CNC Machine Market was valued at USD 101.01 Bn. in 2023 and it is expected to reach USD 152.9 Bn. by 2030 at a CAGR of 6.1%, throughout the forecast period.CNC Machine Market Overview:

CNC (computer numerical control) is a way of automating machine tool control by using software installed in a microcomputer coupled to the tool. It's often used to machine metal and plastic parts in the manufacturing industry. The machine control unit (MCU), a microcontroller linked to the machine, stores and executes a bespoke computer programme for each object to be made, which is commonly written in an international standard language called G-code. The programme specifies the instructions and parameters that will be followed by the machine tool, such as the material feed rate and the location and speed of the tool's components. CNC can automate the operations of mills, lathes, routers, grinders, and lasers, among other machine equipment. Non-machine tools, such as welding, electronic assembly, and filament-winding machines, can also be controlled with it.To know about the Research Methodology :- Request Free Sample Report

CNC Machine Market Dynamics:

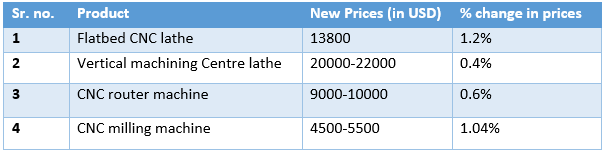

Engineers produce a computer-aided design (CAD) drawing of the part to be made early in the process, then convert the drawing to G-code. To confirm appropriate positioning and performance, the software is loaded into the MCU and a human operator does a test run without the raw material in situ. Because wrong speed or location can damage both the machine and the part, this step is critical. CNC machining is thought to provide greater precision, intricacy, and reproducibility than hand machining. Other advantages include increased precision, speed, and flexibility, as well as features like contour machining, which permits cutting of contoured forms, including those protruding from the surface. Some CNC systems include CAD and CAM software, which can help speed up the MCU programming process. Integration with ERP software and related applications, such as enterprise asset management software, can help improve plant performance and maintenance by facilitating operational intelligence operations. According to Machine tool Manufacturers Association stats, CNC machine penetration is increased by 7% Y-O-Y from 2018 owing to adherence of automation in various end use verticals across the globe and rising demand for smart manufacturing across the globe. End-use industries like automotive, manufacturing, and power & energy are focused on current technical advances in the field of CNC software to improve machine interaction with operators and shop floor flexibility. Machine learning and the Internet of Things (IoT) have led in the introduction of new features, such as an application that tells operators/supervisors on their cell phones or PCs about the state of a machine. Furthermore, the technologies utilised in CNC machines reduce the time required to manufacture work pieces as well as the possibility of errors. Because of their capacity to produce high-precision parts and components, CNC systems are increasingly being used in mass production plants. Furthermore, the diverse range of techniques utilised in CNC to generate standardised parts through machine tools, such as CAD and CAM, are totally interchangeable. Furthermore, the use of CNC in manufacturing plants has a direct impact on cost reduction, as well as a significant increase in productivity and final product quality. As a result, all of CNC's capabilities impact the expansion of end-user industry verticals like automobiles, aircraft, and military, which, in turn, boost demand for CNC machines in mass production. Power generating also makes extensive use of CNC machines, as this process necessitates a high level of automation. Furthermore, the sector's use of bespoke parts and vital components makes it solutions that the industry is turning to in order to reduce and mitigate any breakdown situations. CNC has recently become increasingly important in the automotive industry. CNC tools and machines are entirely responsible for a huge number of elements seen in modern cars, ranging from die-casting similar components to creating unibody frames. CNC Machine Price range, by product range available:

CNC Machine Market Segment Analysis:

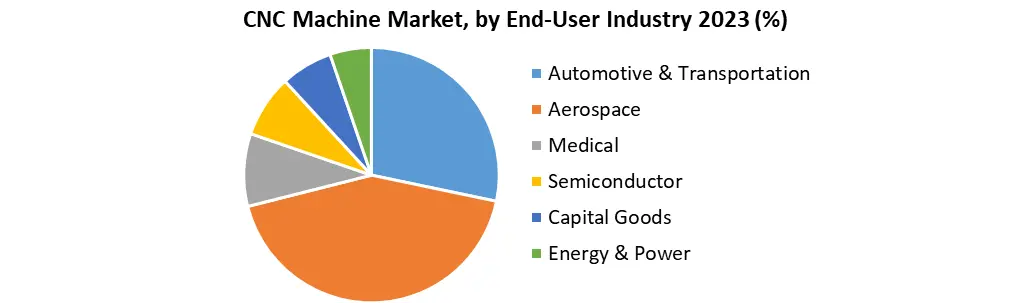

Lathe Machine Segment is expected to dominate the market: In 2023, the lathe machines segment had the biggest revenue share of over 28%, and this trend is expected to continue throughout the forecast period. Five- and six-axis lathes, for example, may perform operations from both ends and can be utilized to make fine cuts and provide a higher finish. Benefits like as ease of use and a wide range of applications are leading to greater acceptance around the world. The laser machines segment is expected to expand in popularity during the projected period, owing to rising demand for faster machining and a lower worker requirement. Furthermore, demand for CNC laser machines is expected to rise due to rising demand for automated metal cutting operations and increased adoption of digitalization in manufacturing processes to develop components and products with complicated geometry over the forecast period. Automotive sector - new opportunities for prominent players: The vehicle segment would have the greatest CAGR of 7.9% during the forecast period, according to Industry Vertical Assessment. The demand for CNC machines is predicted to rise as the global demand for automobiles rises, as well as the mass production of high-quality parts. Furthermore, CNC machines ensure that the parts developed are of the highest quality and precision, pushing automotive suppliers to use cutting-edge technology to produce a wide range of automobile parts in the time allotted. Because these machines are managed by electronic numerical control, errors in the production line are greatly reduced, which is predicted to provide a lucrative opportunity for this area. Moreover, to achieve the correct cuts on the gear blank, the methods required for efficient gear production include the use of several instruments. CNC machining integrates the use of various tools into a single cell that the CNC machine may draw from automatically. CNC machines can move in several axes, both horizontally and longitudinally, as well as rotationally, whereas traditional machines can only move in one or two. The more sophisticated CNC machines' multi-axis capability allowed operators to flip portions of the gear over while cutting on all sides without the need for human involvement.

CNC Machine market trends:

1. Increasing trend of manufacturing as a service: Manufacturing as a service (MaaS) has made inroads into the CNC sector in recent years, and this trend will continue in 2024. Manufacturing as a service (MaaS) is accomplished through the use of networked resources. The expense of maintaining and operating the CNC equipment is shared among the service's subscribers. MaaS allows businesses to be more flexible, productive, and cost-effective. Companies will seek out additional supply chain networks via MaaS as a result of COVID-19's impact. Companies will want to avoid the supply chain disruptions that the pandemic caused. Having a larger supply chain network will help them prepare for whatever happens next. 2. Longer machine life with IOT: According to a recent article by Hitachi, IoT adoption has risen this year as a result of increased need caused by social alienation and mask-wearing. During the pandemic, the ability to monitor remotely and use sensors to determine where a machine is in its lifespan became even more important. The application of sensors has expanded as more sensors have been installed on equipment around the machine shop floor. Sensors can now be used in drill presses, milling and turning machines, lathes, and other machinery. These sensors, in turn, continuously monitor the machine's many components, generating a large amount of data. Predictive maintenance can be made easier with this knowledge. As the gears and belts turn, CNC machines, like any other machine, require routine maintenance. Equipment has traditionally been maintained on a regular basis; nevertheless, when an unanticipated failure occurs, a production can be shut down for hours while a specialist is sent in from afar. Some of this downtime can be reduced by using IoT sensors. 3. Digital twinning technology: In 2022, digital twins will become more widespread. Hexagon's Manufacturing Intelligence business introduced upgraded NCSimul Software as the year came to a close. NC Simulation software creates a virtual twin of the real-world machine, allowing it to prevent errors and reduce setup times. This new feature allows machinists to discover and avoid the 5-axis singularity point, allowing NC programming to be optimised. This has never happened before. What is the significance of the CNC machine's ability to avoid the 5-axis singularity point? If the tool vibrates, it may behave in an erratic manner as it approaches the singularity point, leaving chatter marks on the component being made. Creating a flat surface is the first step. 4. Increasing penetration of Multiaxis machines: Factory use of 5-axis machines has become increasingly cost-effective. It is well-known for its ability to rotate smoothly around the X and Y axes. However, in 2021, the 6-axis machine was introduced, which improved efficiency and speed by adding an additional spin around the Z-axis. As a result of the increase, cut times are faster and more items are produced in a shorter amount of time. Cutting time can be reduced by up to 75% with a 6-axis CNC milling machine. 5. Simulation and optimization software: Through simulation, verification, and optimization software, advancements in CNC machinery technology save firms time and money by minimizing scrap and lowering damage to machining centres. Several firms offer these software packages, some with novel and distinctive features, but most with the same basic capabilities. Simulating the machining of a new part, checking tool paths to avoid crashing and accidents, and improving production are all possible with these software tools. These also aid in the elimination of any surprises by enabling for the measurement and analysis of disparities.CNC Machine Market: New business developments:

• FANUC America, a leading manufacturer of CNCs, robots, and ROBOMACHINES, has announced the availability of an upgrade solution for vintage CNC machines running on operating systems prior to Windows 10 in 2020. FANUC CNCs can be retrofitted with the Panel I Replacement Program, which includes a powerful industrial PC with touch or non-touch LCD display, solid-state HDD, and Windows 10 IoT Enterprise. • DMG MORI AKTIENGESELLSCHAFT and Schaeffler AG are deepening their long-standing business partnership once more. DMG MORI got a forward-looking software development order from Schaeffler during the DMG MORI Partner Summit 2021 in Pfronten®. A contract for the digitization of tool production was signed by both companies. DMG MORI and Schaeffler have teamed up to create and deploy a completely new, dynamically integrated manufacturing system at Schaeffler worldwide. • In 2021, Siemens is offering three powerful technology packages exclusively for the CNC Sinumerik® One with the software version NCU-SW 6.14. One Dynamics Operate, One Dynamics 3-axis milling, and One Dynamics 5-axis milling are the three Sinumerik® One Dynamics products available. The technology packages' software functionalities assist customers with everything from machine-oriented programming in the shop through high-performance machining of CAD-CAM-programmed work pieces with excellent surface quality. The objective of the report is to present a comprehensive analysis of the CNC Machine Market to the stakeholders in the industry. The past and current status of the industry with the forecasted Market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include Market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the Market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the CNC Machine Market dynamics, structure by analyzing the Market segments and project the CNC Machine Market size. Clear representation of competitive analysis of key players by Type, price, financial position, Type portfolio, growth strategies, and regional presence in the CNC Machine Market make the report investor’s guide.CNC Machine Market Scope: Inquire before buying

CNC Machine Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2022 Market Size in 2023: US $ 101.01 Bn. Forecast Period 2024 to 2030 CAGR: 6.1% Market Size in 2030: US $ 152.9 Bn. Segments Covered: by Offering Machines Parts & Accessories Services by Product Type Milling Machines Machining Centers Lathe Machines Laser Machines Drilling Machines Grinding Machines Electrical Discharge Machines by End-User Industry Automotive & Transportation Aerospace Medical Semiconductor Capital Goods Energy & Power CNC Machine Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading Manufacturers in the CNC Machine Market are:

1. Doosan Machine Tools Co. Ltd. 2. FANUC Corporation 3. Amada Machine tools Co. Ltd. 4. Yamazaki Mazak Corporation 5. JTEKT Corporation 6. Trumpf 7. Schuler AG 8. Hyundai WIA 9. Mitsubishi Heavy Industries Machine Tools Ltd. 10. Makino 11. MAG IAS GmbH 12. KOMATSU Ltd. 13. XYZ Machine Tools 14. ANCA Group 15. Okuma Corporation 16. SIEMENS 17. HAAS Automation 18. DMG MORIFAQ’S:

1) What was the CNC Machine Market size in 2023? Answer: The CNC Machine Market was valued at 101.01 Bn. in the year 2023. 2) Which product segment is dominating the CNC Machine Market? Answer: Lathe machine segment is dominating the market owing to increasing use of multiaxis tooling in the mechanism by various end users. 3) What are the key players in the CNC Machine Market? Answer: Doosan Machine Tools Co. Ltd., FANUC Corporation, Amada Machine tools Co. Ltd., Yamazaki Mazak Corporation, JTEKT Corporation, Trumpf, Schuler AG, Hyundai WIA, Mitsubishi Heavy Industries Machine Tools Ltd., Makino, MAG IAS GmbH, KOMATSU Ltd., XYZ Machine Tools, ANCA Group, Okuma Corporation, SIEMENS, HAAS Automation, DMG MORI 4) Which factor acts as the driving factor for the growth of the CNC Machine Market? Answer: Advantages of CNC machine including increased precision, speed, and flexibility, as well as features like contour machining, which permits cutting of contoured forms, including those protruding from the surface are the factors driving the market growth. 5) What factors are restraining the growth of the CNC Machine Market? Answer: high cost of maintenance for CNC machines and robots taking place of work force are the restraining factors hampering the market growth.

1. CNC Machine Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. CNC Machine Market: Dynamics 2.1. CNC Machine Market Trends by Region 2.1.1. North America CNC Machine Market Trends 2.1.2. Europe CNC Machine Market Trends 2.1.3. Asia Pacific CNC Machine Market Trends 2.1.4. Middle East and Africa CNC Machine Market Trends 2.1.5. South America CNC Machine Market Trends 2.2. CNC Machine Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America CNC Machine Market Drivers 2.2.1.2. North America CNC Machine Market Restraints 2.2.1.3. North America CNC Machine Market Opportunities 2.2.1.4. North America CNC Machine Market Challenges 2.2.2. Europe 2.2.2.1. Europe CNC Machine Market Drivers 2.2.2.2. Europe CNC Machine Market Restraints 2.2.2.3. Europe CNC Machine Market Opportunities 2.2.2.4. Europe CNC Machine Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific CNC Machine Market Drivers 2.2.3.2. Asia Pacific CNC Machine Market Restraints 2.2.3.3. Asia Pacific CNC Machine Market Opportunities 2.2.3.4. Asia Pacific CNC Machine Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa CNC Machine Market Drivers 2.2.4.2. Middle East and Africa CNC Machine Market Restraints 2.2.4.3. Middle East and Africa CNC Machine Market Opportunities 2.2.4.4. Middle East and Africa CNC Machine Market Challenges 2.2.5. South America 2.2.5.1. South America CNC Machine Market Drivers 2.2.5.2. South America CNC Machine Market Restraints 2.2.5.3. South America CNC Machine Market Opportunities 2.2.5.4. South America CNC Machine Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For CNC Machine Industry 2.8. Analysis of Government Schemes and Initiatives For CNC Machine Industry 2.9. CNC Machine Market Trade Analysis 2.10. The Global Pandemic Impact on CNC Machine Market 3. CNC Machine Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. CNC Machine Market Size and Forecast, by Offering (2023-2030) 3.1.1. Machines 3.1.2. Parts & Accessories 3.1.3. Services 3.2. CNC Machine Market Size and Forecast, by Product Type (2023-2030) 3.2.1. Milling Machines 3.2.2. Machining Centers 3.2.3. Lathe Machines 3.2.4. Laser Machines 3.2.5. Drilling Machines 3.2.6. Grinding Machines 3.2.7. Electrical Discharge Machines 3.3. CNC Machine Market Size and Forecast, by End-User Industry (2023-2030) 3.3.1. Automotive & Transportation 3.3.2. Aerospace 3.3.3. Medical 3.3.4. Semiconductor 3.3.5. Capital Goods 3.3.6. Energy & Power 3.4. CNC Machine Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America CNC Machine Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America CNC Machine Market Size and Forecast, by Offering (2023-2030) 4.1.1. Machines 4.1.2. Parts & Accessories 4.1.3. Services 4.2. North America CNC Machine Market Size and Forecast, by Product Type (2023-2030) 4.2.1. Milling Machines 4.2.2. Machining Centers 4.2.3. Lathe Machines 4.2.4. Laser Machines 4.2.5. Drilling Machines 4.2.6. Grinding Machines 4.2.7. Electrical Discharge Machines 4.3. North America CNC Machine Market Size and Forecast, by End-User Industry (2023-2030) 4.3.1. Automotive & Transportation 4.3.2. Aerospace 4.3.3. Medical 4.3.4. Semiconductor 4.3.5. Capital Goods 4.3.6. Energy & Power 4.4. North America CNC Machine Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States CNC Machine Market Size and Forecast, by Offering (2023-2030) 4.4.1.1.1. Machines 4.4.1.1.2. Parts & Accessories 4.4.1.1.3. Services 4.4.1.2. United States CNC Machine Market Size and Forecast, by Product Type (2023-2030) 4.4.1.2.1. Milling Machines 4.4.1.2.2. Machining Centers 4.4.1.2.3. Lathe Machines 4.4.1.2.4. Laser Machines 4.4.1.2.5. Drilling Machines 4.4.1.2.6. Grinding Machines 4.4.1.2.7. Electrical Discharge Machines 4.4.1.3. United States CNC Machine Market Size and Forecast, by End-User Industry (2023-2030) 4.4.1.3.1. Automotive & Transportation 4.4.1.3.2. Aerospace 4.4.1.3.3. Medical 4.4.1.3.4. Semiconductor 4.4.1.3.5. Capital Goods 4.4.1.3.6. Energy & Power 4.4.2. Canada 4.4.2.1. Canada CNC Machine Market Size and Forecast, by Offering (2023-2030) 4.4.2.1.1. Machines 4.4.2.1.2. Parts & Accessories 4.4.2.1.3. Services 4.4.2.2. Canada CNC Machine Market Size and Forecast, by Product Type (2023-2030) 4.4.2.2.1. Milling Machines 4.4.2.2.2. Machining Centers 4.4.2.2.3. Lathe Machines 4.4.2.2.4. Laser Machines 4.4.2.2.5. Drilling Machines 4.4.2.2.6. Grinding Machines 4.4.2.2.7. Electrical Discharge Machines 4.4.2.3. Canada CNC Machine Market Size and Forecast, by End-User Industry (2023-2030) 4.4.2.3.1. Automotive & Transportation 4.4.2.3.2. Aerospace 4.4.2.3.3. Medical 4.4.2.3.4. Semiconductor 4.4.2.3.5. Capital Goods 4.4.2.3.6. Energy & Power 4.4.3. Mexico 4.4.3.1. Mexico CNC Machine Market Size and Forecast, by Offering (2023-2030) 4.4.3.1.1. Machines 4.4.3.1.2. Parts & Accessories 4.4.3.1.3. Services 4.4.3.2. Mexico CNC Machine Market Size and Forecast, by Product Type (2023-2030) 4.4.3.2.1. Milling Machines 4.4.3.2.2. Machining Centers 4.4.3.2.3. Lathe Machines 4.4.3.2.4. Laser Machines 4.4.3.2.5. Drilling Machines 4.4.3.2.6. Grinding Machines 4.4.3.2.7. Electrical Discharge Machines 4.4.3.3. Mexico CNC Machine Market Size and Forecast, by End-User Industry (2023-2030) 4.4.3.3.1. Automotive & Transportation 4.4.3.3.2. Aerospace 4.4.3.3.3. Medical 4.4.3.3.4. Semiconductor 4.4.3.3.5. Capital Goods 4.4.3.3.6. Energy & Power 5. Europe CNC Machine Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe CNC Machine Market Size and Forecast, by Offering (2023-2030) 5.2. Europe CNC Machine Market Size and Forecast, by Product Type (2023-2030) 5.3. Europe CNC Machine Market Size and Forecast, by End-User Industry (2023-2030) 5.4. Europe CNC Machine Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom CNC Machine Market Size and Forecast, by Offering (2023-2030) 5.4.1.2. United Kingdom CNC Machine Market Size and Forecast, by Product Type (2023-2030) 5.4.1.3. United Kingdom CNC Machine Market Size and Forecast, by End-User Industry (2023-2030) 5.4.2. France 5.4.2.1. France CNC Machine Market Size and Forecast, by Offering (2023-2030) 5.4.2.2. France CNC Machine Market Size and Forecast, by Product Type (2023-2030) 5.4.2.3. France CNC Machine Market Size and Forecast, by End-User Industry (2023-2030) 5.4.3. Germany 5.4.3.1. Germany CNC Machine Market Size and Forecast, by Offering (2023-2030) 5.4.3.2. Germany CNC Machine Market Size and Forecast, by Product Type (2023-2030) 5.4.3.3. Germany CNC Machine Market Size and Forecast, by End-User Industry (2023-2030) 5.4.4. Italy 5.4.4.1. Italy CNC Machine Market Size and Forecast, by Offering (2023-2030) 5.4.4.2. Italy CNC Machine Market Size and Forecast, by Product Type (2023-2030) 5.4.4.3. Italy CNC Machine Market Size and Forecast, by End-User Industry (2023-2030) 5.4.5. Spain 5.4.5.1. Spain CNC Machine Market Size and Forecast, by Offering (2023-2030) 5.4.5.2. Spain CNC Machine Market Size and Forecast, by Product Type (2023-2030) 5.4.5.3. Spain CNC Machine Market Size and Forecast, by End-User Industry (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden CNC Machine Market Size and Forecast, by Offering (2023-2030) 5.4.6.2. Sweden CNC Machine Market Size and Forecast, by Product Type (2023-2030) 5.4.6.3. Sweden CNC Machine Market Size and Forecast, by End-User Industry (2023-2030) 5.4.7. Austria 5.4.7.1. Austria CNC Machine Market Size and Forecast, by Offering (2023-2030) 5.4.7.2. Austria CNC Machine Market Size and Forecast, by Product Type (2023-2030) 5.4.7.3. Austria CNC Machine Market Size and Forecast, by End-User Industry (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe CNC Machine Market Size and Forecast, by Offering (2023-2030) 5.4.8.2. Rest of Europe CNC Machine Market Size and Forecast, by Product Type (2023-2030) 5.4.8.3. Rest of Europe CNC Machine Market Size and Forecast, by End-User Industry (2023-2030) 6. Asia Pacific CNC Machine Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific CNC Machine Market Size and Forecast, by Offering (2023-2030) 6.2. Asia Pacific CNC Machine Market Size and Forecast, by Product Type (2023-2030) 6.3. Asia Pacific CNC Machine Market Size and Forecast, by End-User Industry (2023-2030) 6.4. Asia Pacific CNC Machine Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China CNC Machine Market Size and Forecast, by Offering (2023-2030) 6.4.1.2. China CNC Machine Market Size and Forecast, by Product Type (2023-2030) 6.4.1.3. China CNC Machine Market Size and Forecast, by End-User Industry (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea CNC Machine Market Size and Forecast, by Offering (2023-2030) 6.4.2.2. S Korea CNC Machine Market Size and Forecast, by Product Type (2023-2030) 6.4.2.3. S Korea CNC Machine Market Size and Forecast, by End-User Industry (2023-2030) 6.4.3. Japan 6.4.3.1. Japan CNC Machine Market Size and Forecast, by Offering (2023-2030) 6.4.3.2. Japan CNC Machine Market Size and Forecast, by Product Type (2023-2030) 6.4.3.3. Japan CNC Machine Market Size and Forecast, by End-User Industry (2023-2030) 6.4.4. India 6.4.4.1. India CNC Machine Market Size and Forecast, by Offering (2023-2030) 6.4.4.2. India CNC Machine Market Size and Forecast, by Product Type (2023-2030) 6.4.4.3. India CNC Machine Market Size and Forecast, by End-User Industry (2023-2030) 6.4.5. Australia 6.4.5.1. Australia CNC Machine Market Size and Forecast, by Offering (2023-2030) 6.4.5.2. Australia CNC Machine Market Size and Forecast, by Product Type (2023-2030) 6.4.5.3. Australia CNC Machine Market Size and Forecast, by End-User Industry (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia CNC Machine Market Size and Forecast, by Offering (2023-2030) 6.4.6.2. Indonesia CNC Machine Market Size and Forecast, by Product Type (2023-2030) 6.4.6.3. Indonesia CNC Machine Market Size and Forecast, by End-User Industry (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia CNC Machine Market Size and Forecast, by Offering (2023-2030) 6.4.7.2. Malaysia CNC Machine Market Size and Forecast, by Product Type (2023-2030) 6.4.7.3. Malaysia CNC Machine Market Size and Forecast, by End-User Industry (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam CNC Machine Market Size and Forecast, by Offering (2023-2030) 6.4.8.2. Vietnam CNC Machine Market Size and Forecast, by Product Type (2023-2030) 6.4.8.3. Vietnam CNC Machine Market Size and Forecast, by End-User Industry (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan CNC Machine Market Size and Forecast, by Offering (2023-2030) 6.4.9.2. Taiwan CNC Machine Market Size and Forecast, by Product Type (2023-2030) 6.4.9.3. Taiwan CNC Machine Market Size and Forecast, by End-User Industry (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific CNC Machine Market Size and Forecast, by Offering (2023-2030) 6.4.10.2. Rest of Asia Pacific CNC Machine Market Size and Forecast, by Product Type (2023-2030) 6.4.10.3. Rest of Asia Pacific CNC Machine Market Size and Forecast, by End-User Industry (2023-2030) 7. Middle East and Africa CNC Machine Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa CNC Machine Market Size and Forecast, by Offering (2023-2030) 7.2. Middle East and Africa CNC Machine Market Size and Forecast, by Product Type (2023-2030) 7.3. Middle East and Africa CNC Machine Market Size and Forecast, by End-User Industry (2023-2030) 7.4. Middle East and Africa CNC Machine Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa CNC Machine Market Size and Forecast, by Offering (2023-2030) 7.4.1.2. South Africa CNC Machine Market Size and Forecast, by Product Type (2023-2030) 7.4.1.3. South Africa CNC Machine Market Size and Forecast, by End-User Industry (2023-2030) 7.4.2. GCC 7.4.2.1. GCC CNC Machine Market Size and Forecast, by Offering (2023-2030) 7.4.2.2. GCC CNC Machine Market Size and Forecast, by Product Type (2023-2030) 7.4.2.3. GCC CNC Machine Market Size and Forecast, by End-User Industry (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria CNC Machine Market Size and Forecast, by Offering (2023-2030) 7.4.3.2. Nigeria CNC Machine Market Size and Forecast, by Product Type (2023-2030) 7.4.3.3. Nigeria CNC Machine Market Size and Forecast, by End-User Industry (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A CNC Machine Market Size and Forecast, by Offering (2023-2030) 7.4.4.2. Rest of ME&A CNC Machine Market Size and Forecast, by Product Type (2023-2030) 7.4.4.3. Rest of ME&A CNC Machine Market Size and Forecast, by End-User Industry (2023-2030) 8. South America CNC Machine Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America CNC Machine Market Size and Forecast, by Offering (2023-2030) 8.2. South America CNC Machine Market Size and Forecast, by Product Type (2023-2030) 8.3. South America CNC Machine Market Size and Forecast, by End-User Industry(2023-2030) 8.4. South America CNC Machine Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil CNC Machine Market Size and Forecast, by Offering (2023-2030) 8.4.1.2. Brazil CNC Machine Market Size and Forecast, by Product Type (2023-2030) 8.4.1.3. Brazil CNC Machine Market Size and Forecast, by End-User Industry (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina CNC Machine Market Size and Forecast, by Offering (2023-2030) 8.4.2.2. Argentina CNC Machine Market Size and Forecast, by Product Type (2023-2030) 8.4.2.3. Argentina CNC Machine Market Size and Forecast, by End-User Industry (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America CNC Machine Market Size and Forecast, by Offering (2023-2030) 8.4.3.2. Rest Of South America CNC Machine Market Size and Forecast, by Product Type (2023-2030) 8.4.3.3. Rest Of South America CNC Machine Market Size and Forecast, by End-User Industry (2023-2030) 9. Global CNC Machine Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading CNC Machine Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Doosan Machine Tools Co. Ltd. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. FANUC Corporation 10.3. Amada Machine tools Co. Ltd. 10.4. Yamazaki Mazak Corporation 10.5. JTEKT Corporation 10.6. Trumpf 10.7. Schuler AG 10.8. Hyundai WIA 10.9. Mitsubishi Heavy Industries Machine Tools Ltd. 10.10. Makino 10.11. MAG IAS GmbH 10.12. KOMATSU Ltd. 10.13. XYZ Machine Tools 10.14. ANCA Group 10.15. Okuma Corporation 10.16. SIEMENS 10.17. HAAS Automation 10.18. DMG MORI 11. Key Findings 12. Industry Recommendations 13. CNC Machine Market: Research Methodology 14. Terms and Glossary