Coffee Machine Market is worth USD 5.13 Billion in 2023 and is estimated to grow at a CAGR of 7.35% in the forecast period. The forecast revenue hints at around 9.31 billion USD growth by 2030. The coffee machine has been used in various households for different reasons. Coffee Machines thus have become a common application in brewing coffee. The market offers a wide range of coffee machines catering to different needs and preferences. Some popular types include espresso machines, drip brewers, single-serve machines, French press machines, and bean-to-cup machines. Such varieties have helped the market sustain and grow in this competitive world. The use of technology has been the key to success. Features like programmable settings, smart connectivity, built-in grinders, and milk frothers are increasingly incorporated into coffee machines and have enhanced user experience and coffee quality. The efficiency and feasibility of the machine has been its main USP. Home coffee machines offer a range of brewing options, allowing users to prepare their preferred coffee beverages such as espresso, cappuccino, latte, or a simple cup of drip coffee, while Coffee machines are also found in offices and workplaces to provide employees with a convenient and readily available source of coffee. They boost productivity and also provide a social gathering space. Right from homes to speciality stores all have the access to coffee machines, which makes the market a huge prospect for many brands.To know about the Research Methodology :- Request Free Sample Report The coffee machine market is highly competitive, with several prominent players vying for market share. Companies like De'Longhi, Breville, Keurig Dr Pepper, JURA Elektroapparate, and Nestlé (Nespresso) are among the key players in the industry. Europe has been leading the market share as many European countries have their staple drinks as coffee. Also, this high consumption has given rise to higher demand which has caused many more opportunities is coffee machine market. Increasing Demand for Coffee Has Driven the Growth in Coffee Machine Market One of the major reasons for this growth has been increasing demand. Coffee machines are in high demand due to the growing popularity of speciality and gourmet coffee. The International Coffee Organization (ICO) anticipated worldwide coffee consumption in 2023/22 at 170.3 million 60-kilogram bags, which is 3.3% over the previous year. This rise is not just related to taste, but also a culture is involved in this increasing demand. Coffee culture is a term that refers to the social and cultural aspects of coffee drinking. Coffee enthusiasts seek machines that allow them to explore different brewing techniques and experiment with Flavors. Thus, coffee culture is becoming increasingly popular around the world, and it is driving the increasing coffee consumption. Coffee machines are also handy, feasible and affordable which makes it a popular choice amongst coffee lovers. Consumers appreciate the ability to brew coffee quickly and easily at home or in the workplace. The desire for hassle-free brewing without compromising on taste has propelled the demand for coffee machines. Increasing stress and workloads have also played part in increasing sales of coffee machines. Nowadays the availability of such machines is universal which makes the distribution channels broader and feasible for consumers. The availability of coffee machines through various distribution channels, including online platforms, specialty stores, supermarkets, and home appliance retailers, has been the reason for this growth. Competition Becoming a Huge Challenge in the Coffee Machine Market One of the major challenges the coffee machine market faces is its competition. As the machines lack complexity, many players can gain traction by copying the designs. Also, startups and niche brands have been entering the coffee machine market, offering unique value propositions and targeting specific consumer segments. These companies have promoted a new focus on specialty coffee, sustainability, or innovative brewing methods which has directly affected the traditional coffee machines market. In specific regions or markets, regional and local coffee machine manufacturers can pose challenges to international players. These competitors understand local preferences and have a better grasp of the regional market dynamics, enabling them to offer tailored products and gain a competitive advantage. Vertical Integration by coffee companies have also constricted the market share of coffee machine companies. Some coffee companies have ventured into the coffee machine market like Nespresso, leveraging their brand recognition and expertise in coffee. By offering coffee machines alongside their coffee products, these brands create an ecosystem to churn out more profits from the business. Alternative Brewing Methods have also hampered While traditional coffee machines dominate the market, alternative brewing methods like pour-over, cold brew, and AeroPress have gained popularity. These methods require different equipment and offer unique flavor profiles, challenging the dominance of conventional coffee machines. Innovation Is the Key to Every Successful Trend in Coffee Machine Market The growing popularity of specialty coffee has influenced the coffee machine market immensely. Consumers are seeking machines that can brew high-quality specialty coffee beverages like single-origin espresso. Coffee machines with precise temperature control, pressure profiling, and adjustable brewing parameters cater to this trend which would eventually become a huge segment in this market. Technology has governed many trends in many industries, so is with Coffee machine market. Smart and Connected Coffee Machines are recognized as revolutionary in coffee business. The integration of smart technology and connectivity features is a prominent trend in the coffee machine market. Smart coffee machines can be controlled remotely through mobile apps, allowing users to customize brewing settings, schedule brew times, and receive notifications. Voice command functionality and compatibility with virtual assistants further enhance user convenience. Not just on technology, but also new and fresh designs have become a new trend. Compact coffee machines designed for small kitchens, offices, or travel purposes are gaining popularity. These machines have smaller footprint while maintaining functionality and brewing quality. Portable coffee machines, including handheld espresso makers and travel-sized brewers have been emerging products in this industry. Coffee machines with built-in grinders are gaining popularity, especially among coffee enthusiasts who prefer freshly ground coffee. These machines eliminate the need for a separate grinder, ensuring optimal freshness and flavour. Adjustable grind settings cater to different brewing methods and coffee preferences. Environmental sustainability has become a significant concern for consumers. Coffee machine manufacturers are increasingly incorporating eco-friendly features such as energy-efficient brewing processes, recyclable materials, and reusable coffee capsules. Some machines also offer options for using organic and fair-trade coffee beans, appealing to environmentally conscious consumers. Thus, this has become an attraction for environmental lovers. Nowadays coffee machine companies are expanding their opportunities by adding new functionalities in coffee machine market. Some machines incorporate features like milk frothers for creating specialty coffee beverages and hot water dispensers for tea.

Coffee Machine Market Segmentation

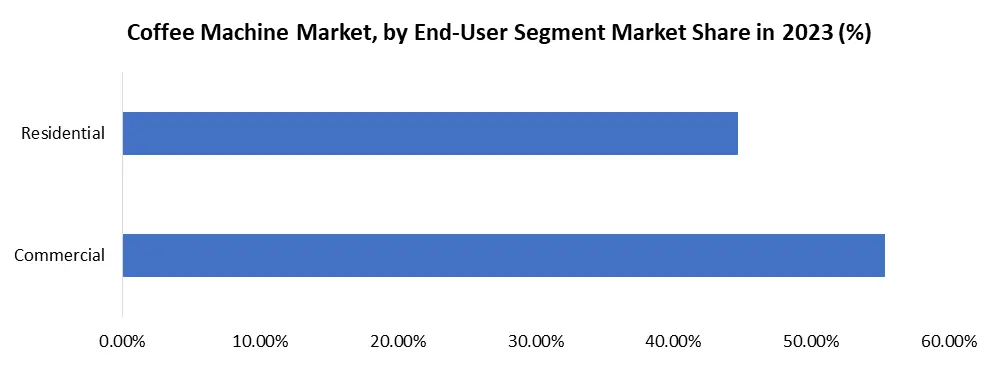

By Type: The Coffee Machine Market exhibits a diverse array of types catering to varying consumer preferences. Drip/Filter coffee machines offer a classic and convenient brewing method, suitable for a large volume of coffee, making them popular in households and offices. Pod/Capsule machines provide a quick and hassle-free brewing experience with pre-packaged coffee pods, appealing to those who value convenience and a variety of flavors. Espresso machines, known for their ability to produce strong and concentrated coffee, are favored by coffee enthusiasts seeking a rich and bold flavor profile. Bean-to-cup machines offer the ultimate freshness by grinding coffee beans on demand, providing a customizable and premium brewing experience. This segmentation ensures that the Coffee Machine Market accommodates a wide spectrum of consumer preferences and brewing styles. By End-Use: The Coffee Machine Market is further segmented based on end-use, primarily distinguishing between Commercial and Residential applications. In the Commercial sector, coffee machines are designed to meet the demands of cafes, restaurants, offices, and other hospitality establishments, focusing on durability, efficiency, and often incorporating advanced features to handle high-volume brewing. The Residential segment, on the other hand, caters to the needs of individual households, emphasizing user-friendly designs, compact sizes, and diverse brewing options to suit personal preferences. This segmentation recognizes the distinct requirements of different settings, ensuring that coffee machines are tailored to deliver optimal performance and convenience in both commercial and residential environments.

Coffee Machine Market Segmentation, by region

Europe is the leading market in the coffee machine market. It dominates nearly 35% of the market and is one of the largest coffee-consuming regions. Major coffee markets include Italy, Germany, France, the United Kingdom, Spain, and the Nordic countries. Instant coffee offers convenience and remains a staple in many households and offices across Europe. North America is the 2nd largest market share holder of the coffee machine market. The market is characterized by a preference for convenience, single-serve machines, and specialty coffee. Technological advancements, smart features, and sustainability have played a huge role in this market. Asia Pacific is the fastest-growing market. The market is influenced by a rising middle class and the adoption of Western coffee culture. The demand for premium espresso machines and single-serve brewers is increasing in this region which has been a huge positive for the industry. Latin America is renowned for its coffee production, and countries like Brazil and Colombia play a significant role in the global coffee industry. The coffee machine market in this region is heavily influenced by its domestic use. The Middle East and Africa region has a unique coffee culture, with a strong preference for traditional Arabic coffee preparations like Turkish coffee and Qahwa. Middle East is an emerging market and has huge potential in the future. Competitive Landscape The coffee machine market is a competitive market with many players providing more or less a similar output. New inventions like Keurig which uses artificial intelligence to personalize the brewing settings for each K-Cup pod and Miele CM 3600, is a high-end coffee machine that features a milk frother that can create microfoam. Thus, such innovations have given companies a competitive edge. Some prominent companies in the market have expanded from coffee-to-coffee machines and one such example is Nestle’s Nespresso which is one of leading player in the market. Nespresso offers a range of single-serve coffee machines and coffee capsules, known for their convenience and quality. De'Longhi is a well-known Italian manufacturer of coffee machines, including espresso machines, drip brewers, and specialty coffee machines. It holds a huge majority share in Italy and worldwide. WMF Group, a German company, offers a wide range of coffee machines for both commercial and residential use. Their product portfolio includes traditional espresso machines, fully automatic machines, and specialty coffee systems. Breville is an Australian manufacturer known for its high-quality coffee machines and has invested heavily in innovation and user-friendly features. JURA is a Swiss company specializing in premium fully automatic coffee machines. The brand is renowned for its precision, craftsmanship, and advanced brewing technologies.Coffee Machine Market Scope: Inquire before buying

Global Coffee Machine Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 5.13 Bn. Forecast Period 2024 to 2030 CAGR: 7.35% Market Size in 2030: US $ 9.31 Bn. Segments Covered: by Type Drip/Filter Pod/Capsule Espresso Bean-to-Cup by End Use Commercial Residential Coffee Machine Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Coffee Machine Key Players:

1. Nestlé SA (Switzerland) 2. De'Longhi Group (Italy) 3. Breville Group Limited (Australia) 4. JURA Elektroapparate AG (Switzerland) 5. WMF Group GmbH (Germany) 6. Philips (Netherlands) 7. Technivorm (Netherlands) 8. Crem International AB (Sweden) 9. Melitta Group (Germany) 10. Schaerer Ltd. (Switzerland) 11. Franke Coffee Systems (Switzerland) 12. La Marzocco International LLC (Italy) 13. Nuova Simonelli S.p.A. (Italy) 14. Elektra srl (Italy) 15. Gaggia Milano (Italy) 16. Smeg (Italy) 17. Rocket Espresso Milano (Italy) 18. Bezzera S.r.l. (Italy) 19. Faema S.p.A. (Italy) 20. La Pavoni (Italy) 21. Rancilio Group S.p.A. (Italy) 22. Mazzer Luigi S.r.l. (Italy) 23. Hamilton Beach Brands Holding Company (United States) 24. Keurig Dr Pepper Inc. (United States) 25. Wilbur Curtis Company (United States) FAQ Q.1) What is the CAGR of Coffee Machine Market? Ans: The CAGR for Coffee Machine Market is 7.35%. Q.2) Which are the leading companies in the Coffee Machine Market? Ans: Nestle and Phillips are some of the leading companies in the Coffee Machine Market. Q.3) Which region shows maximum potential in the Coffee Machine Market? Ans: Asia Pacific is expected to grow exponentially and is likely to dominate the Coffee Machine Market in the future. Q,4) Which is the leading region in the Coffee Machine Market? Ans: Europe leads the market of Coffee Machine Market significantly. Q.5) What was the forecast period of this report? Ans: The forecasted period for the Coffee Machine Market research was 2023 – 2030.

1. Coffee Machine Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Coffee Machine Market: Dynamics 2.1. Coffee Machine Market Trends by Region 2.1.1. North America Coffee Machine Market Trends 2.1.2. Europe Coffee Machine Market Trends 2.1.3. Asia Pacific Coffee Machine Market Trends 2.1.4. Middle East and Africa Coffee Machine Market Trends 2.1.5. South America Coffee Machine Market Trends 2.2. Coffee Machine Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Coffee Machine Market Drivers 2.2.1.2. North America Coffee Machine Market Restraints 2.2.1.3. North America Coffee Machine Market Opportunities 2.2.1.4. North America Coffee Machine Market Challenges 2.2.2. Europe 2.2.2.1. Europe Coffee Machine Market Drivers 2.2.2.2. Europe Coffee Machine Market Restraints 2.2.2.3. Europe Coffee Machine Market Opportunities 2.2.2.4. Europe Coffee Machine Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Coffee Machine Market Drivers 2.2.3.2. Asia Pacific Coffee Machine Market Restraints 2.2.3.3. Asia Pacific Coffee Machine Market Opportunities 2.2.3.4. Asia Pacific Coffee Machine Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Coffee Machine Market Drivers 2.2.4.2. Middle East and Africa Coffee Machine Market Restraints 2.2.4.3. Middle East and Africa Coffee Machine Market Opportunities 2.2.4.4. Middle East and Africa Coffee Machine Market Challenges 2.2.5. South America 2.2.5.1. South America Coffee Machine Market Drivers 2.2.5.2. South America Coffee Machine Market Restraints 2.2.5.3. South America Coffee Machine Market Opportunities 2.2.5.4. South America Coffee Machine Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Coffee Machine Industry 2.8. Analysis of Government Schemes and Initiatives For Coffee Machine Industry 2.9. Coffee Machine Market Trade Analysis 2.10. The Global Pandemic Impact on Coffee Machine Market 3. Coffee Machine Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Coffee Machine Market Size and Forecast, by Type (2023-2030) 3.1.1. Drip/Filter 3.1.2. Pod/Capsule 3.1.3. Espresso 3.1.4. Bean-to-Cup 3.2. Coffee Machine Market Size and Forecast, by End User (2023-2030) 3.2.1. Commercial 3.2.2. Residential 3.3. Coffee Machine Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Coffee Machine Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Coffee Machine Market Size and Forecast, by Type (2023-2030) 4.1.1. Drip/Filter 4.1.2. Pod/Capsule 4.1.3. Espresso 4.1.4. Bean-to-Cup 4.2. North America Coffee Machine Market Size and Forecast, by End User (2023-2030) 4.2.1. Commercial 4.2.2. Residential 4.3. North America Coffee Machine Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Coffee Machine Market Size and Forecast, by Type (2023-2030) 4.3.1.1.1. Drip/Filter 4.3.1.1.2. Pod/Capsule 4.3.1.1.3. Espresso 4.3.1.1.4. Bean-to-Cup 4.3.1.2. United States Coffee Machine Market Size and Forecast, by End User (2023-2030) 4.3.1.2.1. Commercial 4.3.1.2.2. Residential 4.3.2. Canada 4.3.2.1. Canada Coffee Machine Market Size and Forecast, by Type (2023-2030) 4.3.2.1.1. Drip/Filter 4.3.2.1.2. Pod/Capsule 4.3.2.1.3. Espresso 4.3.2.1.4. Bean-to-Cup 4.3.2.2. Canada Coffee Machine Market Size and Forecast, by End User (2023-2030) 4.3.2.2.1. Commercial 4.3.2.2.2. Residential 4.3.3. Mexico 4.3.3.1. Mexico Coffee Machine Market Size and Forecast, by Type (2023-2030) 4.3.3.1.1. Drip/Filter 4.3.3.1.2. Pod/Capsule 4.3.3.1.3. Espresso 4.3.3.1.4. Bean-to-Cup 4.3.3.2. Mexico Coffee Machine Market Size and Forecast, by End User (2023-2030) 4.3.3.2.1. Commercial 4.3.3.2.2. Residential 5. Europe Coffee Machine Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Coffee Machine Market Size and Forecast, by Type (2023-2030) 5.2. Europe Coffee Machine Market Size and Forecast, by End User (2023-2030) 5.3. Europe Coffee Machine Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Coffee Machine Market Size and Forecast, by Type (2023-2030) 5.3.1.2. United Kingdom Coffee Machine Market Size and Forecast, by End User (2023-2030) 5.3.2. France 5.3.2.1. France Coffee Machine Market Size and Forecast, by Type (2023-2030) 5.3.2.2. France Coffee Machine Market Size and Forecast, by End User (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Coffee Machine Market Size and Forecast, by Type (2023-2030) 5.3.3.2. Germany Coffee Machine Market Size and Forecast, by End User (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Coffee Machine Market Size and Forecast, by Type (2023-2030) 5.3.4.2. Italy Coffee Machine Market Size and Forecast, by End User (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Coffee Machine Market Size and Forecast, by Type (2023-2030) 5.3.5.2. Spain Coffee Machine Market Size and Forecast, by End User (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Coffee Machine Market Size and Forecast, by Type (2023-2030) 5.3.6.2. Sweden Coffee Machine Market Size and Forecast, by End User (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Coffee Machine Market Size and Forecast, by Type (2023-2030) 5.3.7.2. Austria Coffee Machine Market Size and Forecast, by End User (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Coffee Machine Market Size and Forecast, by Type (2023-2030) 5.3.8.2. Rest of Europe Coffee Machine Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Coffee Machine Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Coffee Machine Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Coffee Machine Market Size and Forecast, by End User (2023-2030) 6.3. Asia Pacific Coffee Machine Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Coffee Machine Market Size and Forecast, by Type (2023-2030) 6.3.1.2. China Coffee Machine Market Size and Forecast, by End User (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Coffee Machine Market Size and Forecast, by Type (2023-2030) 6.3.2.2. S Korea Coffee Machine Market Size and Forecast, by End User (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Coffee Machine Market Size and Forecast, by Type (2023-2030) 6.3.3.2. Japan Coffee Machine Market Size and Forecast, by End User (2023-2030) 6.3.4. India 6.3.4.1. India Coffee Machine Market Size and Forecast, by Type (2023-2030) 6.3.4.2. India Coffee Machine Market Size and Forecast, by End User (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Coffee Machine Market Size and Forecast, by Type (2023-2030) 6.3.5.2. Australia Coffee Machine Market Size and Forecast, by End User (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Coffee Machine Market Size and Forecast, by Type (2023-2030) 6.3.6.2. Indonesia Coffee Machine Market Size and Forecast, by End User (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Coffee Machine Market Size and Forecast, by Type (2023-2030) 6.3.7.2. Malaysia Coffee Machine Market Size and Forecast, by End User (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Coffee Machine Market Size and Forecast, by Type (2023-2030) 6.3.8.2. Vietnam Coffee Machine Market Size and Forecast, by End User (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Coffee Machine Market Size and Forecast, by Type (2023-2030) 6.3.9.2. Taiwan Coffee Machine Market Size and Forecast, by End User (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Coffee Machine Market Size and Forecast, by Type (2023-2030) 6.3.10.2. Rest of Asia Pacific Coffee Machine Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Coffee Machine Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Coffee Machine Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Coffee Machine Market Size and Forecast, by End User (2023-2030) 7.3. Middle East and Africa Coffee Machine Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Coffee Machine Market Size and Forecast, by Type (2023-2030) 7.3.1.2. South Africa Coffee Machine Market Size and Forecast, by End User (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Coffee Machine Market Size and Forecast, by Type (2023-2030) 7.3.2.2. GCC Coffee Machine Market Size and Forecast, by End User (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Coffee Machine Market Size and Forecast, by Type (2023-2030) 7.3.3.2. Nigeria Coffee Machine Market Size and Forecast, by End User (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Coffee Machine Market Size and Forecast, by Type (2023-2030) 7.3.4.2. Rest of ME&A Coffee Machine Market Size and Forecast, by End User (2023-2030) 8. South America Coffee Machine Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Coffee Machine Market Size and Forecast, by Type (2023-2030) 8.2. South America Coffee Machine Market Size and Forecast, by End User (2023-2030) 8.3. South America Coffee Machine Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Coffee Machine Market Size and Forecast, by Type (2023-2030) 8.3.1.2. Brazil Coffee Machine Market Size and Forecast, by End User (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Coffee Machine Market Size and Forecast, by Type (2023-2030) 8.3.2.2. Argentina Coffee Machine Market Size and Forecast, by End User (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Coffee Machine Market Size and Forecast, by Type (2023-2030) 8.3.3.2. Rest Of South America Coffee Machine Market Size and Forecast, by End User (2023-2030) 9. Global Coffee Machine Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Coffee Machine Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Nestlé SA (Switzerland) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. De'Longhi Group (Italy) 10.3. Breville Group Limited (Australia) 10.4. JURA Elektroapparate AG (Switzerland) 10.5. WMF Group GmbH (Germany) 10.6. Philips (Netherlands) 10.7. Technivorm (Netherlands) 10.8. Crem International AB (Sweden) 10.9. Melitta Group (Germany) 10.10. Schaerer Ltd. (Switzerland) 10.11. Franke Coffee Systems (Switzerland) 10.12. La Marzocco International LLC (Italy) 10.13. Nuova Simonelli S.p.A. (Italy) 10.14. Elektra srl (Italy) 10.15. Gaggia Milano (Italy) 10.16. Smeg (Italy) 10.17. Rocket Espresso Milano (Italy) 10.18. Bezzera S.r.l. (Italy) 10.19. Faema S.p.A. (Italy) 10.20. La Pavoni (Italy) 10.21. Rancilio Group S.p.A. (Italy) 10.22. Mazzer Luigi S.r.l. (Italy) 10.23. Hamilton Beach Brands Holding Company (United States) 10.24. Keurig Dr Pepper Inc. (United States) 10.25. Wilbur Curtis Company (United States) 11. Key Findings 12. Industry Recommendations 13. Coffee Machine Market: Research Methodology 14. Terms and Glossary