The Connected and Autonomous Mobility Vehicles Market size was valued at USD 149.43 Billion in 2023 and is expected to grow at a CAGR of 40.1 % from 2024 to 2030, reaching nearly USD 1583.08 Billion. The Connected and Autonomous Mobility Vehicles Market is a rapidly evolving sector that has the potential to revolutionize transportation. It represents a convergence of cutting-edge technologies, integrating connectivity, automation, and artificial intelligence to create a new era of safer, more efficient, and sustainable mobility. Connected mobility vehicles are equipped with advanced communication systems that allow real-time data exchange, facilitating vehicle-to-vehicle and vehicle-to-infrastructure communications to improve traffic management and enhance safety. Automation is a crucial aspect, with vehicles equipped with sensors, cameras, and AI-powered algorithms, reducing human errors and fatigue, making transportation safer. AI processes and massive data analysis enhance vehicle performance, optimize routes, and enable predictive maintenance, elevating efficiency and reliability. A significant trend is the focus on sustainability, with many vehicles powered by electric drivetrains contributing to a cleaner transportation ecosystem. The rise of connected and autonomous mobility has given birth to innovative mobility services, such as ride-sharing and Mobility-as-a-Service platforms. For successful implementation, smart cities and infrastructure play a vital role. Challenges include regulatory hurdles, safety concerns, and data security, requiring comprehensive frameworks and consumer trust. Despite these challenges, the market offers vast opportunities, with new business models emerging, data monetization potential, and improved user experiences. In conclusion, the Connected and Autonomous Mobility Vehicles Market promises safer, more efficient, and sustainable mobility solutions. It is poised for exponential growth and innovation. Integrating technology into urban planning and infrastructure enables efficient traffic management, optimized routing, and seamless communication between vehicles and transportation systems.Connected and Autonomous Mobility Vehicles Market Scope and research methodology:

The scope of the study focuses on the Connected and Autonomous Mobility Vehicles (CAMVs) market globally, covering a specific period. The research objectives encompass understanding market trends, analyzing market size and growth, identifying key market players, assessing the competitive landscape, exploring regulatory factors, and understanding consumer preferences. Data for the research is gathered from both primary and secondary sources, including surveys among EMS providers, healthcare professionals, and manufacturers. In addition, it is gathered from relevant publications and reports. Market segmentation categorizes the market based on Vehicle Type Level of automation, Propulsion Type, and geographical regions. Data analysis employs statistical analysis, qualitative content analysis, and visualization methods. Market forecasting involves projecting future growth and trends considering technological advancements, regulatory changes, and market demand drivers. The research also includes a competitive analysis of major players in the CAMVs market globally. This analysis evaluates their market share, Vehicle Type offerings, growth strategies, and competitive advantages. Ethical considerations address data privacy, participant consent, and potential conflicts of interest. In addition, they acknowledge research limitations related to data availability, biases, and unforeseen events.To know about the Research Methodology :- Request Free Sample Report

Connected and Autonomous Mobility Vehicles Market Dynamics:

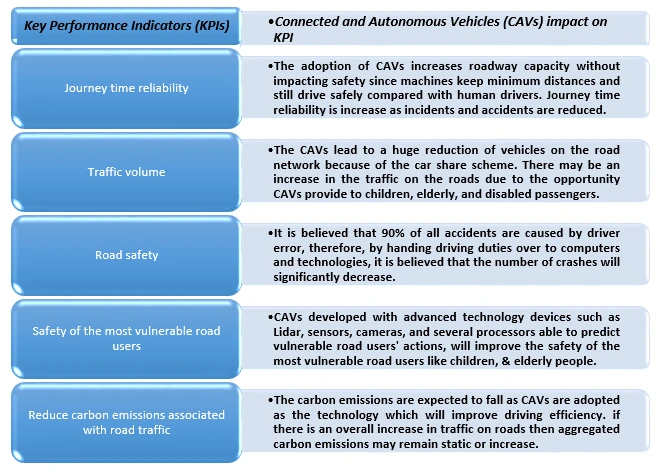

Smart Cities Embrace Connected and Autonomous Mobility Vehicles for Efficient Mobility. The Connected and Autonomous Mobility Vehicles market has had rapid advancements in recent years, transforming people and goods transportation. These vehicles, equipped with advanced technologies like sensors, artificial intelligence, and connectivity, promise to revolutionize the transportation industry. One of the primary drivers behind CAMVs is improved road safety. Autonomous vehicles are expected to significantly decrease accidents caused by human error, which accounts for a substantial portion of road mishaps. The global increasing focus on environmental sustainability and climate change combat is driving the adoption of connected and autonomous electric vehicles. These vehicles have the potential to reduce carbon emissions significantly and combat air pollution. CAMVs optimize traffic flow, reduce congestion, and enhance transportation efficiency. Continuous advancements in sensor technology, AI, and data processing have propelled autonomous vehicles. These innovations have made the technology more reliable and capable of handling various real-world scenarios. Ride-sharing and Mobility-as-a-Service platforms have increased demand for connected and autonomous vehicles. CAMVs can serve as a vital component of these services, providing efficient, cost-effective, and on-demand transportation solutions. CAMV can offer accessible and safe transportation options, promoting independence and social inclusion. Governments around the world actively support CAMV development and adoption. Supportive regulations and financial incentives encourage companies to invest in research and development in this field. Challenges of Ensuring Safety in Fully Autonomous Vehicles. Developing fully autonomous vehicles with fail-safe systems is complex and expensive. Ensuring the safety and reliability of CAVs remains a significant challenge for manufacturers and regulators. Connected and Autonomous Mobility Vehicles deployment relies on advanced infrastructure, including high-quality road networks, smart traffic signals, and communication systems. Upgrading existing infrastructure to support CAVs can be costly and time-consuming. The lack of standardized regulations for CAVs across different regions and countries is a major hindrance. Clear and consistent regulatory guidelines are essential for widespread CAV adoption. Connected vehicles are susceptible to cyber security threats, including hacking and data breaches. Ensuring the security and privacy of data transmitted and received by CAVs is critical to building trust among consumers. Convincing the general public about CAV safety and reliability is a challenge. Overcoming scepticism and fear of autonomous technology is crucial to their widespread acceptance. Determining liability in accidents involving CAVs is a complex legal challenge. Addressing liability concerns and establishing a clear legal framework is essential to support the CAV market growth. Smart Cities Change Governance for Connected and Autonomous Mobility Vehicle Advancements. Collaboration between technology companies, automotive manufacturers, and governments can accelerate CAV development and deployment. Partnerships leverage various sectors' expertise and resources. Governments around the world that aspire to develop smart cities need to change their governance models. The reduction of greenhouse gas emissions, sustainable development, and improved urban infrastructure energy efficiency are other societal challenges. Smart mobility challenges to create an inclusive, environmentally friendly, and efficient transportation system for people and Vehicle Types. This could be achieved with CAVs. CAVs generate vast amounts of data, offering opportunities for data-driven services and insights. Companies utilize this data for personalized mobility solutions and urban planning. CAVs drive urban planning initiatives focused on environmentally friendly and efficient transportation. Cities redesign infrastructure to accommodate CAVs and promote sustainable mobility options. Ride-sharing companies can reduce congestion and enhance mobility options for metro dwellers. The Connected and Autonomous Mobility Vehicles Market holds significant potential for transforming transportation and mobility in the future. The benefits of increased safety, efficiency, and environmental sustainability offer exciting opportunities for the automotive industry, technology companies, and governments to shape the future of transportation.

Connected and Autonomous Mobility Vehicles Market Segmental Insights:

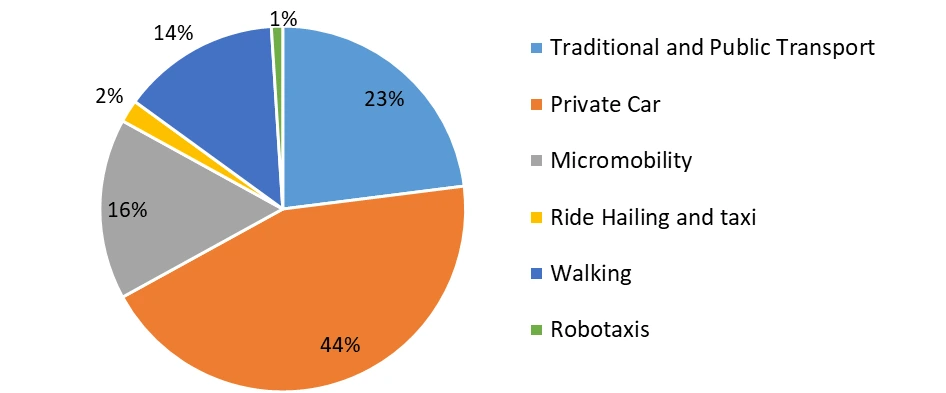

Based on the Vehicle Level of Automation, In the Connected and Autonomous Mobility Vehicles Market, passenger vehicles dominate the market in 2023 and are expected to grow during the forecast period. CAMVs in passenger vehicles are driven by enhanced safety, convenience, and improved mobility solutions. High initial costs and concerns about consumer acceptance can be significant challenges to CAMV adoption in passenger vehicles. Ride-sharing and Mobility-as-a-Service (MaaS) platforms offer opportunities for CAMV integration, providing cost-effective and efficient transportation services. Commercial Vehicles Fleet operators seek to optimize their operations through autonomous commercial vehicles, reducing labor costs and improving logistics efficiency. The cost of transitioning to CAMVs and the need for specialized training for drivers can be barriers to adoption. Autonomous delivery vehicles and trucks have the potential to revolutionize the logistics and transportation industry, providing faster and more efficient delivery services.Mobility split by mode of transportation, worldwide, 2023, (%)

Connected and Autonomous Mobility Vehicles Market Regional Insights:

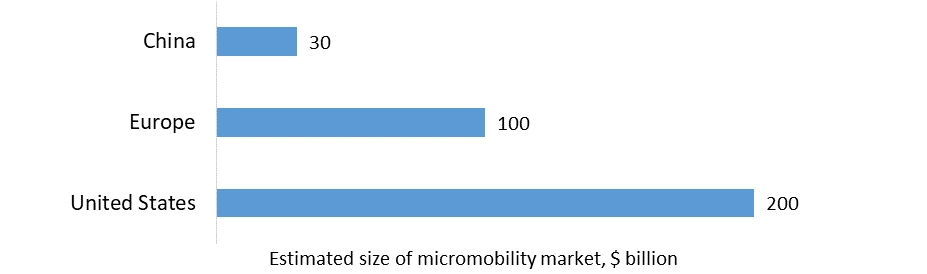

North America is at the forefront of the Connected and Autonomous Mobility Vehicles (CAMV) market, with the United States and Canada leading in research, development, and testing. The region benefits from a strong automotive industry and a vibrant technology ecosystem. Government support and permissive regulations in various states have encouraged companies like Waymo, Tesla, and GM's Cruise to conduct extensive trials and pilot programs. Ride-sharing and Mobility-as-a-Service (MaaS) platforms have become popular, creating an environment conducive to the adoption of CAMVs. Safety, liability, and robust infrastructure remain challenges to address, especially in less populated and rural areas. Europe presents significant opportunities for CAMVs, driven by strong government support and initiatives. Countries like Germany, the UK, and Sweden have established comprehensive frameworks and regulations to facilitate testing and deployment. Europe's established automotive industry, with companies like Volkswagen, BMW, and Daimler, invests heavily in CAMV development, making substantial progress in Level 2 and Level 3 automation. Urbanization and the need for sustainable transportation solutions propel CAMVs into crowded cities like London, Paris, and Berlin. The region faces challenges of regulatory fragmentation, as each country has distinct autonomous vehicle rules. Data protection laws, particularly in the European Union, impose strict requirements for handling and storing vehicle data, affecting data-driven innovation. Furthermore, Brexit introduces uncertainties regarding cross-border collaborations and regulatory harmonization in the CAMV market. Despite these challenges, Europe's commitment to innovation and robust research and development capabilities continue to drive advancements in the CAMV sector. Asia-Pacific fast-growing urban centers face increasing transportation challenges, leading to demand for smart and efficient mobility solutions. Asia-Pacific countries, such as China and Singapore, have ambitious plans and policies to support CAMV development. Asian countries, particularly China, invest heavily in AI and autonomous vehicle technologies, driving market growth. International companies form partnerships with local automakers and technology firms to tailor CAMV solutions to the region's specific needs. CAMVs support the growing trend of shared mobility services in urban centers.The Shared micromobility market in China, Europe, and The United States. in 2030, (In Billion)

Competitive Landscape

Key Players of the Connected and Autonomous Mobility Vehicles Market profiled in the report include AB Volvo, Amazon Web Services, Inc., Aptiv, ARTHUR D. LITTLE, AVL, BMW AG, Daimler AG, Dassault Systèmes, Ford Motor Company, FutureBridge, General Motors, Honda, Motor Co., Ltd., Hyundai Motor Company, Infineon Technologies AG, Nissan Motors Co., Ltd., Renault Group, SAE International, Segula Technologies, Swiss Re, Tesla, Inc., Toyota Motor Corporation, UITP Advanced Public Transport, Volkswagen AG, WirelessCar, WSP. This provides huge opportunities to serve many End-uses & customers and expand the Connected and Autonomous Mobility Vehicles Market.Connected and Autonomous Mobility Vehicles Market Scope: Inquire before buying

Connected and Autonomous Mobility Vehicles Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: USD 149.43 Billion. Forecast Period 2024 to 2030 CAGR: 40.1% Market Size in 2030: USD 1583.08 Billion. Segments Covered: by Level of Automation Level 1 Level 2 Level 3 Level 4 Level 5 by Vehicle Level of Automation Passenger Car Commercial Vehicle by Propulsion Level of Automation Semi-autonomous Fully Autonomous by Application Residential Commercial Connected and Autonomous Mobility Vehicles Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina, and the Rest of South America)Connected and Autonomous Mobility Vehicles Market, Key Players

Technology Providers: 1. Amazon Web Services, Inc. 2. Aptiv 3. AVL 4. Dassault Systèmes 5. Infineon Technologies AG 6. SAE International 7. Segula Technologies 8. Swiss Re 9. WirelessCar 10. WSP Manufacturers: 1. AB Volvo 2. BMW Group 3. Tesla, Inc. 4. General Motors 5. Honda Motor Co., Ltd. 6. Hyundai Motor Company 7. Nissan Motors Co., Ltd. 8. Renault Group 9. Continental AG 10. Toyota Motor Corporation 11. Waymo LLCFAQs:

1. What are the growth drivers for the Connected and Autonomous Mobility Vehicles Market? Ans. Smart Cities Embrace Connected and Autonomous Mobility Vehicles for Efficient Mobility is expected to be the major driver for the Connected and Autonomous Mobility Vehicles Market. 2. What is the major restraint for the Connected and Autonomous Mobility Vehicles Market growth? Ans. Challenges of Ensuring Safety in Fully Autonomous Vehicles are expected to be the major restraining factor for the Connected and Autonomous Mobility Vehicles Market growth. 3. Which region is expected to lead the global Connected and Autonomous Mobility Vehicles Market during the forecast period? Ans. North America is expected to lead the global Connected and Autonomous Mobility Vehicles Market during the forecast period. 4. What is the projected market size & growth rate of the Connected and Autonomous Mobility Vehicles Market? Ans. The Connected and Autonomous Mobility Vehicles Market size was valued at USD 149.43 Billion in 2023 and is expected to grow at a CAGR of 40.1 % from 2024 to 2030, reaching nearly USD 1583.08 Billion. 5. What segments are covered in the Connected and Autonomous Mobility Vehicles Market report? Ans. The segments covered in the Connected and Autonomous Mobility Vehicles Market report are By Level of Automation, Vehicle Level of Automation, Application, Propulsion Level of Automation, and Region.

1. Connected and Autonomous Mobility Vehicles Market: Research Methodology 2. Connected and Autonomous Mobility Vehicles Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Global Connected and Autonomous Mobility Vehicles Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.3.1. Company Name 3.3.2. Product Segment 3.3.3. End User Segment 3.3.4. Revenue (2023) 3.3.5. Headquarter 4. Connected and Autonomous Mobility Vehicles Market: Dynamics 4.1. Connected and Autonomous Mobility Vehicles Market Trends 4.2. Connected and Autonomous Mobility Vehicles Market Dynamics 4.2.1.1. Drivers 4.2.1.2. Restraints 4.2.1.3. Opportunities 4.2.1.4. Challenges 4.3. PORTER’s Five Forces Analysis 4.4. PESTLE Analysis 4.5. Key Opinion Leader Analysis For the Connected and Autonomous Mobility Vehicles Market 4.6. Analysis of Government Schemes and Initiatives Connected and Autonomous Mobility Vehicles Market 4.7. Regulatory and Policy Landscape 4.7.1. Government Regulations on Autonomous Vehicles 4.7.1.1. National and International Regulatory Bodies 4.7.1.2. Safety and Compliance Standards 4.7.1.3. Testing and Deployment Guidelines 4.7.2. Legal and Liability Considerations 4.7.2.1. Autonomous Driving Laws and Insurance 4.7.2.2. Ethical Concerns and Public Safety 4.7.3. Data Privacy and Security Regulations 4.7.4. Government Policy and Fiscal Stimulus 4.7.4.1. Government Spending on Infrastructure and CAV Ecosystem 4.7.4.2. Public Investment in Autonomous Driving Technologies 4.7.4.3. Tax Incentives and Subsidies for Autonomous Vehicles 5. Industry and Economy-Wide Influences 5.1. Global GDP Growth and Automotive Sector Trends 5.2. Impact of Economic Growth on Consumer Spending in Mobility 6. Consumer Demand and Behavioral Shifts 6.1. Consumer Adaptability 6.2. Willingness to Pay for Autonomous Feature 6.3. Connected and Autonomous Mobility Vehicles penetration by region 7. Key Technologies Enabling CAVs and their impact on Automotive Sales 7.1. Autonomous Driving Technologies 7.1.1. Sensors (LIDAR, Radar, Cameras, etc.) 7.1.2. Machine Learning and AI Algorithms 7.1.3. Real-time Data Processing and Edge Computing 7.2. Connectivity Technologies 7.2.1. V2X Communication (Vehicle-to-Everything) 7.2.2. 5G and Next-Gen Wireless Networks 7.2.3. Cloud and Edge Computing Infrastructure 7.3. Digital Mapping and Localization 7.4. Cybersecurity in CAVs 7.5. Data Analytics and Fleet Management Systems 8. Business Models and Investment Opportunities 8.1. Investment in Technology Startups 8.1.1. Autonomous Driving Software and Hardware 8.1.2. Sensor and Communication Technology Providers 8.2. Mobility as a Service (MaaS) Investment 8.2.1. Carsharing, Ridesharing, and On-Demand Services 8.2.2. Autonomous Fleet Management 8.3. Infrastructure Development (Charging, Mapping, Road Networks) 8.4. Public-Private Partnerships in CAV Development 9. Emerging Business Models 9.1. Subscription and Pay-Per-Use Models 9.2. Collaborative Economy in CAV Sector 10. Connected and Autonomous Mobility Vehicles Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 10.1. Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 10.1.1. Level 1 10.1.2. Level 2 10.1.3. Level 3 10.1.4. Level 4 10.1.5. Level 5 10.2. Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 10.2.1. Passenger Car 10.2.2. Commercial Vehicle 10.3. Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 10.3.1. Semi-autonomous 10.3.2. Fully Autonomous 10.4. Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030 10.4.1. Civil 10.4.2. Defence 10.4.3. Transportation & Logistics 10.4.4. Construction 10.4.5. Others 10.5. Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Region (2023-2030) 10.5.1. North America 10.5.2. Europe 10.5.3. Asia Pacific 10.5.4. Middle East and Africa 10.5.5. South America 11. North America Connected and Autonomous Mobility Vehicles Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 11.1. North America Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 11.1.1. Level 1 11.1.2. Level 2 11.1.3. Level 3 11.1.4. Level 4 11.1.5. Level 5 11.2. North America Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 11.2.1. Passenger Car 11.2.2. Commercial Vehicle 11.3. North America Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 11.3.1. Semi-autonomous 11.3.2. Fully Autonomous 11.4. North America Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030) 11.4.1. Civil 11.4.2. Defence 11.4.3. Transportation & Logistics 11.4.4. Construction 11.4.5. Others 11.5. North America Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Country (2023-2030) 11.5.1. United States 11.5.1.1. United States Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 11.5.1.1.1. Level 1 11.5.1.1.2. Level 2 11.5.1.1.3. Level 3 11.5.1.1.4. Level 4 11.5.1.1.5. Level 5 11.5.1.2. United States Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 11.5.1.2.1. Passenger Car 11.5.1.2.2. Commercial Vehicle 11.5.1.3. United States Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 11.5.1.3.1. Semi-autonomous 11.5.1.3.2. Fully Autonomous 11.5.1.4. United States Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030) 11.5.1.4.1. Civil 11.5.1.4.2. Defence 11.5.1.4.3. Transportation & Logistics 11.5.1.4.4. Construction 11.5.1.4.5. Others 11.5.2. Canada 11.5.2.1. Canada Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 11.5.2.1.1. Level 1 11.5.2.1.2. Level 2 11.5.2.1.3. Level 3 11.5.2.1.4. Level 4 11.5.2.1.5. Level 5 11.5.2.2. Canada Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 11.5.2.2.1. Passenger Car 11.5.2.2.2. Commercial Vehicle 11.5.2.3. Canada Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 11.5.2.3.1. Semi-autonomous 11.5.2.3.2. Fully Autonomous 11.5.2.4. Canada Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030) 11.5.2.4.1. Civil 11.5.2.4.2. Defence 11.5.2.4.3. Transportation & Logistics 11.5.2.4.4. Construction 11.5.2.4.5. Others 11.5.3. Mexico 11.5.3.1. Mexico Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 11.5.3.1.1. Level 1 11.5.3.1.2. Level 2 11.5.3.1.3. Level 3 11.5.3.1.4. Level 4 11.5.3.1.5. Level 5 11.5.3.2. Mexico Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 11.5.3.2.1. Passenger Car 11.5.3.2.2. Commercial Vehicle 11.5.3.3. Mexico Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 11.5.3.3.1. Semi-autonomous 11.5.3.3.2. Fully Autonomous 11.5.3.4. Mexico Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030) 11.5.3.4.1. Civil 11.5.3.4.2. Defence 11.5.3.4.3. Transportation & Logistics 11.5.3.4.4. Construction 11.5.3.4.5. Others 12. Europe Connected and Autonomous Mobility Vehicles Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 12.1. Europe Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 12.2. Europe Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 12.3. Europe Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 12.4. Europe Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030) 12.5. Europe Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Country (2023-2030) 12.5.1. United Kingdom 12.5.1.1. United Kingdom Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 12.5.1.2. United Kingdom Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 12.5.1.3. United Kingdom Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 12.5.1.4. United Kingdom Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030) 12.5.2. France 12.5.2.1. France Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 12.5.2.2. France Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 12.5.2.3. France Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 12.5.2.4. France Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030) 12.5.3. Germany 12.5.3.1. Germany Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 12.5.3.2. Germany Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 12.5.3.3. Germany Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 12.5.3.4. Germany Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030) 12.5.4. Italy 12.5.4.1. Italy Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 12.5.4.2. Italy Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 12.5.4.3. Italy Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 12.5.4.4. Italy Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030) 12.5.5. Spain 12.5.5.1. Spain Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 12.5.5.2. Spain Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 12.5.5.3. Spain Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 12.5.5.4. Spain Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030) 12.5.6. Sweden 12.5.6.1. Sweden Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 12.5.6.2. Sweden Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 12.5.6.3. Sweden Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 12.5.6.4. Sweden Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030) 12.5.7. Russia 12.5.7.1. Russia Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 12.5.7.2. Russia Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 12.5.7.3. Russia Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 12.5.7.4. Russia Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030) 12.5.8. Rest of Europe 12.5.8.1. Rest of Europe Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 12.5.8.2. Rest of Europe Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 12.5.8.3. Rest of Europe Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 12.5.8.4. Rest of Europe Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030) 13. Asia Pacific Connected and Autonomous Mobility Vehicles Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 13.1. Asia Pacific Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 13.2. Asia Pacific Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 13.3. Asia Pacific Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 13.4. Asia Pacific Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030) 13.5. Asia Pacific Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Country (2023-2030) 13.5.1. China 13.5.1.1. China Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 13.5.1.2. China Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 13.5.1.3. China Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 13.5.1.4. China Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030) 13.5.2. S Korea 13.5.2.1. S Korea Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 13.5.2.2. S Korea Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 13.5.2.3. S Korea Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 13.5.2.4. S Korea Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030) 13.5.3. Japan 13.5.3.1. Japan Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 13.5.3.2. Japan Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 13.5.3.3. Japan Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 13.5.3.4. Japan Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030) 13.5.4. India 13.5.4.1. India Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 13.5.4.2. India Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 13.5.4.3. India Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 13.5.4.4. India Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030) 13.5.5. Australia 13.5.5.1. Australia Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 13.5.5.2. Australia Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 13.5.5.3. Australia Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 13.5.5.4. Australia Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030) 13.5.6. Indonesia 13.5.6.1. Indonesia Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 13.5.6.2. Indonesia Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 13.5.6.3. Indonesia Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 13.5.6.4. Indonesia Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030) 13.5.7. Malaysia 13.5.7.1. Malaysia Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 13.5.7.2. Malaysia Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 13.5.7.3. Malaysia Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 13.5.7.4. Malaysia Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030) 13.5.8. Philippines 13.5.8.1. Philippines Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 13.5.8.2. Philippines Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 13.5.8.3. Philippines Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 13.5.8.4. Philippines Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030) 13.5.9. Thailand 13.5.9.1. Thailand Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 13.5.9.2. Thailand Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 13.5.9.3. Thailand Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 13.5.9.4. Thailand Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030) 13.5.10. Vietnam 13.5.10.1. Vietnam Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 13.5.10.2. Vietnam Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 13.5.10.3. Vietnam Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 13.5.10.4. Vietnam Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030) 13.5.11. Rest of Asia Pacific 13.5.11.1. Rest of Asia Pacific Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 13.5.11.2. Rest of Asia Pacific Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 13.5.11.3. Rest of Asia Pacific Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 13.5.11.4. Rest of Asia Pacific Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030) 14. Middle East and Africa Connected and Autonomous Mobility Vehicles Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 14.1. Middle East and Africa Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 14.2. Middle East and Africa Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 14.3. Middle East and Africa Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 14.4. Middle East and Africa Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030) 14.5. Middle East and Africa Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Country (2023-2030) 14.5.1. South Africa 14.5.1.1. South Africa Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 14.5.1.2. South Africa Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 14.5.1.3. South Africa Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 14.5.1.4. South Africa Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030) 14.5.2. GCC 14.5.2.1. GCC Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 14.5.2.2. GCC Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 14.5.2.3. GCC Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 14.5.2.4. GCC Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030) 14.5.3. Nigeria 14.5.3.1. Nigeria Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 14.5.3.2. Nigeria Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 14.5.3.3. Nigeria Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 14.5.3.4. Nigeria Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030) 14.5.4. Rest of ME&A 14.5.4.1. Rest of ME&A Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 14.5.4.2. Rest of ME&A Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 14.5.4.3. Rest of ME&A Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 14.5.4.4. Rest of ME&A Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030) 15. South America Connected and Autonomous Mobility Vehicles Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 15.1. South America Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 15.2. South America Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 15.3. South America Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 15.4. South America Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030) 15.5. South America Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Country (2023-2030) 15.5.1. Brazil 15.5.1.1. Brazil Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 15.5.1.2. Brazil Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 15.5.1.3. Brazil Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 15.5.1.4. Brazil Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030) 15.5.2. Argentina 15.5.2.1. Argentina Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 15.5.2.2. Argentina Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 15.5.2.3. Argentina Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 15.5.2.4. Argentina Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030) 15.5.3. Colombia 15.5.3.1. Colombia Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 15.5.3.2. Colombia Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 15.5.3.3. Colombia Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 15.5.3.4. Colombia Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030) 15.5.4. Chile 15.5.4.1. Chile Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 15.5.4.2. Chile Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 15.5.4.3. Chile Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 15.5.4.4. Chile Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030) 15.5.5. Rest of South America 15.5.5.1. Rest of South America Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Level of Automation (2023-2030) 15.5.5.2. Rest of South America Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Vehicle Level of Automation (2023-2030) 15.5.5.3. Rest of South America Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Propulsion Level of Automation (2023-2030) 15.5.5.4. Rest of South America Connected and Autonomous Mobility Vehicles Market Size and Forecast, by Application (2023-2030) 16. Company Profile: Key Players 16.1. Amazon Web Services, Inc. 16.1.1. Company Overview 16.1.2. Business Portfolio 16.1.3. Financial Overview 16.1.4. SWOT Analysis 16.1.5. Strategic Analysis 16.2. Aptiv 16.3. AVL 16.4. Dassault Systèmes 16.5. Infineon Technologies AG 16.6. SAE International 16.7. Segula Technologies 16.8. Swiss Re 16.9. WirelessCar 16.10. WSP 16.11. AB Volvo 16.12. BMW Group 16.13. Tesla, Inc. 16.14. General Motors 16.15. Honda Motor Co., Ltd. 16.16. Hyundai Motor Company 16.17. Nissan Motors Co., Ltd. 16.18. Renault Group 16.19. Continental AG 16.20. Toyota Motor Corporation 16.21. Waymo LLC 17. Key Findings 18. Analyst Recommendations