Communication Intelligence Market was valued at USD 8.22 Billion in 2023, and it is expected to reach USD 12.95 Billion by 2030, exhibiting a CAGR of 6.70 % during the forecast period.Communication Intelligence Market Overview and Dynamics:

Communication intelligence i.e., COMINT is unique among intelligence collection assets for its capability to expose the intercepted source's activity, intent and posture. The growing density, diversity, and complexity of communications calls for highly automated interruption and misuse facilitate early detect & locate potential threats. Communication intelligence systems are strategic intelligence collection capabilities for national intelligence or joint users, able to satisfy border surveillance, homeland defence, and national security requirements to address immediate and prospective threats.To know about the Research Methodology :- Request Free Sample Report Communication Intelligence Market dynamics are thoroughly studied and explained in the MMR report, which helps reader to understand emerging market trends, drivers, restraints, opportunities, and challenges at global and regional level for the communication intelligence market. Some of the drivers and restraints are illustrate below, their detailed explanation is discussed in the MMR report with other supporting: Drivers: Security has emerged as a top priority for many countries throughout the world owing to the increasing threat to national and international security posed by unauthorised cross-border operations. Generally, a nation's security agencies rely on communication surveillance and intelligence technologies to protect its citizens and organisations. The demand for technology that give law enforcement and defence organisations crucial information about unlawful operations has increased exponentially in recent years. For military operations to be successful, the data obtained utilising intelligence technologies has become essential. One of the intelligence technologies that is heavily utilised in operations aimed at ensuring both national and international security is communication intelligence (COMINT). As a result, in the upcoming years, it is anticipated that the need for and adoption of advanced security technologies, particularly in the defence and aerospace industries, will accelerate the expansion of the communication intelligence market globally. Government organizations and defence sectors have been harnessing the benefits of COMINT technology since many years. A wide range of fields, including radio frequency (RF), maritime domain awareness, jamming, spectrum mapping, eavesdropping, and cyber-security have all made extensive use of COMINT technologies in recent years. The use of COMINT technologies by several companies for improved security and protection is fuelling the expansion of the communication intelligence (COMINT) market. For instance, in January 2019, Energean plc, a company engaged in the production and exploration of hydrocarbons, awarded a $15 million contract to Elbit Systems Ltd. to deliver advanced COMINT solutions for the offloading platform of the Karish-Tanin gas fields. The use of COMINT by several businesses will probably increase demand for COMINT technology in the upcoming years. The global communication intelligence (COMINT) market is anticipated to have excellent growth and reach $12,930.3 million between 2023 and 2029, as per the research study. The security and secrecy of military communications are the main requirements of the defence sector. Thanks to the increasing amount of IP-based data, including situational awareness video and remote sensor data exchanged through industry-standard interfaces, advanced data network security is necessary. Additionally, given that cyber resources on the ground, in the air, and in space are vulnerable to a range of threats, safeguarding military satellites against cyberattacks has become increasingly crucial. Security flaws in military communication data and network infrastructure could endanger public safety given their significance. To stop this, the defence sector is deploying secure military communications systems. In the anticipated time frame, these elements are anticipated to enhance the market opportunity for global communication intelligence. Opportunities: The U.S. military is also creating a comprehensive, consistent, and interoperable wireless networking system and control system (JADC2). Every branch of the armed services, including the Army and the Marine Corps, will have access to sensors through this 5G-enabled system, which will connect them into a single network. Additionally, the expansion of the worldwide communication intelligence (COMINT) market is predicted to benefit greatly from the use of cutting-edge technologies like KA-band satellite for communication services. Whether or not the signal counts as a general broadcast and regardless of whether the dispatch can deliver the addresses, the COMINT approach likewise picks up the addresses. When fighting on the front lines, understanding the enemy's goals and utilising communication tools to guide activities are of the utmost importance. When they are on the battlefield, the air platforms are rather silent. As a result, militaries use data linkages and other communication networks to coordinate their operations. Restraints: Interconnection improves a force's capacity to operate effectively and cogently across borders. Military communications connectivity issues are caused by a lack of funding, a shortage of spectrum, rapidly advancing technology, altering the nature of operations, and poor spectrum allocation. Using the same communication technology everywhere is not realistic, despite the fact that it might be a solution. To meet the rising demand for communication services, military communications operations must be scalable. This is achieved through adaptable communication that makes sure the requirements of different operational environments, which alter over time, are met. In the anticipated timeframe, these factors are projected to hinder the growth of the global communication intelligence (COMINT) market share.

Communication Intelligence Market Segment Analysis:

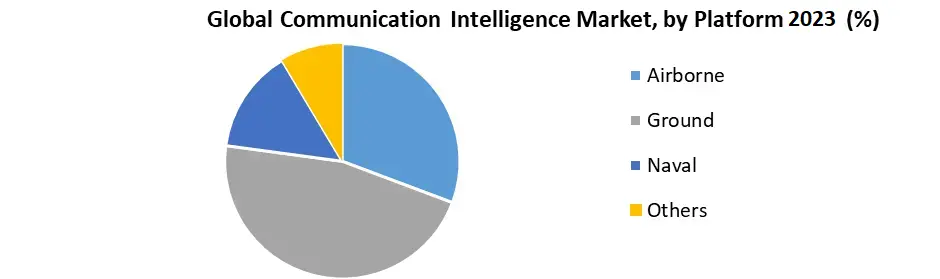

The report will provide an accurate prediction of the contribution of the various segments to the growth of the communication intelligence market size. Fixed Segment is expected to Witness Significant Growth during 2023-2029. The increase in the need for effective warning systems for armoured fighting vehicles, ships, and planes to survive in the electromagnetic danger environment of the modern battlefield is having a substantial impact on the global COMINT market. Fixed systems may be advantageous when dealing with large, heavy, and powerful systems and equipment. Over the coming years, there will probably be a rise in the demand for fixed systems at various military stations, training grounds, and other defence facilities. Over the course of the forecast period, it is expected that rising national security investment spending, consistent global communication intelligence (COMINT) market trends, the modernization of the defence industry, and significant advancements in electronic intelligence technology will all contribute to the growing demand for cutting-edge security solutions. The Ground Segment Held the Largest Market Share in 2022: In 2022, ground segment commanded the largest share of the communication intelligence market. Communication intelligence (COMINT) is frequently employed in the defence sector to locate radio installations, follow radio traffic, and intercept adversary radar signals. This dominance is due to the rising use of advanced data networks, VHF/UHF/L-Band, and high-frequency communication platforms. The ground forces use military antennas to create situational awareness for threat identification. The military is fast integrating digital technology into its ground forces due to the unpredictable and volatile nature of combat operations. Thus, situational awareness (SA) establishment and maintenance for ground forces is becoming more challenging. During the analysis period, these factors are predicted to fuel growth in the communication intelligence market.

Communication Intelligence Market Regional Analysis:

North America is projected to lead the global communication intelligence market during 2023-2029. This is mainly owing to the US consistently leading the world in the adoption of new technologies for its defence industry. Additionally, COMINT will eventually profit from the increased funding for science, technology, and military & intelligence in nations like the US and Canada. In addition, the government is promoting the adoption of innovative technologies like SIGINT, which is anticipated to fuel the regional communication intelligence (COMINT) market's growth in the years to come. The Asia-Pacific Communication Intelligence Market recorded a highest revenue in 2022. This is mostly driven to the steadily rising need for communication intelligence (COMINT) platforms. Additionally, the region's nations—including China and India—are utilising cutting-edge security technologies to uphold safety and peace within their own borders.Communication Intelligence Market Country-wise Analysis:

The US Department of Défense announced plans to invest nearly USD 13 billion over the following five years on the development and acquisition of military communication satellites in June 2022. The United States armed services and national security agencies' increasing demands for connectivity and secure data networks will be supported by this large investment. The low Earth orbit broadband constellation and a few additional communications satellites to supplement or replace current systems are funded as part of the 2023–2029 spending plan. Additionally, to enable the launching of Capability Set 21, the US Army tactical network acquisition team sought USD 537 million in June 2022 for the purchase of tactical radios and other commercial communications equipment. The growth of the market is also fuelled by rising defence spending by the Canadian defence forces and rising spending on the acquisition of modern communication equipment. The Canadian Armed Forces (CAF) and L3Harris Technologies agreed to a deal in November 2022 for the delivery of more than 1,000 compact team radios and associated kits. These tools will enhance tactical communications between command headquarters and operating personnel on the battlefield. Thus, the market for military communications in USA will grow as a result of increased technological development and a growth in satellite connectivity research and development. Communication Intelligence Market Recent Developments: The MMR reports cover key developments in the communication intelligence market as organic and inorganic growth strategies. Various companies are focusing on organic growth strategies for example product launches, product approvals and others like patents and events. 1. The National Security Agency (NSA) granted General Dynamics Mission Systems a contract in May 2022 to design, develop, test, and deliver a certifiable 400 Gbps high-assurance encryption solution that complies with the Ethernet Data Encryption Cryptographic Interoperability Specification (EDE-CIS). 2. NetVIPRTM, the newest deployable networking system from BAE Systems, was launched in August 2022. It offers intelligent and secure military communication networks connecting everything from small reconnaissance drones to combat vehicles, fighter jets, aircraft carriers, or military commanders.Scope of the Report

The objective of the Communication Intelligence Market report is to give a comprehensive analysis of the integration of Communication Intelligence Sector across the Five Main Region like North America, Europe, Asia Pacific, Middle East and Africa and South America. The report has presented the current status of the banking and financial industry with the forecasted market size and trends. The report covers dynamic aspects of the various industry with a dedicated study of key players that include market leaders, followers, and new entrants. The reports also help in understanding the Communication Intelligence Market dynamic, structure by analyzing the market segments and projecting the Communication Intelligence Market size. Clear representation of competitive analysis of key players by segment type and regional presence in the Communication Intelligence Market make the report investor’s guide.Communication Intelligence Market Scope: Inquiry Before Buying

Communication Intelligence Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US 8.22 Bn. Forecast Period 2024 to 2030 CAGR: 6.70 % Market Size in 2030: US 12.95 Bn. Segments Covered: by Mobility 1. Fixed 2. Man-Portable by Platform 1. Airborne 2. Ground 3. Naval 4. Others Communication Intelligence Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Communication Intelligence Market, Key Players are

1. Lockheed Martin Corporation (US) 2. Raytheon Company (US) 3. General Dynamics Corporation (US) 4. Northrop Grumman Corporation (US) 5. TCI International, Inc.(US) 6. L3Harris Technologies, Inc. (US) 7. Thales Group (France) 8. BAE Systems (UK) 9. Rheinmetall AG (Germany) 10. HENSOLDT (Germany) 11. Avantix SAS (France) 12. Rohde & Schwarz(Germany) 13. Saab AB (Sweden) 14. Elbit Systems Ltd. (Israel) Frequently Asked Questions: 1] What segments are covered in the Global Communication Intelligence Market report? Ans. The segments covered in the Communication Intelligence Market report are based on Mobility and Platform. 2] Which region is expected to hold the highest share in the Global Communication Intelligence Market? Ans. The North America region is expected to hold the highest share in the Communication Intelligence Market. 3] What is the market size of the Global Communication Intelligence Market by 2030? Ans. The market size of the Communication Intelligence Market by 2030 is expected to reach USD 12.95 Bn. 4] What is the forecast period for the Global Communication Intelligence Market? Ans. The forecast period for the Communication Intelligence Market is 2024-2030 5] What was the market size of the Global Communication Intelligence Market in 2023? Ans. The market size of the Communication Intelligence Market in 2023 was valued at USD 8.22 Bn.

1. Communication Intelligence Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Communication Intelligence Market: Dynamics 2.1. Communication Intelligence Market Trends by Region 2.1.1. North America Communication Intelligence Market Trends 2.1.2. Europe Communication Intelligence Market Trends 2.1.3. Asia Pacific Communication Intelligence Market Trends 2.1.4. Middle East and Africa Communication Intelligence Market Trends 2.1.5. South America Communication Intelligence Market Trends 2.2. Communication Intelligence Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Communication Intelligence Market Drivers 2.2.1.2. North America Communication Intelligence Market Restraints 2.2.1.3. North America Communication Intelligence Market Opportunities 2.2.1.4. North America Communication Intelligence Market Challenges 2.2.2. Europe 2.2.2.1. Europe Communication Intelligence Market Drivers 2.2.2.2. Europe Communication Intelligence Market Restraints 2.2.2.3. Europe Communication Intelligence Market Opportunities 2.2.2.4. Europe Communication Intelligence Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Communication Intelligence Market Drivers 2.2.3.2. Asia Pacific Communication Intelligence Market Restraints 2.2.3.3. Asia Pacific Communication Intelligence Market Opportunities 2.2.3.4. Asia Pacific Communication Intelligence Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Communication Intelligence Market Drivers 2.2.4.2. Middle East and Africa Communication Intelligence Market Restraints 2.2.4.3. Middle East and Africa Communication Intelligence Market Opportunities 2.2.4.4. Middle East and Africa Communication Intelligence Market Challenges 2.2.5. South America 2.2.5.1. South America Communication Intelligence Market Drivers 2.2.5.2. South America Communication Intelligence Market Restraints 2.2.5.3. South America Communication Intelligence Market Opportunities 2.2.5.4. South America Communication Intelligence Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Communication Intelligence Industry 2.8. Analysis of Government Schemes and Initiatives For Communication Intelligence Industry 2.9. Communication Intelligence Market Trade Analysis 2.10. The Global Pandemic Impact on Communication Intelligence Market 3. Communication Intelligence Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Communication Intelligence Market Size and Forecast, by Mobility (2023-2030) 3.1.1. Fixed 3.1.2. Man-Portable 3.2.1. Airborne 3.2.2. Ground 3.2.3. Naval 3.2.4. Others 3.3. Communication Intelligence Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Communication Intelligence Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Communication Intelligence Market Size and Forecast, by Mobility (2023-2030) 4.1.1. Fixed 4.1.2. Man-Portable 4.2.1. Airborne 4.2.2. Ground 4.2.3. Naval 4.2.4. Others 4.3. North America Communication Intelligence Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Communication Intelligence Market Size and Forecast, by Mobility (2023-2030) 4.3.1.1.1. Fixed 4.3.1.1.2. Man-Portable 4.3.1.2.1. Airborne 4.3.1.2.2. Ground 4.3.1.2.3. Naval 4.3.1.2.4. Others 4.7.2. Canada 4.3.2.1. Canada Communication Intelligence Market Size and Forecast, by Mobility (2023-2030) 4.3.2.1.1. Fixed 4.3.2.1.2. Man-Portable 4.3.2.2.1. Airborne 4.3.2.2.2. Ground 4.3.2.2.3. Naval 4.3.2.2.4. Others 4.7.3. Mexico 4.3.3.1. Mexico Communication Intelligence Market Size and Forecast, by Mobility (2023-2030) 4.3.3.1.1. Fixed 4.3.3.1.2. Man-Portable 4.3.3.2.1. Airborne 4.3.3.2.2. Ground 4.3.3.2.3. Naval 4.3.3.2.4. Others 5. Europe Communication Intelligence Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Communication Intelligence Market Size and Forecast, by Mobility (2023-2030) 5.3. Europe Communication Intelligence Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Communication Intelligence Market Size and Forecast, by Mobility (2023-2030) 5.3.2. France 5.3.2.1. France Communication Intelligence Market Size and Forecast, by Mobility (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Communication Intelligence Market Size and Forecast, by Mobility (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Communication Intelligence Market Size and Forecast, by Mobility (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Communication Intelligence Market Size and Forecast, by Mobility (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Communication Intelligence Market Size and Forecast, by Mobility (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Communication Intelligence Market Size and Forecast, by Mobility (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Communication Intelligence Market Size and Forecast, by Mobility (2023-2030) 6. Asia Pacific Communication Intelligence Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Communication Intelligence Market Size and Forecast, by Mobility (2023-2030) 6.7. Asia Pacific Communication Intelligence Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Communication Intelligence Market Size and Forecast, by Mobility (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Communication Intelligence Market Size and Forecast, by Mobility (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Communication Intelligence Market Size and Forecast, by Mobility (2023-2030) 6.3.4. India 6.3.4.1. India Communication Intelligence Market Size and Forecast, by Mobility (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Communication Intelligence Market Size and Forecast, by Mobility (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Communication Intelligence Market Size and Forecast, by Mobility (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Communication Intelligence Market Size and Forecast, by Mobility (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Communication Intelligence Market Size and Forecast, by Mobility (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Communication Intelligence Market Size and Forecast, by Mobility (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Communication Intelligence Market Size and Forecast, by Mobility (2023-2030) 7. Middle East and Africa Communication Intelligence Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Communication Intelligence Market Size and Forecast, by Mobility (2023-2030) 7.7. Middle East and Africa Communication Intelligence Market Size and Forecast, by Country (2023-2030) 7.7.1. South Africa 7.3.1.1. South Africa Communication Intelligence Market Size and Forecast, by Mobility (2023-2030) 7.7.2. GCC 7.3.2.1. GCC Communication Intelligence Market Size and Forecast, by Mobility (2023-2030) 7.7.3. Nigeria 7.3.3.1. Nigeria Communication Intelligence Market Size and Forecast, by Mobility (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Communication Intelligence Market Size and Forecast, by Mobility (2023-2030) 8. South America Communication Intelligence Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Communication Intelligence Market Size and Forecast, by Mobility (2023-2030) 8.7. South America Communication Intelligence Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Communication Intelligence Market Size and Forecast, by Mobility (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Communication Intelligence Market Size and Forecast, by Mobility (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Communication Intelligence Market Size and Forecast, by Mobility (2023-2030) 9. Global Communication Intelligence Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Leading Communication Intelligence Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Lockheed Martin Corporation (US) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Raytheon Company (US) 10.3. General Dynamics Corporation (US) 10.4. Northrop Grumman Corporation (US) 10.5. TCI International, Inc.(US) 10.6. L3Harris Technologies, Inc. (US) 10.7. Thales Group (France) 10.8. BAE Systems (UK) 10.9. Rheinmetall AG (Germany) 10.10. HENSOLDT (Germany) 10.11. Avantix SAS (France) 10.12. Rohde & Schwarz(Germany) 10.13. Saab AB (Sweden) 10.14. Elbit Systems Ltd. (Israel) 11. Key Findings 12. Industry Recommendations 13. Communication Intelligence Market: Research Methodology 14. Terms and Glossary