Cold Chain Packaging Refrigerants Market size was valued at USD 1.39 Bn. in 2022 and the total Cold Chain Packaging Refrigerants revenue is expected to grow by 7.9 % from 2023 to 2029, reaching nearly USD 2.37 Bn.Cold Chain Packaging Refrigerants Market Overview:

Cold chain packaging refrigerants are specialized materials essential for maintaining low temperatures while transporting and storing temperature-sensitive products. Throughout the supply chain, they are crucial in preserving the quality and integrity of perishable goods, including pharmaceuticals, food and beverages, and chemicals. The Cold chain packaging refrigerants market is expected growth in recent years due to the increasing demand for temperature-controlled logistics across various industries. Pharmaceuticals require strict temperature control to maintain their potency and efficacy. The increasing demand for pharmaceutical products, combined with the need for temperature-sensitive transportation and storage, has resulted in significant uptake of cold chain packaging refrigerants in the pharmaceutical industry. For instance, African countries like Nigeria have witnessed a rise in the supply of polio vaccines, thanks to increased government support in high-risk areas. Coolways, Creative Packaging Company, and Cryolux America are some market leaders, actively involved in technological advancements in storage and transport services for cold chain packaging. Their innovative approaches and solutions contribute to maintaining cold chain integrity and ensuring the safe and efficient delivery of temperature-sensitive goods. Cold Chain Packaging Refrigerants Market Scope and Research Methodology The Cold Chain Packaging Refrigerants Market report represents innovation, policy support, increased competition, and environmental concerns by global and local players holding the Cold Chain Packaging Refrigerants Market in different countries. The report covered Market structure by comparative analysis of key players, and market followers, which makes this report insightful to the Cold Chain Packaging Refrigerants Outlook. The Cold Chain Packaging Refrigerants Market report aims to outlook the market size based on segments, regional distribution and industry competition. The bottom-up approach has been used to estimate and forecast market size and market growth. The report provides a detailed examination of the key players in the Cold Chain Packaging Refrigerants industry, including revenue. The report covers the global, regional and local level analysis of the Cold Chain Packaging Refrigerants Market with the factors restraining, driving and challenging the market growth during the forecast period.To know about the Research Methodology :- Request Free Sample Report

Cold Chain Packaging Refrigerants Market Dynamics:

Cold Chain Packaging Refrigerants Market Drivers Ensuring Quality and Integrity of Temperature-Sensitive Drugs Driving the Growth of Market The increasing global trade of perishable goods, particularly in the pharmaceutical and food industries, has created a significant demand for efficient cold-chain logistics. This has fueled the market for cold chain packaging refrigerants, which play a crucial role in maintaining the required temperature conditions during transportation and storage. Strict regulations for product safety imposed by regulatory bodies worldwide have further accelerated the adoption of cold chain packaging refrigerants, enabling companies to meet temperature requirements and comply with stringent safety standards. The Cold Chain Packaging Refrigerants market has also benefited from technological advancements in packaging materials, such as phase change materials and advanced insulation solutions, which have greatly improved the efficiency of cold chain packaging refrigerants. These advancements have enhanced the ability to maintain the desired temperature range for perishable goods during transportation and storage. The growing pharmaceutical industry heavily relies on temperature-controlled logistics to preserve the efficacy of drugs. With the increasing demand for pharmaceutical products globally, the need for temperature-sensitive transportation has risen, driving the demand for cold chain packaging refrigerants to ensure the quality and integrity of temperature-sensitive drugs throughout the supply chain. Cold Chain Packaging Refrigerants Market Restraint High Establishment Cost for Cold Chain Infrastructure Establishing and maintaining a cold chain infrastructure is a significant restraint for smaller players or companies operating in developing regions due to the substantial investment required. For example, the high initial costs associated with building and maintaining refrigerated warehouses can pose financial challenges. Compliance with stringent regulations and guidelines for temperature-sensitive products can be complex and resource-intensive. Meeting standards such as Good Distribution Practices (GDP) for pharmaceutical products, which involve temperature monitoring, documentation, and validation, requires significant effort. Another challenge lies in ensuring temperature integrity during the last-mile delivery, particularly in densely populated urban areas. Factors like traffic congestion, unpredictable delivery routes, and limited access to temperature-controlled vehicles make it challenging to maintain the required temperature conditions until the final delivery point. Cold Chain Packaging Refrigerants Market Opportunities Expansion of Refrigerated Warehouses Enhances Perishable Goods Transportation The cold chain logistics sector is experiencing various industry-defining trends, creating new market opportunities. The globalization of the cold chain industry has prompted the freight forwarding industry to ensure quality and temperature control throughout the shipping process. The emergence of online grocery services and the growing desire for convenient door-to-door deliveries of perishable goods have created a demand surge for cold chain shipping services. Consequently, the industry is experiencing increased pressure to meet these evolving customer needs. Furthermore, there has been a notable rise in the establishment of refrigerated warehouses that offer optimal storage conditions for temperature-sensitive products. This expansion of refrigerated warehouse infrastructure plays a crucial role in supporting the efficient and safe transportation of perishable items throughout the supply chain. Another important trend is the focus on creating sustainable cold chains to minimize the environmental impact. Companies are investing in research and development to enhance insulation, use alternative refrigerants, and adopt sustainable packaging solutions. The implementation of new regional regulations and the investments in technology, such as real-time monitoring and traceability, are also shaping the cold chain logistics sector. These trends present market opportunities for cold chain packaging refrigerants, as companies seek to meet the evolving demands of temperature-controlled logistics while ensuring product integrity, compliance with regulations, and efficient transportation of perishable goods.

Cold Chain Packaging Refrigerants Market Segment Analysis:

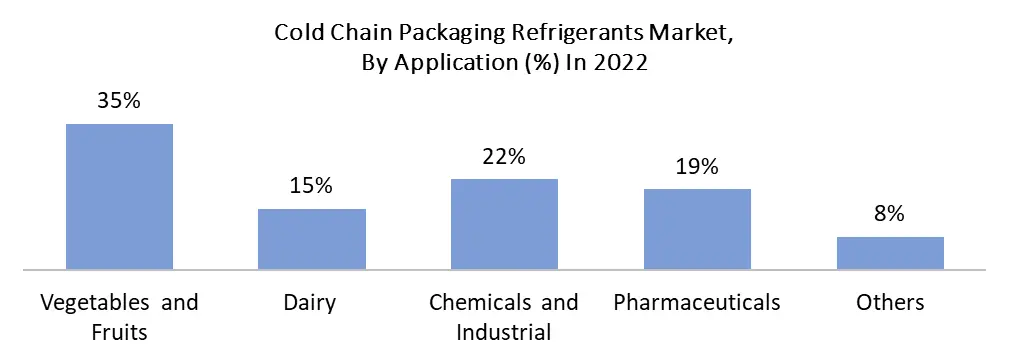

Based on Type, the Gel pack segment dominated the market share in 2022 and is expected to dominate the Cold Chain Packaging Refrigerants Market during the forecast period, as they are widely used in cold chain logistics due to their flexibility, ease of use, and ability to conform to different packaging shapes. They provide efficient cooling and are commonly used for short to medium-duration shipments. The foam bricks segment is the fast-growing segment due to their easy-to-use properties such as being lightweight and easy to handle. bricks offer excellent insulation properties, helping to maintain the desired temperature for extended periods. They are commonly used for longer-duration shipments, where temperature stability is critical. Several types of refrigerants and insulation materials may not fall specifically under gel packs or foam bricks. Examples include phase change materials (PCMs), dry ice, and liquid nitrogen. PCMs absorb and release thermal energy during phase transitions and provide consistent temperature control. Dry ice is commonly used for ultra-low temperature applications, and liquid nitrogen is used for maintaining sub-zero temperatures during transportation. Gel packs are versatile and easy to use, suitable for shorter-duration shipments, while foam bricks offer superior insulation and are ideal for longer-duration shipments.Based on the Application, the food and beverage segment dominated the cold chain packaging refrigerants market in 2022. Cold chain packaging refrigerants play a crucial role in preventing spoilage, extending shelf life, and ensuring food safety throughout the supply chain. The pharmaceutical segment is expected to grow rapidly during the forecast period and represents over one-fourth of the cold chain packaging refrigerant market. The increasing trade of medicines, vaccines, and other medical drugs contributes to this growth. Cold chain packaging refrigerants are essential for maintaining the required temperature range during the transportation of pharmaceutical products, preserving their potency and effectiveness. The industrial segment, accounting for around one-seventh of the global market, relies on cold chain packaging refrigerants for transporting temperature-sensitive chemicals, raw materials, and industrial products. These refrigerants play a critical role in maintaining the stability and integrity of these substances, safeguarding their usability and effectiveness. By mitigating the risk of degradation, chemical reactions, and loss of product quality caused by temperature fluctuations, cold chain packaging refrigerants ensure the safe transport of industrial goods.

Cold Chain Packaging Refrigerants Market Regional Insights:

Asia Pacific region dominated the global Cold Chain Packaging Refrigerants market with the largest share during the forecast period. The rising biopharmaceutical industry in developing countries such as India, China, Japan, and South Korea is driving the growth of this region. Efficient management and distribution of food and pharmaceutical products will play a crucial role in shaping the market landscape in the Asia Pacific. For example, China's investment in a cold chain logistics network and related infrastructure demonstrates the country's commitment to fulfilling its domestic food and healthcare demands. In North America, the market for cold chain packaging refrigerants experienced rapid growth, fueled by the rising demand for temperature-sensitive and perishable food products. Consumers in this region shifted away from highly processed and unhealthy foods towards fresher options, necessitating a robust cold supply chain with advanced technology. To meet this demand, industry players launched new transport facilities, such as A.P. Moller-Maersk's acquisition of eight electric trucks from Volvo for food and product distribution in Southern California. France emerged as a significant market for cold chain packaging, leveraging its strong presence of pharmaceutical companies and an extensive transportation network. The country housed renowned pharmaceutical giants and boasted the second-largest railway network in Europe, facilitating efficient domestic and international transportation of temperature-sensitive products through its 12 international airports, including Paris Charles de Gaulle. South Africa witnessed increased demand for cold chain packaging refrigerants facilities driven by a growing middle class and the need to store perishable goods and pharmaceuticals. The country housed a significant portion of the continent's cold storage capacity, offering diverse options for both positive (fresh fruit and vegetables) and negative (fish and meat) storage. Investments were made to establish large-scale cold storage facilities, including a warehouse covering 25,500 square meters, which became one of Africa's largest cold storage facilities.Competitive Landscape: The cold chain packaging refrigerants market is highly competitive, with several players operating globally. These companies provide various refrigerant solutions and strive to innovate and meet the specific needs of industries such as food and beverages, pharmaceuticals, chemicals, and more. Aegis Packaging, based in Singapore, specializes in providing cold chain packaging solutions including gel packs, foam bricks, and insulated containers. American Aerogel Corporation, headquartered in the United States, excels in advanced insulation materials for cold chain packaging with its exceptional thermal performance aerogel-based products. Blowkings, based in India, manufactures and supplies cold chain packaging refrigerants like gel packs and ice packs, serving industries such as pharmaceuticals and food. Cold Box, located in South Africa, offers a comprehensive range of temperature-controlled packaging solutions such as insulated containers, pallet shippers, and temperature monitoring devices. Cold Chain Technologies, based in the United States, is a major player, providing a wide range of insulated shipping containers, phase change materials, and thermal blankets. Cold Ice Inc., also based in the United States, specializes in manufacturing gel packs, ice packs, and other refrigerants for cold chain packaging. Cool Sarvam, headquartered in India, focuses on providing reliable and efficient temperature control through insulated boxes, pouches, and gel packs.

Cold Chain Packaging Refrigerants Market Scope: Inquire Before Buying

Global Cold Chain Packaging Refrigerants Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 1.39 Bn. Forecast Period 2023 to 2029 CAGR: 7.9% Market Size in 2029: US $ 2.37 Bn. Segments Covered: by Type Gel Packs Foam Bricks Others by Service Storage Transport by Application Pharmaceuticals Food & Beverages Chemicals and Industrial Others Cold Chain Packaging Refrigerants Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Cold Chain Packaging Refrigerants Market, Key Players are

1. American Aerogel Corporation 2. Blowkings 3. Cold Chain Technologies 4. Cold Ice Inc. 5. Coolways 6. Creative Packaging Company 7. Cryolux America 8. Cryopak 9. CryoStore 10. Nordic Cold Chain Solutions 11. Pelton Shepherd Industries 12. Sancell 13. Sofrigam 14. Sonoco Thermosafe 15. Tempack 16. TempAidFrequently Asked Questions:

1] What segments are covered in the Global Market report? Ans. The segments covered in the Market report are based on Type, Service, Application and Region. 2] Which region is expected to hold the highest share of the Global Market? Ans. The Asia Pacific region is expected to hold the highest share of the Market. 3] What is the market size of the Global Market by 2029? Ans. The market size of the Market by 2029 is expected to reach US$ 2.37 Bn. 4] What is the forecast period for the Global Market? Ans. The forecast period for the Market is 2022-2029. 5] What was the market size of the Global Market in 2022? Ans. The market size of the Market in 2022 was valued at US$ 1.39 Bn.

1. Cold Chain Packaging Refrigerants Market: Research Methodology 2. Cold Chain Packaging Refrigerants Market: Executive Summary 3. Cold Chain Packaging Refrigerants Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Cold Chain Packaging Refrigerants Market: Dynamics 4.1. Market Trends by region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Cold Chain Packaging Refrigerants Market: Segmentation (by Value USD and Volume Units) 5.1. Cold Chain Packaging Refrigerants Market, by Type (2022-2029) 5.1.1. Gel Packs 5.1.2. Foam Bricks 5.1.3. Others 5.2. Cold Chain Packaging Refrigerants Market, by Service (2022-2029) 5.2.1. Storage 5.2.2. Transport 5.3. Cold Chain Packaging Refrigerants Market, by Application (2022-2029) 5.3.1. Pharmaceuticals 5.3.2. Food & Beverages 5.3.3. Chemicals and Industrial 5.3.4. Others 5.4. Cold Chain Packaging Refrigerants Market, by Region (2022-2029) 5.4.1. North America 5.4.2. Europe 5.4.3. Asia Pacific 5.4.4. Middle East and Africa 5.4.5. South America 6. North America Cold Chain Packaging Refrigerants Market (by Value USD and Volume Units) 6.1. North America Cold Chain Packaging Refrigerants Market, by Type (2022-2029) 6.1.1. Gel Packs 6.1.2. Foam Bricks 6.1.3. Others 6.2. North America Cold Chain Packaging Refrigerants Market, by Service (2022-2029) 6.2.1. Storage 6.2.2. Transport 6.3. North America Cold Chain Packaging Refrigerants Market, by Application (2022-2029) 6.3.1. Pharmaceuticals 6.3.2. Food & Beverages 6.3.3. Chemicals and Industrial 6.3.4. Others 6.4. North America Cold Chain Packaging Refrigerants Market, by End User (2022-2029) 6.4.1. Consumer Electronics 6.4.2. Communication And Technology 6.4.3. Automotive 6.4.4. Energy And Power 6.4.5. Manufacturing 6.5. North America Cold Chain Packaging Refrigerants Market, by Country (2022-2029) 6.5.1. United States 6.5.2. Canada 6.5.3. Mexico 7. Europe Cold Chain Packaging Refrigerants Market (by Value USD and Volume Units) 7.1. Europe Cold Chain Packaging Refrigerants Market, by Type (2022-2029) 7.2. Europe Cold Chain Packaging Refrigerants Market, by Service (2022-2029) 7.3. Europe Cold Chain Packaging Refrigerants Market, by Application (2022-2029) 7.4. Europe Cold Chain Packaging Refrigerants Market, by Country (2022-2029) 7.4.1. UK 7.4.2. France 7.4.3. Germany 7.4.4. Italy 7.4.5. Spain 7.4.6. Sweden 7.4.7. Austria 7.4.8. Rest of Europe 8. Asia Pacific Cold Chain Packaging Refrigerants Market (by Value USD and Volume Units) 8.1. Asia Pacific Cold Chain Packaging Refrigerants Market, by Type (2022-2029) 8.2. Asia Pacific Cold Chain Packaging Refrigerants Market, by Service (2022-2029) 8.3. Asia Pacific Cold Chain Packaging Refrigerants Market, by Application (2022-2029) 8.4. Asia Pacific Cold Chain Packaging Refrigerants Market, by Country (2022-2029) 8.4.1. China 8.4.2. S Korea 8.4.3. Japan 8.4.4. India 8.4.5. Australia 8.4.6. Indonesia 8.4.7. Malaysia 8.4.8. Vietnam 8.4.9. Taiwan 8.4.10. Bangladesh 8.4.11. Pakistan 8.4.12. Rest of Asia Pacific 9. Middle East and Africa Cold Chain Packaging Refrigerants Market (by Value USD and Volume Units) 9.1. Middle East and Africa Cold Chain Packaging Refrigerants Market, by Type (2022-2029) 9.2. Middle East and Africa Cold Chain Packaging Refrigerants Market, by Service (2022-2029) 9.3. Middle East and Africa Cold Chain Packaging Refrigerants Market, by Application (2022-2029) 9.4. Middle East and Africa Cold Chain Packaging Refrigerants Market, by Country (2022-2029) 9.4.1. South Africa 9.4.2. GCC 9.4.3. Egypt 9.4.4. Nigeria 9.4.5. Rest of ME&A 10. South America Cold Chain Packaging Refrigerants Market (by Value USD and Volume Units) 10.1. South America Cold Chain Packaging Refrigerants Market, by Type (2022-2029) 10.2. South America Cold Chain Packaging Refrigerants Market, by Service (2022-2029) 10.3. South America Cold Chain Packaging Refrigerants Market, by Application (2022-2029) 10.4. South America Cold Chain Packaging Refrigerants Market, by Country (2022-2029) 10.4.1. Brazil 10.4.2. Argentina 10.4.3. Rest of South America 11. Company Profile: Key players 11.1. Aegis Packaging (Singapore) 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. American Aerogel Corporation (United States) 11.3. Blowkings (India) 11.4. Cold Box (South Africa) 11.5. Cold Chain Technologies (USA) 11.6. Cold Ice Inc. (United States) 11.7. Cool Sarvam (India) 11.8. Coolways (The Netherlands) 11.9. Creative Packaging Company (USA) 11.10. Cryolux America (USA) 11.11. Cryopak (USA) 11.12. CryoStore (Canada) 11.13. Nordic Cold Chain Solutions (USA) 11.14. Pelton Shepherd Industries (USA) 11.15. Sancell (Australia) 11.16. Sofrigam (France) 11.17. Sonoco Thermosafe (USA) 11.18. Tempack (Spain) 11.19. The pack (USA) 11.20. TempAid 12. Key Findings 13. Industry Recommendation