The Global Composite AI Market size was valued at USD 1.15 Billion in 2023 and the total Composite AI revenue is expected to grow at a CAGR of 36.06 % from 2024 to 2030, reaching nearly USD 9.98 Billion By 2030.Composite AI Market Definition:

Composite AI is an approach to artificial intelligence (AI) that combines different AI techniques to solve complex problems. It is also known as multidisciplinary AI or hybrid AI. Composite AI systems are designed to take advantage of the strengths of different AI techniques to achieve better results than any single technique. Artificial Intelligence is becoming the Offering with the greatest potential to reshape how organization develop their activities and generate value through new business models. Composite AI systems take a holistic approach to problem-solving, considering all aspects of the problem and using the most appropriate AI technique for each aspect.To know about the Research Methodology :- Request Free Sample Report

Composite AI Market Overview:

AI is becoming increasingly adopted across various industries, including healthcare, finance, manufacturing, and retail. High adoption is driving the demand for composite AI solutions, which offer more sophisticated and effective AI capabilities compared to single-technique AI solutions. The amount and complexity of data are growing exponentially, making it challenging to analyze and extract meaningful insights using traditional methods. Composite AI can effectively handle complex data sets by combining different AI techniques, such as machine learning, natural language processing, and computer vision. Composite AI is poised to play a transformative role in the future of AI, enabling organizations to tackle complex challenges, gain valuable insights from data, and achieve operational excellence. As AI continues to evolve, Composite AI will become increasingly essential for organizations seeking to harness the power of AI to drive innovation and success. The global Composite AI market is dominated by a few large players, such as IBM, Microsoft, Google, and Amazon. Prominent companies are offering a comprehensive range of composite AI solutions, including platforms, tools, and services and also actively investing in research and development to advance composite AI technology and develop innovative solutions. IBM is a leading provider of AI solutions, including composite AI solutions. The company's Watson AI platform is a comprehensive platform for developing and deploying composite AI models. IBM also offers a wide range of consulting and support services to help organizations adopt composite AI. Insights are crucial for modern businesses to thrive in today's competitive landscape. Without a clear understanding of their data, businesses risk making poor decisions that could jeopardize their success. AI techniques, particularly machine learning (ML) and natural language processing (NLP), have emerged as powerful tools for extracting actionable insights from unstructured data, which often holds valuable information about customer behavior, market trends, and potential risks.Composite AI Market Dynamics:

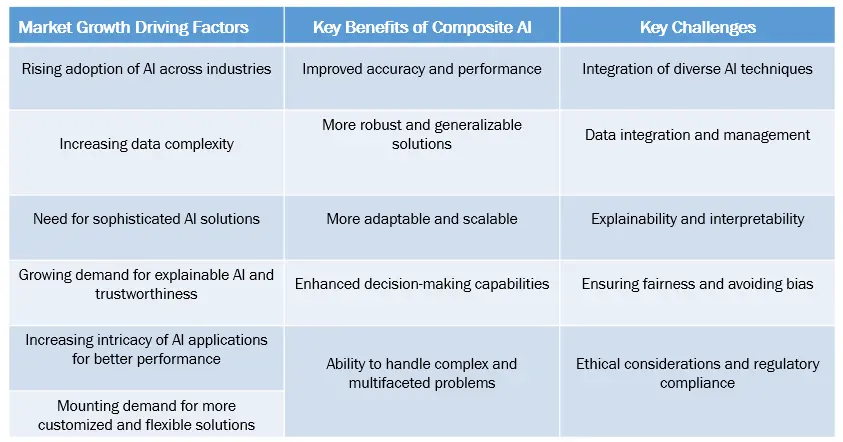

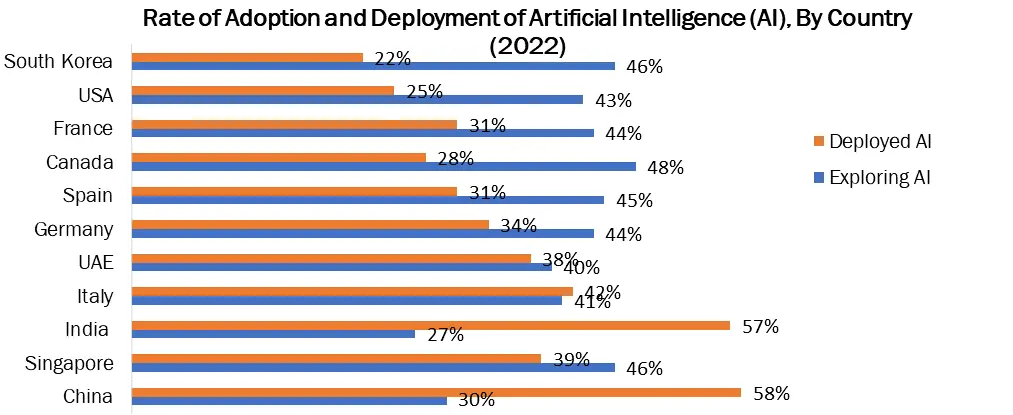

Composite AI is expected to become A Game Changer Technology for Industry Vertical Composite AI is indeed a game-changer in the field of artificial intelligence. It's an approach that combines different AI techniques to create more powerful, versatile, and adaptable AI systems. By integrating various AI components and technologies, composite AI overcomes the limitations of single-technique AI and tackles complex problems that were previously intractable. An composite AI is expected to become a game-changer technology for industry verticals. Composite AI systems is used to diagnose diseases, develop personalized treatment plans, and monitor patient health. For instance, composite AI algorithms can analyze medical images, such as X-rays and MRI scans, to identify abnormalities and assist in diagnosis. It is also to detect fraud, assess risk, and optimize financial portfolios. For example, composite AI algorithms can analyze financial transactions to detect patterns that indicate fraudulent activity in Banking and financial sector. Composite AI systems is used to personalize customer experiences, optimize product pricing, and manage inventory levels in the retail Industry. For example, composite AI algorithms help to analyze customer data to recommend products that are likely to be of interest to individual customers. An increase in adoption of AI in edge computing across the globe one of the key drivers behind the Composite AI Market Growth North America is at the forefront of AI adoption in edge computing, with major players like IBM, Microsoft, and Amazon Web Services (AWS) offering comprehensive edge computing solutions. The region is also home to a thriving startup ecosystem focused on developing innovative edge AI applications. Walmart is using edge AI to optimize inventory management and improve customer experiences in its stores. Europe is making significant strides in edge AI adoption and Composite AI technology, driven by initiatives like the European AI Alliance and the European Commission's commitment to digital transformation. The region is particularly focused on using edge AI for industrial applications, such as predictive maintenance and anomaly detection. Siemens is using edge AI for predictive maintenance in industrial machinery to reduce downtime and improve efficiency. The Asia Pacific region is rapidly adopting AI in edge computing, with countries like China, India, and South Korea leading the way. The region's growing adoption of IoT devices and the increasing demand for real-time data processing are driving the demand for edge AI solutions. China is using edge AI to manage traffic flow, optimize energy consumption, and improve public safety in its cities. The integration of artificial intelligence (AI) with other technologies is a significant trend in the Composite AI Market that is transforming various industries Artificial intelligence (AI) is rapidly transforming various industries by integrating with other technologies. The transformation is leading to the development of more sophisticated and powerful AI systems that are capable of solving complex problems and automating tasks that were previously thought to be the exclusive domain of humans. AI is increasingly being used to analyze the vast amounts of data generated by IoT devices, which helps to improve decision-making, predict customer behavior, and optimize operations. AI applications are increasingly being deployed in the cloud, which makes them easier to scale and manage. Cloud computing also makes it possible to share AI resources with others that accelerate innovation. Researchers are developing new AI algorithms that are more efficient and accurate than ever before. These algorithms are making it possible to apply AI to a wider range of problems. The integration of AI with other technologies is still in its early stages, but it is already having a profound impact on the world. As AI continues to develop, the integration of the Composite AI is expected to increase at a more than 35% growth rate during the forecast period. Composite AI Market Dynamics Snapshot:

Composite AI Market Segment Analysis:

Based on the Offering, Composite AI Market is segmented into Software, Hardware and Services. The hardware segment consists of the components like Processors, Memory Units, Network Equipment and Others. The composite AI hardware market is a highly competitive market with a number of large and established players. The major players are focusing on developing innovative AI-powered hardware that meets the needs of their customers. They are also investing heavily in research and development to stay ahead of the competition. The composite AI hardware market offers a number of opportunities for growth. The increasing adoption of AI technologies across various industries is creating a demand for more sophisticated AI-powered hardware. Additionally, the growing demand for personalized and predictive AI solutions is creating opportunities for new entrants to the market. The high cost of AI-powered hardware can be a barrier to adoption for some businesses. Additionally, the lack of skilled AI hardware engineers is expected to limit the positive growth revenue for businesses to develop and maintain AI hardware systems. The Software segment includes the module like AI development Platform and Tools, ML Framworks and AI Middleware. An increase in increasing adoption of AI technologies across various industries is creating a demand for more sophisticated AI software solutions. Additionally, the growing demand for personalized and predictive AI solutions are expected to create opportunities for new entrants in the Composite AI market. The demand for AI software is expected to be driven by businesses of all sizes, from small and medium-sized businesses (SMBs) to large enterprises. Based on the Technique, machine learning is expected to be the most dominant force in the composite AI market. The technology has its ability to learn from data and make predictions without being explicitly programmed. Machine learning is already being used in a wide variety of applications, including fraud detection, customer service, and medical diagnosis. By Application, Composite AI Market is segmented into product design and development, customer service, fraud detection, risk management and supply chain management. The product design and development segment are expected to hold the more than 25% share in the Composite AI Market during the forecast period. Product design and development is expected to be the largest application area for composite AI in 2023, as businesses increasingly adopt AI-powered tools to automate design tasks, optimize product performance, and personalize products for individual customers. Customer service is another significant application area, where AI chatbots and virtual assistants are being used to provide 24/7 customer support and handle routine inquiries. Fraud detection is also a growing application area for composite AI, as businesses leverage AI algorithms to identify and prevent fraudulent transactions. Risk management is another important application area, where AI is being used to assess and mitigate risks associated with investments, loans, and other financial activities. Supply chain management is also benefiting from composite AI, as businesses use AI to optimize logistics, predict demand, and manage inventory levels. Key players operating in the Composite AI market are focusing on the integration of the Composite AI technology. For instance, Amazon is using composite AI to personalize product recommendations for its customers. Netflix is using composite AI to recommend movies and TV shows that are more likely to appeal to its customers.In the Industry Vertical Segment, Banking and financial services is projected to be dominant share in the composite AI market. The BFSI industry is awash in data, with data volumes growing at an exponential rate. The data is complex and unstructured, making it difficult to analyze and extract insights from. Composite AI helps to make sense of this data and extract valuable insights in BFSI industry. Fraud is a major problem for the BFSI industry, costing businesses billions of dollars each year. Composite AI is used to detect fraud more effectively by identifying patterns and anomalies in data. Customers are increasingly demanding personalized experiences from their banks and financial institutions. The Composite technology used to personalize customer experiences by understanding customer needs and preferences and tailoring products and services.

Composite AI Market Regional Insights:

Artificial intelligence (AI) is rapidly reshaping economies and societies. AI-driven products and services are already a crucial part of most people’s routines in North America. Governments across North America are actively promoting the adoption of AI in various industries, recognizing its transformative potential. The initiatives include funding research and development, providing tax incentives for AI adoption, and establishing AI centers of excellence. North America boasts a robust research and development ecosystem for composite AI, with world-class universities, research institutions, and private companies collaborating to advance the field. The region has seen early and widespread adoption of AI across various industries, including healthcare, automotive, and retail. An early adoption of technology is expected to creat a thriving market for composite AI solutions, attracting further investment and innovation. North America is home to a plethora of renowned AI companies, including IBM, Microsoft, Google, Amazon, Salesforce, Adobe, SAP, Oracle, Cisco, and Hewlett Packard Enterprise (HPE). These companies are at the forefront of AI innovation, constantly pushing the boundaries of what's possible with composite AI solutions.

Composite AI Market Competitive Landscape:

The composite AI market is a rapidly growing and evolving space, with a number of key players emerging as leaders in the field. Many companies are focusing on the development of innovative AI solutions that are addressing a wide range of challenges across industries. AI technology is constantly evolving, with new algorithms and techniques being developed all the time, which is also leading to the development of more powerful and sophisticated composite AI systems. Google AI is one of the leading research labs in the field of composite AI. The company is working on a number of different projects, including developing new AI algorithms, designing new AI systems, and applying AI to real-world problems. SAS is a provider of business analytics software. The company is developing AI solutions that can help businesses to analyze their data and make better decisions. Opentext is a provider of enterprise content management software. The company is developing AI solutions that can help businesses to manage their unstructured data. In 2023, Amazon SageMaker Model Registry is announced. SageMaker Model Registry is a centralized repository for managing machine learning models. SageMaker Model Registry makes it easy for developers to track the lineage of their models and deploy them to production. In February 2023, Amazon Web Services (AWS) and Hugging Face announced a collaboration to make generative AI more accessible and cost-efficient. AWS will make it easy for developers to find, deploy, and manage Hugging Face models on AWS. It includes Hugging Face models into Amazon SageMaker, AWS's machine learning platform. AWS and Hugging Face will work together to make it easier for developers to collaborate on generative AI projects to create tools and resources that make it easy for developers to share code, data, and models.Composite AI Market Scope: Inquiry Before Buying

Composite AI Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: USD 1.15 Bn. Forecast Period 2024 to 2030 CAGR: 36.06% Market Size in 2030: USD 9.98 Bn. Segments Covered: by Offering Software Hardware Services by Industry Vertical Data processing Pattern recognition Machine learning Natural language processing by Technique Product design and development Customer service Fraud detection Risk management Supply chain management by Application Banking and financial services Healthcare Retail Manufacturing Transportation and logistics Others Composite AI Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Composite AI Market, Key Players

1. OpenAI 2. Google DeepMind 3. IBM 4. Microsoft 5. Facebook AI Research (FAIR) 6. Amazon AI 7. NVIDIA 8. Intel AI 9. Salesforce Einstein 10. C3.ai 11. UiPath 12. Palantir Technologies 13. SAS Institute 14. Blackswan Technologies 15. Oracle 16. Opentext 17. Zest AI 18. DatarobotFAQs:

1. What are the growth drivers for the Composite AI Market? Ans. Increasing AI adoption, Growing Complexity of Data and Problems and Advancements in AI Technologies are expected to be the major drivers for the Composite AI Market. 2. What is the major restraint for the Composite AI Market growth? Ans. Data privacy concern is expected to be the major restraining factor for the Composite AI Market growth. 3. Which region is expected to lead the global Composite AI Market during the forecast period? Ans. Asia Pacific is expected to lead the global Composite AI Market during the forecast period. 4. What is the projected market size & and growth rate of the Composite AI Market? Ans. The Composite AI Market size was valued at USD 1.15 Billion in 2023 and the total Composite AI revenue is expected to grow at a CAGR of 36.06% from 2024 to 2030, reaching nearly USD 9.98 Million By 2030. 5. What segments are covered in the Composite AI Market report? Ans. The segments covered in the Composite AI Market report are Offering, Technique, Application, Industry Vertical and Region.

1. Composite AI Market: Research Methodology 2. Composite AI Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Composite AI Market: Dynamics 3.1. Composite AI Market Trends by Region 3.2. Composite AI Market Dynamics by Region 3.2.1. Composite AI Market Drivers 3.2.2. Composite AI Market Restraints 3.2.3. Composite AI Market Opportunities 3.2.4. Composite AI Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Regulatory Landscape by Region 3.5.1. Global 3.5.2. North America 3.5.3. Europe 3.5.4. Asia Pacific 3.5.5. Middle East and Africa 3.5.6. South America 3.6. Analysis of Government Schemes and Initiatives For Composite AI Industry 3.7. The Global Pandemic Impact on Composite AI Market 4. Composite AI Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 4.1. Composite AI Market Size and Forecast, by Offering (2023-2030) 4.1.1. Software 4.1.2. Hardware 4.1.3. Services 4.2. Composite AI Market Size and Forecast, by Technique (2023-2030) 4.2.1. Portable 4.2.2. Non Portable 4.3. Composite AI Market Size and Forecast, by Application (2023-2030) 4.3.1. Product design and development 4.3.2. Customer service 4.3.3. Fraud detection 4.3.4. Risk management 4.3.5. Supply chain management 4.4. Composite AI Market Size and Forecast, by Industry Vertical (2023-2030) 4.4.1. Banking and financial services 4.4.2. Healthcare 4.4.3. Retail 4.4.4. Manufacturing 4.4.5. Transportation and logistics 4.4.6. Others 4.5. Composite AI Market Size and Forecast, by Region (2023-2030) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Composite AI Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 5.1. North America Composite AI Market Size and Forecast, by Offering (2023-2030) 5.1.1. Software 5.1.2. Hardware 5.1.3. Services 5.2. North America Composite AI Market Size and Forecast, by Technique (2023-2030) 5.2.1. Data processing 5.2.2. Pattern recognition 5.2.3. Machine learning 5.2.4. Natural language processing 5.3. North America Composite AI Market Size and Forecast, by Application (2023-2030) 5.3.1. Product design and development 5.3.2. Customer service 5.3.3. Fraud detection 5.3.4. Risk management 5.3.5. Supply chain management 5.4. North America Composite AI Market Size and Forecast, by Industry Vertical (2023-2030) 5.4.1. Banking and financial services 5.4.2. Healthcare 5.4.3. Retail 5.4.4. Manufacturing 5.4.5. Transportation and logistics 5.4.6. Others 5.5. Composite AI Market Size and Forecast, by Country (2023-2030) 5.5.1. United States 5.5.1.1. United States Composite AI Market Size and Forecast, by Offering (2023-2030) 5.5.1.1.1. Software 5.5.1.1.2. Hardware 5.5.1.1.3. Services 5.5.1.2. United States Composite AI Market Size and Forecast, by Technique (2023-2030) 5.5.1.2.1. Data processing 5.5.1.2.2. Pattern recognition 5.5.1.2.3. Machine learning 5.5.1.2.4. Natural language processing 5.5.1.3. United States Composite AI Market Size and Forecast, by Application (2023-2030) 5.5.1.3.1. Product design and development 5.5.1.3.2. Customer service 5.5.1.3.3. Fraud detection 5.5.1.3.4. Risk management 5.5.1.3.5. Supply chain management 5.5.1.4. Training United States Composite AI Market Size and Forecast, by Industry Vertical (2023-2030) 5.5.1.4.1. Banking and financial services 5.5.1.4.2. Healthcare 5.5.1.4.3. Retail 5.5.1.4.4. Manufacturing 5.5.1.4.5. Transportation and logistics 5.5.1.4.6. Others 5.5.2. Canada 5.5.2.1. Canada Composite AI Market Size and Forecast, by Offering (2023-2030) 5.5.2.1.1. Software 5.5.2.1.2. Hardware 5.5.2.1.3. Services 5.5.2.2. Canada Composite AI Market Size and Forecast, by Technique (2023-2030) 5.5.2.2.1. Data processing 5.5.2.2.2. Pattern recognition 5.5.2.2.3. Machine learning 5.5.2.2.4. Natural language processing 5.5.2.3. Canada Composite AI Market Size and Forecast, by Application (2023-2030) 5.5.2.3.1. Product design and development 5.5.2.3.2. Customer service 5.5.2.3.3. Fraud detection 5.5.2.3.4. Risk management 5.5.2.3.5. Supply chain management 5.5.2.4. Canada Composite AI Market Size and Forecast, by Industry Vertical (2023-2030) 5.5.2.4.1. Banking and financial services 5.5.2.4.2. Healthcare 5.5.2.4.3. Retail 5.5.2.4.4. Manufacturing 5.5.2.4.5. Transportation and logistics 5.5.2.4.6. Others 5.5.3. Mexico 5.5.3.1. Mexico Composite AI Market Size and Forecast, by Offering (2023-2030) 5.5.3.1.1. Software 5.5.3.1.2. Hardware 5.5.3.1.3. Services 5.5.3.2. Mexico Composite AI Market Size and Forecast, by Technique (2023-2030) 5.5.3.2.1. Data processing 5.5.3.2.2. Pattern recognition 5.5.3.2.3. Machine learning 5.5.3.2.4. Natural language processing 5.5.3.3. Mexico Composite AI Market Size and Forecast, by Application (2023-2030) 5.5.3.3.1. Product design and development 5.5.3.3.2. Customer service 5.5.3.3.3. Fraud detection 5.5.3.3.4. Risk management 5.5.3.3.5. Supply chain management 5.5.3.4. Mexico Composite AI Market Size and Forecast, by Industry Vertical (2023-2030) 5.5.3.4.1. Banking and financial services 5.5.3.4.2. Healthcare 5.5.3.4.3. Retail 5.5.3.4.4. Manufacturing 5.5.3.4.5. Transportation and logistics 5.5.3.4.6. Others 6. Europe Composite AI Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 6.1. Europe Composite AI Market Size and Forecast, by Offering (2023-2030) 6.2. Europe Composite AI Market Size and Forecast, by Technique (2023-2030) 6.3. Europe Composite AI Market Size and Forecast, by Application(2023-2030) 6.4. Europe Composite AI Market Size and Forecast, by Industry Vertical (2023-2030) 6.5. Europe Composite AI Market Size and Forecast, by Country (2023-2030) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Composite AI Market Size and Forecast, by Offering (2023-2030) 6.5.1.2. United Kingdom Composite AI Market Size and Forecast, by Technique (2023-2030) 6.5.1.3. United Kingdom Composite AI Market Size and Forecast, by Application(2023-2030) 6.5.1.4. United Kingdom Composite AI Market Size and Forecast, by Industry Vertical (2023-2030) 6.5.2. France 6.5.2.1. France Composite AI Market Size and Forecast, by Offering (2023-2030) 6.5.2.2. France Composite AI Market Size and Forecast, by Technique (2023-2030) 6.5.2.3. France Composite AI Market Size and Forecast, by Application(2023-2030) 6.5.2.4. France Composite AI Market Size and Forecast, by Industry Vertical (2023-2030) 6.5.3. Germany 6.5.3.1. Germany Composite AI Market Size and Forecast, by Offering (2023-2030) 6.5.3.2. Germany Composite AI Market Size and Forecast, by Technique (2023-2030) 6.5.3.3. Germany Composite AI Market Size and Forecast, by Application(2023-2030) 6.5.3.4. Germany Composite AI Market Size and Forecast, by Industry Vertical (2023-2030) 6.5.4. Italy 6.5.4.1. Italy Composite AI Market Size and Forecast, by Offering (2023-2030) 6.5.4.2. Italy Composite AI Market Size and Forecast, by Technique (2023-2030) 6.5.4.3. Italy Composite AI Market Size and Forecast, by Application(2023-2030) 6.5.4.4. Italy Composite AI Market Size and Forecast, by Industry Vertical (2023-2030) 6.5.5. Spain 6.5.5.1. Spain Composite AI Market Size and Forecast, by Offering (2023-2030) 6.5.5.2. Spain Composite AI Market Size and Forecast, by Technique (2023-2030) 6.5.5.3. Spain Composite AI Market Size and Forecast, by Application(2023-2030) 6.5.5.4. Spain Composite AI Market Size and Forecast, by Industry Vertical (2023-2030) 6.5.6. Sweden 6.5.6.1. Sweden Composite AI Market Size and Forecast, by Offering (2023-2030) 6.5.6.2. Sweden Composite AI Market Size and Forecast, by Technique (2023-2030) 6.5.6.3. Sweden Composite AI Market Size and Forecast, by Application(2023-2030) 6.5.6.4. Sweden Composite AI Market Size and Forecast, by Industry Vertical (2023-2030) 6.5.7. Austria 6.5.7.1. Austria Composite AI Market Size and Forecast, by Offering (2023-2030) 6.5.7.2. Austria Composite AI Market Size and Forecast, by Technique (2023-2030) 6.5.7.3. Austria Composite AI Market Size and Forecast, by Application(2023-2030) 6.5.7.4. Austria Composite AI Market Size and Forecast, by Industry Vertical (2023-2030) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Composite AI Market Size and Forecast, by Offering (2023-2030) 6.5.8.2. Rest of Europe Composite AI Market Size and Forecast, by Technique (2023-2030) 6.5.8.3. Rest of Europe Composite AI Market Size and Forecast, by Application(2023-2030) 6.5.8.4. Rest of Europe Composite AI Market Size and Forecast, by Industry Vertical (2023-2030) 7. Asia Pacific Composite AI Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Composite AI Market Size and Forecast, by Offering (2023-2030) 7.2. Asia Pacific Composite AI Market Size and Forecast, by Technique (2023-2030) 7.3. Asia Pacific Composite AI Market Size and Forecast, by Application(2023-2030) 7.4. Asia Pacific Composite AI Market Size and Forecast, by Industry Vertical (2023-2030) 7.5. Asia Pacific Composite AI Market Size and Forecast, by Country (2023-2030) 7.5.1. China 7.5.1.1. China Composite AI Market Size and Forecast, by Offering (2023-2030) 7.5.1.2. China Composite AI Market Size and Forecast, by Technique (2023-2030) 7.5.1.3. China Composite AI Market Size and Forecast, by Application(2023-2030) 7.5.1.4. China Composite AI Market Size and Forecast, by Offering (2023-2030) 7.5.1.5. China Composite AI Market Size and Forecast, by Technique (2023-2030) 7.5.1.6. China Composite AI Market Size and Forecast, by Application(2023-2030) 7.5.2. S Korea 7.5.2.1. S Korea Composite AI Market Size and Forecast, by Industry Vertical (2023-2030) 7.5.3. Japan 7.5.3.1. Japan Composite AI Market Size and Forecast, by Offering (2023-2030) 7.5.3.2. Japan Composite AI Market Size and Forecast, by Technique (2023-2030) 7.5.3.3. Japan Composite AI Market Size and Forecast, by Application(2023-2030) 7.5.3.4. Japan Composite AI Market Size and Forecast, by Industry Vertical (2023-2030) 7.5.4. India 7.5.4.1. India Composite AI Market Size and Forecast, by Offering (2023-2030) 7.5.4.2. India Composite AI Market Size and Forecast, by Technique (2023-2030) 7.5.4.3. India Composite AI Market Size and Forecast, by Application(2023-2030) 7.5.4.4. India Composite AI Market Size and Forecast, by Industry Vertical (2023-2030) 7.5.5. Australia 7.5.5.1. Australia Composite AI Market Size and Forecast, by Offering (2023-2030) 7.5.5.2. Australia Composite AI Market Size and Forecast, by Technique (2023-2030) 7.5.5.3. Australia Composite AI Market Size and Forecast, by Application(2023-2030) 7.5.5.4. Australia Composite AI Market Size and Forecast, by Industry Vertical (2023-2030) 7.5.6. Indonesia 7.5.6.1. Indonesia Composite AI Market Size and Forecast, by Offering (2023-2030) 7.5.6.2. Indonesia Composite AI Market Size and Forecast, by Technique (2023-2030) 7.5.6.3. Indonesia Composite AI Market Size and Forecast, by Application(2023-2030) 7.5.6.4. Indonesia Composite AI Market Size and Forecast, by Industry Vertical (2023-2030) 7.5.7. Malaysia 7.5.7.1. Malaysia Composite AI Market Size and Forecast, by Offering (2023-2030) 7.5.7.2. Malaysia Composite AI Market Size and Forecast, by Technique (2023-2030) 7.5.7.3. Malaysia Composite AI Market Size and Forecast, by Application(2023-2030) 7.5.7.4. Malaysia Composite AI Market Size and Forecast, by Industry Vertical (2023-2030) 7.5.8. Vietnam 7.5.8.1. Vietnam Composite AI Market Size and Forecast, by Offering (2023-2030) 7.5.8.2. Vietnam Composite AI Market Size and Forecast, by Technique (2023-2030) 7.5.8.3. Vietnam Composite AI Market Size and Forecast, by Application(2023-2030) 7.5.8.4. Vietnam Composite AI Market Size and Forecast, by Industry Vertical (2023-2030) 7.5.9. Taiwan 7.5.9.1. Taiwan Composite AI Market Size and Forecast, by Offering (2023-2030) 7.5.9.2. Taiwan Composite AI Market Size and Forecast, by Technique (2023-2030) 7.5.9.3. Taiwan Composite AI Market Size and Forecast, by Application(2023-2030) 7.5.9.4. Taiwan Composite AI Market Size and Forecast, by Industry Vertical (2023-2030) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Composite AI Market Size and Forecast, by Offering (2023-2030) 7.5.10.2. Rest of Asia Pacific Composite AI Market Size and Forecast, by Technique (2023-2030) 7.5.10.3. Rest of Asia Pacific Composite AI Market Size and Forecast, by Application(2023-2030) 7.5.10.4. Rest of Asia Pacific Composite AI Market Size and Forecast, by Industry Vertical (2023-2030) 8. Middle East and Africa Composite AI Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 8.1. Middle East and Africa Composite AI Market Size and Forecast, by Offering (2023-2030) 8.2. Middle East and Africa Composite AI Market Size and Forecast, by Technique (2023-2030) 8.3. Middle East and Africa Composite AI Market Size and Forecast, by Application(2023-2030) 8.4. Middle East and Africa Composite AI Market Size and Forecast, by Industry Vertical (2023-2030) 8.5. Middle East and Africa Composite AI Market Size and Forecast, by Country (2023-2030) 8.5.1. South Africa 8.5.1.1. South Africa Composite AI Market Size and Forecast, by Offering (2023-2030) 8.5.1.2. South Africa Composite AI Market Size and Forecast, by Technique (2023-2030) 8.5.1.3. South Africa Composite AI Market Size and Forecast, by Application(2023-2030) 8.5.1.4. South Africa Composite AI Market Size and Forecast, by Industry Vertical (2023-2030) 8.5.2. GCC 8.5.2.1. GCC Composite AI Market Size and Forecast, by Offering (2023-2030) 8.5.2.2. GCC Composite AI Market Size and Forecast, by Technique (2023-2030) 8.5.2.3. GCC Composite AI Market Size and Forecast, by Application(2023-2030) 8.5.2.4. GCC Composite AI Market Size and Forecast, by Industry Vertical (2023-2030) 8.5.3. Nigeria 8.5.3.1. Nigeria Composite AI Market Size and Forecast, by Offering (2023-2030) 8.5.3.2. Nigeria Composite AI Market Size and Forecast, by Technique (2023-2030) 8.5.3.3. Nigeria Composite AI Market Size and Forecast, by Application(2023-2030) 8.5.3.4. Nigeria Composite AI Market Size and Forecast, by Industry Vertical (2023-2030) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Composite AI Market Size and Forecast, by Offering (2023-2030) 8.5.4.2. Rest of ME&A Composite AI Market Size and Forecast, by Technique (2023-2030) 8.5.4.3. Rest of ME&A Composite AI Market Size and Forecast, by Application (2023-2030) 8.5.4.4. Rest of ME&A Composite AI Market Size and Forecast, by Industry Vertical (2023-2030) 9. South America Composite AI Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030 9.1. South America Composite AI Market Size and Forecast, by Offering (2023-2030) 9.2. South America Composite AI Market Size and Forecast, by Technique (2023-2030) 9.3. South America Composite AI Market Size and Forecast, by Application(2023-2030) 9.4. South America Composite AI Market Size and Forecast, by Industry Vertical (2023-2030) 9.5. South America Composite AI Market Size and Forecast, by Country (2023-2030) 9.5.1. Brazil 9.5.1.1. Brazil Composite AI Market Size and Forecast, by Offering (2023-2030) 9.5.1.2. Brazil Composite AI Market Size and Forecast, by Technique (2023-2030) 9.5.1.3. Brazil Composite AI Market Size and Forecast, by Application(2023-2030) 9.5.1.4. Brazil Composite AI Market Size and Forecast, by Industry Vertical (2023-2030) 9.5.2. Argentina 9.5.2.1. Argentina Composite AI Market Size and Forecast, by Offering (2023-2030) 9.5.2.2. Argentina Composite AI Market Size and Forecast, by Technique (2023-2030) 9.5.2.3. Argentina Composite AI Market Size and Forecast, by Application(2023-2030) 9.5.3. Argentina 9.5.3.1. Argentina Composite AI Market Size and Forecast, by Industry Vertical (2023-2030) 9.5.4. Rest Of South America 9.5.4.1. Rest Of South America Composite AI Market Size and Forecast, by Offering (2023-2030) 9.5.4.2. Rest Of South America Composite AI Market Size and Forecast, by Technique (2023-2030) 9.5.4.3. Rest Of South America Composite AI Market Size and Forecast, by Application(2023-2030) 9.5.4.4. Rest Of South America Composite AI Market Size and Forecast, by Industry Vertical (2023-2030) 10. Global Composite AI Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Market Segment 10.3.3. Industry Vertical Segment 10.3.4. Revenue (2022) 10.3.5. Company Locations 10.4. Leading Composite AI Market Companies, by market capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. OpenAI 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (small, medium, and large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. Google DeepMind 11.3. IBM 11.4. Microsoft 11.5. Facebook AI Research (FAIR) 11.6. Amazon AI 11.7. NVIDIA 11.8. Intel AI 11.9. Salesforce Einstein 11.10. C3.ai 11.11. UiPath 11.12. Palantir Technologies 11.13. SAS Institute 11.14. Blackswan Technologies 11.15. Oracle 11.16. Opentext 11.17. Zest AI 11.18. Datarobot 12. Key Findings 13. Industry Recommendations 14. Research Methodology