The Consumer Luxury Goods Market size was valued at USD 270.1 billion in 2022 and the total Consumer Luxury Goods Market revenue is expected to grow at a CAGR of 5.1% from 2023 to 2029, reaching nearly USD 382.74 Billion.Consumer Luxury Goods Market Overview:

Luxury goods account for a growing share of consumer expenditure. The luxury goods industry, produces and sells clothes, leather goods, shoes, silk scarves and neckties, watches, jewelry, perfume, and cosmetics. A strengthening economy and rising disposable income of the people accelerate the demand for Luxury Goods. The middle-class population in emerging markets expands rapidly. A new group of potential luxury consumers is emerging. People are now seeking more experiential luxury, giving luxury brands the chance to offer attractive experiences to customers. To know deeper information on the Consumer Luxury Goods Market penetration, competitive structure, pricing, and demand analysis are involved in the report. The report includes historical data, present and future trends, competitive environment of the Consumer Luxury Goods Market.Consumer Luxury Goods Market Snapshot

To know about the Research Methodology :- Request Free Sample Report

Consumer Luxury Goods Market Dynamics:

Increasing Economic Growth and Income Levels drive the Consumer Luxury Goods Market Growth Economic growth and income levels shape the dynamics of the Consumer Luxury Goods Market. Economic growth in a country and region translates into higher income levels for individuals and households, allowing them to have more disposable income. This surplus money helps people to spend on non-essential items, including luxury goods and experiences. Luxury goods become more affordable and attainable for a larger segment of the population. The increasing demand resulting from increased consumer spending drives growth in the Consumer Luxury Goods Market. As a response, luxury brands expand their product offerings to cater to a wider range of consumers. This symbiotic relationship between economic growth and the luxury goods market encourages further expansion, benefiting both consumers and luxury brands also. Furthermore, economic growth adopts a climate of optimism and aspiration, where consumers desire to elevate their lifestyles and showcase their success. Owning luxury items becomes a status symbol, representing social standing and affluence. Consumers perceive luxury goods as a tangible reflection of their achievements and rewards for their hard work. Luxury brands often target regions with strong economic growth and rising income levels. Developing economies, in particular, offer immense potential for the luxury market, as the growing middle and upper classes seek to spend on aspirational purchases.Economic Growth of countries from 2018 to 2022

Surging Globalization and Emerging Markets Drive the Market Growth Globalization and emerging markets have had a deep impact on the consumer luxury goods industry. Globalization, characterized by increased interconnectedness among economies, cultures, and societies worldwide, has been fuelled by technological advancements, communication networks, and transportation improvements. This Globalization opened up new opportunities for luxury brands to reach consumers in diverse geographical locations. Also, the widespread accessibility of luxury products. Through e-commerce and digital marketing, luxury brands reach a global audience and go beyond their traditional brick-and-mortar stores and domestic markets. This expanded online presence allows consumers from different corners of the world to purchase luxury items conveniently. Globalization facilitated the movement of people, including tourists and expatriates. As these individuals travel internationally, they contribute to the demand for luxury goods in various regions, which impacts the Consumer Luxury Goods industry's growth and diversifying the consumer base. Growing Adoption Of Second-Hand Branded Items Limits The Consumer Luxury Goods Market Growth. The growing adoption of second-hand branded items hampers a significant challenge to the growth of the consumer luxury goods market. The rise in consumer awareness regarding sustainability and cost-effectiveness encouraged a significant shift in purchasing behavior of the people. Nowadays, people favor pre-owned luxury products rather than new ones. The commitment to minimizing environmental impact, and the convenience offered by online platforms that facilitate second-hand sales. Through second-hand luxury items, consumers enjoy high-end products at a lower cost as compared to their original cost, and this factor directly affects the demand for new luxury goods. Consequently, luxury brands are experiencing a notable decline in both sales and profitability. Moreover, the resale market's increasing credibility and trustworthiness have further encouraged consumers to embrace this alternative shopping avenue. In response, luxury brands must adapt to this shifting consumer behavior by exploring strategies like refurbishment and promoting sustainable practices to retain their Innovation. Additionally, embracing the pre-owned market as a complementary channel or offering their own certified pre-owned programs can help brands leverage the growing interest in second-hand luxury items while minimizing its adverse effects on their new product sales. Digital Transformation creates lucrative growth opportunities for Consumer Luxury Goods Market growth. Social media platforms like Instagram, Facebook, and TikTok are giving luxury brands a new way to connect with consumers. Digital platforms allow brands to share their stories, showcase products, and also build relationships with customers. Digital technologies make it possible for luxury brands to personalize the customer experience. This includes using data to target customers with relevant products and offers, as well as providing a more immersive and engaging shopping experience. Luxury brands are increasingly using digital technologies to promote sustainability. This includes using blockchain to track the provenance of materials, using virtual reality to allow customers to try on products before they buy them, and using 3D printing to create custom-made products. Customer experience becomes a primary focus in digital transformation. Companies harness digital tools to better understand customer needs and preferences, personalize interactions, and offer seamless, Omni channel experiences. This approach enhances customer satisfaction and loyalty. These factors significantly create ample growth opportunities for the Consumer Luxury Goods Market Growth.

Competitive Landscape

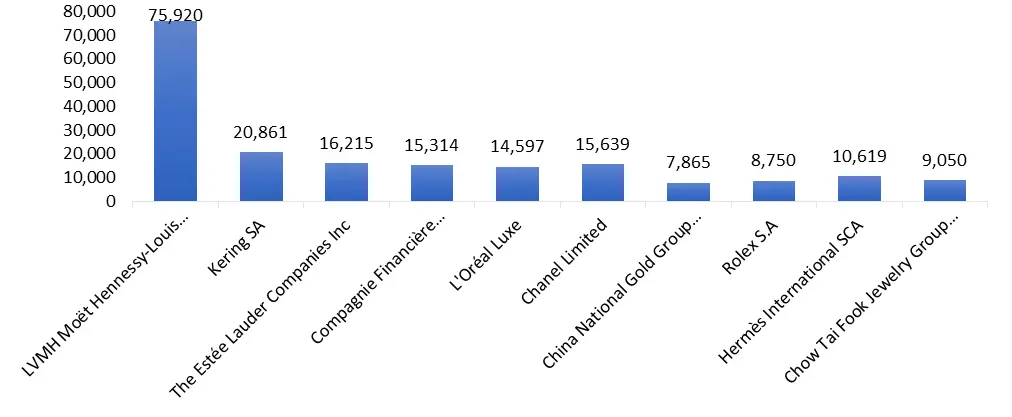

The Consumer Luxury Goods Market is highly competitive with the number of companies operating in this market. such as LVMH, Kering SA, The Estée Lauder Companies Inc., Chanel Limited, L'Oréal Luxe, Compagnie Financière Richemont SA Hermès International SCA, Chow Tai Fook Jewellery Group Limited), Rolex SA, China National Gold Group Gold Jewellery Co., Ltd (China), The Swatch Group Ltd., Lao Feng Xiang Co., Ltd., PVH Corp., Tapestry, Inc., Shiseido Company, Limited, Ralph Lauren Corporation, Capri Holdings Limited, and Prada Group. LVMH protected its position as the world’s leading luxury Goods Company in the year 2022. Its sales of personal luxury goods jumped by more than 55% year-on-year, this was due partly to the inclusion of the 2021 acquisition of Tiffany & Co., which produced a record performance in terms of revenue, profits, and cash flow. Organic growth in sales was also very strong, exceeding pre-pandemic levels. The group saw high revenue growth in Asia and the United States and a gradual recovery in Europe, and continuing growth in online sales, although travel retail activities were still held back by constraints on international travel.LVMH is the clear luxury goods leader, contributing 32% of the top 10 sales.Top 10 companies share luxury goods sales

Luxury goods companies are making strategic partnerships with both experienced players in the digital field and with innovative start-ups to create new products and find alternative ways of improving services while reducing their environmental impact. Innovation is the lever of change in the fashion and luxury industry. Indeed, the largest companies in the industry are sponsoring innovation competitions between start-ups and incubators, with the aim of promoting innovative practices and fuelling the proliferation of new approaches to fashion. The ultimate goal is to become digital and sustainable by design. Top 10 luxury goods companies by sales, FY2021

FY2021 Total revenue (US$M)

Consumer Luxury Goods Market Segment Analysis:

Based on Product Type, The clothing segment dominates the Product Type segment of Consumer Luxury Goods Market in the year 2022. Clothing is a necessity for everyone appealing to a wide range of consumers, from wealthy individuals to those aspiring for luxury. The target market for luxury clothing is larger compared to other luxury goods. Fashion is always changing, and luxury brands shine in setting trends, creating an exclusive and desirable image. These brands invest heavily in building strong identities and reputations, regularly boasting a rich history of craftsmanship, heritage, and excellence. This history adds to their prestige and exclusivity. While luxury cars, yachts, jewelry, and properties are desirable but out of reach for many people. Luxury clothing is more accessible to a broader segment of the population therefore the clothing segment dominates the Consumer luxury Goods Market.Consumer Luxury Goods Market by Product Type in year 2022 (%)

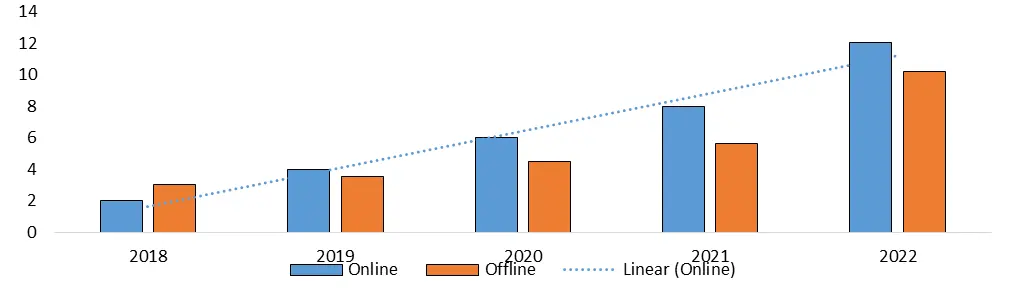

Based on Distribution Channel, the online distribution channel dominates the Distribution Channel segment of the Consumer Luxury Goods Market in the year 2022. The growing internet penetration transformed Consumer Luxury Goods Market. Luxury brands engage with customers worldwide, making physical stores in every location unnecessary. This allows them to expand beyond traditional markets and reach emerging markets with a growing appetite for luxury goods. Online shopping offers unparalleled convenience, letting customers browse and compare luxury products from the comfort of their homes or on the go using smartphones. This is particularly appealing to busy consumers. Extensive investments in e-commerce infrastructure and logistics ensure the smooth and efficient delivery of luxury goods globally. Online presence enables luxury brands to showcase their products to a much larger audience, gaining visibility on prestigious online marketplaces and luxury-specific platforms, and standing alongside other well-known names.

Consumer Luxury Goods Market by Product Type in year 2018 to 2022 (%)

Regional Insights of the Consumer Luxury Goods Market

Asia –Pacific region dominates the global Consumer Luxury Goods Market in the year 2022. The Asia-Pacific region has experienced economic growth, resulting in the rise of a substantial and wealthy middle class. As more people enter higher income brackets, purchasing power increases, and aspire to enhance their lifestyles by investing in luxury products. The rising disposable income of people in countries such as China, India, and Southeast Asian nations significantly drives the demand for Consumer Luxury Goods in Asia Pacific Region. Also, growing Urbanization in many Asia-Pacific countries helps to shift consumer preferences and improve lifestyles. Also, Asia-Pacific countries are significant tourist destinations and attract visitors from around the world. Tourists a lot spend on luxury shopping while visiting popular cities such as Hong Kong, Singapore, Tokyo, Seoul, and Dubai. This factor significantly helps to Asia Pacifica region to dominate the Consumer Luxury Goods Market.Consumer Luxury Goods Market Scope : Inquire Before Buying

Global Consumer Luxury Goods Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 270.1 Bn. Forecast Period 2023 to 2029 CAGR: 5.1% Market Size in 2029: US $ 382.74 Bn. Segments Covered: by Product Watches Jewelry Perfumes and Cosmetics Clothing Bags and Purses Others by End User Women Men by Distribution Channel Online Offline Consumer Luxury Goods Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Consumer Luxury Goods Market, Key Players are

1. LVMH (France) 2. Kering SA (France) 3. The Estée Lauder Companies Inc. (United States) 4. Chanel Limited (United Kingdom) 5. L'Oréal Luxe (France) 6. Compagnie Financière Richemont SA (Switzerland) 7. Hermès International SCA (France) 8. Chow Tai Fook Jewellery Group Limited (China/HK SAR) 9. Rolex SA (Switzerland) 10. China National Gold Group Gold Jewellery Co., Ltd (China) 11. The Swatch Group Ltd. (Switzerland) 12. Lao Feng Xiang Co., Ltd. (China) 13. PVH Corp. (United States) 14. Tapestry, Inc. (United States) 15. Shiseido Company, Limited (Japan) 16. Ralph Lauren Corporation (United States) 17. Capri Holdings Limited (United Kingdom) 18. Prada Group (Italy)Frequently Asked Questions:

1] What segments are covered in the Global Consumer Luxury Goods Market report? Ans. The segments covered in the Consumer Luxury Goods Market report are based on product Type, End User, and Regions. 2] Which region is expected to hold the highest share in the Global Consumer Luxury Goods Market? Ans. The Asia Pacific region is expected to hold the highest share of the Consumer Luxury Goods Market. 3] What was the market size of the Global Consumer Luxury Goods Market by 2022? Ans. The market size of the Consumer Luxury Goods Market by 2022 is US$ 270.1 Bn. 4] What is the forecast period for the Global Consumer Luxury Goods Market? Ans. The forecast period for the Consumer Luxury Goods Market is 2023-2029. 5] What is the market size of the Global Consumer Luxury Goods Market in 2029? Ans. The market size of the Consumer Luxury Goods Market in 2029 is expected to reach valued at US$ 382.74 Bn.

1. Consumer Luxury Goods Market: Research Methodology 2. Consumer Luxury Goods Market: Executive Summary 3. Consumer Luxury Goods Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Consumer Luxury Goods Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Consumer Luxury Goods Market Size and Forecast by Segments (by Value USD and Volume Units) 5.1. Consumer Luxury Goods Market Size and Forecast, by Product Type (2022-2029) 5.1.1. Watches 5.1.2. Jewelry 5.1.3. Perfumes and Cosmetics 5.1.4. Clothing 5.1.5. Bags and Purses 5.1.6. Others 5.2. Consumer Luxury Goods Market Size and Forecast, by End User (2022-2029) 5.2.1. Women 5.2.2. Men 5.3. Consumer Luxury Goods Market Size and Forecast, by Distribution Channel (2022-2029) 5.3.1. Online 5.3.2. Offline 5.4. Consumer Luxury Goods Market Size and Forecast, by Region (2022-2029) 5.4.1. North America 5.4.2. Europe 5.4.3. Asia Pacific 5.4.4. Middle East and Africa 5.4.5. South America 6. North America Consumer Luxury Goods Market Size and Forecast (by Value USD and Volume Units) 6.1. North America Consumer Luxury Goods Market Size and Forecast, by Product Type (2022-2029) 6.1.1. Watches 6.1.2. Jewelry 6.1.3. Perfumes and Cosmetics 6.1.4. Clothing 6.1.5. Bags and Purses 6.1.6. Others 6.2. North America Consumer Luxury Goods Market Size and Forecast, by End User (2022-2029) 6.2.1. Women 6.2.2. Men 6.3. North America Consumer Luxury Goods Market Size and Forecast, by Distribution Channel (2022-2029) 6.3.1. Online 6.3.2. Offline 6.4. North America Consumer Luxury Goods Market Size and Forecast, by Country (2022-2029) 6.4.1. United States 6.4.2. Canada 6.4.3. Mexico 7. Europe Consumer Luxury Goods Market Size and Forecast (by Value USD and Volume Units) 7.1. Europe Consumer Luxury Goods Market Size and Forecast, by Product Type (2022-2029) 7.1.1. Watches 7.1.2. Jewelry 7.1.3. Perfumes and Cosmetics 7.1.4. Clothing 7.1.5. Bags and Purses 7.1.6. Others 7.2. Europe Consumer Luxury Goods Market Size and Forecast, by End User (2022-2029) 7.2.1. Women 7.2.2. Men 7.3. Europe Consumer Luxury Goods Market Size and Forecast, by Distribution Channel (2022-2029) 7.3.1. Online 7.3.2. Offline 7.4. Europe Consumer Luxury Goods Market Size and Forecast, by Country (2022-2029) 7.4.1. UK 7.4.2. France 7.4.3. Germany 7.4.4. Italy 7.4.5. Spain 7.4.6. Sweden 7.4.7. Austria 7.4.8. Rest of Europe 8. Asia Pacific Consumer Luxury Goods Market Size and Forecast (by Value USD and Volume Units) 8.1. Asia Pacific Consumer Luxury Goods Market Size and Forecast, by Product Type (2022-2029) 8.1.1. Watches 8.1.2. Jewelry 8.1.3. Perfumes and Cosmetics 8.1.4. Clothing 8.1.5. Bags and Purses 8.1.6. Others 8.2. Asia Pacific Consumer Luxury Goods Market Size and Forecast, by End User (2022-2029) 8.2.1. Women 8.2.2. Men 8.3. Asia Pacific Consumer Luxury Goods Market Size and Forecast, by Distribution Channel (2022-2029) 8.3.1. Online 8.3.2. Offline 8.4. Asia Pacific Consumer Luxury Goods Market Size and Forecast, by Country (2022-2029) 8.4.1. China 8.4.2. S Korea 8.4.3. Japan 8.4.4. India 8.4.5. Australia 8.4.6. Indonesia 8.4.7. Malaysia 8.4.8. Vietnam 8.4.9. Taiwan 8.4.10. Bangladesh 8.4.11. Pakistan 8.4.12. Rest of Asia Pacific 9. Middle East and Africa Consumer Luxury Goods Market Size and Forecast (by Value USD and Volume Units) 9.1. Middle East and Africa Consumer Luxury Goods Market Size and Forecast, by Product Type (2022-2029) 9.1.1. Watches 9.1.2. Jewelry 9.1.3. Perfumes and Cosmetics 9.1.4. Clothing 9.1.5. Bags and Purses 9.1.6. Others 9.2. Middle East and Africa Consumer Luxury Goods Market Size and Forecast, by End User (2022-2029) 9.2.1. Women 9.2.2. Men 9.3. Middle East and Africa Consumer Luxury Goods Market Size and Forecast, by Distribution Channel (2022-2029) 9.3.1. Online 9.3.2. Offline 9.4. Middle East and Africa Consumer Luxury Goods Market Size and Forecast, by Country (2022-2029) 9.4.1. South Africa 9.4.2. GCC 9.4.3. Egypt 9.4.4. Nigeria 9.4.5. Rest of ME&A 10. South America Consumer Luxury Goods Market Size and Forecast (by Value USD and Volume Units) 10.1. South America Consumer Luxury Goods Market Size and Forecast, by Product Type (2022-2029) 10.1.1. Watches 10.1.2. Jewelry 10.1.3. Perfumes and Cosmetics 10.1.4. Clothing 10.1.5. Bags and Purses 10.1.6. Others 10.2. South America Consumer Luxury Goods Market Size and Forecast, by End User (2022-2029) 10.2.1. Women 10.2.2. Men 10.3. South America Consumer Luxury Goods Market Size and Forecast, by Distribution Channel (2022-2029) 10.3.1. Online 10.3.2. Offline 10.4. South America Consumer Luxury Goods Market Size and Forecast, by Country (2022-2029) 10.4.1. Brazil 10.4.2. Argentina 10.4.3. Rest of South America 11. Company Profile: Key players 11.1. LVMH Moët Hennessy-Louis Vuitton SE (France) 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Kering SA (France) 11.3. The Estée Lauder Companies Inc. (United States) 11.4. Chanel Limited (United Kingdom) 11.5. L'Oréal Luxe (France) 11.6. Compagnie Financière Richemont SA (Switzerland) 11.7. Hermès International SCA (France) 11.8. Chow Tai Fook Jewellery Group Limited (China/HK SAR) 11.9. Rolex SA (Switzerland) 11.10. China National Gold Group Gold Jewellery Co., Ltd (China) 11.11. The Swatch Group Ltd. (Switzerland) 11.12. Lao Feng Xiang Co., Ltd. (China) 11.13. PVH Corp. (United States) 11.14. Tapestry, Inc. (United States) 11.15. Shiseido Company, Limited (Japan) 11.16. Ralph Lauren Corporation (United States) 11.17. Capri Holdings Limited (United Kingdom) 11.18. Prada Group (Italy) 11.19. Titan Company Limited (India) 12. Key Findings 13. Industry Recommendation