The Composite Rebar Market size was valued at USD 618.2 Mn. In 2022 the Composite Rebar revenue will grow by 9.8 % from 2023 to 2029, reaching nearly USD 1189.45 Mn.Composite Rebar Market Overview:

Composite rebar is impervious to environmental elements such as water, salt, and chemicals, making it a more durable, longer-lasting reinforcement material. The composite rebar market has been experiencing significant growth due to several key advantages over conventional steel rebar. Composite rebar, composed of materials such as fiberglass, carbon fiber, or basalt fiber within a polymer matrix, offers excellent corrosion resistance, making it a reliable choice for concrete reinforcement in challenging environments. Its lightweight nature simplifies handling and transportation, reducing personnel and equipment costs. Its impressive strength-to-weight ratio enhances its effectiveness in strengthening concrete structures. The growth of the composite rebar market is primarily driven by infrastructure development, where the need for corrosion-resistant and long-lasting reinforcement solutions is paramount. The market has seen increased popularity due to a growing emphasis on sustainability in construction. With its extended service life and reduced environmental impact, composite rebar aligns with the construction industry's focus on sustainability. The industry's embrace of regulations and standards, as well as ongoing research to enhance its properties, has further contributed to its increasing acceptance. Architects, engineers, and construction professionals are becoming more aware of the benefits of composite rebar, leading to its incorporation into various projects. Staying informed through industry reports and analyses is crucial for a comprehensive understanding of the evolving composite rebar market.To know about the Research Methodology :- Request Free Sample Report

Composite Rebar Market Dynamics:

Drivers Increasing demand for strong and enduring infrastructure boosts Market Growth The growing market for composite rebar is primarily driven by a confluence of compelling factors, with the paramount force being the increasing demand for robust and enduring infrastructure, both in new construction and renovation endeavors. Composite rebar stands out as a superior choice due to its rebar components, and exceptional resistance to corrosion, making it an ideal solution for structures susceptible to decay over time, even in adverse weather conditions. The surging emphasis on sustainability within the construction sector aligns perfectly with the extended lifespan and reduced maintenance requirements of composite rebar, further boosting its adoption as an eco-friendly alternative. Composite Rebar vs Steel Rebar Composite Rebar has more demand in construction. Shifts in building industry regulations and standards have spurred a trend toward corrosion-resistant materials such as composite rebar, ensuring adherence to stringent quality and safety requirements. Continual advancements in materials science and innovative research have consistently enhanced the qualities of composite rebar, positioning it as an attractive substitute for traditional steel rebar in terms of strength, weight, and customizability. These attributes synergistically drive the growing utilization of composite rebar across a diverse range of construction projects, heralding a significant transformation in the landscape of reinforcement materials. Composite rebar's unique combination of resilience, sustainability, and compliance with industry standards makes it essential driving force in the construction market, shaping the future of infrastructure development.Restrain Cost differential limits the Market growth One of the foremost inhibiting factors is the cost differential between composite rebar and traditional steel rebar. Producing composite rebar tends to be more expensive, and this cost gap prevent its utilization, especially in projects with limited budgets or those where cost-effectiveness is a paramount consideration. Another challenge lies in the long-term performance and durability of composite rebar in specific environmental conditions. While it offers superior corrosion resistance, questions persist about its resilience in high-temperature settings or harsh chemical environments. These uncertainties make stakeholders hesitant to embrace composite rebar in projects where its performance under challenging conditions is critical. The construction industry's longstanding reliance on steel rebar poses a significant hurdle to the rapid adoption of composite rebar. Industry professionals are accustomed to using steel, and there is resistance to change, as well as concerns about the familiarity and proven performance of steel. The evolving landscape of standards and regulations governing the use of composite rebar creates a sense of uncertainty for both producers and project stakeholders. In some regions, these regulations are still in the development stage, making it challenging to predict the compliance requirements and navigate potential legal or technical obstacles. This regulatory uncertainty acts as a deterrent to the broader integration of composite rebar in construction projects. Despite its numerous advantages, these restraining factors present challenges that need to be addressed for composite rebar to gain wider acceptance in the construction industry. Opportunity Integration of Composite Rebar in Construction Projects Opens Lucrative Growth Opportunities for The Market. The integration of composite rebar into diverse construction projects such as bridges, tunnels, highways, and buildings holds immense market potential, especially as urbanization and infrastructure demands continue to surge. Its exceptional resistance to corrosion ensures the longevity of structures, reducing maintenance costs and extending their overall lifespan. Moreover, the environmentally friendly attributes of composite rebar align perfectly with the global shift toward sustainable construction practices, presenting a compelling opportunity to cater to the increasing demand for eco-conscious building materials. The ever-evolving landscape of composite materials technology opens the door to innovative solutions and the development of even more efficient and versatile composite rebar. As awareness of the numerous benefits of composite rebar spreads, there exists a significant prospect to position it as the preferred material of choice among architects, engineers, and construction professionals, thereby expediting its market penetration. Also the evolving composite rebar technologies boost the market growth. The market for composite rebar is poised for substantial growth, offering a remarkable opportunity to simultaneously address infrastructure requirements, environmental sustainability goals, and technological advancements. This burgeoning market presents a promising avenue for stakeholders to contribute to the construction industry's evolution, offering resilient and sustainable solutions that will shape the future of infrastructure development.

Composite Rebar Market Segment Analysis:

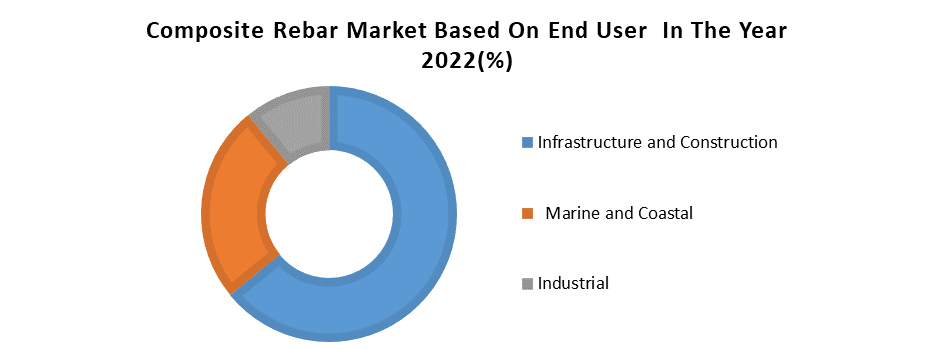

Based On Product Type: The Glass Fiber Reinforced Polymer dominates the type segment of the Composite Rebar Market in the year 2022. GFRP rebar is preferred due to its superior corrosion resistance, which is crucial in concrete structures, particularly in aggressive environments where traditional steel rebar is prone to corrosion. This resilience leads to lower maintenance costs and an extended lifespan of structures, making GFRP a cost-effective choice in the long run.GFRP rebar is significantly lighter than steel rebar, which simplifies transportation and installation, reducing labor and equipment costs. This weight advantage is particularly relevant in large-scale infrastructure projects. GFRP's non-conductive properties make it ideal for projects where electrical conductivity is a concern, ensuring safety and performance. The global push for sustainable and eco-friendly building materials aligns perfectly with GFRP rebar's characteristics, as it is corrosion-resistant, non-metallic, and longer-lasting, contributing to a reduction in the environmental impact of construction projects. These eco-friendly qualities resonate with the growing demand for sustainable construction practices and green building materials.Based on End User, The Infrastructure and Construction segment dominates the End User segment of the Composite Rebar Market in the year 2022. The Infrastructure and Construction segment maintains its dominant position in the End User category of the Composite Rebar Market due to several compelling reasons. This segment represents a significant portion of the construction industry, encompassing a wide array of projects ranging from bridges, highways, and tunnels, to various civil engineering endeavors. The diverse nature of these projects provides numerous opportunities for the incorporation of composite rebar. One of the major factors driving the dominance of this segment is the superior durability and longevity offered by composite rebar. Its exceptional resistance to corrosion is highly valued in the construction of infrastructure, where long-term performance and minimal maintenance costs are paramount. In coastal and marine construction, composite rebar's ability to withstand the corrosive effects of saltwater makes it an indispensable choice for projects such as seawalls, piers, jetties, and port facilities. Its resilience in such challenging environments further cements its position in this sector. The Infrastructure and Construction segment's dominance is a result of the segment's extensive utilization of composite rebar, its unmatched durability, adaptability, corrosion resistance, and alignment with sustainable construction principles, collectively making it the preferred material for various construction projects within this sector.

Regional Insight:

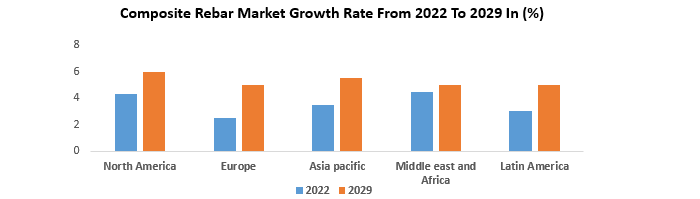

North America dominated the composite rebar market in the year 2022. The North American region is poised to maintain its market leadership, driven by several key factors. The construction sector in countries such as the United States, Canada, and Mexico is experiencing significant growth, which is anticipated to bolster the demand for composite rebar in the region throughout the forecast period. The United States, in particular, boasts one of the world's most expansive construction industries. The deteriorating state of highway infrastructure across the United States and North America at large presents a mounting problem, incurring substantial rehabilitation costs for governments. In light of the pressing need for more sustainable construction materials, the significance of composite rebars has surged. These rebars are the ideal material for rehabilitating and reinforcing deteriorated and underperforming concrete infrastructure. Asia-Pacific is the fastest-growing region for the composite rebar market. China's increasing urbanization, infrastructural growth, and building boom fueled demand for cutting-edge reinforcement techniques such as composite rebar. Local building customs, regulatory frameworks, and cost competitiveness with traditional steel rebar, among other variables, have had an impact on the market. When corrosion resistance was essential, projects including mining facilities and marine infrastructure in Australia used composite rebar.

Competitive Landscape:

The Competitive Landscape of the Composite Rebar Market covers the number of key reinforcing rebar companies, company size, strengths, weaknesses, barriers, and threats. It also focuses on the power of the company’s competitive rivals, potential, new market entrants, customers, suppliers, and substitute products that drive the profitability of the companies in the Composite Rebar Market. The global Composite Rebar Market includes several market players at the country, regional, and global levels. Some of the composite rebar manufacturers are Unicomposite, Pultrall Inc., Schoeck International, Dextra Group, and ArmastekMany companies have conducted research and development activities to fulfill consumer demand and increase their portfolio. The company focuses on strategic partnerships mergers and acquisitions to expand the global reach and maintain the brand name.Global Composite Rebar Market Scope: Inquire before buying

Global Composite Rebar Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 618.2 Mn. Forecast Period 2023 to 2029 CAGR: 9.8% Market Size in 2029: US $ 1189.45 Mn. Segments Covered: by Type Glass Fiber-Reinforced Polymer (GFRP) Rebar Carbon Fiber-Reinforced Polymer (CFRP) Rebar Basalt Fiber-Reinforced Polymer (BFRP) Rebar Hybrid Rebar by End User Road & Building Bridges & Port Underground Construction Water Treatment Plants Others by End User Infrastructure and Construction Marine and Coastal Industrial Others Composite Rebar Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Composite Rebar Market Key Players

1. Unicomposite 2. Pultrall Inc. 3. Schoeck International 4. Dextra Group 5. Armastek 6. Marshall Composites Technologies 7. Mateenbar 8. TUF-BAR 9. Captrad 10. Neuvokas Corporation 11. Composite Rebar Technologies, Inc. 12. Technobasalt 13. GFRP Rebar 14. Helix Steel 15. Pulwell Composites Co., Ltd. 16. FiReP Group 17. Fiberline Composites Frequently Asked Questions: 1] What segments are covered in the Global Composite Rebar Market report? Ans. The segments covered in the Composite Rebar Market report are based on Type, Application, End User and Regions. 2] Which region is expected to hold the highest share in the Global Composite Rebar Market? Ans. The North American region is expected to hold the highest share of the Composite Rebar Market. 3] What was the market size of the Global Composite Rebar Market by 2022? Ans. The market size of the Composite Rebar Market by 2022 is expected to reach US$ 618.2 Mn. 4] What is the forecast period for the Global Composite Rebar Market? Ans. The forecast period for the Composite Rebar Market is 2023-2029. 5] What is the market size of the Global Composite Rebar Market in 2029? Ans. The market size of the Composite Rebar Market in 2029 is valued at US$ 1189.45 Mn.

1. Composite Rebar Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Composite Rebar Market: Dynamics 2.1. Composite Rebar Market Trends by Region 2.1.1. North America Composite Rebar Market Trends 2.1.2. Europe Composite Rebar Market Trends 2.1.3. Asia Pacific Composite Rebar Market Trends 2.1.4. Middle East and Africa Composite Rebar Market Trends 2.1.5. South America Composite Rebar Market Trends 2.2. Composite Rebar Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Composite Rebar Market Drivers 2.2.1.2. North America Composite Rebar Market Restraints 2.2.1.3. North America Composite Rebar Market Opportunities 2.2.1.4. North America Composite Rebar Market Challenges 2.2.2. Europe 2.2.2.1. Europe Composite Rebar Market Drivers 2.2.2.2. Europe Composite Rebar Market Restraints 2.2.2.3. Europe Composite Rebar Market Opportunities 2.2.2.4. Europe Composite Rebar Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Composite Rebar Market Drivers 2.2.3.2. Asia Pacific Composite Rebar Market Restraints 2.2.3.3. Asia Pacific Composite Rebar Market Opportunities 2.2.3.4. Asia Pacific Composite Rebar Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Composite Rebar Market Drivers 2.2.4.2. Middle East and Africa Composite Rebar Market Restraints 2.2.4.3. Middle East and Africa Composite Rebar Market Opportunities 2.2.4.4. Middle East and Africa Composite Rebar Market Challenges 2.2.5. South America 2.2.5.1. South America Composite Rebar Market Drivers 2.2.5.2. South America Composite Rebar Market Restraints 2.2.5.3. South America Composite Rebar Market Opportunities 2.2.5.4. South America Composite Rebar Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Composite Rebar Industry 2.8. Analysis of Government Schemes and Initiatives For Composite Rebar Industry 2.9. Composite Rebar Market Trade Analysis 2.10. The Global Pandemic Impact on Composite Rebar Market 3. Composite Rebar Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Composite Rebar Market Size and Forecast, by Type (2022-2029) 3.1.1. Glass Fiber-Reinforced Polymer (GFRP) Rebar 3.1.2. Carbon Fiber-Reinforced Polymer (CFRP) Rebar 3.1.3. Basalt Fiber-Reinforced Polymer (BFRP) Rebar 3.1.4. Hybrid Rebar 3.2. Composite Rebar Market Size and Forecast, by Application (2022-2029) 3.2.1. Road and Building 3.2.2. Bridges and Port 3.2.3. Underground Construction 3.2.4. Water Treatment Plants 3.2.5. Others 3.3. Composite Rebar Market Size and Forecast, by End User (2022-2029) 3.3.1. Infrastructure and Construction 3.3.2. Marine and Coastal 3.3.3. Industrial 3.3.4. Others 3.4. Composite Rebar Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Composite Rebar Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Composite Rebar Market Size and Forecast, by Type (2022-2029) 4.1.1. Glass Fiber-Reinforced Polymer (GFRP) Rebar 4.1.2. Carbon Fiber-Reinforced Polymer (CFRP) Rebar 4.1.3. Basalt Fiber-Reinforced Polymer (BFRP) Rebar 4.1.4. Hybrid Rebar 4.2. North America Composite Rebar Market Size and Forecast, by Application (2022-2029) 4.2.1. Road and Building 4.2.2. Bridges and Port 4.2.3. Underground Construction 4.2.4. Water Treatment Plants 4.2.5. Others 4.3. North America Composite Rebar Market Size and Forecast, by End User (2022-2029) 4.3.1. Infrastructure and Construction 4.3.2. Marine and Coastal 4.3.3. Industrial 4.3.4. Others 4.4. North America Composite Rebar Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Composite Rebar Market Size and Forecast, by Type (2022-2029) 4.4.1.1.1. Glass Fiber-Reinforced Polymer (GFRP) Rebar 4.4.1.1.2. Carbon Fiber-Reinforced Polymer (CFRP) Rebar 4.4.1.1.3. Basalt Fiber-Reinforced Polymer (BFRP) Rebar 4.4.1.1.4. Hybrid Rebar 4.4.1.2. United States Composite Rebar Market Size and Forecast, by Application (2022-2029) 4.4.1.2.1. Road and Building 4.4.1.2.2. Bridges and Port 4.4.1.2.3. Underground Construction 4.4.1.2.4. Water Treatment Plants 4.4.1.2.5. Others 4.4.1.3. United States Composite Rebar Market Size and Forecast, by End User (2022-2029) 4.4.1.3.1. Infrastructure and Construction 4.4.1.3.2. Marine and Coastal 4.4.1.3.3. Industrial 4.4.1.3.4. Others 4.4.2. Canada 4.4.2.1. Canada Composite Rebar Market Size and Forecast, by Type (2022-2029) 4.4.2.1.1. Glass Fiber-Reinforced Polymer (GFRP) Rebar 4.4.2.1.2. Carbon Fiber-Reinforced Polymer (CFRP) Rebar 4.4.2.1.3. Basalt Fiber-Reinforced Polymer (BFRP) Rebar 4.4.2.1.4. Hybrid Rebar</em 4.4.2.2. Canada Composite Rebar Market Size and Forecast, by Application (2022-2029) 4.4.2.2.1. Road and Building 4.4.2.2.2. Bridges and Port 4.4.2.2.3. Underground Construction 4.4.2.2.4. Water Treatment Plants 4.4.2.2.5. Others 4.4.2.3. Canada Composite Rebar Market Size and Forecast, by End User (2022-2029) 4.4.2.3.1. Infrastructure and Construction 4.4.2.3.2. Marine and Coastal 4.4.2.3.3. Industrial 4.4.2.3.4. Others 4.4.3. Mexico 4.4.3.1. Mexico Composite Rebar Market Size and Forecast, by Type (2022-2029) 4.4.3.1.1. Glass Fiber-Reinforced Polymer (GFRP) Rebar 4.4.3.1.2. Carbon Fiber-Reinforced Polymer (CFRP) Rebar 4.4.3.1.3. Basalt Fiber-Reinforced Polymer (BFRP) Rebar 4.4.3.1.4. Hybrid Rebar 4.4.3.2. Mexico Composite Rebar Market Size and Forecast, by Application (2022-2029) 4.4.3.2.1. Road and Building 4.4.3.2.2. Bridges and Port 4.4.3.2.3. Underground Construction 4.4.3.2.4. Water Treatment Plants 4.4.3.2.5. Others 4.4.3.3. Mexico Composite Rebar Market Size and Forecast, by End User (2022-2029) 4.4.3.3.1. Infrastructure and Construction 4.4.3.3.2. Marine and Coastal 4.4.3.3.3. Industrial 4.4.3.3.4. Others 5. Europe Composite Rebar Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Composite Rebar Market Size and Forecast, by Type (2022-2029) 5.2. Europe Composite Rebar Market Size and Forecast, by Application (2022-2029) 5.3. Europe Composite Rebar Market Size and Forecast, by End User (2022-2029) 5.4. Europe Composite Rebar Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Composite Rebar Market Size and Forecast, by Type (2022-2029) 5.4.1.2. United Kingdom Composite Rebar Market Size and Forecast, by Application (2022-2029) 5.4.1.3. United Kingdom Composite Rebar Market Size and Forecast, by End User (2022-2029) 5.4.2. France 5.4.2.1. France Composite Rebar Market Size and Forecast, by Type (2022-2029) 5.4.2.2. France Composite Rebar Market Size and Forecast, by Application (2022-2029) 5.4.2.3. France Composite Rebar Market Size and Forecast, by End User (2022-2029) 5.4.3. Germany 5.4.3.1. Germany Composite Rebar Market Size and Forecast, by Type (2022-2029) 5.4.3.2. Germany Composite Rebar Market Size and Forecast, by Application (2022-2029) 5.4.3.3. Germany Composite Rebar Market Size and Forecast, by End User (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Composite Rebar Market Size and Forecast, by Type (2022-2029) 5.4.4.2. Italy Composite Rebar Market Size and Forecast, by Application (2022-2029) 5.4.4.3. Italy Composite Rebar Market Size and Forecast, by End User (2022-2029) 5.4.5. Spain 5.4.5.1. Spain Composite Rebar Market Size and Forecast, by Type (2022-2029) 5.4.5.2. Spain Composite Rebar Market Size and Forecast, by Application (2022-2029) 5.4.5.3. Spain Composite Rebar Market Size and Forecast, by End User (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Composite Rebar Market Size and Forecast, by Type (2022-2029) 5.4.6.2. Sweden Composite Rebar Market Size and Forecast, by Application (2022-2029) 5.4.6.3. Sweden Composite Rebar Market Size and Forecast, by End User (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Composite Rebar Market Size and Forecast, by Type (2022-2029) 5.4.7.2. Austria Composite Rebar Market Size and Forecast, by Application (2022-2029) 5.4.7.3. Austria Composite Rebar Market Size and Forecast, by End User (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Composite Rebar Market Size and Forecast, by Type (2022-2029) 5.4.8.2. Rest of Europe Composite Rebar Market Size and Forecast, by Application (2022-2029) 5.4.8.3. Rest of Europe Composite Rebar Market Size and Forecast, by End User (2022-2029) 6. Asia Pacific Composite Rebar Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Composite Rebar Market Size and Forecast, by Type (2022-2029) 6.2. Asia Pacific Composite Rebar Market Size and Forecast, by Application (2022-2029) 6.3. Asia Pacific Composite Rebar Market Size and Forecast, by End User (2022-2029) 6.4. Asia Pacific Composite Rebar Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Composite Rebar Market Size and Forecast, by Type (2022-2029) 6.4.1.2. China Composite Rebar Market Size and Forecast, by Application (2022-2029) 6.4.1.3. China Composite Rebar Market Size and Forecast, by End User (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Composite Rebar Market Size and Forecast, by Type (2022-2029) 6.4.2.2. S Korea Composite Rebar Market Size and Forecast, by Application (2022-2029) 6.4.2.3. S Korea Composite Rebar Market Size and Forecast, by End User (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Composite Rebar Market Size and Forecast, by Type (2022-2029) 6.4.3.2. Japan Composite Rebar Market Size and Forecast, by Application (2022-2029) 6.4.3.3. Japan Composite Rebar Market Size and Forecast, by End User (2022-2029) 6.4.4. India 6.4.4.1. India Composite Rebar Market Size and Forecast, by Type (2022-2029) 6.4.4.2. India Composite Rebar Market Size and Forecast, by Application (2022-2029) 6.4.4.3. India Composite Rebar Market Size and Forecast, by End User (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Composite Rebar Market Size and Forecast, by Type (2022-2029) 6.4.5.2. Australia Composite Rebar Market Size and Forecast, by Application (2022-2029) 6.4.5.3. Australia Composite Rebar Market Size and Forecast, by End User (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Composite Rebar Market Size and Forecast, by Type (2022-2029) 6.4.6.2. Indonesia Composite Rebar Market Size and Forecast, by Application (2022-2029) 6.4.6.3. Indonesia Composite Rebar Market Size and Forecast, by End User (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Composite Rebar Market Size and Forecast, by Type (2022-2029) 6.4.7.2. Malaysia Composite Rebar Market Size and Forecast, by Application (2022-2029) 6.4.7.3. Malaysia Composite Rebar Market Size and Forecast, by End User (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Composite Rebar Market Size and Forecast, by Type (2022-2029) 6.4.8.2. Vietnam Composite Rebar Market Size and Forecast, by Application (2022-2029) 6.4.8.3. Vietnam Composite Rebar Market Size and Forecast, by End User (2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Composite Rebar Market Size and Forecast, by Type (2022-2029) 6.4.9.2. Taiwan Composite Rebar Market Size and Forecast, by Application (2022-2029) 6.4.9.3. Taiwan Composite Rebar Market Size and Forecast, by End User (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Composite Rebar Market Size and Forecast, by Type (2022-2029) 6.4.10.2. Rest of Asia Pacific Composite Rebar Market Size and Forecast, by Application (2022-2029) 6.4.10.3. Rest of Asia Pacific Composite Rebar Market Size and Forecast, by End User (2022-2029) 7. Middle East and Africa Composite Rebar Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Composite Rebar Market Size and Forecast, by Type (2022-2029) 7.2. Middle East and Africa Composite Rebar Market Size and Forecast, by Application (2022-2029) 7.3. Middle East and Africa Composite Rebar Market Size and Forecast, by End User (2022-2029) 7.4. Middle East and Africa Composite Rebar Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Composite Rebar Market Size and Forecast, by Type (2022-2029) 7.4.1.2. South Africa Composite Rebar Market Size and Forecast, by Application (2022-2029) 7.4.1.3. South Africa Composite Rebar Market Size and Forecast, by End User (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Composite Rebar Market Size and Forecast, by Type (2022-2029) 7.4.2.2. GCC Composite Rebar Market Size and Forecast, by Application (2022-2029) 7.4.2.3. GCC Composite Rebar Market Size and Forecast, by End User (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Composite Rebar Market Size and Forecast, by Type (2022-2029) 7.4.3.2. Nigeria Composite Rebar Market Size and Forecast, by Application (2022-2029) 7.4.3.3. Nigeria Composite Rebar Market Size and Forecast, by End User (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Composite Rebar Market Size and Forecast, by Type (2022-2029) 7.4.4.2. Rest of ME&A Composite Rebar Market Size and Forecast, by Application (2022-2029) 7.4.4.3. Rest of ME&A Composite Rebar Market Size and Forecast, by End User (2022-2029) 8. South America Composite Rebar Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Composite Rebar Market Size and Forecast, by Type (2022-2029) 8.2. South America Composite Rebar Market Size and Forecast, by Application (2022-2029) 8.3. South America Composite Rebar Market Size and Forecast, by End User(2022-2029) 8.4. South America Composite Rebar Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Composite Rebar Market Size and Forecast, by Type (2022-2029) 8.4.1.2. Brazil Composite Rebar Market Size and Forecast, by Application (2022-2029) 8.4.1.3. Brazil Composite Rebar Market Size and Forecast, by End User (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Composite Rebar Market Size and Forecast, by Type (2022-2029) 8.4.2.2. Argentina Composite Rebar Market Size and Forecast, by Application (2022-2029) 8.4.2.3. Argentina Composite Rebar Market Size and Forecast, by End User (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Composite Rebar Market Size and Forecast, by Type (2022-2029) 8.4.3.2. Rest Of South America Composite Rebar Market Size and Forecast, by Application (2022-2029) 8.4.3.3. Rest Of South America Composite Rebar Market Size and Forecast, by End User (2022-2029) 9. Global Composite Rebar Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Composite Rebar Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Unicomposite 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Pultrall Inc. 10.3. Schoeck International 10.4. Dextra Group 10.5. Armastek 10.6. Marshall Composites Technologies 10.7. Mateenbar 10.8. TUF-BAR 10.9. Captrad 10.10. Neuvokas Corporation 10.11. Composite Rebar Technologies, Inc. 10.12. Technobasalt 10.13. GFRP Rebar 10.14. Helix Steel 10.15. Pulwell Composites Co., Ltd. 10.16. FiReP Group 10.17. Fiberline Composites 11. Key Findings 12. Industry Recommendations 13. Composite Rebar Market: Research Methodology 14. Terms and Glossary