The China Ambulance Services Market size was valued at USD 30.4 Billion in 2023 and the total China Ambulance Services Market revenue is expected to grow at a CAGR of 5.2 % from 2023 to 2030, reaching nearly USD 43.35 Billion.China Ambulance Services Industry Analysis

China’s Huge Ambulance Service market continues to proliferate at a CAGR of 5.2 %. It is driven by economic growth and the increasing basic healthcare sector of China. China's Ambulance Service spending reached 5500 billion in 2023, continuing a 13.2% annual growth pace that began in 2018. From 2018 to 2022, Chinese Ambulance Service markets have seen significant investments from venture capital and private equity (VC/PE) firms. Between January 2021 and July 2022, there were 14 deals totaling US$ 450 million in venture capital (VC/PE) financing, which accounted for 45% of the total volume of transactions during the previous ten years. With 70 % of all hospital VC/PE capital volume going to specialized hospitals over the last ten years, these hospitals are in the limelight for investors. Government funding plays a significant role in the China Ambulance Service Market, particularly for emergency services provided by public hospitals. Private healthcare providers generate their revenue through patient transport fees and insurance reimbursements. The MMR report covers how this revenue growth impacts the China ambulance Service market and Investment opportunities for attracting private funding. This money has been used to improve infrastructure, enhance vehicles, and integrate advanced technology.To know about the Research Methodology :- Request Free Sample Report Table: Several cities in China have implemented pilot programs using intelligent traffic systems to prioritize ambulance movement.

Technological Advancement in Ambulance Services and Their Growth in China Advancements in technology, such as GPS tracking and communication systems, play a crucial role in improving the responsiveness of ambulance services. The Adoption of GPS tracking systems in the major cities of China has experienced tremendous growth, with over 97% of ambulances now equipped. Chinese government demonstrated a commitment to modernizing ambulance communication infrastructure. Chinese Government has invested over $1.2 billion to enhance the communication system in ambulances. This investment reflects a strategic approach to improve the inclusive effectiveness of ambulance services in responding to emergencies across the country. Millions of Chinese citizens use mobile health apps and wearables that send emergency alerts and transmit health data to ambulance services in China. Over 250 million Chinese people actively use the mHealth app and it covers a significant portion of the population. 13% of Emergency alerts originate from mHealth App, which also offers valuable initial information about the situation. These developments are transforming China's ambulance services, leading to faster response times, improved patient care, and a more efficient overall emergency response system. The National Basic Public Health Service Program (NBPHSP) plays a pivotal role in supporting China’s ambulance Services Market, Shaping its landscape through robust government and targeted resource allocation. 1. Financial allocation for NBPHSP is dedicates around 82 billion yuan ($12.3 billion) annually to basic public health services, a significant portion of which directly or indirectly supports ambulance operations. 2. The program's initiatives focus on enhancing public awareness and improving access to ambulance services, resulting in a notable increase in utilization rates. 3. A significant factor contributing to the market's demand is the stable funding offered by NBPHSP. This consistent financial support establishes a foundation of long-term stability and predictability, making the market an attractive prospect for investors and entrepreneurs seeking security in their projects.

City Program Details Numbers & Outcomes Shenzhen 1. Integrated with city traffic control system (TMS) 2. Dedicated “Green Wave” System prioritizes ambulances at traffic lights 3. Real-Time traffic data optimizes ambulance routes. 1. Reduced average ambulance travel time by 9% in the pilot area 2. Increased number of emergency calls handled per day Hangzhou 1. Collaborated with Alibaba Cloud for AI-powered traffic management 2. Predictive algorithm anticipates congestion and adjusts routes accordingly 1. Decreased Ambulance travel time by 13% during peak hours. 2. Improved Responsiveness to critical emergencies. Beijing 1. Trialing V2X communication technology (vehicle-to-everything) 2. Ambulances exchange real-time data with traffic infrastructure 3. Dynamic signal adjustment clears paths for approaching ambulances 1. Early results show potential for further time savings and increased safety Shanghai 1. Implementing cloud-based traffic management platform Centralized control optimizes traffic flow and prioritizes emergency vehicles 2. Utilizes historical data and real-time information 1. Expected to decrease travel time by 6 % across the city 2. Aims to improve emergency response efficiency in densely populated areas Challenges Faced by China for the Ambulance Services Market

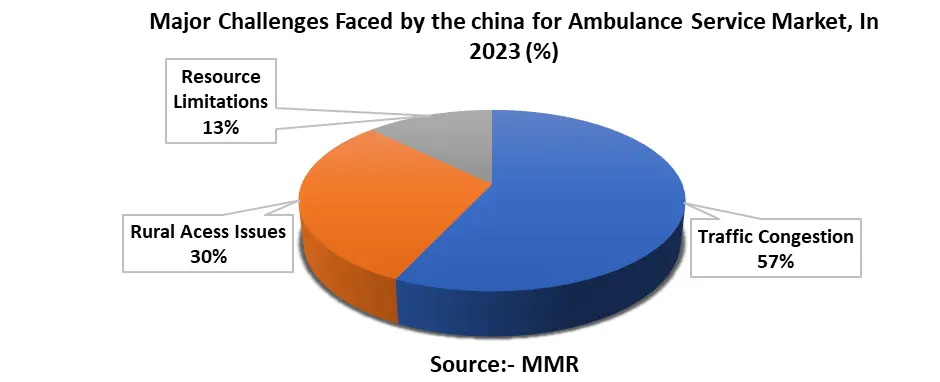

One significant challenge facing the ambulance services market in China is the issue of congestion and traffic-related hurdles. In densely populated urban areas, navigating through heavy traffic leads to delays in reaching emergencies at the appointed time. In 2022, Beijing ranked as the world's second most congested city, followed by Shanghai at Seventh. On average drivers in these cities spend over 40% of their travel time stuck in traffic. Implementing the Dedicated ambulance lanes is expected to reduce ambulance response times also potentially saving lives. MMR research estimates that it decreases travel time by up to 35%.

Ambulance Services Market in China Segments Analysis

By Transport, the ground ambulance segment, accounting for over 96 % of the market, forms the bedrock of China's emergency response system. The ground ambulance segment dominates the market, contributing over $43 billion to the total revenue of China's ambulance services market. An estimated 200,000 ground ambulances operate in China, catering to the vast population and diverse geography.China Ambulance Services Market Scope: Inquiry Before Buying

China Ambulance Services Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2022 Market Size in 2023: US $ 30.4 Bn. Forecast Period 2024 to 2030 CAGR: 5.2% Market Size in 2030: US $ 43.35 Bn. Segments Covered: by Transport Ground Ambulance Air Ambulance Water Ambulance by Equipment and Capabilities Basic Life Support (BLS) Advanced Life Support (ALS) by Service Type Emergency Services Non-Emergency Services Key Manufacturers in the China Ambulance Service Market

1. Ju An Medical 2. Huatai Emergency Medical Service 3. Civil Aviation Medical Emergency Rescue Center 4. NavInfo 5. Baidu Apollo 6. Alibaba Health 7. Ping An Good Doctor

1. China Ambulance Services Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. China Ambulance Services Market: Dynamics 2.1. China Ambulance Services Market Trends 2.2. PORTER’s Five Forces Analysis 2.3. PESTLE Analysis 2.4. Value Chain Analysis 2.5. Challenges and Opportunities in the Ambulance Services Market in China 2.6. Regulatory Landscape of China Ambulance Services Market 2.7. Technological Advancements in China Ambulance Services Market 2.8. Factors Driving the Growth of the Ambulance Services Market 2.9. Technological Advancements 2.10. Government Policies Reform for Healthcare Sector in China 2.11. Government Funding and Schemes 2.12. Initiative Focus on Dedicated Ambulance Lanes in China 2.13. Key Opinion Leader Analysis for China Ambulance Services Industry 2.14. China Ambulance Services Market Price Trend Analysis (2022-23) 3. China Ambulance Services Market: Market Size and Forecast by Segmentation for (by Value in USD Million) (2023-2030) 3.1. China Ambulance Services Market Size and Forecast, by Transport (2023-2030) 3.1.1. Ground Ambulance 3.1.2. Water Ambulance 3.1.3. Air Ambulance 3.2. China Ambulance Services Market Size and Forecast, by Equipment and Capabilities (2023-2030) 3.2.1. Basic Life Support (BLS) 3.2.2. Advanced Life Support (ALS) 3.3. China Ambulance Services Market Size and Forecast, by Service Type (2023-2030) 3.3.1. Emergency Services 3.3.2. Non-Emergency Services 4. China Ambulance Services Market: Competitive Landscape 4.1. MMR Competition Matrix 4.2. Competitive Landscape 4.3. Key Players Benchmarking 4.3.1. Company Name 4.3.2. Product Segment 4.3.3. End-user Segment 4.3.4. Revenue (2023) 4.4. Market Analysis by Organized Players vs. Unorganized Players 4.4.1. Organized Players 4.4.2. Unorganized Players 4.5. Leading China Ambulance Services Market Companies, by market capitalization 4.6. Market Trends and Challenges in China 4.6.1. Technological Advancements 4.6.2. Affordability and Accessibility 4.6.3. Shortage of Skilled Professionals 4.7. Market Structure 4.7.1. Market Leaders 4.7.2. Market Followers 4.7.3. Emerging Players in the Market 4.7.4. Challenges 4.7.5. Mergers and Acquisitions Details 5. Company Profile: Key Players 5.1. Ju An Medical 5.1.1. Company Overview 5.1.2. Business Portfolio 5.1.3. Financial Overview 5.1.4. SWOT Analysis 5.1.5. Strategic Analysis 5.1.6. Details on Partnership 5.1.7. Potential Impact of Emerging Technologies 5.1.8. Regulatory Accreditations and Certifications Received by Them 5.1.9. Strategies Adopted by Key Players 5.1.10. Recent Developments 5.2. Huatai Emergency Medical Service 5.3. Civil Aviation Medical Emergency Rescue Center 5.4. NavInfo 5.5. Baidu Apollo 5.6. Alibaba Health 5.7. Ping An Good Doctor 6. Key Findings 7. Industry Recommendations 8. China Ambulance Services Market: Research Methodology