The Cough Syrup Market size was valued at USD 5.31 Billion in 2023 and the total Cough Syrup Market revenue is expected to grow at a CAGR of 4.2% from 2024 to 2030, reaching nearly USD 7.08 Billion.Cough Syrup Market

The global cough syrup market stands at a crossroads, shaped by two significant demographic shifts and pressing health concerns. Urbanization's rapid growth has escalated air pollution, leading to a surge in chronic illnesses such as asthma and COPD. The MMR Study Report notes COPD as the third major cause of global death, claiming over 3.23 million lives in 2022, underscoring the severe health impact of heightened pollution levels in urban areas. A common and persistent symptom associated with these respiratory issues is coughing, leading to a rising demand for effective remedies such as Cough Syrup.To know about the Research Methodology :- Request Free Sample Report The MMR Study Report that predicts a doubling of the global population aged 60 and above by 2050. Within this demographic, chronic cough has emerged as a pressing issue, leading to a surge in demand for adult-targeted over-the-counter cough suppressants This factor is Significantly Responsible for the growth of the Cough Syrup Market. Government initiatives to enhance healthcare infrastructure, coupled with the expansion of pharmaceutical distribution channels, have contributed to market growth. The regulatory scrutiny and concerns about the misuse of certain cough syrup ingredients have prompted manufacturers to invest in research and development to ensure product safety and compliance. The COVID-19 pandemic has also influenced the market dynamics, with a heightened emphasis on respiratory health, fostering a demand for cough syrups with immune-boosting properties. Cough Syrup Market Methodology: The scope of the Cough Syrup Market encompasses an in-depth analysis of the global industry. Factors driving market growth, challenges, and opportunities, such as cost reductions, government incentives, environmental concerns, and technological advancements, are analyzed. Additionally, the report examines the competitive landscape, investment trends, and regulatory frameworks impacting the industry. The research methodology employed for this market analysis involves a combination of primary and secondary research. Key market growth drivers and restraints, recent developments, and emerging trends are evaluated using a qualitative and quantitative approach. The report compiles market data, statistics, and forecasts through a thorough process of analysis, modeling, and leveraging industry expertise. Designed to provide valuable insights for a diverse audience, including businesses, investors, policymakers, and stakeholders, the document focuses on the healthcare industry. By delivering comprehensive information, the report aims to empower decision-makers to make informed choices and strategic investments in this pivotal and swiftly evolving sector. The rigorous methodology applied ensures the reliability and accuracy of the insights, facilitating a deeper understanding of the market dynamics and trends. The report serves as a reliable resource for navigating the complexities of the industry and capitalizing on emerging opportunities. Covid 19 Impact On cough Syrup Market The COVID-19 pandemic has significantly impacted the cough syrup market as the virus is associated with persistent cough symptoms both in the acute phase and post-infection. With=Covid 19 Impact on Cough Syrup Market Cough is a common and distressing symptom of COVID-19, and there is a heightened demand for effective cough treatments. The stigma associated with cough, particularly during the pandemic, has further intensified the need for solutions. The market for cough syrup has seen increased consumer interest, driven by individuals seeking relief from COVID-19-related cough. Traditional over-the-counter cough medicines, as well as newer formulations targeting neuroinflammatory and neuroimmune pathways, are gaining attention. The effectiveness of traditional cough remedies for post-COVID cough is uncertain, prompting a need for evidence-backed treatments. Pharmaceutical companies are exploring novel strategies, including the investigation of neuromodulators such as gabapentin or opioids, as well as potential advancements in anti-inflammatories and neuromodulation approaches. As the understanding of COVID-19-associated cough evolves, there is a growing emphasis on research and development to address gaps in knowledge, providing opportunities for the cough syrup market to offer targeted solutions for acute and chronic phases of the disease. Overall, the impact of COVID-19 on the cough syrup market underscores the importance of adapting to changing healthcare needs during the pandemic.

Cough Syrup Market Dynamics

Driver Increasing Prevalence of Respiratory Disorders Boost the Market Growth The global cough syrup market is expected to have significant growth in demand, Due to the increasing prevalence of respiratory disorders, especially chronic respiratory diseases (CRDs) such as chronic obstructive pulmonary disease (COPD) and asthma. According to the recent MMR Study report, CRDs emerged as the third leading cause of global mortality in 2022, resulting in over 4.0 million deaths, with COPD standing out as the primary contributor responsible for 3.3 million fatalities. The prevalence of CRDs has exhibited a significant upswing, reaching a global total of 454.6 million cases, with COPD contributing to 212.3 million prevalent cases. This surge in respiratory disorders underscores the demand for effective therapeutic solutions, positioning the cough syrup market for significant growth. The increasing incidence of respiratory ailments underscores the necessity for effective treatment methods, with cough syrup emerging as a pivotal element in alleviating symptoms. Among these respiratory issues, chronic obstructive pulmonary disease (COPD) has evolved into a significant worldwide public health challenge, impacting approximately 392 million individuals globally. The correlation between tobacco uses and COPD, a significant risk factor, is especially worrisome in light of the growing smoking epidemic, particularly in low- and middle-income nations. Given this expanding issue, immediate intervention is required. The consequences of respiratory diseases such as COPD go beyond death; those who have them have a higher chance of acquiring other illnesses including lung cancer, heart disease, and type 2 diabetes. This highlights the complex nature of health. This underscores the multifaceted health impact of COPD, emphasizing the importance of comprehensive strategies in managing and mitigating its associated risks. The COVID-19 pandemic has further emphasized the challenges in accessing healthcare for those with respiratory conditions, creating a heightened awareness of the importance of managing and treating such disorders Governments and healthcare bodies, responding to the increasing respiratory disease burden, anticipate a surge in demand for cough syrups. This is important in easing cough symptoms related to conditions including COPD and asthma. Restrain Stringent Rules and Regulations to hampers the cough syrup Market Growth Excessive regulatory restrictions, including complex approval processes and stringent labeling requirements, pose significant obstacles to the growth of the Cough Syrup Market. Cumbersome rules impede innovation, hinder market entry, and create barriers for manufacturers, limiting their ability to meet consumer demands and stalling overall industry expansion. For Instance, the recent imposition of stringent regulations requiring cough syrup exporters from India to undergo mandatory testing at designated government laboratories is poised to significantly impact the market's growth. The Directorate General of Foreign Trade's directive, effective from June 1, 2023, necessitates the testing of export samples and the production of a certificate of analysis from specified central government labs before permitting outbound shipments. This move aims to address global concerns regarding the quality of cough syrups exported by Indian companies. To reinforce India's commitment to ensuring the quality of pharmaceutical products, the central government has initiated a pre-quality check process for cough syrup formulations destined for export. The decision comes in the wake of previous incidents, such as the recall of eye drops by Global Pharma Healthcare and allegations linking India-made cough syrups to child deaths in Gambia and Uzbekistan. India is a major player in global pharmaceuticals, with over 80% of antiretroviral drugs combating AIDS supplied by Indian firms, the new regulations pose challenges to the cough syrup market. The added layer of testing and certification leads to delays in export approvals, impacting the industry's efficiency. This development underscores the growing importance of quality assurance in pharmaceutical exports and the need for industry stakeholders to adapt to evolving regulatory landscapes. Rules and Regulations Related to Cough Syrup:Rising Preference for Natural and Herbal Products Creates Lucrative Opportunities for Market Growth The increasing consumer inclination toward Ayurvedic remedies has created lucrative prospects for market growth in the cough syrup industry. Capitalizing on this trend involves developing formulations with natural ingredients, aligning with health-conscious preferences, and differentiating products in a competitive market. This rising demand reflects a broader shift towards wellness-focused choices in pharmaceuticals, positioning companies favorably in meeting consumer expectations. Polyherbal cough syrups are becoming increasingly popular due to their natural and safe ingredients. Many of these syrups incorporate a mix of various herbs with a longstanding history of being utilized to address coughs and respiratory issues in traditional medicine. The growing preference for natural and herbal remedies has fueled the popularity of polyherbal cough syrups. Commonly featured herbs in these syrups encompass ginger, turmeric, licorice, basil, honey, and thyme. These herbs boast anti-inflammatory, antibacterial, and expectorant properties, offering relief for coughs and respiratory symptoms. Additionally, a noteworthy trend in polyherbal cough syrups involves the integration of essential vitamins and minerals such as vitamin C, zinc, and magnesium. These nutrients serve to fortify the immune system, aiding in the battle against infections that lead to coughs.

Country Regulatory Act Key Regulations Recent Developments United States FDA, DEA, Controlled Substances Act Monitoring controlled substances; Schedule V for codeine-containing cough preparations Child-resistant packaging mandated by the Poison Prevention and Packaging Act of 1970 India Various regulatory authorities, Export quality checks Stringent quality checks and Certificate of Analysis (CoA) verification Global concerns about the safety and quality of cough syrups following toxic contamination incidents California, USA State-specific regulations Introduction of rules targeting flavors in kids' medication; Pharmacies complying with stricter regulations with stricter regulations Ongoing developments in response to flavor regulations in children's medication Cough Syrup Market Segment Analysis:

Based On Product, The Cough suppressants segment dominated the cough Syrup Market growth in the year 2023. Cough suppressants are used to alleviate cough symptoms by suppressing the urge to cough. This segment's prominence is driven by the widespread prevalence of conditions such as the common cold, influenza, and respiratory infections, where coughing is a common symptom. Formulations for cough suppression commonly feature active components like dextromethorphan and codeine, influencing the cough reflex in the central nervous system to diminish the frequency and intensity of coughing. The growing consumer inclination towards over-the-counter (OTC) medications additionally drives the growth of the cough suppressants segment. With an increasing emphasis on self-medication, individuals often opt for easily accessible cough syrups that contain cough suppressants for quick and convenient relief. The availability of these products in pharmacies, supermarkets, and online platforms enhances their accessibility, contributing to market dominance. Also, healthcare professionals recommend cough suppressants for patients with dry or non-productive coughs, this factor significantly driving the demand for this segment. The versatility of cough suppressants in addressing different types of coughs adds to their widespread acceptance among both consumers and healthcare providers. Innovations in formulation and the introduction of combination cough syrups that integrate cough suppressants with other active ingredients, such as expectorants or decongestants, contribute to the segment's growth. These combinations cater to a broader spectrum of cough symptoms, enhancing the overall efficacy of the cough syrup products.Regional Analysis:

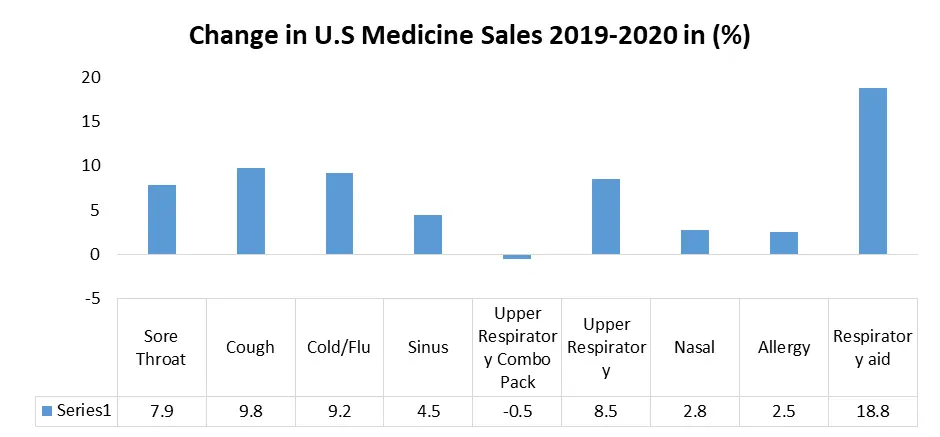

Asia Pacific Region Dominated the Cough Syrup Market in the year 2023.The growth of the cough syrup market in the Asia-Pacific region is also driven by an increase in respiratory disorders, the rise in the geriatric population, and immense air pollution. These factors have contributed to the higher demand for cough syrup products in the region. In the Asia-Pacific region, retail pharmacies wield significant market dominance due to the non-prescription nature of cough syrups, readily accessible in drug stores. The absence of a mandatory prescription facilitates easy availability. Physicians contribute to this trend by prescribing over-the-counter cough syrups for common colds and respiratory ailments, amplifying market growth. This convenience-driven landscape in the region underscores the important role of retail pharmacies in meeting the demand for accessible and prescription-free cough remedies, aligning with consumer preferences for straightforward access to effective respiratory solutions. North America Cough Syrup Market The Cough Syrup Market of North America has witnessed strong growth due to changing weather patterns and heightened awareness of health issues innovative product formulations, and marketing strategies by key pharmaceutical companies have boosted the demand. The market's growth is expected to persist, driven by a steady stream of new product launches and a proactive approach to addressing diverse consumer needs in the region.

Competitive Analysis

The cough syrup market is a dynamic and competitive. Due to increasing respiratory ailments, changing consumer lifestyles, and growing awareness about self-medication. Key players in the cough syrup market include pharmaceutical giants such as Johnson & Johnson, GlaxoSmithKline, Reckitt Benckiser, Novartis, and Procter & Gamble. One of the critical factors influencing competition is the formulation of cough syrups. Companies are investing heavily in research and development to create innovative and effective formulations, incorporating ingredients such as antitussives, expectorants, and decongestants. This drive for innovation is aimed at addressing diverse consumer needs, such as soothing dry coughs and relieving chest congestion. Branding and marketing strategies play a pivotal role in the competitive landscape of the Cough Syrup Market. Established brands leverage their reputation and consumer trust, while newer entrants focus on aggressive marketing campaigns to gain market share. Social media and digital platforms are increasingly being utilized to reach a wider audience and build brand loyalty. Companies adopt competitive pricing to gain a foothold in the market or premium pricing for products positioned as advanced or superior. Pricing decisions are also influenced by factors such as distribution channels, target demographics, and regional variations in consumer preferences.Cough Syrup Market Scope: Inquire Before Buying

Cough Syrup Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 5.31 Bn. Forecast Period 2024 to 2030 CAGR: 4.2% Market Size in 2030: US $ 7.08 Bn. Segments Covered: by Product Expectorants Cough Suppressants Antihistamines Combination Medication by Age Group Pediatric Adult by Distribution Channel Retail Pharmacy Hospital Others Cough Syrup Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Cough Syrup Market, Key Players:

1. Johnson & Johnson 2. Pfizer Inc. 3. Roche Holding AG 4. Novartis International AG 5. Merck & Co., Inc. 6. GlaxoSmithKline (GSK) 7. Sanofi 8. AstraZeneca PLC 9. AbbVie Inc. 10. Amgen Inc. 11. Eli Lilly and Company 12. Bristol Myers Squibb 13. Takeda Pharmaceutical Company Limited 14. Abbott Laboratories 15. Bayer AG 16. Biogen Inc. 17. Gilead Sciences, Inc. 18. Novo Nordisk A/S 19. Regeneron Pharmaceuticals, Inc. 20. Vertex Pharmaceuticals Incorporated FAQs: 1. What are the growth drivers for the Cough Syrup Market? Ans. The growing awareness and acceptance of self-medication among consumers contribute to the Growth of the cough syrup market. 2. What is the major opportunity for the Cough Syrup Market growth? Ans. Increasing awareness of the potential side effects associated with certain synthetic ingredients in traditional cough syrups has led consumers to seek alternatives expected to be a major Opportunity in the Cough Syrup Market. 3. Which country is expected to lead the global Cough Syrup Market during the forecast period? Ans. Asia Pacific is expected to lead the Cough Syrup Market during the forecast period. 4. What is the projected market size and growth rate of the Cough Syrup Market? Ans. The Cough Syrup Market size was valued at USD 5.31 Billion in 2023 and the total Cough Syrup Market revenue is expected to grow at a CAGR of 4.2% from 2024 to 2030, reaching nearly USD 7.08 Billion. 5. What segments are covered in the Cough Syrup Market report? Ans. The segments covered in the Cough Syrup Market report are by Product, Age Group, Distribution channel and Region.

1. Cough Syrup Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Cough Syrup Market: Dynamics 2.1. Cough Syrup Market Trends by Region 2.1.1. North America Cough Syrup Market Trends 2.1.2. Europe Cough Syrup Market Trends 2.1.3. Asia Pacific Cough Syrup Market Trends 2.1.4. Middle East and Africa Cough Syrup Market Trends 2.1.5. South America Cough Syrup Market Trends 3. Cough Syrup Market Dynamics by Region 3.1.1. North America 3.1.1.1. North America Cough Syrup Market Drivers 3.1.1.2. North America Cough Syrup Market Restraints 3.1.1.3. North America Cough Syrup Market Opportunities 3.1.1.4. North America Cough Syrup Market Challenges 3.1.2. Europe 3.1.2.1. Europe Cough Syrup Market Drivers 3.1.2.2. Europe Cough Syrup Market Restraints 3.1.2.3. Europe Cough Syrup Market Opportunities 3.1.2.4. Europe Cough Syrup Market Challenges 3.1.3. Asia Pacific 3.1.3.1. Asia Pacific Cough Syrup Market Drivers 3.1.3.2. Asia Pacific Cough Syrup Market Restraints 3.1.3.3. Asia Pacific Cough Syrup Market Opportunities 3.1.3.4. Asia Pacific Cough Syrup Market Challenges 3.1.4. Middle East and Africa 3.1.4.1. Middle East and Africa Cough Syrup Market Drivers 3.1.4.2. Middle East and Africa Cough Syrup Market Restraints 3.1.4.3. Middle East and Africa Cough Syrup Market Opportunities 3.1.4.4. Middle East and Africa Cough Syrup Market Challenges 3.1.5. South America 3.1.5.1. South America Cough Syrup Market Drivers 3.1.5.2. South America Cough Syrup Market Restraints 3.1.5.3. South America Cough Syrup Market Opportunities 3.1.5.4. South America Cough Syrup Market Challenges 3.2. PORTER’s Five Forces Analysis 3.3. PESTLE Analysis 3.4. Value Chain Analysis 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 3.6. Cough Syrup Clinical Trial Analysis for Cough Syrup 3.7. Key Opinion Leader Analysis For Cough Syrup Industry 3.8. Analysis of Government Schemes and Initiatives For Cough Syrup Industry 3.9. The Global Pandemic Impact on Cough Syrup Market 3.10. Cough Syrup Price Trend Analysis (2023-2023) 4. Cough Syrup Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. Cough Syrup Market Size and Forecast, by Product (2023-2030) 4.1.1. Expectorants 4.1.2. Cough Suppressants 4.1.3. Antihistamines 4.1.4. Combination Medication 4.2. Cough Syrup Market Size and Forecast, by Age Group (2023-2030) 4.2.1. Paediatric 4.2.2. Adult 4.3. Cough Syrup Market Size and Forecast, by Distribution Channel (2023-2030) 4.3.1. Retail 4.3.2. PHARMACY 4.3.3. Hospital 4.3.4. Others 4.4. Cough Syrup Market Size and Forecast, by End User (2023-2030) 4.4.1. Biopharmaceuticals and Pharma companies 4.4.2. Research Organisations 4.4.3. Clinical Laboratories 4.4.4. Others 4.5. Cough Syrup Market Size and Forecast, by region (2023-2030) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Cough Syrup Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America Cough Syrup Market Size and Forecast, by Product (2023-2030) 5.1.1. Expectorants 5.1.2. Cough Suppressants 5.1.3. Antihistamines 5.1.4. Combination Medication 5.2. North America Cough Syrup Market Size and Forecast, by Age Group (2023-2030) 5.2.1. Paediatric 5.2.2. Adult 5.3. North America Cough Syrup Market Size and Forecast, by Distribution Channel (2023-2030) 5.3.1. Retail 5.3.2. PHARMACY 5.3.3. Hospital 5.3.4. Others 5.4. North America Cough Syrup Market Size and Forecast, by End User (2023-2030) 5.4.1. Biopharmaceuticals and Pharma companies 5.4.2. Research Organisations 5.4.3. Clinical Laboratories 5.4.4. Others 5.5. North America Cough Syrup Market Size and Forecast, by Country (2023-2030) 5.5.1. United States 5.5.1.1. United States Cough Syrup Market Size and Forecast, by Product (2023-2030) 5.5.1.1.1. Expectorants 5.5.1.1.2. Cough Suppressants 5.5.1.1.3. Antihistamines 5.5.1.1.4. Combination Medication 5.5.1.2. United States Cough Syrup Market Size and Forecast, by Age Group (2023-2030) 5.5.1.2.1. Paediatric 5.5.1.2.2. Adult 5.5.1.3. United States Cough Syrup Market Size and Forecast, by Distribution Channel (2023-2030) 5.5.1.3.1. Retail 5.5.1.3.2. Pharmacy 5.5.1.3.3. Hospital 5.5.1.3.4. Others 5.5.1.4. United States Cough Syrup Market Size and Forecast, by End User (2023-2030) 5.5.1.4.1. Biopharmaceuticals and Pharma companies 5.5.1.4.2. Research Organisations 5.5.1.4.3. Clinical Laboratories 5.5.1.4.4. Others 5.5.2. Canada 5.5.2.1. Canada Cough Syrup Market Size and Forecast, by Product (2023-2030) 5.5.2.1.1. Expectorants 5.5.2.1.2. Cough Suppressants 5.5.2.1.3. Antihistamines 5.5.2.1.4. Combination Medication 5.5.2.2. Canada Cough Syrup Market Size and Forecast, by Age Group (2023-2030) 5.5.2.2.1. Paediatric 5.5.2.2.2. Adult 5.5.2.3. Canada Cough Syrup Market Size and Forecast, by Distribution Channel (2023-2030) 5.5.2.3.1. Retail 5.5.2.3.2. Pharmacy 5.5.2.3.3. Hospital 5.5.2.3.4. Others 5.5.3. Mexico 5.5.3.1. Mexico Cough Syrup Market Size and Forecast, by Product (2023-2030) 5.5.3.1.1. Expectorants 5.5.3.1.2. Cough Suppressants 5.5.3.1.3. Antihistamines 5.5.3.1.4. Combination Medication 5.5.3.2. Mexico Cough Syrup Market Size and Forecast, by Age Group (2023-2030) 5.5.3.2.1. Paediatric 5.5.3.2.2. Adult 5.5.3.3. Mexico Cough Syrup Market Size and Forecast, by Distribution Channel (2023-2030) 5.5.3.3.1. Retail 5.5.3.3.2. Pharmacy 5.5.3.3.3. Hospital 5.5.3.3.4. Others 5.5.3.4. Mexico Cough Syrup Market Size and Forecast, by End User (2023-2030) 5.5.3.4.1. Biopharmaceuticals and Pharma companies 5.5.3.4.2. Research Organisations 5.5.3.4.3. Clinical Laboratories 5.5.3.4.4. Others 6. Europe Cough Syrup Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe Cough Syrup Market Size and Forecast, by Product (2023-2030) 6.2. Europe Cough Syrup Market Size and Forecast, by Age Group (2023-2030) 6.3. Europe Cough Syrup Market Size and Forecast, by Distribution Channel (2023-2030) 6.4. Europe Cough Syrup Market Size and Forecast, by Country (2023-2030) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Cough Syrup Market Size and Forecast, by Product (2023-2030) 6.4.1.2. United Kingdom Cough Syrup Market Size and Forecast, by Age Group (2023-2030) 6.4.1.3. United Kingdom Cough Syrup Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.2. France 6.4.2.1. France Cough Syrup Market Size and Forecast, by Product (2023-2030) 6.4.2.2. France Cough Syrup Market Size and Forecast, by Age Group (2023-2030) 6.4.2.3. France Cough Syrup Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.3. Germany 6.4.3.1. Germany Cough Syrup Market Size and Forecast, by Product (2023-2030) 6.4.3.2. Germany Cough Syrup Market Size and Forecast, by Age Group (2023-2030) 6.4.3.3. Germany Cough Syrup Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.4. Italy 6.4.4.1. Italy Cough Syrup Market Size and Forecast, by Product (2023-2030) 6.4.4.2. Italy Cough Syrup Market Size and Forecast, by Age Group (2023-2030) 6.4.4.3. Italy Cough Syrup Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.5. Spain 6.4.5.1. Spain Cough Syrup Market Size and Forecast, by Product (2023-2030) 6.4.5.2. Spain Cough Syrup Market Size and Forecast, by Age Group (2023-2030) 6.4.5.3. Spain Cough Syrup Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.6. Sweden 6.4.6.1. Sweden Cough Syrup Market Size and Forecast, by Product (2023-2030) 6.4.6.2. Sweden Cough Syrup Market Size and Forecast, by Age Group (2023-2030) 6.4.6.3. Sweden Cough Syrup Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.7. Austria 6.4.7.1. Austria Cough Syrup Market Size and Forecast, by Product (2023-2030) 6.4.7.2. Austria Cough Syrup Market Size and Forecast, by Age Group (2023-2030) 6.4.7.3. Austria Cough Syrup Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Cough Syrup Market Size and Forecast, by Product(2023-2030) 6.4.8.2. Rest of Europe Cough Syrup Market Size and Forecast, by Age Group (2023-2030) 6.4.8.3. Rest of Europe Cough Syrup Market Size and Forecast, by Distribution Channel (2023-2030) 7. Asia Pacific Cough Syrup Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Cough Syrup Market Size and Forecast, by Product(2023-2030) 7.2. Asia Pacific Cough Syrup Market Size and Forecast, by Age Group (2023-2030) 7.3. Asia Pacific Cough Syrup Market Size and Forecast, by Distribution Channel (2023-2030) 7.4. Asia Pacific Cough Syrup Market Size and Forecast, by Country (2023-2030) 7.4.1. China 7.4.1.1. China Cough Syrup Market Size and Forecast, by Product(2023-2030) 7.4.1.2. China Cough Syrup Market Size and Forecast, by Age Group (2023-2030) 7.4.1.3. China Cough Syrup Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.2. S Korea 7.4.2.1. S Korea Cough Syrup Market Size and Forecast, by Product(2023-2030) 7.4.2.2. S Korea Cough Syrup Market Size and Forecast, by Age Group (2023-2030) 7.4.2.3. S Korea Cough Syrup Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.3. Japan 7.4.3.1. Japan Cough Syrup Market Size and Forecast, by Product(2023-2030) 7.4.3.2. Japan Cough Syrup Market Size and Forecast, by Age Group (2023-2030) 7.4.3.3. Japan Cough Syrup Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.4. India 7.4.4.1. India Cough Syrup Market Size and Forecast, by Product(2023-2030) 7.4.4.2. India Cough Syrup Market Size and Forecast, by Age Group (2023-2030) 7.4.4.3. India Cough Syrup Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.5. Australia 7.4.5.1. Australia Cough Syrup Market Size and Forecast, by Product(2023-2030) 7.4.5.2. Australia Cough Syrup Market Size and Forecast, by Age Group (2023-2030) 7.4.5.3. Australia Cough Syrup Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.6. Indonesia 7.4.6.1. Indonesia Cough Syrup Market Size and Forecast, by Product(2023-2030) 7.4.6.2. Indonesia Cough Syrup Market Size and Forecast, by Age Group (2023-2030) 7.4.6.3. Indonesia Cough Syrup Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.7. Malaysia 7.4.7.1. Malaysia Cough Syrup Market Size and Forecast, by Product(2023-2030) 7.4.7.2. Malaysia Cough Syrup Market Size and Forecast, by Age Group (2023-2030) 7.4.7.3. Malaysia Cough Syrup Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.8. Vietnam 7.4.8.1. Vietnam Cough Syrup Market Size and Forecast, by Product(2023-2030) 7.4.8.2. Vietnam Cough Syrup Market Size and Forecast, by Age Group (2023-2030) 7.4.8.3. Vietnam Cough Syrup Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.9. Taiwan 7.4.9.1. Taiwan Cough Syrup Market Size and Forecast, by Product(2023-2030) 7.4.9.2. Taiwan Cough Syrup Market Size and Forecast, by Age Group (2023-2030) 7.4.9.3. Taiwan Cough Syrup Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Cough Syrup Market Size and Forecast, by Product(2023-2030) 7.4.10.2. Rest of Asia Pacific Cough Syrup Market Size and Forecast, by Age Group (2023-2030) 7.4.10.3. Rest of Asia Pacific Cough Syrup Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.10.4. Rest of Asia Pacific Cough Syrup Market Size and Forecast, by End User(2023-2030) 8. Middle East and Africa Cough Syrup Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 8.1. Middle East and Africa Cough Syrup Market Size and Forecast, by Product(2023-2030) 8.2. Middle East and Africa Cough Syrup Market Size and Forecast, by Age Group (2023-2030) 8.3. Middle East and Africa Cough Syrup Market Size and Forecast, by Distribution Channel (2023-2030) 8.4. Middle East and Africa Cough Syrup Market Size and Forecast, by Country (2023-2030) 8.4.1. South Africa 8.4.1.1. South Africa Cough Syrup Market Size and Forecast, by Product(2023-2030) 8.4.1.2. South Africa Cough Syrup Market Size and Forecast, by Age Group (2023-2030) 8.4.1.3. South Africa Cough Syrup Market Size and Forecast, by Distribution Channel (2023-2030) 8.4.2. GCC 8.4.2.1. GCC Cough Syrup Market Size and Forecast, by Product(2023-2030) 8.4.2.2. GCC Cough Syrup Market Size and Forecast, by Age Group (2023-2030) 8.4.2.3. GCC Cough Syrup Market Size and Forecast, by Distribution Channel (2023-2030) 8.4.3. Nigeria 8.4.3.1. Nigeria Cough Syrup Market Size and Forecast, by Product(2023-2030) 8.4.3.2. Nigeria Cough Syrup Market Size and Forecast, by Age Group (2023-2030) 8.4.3.3. Nigeria Cough Syrup Market Size and Forecast, by Distribution Channel (2023-2030) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Cough Syrup Market Size and Forecast, by Product(2023-2030) 8.4.4.2. Rest of ME&A Cough Syrup Market Size and Forecast, by Age Group (2023-2030) 8.4.4.3. Rest of ME&A Cough Syrup Market Size and Forecast, by Distribution Channel (2023-2030) 9. South America Cough Syrup Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 9.1. South America Cough Syrup Market Size and Forecast, by Product(2023-2030) 9.2. South America Cough Syrup Market Size and Forecast, by Age Group (2023-2030) 9.3. South America Cough Syrup Market Size and Forecast, by Distribution Channel (2023-2030) 9.4. South America Cough Syrup Market Size and Forecast, by Country (2023-2030) 9.4.1. Brazil 9.4.1.1. Brazil Cough Syrup Market Size and Forecast, by Product(2023-2030) 9.4.1.2. Brazil Cough Syrup Market Size and Forecast, by Age Group (2023-2030) 9.4.1.3. Brazil Cough Syrup Market Size and Forecast, by End User(2023-2030) 9.4.2. Argentina 9.4.2.1. Argentina Cough Syrup Market Size and Forecast, by Product(2023-2030) 9.4.2.2. Argentina Cough Syrup Market Size and Forecast, by Age Group (2023-2030) 9.4.2.3. Argentina Cough Syrup Market Size and Forecast, by Distribution Channel (2023-2030) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Cough Syrup Market Size and Forecast, by Product(2023-2030) 9.4.3.2. Rest Of South America Cough Syrup Market Size and Forecast, by Age Group (2023-2030) 9.4.3.3. Rest Of South America Cough Syrup Market Size and Forecast, by Distribution Channel (2023-2030) 10. Global Cough Syrup Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Product Segment 10.3.3. End-user Segment 10.3.4. Revenue (2022) 10.3.5. Company Locations 10.4. Leading Cough Syrup Market Companies, by market capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Johnson & Johnson 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (small, medium, and large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. Pfizer Inc. 11.3. Roche Holding AG 11.4. Novartis International AG 11.5. Merck & Co., Inc. 11.6. GlaxoSmithKline (GSK) 11.7. Sanofi 11.8. AstraZeneca PLC 11.9. AbbVie Inc. 11.10. Amgen Inc. 11.11. Eli Lilly and Company 11.12. Bristol Myers Squibb 11.13. Takeda Pharmaceutical Company Limited 11.14. Abbott Laboratories 11.15. Bayer AG 11.16. Biogen Inc. 11.17. Gilead Sciences, Inc. 11.18. Novo Nordisk A/S 11.19. Regeneron Pharmaceuticals, Inc. 11.20. Vertex Pharmaceuticals Incorporated 12. Key Findings 13. Industry Recommendations 14. Cough Syrup Market: Research Methodology