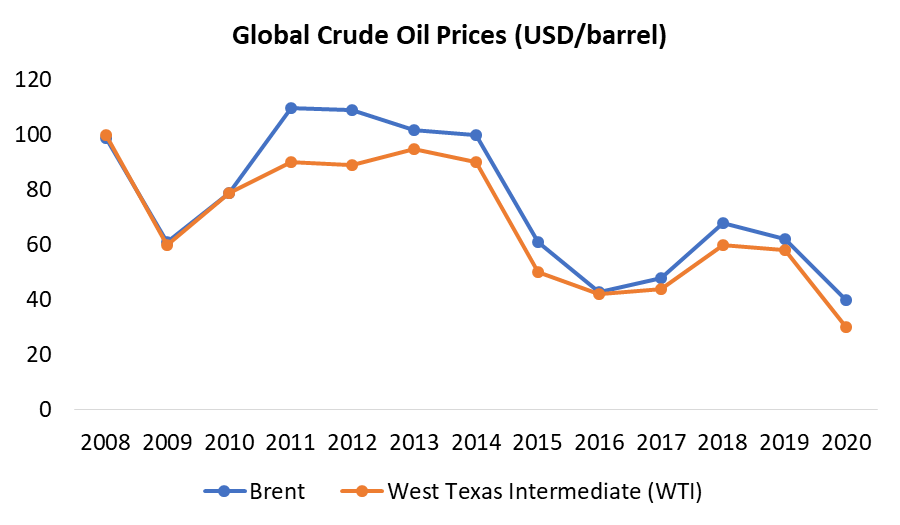

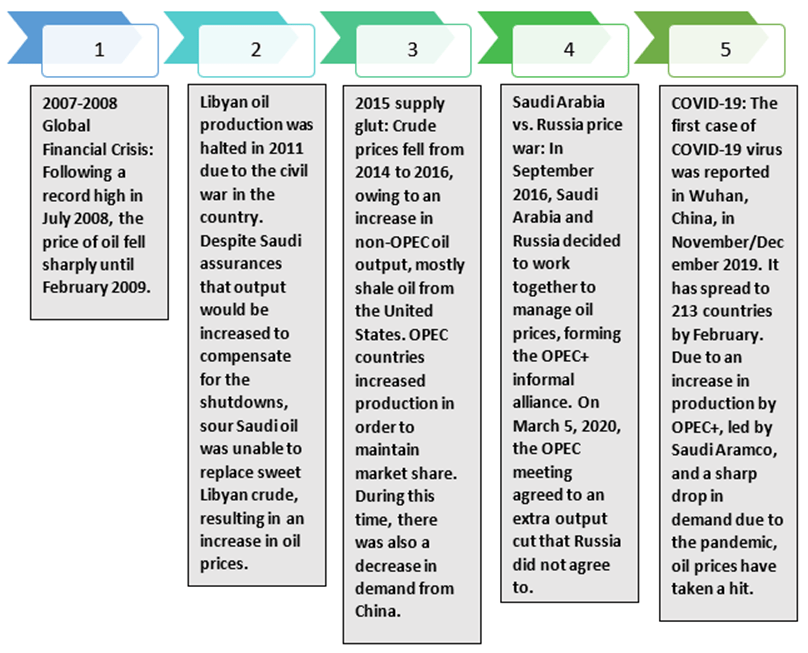

Due to the COVID-19 pandemic and geopolitical difficulties, the oil and gas industry has experienced a collapse in demand and supply.

Factors that influence the price of oil:

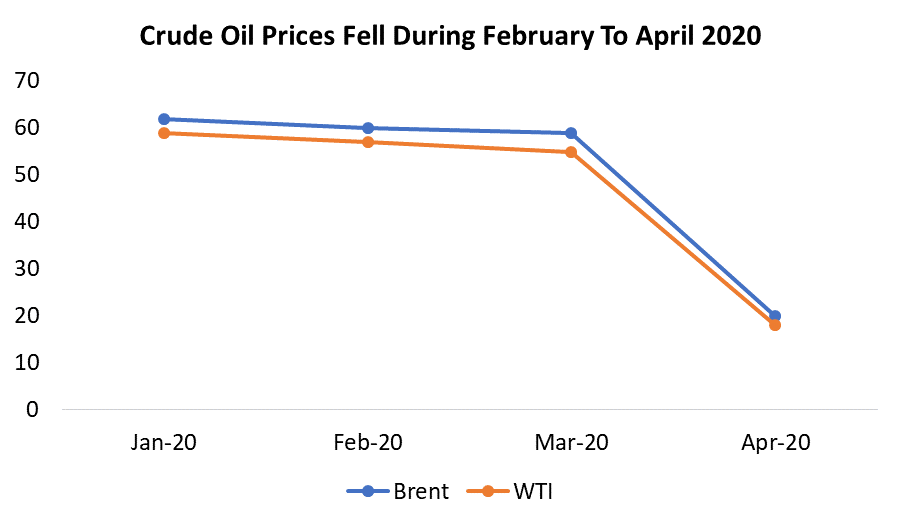

1. Decreased demand Oil demand fell from 100 million to 73 million barrels per day in April due to lockdowns and company closures. 2. Inadequate storage The supply glut has clogged up 76% of crude storage facilities at Cushing, Oklahoma, where crude oil is distributed according to contracts. Storage costs have risen due to a lack of storage space and pipeline transmission capacity, causing contract holders to sell WTI contracts at negative prices. 3. Technical difficulties in well filling Reducing supplies by temporarily sealing off wells is a complicated procedure that has a substantial impact on reservoir health, as well as is costly and time-consuming. As a result, operators continue to lose money on their wells.The total consumption of oil in 2019 was approximately 98.2 Mn. BOPD (barrels per day). Around the world, there have been lockdowns and social distancing measures: • To prevent the COVID-19 pandemic, several countries have implemented workplace lockdowns and closures. • The top 12 countries that were on lockdown (for a period ranging from 6 to 12 weeks) account for 61% of crude oil consumption.

Country Lockdown Inception China 23rd January 2020 Italy 9th March 2020 France 17th March 2020 Spain 14th March 2020 United States of America 20th March 2020 India 24th March 2020 Germany 22nd March 2020 United Kingdom 23rd March 2020 Saudi Arabia 6th April 2020 Russia 31st March 2020 Oil &Gas has a bright future ahead:

Only after December 2020 will oil demand likely reach 2019 levels. • On April 12, OPEC and Russia agreed to decrease output by 9.7 million barrels of oil per day (BOPD). • Wells with little technical risk (for example, oil sands in Canada may shut down 2 million BOPD output in April/May) will be shut down. • Smaller players are expected to halt production shortly due to a lack of liquid finances. • On a year-over-year (YoY) basis, the number of active drilling rigs in the United States of America has decreased from 991 to 465, implying a reduction in exploration and well development. • The relaxation of lockdown measures and plans for economic recovery are expected to drive Oil & gas consumption.

Oil & Gas Industry: India Analysis

Weaker crude prices have dried up income for oil exporters, while lower demand due to the pandemic has prevented oil importers from profiting.Lower consumption and pricing have allowed for the development of strategic reserves: • Due to a nationwide lockdown implemented to control the spread of coronavirus, consumption for March and April 2020 was down 12% and 38%, respectively, from prior months. • Thanks to the Indian government's relaxation of the lockdown effective June 8, 2020 (Unlock 1.0), consumption surged in May and June 2020. The rise in consumption was mostly due to higher demand for diesel and gasoline. • India has taken advantage of lower crude prices to accumulate strategic reserves. India's stored oil (including oil transported by private players) accounts for 20% (39 MMT) of the country's annual consumption, according to a federal minister. • Over the next five years, India expects to enhance its strategic storage capacity by 6.5 MMT. During the shutdown, India parked roughly 8.5-9 MMT of oil on ships across the world, especially in the Gulf region, to take advantage of reduced crude prices.

Lower crude oil prices are unlikely to benefit consumers: • Due to increases in indirect taxes by the Central and State Governments (see below for details of the excise duty hikes from 1 March 2020), a fall in crude prices has not resulted in an equivalent reduction in retail pricing of HSD and MS in India. o 14th March: The excise duty on fuel and gasoline was increased by INR 3 per liter. o 6th May: The Centre increases petrol excise duty by INR 10 per liter and diesel excise charge by INR 13 per liter. o The VAT on gasoline and diesel has also been raised by the respective state governments. • The additional government revenue cannot be estimated because gasoline and diesel usage has plummeted to 35% - 40%. • The increase in oil prices from June 2020 onwards has been passed on to consumers through a change in retail prices. OMCs have commenced daily oil price revisions as of June 7, 2020.

Oil & Gas Industry: Post COVID-19

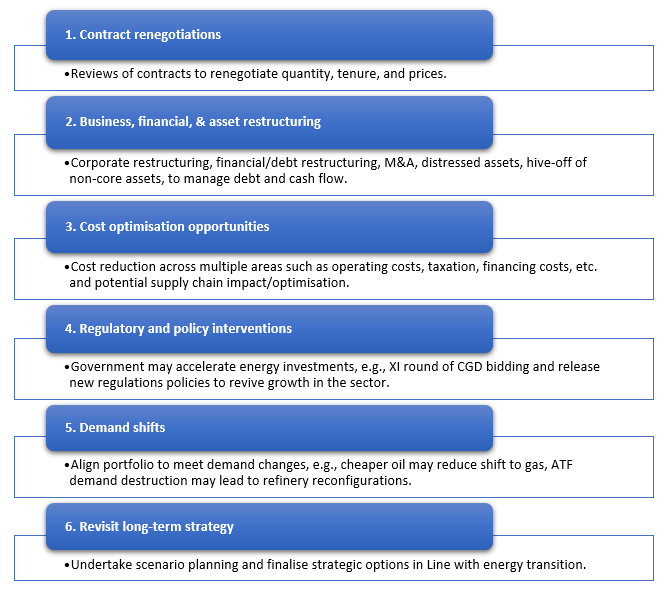

A possible strategy for players in the oil and gas industry.