China Automotive Telematics Market is expected to grow at a CAGR of 27.1% throughout the forecast period, to reach US$ 38,723.4 Mn. by 2027.To know about the Research Methodology :- Request Free Sample Report China Automotive Telematics Market Overview: As Chinese passenger vehicle companies accelerate to promote telematics system in 2015, smartphone integration & 4G LTE technologies have found extensive application, & IVI (In-Vehicle Infotainment) & networking functions have got improved & optimized to get a better customer experience. In January-September 2017, China’s new passenger vehicles equipped with telematics products approximated 2.8 Mn units, up 32.1percent from a year earlier. Among them, OnStar held 26 percent & ranked 1st, followed by SYNC & Honda Link. It is noted that in 2017 Changan Automobile introduced some models equipped with In Call system, occupying 7 percent, thus making it the only self-owned brand which ranked among the top five. Pre-installation of Key Branded Telematics in China’s Passenger Vehicle Market:

Traditional Chinese 3rd party telematics enterprises are still in problems. For instance, the enterprises such as PATEO & China TSP are following transformation based on its OEM business, & LAUNCH Tech & Carsmart continued to seek for customers’ concern in the aftermarket. Meanwhile, mapping service providers like NavInfo, AutoNavi, & Careland began to speed up strategy in telematics with plan as the breakthrough point. The penetration of OEM telematics will be on the growth. On the one hand, the model of OEM-led platform & 3rd party telematics enterprises providing services will endure being adopted. They will work together to bring more of more mature products & services to car owners. On the other hand, the passenger vehicle market is unlikely to improve & grow like the previous high-speed development, which would involve prompting OEMs to fast lift OEM telematics pre-installations to compete for the market. At the same time, the aftermarket such as intelligent rearview mirror also offers networking & recreational functions, which, to some extent, benefits diversify the options of car owners. The Opportunity of After Sales Revenues: The automotive industry has come an extensive way as the invention of the steam-powered automobile. Over two centuries of constant development as well as growing disposable incomes throughout the globe have produced a huge market for the industry. It has laid an environment conducive for the development of other industries & thus become a vital cog in the growth of economies worldwide. Markets, especially in established countries, are saturated. To add to the fluctuating nature of the industry, consumer demands through geographies are significantly different. Automakers must pursue new business models which go beyond selling their latest models. With a vast number of their vehicles already in the hands of consumers, the opportunity for automakers is in after-sales revenue streams. Basically, the model needs to be based on constant spending on the same vehicle rather than a particular focus on driving consumption of new vehicles. This explains the changed focus on telematics by the automotive OEMs. Telematics permits OEMs to wirelessly gather an extensive range of data, from geolocation & usage patterns to maintenance needs & performance information. Through telematics gateways, OEMs have the opportunity to track their consumers even after the sale of the vehicle. Telematics also allows OEMs, their partners & independent content creators & aggregators to provide content like maps, weather forecasts, traffic conditions, news, stock quotes, social updates, messages & entertainment to the automobile. IT intervention & connection is required through the telematics value chain:

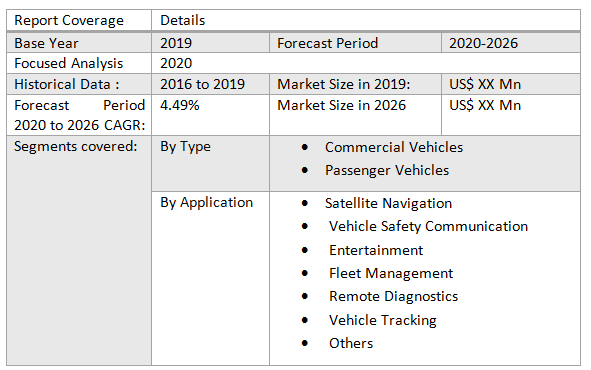

The report covers Commercial Vehicles, Passenger Vehicles, with detailed analysis China Automotive Telematics Market industry with the classifications of the market on the Type, Application & region. Analysis of past market dynamics from 2016 to 2019 is given in the report, which will help readers to benchmark the past trends with current market scenarios with the key players' contribution in it. The report has profiled twelve key players in the market from different regions. However, the report has considered all market leaders, followers, and new entrants with investors while analyzing the market and estimation the size of the same. The manufacturing environment in each region is different and focus is given on the regional impact on the cost of manufacturing, supply chain, availability of raw materials, labor cost, availability of advanced Plastic Type, trusted vendors are analyzed and the report has come up with recommendations for a future hot spot in five regions. The major country’s policies about manufacturing & Covid 19 impact on the demand-side are covered in the report.

Scope of the China Automotive Telematics Market: Inquire before Buying

China Automotive Telematics Market Key Players

• Agero • Airbiquity • Continental • Verizon Telematics • Visteon • Bynx • Connexis • Ericsson • Fleetmatics • Luxoft • Magneti Marelli • WirelessCar AB • NTT Docomo. • AT&T Inc. • Ford Motor Company • BMW AG • Robert Bosch GmbH • Valeo S.A • Harman International Industries, Incorporated • Vodafone Group Plc • TELEFÓNICA, S.A.

China Automotive Telematics Market 1. Preface 1.1. Report Scope and Market Segmentation 1.2. Research Highlights 1.3. Research Objectives 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: China Automotive Telematics Market Size, by Market Value (US$ Mn) 4. Market Overview 4.1. Introduction 4.2. Market Indicator 4.2.1. Drivers 4.2.2. Restraints 4.2.3. Opportunities 4.2.4. Challenges 4.3. Porter’s Analysis 4.4. Value Chain Analysis 4.5. Market Risk Analysis 4.6. SWOT Analysis 4.7. Industry Trends and Emerging Technologies 5. Supply Side and Demand Side Indicators 6. China Automotive Telematics Market Analysis and Forecast 7. China Automotive Telematics Market Analysis and Forecast, by Type 7.1. Introduction and Definition 7.2. Key Findings 7.3. China Automotive Telematics Market Value Share Analysis, by Type 7.4. China Automotive Telematics Market Size (US$ Mn) Forecast, by Type 7.5. China Automotive Telematics Market Analysis, by Type 8. China Automotive Telematics Market Analysis and Forecast, by Application 8.1. Introduction and Definition 8.2. Key Findings 8.3. China Automotive Telematics Market Value Share Analysis, by Application 8.4. China Automotive Telematics Market Size (US$ Mn) Forecast, by Application 8.5. China Automotive Telematics Market Analysis, by Application 8.6. China Automotive Telematics Market Attractiveness Analysis, by Application 9. China Automotive Telematics Market Analysis 9.1. Key Findings 9.2. China Automotive Telematics Market Overview 9.3. China Automotive Telematics Market Forecast, by Type 9.3.1. Commercial Vehicles 9.3.2. Passenger Vehicles 9.4. China Automotive Telematics Market Forecast, by Application 9.4.1. Satellite Navigation 9.4.2. Vehicle Safety Communication 9.4.3. Entertainment 9.4.4. Fleet Management 9.4.5. Remote Diagnostics 9.4.6. Vehicle Tracking 9.4.7. Others 9.5. PEST Analysis 9.6. Key Trends 9.7. Key Developments 9.8. China Automotive Telematics Market Forecast, by Type 9.8.1. Commercial Vehicles 9.8.2. Passenger Vehicles 9.9. China Automotive Telematics Market Forecast, by Application 9.9.1. Satellite Navigation 9.9.2. Vehicle Safety Communication 9.9.3. Entertainment 9.9.4. Fleet Management 9.9.5. Remote Diagnostics 9.9.6. Vehicle Tracking 9.9.7. Others 9.10. PEST Analysis 9.11. Key Trends 9.12. Key Developments 10. Company Profiles 10.1. Market Share Analysis, by Company 10.2. Market Share Analysis, by Region 10.3. Market Share Analysis, by Country 10.4. Competition Matrix 10.4.1. Competitive Benchmarking of key players by price, presence, market share, Raw material and R&D investment 10.4.2. New Raw material Launches and Raw material Enhancements 10.4.2.1. Market Consolidation 10.4.2.2. M&A by Regions, Investment and Raw material 10.4.2.3. M&A Key Players, Forward Integration and Backward Integration 10.5. Company Profiles: Key Players 10.5.1. Agero 10.5.2. Airbiquity 10.5.3. Continental 10.5.4. Verizon Telematics 10.5.5. Visteon 10.5.6. Bynx 10.5.7. Connexis 10.5.8. Ericsson 10.5.9. Fleetmatics 10.5.10. Luxoft 10.5.11. Magneti Marelli 10.5.12. WirelessCar AB 10.5.13. NTT Docomo. 10.5.14. AT&T Inc. 10.5.15. Ford Motor Company 10.5.16. BMW AG 10.5.17. Robert Bosch GmbH 10.5.18. Valeo S.A 10.5.19. Harman International Industries, Incorporated 10.5.20. Vodafone Group Plc 10.5.21. TELEFÓNICA, S.A.