The China Electric Vehicle Market size was valued at USD 260.84 Million in 2023 and the total China Electric Vehicle revenue is expected to grow at a CAGR of 17.15 % from 2024 to 2030, reaching nearly USD 789.90 Million by 2030. An Electric Vehicle (EV) is a vehicle, drawing power from a battery and rechargeable externally. It includes all-electric vehicles and plug-in hybrid electric vehicles with both electric and internal combustion engine capabilities. China's electric vehicle market rapidly growing, establishing itself as the global leader in the industry. This rise is largely attributed to government support and policies aimed at reducing pollution and promoting sustainable transportation. China has implemented various incentives, subsidies, and ambitious targets for new energy vehicle (NEV) adoption, driving rapid expansion in both production and sales of electric vehicles. Domestically, companies such as BYD, NIO, and XPeng Motors have emerged as China Electric Vehicle Market key players, alongside traditional automakers investing significantly in electric vehicle technologies. The country's commitment extends beyond manufacturing, with extensive investments in charging infrastructure and advancements in battery technology, making China a major global player in the electric vehicle sector. The regulatory environment is continually evolving to address safety standards, subsidy policies, and environmental considerations.To know about the Research Methodology :- Request Free Sample Report

China Electric Vehicle Market Dynamics:

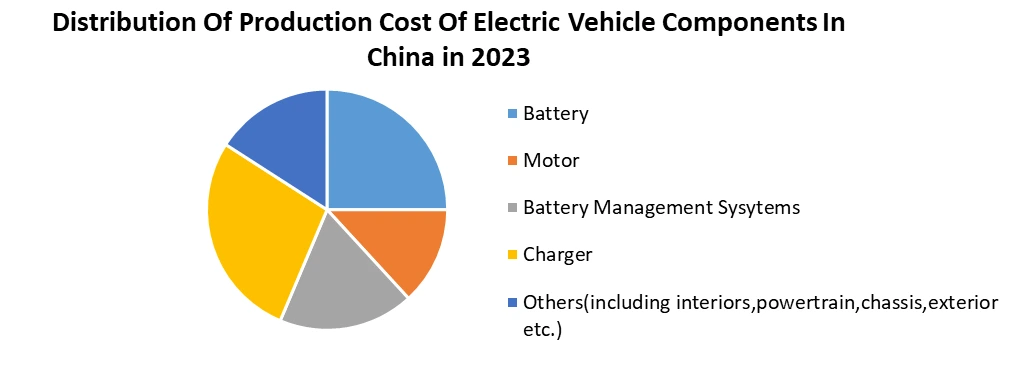

China's Strategic Focus On Core Technology, Particularly Battery Technology driving the growth of China Electric Vehicle Market China's dominance in the electric vehicle (EV) market is underscored by its impressive growth, outpacing traditional automotive leaders like Germany and Japan. In 2023, China experienced an 82% surge in new EV sales, capturing nearly 60% of global EV purchases, surpassing early adopters like the U.S., Norway, and Scandinavian nations. The International Energy Agency notes that over half of the world's electric cars are now found in China, with the nation accounting for 35% of global EV exports in 2023. Two key Chinese automakers, BYD and Geely, stealthily emerged as EV giants by employing innovative strategies in adjacent industries, focusing on operational solutions, and doubling down on core technology. China's unique approach involves experimenting in adjacent industries, as exemplified by BYD and Geely's early foray into electric buses and motorcycles. Unlike Tesla's direct "big banner" approach, Chinese companies operated quietly, tackling the challenges posed by buses and motorcycles to gain insights that shaped their eventual EV manufacturing strategies. Additionally, China tackled operational challenges head-on by collaborating with local groups and taxi companies. A notable example is the collaboration between EV producers and taxi companies to design optimal battery charging schedules, addressing concerns like short driving range and long charging times. Moreover, China strategically focused on core technology, recognizing the potential of battery technology. Chinese automakers leveraged their proximity to critical raw material supplies, such as rare earth, and collaborated broadly to strengthen their capabilities in EV manufacturing.Limited Availability and Variety of EV Models in Chinese Markets Hinder the Market Growth China electric vehicle market, experiencing significant growth, grapples with several challenges that could impact its trajectory. The transition from subsidies to market-driven demand poses a notable hurdle. Despite strong government support stimulating demand, the gradual cancellation of subsidies between 2020 and 2022 led to a temporary surge in battery electric vehicle (BEV) sales. However, this trend has since slowed, emphasizing the need for local EV brands to become more competitive and adapt to diverse consumer needs without relying on subsidies. Intense competition among the multitude of carmakers in China has resulted in price wars, leading to unprecedented cuts in vehicle prices and negatively impacting the gross margins of domestic brands. This pricing pressure, exacerbated by trade conflicts and fluctuating battery resource costs, has prompted Chinese EV businesses to explore opportunities abroad, potentially facing obstacles related to local protectionism in other countries. Additionally, the uneven distribution of raw material reserves, particularly in cobalt, poses a significant risk to the EV battery supply chain. While China dominates global graphite mining, it has only a 1% share in cobalt mining, potentially increasing battery prices and affecting consumer demand for EVs. Low self-sufficiency in critical components like batteries, electric motors, and power semiconductors further compounds the challenges faced by the Chinese EV market. Despite these hurdles, the Chinese government remains a crucial driving force behind the EV industry, implementing supportive policies, incentives, and national targets. However, the diverse political economies and unique circumstances across regions may lead to variations in the local implementation of these policies. Navigating these challenges will be crucial for sustaining and advancing China's position in the global electric vehicle landscape.

China Electric Vehicle Market Segment Analysis:

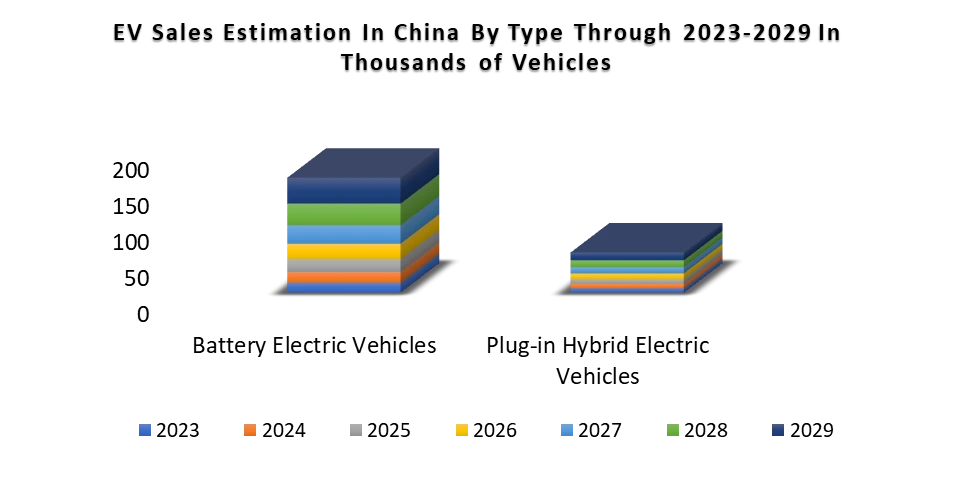

Based on Type, Battery Electric Vehicles (BEVs) dominated the China Electric Vehicle market in 2023 as electric batteries, are gaining traction primarily in urban settings due to their zero-emission nature, appealing to environmentally conscious consumers and governmental initiatives promoting clean transportation. Plug-in Hybrid Electric Vehicles (PHEVs) is fast growing segment in China Electric Vehicle market, offering both electric and internal combustion engine power, find favour among consumers seeking a balance between electric range and the convenience of a backup combustion engine, suitable for longer drives and regions with inadequate charging infrastructure. HEVs, operating on both electric and internal combustion engines but not requiring external charging, maintain popularity among consumers transitioning to electric mobility, especially in areas where charging infrastructure remains limited, serving as an intermediary step towards full electrification. BEVs dominate urban landscapes, PHEVs find application in mixed-use scenarios, and HEVs serve as a transitional option in regions with evolving charging infrastructure, reflecting diverse adoption patterns based on application suitability and regional infrastructure readiness.

China Electric Vehicle Market Regional Insights:

Beijing, as the capital, leads the way with its proactive approach, spearheading the implementation of new policies and incentives to boost EV usage. The city has made substantial investments in charging infrastructure, demonstrating a commitment to advancing sustainable transportation. Similarly, Shanghai plays a pivotal role in the electric vehicle sector, fostering an environment conducive to EV adoption. The local government has enacted supportive policies, encouraged the use of electric vehicles, while also hosting numerous EV manufacturers and research centers. Shenzhen, renowned for its early adoption of electric buses, stands out as a trailblazer in electric mobility. The city's dedication to electrifying public transportation has elevated awareness and acceptance of electric vehicles among its residents. Hangzhou follows suit, actively promoting electric vehicles through supportive policies and infrastructure development, aligning with broader national goals for clean energy and emissions reduction. Each city's distinctive efforts contribute collectively to China's ongoing commitment to sustainable and eco-friendly transportation solutions.Ten Cities, a Thousand Electric Vehicles

City Local xEV Makers Major Supplier EV Type Beijing Beiqi Foton Beiqi Foton HEV/FCV bus Jinghua Bus Jinghua Bus HEV/EV bus Beifang Neoplan Beifang Neoplan EV bus Shanghai SAIC Wanxiang Daewoo EV bus Sunwin EV bus SGM HEV PV Chongqin Chang'an Auto Chang'an Auto HEV PV Hengtong Auto Hengtong Auto Hangzhou Wanxiang EV Wanxiang EV HEV PV Xiamen Kinlong Xiamen Kinlong Wuhan Dongfeng Dongfeng HEV bus Shenzhen BYD BYD HEV PV Wuzhoulong Wuzhoulong HEV bus Changchu FAW FAW Car HEV PV FAW Fengyue HEV PV Jinan Zhongtong Auto Zhongtong Auto HEV/EV bus Beiqi Foton Beiqi Foton Dalian FAW FAW Bus HEV bus Hefei Ankai Auto Ankai Auto HEV bus Chery Chery Nanchang Anyuan Bus Anyuan Bus HEV bus Kunming Beiqi Foton Changsha Zhuzhou CSR Times Zhuzhou CSR Times HEV bus China Electric Vehicle Market Scope: Inquire before buying

China Electric Vehicle Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 260.84 Mn. Forecast Period 2024 to 2030 CAGR: 4.5% Market Size in 2030: US $ 789.90 Mn. Segments Covered: by Type BEV PHEV HEV by Vehicle Class Mid-Priced Luxury by Vehicle Type Two-wheelers Passenger Cars Commercial Vehicles by End-User Shared mobility providers Government organizations Personal users Others China Electric Vehicle Market Key Players:

1. SAIC-GM Wuling 2. NIO 3. Xpeng 4. Li Auto 5. WM Motors 6. Geely 7. Byton 8. Zhiji 9. Xiaomi 10. Guangzhou Automobile. FAQs: 1] What segments are covered in the China Electric Vehicle Market report? Ans. The segments covered in the China Electric Vehicle Market report are based on Type, Vehicle Class, Vehicle Type, End-User and Region. 3] What is the market size of the China Electric Vehicle Market by 2030? Ans. The market size of the China Electric Vehicle Market by 2030 is expected to reach US$ 789.90 Mn. 4] What is the forecast period for the China Electric Vehicle Market? Ans. The forecast period for the China Electric Vehicle Market is 2024-2030. 5] What was the market size of the China Electric Vehicle Market in 2023? Ans. The market size of the China Electric Vehicle Market in 2023 was valued at US$ 260.84 Mn.

1. China Electric Vehicle Market: Research Methodology 2. China Electric Vehicle Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. China Electric Vehicle Market: Dynamics 3.1. China Electric Vehicle Market Trends 3.2. China Electric Vehicle Market Drivers 3.3. China Electric Vehicle Market Restraints 3.4. China Electric Vehicle Market Opportunities 3.5. China Electric Vehicle Market Challenges 4. PORTER’s Five Forces Analysis 5. PESTLE Analysis 6. Technological Roadmap 7. Regulatory Landscape 8. Key Opinion Leader Analysis for China Electric Vehicle End User 9. Analysis of Government Schemes and Initiatives for China Electric Vehicle End User 10. The Covid 19 Pandemic Impact on China Electric Vehicle Market 11. China Electric Vehicle Market: Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 11.1. China Electric Vehicle Market Size and Forecast, by Type (2023-2030) 11.1.1. BEV 11.1.2. PHEV 11.1.3. HEV 11.2. China Electric Vehicle Market Size and Forecast, by Vehicle Class (2023-2030) 11.2.1. Mid-Priced 11.2.2. Luxury 11.3. China Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 11.3.1. Two-wheelers 11.3.2. Passenger Cars 11.3.3. Commercial Vehicles 11.4. China Electric Vehicle Market Size and Forecast, by End-User (2023-2030) 11.4.1. Shared mobility providers 11.4.2. Government organizations 11.4.3. Personal users 11.4.4. Others 12. China Electric Vehicle Market: Competitive Landscape 12.1. MMR Competition Matrix 12.2. Competitive Landscape 12.3. Key Players Benchmarking 12.3.1. Company Name 12.3.2. Service Segment 12.3.3. End-user Segment 12.3.4. Revenue (2022) 12.3.5. Company Locations 12.4. Leading China Electric Vehicle Market Companies, by Market Capitalization 12.5. Market Structure 12.5.1. Market Leaders 12.5.2. Market Followers 12.5.3. Emerging Players 12.6. Mergers and Acquisitions Details 13. Company Profile: Key Players 14. SAIC-GM Wuling 14.1.1. Company Overview 14.1.2. Business Portfolio 14.1.3. Financial Overview 14.1.4. SWOT Analysis 14.1.5. Strategic Analysis 14.1.6. Scale of Operation (Small, Medium, and Large) 14.1.7. Details on Partnership 14.1.8. Regulatory Accreditations and Certifications Received by Them 14.1.9. Awards Received by the Firm 14.1.10. Recent Developments 15. NIO 16. Xpeng 17. Li Auto 18. WM Motors 19. Geely 20. Byton 21. Zhiji 22. Xiaomi 23. Guangzhou Automobile. 24. Key Findings 25. End User Recommendations