The China Dental Service Market size was valued at USD 7.9 Billion in 2023 and the total China Dental Service Market revenue is expected to grow at a CAGR of 15.80 % from 2023 to 2030, reaching nearly USD 22.06 Billion. Dental services refer to a range of healthcare services provided by dental professionals to maintain, diagnose, prevent, and treat oral health issues. China has observed a growing demand for dental services, driven by various factors such as an aging population, increased awareness of oral health, and rising disposable income. Developments in dental technology, such as digital diagnostics and preventive treatment modalities, are expected to make preventive dentistry more accessible to the population. The integration of TeleDentistry and remote consultations facilitates easier access to preventive advice, encouraging individuals to seek guidance from dental professionals without the need for physical visits. For example, Patients schedule online appointments with their dentists to talk about issues related to oral health, get advice on preventive care, and ask questions. Through video chats, dentists are expected to visually evaluate patients' oral issues and offer individualized advice based on each patient's unique needs. China has implemented a National Oral Health Promotion Plan, which aims to improve oral health awareness and practices among the general population. The plan includes educational campaigns, community outreach, and the distribution of informational materials to raise awareness about the significance of preventive dentistry. In some regions of China, the government provides subsidies for preventive dental services to make them more accessible to a wider population. This includes subsidies for routine dental check-ups, cleanings, and preventive treatments, reducing financial barriers for individuals seeking preventive care.To know about the Research Methodology :- Request Free Sample Report

Technological Developments in China Dental Services

Investment in advanced dental technologies presents an opportunity for the growth of the China dental service market. Adopting digital dentistry, 3D imaging, and other technological innovations can enhance diagnostics, treatment precision, and overall patient experience. Digital dentistry, including digital impressions, CAD/CAM systems, and computer-aided design, is expected to increase implementation. Dental practices embracing these technologies can streamline workflows, improve accuracy, and enhance the overall patient experience. The growth of telehealth and telemedicine is expected to lead to the development of more sophisticated TeleDentistry platforms. These platforms can facilitate remote consultations, treatment planning, and follow-ups, expanding access to dental care.Rising Demand for Cosmetic Dentistry Increasing consumer interest in cosmetic dentistry procedures, such as teeth whitening, veneers, and orthodontic treatments, is driven by a growing middle class and a focus on aesthetics. The demand for cosmetic dentistry encourages ongoing technological advancements. Innovations in materials, techniques, and equipment for cosmetic procedures may drive further investments in technology within the dental industry. Cultural influences, including beauty standards and trends, impact the demand for cosmetic dentistry. As cultural perceptions evolve, the demand for specific aesthetic enhancements is expected to change accordingly. Shortage of Skilled dental professionals in China China has faced a shortage of skilled dental professionals in some areas, which is leading to a strain on the healthcare system’s capacity. Limited availability of qualified practitioners results in longer waiting times for appointments and challenges in delivering timely and comprehensive care. Establishing new dental schools and increasing existing programs to accommodate a larger number of students. This growth is expected to help increase the overall pool of skilled dental professionals entering the workforce.

China Dental Services Market Segment Analysis

By product type, the General Dentistry segment dominates the China Dental Services Market and is expected to experience substantial growth throughout the forecast period. The demand for general dentistry services is consistently high as these services form the core of oral health maintenance. Routine check-ups and cleanings are required by individuals of all ages, contributing significantly to China's Dental Services market demand. The government is implementing several programs for General Dentistry in schools that highlight preventive dental care. It involves regular dental check-ups for students, oral health education sessions, and the application of preventive measures like dental sealants and fluoride treatments.Competitive Landscape of China Dental Services Market

The competitive landscape of the dental services market in China is influenced by various factors, including the presence of key players, market dynamics, and technological advancements. The presence and growth of private dental clinics and chains contribute to competition. These entities regularly focus on providing a range of dental services, including general dentistry, orthodontics, cosmetic dentistry, and oral surgery. Government-operated dental facilities and hospitals also contribute to the competitive landscape. These facilities may be part of wider healthcare institutions and provide dental services to the public.China Dental Services Market Scope: Inquiry Before Buying

China Dental Services Market Report Coverage Details Base Year: 2023 Forecast Period: 2023-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 7.9 Bn. Forecast Period 2024 to 2030 CAGR: 15.8% Market Size in 2030: US $ 22.06 Bn. Segments Covered: by Services General Dentistry Oral Surgery Cosmetic Dentistry by Application Children Adults Geriatric by Sales Channel Hypermarkets Drug stores and pharmacies Convenience Stores China Dental Services Market Key Players

1. Hawley & Hazel 2. Yunnan Baiyao Group 3. Shanghai Jahwa United Co 4. Guangzhou Lion Company 5. Fujian Sanli Group 6. Midmark 7. iByer Dental Group 8. Bybo Dental Group 9. ChengDu Huamei Dental Chain Co 10. Sirona Dental Systems 11. Foshan.

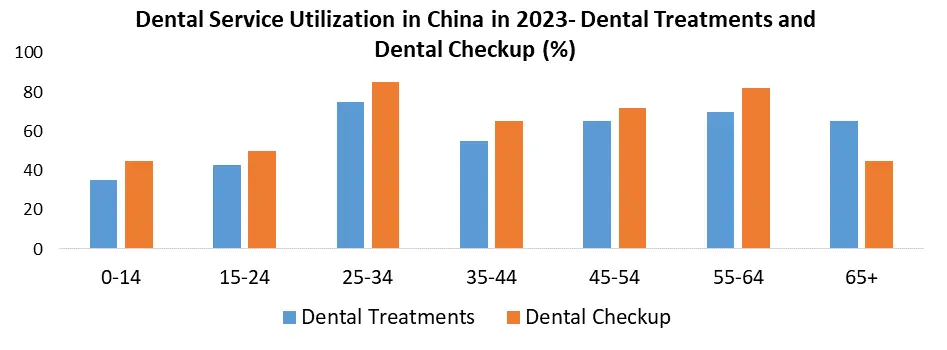

1. Dental Service Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. China Dental Service Market: Dynamics 2.1. China Dental Service Market Trends 2.2. PORTER’s Five Forces Analysis 2.3. PESTLE Analysis 2.4. Threats of new entrants 2.5. Value Chain Analysis 2.6. Regulatory Landscape of China Dental Service Market 2.7. China Dental Service Clinical Trial Analysis 2.8. Technological Advancements in China Dental Service Market 2.9. Dental Service Utilization in China by Different Age Groups 2.9.1. Dental Checkup 2.9.2. Dental Treatments 2.10. Key Opinion Leader Analysis for China Dental Service Industry 2.11. Shifting Consumer Preference Towards Dental Services in China 2.12. Analysis of Government Schemes and Initiatives for China Dental Service Industry 2.13. The Global Pandemic Impact on China Dental Service Market 2.14. China Dental Service Price Trend Analysis (2022-23) 3. China Dental Service Market: Market Size and Forecast by Segmentation for (by Value in USD Million) (2023-2030) 3.1. China Dental Service Market Size and Forecast, by Services (2023-2030) 3.1.1. General Dentistry 3.1.2. Oral Surgery 3.1.3. Cosmetic Dentistry 3.2. China Dental Service Market Size and Forecast, by Application (2023-2030) 3.2.1. Children 3.2.2. Adults 3.2.3. Geriatric 3.3. China Dental Service Market Size and Forecast, by Sales Channel (2023-2030) 3.3.1. Hypermarkets 3.3.2. Drug stores & Pharmacies 3.3.3. Convenience Stores 4. China Dental Service Market: Competitive Landscape 4.1. MMR Competition Matrix 4.2. Competitive Landscape 4.3. Key Players Benchmarking 4.3.1. Company Name 4.3.2. Product Segment 4.3.3. End-user Segment 4.3.4. Revenue (2023) 4.4. Market Analysis by Organized Players vs. Unorganized Players 4.4.1. Organized Players 4.4.2. Unorganized Players 4.5. Leading China Dental Service Market Companies, by market capitalization 4.6. Market Drivers and Challenges in China 4.6.1. Increasing Awareness of Oral Health 4.6.2. Aging Population and Demand for Dental Services 4.6.3. Technological Advancements 4.6.4. Affordability and Accessibility 4.6.5. Shortage of Skilled Professionals 4.7. Market Structure 4.7.1. Market Leaders 4.7.2. Market Followers 4.7.3. Emerging Players and Trends in the Market 4.7.4. Opportunities for Growth 4.8. Mergers and Acquisitions Details 5. Company Profile: Key Players 5.1. Hawley & Hazel 5.1.1. Company Overview 5.1.2. Business Portfolio 5.1.3. Financial Overview 5.1.4. SWOT Analysis 5.1.5. Strategic Analysis 5.1.6. Details on Partnership 5.1.7. Regulatory Accreditations and Certifications Received by Them 5.1.8. Awards Received by the Firm 5.1.9. Strategies Adopted by Key Players 5.1.10. Recent Developments 5.2. Yunnan Baiyao Group 5.3. Shanghai Jahwa United Co 5.4. Guangzhou Lion Company 5.5. Fujian Sanli Group 5.6. Midmark 5.7. iByer Dental Group 5.8. Bybo Dental Group 5.9. ChengDu Huamei Dental Chain Co 5.10. Sirona Dental Systems 5.11. Foshan. 6. Key Findings 7. Industry Recommendations 8. China Dental Service Market: Research Methodology