The Cold Milling Machine Market size was valued at USD 2336.7Mn. in 2022 the Cold Milling Machine Market revenue will grow by 6.2 % from 2023 to 2029, reaching nearly USD 3560.20 Mn.Cold Milling Machine Market Overview:

Cold milling machines are used to build roads. They can also be used to quickly and effectively remove asphalt and concrete. The market for cold milling machines has maintained a steady demand, primarily fueled by factors such as the expansion of infrastructure, the deterioration of road systems, urbanization, and ongoing technological advancements. These robust construction tools, designed to remove the top layers of asphalt or concrete from pavements and roads, play a crucial role in road maintenance and rehabilitation projects.To know about the Research Methodology :- Request Free Sample Report The market offers a range of cold milling machines in various sizes, from compact models for minor repairs to large-scale units for substantial construction endeavors. Key trends in the industry include the integration of automation and advanced control systems, expansion into emerging markets, and a growing emphasis on environmental sustainability through reduced emissions and improved fuel efficiency.

Cold Milling Machine Market Dynamics:

Driver Rising Infrastructure Development Boosts Market Growth Infrastructure expansion contributes to resilience and safety as well. Modern infrastructure can be designed to withstand natural disasters and emergencies, making communities more resilient and less susceptible to damage. Properly engineered bridges, buildings, and flood control systems can minimize the impact of earthquakes, hurricanes, or flooding. With urbanization trends on the rise, infrastructure expansion is critical to support growing urban populations. Cities need to build and upgrade infrastructure to address challenges such as increased congestion, waste management, and housing demands. Infrastructure projects represent long-term investments. The long-term benefits in terms of societal well-being and economic progress usually outweigh the initial costs, which might be large. This guarantees that the advantages of building more infrastructure will mount over a long period of time. Through the incorporation of environmentally friendly materials and technology to lessen their impact on the environment, modern infrastructure projects also emphasize the significance of environmental sustainability. Maintaining infrastructure requires constant investment in order to support sustainable growth and meet changing societal demands.Investment Commitments and Number of Infrastructure Projects with Private Participation in IDA Countries, 2022

Country Total Investment (US$ Million) Number of Projects Senegal 1,283 2 Lao PDR 1,051 2 Bangladesh 991 2 Nepal 859 2 Cote d'Ivoire 176 1 Mozambique 130 1 Benin 16 6 Lesotho 10 1 Tajikistan 5 1 Cambodia 7 1 High Initial Cost Restrain the Market Growth

High initial investment costs represent a substantial restraining factor in the cold milling machine market. These costs encompass the significant expenses associated with the acquisition and operation of cold milling machines, which are important in road construction and maintenance. The purchase price of cold milling machines is notably high due to their complexity, size, and the advanced technology required for their efficient operation. This initial financial outlay can be a formidable barrier, particularly for small and medium-sized contractors and construction companies. Operating cold milling machines incurs ongoing expenses that contribute to the overall cost. These machines require skilled operators to run them effectively, which translates to labor costs. Additionally, regular maintenance is imperative to ensure the equipment functions optimally, further increasing operational expenditures. Depreciation is another factor that compounds the high initial investment costs. Cold milling machines can depreciate rapidly, affecting their resale or trade-in value. Businesses hesitate to invest in newer models, as the potential for significant losses in case of resale or upgrades are deterrent. Securing financing for such expensive equipment is a challenging endeavor. Many construction companies, especially smaller ones, encounter difficulties in obtaining loans or credit to cover the substantial initial investment. This financing barrier limits their ability to acquire the necessary machinery to compete effectively in the market. The high cost of entry into the cold milling machine market serves as a deterrent for new entrants. The lack of competition resulting from this financial hurdle limit options for customers and potentially lead to higher prices for equipment and services.Opportunity

Technological Development Creates Lucrative Growth Opportunities for market growth Technological advancements in the field of cold milling machines have ushered in a new era of efficiency and precision in road rehabilitation and construction projects. These innovations have become instrumental in driving the growth of the cold milling machine market. Modern cold milling machines are now equipped with advanced automation and control systems, enabling operators too finely control milling depth and width, resulting in optimized and precise milling operations while reducing operator fatigue. Such as The CNC milling machine is a precision tool for machining various materials also An EDM milling machine utilizes electrical discharge machining to shape and finish workpieces. Furthermore, the integration of telematics technology allows for real-time monitoring of machine performance, facilitating remote management and data-driven decision-making, ultimately enhancing operational efficiency and reducing downtime. The improvements in milling drum design and cutter technology have led to enhanced milling performance, ensuring smoother and more consistent milling results. For example, Wirtgen milling machines are known for their reliability and performance in road construction. This, in turn, reduces the need for additional surface preparation before road resurfacing, saving both time and resources. To meet stricter emissions regulations and environmental concerns, cold milling machines now feature cleaner and more efficient engines with advanced emission control technologies, making them environmentally friendly. User-friendly interfaces and intuitive control panels have become standard, simplifying operator training and operation, thereby increasing the accessibility of these advanced machines. Moreover, safety features, including collision avoidance systems, cameras, and warning alarms, have been integrated to minimize the risk of accidents and collisions on construction sites, ensuring the safety of both operators and pedestrians. These technological advancements have not only improved the efficiency of cold milling machines but have also contributed to reduced operating costs, enhanced safety, and minimized environmental impact. Consequently, construction companies and contractors are increasingly embracing these advanced machines to improve project quality and cost-effectiveness. This trend is driving market growth and presents a promising opportunity for manufacturers and service providers in the cold milling machine industry.Cold Milling Machine Market Segment Analysis

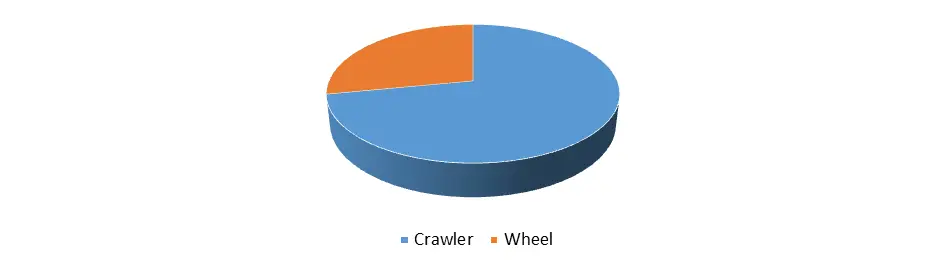

Based on Type: The crawler segment dominates the type segment of the Cold Milling Machine Market in the year 2022. The prominence of this segment can be attributed to the widespread utilization of crawler-type cold milling machines across various land surface regions. A significant example is Caterpillar Inc., which offers the PM825, a high-production milling machine with a cutting width of 2505 mm. This machine excels at efficiently removing full-depth asphalt and concrete pavements in a single pass, making it a preferred choice for many construction projects. These wheeled road planers are capable of grinding away surface imperfections, addressing bumps, and repairing damaged areas on various surfaces, such as bridges, runways, roads, racetracks, and parking lots, using a spinning drum or rotor. Key manufacturers such as BOMAG and Wirtgen offer a range of milling machines, including smaller models with wheels and larger cold planers with tracks. Compact wheel planers offer enhanced maneuverability, allowing them to efficiently navigate around obstacles that larger tracked models would need to pass over. Wheels also provide superior traction on lightweight planers, directing ground pressure to the tire contact patches, which are smaller than the surface area of tracks. These advantages are expected to drive the demand for wheeled cold milling machines in the years to come.Cold Milling Machine Market based on Type in the year 2022(%)

Cold Milling Machine Market Regional Analysis:

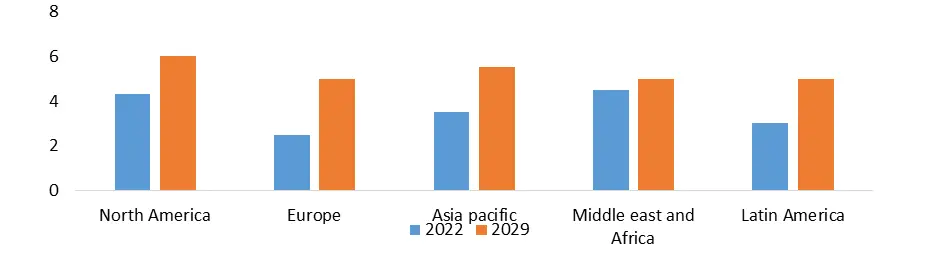

Asia Pacific region will dominate the Cold Milling Machine Market in the year 2022. This prominence is largely attributed to the surge in smart city initiatives within the region, which is predicted to stimulate the demand for cold milling machines. The adoption of advanced construction technologies as part of smart city development is expected to bolster the market. A framework agreement between Morocco and China for the Mohammed VI Tangier Tech metropolis project exemplifies the region's commitment to building integrated, intelligent, and sustainable industrial metropolises. There is a growing emphasis on smart city construction and maintenance initiatives, with organizations such as the European Commission promoting digital transformation through campaigns. India is experiencing a surge in demand for cold milling machines due to increased investments in highway and roadway reconstruction. These machines are crucial for the efficient removal of asphalt and concrete surfaces, facilitating essential infrastructure projects. Rapid urbanization, expanding road networks, and ambitious infrastructure-building programs are the driving forces behind this growth. Manufacturers are targeting this region with a variety of machine sizes to provide diverse projects, and local production and economic solutions play a significant role.Cold Milling Machine Market Growth Rate From 2022 To 2029 In (%)

Cold Milling Machine Market Competitive Landscape

The Competitive Landscape of the Cold Milling Machine Market covers the number of key companies, company size, strengths, weaknesses, barriers, and threats. It also focuses on the power of the company’s competitive rivals, potential, new market entrants, customers, suppliers, and substitute products that drive the profitability of the companies in the Cold Milling Machine industry. The global Cold Milling Machine Market includes several market players at the country, regional, and global levels. Some of the milling machine manufacturers Deere & Company (Wirtgen Group), Caterpillar Inc., Astec Industries Inc., SANY Group, Fayat Group (Bomag GmbH), and CMI Roadbuilding Limited. Many companies have conducted research and development activities to fulfill consumer demand and increase their portfolio. The company focuses on strategic partnerships mergers and acquisitions to expand the global reach and maintain the brand name.Cold Milling Machine Market Scope Table : Inquire Before Buying

Global Cold Milling Machine Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 2336.7 Mn. Forecast Period 2023 to 2029 CAGR: 6.2% Market Size in 2029: US $ 3560.2 Mn. Segments Covered: by Type Crawler Wheel by Power Below 300 kW 300 kW to 500 kW Above 500 kW by Application Concrete Rehabilitation Asphalt Rehabilitation Cold Milling Machine Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Cold Milling Machine Market Key Players

1. DEERE & COMPANY (Wirtgen Group) 2. Caterpillar Inc. 3. Astec Industries Inc. 4. SANY Group 5. Fayat Group (Bomag GmbH) 6. Simex srl 7. Kubota Corporation 8. Volvo Construction Equipment 9. Liugong Machinery Co., Ltd. 10. J C Bamford Excavators Ltd 11. CMI Roadbuilding Limited 12. Sakai Heavy Industries Limited 13. Komatsu Ltd. 14. CNH Industrial NV Frequently Asked Questions: 1] What segments are covered in the Global Cold Milling Machine Market report? Ans. The segments covered in the Cold Milling Machine Market report are based on type, Power, Application, and Region. 2] Which region is expected to hold the highest share in the Global Cold Milling Machine Market? Ans. The Asia Pacific region is expected to hold the highest share of the Cold Milling Machine Market. 3] What was the market size of the Global Cold Milling Machine Market by 2022? Ans. The market size of the Cold Milling Machine Market by 2022 is expected to reach US$ 23.36.7 Mn. 4] What is the forecast period for the Global Cold Milling Machine Market? Ans. The forecast period for the Cold Milling Machine Market is 2023-2029. 5] What is the market size of the Global Cold Milling Machine Market in 2029? Ans. The market size of the Cold Milling Machine Market in 2029 is valued at US$ 3560.20Mn.

1. Cold Milling Machine Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Cold Milling Machine Market: Dynamics 2.1. Cold Milling Machine Market Trends by Region 2.1.1. North America Cold Milling Machine Market Trends 2.1.2. Europe Cold Milling Machine Market Trends 2.1.3. Asia Pacific Cold Milling Machine Market Trends 2.1.4. Middle East and Africa Cold Milling Machine Market Trends 2.1.5. South America Cold Milling Machine Market Trends 2.2. Cold Milling Machine Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Cold Milling Machine Market Drivers 2.2.1.2. North America Cold Milling Machine Market Restraints 2.2.1.3. North America Cold Milling Machine Market Opportunities 2.2.1.4. North America Cold Milling Machine Market Challenges 2.2.2. Europe 2.2.2.1. Europe Cold Milling Machine Market Drivers 2.2.2.2. Europe Cold Milling Machine Market Restraints 2.2.2.3. Europe Cold Milling Machine Market Opportunities 2.2.2.4. Europe Cold Milling Machine Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Cold Milling Machine Market Drivers 2.2.3.2. Asia Pacific Cold Milling Machine Market Restraints 2.2.3.3. Asia Pacific Cold Milling Machine Market Opportunities 2.2.3.4. Asia Pacific Cold Milling Machine Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Cold Milling Machine Market Drivers 2.2.4.2. Middle East and Africa Cold Milling Machine Market Restraints 2.2.4.3. Middle East and Africa Cold Milling Machine Market Opportunities 2.2.4.4. Middle East and Africa Cold Milling Machine Market Challenges 2.2.5. South America 2.2.5.1. South America Cold Milling Machine Market Drivers 2.2.5.2. South America Cold Milling Machine Market Restraints 2.2.5.3. South America Cold Milling Machine Market Opportunities 2.2.5.4. South America Cold Milling Machine Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Cold Milling Machine Industry 2.8. Analysis of Government Schemes and Initiatives For Cold Milling Machine Industry 2.9. The Global Pandemic Impact on Cold Milling Machine Market 2.10. Cold Milling Machine Price Trend Analysis (2021-22) 2.11. Global Cold Milling Machine Market Trade Analysis (2017-2022) 3. Cold Milling Machine Market: Global Market Size and Forecast by Segmentation (by Value and Volume) (2022-2029) 3.1. Cold Milling Machine Market Size and Forecast, by Type (2022-2029) 3.1.1. Crawler 3.1.2. Wheel 3.2. Cold Milling Machine Market Size and Forecast, by Power (2022-2029) 3.2.1. Below 300 kW 3.2.2. 300 kW to 500 kW 3.2.3. Above 500 kW 3.3. Cold Milling Machine Market Size and Forecast, by Application (2022-2029) 3.3.1. Concrete Rehabilitation 3.3.2. Asphalt Rehabilitation 3.4. Cold Milling Machine Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Cold Milling Machine Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 4.1. North America Cold Milling Machine Market Size and Forecast, by Type (2022-2029) 4.1.1. Crawler 4.1.2. Wheel 4.2. North America Cold Milling Machine Market Size and Forecast, by Power (2022-2029) 4.2.1. Below 300 kW 4.2.2. 300 kW to 500 kW 4.2.3. Above 500 kW 4.3. North America Cold Milling Machine Market Size and Forecast, by Application (2022-2029) 4.3.1. Concrete Rehabilitation 4.3.2. Asphalt Rehabilitation 4.4. North America Cabinet Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Cold Milling Machine Market Size and Forecast, by Type (2022-2029) 4.4.1.1.1. Crawler 4.4.1.1.2. Wheel 4.4.1.2. United States Cold Milling Machine Market Size and Forecast, by Power (2022-2029) 4.4.1.2.1. Below 300 kW 4.4.1.2.2. 300 kW to 500 kW 4.4.1.2.3. Above 500 kW 4.4.2. United States Cold Milling Machine Market Size and Forecast, by Application (2022-2029) 4.4.2.1.1. Concrete Rehabilitation 4.4.2.1.2. Asphalt Rehabilitation 4.4.3. Canada 4.4.4. Canada Cold Milling Machine Market Size and Forecast, by Type (2022-2029) 4.4.4.1.1. Crawler 4.4.4.1.2. Wheel 4.4.5. Canada Cold Milling Machine Market Size and Forecast, by Power (2022-2029) 4.4.5.1.1. Below 300 kW 4.4.5.1.2. 300 kW to 500 kW 4.4.5.1.3. Above 500 kW 4.4.6. Canada Cold Milling Machine Market Size and Forecast, by Application (2022-2029) 4.4.6.1.1. Concrete Rehabilitation 4.4.6.1.2. Asphalt Rehabilitation 4.4.7. Mexico 4.4.7.1 Mexico Cold Milling Machine Market Size and Forecast, by Type (2022-2029) 4.4.7.1.1. Crawler 4.4.7.1.2. Wheel 4.4.7.2 Mexico Cold Milling Machine Market Size and Forecast, by Power (2022-2029) 4.4.7.1.1. Below 300 kW 4.4.7.1.2. 300 kW to 500 kW 4.4.7.1.3. Above 500 kW 4.4.7.3 North America Cold Milling Machine Market Size and Forecast, by Application (2022-2029) 4.4.7.1.1. Concrete Rehabilitation 4.4.7.1.2. Asphalt Rehabilitation 5. Europe Cold Milling Machine Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 5.4. Europe Cold Milling Machine Market Size and Forecast, by Type (2022-2029) 5.5. Europe Cold Milling Machine Market Size and Forecast, by Power (2022-2029) 5.6. Europe Cold Milling Machine Market Size and Forecast, by Application (2022-2029) 5.7. Europe Cold Milling Machine Market Size and Forecast, by Country (2022-2029) 5.7.7. United Kingdom 5.7.7.1. United Kingdom Cold Milling Machine Market Size and Forecast, by Type (2022-2029) 5.7.7.2. United Kingdom Cold Milling Machine Market Size and Forecast, by Power (2022-2029) 5.7.7.3. United Kingdom Cold Milling Machine Market Size and Forecast, by Application (2022-2029) 5.7.8. France 5.7.8.1. France Cold Milling Machine Market Size and Forecast, by Type (2022-2029) 5.7.8.2. France Cold Milling Machine Market Size and Forecast, by Power (2022-2029) 5.7.8.3. France Cold Milling Machine Market Size and Forecast, by Application (2022-2029) 5.7.9. Germany 5.7.9.1. Germany Cold Milling Machine Market Size and Forecast, by Type (2022-2029) 5.7.9.2. Germany Cold Milling Machine Market Size and Forecast, by Power (2022-2029) 5.7.9.3. Germany Cold Milling Machine Market Size and Forecast, by Application (2022-2029) 5.7.10. Italy 5.7.10.1. Italy Cold Milling Machine Market Size and Forecast, by Type (2022-2029) 5.7.10.2. Italy Cold Milling Machine Market Size and Forecast, by Power (2022-2029) 5.7.10.3. Italy Cold Milling Machine Market Size and Forecast, by Application (2022-2029) 5.7.11. Spain 5.7.11.1. Spain Cold Milling Machine Market Size and Forecast, by Type (2022-2029) 5.7.11.2. Spain Cold Milling Machine Market Size and Forecast, by Power (2022-2029) 5.7.11.3. Spain Cold Milling Machine Market Size and Forecast, by Application (2022-2029) 5.7.12. Sweden 5.7.12.1. Sweden Cold Milling Machine Market Size and Forecast, by Type (2022-2029) 5.7.12.2. Sweden Cold Milling Machine Market Size and Forecast, by Power (2022-2029) 5.7.12.3. Sweden Cold Milling Machine Market Size and Forecast, by Application (2022-2029) 5.7.13. Austria 5.7.13.1. Austria Cold Milling Machine Market Size and Forecast, by Type (2022-2029) 5.7.13.2. Austria Cold Milling Machine Market Size and Forecast, by Power (2022-2029) 5.7.13.3. Austria Cold Milling Machine Market Size and Forecast, by Application (2022-2029) 5.7.14. Rest of Europe 5.7.14.1. Rest of Europe Cold Milling Machine Market Size and Forecast, by Type (2022-2029) 5.7.14.2. Rest of Europe Cold Milling Machine Market Size and Forecast, by Power (2022-2029 5.7.14.3. Rest of Europe Cold Milling Machine Market Size and Forecast, by Application (2022-2029) 6. Asia Pacific Cold Milling Machine Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 6.1 Asia Pacific Cold Milling Machine Market Size and Forecast, by Type (2022-2029) 6.2 Asia Pacific Cold Milling Machine Market Size and Forecast, by Power (2022-2029) 6.3 Asia Pacific Cold Milling Machine Market Size and Forecast, by Application (2022-2029) 6.4 Asia Pacific Cold Milling Machine Market Size and Forecast, by Country (2022-2029) 6.4.1 China 6.4.1.1. China Cold Milling Machine Market Size and Forecast, by Type (2022-2029) 6.4.1.2. China Cold Milling Machine Market Size and Forecast, by Power (2022-2029) 6.4.1.3. China Cold Milling Machine Market Size and Forecast, by Application (2022-2029) 6.4.2 S Korea 6.4.2.1 S Korea Cold Milling Machine Market Size and Forecast, by Type (2022-2029) 6.4.2.2 S Korea Cold Milling Machine Market Size and Forecast, by Power (2022-2029) 6.4.2.3 S Korea Cold Milling Machine Market Size and Forecast, by Application (2022-2029) 6.4.3 Japan 6.4.3.1 Japan Cold Milling Machine Market Size and Forecast, by Type (2022-2029) 6.4.3.2 Japan Cold Milling Machine Market Size and Forecast, by Power (2022-2029) 6.4.3.3 Japan Cold Milling Machine Market Size and Forecast, by Application (2022-2029) 6.4.4 India 6.4.4.1 India Cold Milling Machine Market Size and Forecast, by Type (2022-2029) 6.4.4.2 India Cold Milling Machine Market Size and Forecast, by Power (2022-2029) 6.4.4.3 India Cold Milling Machine Market Size and Forecast, by Application (2022-2029) 6.4.5 Australia 6.4.5.1 Australia Cold Milling Machine Market Size and Forecast, by Type (2022-2029) 6.4.5.2 Australia Cold Milling Machine Market Size and Forecast, by Power (2022-2029) 6.4.5.3 Australia Cold Milling Machine Market Size and Forecast, by Application (2022-2029) 6.4.6 Indonesia 6.4.6.1 Indonesia Cold Milling Machine Market Size and Forecast, by Type (2022-2029) 6.4.6.2 Indonesia Cold Milling Machine Market Size and Forecast, by Power (2022-2029) 6.4.6.3 Indonesia Cold Milling Machine Market Size and Forecast, by Application (2022-2029) 6.4.7 Malaysia 6.4.7.1 Malaysia Cold Milling Machine Market Size and Forecast, by Type (2022-2029) 6.4.7.2 Malaysia Cold Milling Machine Market Size and Forecast, by Power (2022-2029) 6.4.7.3 Malaysia Cold Milling Machine Market Size and Forecast, by Application (2022-2029) 6.4.8 Vietnam 6.4.8.1 Vietnam Cold Milling Machine Market Size and Forecast, by Type (2022-2029) 6.4.8.2 Vietnam Cold Milling Machine Market Size and Forecast, by Power (2022-2029) 6.4.8.3 Vietnam Cold Milling Machine Market Size and Forecast, by Application (2022-2029) 6.4.9 Taiwan 6.4.9.1 Taiwan Cold Milling Machine Market Size and Forecast, by Type (2022-2029) 6.4.9.2 Taiwan Cold Milling Machine Market Size and Forecast, by Power (2022-2029) 6.4.9.3 Taiwan Cold Milling Machine Market Size and Forecast, by Application (2022-2029) 6.4.10 Rest of Asia Pacific 6.4.10.1 Rest of Asia Pacific Cold Milling Machine Market Size and Forecast, by Type (2022-2029) 6.4.10.2 Rest of Asia Pacific Cold Milling Machine Market Size and Forecast, by Power (2022-2029) 6.4.10.3 Rest of Asia Pacific Cold Milling Machine Market Size and Forecast, by Application (2022-2029) 7 Middle East and Africa Cold Milling Machine Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029 7.1 Middle East and Africa Cold Milling Machine Market Size and Forecast, by Type (2022-2029) 7.2 Middle East and Africa Cold Milling Machine Market Size and Forecast, by Type (2022-2029) 7.3 Middle East and Africa Cold Milling Machine Market Size and Forecast, by Application (2022-2029) 7.4 Middle East and Africa Cold Milling Machine Market Size and Forecast, by Country (2022-2029) 7.4.1 South Africa 7.4.1.1 South Africa Cold Milling Machine Market Size and Forecast, by Type (2022-2029) 7.4.1.2 South Africa Cold Milling Machine Market Size and Forecast, by Power (2022-2029) 7.4.1.3 South Africa Cold Milling Machine Market Size and Forecast, by Application (2022-2029) 7.4.2 GCC 7.4.2.1 GCC Cold Milling Machine Market Size and Forecast, by Type (2022-2029) 7.4.2.2 GCC Cold Milling Machine Market Size and Forecast, by Power (2022-2029) 7.4.2.3 GCC Cold Milling Machine Market Size and Forecast, by Application (2022-2029) 7.4.3 Nigeria 7.4.3.1 Nigeria Cold Milling Machine Market Size and Forecast, by Type (2022-2029) 7.4.3.2 Nigeria Cold Milling Machine Market Size and Forecast, by Power (2022-2029) 7.4.3.3 Nigeria Cold Milling Machine Market Size and Forecast, by Application (2022-2029) 7.4.4 Rest of ME&A 7.4.4.1 Rest of ME&A Cold Milling Machine Market Size and Forecast, by Type (2022-2029) 7.4.4.2 Rest of ME&A Cold Milling Machine Market Size and Forecast, by Power (2022-2029) 7.4.4.3 Rest of ME&A Cold Milling Machine Market Size and Forecast, by Application (2022-2029) 8 South America Cold Milling Machine Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029 8.1 South America Cold Milling Machine Market Size and Forecast, by Type (2022-2029) 8.2 South America Cold Milling Machine Market Size and Forecast, by Power (2022-2029) 8.3 South America Cold Milling Machine Market Size and Forecast, by Application (2022-2029) 8.4 South America Cold Milling Machine Market Size and Forecast, by Country (2022-2029) 8.4.1 Brazil 8.4.1.1 Brazil Cold Milling Machine Market Size and Forecast, by Type (2022-2029) 8.4.1.2 Brazil Cold Milling Machine Market Size and Forecast, by Power (2022-2029) 8.4.1.3 Brazil Cold Milling Machine Market Size and Forecast, by Application (2022-2029) 8.4.2 Argentina 8.4.2.1 Argentina Cold Milling Machine Market Size and Forecast, by Type (2022-2029) 8.4.2.2 Argentina Cold Milling Machine Market Size and Forecast, by Power (2022-2029) 8.4.2.3 Argentina Cold Milling Machine Market Size and Forecast, by Application (2022-2029) 8.4.3 Rest Of South America 8.4.3.1 Rest Of South America Cold Milling Machine Market Size and Forecast, by Type (2022-2029) 8.4.3.2 Rest Of South America Cold Milling Machine Market Size and Forecast, by Power (2022-2029) 8.4.3.3 Rest Of South America Cold Milling Machine Market Size and Forecast, by Application (2022-2029) 9 Global Cold Milling Machine Market: Competitive Landscape 9.1 MMR Competition Matrix 9.2 Competitive Landscape 9.3 Key Players Benchmarking 9.3.1 Company Name 9.3.2 Type Segment 9.3.3 End-user Segment 9.3.4 Revenue (2022) 9.3.5 Company Locations 9.4 Leading Cold Milling Machine Market Companies, by market capitalization 9.5 Market Structure 9.5.1 Market Leaders 9.5.2 Market Followers 9.5.3 Emerging Players 9.6 Mergers and Acquisitions Details 10 Company Profile: Key Players 10.1 DEERE & COMPANY (Wirtgen Group) 10.1.1 Company Overview 10.1.2 Business Portfolio 10.1.3 Financial Overview 10.1.4 SWOT Analysis 10.1.5 Strategic Analysis 10.1.6 Scale of Operation (small, medium, and large) 10.1.7 Details on Partnership 10.1.8 Regulatory Accreditations and Certifications Received by Them 10.1.9 Awards Received by the Firm 10.1.10 Recent Developments 10.2 DEERE & COMPANY (Wirtgen Group) 10.3 Caterpillar Inc. 10.4 Astec Industries Inc. 10.5 SANY Group 10.6 Fayat Group (Bomag GmbH) 10.7 Simex srl 10.8 Kubota Corporation 10.9 Volvo Construction Equipment 10.10 Liugong Machinery Co., Ltd. 10.11 J C Bamford Excavators Ltd 10.12 CMI Roadbuilding Limited 10.13 Sakai Heavy Industries Limited 10.14 Komatsu Ltd. 10.15 CNH Industrial NV 11 Key Findings 12 Industry Recommendations 13 Cold Milling Machine Market: Research Methodology