The Companion Animal Diagnostics Market size was valued at USD 2.8 Billion in 2023 and the total Companion Animal Diagnostics Market revenue is expected to grow at a CAGR of 9.6 % from 2024 to 2030, reaching nearly USD 5.32 Billion. Companion Animal Diagnostics involves the application of diagnostic tests and technologies to assess the health and well-being of companion animals, primarily focusing on pets such as dogs and cats. These diagnostics play a crucial role in detecting, monitoring, and managing various diseases and conditions in animals, contributing to their overall healthcare. The Companion Animal Diagnostics Market is a dynamic sector driven by the increasing pet population, growing awareness about animal health, and advancements in diagnostic technologies. This market's current scenario is characterized by a growing demand for advanced diagnostic solutions, emphasizing the need for accurate and timely assessments of companion animals' health. The rise in pet ownership, coupled with a shift in consumer preferences toward preventive healthcare for pets, fuels the demand for diagnostic services. The increasing prevalence of diseases in companion animals and the expanding scope of veterinary services further propel market growth. The incorporation of cutting-edge technologies, such as artificial intelligence (AI) and molecular diagnostics, enhances diagnostic accuracy and efficiency, fostering Companion Animal Diagnostics industry growth.To know about the Research Methodology :- Request Free Sample Report Key growth factors in this Companion Animal Diagnostics Market include the adoption of point-of-care diagnostics, and facilitating in-clinic analysis for timely decision-making by veterinarians. Industry trends reflect a shift towards comprehensive diagnostics, with a particular focus on areas like immunodiagnostics, clinical biochemistry, hematology, urinalysis, and molecular diagnostics. These trends underscore the market's commitment to providing holistic healthcare solutions for companion animals. As technology evolves, there is room for innovation and the development of more advanced diagnostic tools, expanding the Companion Animal Diagnostics Market potential. The trend towards personalized medicine for pets creates avenues for tailored diagnostic solutions, catering to individual animal health needs. Furthermore, the integration of telemedicine and mobile diagnostic services, as seen with companies like PepiPets launching mobile testing services, opens new frontiers for convenient and accessible veterinary care. Recent developments in the Companion Animal Diagnostics Market highlights the progressive nature of companion animal diagnostics. Zoetis, a key player in the industry, announced the expansion of its Vetscan Imagyst Platform to include AI Urine Sediment analysis. This represents a significant leap in diagnostic capabilities, streamlining workflows and enabling veterinarians to make timely and accurate treatment decisions for pets. Such advancements underscore the industry's commitment to leveraging cutting-edge technologies for the benefit of companion animals.

Market Dynamics:

Technological Innovation Drives Companion Animal Diagnostics Market Growth: Continuous technological progress in Companion Animal Diagnostics Market, such as advanced imaging and molecular testing, drives market growth. For instance, companies like IDEXX Laboratories leverage cutting-edge technology to offer diagnostic solutions, contributing to improved pet healthcare globally. The rising trend of pet ownership, evidenced by the approximately 123,000 Veterinary Technicians in 28,000 U.S. clinics, fuels demand for companion animal diagnostics. As more people welcome pets into their homes, the need for accurate and timely diagnostics intensifies, propelling Companion Animal Diagnostics Market growth. The American Animal Hospital Association (AAHA)'s forward-looking approach, including the inclusion of a credentialed Veterinary Technician on its Board, showcases industry leadership. Such initiatives promote excellence, fostering a robust companion animal diagnostics industry by setting high standards and encouraging innovation. Growing emphasis on preventative healthcare practices for pets underscores the importance of diagnostic tools. Mars Petcare's MARS PETCARE BIOBANKTM, a 10-year study uniting clinical, genetic, and lifestyle data from 20,000 pets, exemplifies a preventive approach. This initiative aims to revolutionize pet health, driving the need for companion animal diagnostics. Collaborations between industry players and academic institutions, like the Louisiana Animal Disease Diagnostic Lab's partnership with LSU, enhance research and diagnostic capabilities. Such collaborations bring forth innovative solutions and contribute to the overall growth of the companion animal diagnostics market. The voluntary adherence of clinics to AAHA's accreditation standards demonstrates a commitment to quality care. This commitment, exemplified by the rigorous accreditation process, fosters market growth by ensuring a standardized and elevated level of companion animal diagnostics across accredited clinics. The global growth of companies like IDEXX Laboratories, serving veterinary professionals and pet owners worldwide, contributes to market growth. Companies like PepiPets, offering mobile diagnostic testing services, cater to the convenience and awareness of pet owners, contributing to the market's upward trajectory. The growing expenditure on veterinary healthcare, reflected in the GBP 50.5 million acquisition of Bova Holdings Limited by Vimian Group, demonstrates the industry's financial commitment. This investment supports the development and accessibility of advanced companion animal diagnostics. Mars Incorporated's strategic acquisition of Heska Corporation for $120.00 per share illustrates market consolidation. Such acquisitions enable companies to broaden access to diagnostics and technology, fostering innovation and contributing to the overall growth of the companion animal diagnostics market.AI-powered urinalysis a Comprehensive Solution for Companion Animal Health: The integration of artificial intelligence (AI) into diagnostic platforms, as exemplified by Zoetis' Vetscan Imagyst, marks a transformative opportunity for companion animal diagnostics market. Vetscan Imagyst is the first AI-driven technology offering five applications on a single platform, including AI urine sediment analysis. This not only streamlines diagnostic workflows but also facilitates timely and accurate treatment decisions for pets. The growth of diagnostic capabilities to point-of-care settings, as demonstrated by Vetscan Imagyst, provides a unique growth avenue. Point-of-care diagnostics enable veterinarians to perform in-clinic sediment analysis of fresh urine, reducing the time it takes to read results. This approach aligns with the need for rapid diagnostics, contributing to better patient outcomes. The application of AI in urine sediment analysis, covering elements such as red and white blood cells, epithelial cells, casts, crystals, and bacteria, represents an opportunity for comprehensive urinalysis solutions. Vetscan Imaging's validated sample preparation method ensures consistent and thorough results, addressing challenges related to traditional urine sediment examinations. Advanced diagnostic platforms, like Vetscan Imagyst, not only aid in diagnosis but also contribute to improved veterinary compliance. The emergence of AI-driven technologies facilitates rapid diagnostics, crucial for timely and accurate treatment decisions. Vetscan Imagyst's deep learning AI expedites the visualization and identification of urine sediment elements within minutes, enhancing the veterinary care team's ability to perform vital screenings promptly. Continuous technological progress in companion animal diagnostics, particularly the incorporation of AI, opens up avenues for improved diagnostic accuracy, streamlined workflows, and enhanced patient care. The companion animal diagnostics market growth opportunities align with the industry's commitment to leveraging cutting-edge technology for the well-being of companion animals.

Companion Animal Diagnostics Market Segment Analysis:

Based on Technology, The Companion Animal Diagnostics Market is characterized by a diverse range of technologies, each playing a crucial role in diagnostic capabilities for companion animals. Among these, immunodiagnostics, leveraging immunological principles and techniques, stands out as the dominant segment, with companies like BioVenic leading advancements in veterinary immunodiagnostics. This segment is expected to continue its dominance, fueled by ongoing innovation and a commitment to cutting-edge laboratory services. Clinical Biochemistry, Hematology, and Urinalysis constitute fundamental pillars in the diagnostic framework, each contributing significantly to comprehensive health screenings. The recent development of Zoetis' Vetscan Imagyst Platform with AI Urine Sediment Analysis exemplifies the continuous advancements in Urinalysis, addressing challenges highlighted by industry guidelines. Molecular Diagnostics emerges as a transformative force, contributing to comprehensive diagnostic solutions, and its integration into platforms like Zoetis signifies a shift toward efficient and rapid diagnostic procedures. The dominance of Immunodiagnostics, coupled with the growing influence of Molecular Diagnostics, underscores the industry's commitment to leveraging cutting-edge technologies, ensuring the well-being of companion animals through accurate and timely diagnostics. Based on Animals, The Companion Animal Diagnostics Market exhibits a diverse segment analysis based on the type of animals involved, primarily focusing on dogs, cats, and horses. Dogs represent a dominant segment in the market in 2023 and are expected to grow during the forecast period, driven by the high prevalence of cancer in approximately 1 in 4 dogs, and nearly 50% of dogs over the age of 10 develop cancer. This underscores the significance of diagnostic services for canine health. Cats also play a substantial role in the market. Around 95% of pet owners consider their cats part of the family, emphasizing the need for comprehensive diagnostics for feline health. The dominance of the cat segment is reinforced by the strong bond between pet owners and their feline companions, creating a demand for advanced diagnostic solutions. The collective companion animal diagnostics market dominance of these segments aligns with the prevalence of specific diseases and the emphasis on preventative care. The dominance of the dog and cat segments is expected to persist, driven by the increasing awareness of preventative care and the integral role of pets in families.

Companion Animal Diagnostics Market Regional Insights:

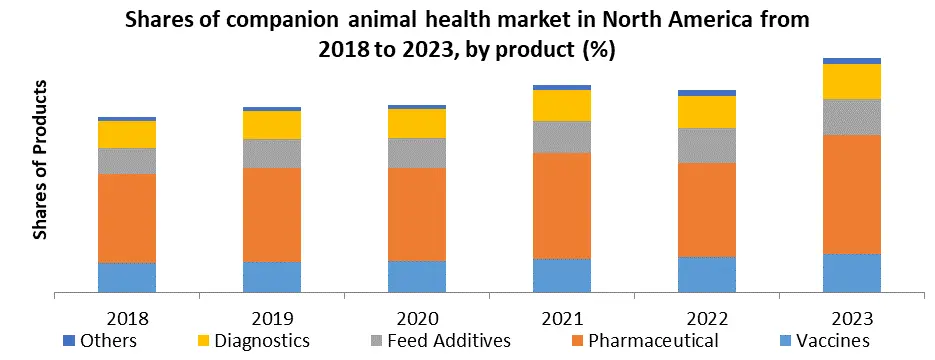

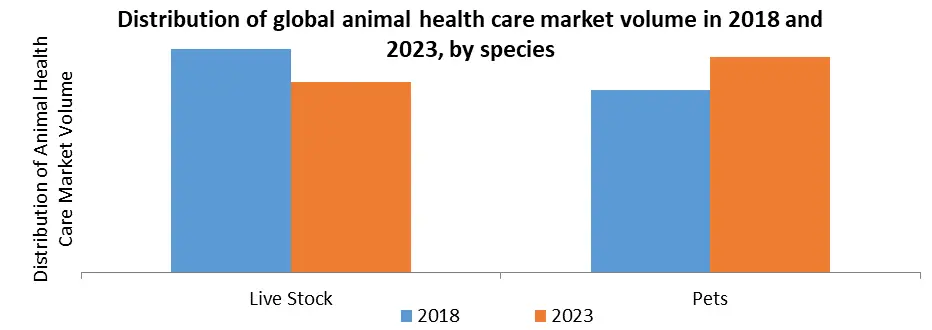

The Companion Animal Diagnostics Market exhibits dynamic regional insights, with North America currently dominating the market and Asia-Pacific poised for significant growth. North America, particularly the United States, holds a prominent position in the market, driven by a robust companion animal culture, high pet ownership rates, and a proactive approach to veterinary care. For instance, the Veterinary Cancer Society estimates that 1 in 4 dogs will develop cancer, emphasizing the need for advanced diagnostics in this region. Moreover, 95% of pet owners in North America strongly agree that their pets are part of their family, underscoring the importance of comprehensive diagnostics. Asia-Pacific presents a compelling growth landscape. The rising middle-class population, urbanization, and increasing awareness of pet health in countries like China and India contribute to the region's potential. The companion animal diagnostics market is witnessing a paradigm shift, as exemplified by the growing adoption of preventative care practices in the Asia-Pacific region. Around 50% of dogs have preventative care visits each year, which aligns with the increasing focus on proactive veterinary care in these emerging markets. The region is expected to witness substantial growth in companion animal diagnostics due to a burgeoning pet population and a shift towards a more responsible and informed approach to pet healthcare. Europe, while currently a significant market player, faces saturation in some mature markets, leading to a steady yet moderate growth trajectory. The region's dominance is characterized by a well-established veterinary infrastructure and high pet ownership rates. The trends in Europe are indicative of a mature market, where routine diagnostics play a crucial role. Europe, while maintaining a significant companion animal diagnostics market share, is expected to experience more moderate growth due to market saturation in certain segments and regions. Competitive Landscape The advancements in the pet care industry, marked by PepiPets' at-home diagnostic testing, Zoetis' acquisition of NewMetrica's innovative HRQL instruments, Mars Petcare's groundbreaking MARS PETCARE BIOBANKTM initiative, Vimian Group's strategic acquisition of Bova Holdings, and Mars Incorporated's successful acquisition of Heska, collectively signify a transformative era in veterinary health. These developments drive market growth by introducing convenient, technology-driven solutions, revolutionizing diagnostics, and fostering a deeper understanding of pet health. With streamlined processes, early disease detection, and innovative research, these initiatives not only enhance pet well-being but also position the industry for significant growth and improved care standards, aligning with the growing demand for advanced veterinary solutions globally. On April 3, 2023, Mars Incorporated successfully acquired Heska Corporation, a global leader in advanced veterinary diagnostic and specialty products. The deal, priced at $120.00 per share, reflects a 38% premium over Heska's 60-calendar day average and a 23% premium over its closing stock price on March 31, 2023. The agreement, unanimously approved by both companies' boards, positions Heska under Mars Petcare, fostering innovation in veterinary health and diagnostics. This strategic move aims to enhance access to diagnostics, accelerate research and development, and broaden technological advancements, ultimately benefitting veterinary professionals and pets worldwide. On June 8, 2022, Mars Petcare introduced a groundbreaking initiative, the MARS PETCARE BIOBANKTM. This 10-year endeavor aims to revolutionize pet health by uniting clinical, genetic, and lifestyle data from 20,000 cats and dogs across the United States. The biobank, a first of its kind, seeks to enhance disease diagnosis and prevention. By enrolling their pets, owners contribute to a comprehensive study generating longitudinal physiological data, shedding light on aging and disease development. Mars Petcare's commitment to innovation and science drives this initiative, aligning with its purpose to create a better world for pets through cutting-edge research.Companion Animal Diagnostics Market Scope: Inquiry Before Buying

Global Companion Animal Diagnostics Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 2.8 Bn. Forecast Period 2024 to 2030 CAGR: 9.6% Market Size in 2030: US $ 5.32 Bn. Segments Covered: by Technology Immunodiagnostics Clinical Biochemistry Hematology Urinalysis Molecular Diagnostics Other Companion Animal Diagnostics Technologies by Application Clinical Pathology Bacteriology Virology Parasitology Other Applications by Animal Dog Cat Horse Other Companion Animals by End-User Diagnostics Laboratories Veterinary Clinics and Hospitals Research Institute and Universities Home-care Settings Companion Animal Diagnostics Market Key Players:

North America: 1. Abaxis Corporation (California, USA) 2. Idexx Laboratories, Inc. (Maine, USA) 3. Zoetis, Inc. (New Jersey, USA) 4. Heska Corporation (Colorado, USA) 5. Thermo Fisher Scientific, Inc. (Massachusetts, USA) Europe: 6. Biomerieux SA (France) 7. Creative Diagnostics (New York, USA) 8. Agrolabo Spa (Italy). 9. Virbac (Carros, France) 10. Indical Bioscience GmbH (Leipzig, Germany) 11. Idvet (Grabels, France) 12. Randox Laboratories Ltd. (Northern Ireland, UK) Asia Pacific: 13. Fujifilm Holdings Corporation (Tokyo, Japan) 14. Shenzhen Mindray Animal Medical Technology Co., Ltd. (Shenzhen, China) 15. BioNote, Inc (Hawseong, South Korea) FAQs: 1. What are the growth drivers for the Companion Animal Diagnostics Market? Ans. Technological Innovation Drives Companion Animal Diagnostics Market Growth and is expected to be the major driver for the Companion Animal Diagnostics Market. 2. What is the major restraint for the Companion Animal Diagnostics Market growth? Ans AI-powered urinalysis a Comprehensive Solution for Companion Animal Health are expected to be major restraints In the Companion Animal Diagnostics Market. 3. Which country is expected to lead the global Companion Animal Diagnostics Market during the forecast period? Ans. North America is expected to lead the Companion Animal Diagnostics Market during the forecast period. 4. What is the projected market size and growth rate of the Companion Animal Diagnostics Market? Ans. The Companion Animal Diagnostics Market size was valued at USD 2.8 Million in 2023 and the total Companion Animal Diagnostics Market revenue is expected to grow at a CAGR of 9.6% from 2024 to 2030, reaching nearly USD 5.32 Million. 5. What segments are covered in the Companion Animal Diagnostics Market report? Ans. The segments covered in the Companion Animal Diagnostics Market report are by Technology, Application, Animal, End-User and Region.

1. Companion Animal Diagnostics Market: Research Methodology 2. Companion Animal Diagnostics Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Companion Animal Diagnostics Market: Dynamics 3.1 Companion Animal Diagnostics Market Trends by Region 3.1.1 North America Companion Animal Diagnostics Market Trends 3.1.2 Europe Companion Animal Diagnostics Market Trends 3.1.3 Asia Pacific Companion Animal Diagnostics Market Trends 3.1.4 Middle East and Africa Companion Animal Diagnostics Market Trends 3.1.5 South America Companion Animal Diagnostics Market Trends 3.2 Companion Animal Diagnostics Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Companion Animal Diagnostics Market Drivers 3.2.1.2 North America Companion Animal Diagnostics Market Restraints 3.2.1.3 North America Companion Animal Diagnostics Market Opportunities 3.2.1.4 North America Companion Animal Diagnostics Market Challenges 3.2.2 Europe 3.2.2.1 Europe Companion Animal Diagnostics Market Drivers 3.2.2.2 Europe Companion Animal Diagnostics Market Restraints 3.2.2.3 Europe Companion Animal Diagnostics Market Opportunities 3.2.2.4 Europe Companion Animal Diagnostics Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Companion Animal Diagnostics Market Drivers 3.2.3.2 Asia Pacific Companion Animal Diagnostics Market Restraints 3.2.3.3 Asia Pacific Companion Animal Diagnostics Market Opportunities 3.2.3.4 Asia Pacific Companion Animal Diagnostics Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Companion Animal Diagnostics Market Drivers 3.2.4.2 Middle East and Africa Companion Animal Diagnostics Market Restraints 3.2.4.3 Middle East and Africa Companion Animal Diagnostics Market Opportunities 3.2.4.4 Middle East and Africa Companion Animal Diagnostics Market Challenges 3.2.5 South America 3.2.5.1 South America Companion Animal Diagnostics Market Drivers 3.2.5.2 South America Companion Animal Diagnostics Market Restraints 3.2.5.3 South America Companion Animal Diagnostics Market Opportunities 3.2.5.4 South America Companion Animal Diagnostics Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power of Suppliers 3.3.2 Bargaining Power of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 North America 3.6.2 Europe 3.6.3 Asia Pacific 3.6.4 Middle East and Africa 3.6.5 South America 3.7 Analysis of Government Schemes and Initiatives for the Companion Animal Diagnostics Industry 3.8 The Global Pandemic and Redefining of The Companion Animal Diagnostics Industry Landscape 3.9 Technological Road Map 4. Global Companion Animal Diagnostics Market: Global Market Size and Forecast by Segmentation (Value) (2023-2030) 4.1 Global Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 4.1.1 Immunodiagnostics 4.1.2 Clinical Biochemistry 4.1.3 Hematology 4.1.4 Urinalysis 4.1.5 Molecular Diagnostics 4.1.6 Other Companion Animal Diagnostics Technologies 4.2 Global Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030) 4.2.1 Clinical Pathology 4.2.2 Bacteriology 4.2.3 Virology 4.2.4 Parasitology 4.2.5 Other Applications 4.3 Global Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 4.3.1 Dog 4.3.2 Cat 4.3.3 Horse 4.3.4 Other Companion Animals 4.4 Global Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 4.4.1 Diagnostics Laboratories 4.4.2 Veterinary Clinics and Hospitals 4.4.3 Research Institute and Universities 4.4.4 Home-care Settings 4.5 Global Companion Animal Diagnostics Market Size and Forecast, by Region (2023-2030) 4.5.1 North America 4.5.2 Europe 4.5.3 Asia Pacific 4.5.4 Middle East and Africa 4.5.5 South America 5. North America Companion Animal Diagnostics Market Size and Forecast by Segmentation (Value) (2023-2030) 5.1 North America Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 5.1.1 Immunodiagnostics 5.1.2 Clinical Biochemistry 5.1.3 Hematology 5.1.4 Urinalysis 5.1.5 Molecular Diagnostics 5.1.6 Other Companion Animal Diagnostics Technologies 5.2 North America Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030) 5.2.1 Clinical Pathology 5.2.2 Bacteriology 5.2.3 Virology 5.2.4 Parasitology 5.2.5 Other Applications 5.3 North America Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 5.3.1 Dog 5.3.2 Cat 5.3.3 Horse 5.3.4 Other Companion Animals 5.4 North America Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 5.4.1 Diagnostics Laboratories 5.4.2 Veterinary Clinics and Hospitals 5.4.3 Research Institute and Universities 5.4.4 Home-care Settings 5.5 North America Companion Animal Diagnostics Market Size and Forecast, by Country (2023-2030) 5.5.1 United States 5.5.1.1 United States Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 5.5.1.1.1 Immunodiagnostics 5.5.1.1.2 Clinical Biochemistry 5.5.1.1.3 Hematology 5.5.1.1.4 Urinalysis 5.5.1.1.5 Molecular Diagnostics 5.5.1.1.6 Other Companion Animal Diagnostics Technologies 5.5.1.2 United States Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030) 5.5.1.2.1 Clinical Pathology 5.5.1.2.2 Bacteriology 5.5.1.2.3 Virology 5.5.1.2.4 Parasitology 5.5.1.2.5 Other Applications 5.5.1.3 United States Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 5.5.1.3.1 Dog 5.5.1.3.2 Cat 5.5.1.3.3 Horse 5.5.1.3.4 Other Companion Animals 5.5.1.4 United States Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 5.5.1.4.1 Diagnostics Laboratories 5.5.1.4.2 Veterinary Clinics and Hospitals 5.5.1.4.3 Research Institute and Universities 5.5.1.4.4 Home-care Settings 5.5.2 Canada 5.5.2.1 Canada Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 5.5.2.1.1 Immunodiagnostics 5.5.2.1.2 Clinical Biochemistry 5.5.2.1.3 Hematology 5.5.2.1.4 Urinalysis 5.5.2.1.5 Molecular Diagnostics 5.5.2.1.6 Other Companion Animal Diagnostics Technologies 5.5.2.2 Canada Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030) 5.5.2.2.1 Clinical Pathology 5.5.2.2.2 Bacteriology 5.5.2.2.3 Virology 5.5.2.2.4 Parasitology 5.5.2.2.5 Other Applications 5.5.2.3 Canada Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 5.5.2.3.1 Dog 5.5.2.3.2 Cat 5.5.2.3.3 Horse 5.5.2.3.4 Other Companion Animals 5.5.2.4 Canada Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 5.5.2.4.1 Diagnostics Laboratories 5.5.2.4.2 Veterinary Clinics and Hospitals 5.5.2.4.3 Research Institute and Universities 5.5.2.4.4 Home-care Settings 5.5.3 Mexico 5.5.3.1 Mexico Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 5.5.3.1.1 Immunodiagnostics 5.5.3.1.2 Clinical Biochemistry 5.5.3.1.3 Hematology 5.5.3.1.4 Urinalysis 5.5.3.1.5 Molecular Diagnostics 5.5.3.1.6 Other Companion Animal Diagnostics Technologies 5.5.3.2 Mexico Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030) 5.5.3.2.1 Clinical Pathology 5.5.3.2.2 Bacteriology 5.5.3.2.3 Virology 5.5.3.2.4 Parasitology 5.5.3.2.5 Other Applications 5.5.3.3 Mexico Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 5.5.3.3.1 Dog 5.5.3.3.2 Cat 5.5.3.3.3 Horse 5.5.3.3.4 Other Companion Animals 5.5.3.4 Mexico Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 5.5.3.4.1 Diagnostics Laboratories 5.5.3.4.2 Veterinary Clinics and Hospitals 5.5.3.4.3 Research Institute and Universities 5.5.3.4.4 Home-care Settings 6. Europe Companion Animal Diagnostics Market Size and Forecast by Segmentation (Value) (2023-2030) 6.1 Europe Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 6.2 Europe Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030) 6.3 Europe Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 6.4 Europe Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 6.5 Europe Companion Animal Diagnostics Market Size and Forecast, by Country (2023-2030) 6.5.1 United Kingdom 6.5.1.1 United Kingdom Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 6.5.1.2 United Kingdom Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030) 6.5.1.3 United Kingdom Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 6.5.1.4 United Kingdom Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 6.5.2 France 6.5.2.1 France Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 6.5.2.2 France Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030) 6.5.2.3 France Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 6.5.2.4 France Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 6.5.3 Germany 6.5.3.1 Germany Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 6.5.3.2 Germany Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030) 6.5.3.3 Germany Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 6.5.3.4 Germany Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 6.5.4 Italy 6.5.4.1 Italy Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 6.5.4.2 Italy Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030) 6.5.4.3 Italy Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 6.5.4.4 Italy Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 6.5.5 Spain 6.5.5.1 Spain Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 6.5.5.2 Spain Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030) 6.5.5.3 Spain Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 6.5.5.4 Spain Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 6.5.6 Sweden 6.5.6.1 Sweden Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 6.5.6.2 Sweden Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030) 6.5.6.3 Sweden Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 6.5.6.4 Sweden Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 6.5.7 Austria 6.5.7.1 Austria Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 6.5.7.2 Austria Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030) 6.5.7.3 Austria Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 6.5.7.4 Austria Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 6.5.8 Rest of Europe 6.5.8.1 Rest of Europe Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 6.5.8.2 Rest of Europe Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030). 6.5.8.3 Rest of Europe Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 6.5.8.4 Rest of Europe Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 7. Asia Pacific Companion Animal Diagnostics Market Size and Forecast by Segmentation (Value) (2023-2030) 7.1 Asia Pacific Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 7.2 Asia Pacific Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030) 7.3 Asia Pacific Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 7.4 Asia Pacific Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 7.5 Asia Pacific Companion Animal Diagnostics Market Size and Forecast, by Country (2023-2030) 7.5.1 China 7.5.1.1 China Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 7.5.1.2 China Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030) 7.5.1.3 China Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 7.5.1.4 China Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 7.5.2 South Korea 7.5.2.1 S Korea Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 7.5.2.2 S Korea Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030) 7.5.2.3 S Korea Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 7.5.2.4 S Korea Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 7.5.3 Japan 7.5.3.1 Japan Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 7.5.3.2 Japan Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030) 7.5.3.3 Japan Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 7.5.3.4 Japan Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 7.5.4 India 7.5.4.1 India Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 7.5.4.2 India Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030) 7.5.4.3 India Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 7.5.4.4 India Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 7.5.5 Australia 7.5.5.1 Australia Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 7.5.5.2 Australia Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030) 7.5.5.3 Australia Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 7.5.5.4 Australia Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 7.5.6 Indonesia 7.5.6.1 Indonesia Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 7.5.6.2 Indonesia Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030) 7.5.6.3 Indonesia Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 7.5.6.4 Indonesia Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 7.5.7 Malaysia 7.5.7.1 Malaysia Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 7.5.7.2 Malaysia Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030) 7.5.7.3 Malaysia Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 7.5.7.4 Malaysia Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 7.5.8 Vietnam 7.5.8.1 Vietnam Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 7.5.8.2 Vietnam Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030) 7.5.8.3 Vietnam Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 7.5.8.4 Vietnam Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 7.5.9 Taiwan 7.5.9.1 Taiwan Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 7.5.9.2 Taiwan Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030) 7.5.9.3 Taiwan Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 7.5.9.4 Taiwan Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 7.5.10 Bangladesh 7.5.10.1 Bangladesh Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 7.5.10.2 Bangladesh Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030) 7.5.10.3 Bangladesh Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 7.5.10.4 Bangladesh Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 7.5.11 Pakistan 7.5.11.1 Pakistan Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 7.5.11.2 Pakistan Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030) 7.5.11.3 Pakistan Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 7.5.11.4 Pakistan Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 7.5.12 Rest of Asia Pacific 7.5.12.1 Rest of Asia Pacific Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 7.5.12.2 Rest of Asia Pacific Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030) 7.5.12.3 Rest of Asia Pacific Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 7.5.12.4 Rest of Asia Pacific Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 8. Middle East and Africa Companion Animal Diagnostics Market Size and Forecast by Segmentation (Value) (2023-2030) 8.1 Middle East and Africa Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 8.2 Middle East and Africa Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030) 8.3 Middle East and Africa Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 8.4 Middle East and Africa Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 8.5 Middle East and Africa Companion Animal Diagnostics Market Size and Forecast, by Country (2023-2030) 8.5.1 South Africa 8.5.1.1 South Africa Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 8.5.1.2 South Africa Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030) 8.5.1.3 South Africa Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 8.5.1.4 South Africa Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 8.5.2 GCC 8.5.2.1 GCC Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 8.5.2.2 GCC Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030) 8.5.2.3 GCC Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 8.5.2.4 GCC Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 8.5.3 Egypt 8.5.3.1 Egypt Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 8.5.3.2 Egypt Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030) 8.5.3.3 Egypt Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 8.5.3.4 Egypt Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 8.5.4 Nigeria 8.5.4.1 Nigeria Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 8.5.4.2 Nigeria Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030) 8.5.4.3 Nigeria Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 8.5.4.4 Nigeria Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 8.5.5 Rest of ME&A 8.5.5.1 Rest of ME&A Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 8.5.5.2 Rest of ME&A Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030) 8.5.5.3 Rest of ME&A Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 8.5.5.4 Rest of ME&A Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 9. South America Companion Animal Diagnostics Market Size and Forecast by Segmentation (Value) (2023-2030) 9.1 South America Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 9.2 South America Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030) 9.3 South America Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 9.4 South America Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 9.5 South America Companion Animal Diagnostics Market Size and Forecast, by Country (2023-2030) 9.5.1 Brazil 9.5.1.1 Brazil Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 9.5.1.2 Brazil Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030) 9.5.1.3 Brazil Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 9.5.1.4 Brazil Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 9.5.2 Argentina 9.5.2.1 Argentina Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 9.5.2.2 Argentina Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030) 9.5.2.3 Argentina Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 9.5.2.4 Argentina Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 9.5.3 Rest Of South America 9.5.3.1 Rest Of South America Companion Animal Diagnostics Market Size and Forecast, By Technology (2023-2030) 9.5.3.2 Rest Of South America Companion Animal Diagnostics Market Size and Forecast, By Application (2023-2030) 9.5.3.3 Rest Of South America Companion Animal Diagnostics Market Size and Forecast, By Animal (2023-2030) 9.5.3.4 Rest Of South America Companion Animal Diagnostics Market Size and Forecast, By End-User (2023-2030) 10. Global Companion Animal Diagnostics Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Product Segment 10.3.3 End-user Segment 10.3.4 Revenue (2023) 10.3.5 Manufacturing Locations 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Leading Companion Animal Diagnostics Global Companies, by market capitalization 10.6 Market Structure 10.6.1 Market Leaders 10.6.2 Market Followers 10.6.3 Emerging Players 10.7 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Biomerieux SA,(US) 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2 HyTest Ltd,(Finland) 11.3 Triviumvet, (Ireland) 11.4 Creative Diagnostics 11.5 agrolabo spa, 11.6 BioNote Inc, 11.7 Abaxis Corporation 11.8 Idexx Laboratories, INC. (US), 11.9 Zoetis, INC. (US), 11.10 Heska Corporation (US), 11.11 Thermo Fisher Scientific, INC. (US), 11.12 Biomérieux SA (France), 11.13 Virbac (France), 11.14 Neogen Corporation (US), 11.15 Fujifilm Holdings Corporation (Japan), 11.16 Indical Bioscience GmbH (Germany), 11.17 Idvet (France), 11.18 Randox Laboratories, LTD. (UK), 11.19 Shenzhen Mindray Animal Medical Technology Co., Ltd. (China), 11.20 BioNote, Inc (South Korea). 12. Key Findings 13. Industry Recommendations