Global Cosmetic Serum Market size was valued at USD 3.86 Bn in 2023 and Cosmetic Serum revenue is expected to reach USD 5.47 Bn by 2030, at a CAGR of 5.1 % over the forecast period.Cosmetic Serum Market Overview

A cosmetic serum is a concentrated concoction of potent active ingredients meticulously formulated to address specific skincare concerns with remarkable precision and efficacy. The cosmetic serum emerges as a formidable player, captivating the attention of beauty enthusiasts and dermatologists alike. The Cosmetic Serum Industry landscape is undergoing a dynamic transformation, marked by a surge in consumer interest and a spate of innovations. This sector, positioned at the intersection of beauty and science, is witnessing an evolution in response to the discerning demands of consumers seeking advanced skincare solutions. Brands in Cosmetic Serum Market are engaged in a competitive race, striving to create formulations that not only address specific skincare concerns but also promise a transformative experience. The growth prospects of the Cosmetic Serum Market are robust, fueled by several factors that shape the industry landscape. An increasingly aging population, coupled with a heightened emphasis on personal grooming, propels the demand for serums promising efficacy and visible results. The concentration of active ingredients in cosmetic serum formulations stands out as a key growth driver for the market. Consumer behavior in the Cosmetic Serum Market is a fundamental factor shaping the industry's trajectory. The application of serums has become a staple in skincare routines worldwide, positioned strategically after cleansing and toning but before moisturizing. The Cosmetic Serum industry has a global footprint, with consumers across regions embracing these products as essential components of their skincare routines. Established markets in North America and Europe coexist with rapidly growing markets in Asia-Pacific, creating a truly international landscape. The Cosmetic Serum market scope extends to customization and personalization trends. Serum Brands are increasingly offering personalized cosmetic serums, allowing consumers to address their unique skincare concerns with tailor-made solutions. This customization aligns with the modern consumer's desire for products that cater to individual preferences and requirements.To know about the Research Methodology :- Request Free Sample Report

Cosmetic Serum Market Dynamics

Growing consumer inclination towards advanced skincare to boost the Cosmetic Serum Market growth The increasing consumer inclination towards advanced skincare solutions amidst competitive forces in the industry. Modern consumers, armed with information from emerging trends in the Cosmetic serum market, are more informed and discerning about skincare ingredients. They actively seek products that transcend basic skincare, and Cosmetic serums, with their concentrated and potent formulations, align with this demand for advanced and targeted skincare. The surge in awareness regarding the benefits of targeted skincare is a significant driver, spurred by emerging trends and competitive dynamics in the Cosmetic Serum Market. Consumers are now well-versed in the advantages of using cosmetic serums, such as their ability to address specific concerns such fine lines, wrinkles, hyperpigmentation, and dehydration. This heightened awareness, influenced by industry innovations, has contributed to the mainstream acceptance of serums as integral components of skincare routines. The contemporary emphasis on personal grooming is driving the demand for products that contribute to a well-rounded skincare regimen amid competitive forces. Cosmetic serums, with their specialized formulations influenced by emerging trends, cater to this trend by offering solutions for diverse skincare concerns. The market benefits from consumers viewing skincare as a holistic and personalized approach to self-care in the context of Cosmetic serum industry innovation. Technological advancements in skincare formulations and delivery systems, spurred by innovation in the Cosmetic Serum industry, are pivotal drivers for the market. The integration of cutting-edge technologies enhances the efficacy of serums, allowing for better absorption of active ingredients into the skin. This continuous innovation, driven by competitive forces, contributes to the market's dynamism and appeal. The market benefits from the diversity in cosmetic serum formulations, shaped by both emerging trends and competitive strategies within the industry. Serums infused with ingredients like vitamin C, hyaluronic acid, peptides, and retinol cater to a spectrum of concerns, providing consumers influenced by emerging trends with a wide array of options based on their individual preferences and requirements. The influence of social media and beauty influencers, recognized by both competitive forces and industry innovation, is a driving force behind the market's expansion. Platforms like Instagram and YouTube, driven by emerging trends, serve as powerful channels for product promotion and education. Beauty influencers, influenced by competitive dynamics, often highlight the benefits of specific cosmetic serums, contributing to increased awareness and demand. High Cost of Premium Serums to limit the Cosmetic Serum Market growth Premium cosmetic serums often come with a hefty price tag due to the concentration of high-quality and advanced ingredients. The cost factor is significant restraint, deterring price-sensitive consumers from incorporating these products into their skincare routines. This limit the market's reach and accessibility. The potent formulations in cosmetic serums, while effective for many, pose a risk for individuals with sensitive skin or allergies. Certain active ingredients, such as retinol or certain acids, cause irritation or adverse reactions in some users. This limitation necessitates careful product selection and limit the market for those with sensitive skin. The Cosmetic Serum Market is inundated with a plethora of products, each claiming to address specific skincare concerns. This saturation overwhelm consumers and lead to decision fatigue. Additionally, it poses challenges for newer or niche brands to differentiate themselves and gain visibility in a crowded market. The cosmetic industry, including serums, contributes to environmental concerns due to packaging waste and the environmental impact of certain ingredients. Sustainable and eco-friendly practices are gaining importance, and brands that fail to address these concerns face backlash from environmentally-conscious consumers, which is expected to limit the Cosmetic Serum Market share. Cosmetic serums, particularly those with high concentrations of active ingredients, have a limited shelf life once opened. This is restraint for consumers who do not use the product consistently or who does not finish the product within its recommended timeframe.Trends in Cosmetic Serum Market

1. Customization and Personalization: There is a growing demand for customized and personalized cosmetic serums tailored to individual skin types, tones, and concerns. Brands are leveraging technology to offer personalized solutions, allowing consumers to address their unique skincare needs effectively. 2. Innovations in Formulations: Ongoing innovations in cosmetic serum formulations are a notable trend. Cosmetic Serum Brands are exploring new ingredients, encapsulation technologies, and delivery systems to enhance the efficacy of serums. This includes the integration of peptides, probiotics, adaptogens, and other cutting-edge components. 3. Hybrid and Multi-Functional Serums: The market is witnessing a surge in hybrid and multi-functional serums that address multiple skincare concerns simultaneously. Consumers are drawn to products that offer a comprehensive approach, such as serums combining anti-aging, brightening, and hydrating properties.Cosmetic Serum Market Segment Analysis

Based on Serum Type, the market is segmented Anti-Aging Serum, Hydrating Serum, Brightening Serum, Acne-Fighting Serum, and Vitamin C Serum. Anti-Aging Serum segment dominated the market in 2023 and is expected to hold the largest Cosmetic Serum Market share over the forecast period. The Anti-Aging Serum segment in the cosmetic market is a dynamic and highly sought-after category that addresses the growing consumer concern regarding visible signs of aging. As individuals seek effective solutions to maintain youthful and radiant skin, anti-aging serums have become a focal point within the broader skincare industry. Anti-aging serums are distinguished by their potent formulations, often enriched with key ingredients known for their efficacy in addressing aging skin concerns. Technological innovations play a crucial role in the evolution of anti-aging serums. The integration of advanced delivery systems, nanotechnology, and encapsulation techniques enhances the efficacy of these serums, ensuring that active ingredients penetrate the skin effectively. Such advancements contribute to the market's dynamism and the development of increasingly sophisticated formulations. Based on Ingredient, the market is segmented into Hyaluronic Acid Serums, Retinol Serum, Vitamin C Serum, and Peptide Serum. Hyaluronic Acid Serums segment dominated the market in 2023 and is expected to continue the dominance over the forecast period. The global appeal of Hyaluronic Acid Serums is evident as consumers worldwide seek effective hydration solutions. Hyaluronic Acid Serums are versatile for different skincare routines. They are used by individuals with varying skin concerns, from dryness to oiliness, as they provide hydration without adding excess oil, which significantly boosts the Cosmetic Serum market growth. This versatility contributes to their widespread adoption in the cosmetic market. The segment's growth is not limited to specific regions, making it a ubiquitous category within the international cosmetic market. Brands in the Hyaluronic Acid Serums segment often highlight the science behind hyaluronic acid, its natural occurrence in the skin, and the benefits of maintaining optimal skin hydration. Marketing strategies emphasize the serum's ability to address dryness, promote a plump complexion, and contribute to a dewy and youthful appearance. Based on End User, the market is segmented into Individual Consumers, and Professional Use. Individual Consumers segment is expected to dominate the Cosmetic Serum industry over the forecast period. Individual consumers adopt personalized skincare regimens based on their unique skin types, concerns, and goals. They choose cosmetic serums that target specific issues such as aging, hyperpigmentation, dryness, or acne. The flexibility of cosmetic serums allows consumers to customize their routines according to their individual needs. The "Individual Consumers" segment encompasses individuals with a wide range of skincare concerns and goals. Some are focused on preventing signs of aging, while others seek solutions for acne-prone skin or uneven skin tone. The diversity within this segment drives the demand for a variety of cosmetic serum formulations catering to different skincare needs. Individual consumers typically incorporate cosmetic serums into their daily skincare routines. Positioned after cleansing and before moisturizing, serums are valued for their ability to deliver concentrated and targeted ingredients. This strategic placement enhances the effectiveness of the skincare routine, contributing to the popularity of serums among individual consumers.Cosmetic Serum Market Regional Insight

Clean Beauty trend in North America to drive the Cosmetic Serum Market growth North America, particularly the United States, stands as a key region for the cosmetic serum market, hosting prominent players, including leading cosmetic serum manufacturers. This market is defined by a high level of consumer awareness and is home to manufacturers dedicated to delivering premium, science-backed formulations. The region boasts a formidable presence of established beauty and skincare brands, including manufacturers that cater to the discerning preferences of North American consumers. Cosmetic serum companies in North America play a pivotal role in meeting the demands of consumers who prioritize proven efficacy, top-notch formulations, and innovative ingredients. The emphasis on science-backed skincare aligns seamlessly with the commitment of these manufacturers to provide cutting-edge cosmetic serums that resonate with the region's skincare-conscious population. The demand for cosmetic serums is further fueled by the aging population in North America. Manufacturers understand and address this demographic trend by developing anti-aging serums tailored to the specific needs of consumers seeking solutions for fine lines, wrinkles, and other signs of aging. These manufacturers contribute to the market's growth by providing innovative and effective anti-aging formulations that align with the beauty goals of the aging population. Europe is a mature market for cosmetic serums, with consumers valuing quality, efficacy, and innovation. The region is known for its stringent regulatory standards, influencing product formulations and claims. Vitamin C serums and anti-pollution formulations have gained popularity. The market also reflects a preference for luxury and premium skincare products.Cosmetic Serum Market Competitive Landscape

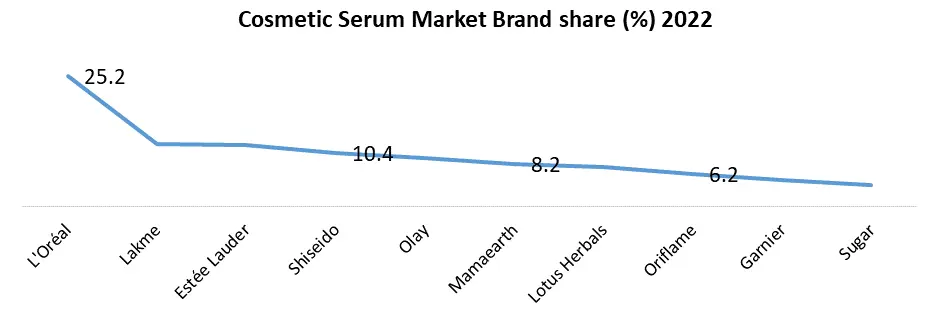

The Cosmetic Serum Market dynamic interplay of established beauty and skincare brands, emerging players, and innovative formulations. The market's growth is propelled by a continuous quest for differentiation, technological advancements, and consumer demand for efficacious and specialized skincare solutions. Renowned global Cosmetic Serum brands with a legacy in skincare, such as L'Oréal, Estée Lauder, and Shiseido, are major players in the cosmetic serum market. Niche and indie brands, like The Ordinary and Drunk Elephant, have gained prominence in the market. These brands regularly focus on transparency, unique selling propositions, and direct-to-consumer models. Many brands collaborate with dermatologists and skincare experts to reinforce the scientific credibility of their offerings. Brands invest in educational campaigns, providing consumers with information about skincare ingredients, product usage, and the benefits of specific formulations.

Cosmetic Serum Market Scope: Inquiry Before Buying

Cosmetic Serum Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 3.86 Bn. Forecast Period 2024 to 2030 CAGR: 5.1% Market Size in 2030: US $ 5.47 Bn. Segments Covered: by Serum Type Anti-Aging Serum Hydrating Serum Brightening Serum Acne-Fighting Serum Vitamin C Serum by Ingredient Hyaluronic Acid Serums Retinol Serum Vitamin C Serum Peptide Serum by End-User Individual Consumers Professional Use Cosmetic Serum Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Cosmetic Serum Key Companies

1. L'Oréal S.A. 2. Lakme 3. Estée Lauder Companies Inc. 4. Shiseido Company, Limited 5. Olay 6. Mamaearth 7. Lotus Herbals Color Cosmetics 8. Oriflame Cosmetics Global SA 9. Garnier LLC 10. Sugar 11. Everyuth 12. Neutrogena 13. Tatcha, LLC 14. Minimalist. 15. Dior Beauty 16. VLCC 17. Chanel S.A. 18. The Avon Company 19. The Ordinary 20. Mary Kay Inc. Frequently Asked Questions: 1. What factors are driving the growth of the Cosmetic Serum Market globally? Ans: The global Cosmetic Serum Market is driven by factors such as an aging population, increasing emphasis on personal grooming, and the concentration of active ingredients in serum formulations that promise efficacy and visible results. 2. How does consumer behavior impact the Cosmetic Serum Market? Ans: Consumer behavior plays a fundamental role in shaping the Cosmetic Serum Market. Consumers are increasingly informed and seek advanced skincare solutions. The application of serums as a crucial step in skincare routines reflects a strategic approach to address specific concerns. 3. Why does the Clean Beauty trend specifically impact the North American Cosmetic Serum Market? Ans: North America, especially the United States, has a strong emphasis on clean beauty. Consumers prioritize products free from harmful additives, aligning with the Clean Beauty trend and influencing the Cosmetic Serum Market. 4. How does the maturity of the European market influence cosmetic serum preferences? Ans: Europe, being a mature market, values quality, efficacy, and innovation. The region shows a preference for luxury and premium skincare products, influencing the types of cosmetic serums that gain popularity. 5. What are the dominant trends in cosmetic serum formulations? Ans: Dominant trends include a shift towards clean beauty, ongoing innovations in formulations with ingredients like peptides and adaptogens, and the development of hybrid serums addressing multiple skincare concerns simultaneously.

1. Cosmetic Serum Market: Research Methodology 2. Cosmetic Serum Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Cosmetic Serum Market: Dynamics 3.1. Cosmetic Serum Market Trends by Region 3.1.1. Global Cosmetic Serum Market Trends 3.1.2. North America Cosmetic Serum Market Trends 3.1.3. Europe Cosmetic Serum Market Trends 3.1.4. Asia Pacific Cosmetic Serum Market Trends 3.1.5. Middle East and Africa Cosmetic Serum Market Trends 3.1.6. South America Cosmetic Serum Market Trends 3.2. Cosmetic Serum Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Cosmetic Serum Market Drivers 3.2.1.2. North America Cosmetic Serum Market Restraints 3.2.1.3. North America Cosmetic Serum Market Opportunities 3.2.1.4. North America Cosmetic Serum Market Challenges 3.2.2. Europe 3.2.2.1. Europe Cosmetic Serum Market Drivers 3.2.2.2. Europe Cosmetic Serum Market Restraints 3.2.2.3. Europe Cosmetic Serum Market Opportunities 3.2.2.4. Europe Cosmetic Serum Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Cosmetic Serum Market Drivers 3.2.3.2. Asia Pacific Cosmetic Serum Market Restraints 3.2.3.3. Asia Pacific Cosmetic Serum Market Opportunities 3.2.3.4. Asia Pacific Cosmetic Serum Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Cosmetic Serum Market Drivers 3.2.4.2. Middle East and Africa Cosmetic Serum Market Restraints 3.2.4.3. Middle East and Africa Cosmetic Serum Market Opportunities 3.2.4.4. Middle East and Africa Cosmetic Serum Market Challenges 3.2.5. South America 3.2.5.1. South America Cosmetic Serum Market Drivers 3.2.5.2. South America Cosmetic Serum Market Restraints 3.2.5.3. South America Cosmetic Serum Market Opportunities 3.2.5.4. South America Cosmetic Serum Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 3.6. Key Opinion Leader Analysis For Cosmetic Serum Market 3.7. Technological Advancement in Cosmetic Serum Industry 3.8. Analysis of Government Schemes and Initiatives For Cosmetic Serum Market 3.9. The Global Pandemic Impact on Cosmetic Serum Market 4. Cosmetic Serum Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. Cosmetic Serum Market Size and Forecast, by Serum Type (2023-2030) 4.1.1. Anti-Aging Serum 4.1.2. Hydrating Serum 4.1.3. Brightening Serum 4.1.4. Acne-Fighting Serum 4.1.5. Vitamin C Serum 4.2. Cosmetic Serum Market Size and Forecast, by Ingredient (2023-2030) 4.2.1. Hyaluronic Acid Serums 4.2.2. Retinol Serum 4.2.3. Vitamin C Serum 4.2.4. Peptide Serum 4.3. Cosmetic Serum Market Size and Forecast, by End User (2023-2030) 4.3.1. Individual Consumers 4.3.2. Professional Use 4.4. Cosmetic Serum Market Size and Forecast, by Region (2023-2030) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Cosmetic Serum Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America Cosmetic Serum Market Size and Forecast, by Serum Type (2023-2030) 5.1.1. Anti-Aging Serum 5.1.2. Hydrating Serum 5.1.3. Brightening Serum 5.1.4. Acne-Fighting Serum 5.1.5. Vitamin C Serum 5.2. North America Cosmetic Serum Market Size and Forecast, by Ingredient (2023-2030) 5.2.1. Hyaluronic Acid Serums 5.2.2. Retinol Serum 5.2.3. Vitamin C Serum 5.2.4. Peptide Serum 5.3. North America Cosmetic Serum Market Size and Forecast, by End User (2023-2030) 5.3.1. Individual Consumers 5.3.2. Professional Use 5.4. North America Cosmetic Serum Market Size and Forecast, by Country (2023-2030) 5.4.1. United States 5.4.1.1. United States Cosmetic Serum Market Size and Forecast, by Serum Type (2023-2030) 5.4.1.1.1. Anti-Aging Serum 5.4.1.1.2. Hydrating Serum 5.4.1.1.3. Brightening Serum 5.4.1.1.4. Acne-Fighting Serum 5.4.1.1.5. Vitamin C Serum 5.4.1.2. United States Cosmetic Serum Market Size and Forecast, by Ingredient (2023-2030) 5.4.1.2.1. Hyaluronic Acid Serums 5.4.1.2.2. Retinol Serum 5.4.1.2.3. Vitamin C Serum 5.4.1.2.4. Peptide Serum 5.4.1.3. United States Cosmetic Serum Market Size and Forecast, by End User (2023-2030) 5.4.1.3.1. Individual Consumers 5.4.1.3.2. Professional Use 5.4.2. Canada 5.4.2.1. Canada Cosmetic Serum Market Size and Forecast, by Serum Type (2023-2030) 5.4.2.1.1. Anti-Aging Serum 5.4.2.1.2. Hydrating Serum 5.4.2.1.3. Brightening Serum 5.4.2.1.4. Acne-Fighting Serum 5.4.2.1.5. Vitamin C Serum 5.4.2.2. Canada Cosmetic Serum Market Size and Forecast, by Ingredient (2023-2030) 5.4.2.2.1. Hyaluronic Acid Serums 5.4.2.2.2. Retinol Serum 5.4.2.2.3. Vitamin C Serum 5.4.2.2.4. Peptide Serum 5.4.2.3. Canada Cosmetic Serum Market Size and Forecast, by End User (2023-2030) 5.4.2.3.1. Individual Consumers 5.4.2.3.2. Professional Use 5.4.3. Mexico 5.4.3.1. Mexico Cosmetic Serum Market Size and Forecast, by Serum Type (2023-2030) 5.4.3.1.1. Anti-Aging Serum 5.4.3.1.2. Hydrating Serum 5.4.3.1.3. Brightening Serum 5.4.3.1.4. Acne-Fighting Serum 5.4.3.1.5. Vitamin C Serum 5.4.3.2. Mexico Cosmetic Serum Market Size and Forecast, by Ingredient (2023-2030) 5.4.3.2.1. Hyaluronic Acid Serums 5.4.3.2.2. Retinol Serum 5.4.3.2.3. Vitamin C Serum 5.4.3.2.4. Peptide Serum 5.4.3.3. Mexico Cosmetic Serum Market Size and Forecast, by End User (2023-2030) 5.4.3.3.1. Individual Consumers 5.4.3.3.2. Professional Use 6. Europe Cosmetic Serum Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe Cosmetic Serum Market Size and Forecast, by Serum Type (2023-2030) 6.2. Europe Cosmetic Serum Market Size and Forecast, by Ingredient (2023-2030) 6.3. Europe Cosmetic Serum Market Size and Forecast, by End User (2023-2030) 6.4. Europe Cosmetic Serum Market Size and Forecast, by Country (2023-2030) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Cosmetic Serum Market Size and Forecast, by Serum Type (2023-2030) 6.4.1.2. United Kingdom Cosmetic Serum Market Size and Forecast, by Ingredient (2023-2030) 6.4.1.3. United Kingdom Cosmetic Serum Market Size and Forecast, by End User (2023-2030) 6.4.2. France 6.4.2.1. France Cosmetic Serum Market Size and Forecast, by Serum Type (2023-2030) 6.4.2.2. France Cosmetic Serum Market Size and Forecast, by Ingredient (2023-2030) 6.4.2.3. France Cosmetic Serum Market Size and Forecast, by End User (2023-2030) 6.4.3. Germany 6.4.3.1. Germany Cosmetic Serum Market Size and Forecast, by Serum Type (2023-2030) 6.4.3.2. Germany Cosmetic Serum Market Size and Forecast, by Ingredient (2023-2030) 6.4.3.3. Germany Cosmetic Serum Market Size and Forecast, by End User (2023-2030) 6.4.4. Italy 6.4.4.1. Italy Cosmetic Serum Market Size and Forecast, by Serum Type (2023-2030) 6.4.4.2. Italy Cosmetic Serum Market Size and Forecast, by Ingredient (2023-2030) 6.4.4.3. Italy Cosmetic Serum Market Size and Forecast, by End User (2023-2030) 6.4.5. Spain 6.4.5.1. Spain Cosmetic Serum Market Size and Forecast, by Serum Type (2023-2030) 6.4.5.2. Spain Cosmetic Serum Market Size and Forecast, by Ingredient (2023-2030) 6.4.5.3. Spain Cosmetic Serum Market Size and Forecast, by End User (2023-2030) 6.4.6. Sweden 6.4.6.1. Sweden Cosmetic Serum Market Size and Forecast, by Serum Type (2023-2030) 6.4.6.2. Sweden Cosmetic Serum Market Size and Forecast, by Ingredient (2023-2030) 6.4.6.3. Sweden Cosmetic Serum Market Size and Forecast, by End User (2023-2030) 6.4.7. Austria 6.4.7.1. Austria Cosmetic Serum Market Size and Forecast, by Serum Type (2023-2030) 6.4.7.2. Austria Cosmetic Serum Market Size and Forecast, by Ingredient (2023-2030) 6.4.7.3. Austria Cosmetic Serum Market Size and Forecast, by End User (2023-2030) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Cosmetic Serum Market Size and Forecast, by Serum Type (2023-2030) 6.4.8.2. Rest of Europe Cosmetic Serum Market Size and Forecast, by Ingredient (2023-2030) 6.4.8.3. Rest of Europe Cosmetic Serum Market Size and Forecast, by End User (2023-2030) 7. Asia Pacific Cosmetic Serum Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Cosmetic Serum Market Size and Forecast, by Serum Type (2023-2030) 7.2. Asia Pacific Cosmetic Serum Market Size and Forecast, by Ingredient (2023-2030) 7.3. Asia Pacific Cosmetic Serum Market Size and Forecast, by End User (2023-2030) 7.4. Asia Pacific Cosmetic Serum Market Size and Forecast, by Country (2023-2030) 7.4.1. China 7.4.1.1. China Cosmetic Serum Market Size and Forecast, by Serum Type (2023-2030) 7.4.1.2. China Cosmetic Serum Market Size and Forecast, by Ingredient (2023-2030) 7.4.1.3. China Cosmetic Serum Market Size and Forecast, by End User (2023-2030) 7.4.2. S Korea 7.4.2.1. S Korea Cosmetic Serum Market Size and Forecast, by Serum Type (2023-2030) 7.4.2.2. S Korea Cosmetic Serum Market Size and Forecast, by Ingredient (2023-2030) 7.4.2.3. S Korea Cosmetic Serum Market Size and Forecast, by End User (2023-2030) 7.4.3. Japan 7.4.3.1. Japan Cosmetic Serum Market Size and Forecast, by Serum Type (2023-2030) 7.4.3.2. Japan Cosmetic Serum Market Size and Forecast, by Ingredient (2023-2030) 7.4.3.3. Japan Cosmetic Serum Market Size and Forecast, by End User (2023-2030) 7.4.4. India 7.4.4.1. India Cosmetic Serum Market Size and Forecast, by Serum Type (2023-2030) 7.4.4.2. India Cosmetic Serum Market Size and Forecast, by Ingredient (2023-2030) 7.4.4.3. India Cosmetic Serum Market Size and Forecast, by End User (2023-2030) 7.4.5. Australia 7.4.5.1. Australia Cosmetic Serum Market Size and Forecast, by Serum Type (2023-2030) 7.4.5.2. Australia Cosmetic Serum Market Size and Forecast, by Ingredient (2023-2030) 7.4.5.3. Australia Cosmetic Serum Market Size and Forecast, by End User (2023-2030) 7.4.6. Indonesia 7.4.6.1. Indonesia Cosmetic Serum Market Size and Forecast, by Serum Type (2023-2030) 7.4.6.2. Indonesia Cosmetic Serum Market Size and Forecast, by Ingredient (2023-2030) 7.4.6.3. Indonesia Cosmetic Serum Market Size and Forecast, by End User (2023-2030) 7.4.7. Malaysia 7.4.7.1. Malaysia Cosmetic Serum Market Size and Forecast, by Serum Type (2023-2030) 7.4.7.2. Malaysia Cosmetic Serum Market Size and Forecast, by Ingredient (2023-2030) 7.4.7.3. Malaysia Cosmetic Serum Market Size and Forecast, by End User (2023-2030) 7.4.8. Vietnam 7.4.8.1. Vietnam Cosmetic Serum Market Size and Forecast, by Serum Type (2023-2030) 7.4.8.2. Vietnam Cosmetic Serum Market Size and Forecast, by Ingredient (2023-2030) 7.4.8.3. Vietnam Cosmetic Serum Market Size and Forecast, by End User (2023-2030) 7.4.9. Taiwan 7.4.9.1. Taiwan Cosmetic Serum Market Size and Forecast, by Serum Type (2023-2030) 7.4.9.2. Taiwan Cosmetic Serum Market Size and Forecast, by Ingredient (2023-2030) 7.4.9.3. Taiwan Cosmetic Serum Market Size and Forecast, by End User (2023-2030) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Cosmetic Serum Market Size and Forecast, by Serum Type (2023-2030) 7.4.10.2. Rest of Asia Pacific Cosmetic Serum Market Size and Forecast, by Ingredient (2023-2030) 7.4.10.3. Rest of Asia Pacific Cosmetic Serum Market Size and Forecast, by End User (2023-2030) 8. Middle East and Africa Cosmetic Serum Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 8.1. Middle East and Africa Cosmetic Serum Market Size and Forecast, by Serum Type (2023-2030) 8.2. Middle East and Africa Cosmetic Serum Market Size and Forecast, by Ingredient (2023-2030) 8.3. Middle East and Africa Cosmetic Serum Market Size and Forecast, by End User (2023-2030) 8.4. Middle East and Africa Cosmetic Serum Market Size and Forecast, by Country (2023-2030) 8.4.1. South Africa 8.4.1.1. South Africa Cosmetic Serum Market Size and Forecast, by Serum Type (2023-2030) 8.4.1.2. South Africa Cosmetic Serum Market Size and Forecast, by Ingredient (2023-2030) 8.4.1.3. South Africa Cosmetic Serum Market Size and Forecast, by End User (2023-2030) 8.4.2. GCC 8.4.2.1. GCC Cosmetic Serum Market Size and Forecast, by Serum Type (2023-2030) 8.4.2.2. GCC Cosmetic Serum Market Size and Forecast, by Ingredient (2023-2030) 8.4.2.3. GCC Cosmetic Serum Market Size and Forecast, by End User (2023-2030) 8.4.3. Nigeria 8.4.3.1. Nigeria Cosmetic Serum Market Size and Forecast, by Serum Type (2023-2030) 8.4.3.2. Nigeria Cosmetic Serum Market Size and Forecast, by Ingredient (2023-2030) 8.4.3.3. Nigeria Cosmetic Serum Market Size and Forecast, by End User (2023-2030) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Cosmetic Serum Market Size and Forecast, by Serum Type (2023-2030) 8.4.4.2. Rest of ME&A Cosmetic Serum Market Size and Forecast, by Ingredient (2023-2030) 8.4.4.3. Rest of ME&A Cosmetic Serum Market Size and Forecast, by End User (2023-2030) 9. South America Cosmetic Serum Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 9.1. South America Cosmetic Serum Market Size and Forecast, by Serum Type (2023-2030) 9.2. South America Cosmetic Serum Market Size and Forecast, by Ingredient (2023-2030) 9.3. South America Cosmetic Serum Market Size and Forecast, by End User (2023-2030) 9.4. South America Cosmetic Serum Market Size and Forecast, by Country (2023-2030) 9.4.1. Brazil 9.4.1.1. Brazil Cosmetic Serum Market Size and Forecast, by Serum Type (2023-2030) 9.4.1.2. Brazil Cosmetic Serum Market Size and Forecast, by Ingredient (2023-2030) 9.4.1.3. Brazil Cosmetic Serum Market Size and Forecast, by End User (2023-2030) 9.4.2. Argentina 9.4.2.1. Argentina Cosmetic Serum Market Size and Forecast, by Serum Type (2023-2030) 9.4.2.2. Argentina Cosmetic Serum Market Size and Forecast, by Ingredient (2023-2030) 9.4.2.3. Argentina Cosmetic Serum Market Size and Forecast, by End User (2023-2030) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Cosmetic Serum Market Size and Forecast, by Serum Type (2023-2030) 9.4.3.2. Rest Of South America Cosmetic Serum Market Size and Forecast, by Ingredient (2023-2030) 9.4.3.3. Rest Of South America Cosmetic Serum Market Size and Forecast, by End User (2023-2030) 10. Global Cosmetic Serum Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2023) 10.3.5. Company Locations 10.4. Leading Cosmetic Serum Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. L'Oréal S.A. 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Recent Developments 11.2. Lakme 11.3. Estée Lauder Companies Inc. 11.4. Shiseido Company, Limited 11.5. Olay 11.6. Mamaearth 11.7. Lotus Herbals Color Cosmetics 11.8. Oriflame Cosmetics Global SA 11.9. Garnier LLC 11.10. Sugar 11.11. Everyuth 11.12. Neutrogena 11.13. Tatcha, LLC 11.14. Minimalist. 11.15. Dior Beauty 11.16. VLCC 11.17. Chanel S.A. 11.18. The Avon Company 11.19. The Ordinary 11.20. Mary Kay Inc. 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary