 2.2.4.2. Middle East and Africa Crocetin Esters Market Restraints 2.2.4.3. Middle East and Africa Crocetin Esters Market Opportunities 2.2.4.4. Middle East and Africa Crocetin Esters Market Challenges 2.2.5. South America 2.2.5.1. South America Crocetin Esters Market Drivers 2.2.5.2. South America Crocetin Esters Market Restraints 2.2.5.3. South America Crocetin Esters Market Opportunities 2.2.5.4. South America Crocetin Esters Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Regulatory Landscape by Region 2.6.1. Global 2.6.2. North America 2.6.3. Europe 2.6.4. Asia Pacific 2.6.5. Middle East and Africa 2.6.6. South America 2.7. Allogeneic Cell Therapy Clinical Trial Analysis for Crocetin Esters 2.8. Key Opinion Leader Analysis For Crocetin Esters Industry 2.9. Analysis of Government Schemes and Initiatives For Crocetin Esters Industry 2.10. The Global Pandemic Impact on Crocetin Esters Market 2.11. Crocetin Esters Price Trend Analysis (2021-22) 3. Crocetin Esters Market: Global Market Size and Forecast by Segmentation for Demand and Supply Side (by Value in USD Million) (2022-2029) 3.1. Crocetin Esters Market Size and Forecast, by Therapeutic Area (2022-2029) 3.1.1. Dietary Supplements 3.1.2. Cosmetics and Skincare 3.1.3. Food and Beverages 3.1.4. Pharmaceuticals 3.2. Crocetin Esters Market Size and Forecast, by Type (2022-2029) 3.2.1. Powder Form 3.2.2. Liquid Form 3.2.3. Capsules 3.2.4. Others 3.3. Crocetin Esters Market Size and Forecast, by Region (2022-2029) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Crocetin Esters Market Size and Forecast by Segmentation for Demand and Supply Side (by Value in USD Million) (2022-2029) 4.1. North America Crocetin Esters Market Size and Forecast, by Therapeutic Area (2022-2029) 4.1.1. Dietary Supplements 4.1.2. Cosmetics and Skincare 4.1.3. Food and Beverages 4.1.4. Pharmaceuticals 4.2. North America Crocetin Esters Market Size and Forecast, by Type (2022-2029) 4.2.1. Powder Form 4.2.2. Liquid Form 4.2.3. Capsules 4.2.4. Others 4.3. North America Crocetin Esters Market Size and Forecast, by Country (2022-2029) 4.3.1. United States 4.3.1.1. United States Crocetin Esters Market Size and Forecast, by Therapeutic Area (2022-2029) 4.3.1.1.1. Dietary Supplements 4.3.1.1.2. Cosmetics and Skincare 4.3.1.1.3. Food and Beverages 4.3.1.1.4. Pharmaceuticals 4.3.1.2. United States Crocetin Esters Market Size and Forecast, by Type (2022-2029) 4.3.1.2.1. Powder Form 4.3.1.2.2. Liquid Form 4.3.1.2.3. Capsules 4.3.1.2.4. Others 4.3.2. Canada 4.3.2.1. Canada Crocetin Esters Market Size and Forecast, by Therapeutic Area (2022-2029) 4.3.2.1.1. Dietary Supplements 4.3.2.1.2. Cosmetics and Skincare 4.3.2.1.3. Food and Beverages 4.3.2.1.4. Pharmaceuticals 4.3.2.2. Canada Crocetin Esters Market Size and Forecast, by Type (2022-2029) 4.3.2.2.1. Powder Form 4.3.2.2.2. Liquid Form 4.3.2.2.3. Capsules 4.3.2.2.4. Others 4.3.3. Mexico 4.3.3.1. Mexico Crocetin Esters Market Size and Forecast, by Therapeutic Area (2022-2029) 4.3.3.1.1. Dietary Supplements 4.3.3.1.2. Cosmetics and Skincare 4.3.3.1.3. Food and Beverages 4.3.3.1.4. Pharmaceuticals 4.3.3.2. Mexico Crocetin Esters Market Size and Forecast, by Type (2022-2029) 4.3.3.2.1. Powder Form 4.3.3.2.2. Liquid Form 4.3.3.2.3. Capsules 4.3.3.2.4. Others 5. Europe Crocetin Esters Market Size and Forecast by Segmentation for Demand and Supply Side (by Value in USD Million) (2022-2029) 5.1. Europe Crocetin Esters Market Size and Forecast, by Therapeutic Area (2022-2029) 5.2. Europe Crocetin Esters Market Size and Forecast, by Type (2022-2029) 5.3. Europe Crocetin Esters Market Size and Forecast, by Country (2022-2029) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Crocetin Esters Market Size and Forecast, by Therapeutic Area (2022-2029) 5.3.1.2. United Kingdom Crocetin Esters Market Size and Forecast, by Type (2022-2029) 5.3.2. France 5.3.2.1. France Crocetin Esters Market Size and Forecast, by Therapeutic Area (2022-2029) 5.3.2.2. France Crocetin Esters Market Size and Forecast, by Type (2022-2029) 5.3.3. Germany 5.3.3.1. Germany Crocetin Esters Market Size and Forecast, by Therapeutic Area (2022-2029) 5.3.3.2. Germany Crocetin Esters Market Size and Forecast, by Type (2022-2029) 5.3.4. Italy 5.3.4.1. Italy Crocetin Esters Market Size and Forecast, by Therapeutic Area (2022-2029) 5.3.4.2. Italy Crocetin Esters Market Size and Forecast, by Type (2022-2029) 5.3.5. Spain 5.3.5.1. Spain Crocetin Esters Market Size and Forecast, by Therapeutic Area (2022-2029) 5.3.5.2. Spain Crocetin Esters Market Size and Forecast, by Type (2022-2029) 5.3.6. Sweden 5.3.6.1. Sweden Crocetin Esters Market Size and Forecast, by Therapeutic Area (2022-2029) 5.3.6.2. Sweden Crocetin Esters Market Size and Forecast, by Type (2022-2029) 5.3.7. Austria 5.3.7.1. Austria Crocetin Esters Market Size and Forecast, by Therapeutic Area (2022-2029) 5.3.7.2. Austria Crocetin Esters Market Size and Forecast, by Type (2022-2029) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Crocetin Esters Market Size and Forecast, by Therapeutic Area (2022-2029) 5.3.8.2. Rest of Europe Crocetin Esters Market Size and Forecast, by Type (2022-2029) 6. Asia Pacific Crocetin Esters Market Size and Forecast by Segmentation for Demand and Supply Side (by Value in USD Million) (2022-2029) 6.1. Asia Pacific Crocetin Esters Market Size and Forecast, by Therapeutic Area (2022-2029) 6.2. Asia Pacific Crocetin Esters Market Size and Forecast, by Type (2022-2029) 6.3. Asia Pacific Crocetin Esters Market Size and Forecast, by Country (2022-2029) 6.3.1. China 6.3.1.1. China Crocetin Esters Market Size and Forecast, by Therapeutic Area (2022-2029) 6.3.1.2. China Crocetin Esters Market Size and Forecast, by Type (2022-2029) 6.3.2. S Korea 6.3.2.1. S Korea Crocetin Esters Market Size and Forecast, by Therapeutic Area (2022-2029) 6.3.2.2. S Korea Crocetin Esters Market Size and Forecast, by Type (2022-2029) 6.3.3. Japan 6.3.3.1. Japan Crocetin Esters Market Size and Forecast, by Therapeutic Area (2022-2029) 6.3.3.2. Japan Crocetin Esters Market Size and Forecast, by Type (2022-2029) 6.3.4. India 6.3.4.1. India Crocetin Esters Market Size and Forecast, by Therapeutic Area (2022-2029) 6.3.4.2. India Crocetin Esters Market Size and Forecast, by Type (2022-2029) 6.3.5. Australia 6.3.5.1. Australia Crocetin Esters Market Size and Forecast, by Therapeutic Area (2022-2029) 6.3.5.2. Australia Crocetin Esters Market Size and Forecast, by Type (2022-2029) 6.3.6. Indonesia 6.3.6.1. Indonesia Crocetin Esters Market Size and Forecast, by Therapeutic Area (2022-2029) 6.3.6.2. Indonesia Crocetin Esters Market Size and Forecast, by Type (2022-2029) 6.3.7. Malaysia 6.3.7.1. Malaysia Crocetin Esters Market Size and Forecast, by Therapeutic Area (2022-2029) 6.3.7.2. Malaysia Crocetin Esters Market Size and Forecast, by Type (2022-2029) 6.3.8. Vietnam 6.3.8.1. Vietnam Crocetin Esters Market Size and Forecast, by Therapeutic Area (2022-2029) 6.3.8.2. Vietnam Crocetin Esters Market Size and Forecast, by Type (2022-2029) 6.3.9. Taiwan 6.3.9.1. Taiwan Crocetin Esters Market Size and Forecast, by Therapeutic Area (2022-2029) 6.3.9.2. Taiwan Crocetin Esters Market Size and Forecast, by Type (2022-2029) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Crocetin Esters Market Size and Forecast, by Therapeutic Area (2022-2029) 6.3.10.2. Rest of Asia Pacific Crocetin Esters Market Size and Forecast, by Type (2022-2029) 7. Middle East and Africa Crocetin Esters Market Size and Forecast by Segmentation for Demand and Supply Side (by Value in USD Million) (2022-2029 7.1. Middle East and Africa Crocetin Esters Market Size and Forecast, by Therapeutic Area (2022-2029) 7.2. Middle East and Africa Crocetin Esters Market Size and Forecast, by Type (2022-2029) 7.3. Middle East and Africa Crocetin Esters Market Size and Forecast, by Country (2022-2029) 7.3.1. South Africa 7.3.1.1. South Africa Crocetin Esters Market Size and Forecast, by Therapeutic Area (2022-2029) 7.3.1.2. South Africa Crocetin Esters Market Size and Forecast, by Type (2022-2029) 7.3.2. GCC 7.3.2.1. GCC Crocetin Esters Market Size and Forecast, by Therapeutic Area (2022-2029) 7.3.2.2. GCC Crocetin Esters Market Size and Forecast, by Type (2022-2029) 7.3.3. Nigeria 7.3.3.1. Nigeria Crocetin Esters Market Size and Forecast, by Therapeutic Area (2022-2029) 7.3.3.2. Nigeria Crocetin Esters Market Size and Forecast, by Type (2022-2029) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Crocetin Esters Market Size and Forecast, by Therapeutic Area (2022-2029) 7.3.4.2. Rest of ME&A Crocetin Esters Market Size and Forecast, by Type (2022-2029) 8. South America Crocetin Esters Market Size and Forecast by Segmentation for Demand and Supply Side (by Value in USD Million) (2022-2029 8.1. South America Crocetin Esters Market Size and Forecast, by Therapeutic Area (2022-2029) 8.2. South America Crocetin Esters Market Size and Forecast, by Type (2022-2029) 8.3. South America Crocetin Esters Market Size and Forecast, by Country (2022-2029) 8.3.1. Brazil 8.3.1.1. Brazil Crocetin Esters Market Size and Forecast, by Therapeutic Area (2022-2029) 8.3.1.2. Brazil Crocetin Esters Market Size and Forecast, by Type (2022-2029) 8.3.2. Argentina 8.3.2.1. Argentina Crocetin Esters Market Size and Forecast, by Therapeutic Area (2022-2029) 8.3.2.2. Argentina Crocetin Esters Market Size and Forecast, by Type (2022-2029) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Crocetin Esters Market Size and Forecast, by Therapeutic Area (2022-2029) 8.3.3.2. Rest Of South America Crocetin Esters Market Size and Forecast, by Type (2022-2029) 9. Global Crocetin Esters Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Crocetin Esters Market Companies, by market capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Sabinsa Corporation 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by The 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Givaudan 10.3. Evonik Industries 10.4. Sami Labs 10.5. Phytochem India 10.6. Flavex Naturextrakte GmbH 10.7. Pharos Nutraceuticals 10.8. Safrante Global Company S.L. 10.9. Valensa International 10.10. Hijos de Eustaquio Abadía S.L. 10.11. Sigma-Aldrich (now part of Merck Group) 10.12. Organic Herb Inc. 10.13. Takasago International Corporation 10.14. Merck KGaA 10.15. Himalaya Wellness Company 10.16. Lionel Hitchen (Essential Oils) Ltd. 10.17. Loyal Super Fabrics 10.18. Taj Agro International 10.19. Exir International 10.20. California Botanicals 11. Key Findings 12. Industry Recommendations 13. Crocetin Esters Market: Research Methodology 14. Terms and Glossary