China Automotive High-Performance Electric Vehicle Market is expected to reach 4.48 million units by 2027, thanks to growth in the battery electric vehicle (BEV) segment. The report analyzes China’s Automotive High-Performance Electric Vehicle market dynamics by region, type, vehicle type, and vehicle class.China Automotive High-Performance Electric Vehicle Market Overview:

Since 2016, China has been the world's largest NEV (New Electric Vehicle) market in terms of sales volume, and it is expected to keep that position over the forecast period. There have been obstacles in the path, and sales have been fluctuating. According to the China Association of Automobile Manufacturers, local NEV wholesales – including passenger and commercial vehicles – totaled 1.21 million units in 2019, down 4% from the previous year. A larger macroeconomic downturn and a reduction in cash incentives on NEV purchases were the key causes of the fall. Sales were down 37.40% year over year in the first half of 2020, because of the COVID-19 pandemic. However, double-digit monthly sales growth returned with the restoration of domestic business activity earlier than in most other parts of the world and the issuance of a government consumer push. As a result, NEV sales in 2020 increased by 10.90% year over year. China has the largest automobile market in the world. Owing to the Covid-19 pandemic, automobile sales in 2020 were 25.3 million units, a 1.90% reduction. This was the third year in a row that growth was a negative year over year. Electric car sales, on the other hand, climbed by 10.90% year over year to 1.40 million units, demonstrating that demand is increasing. Subsidies were extended for another two years, with a 10% reduction each year. Subsidies were the primary driver of growing electric vehicle sales in China. In contrast to the 972,000 battery electric vehicles sold in 2019 and the 232,000 sales in 2020, the market only saw 1,00,000 battery electric vehicle sales in 2020. As of 2020, China has established the world's largest electric car market, industry, and most notable electric vehicle city markets in terms of overall performance. This was accomplished in less than a decade, with electric vehicles accounting for 47% of total vehicle sales in the recent decade. 2020 is considered a base year however 2020's numbers are on the real output of the companies in the market. Special attention is given to 2020 and the effect of lockdown on the demand and supply, and also the impact of lockdown for the next two years on the market. Some companies have done well in lockdown also and specific strategic analysis of those companies is done in the report. Key Areas of Insight – 1. OEMs have the opportunity to considerably improve efficiency throughout vehicle systems, particularly in the e-powertrain. Such advancements have always been significant in combustion engine vehicles, but they tend to happen in little steps over time. MMR’s research, on the other hand, suggests that OEMs can cut e-powertrain costs by double digits pretty soon. OEMs may gain more by focusing on the vehicle- and system-level collaboration rather than the traditional, siloed strategy of trying to optimize individual components as they search for improvement. 2. Chinese OEMs are at the forefront of providing exceptional customer service to local customers. They stand out from the competitors thanks to their strong human-machine interfaces (HMIs) and connection. For applications and services, these technologies require a strong basis in software, electronics, and local ecosystems. OEMs that do not provide such capabilities risk losing market share, first in China and then globally. 3. With China accounting for almost 50% of the global BEV market, OEMs with a presence in the country must add value to customers and discover cost-cutting opportunities by designing vehicles to match local criteria. To compete in China, international players must weigh the benefits of global platform scale versus local optimization (and other major markets). 4. A local battery ecosystem is essential for ensuring the proper specification for the market at the right pricing. Chinese OEMs continue to have a natural advantage in this market. While foreign players are bolstering their technological capabilities, they also require local connections to take advantage of new opportunities. 5. The development cycle for BEVs is being shortened because of the quick speed of invention and frequent technological breakthroughs, particularly in software. Advanced electrical and electronic (E/E) capabilities, such as advanced driver-assistance systems (ADAS) and over-the-air (OTA) software updates, as well as the ability to make design upgrades throughout the vehicle life cycle, are becoming increasingly important to stay competitive in China and around the world.To know about the Research Methodology :- Request Free Sample Report Charging in Future - By 2020, Beijing expects charging piles to be installed in 100% of parking lots attached to residential structures, as well as 25%, 20%, and 15% of parking lots at businesses, schools, and hospitals, respectively. EV users should be able to find at least one charging location within 0.9 kilometers in densely crowded areas, and within five kilometers in other parts of Beijing.

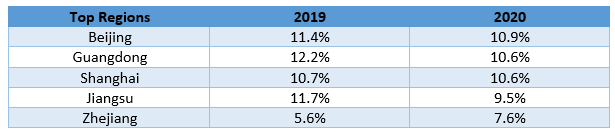

The government's plan is fairly wide, and EV manufacturers and third-party corporations will be in charge of implementing it and owning the majority of the charging stations. Some EV manufacturers have elected to run their charging stations, and the government will provide financial assistance to these businesses. for example, BYD has already constructed 4,600 charging piles and expects to construct another 30,000. Share of public charging piles nationwide by regions -

China Automotive High-Performance Electric Vehicle Market Dynamics:

• To meet demand, charging pile installations must grow and function properly: Consumers' willingness to move to EVs has always been hampered by a lack of charging infrastructure. According to the China Electric Vehicle Charge Infrastructure Promotion Alliance (EVCIPA), China had 1.68 million charging stations at the end of 2020, considerably short of the government's intended 4.8 million objectives. This means that each pile must service three EVs on average. Aside from that, the distribution of charging piles is unbalanced, with little investment in charging infrastructure in less populated areas and some city public charging piles on the outskirts of cities. Worse yet, many parking places with public charging stations are either filled by ICEs or out of operation. As a result of these issues, public charging stations are underutilized, charging network operators' profits suffer, and drivers' faith in the effectiveness of EV infrastructure is eroded. The dense population of China's largest cities complicates the installation of private charging heaps. By the end of 2020, EVCIPA anticipates that just 874,000 private charging heaps would exist across the country, compared to the government's original aim of 4.3 million. More than 30% of EV owners are unable to put up their charging stations due to a lack of permanent parking places and poor electrical infrastructure, among other factors. As a result, people are coming up with new ways to charge their EVs, which may not be safe or sustainable. • Government backing may drive the exponential rise of charging piles: While the Chinese government has reduced monetary incentives for EV sales, the support for charging network expansion demonstrates the government's commitment to promoting the EV business. The EV charging network was identified as one of the main new infrastructure topics by the National Development and Reform Commission (NDRC) in April 2020. With the backing of the world's largest power grid, the State Council's work report in May 2020 included the installation of more charging heaps. Government subsidies are also available to help with the installation and operation of charging piles. The national government's ambition to expand the charging network more quickly has made its way into local government planning. Shanghai, for example, plans to build 100,000 charging and battery switching stations in three years, while Chengdu plans to build 23,000 piles. Overall, given the existing deficiency, the growth rate of charging pile counts may only accelerate in the future to keep up with the rise of EV ownership. In the charging value chain, this opens up a lot of possibilities. A key impediment to the rapid commercialization of electric vehicles in China is the construction of a low-cost, easily accessible charging infrastructure to accommodate the growing number of electric vehicles. The government has committed to installing 7,400 fast-charging (60-100KW) stations and 2.5 million charging units in parking lots, apartment buildings, and office complexes in Beijing, Tianjin, Hebei, Shanghai, and Guangdong provinces, with smaller numbers in second-tier regions and western provinces. Provincial governments are subsidizing over 30% of the charging costs by keeping electricity tariffs low. After spending $3 billion on subsidies in 2018, China has raised the technical requirements for the same. An EV purchased by a commercial fleet user, for example, would be eligible for subsidies only if its annual driving range exceeded 20,000 kilometers. Additionally, automakers must implement platforms for monitoring the operational status of sold vehicles and connect them to a national regulatory platform that was established in 2018. Chinese Automobile Companies to Keep Eye On – Xpeng - An Xpeng P7 car was displayed during the 19th Shanghai International Automobile Industry Exhibition in Shanghai on April 19, 2021. (Photo by Hector RETAMAL for AFP) The G3, P5, and P7 are three separate electric car types offered by the Guangzhou-based company. Despite the collecting restrictions, the company continues to set sales records, with total EV sales reaching 10,000 units in October alone. Nio - The Shanghai-based company, which began operations in 2014, presently sells three models in China, with a fourth due in early 2022. According to sources, the company has delivered 140,000 vehicles to Chinese customers and is now aiming to expand into Europe. The Shanghai-based business, which launched in 2014, currently sells three models in China, with a fourth set to arrive in early 2022. According to estimates, the firm has delivered 140,000 cars to Chinese customers and is now aiming to expand into Europe. Li Auto - Li Auto was launched in 2015 and is one of three Chinese electric vehicle manufacturers listed on the New York Stock Exchange contending for market share with Tesla. There is now only one car in production: the Li-One. Despite this, Li Auto has sold over 100,000 vehicles since beginning deliveries in early 2020, establishing itself as a legitimate competitor in the congested EV industry. • Impact of Carbon Emission: GHG emissions for EVs range from 10.44 to 17.94 kg-CO2eq/100 km in the three cities of Beijing, Shanghai, and Guangzhou. EV GHG emissions range from 15.66 to 26.92 t-CO2eq throughout the length of its lifetime, which is up to 43% less than a comparable ICEV, which produces 27.36 t-CO2eq. The GHG emissions from an EV's manufacturing phase, on the other hand, range from 11.40-13.94 t-CO2eq, which is 0.93-3.47 t-CO2eq more than the emissions from an ICEV's manufacturing phase. As a result, our GHG emission reduction predictions are lowered by roughly 36% when EVs replace ICEVs due to GHG emissions. With a 20% penetration rate, EVs can help lower GHG emissions from the transportation sector by up to 6.20% in 2030, if the carbon intensity of regional power networks continues to improve, despite higher GHG emissions in the manufacturing phase. These findings are based on a national average emission factor that ignores regional differences. Actual emission reductions will be greater in southern China, where hydroelectric power is accessible, and lower in northern China, where coal-fired power is still used. China Automotive High-Performance Electric Vehicle Market Segment Analysis: the China Automotive High-Performance Electric Vehicle Market is segmented into Type, Vehicle class, and Vehicle type. Based on Vehicle Type, the market is sub-segmented into two-wheelers, Passenger Vehicles, and Commercial vehicles. Currently, passenger automobiles are in more demand than commercial vehicles, and this trend is expected to continue throughout the forecast period. The increase is linked to the growing population, which is feeding the demand for electric vehicles (EVs) and the government's strict pollution standards. For example, starting in July 2020, the Chinese government will apply China 6 pollution control criteria in the region, which are stronger than previous China 5 norms and are based on EURO 6 norms, resulting in increased demand for micro-hybrid vehicles in the region. The presence of multiple rivals, as well as the government's considerable backing, has propelled the battery-electric car market in China. China has extended the incentives for buying new energy vehicles (NEVs) until 2022. Non-automotive corporations, like Alibaba, are also entering the country's quickly rising EV sector. For example, in January 2021, Alibaba Group partnered with SAIC Motor to introduce two electric cars in the country under the IM label (Intelligence in Motion). CATL provides the battery cells for these vehicles.The objective of the report is to present a comprehensive analysis of the China Automotive High-Performance Electric Vehicle Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the China Automotive High-Performance Electric Vehicle Market dynamics, structure by analyzing the market segments and projecting the China Automotive High-Performance Electric Vehicle Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the China Automotive High-Performance Electric Vehicle Market make the report investor’s guide.

China Automotive High-Performance Electric Vehicle Market Scope: Inquiry Before Buying

China Automotive High-Performance Electric Vehicle Market Report Coverage Details Base Year: 2020 Forecast Period: 2021-2027 Historical Data: 2016 to 2020 Market Size in 2020: US $ 1.48 Mn Units. Forecast Period 2021 to 2027 CAGR: 17.11% Market Size in 2027: US $ 4.47 Mn Units. Segments Covered: by Type • BEV • PHEV • HEV by Vehicle Class • Mid-Priced • Luxury by Vehicle type • Two-wheelers • Passenger Cars • Commercial Vehicles China Automotive High-Performance Electric Vehicle Market Key Players:

• Tesla • BMW Group • Nissan Motor Corporation • Toyota Motor Corporation • Volkswagen AG • General Motors • Daimler AG • Energica Motor Company S.p.A. • BYD Company Motors • Ford Motor Company. • SAIC-GM Wuling • NIO • Xpeng • Li Auto • WM Motors • Geely • Byton • Dongfeng Motors • Chang’an Automobile • Guangzhou Automobile Frequently Asked Questions: 1) What was the market size of China Automotive High-Performance Electric Vehicle Market markets in 2020? Ans - China Automotive High-Performance Electric Vehicle Market was worth 1.48 Mn Units. in 2020. 2) What is the market segment of the China Automotive High-Performance Electric Vehicle Market? Ans -The market segments are based on Type, Vehicle class, and Vehicle type. 3) What is the forecast period considered for China Automotive High-Performance Electric Vehicle Market? Ans -The forecast period for China Automotive High-Performance Electric Vehicle Market is 2021 to 2027. 4) What is the market size of the China Automotive High-Performance Electric Vehicle Market in 2027? Ans – China Automotive High-Performance Electric Vehicle Market is estimated as worth 4.48 Mn Units. 5) Who are the top 5 Key players in China Automotive High-Performance Electric Vehicle Market? Ans - SAIC-GM Wuling, NIO, Xpeng, Li Auto, WM Motors, and Greely are the top key players in the China Automotive High-Performance Electric Vehicle market.

1.China Automotive High-Performance Electric Vehicle Market: Research Methodology 2. China Automotive High-Performance Electric Vehicle Market: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to China Automotive High-Performance Electric Vehicle Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. China Automotive High-Performance Electric Vehicle Market: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. COVID-19 Impact 4. China Automotive High-Performance Electric Vehicle Market Segmentation 4.1. China Automotive High-Performance Electric Vehicle Market, Type (2020-2027) • BEV • PHEV • HEV 4.2. China Automotive High-Performance Electric Vehicle Market, by Vehicle Class (2020-2027) • Mid-Priced • Luxury 4.3. China Automotive High-Performance Electric Vehicle Market, by Vehicle type (2020-2027) • Two-wheelers • Passenger Cars • Commercial Vehicles 6. Company Profile: Key players 6.1. Tesla 6.1.1. Company Overview 6.1.2. Financial Overview 6.1.3. Presence 6.1.4. Capacity Portfolio 6.1.5. Business Strategy 6.1.6. Recent Developments 6.2. BMW Group 6.3. Nissan Motor Corporation 6.4. Toyota Motor Corporation 6.5. Volkswagen AG 6.6. General Motors 6.7. Daimler AG 6.8. Energica Motor Company S.p.A. 6.9. BYD Company Motors 6.10. Ford Motor Company. 6.11. SAIC-GM Wuling 6.12. NIO 6.13. Xpeng 6.14. Li Auto 6.15. WM Motors 6.16. Geely 6.17. Byton 6.18. Dongfeng Motors 6.19. Chang’an Automobile 6.20. Guangzhou Automobile