The Ceramic Tiles Market size was valued at USD 391.23 Billion in 2025 and the total Ceramic Tiles revenue is expected to grow at a CAGR of 7.1% from 2026 to 2032, reaching nearly USD 632.36 Billion.Ceramic Tiles Market Overview:

Ceramic tiles, made from a mixture of clays and natural elements such as sand, quartz, and water, showcase strength, and resistance to high temperatures and acidic materials. The global ceramic tiles market expected significant growth due to the increasing demand for sustainable and visually appealing building materials, finding extensive application in residential, commercial, healthcare, and hospitality sectors, driven by evolving architectural and interior design trends. The market's growth is fueled by the strong development of construction and infrastructure industries in emerging economies such as India, China, Brazil, and South Asian countries, with various types of tiles catering to diverse construction needs across key regions worldwide. Technological advancements in ceramic tile manufacturing and the availability of abundant raw materials have further contributed to market growth. Leading players in the global ceramic tiles market, including Porcelanosa Group, Kajaria Ceramics Limited, Atlas Concorde S.P.A., Ceramic Industries Group, Cerâmica Carmelo Fior, Cersanit Group, China Ceramics Co., Ltd., Crossville Inc., and Dynasty Ceramic Public Company Limited, engage in strong competition, emphasizing product innovation, quality, and market presence. For instance, since January, Kajaria Ceramics Limited has successfully opened over 15 new ceramic tiles showrooms in India. The Ceramic Tiles Market's bright future is highlighted by its versatility and widespread utilization in various sectors, propelling it towards continued growth.Ceramic Tiles Market Scope and Research Methodology

The Ceramic Tiles Market report offers a thorough evaluation of the market for the forecast period. It examines patterns and factors shaping the market, including drivers, constraints, opportunities, and challenges. The report also provides expected revenue growth for the Ceramic Tiles Market during the forecast period. The research on the Ceramic Tiles Market analyses major applications, business strategies, and influencing factors. The report examines market trends, volume, cost, share, supply and demand, and utilizes methods like SWOT and PESTLE analysis. Primary research resources include databases and surveys.To know about the Research Methodology :- Request Free Sample Report

Ceramic Tiles Market Dynamics:

Ceramic Tiles Market Drivers

Rising Urbanization Drives Ceramic Tiles Demand in Infrastructure Projects The growing construction sector, especially in developing economies driving market growth. Rapid urbanization and population growth fueled an increased demand for infrastructure development, thereby stimulating the need for ceramic tiles in various construction projects. Rising the middle-class population and increasing disposable income in emerging economies led to an increase in demand for improved housing and infrastructure, further boosting the utilization of ceramic tiles in the construction industry. Ceramic tiles possess several advantages, such as durability, water resistance, ease of maintenance, and a wide array of designs and colors, making them a preferred choice among both builders and consumers. As eco-friendly building practices gain popularity, ceramic tiles have gained acceptance due to their natural composition and recyclability, aligning with green construction initiatives. A significant market driver is the escalating demand for digitally printed ceramic tiles. The preference for digitally printed tiles has grown as their composite designs enhance the aesthetic appeal of residential and office spaces. The adoption of new technologies for printing designs on tiles has allowed manufacturers to offer a wide spectrum of unique designs, to diverse consumer preferences. For instance, In April, MSI, a leading supplier of flooring and wall tiles in North America, expanded its Q Premium Natural Quartz product range with five new marble-look colours. These additions cater to diverse styles and preferences, reflecting MSI's commitment to providing an extensive and on-trend selection of products. Visually stimulating mosaic tiles have become increasingly popular due to their inherent beauty. Entire rooms adorned with mosaic designs create a magnificent and visually captivating ambience. This trend is driven by unique customized artworks, with brands like Hindware Italian Tiles offering products inspired by famous artists like Frida Kahlo and Picasso. Hygiene consciousness among consumers has given rise to an innovative segment in the market - germ-resistant tiles. These tiles are made using a special glaze and undergo a unique anti-microbial treatment, effectively preventing the growth of germs, bacteria, and fungus on the tiles. This development has further augmented the demand for ceramic tiles, especially in spaces where hygiene is ultimate concern.

Ceramic Tiles Market Restraint

Regulatory Challenges and Fluctuating Raw Material Prices Impact Ceramic Tiles Market The ceramic tiles market encounters several significant restraints that impact its growth and operations. One major challenge is the high energy consumption during the production process, wherein firing ceramic tiles in kilns at high temperatures requires substantial energy input. This not only leads to higher production costs but also contributes to manufacturers' increased carbon footprint. As environmental concerns and sustainability become more critical, the industry faces the task of balancing energy efficiency while meeting the rising demand for ceramic tiles. To remain competitive and environmentally responsible, investments in more sustainable production methods are necessary. The ceramics industry heavily relies on imported raw materials like clay, feldspar, and quartz, making it susceptible to fluctuations in global prices, disruptions in the supply chain, and logistical challenges. These factors lead to escalated production costs and hinder expansion efforts. Inadequate infrastructure, including inefficient transportation networks and unreliable power supply, poses adverse effects on the industry's operations, with frequent power outages disrupting production schedules and increasing expenses. This scenario makes it challenging for manufacturers to compete effectively in the global market. Another constraint faced by the ceramics industry is limited access to skilled labour and a lack of technological advancements. To improve productivity, efficiency, and competitiveness, the sector must prioritize upgrading machinery, implementing automation, and nurturing skilled human resources. Moreover, intense competition from international players, particularly those with advanced technology and cost-effective production methods, adds to the challenges. To stay competitive, local manufacturers must focus on enhancing product quality, innovation, and diversification to cater to evolving consumer demands effectively. The production of ceramic tiles' significant energy consumption and carbon footprint are concerning amid mounting environmental concerns. Fluctuations in raw material prices pose a threat, affecting manufacturers' profit margins and overall market growth. The presence of alternative flooring materials like vinyl, laminate, and engineered wood, offering competitive pricing and ease of installation, further hinders the ceramics market's growth prospects. Regulatory challenges exert a significant impact on the ceramic tiles market, with different regions having distinct standards for these products. For instance, in the UK and the EU, the norm EN 14411, and in the US, ANSI 137, establish the requirements and classification of ceramic tiles based on specific characteristics. Similarly, in India, IS, ISO, and EN (4457:2007) outline minimum manufacturing requirements that manufacturers must adhere to the rules. These varying standards create complexities for companies operating in multiple regions, potentially requiring additional efforts to ensure compliance and adaptability.Ceramic Tiles market opportunities:

Renovation and Remodeling Projects Boosting Ceramic Tiles Preference The increasing urbanization and population growth in developing economies are driving the demand for infrastructure development, creating opportunities for the ceramic tiles market to grow as construction projects surge. For instance, 10 futuristic cities are set to be built around the world including The Line- Saudi Arabia, New Administrative Capital- Egypt, Biodiversity- Malaysia, Amaravati- India and others. The booming real estate sector in emerging economies also fuels the demand for ceramic tiles in residential and commercial construction, presenting a significant opportunity for their utilization in flooring and wall applications. Advancements in manufacturing technologies and digital printing techniques open up new design possibilities, attracting more consumers and expanding the market. The rising awareness of environmental sustainability and green building practices provides opportunities for ceramic tiles made from recycled materials and eco-friendly processes, appealing to environmentally conscious consumers and projects. The rapid urbanization in the Asia Pacific region, especially in China and India, leads to increased housing and commercial space demand, further driving the ceramic tiles market. Renovation and remodeling projects create a preference for ceramic tiles due to their durability, aesthetics, and easy maintenance. The hospitality industry's growth, encompassing hotels, restaurants, and resorts, offers opportunities for ceramic tiles with their durability and design options. The rise of e-commerce and online retail platforms presents another avenue for manufacturers to reach a broader customer base and explore new market segments. Innovations in manufacturing processes, particularly digital printing technology, enable manufacturers to produce intricate and customized designs, expanding their market presence. manufacturers can explore niche segments by diversifying their product offerings, catering to specialized applications such as anti-slip tiles for healthcare facilities and swimming pool tiles for leisure centres. As emerging economies witness rapid infrastructure development, the ceramic tiles market can capitalize on these opportunities and strengthen its presence in the industry.Ceramic Tiles Market Segment Analysis:

Based on Type, the Porcelain tiles segment dominated the ceramic tiles market in 2025 and is expected to continue its dominance during the forecast period. These tiles are more durable and less porous than glazed ceramic tiles, suitable for both indoor and outdoor applications. They withstand heavy foot traffic and are commonly used in high-traffic areas like commercial spaces and outdoor patios. The glazed ceramic tiles segment is expected fast growth in the ceramic tiles market during the forecast period, known for vibrant colours and glossy finish. Widely used in interior applications for residential and commercial buildings, these tiles offer water resistance and easy cleaning, making them ideal for spaces where aesthetics and design are crucial, such as kitchens and bathrooms. Scratch-free ceramic tiles are expected to hold a significant share during the forecast period. Scratch-free ceramic tiles are highly resistant to scratches and abrasions and manufactured for heavy-duty applications such as industrial floors, hospitals, and airports. They offer excellent longevity and retain their appearance even in demanding environments, making them a reliable choice for durable and long-lasting surfaces. Based on Application, Floor tiles dominated the largest ceramic tiles market share in 2025 and are expected to continue their dominance during the forecast period. Ceramic floor tiles are renowned for their outstanding durability, slip resistance, and ease of cleaning, making them a perfect choice for both residential and commercial spaces. Floor tiles diverse selection of materials, designs, and sizes cater to various interior design preferences, making them extensively used in homes, offices, shopping malls, airports, and public spaces. Wall ceramic tile is a rapidly growing segment in the ceramic tiles market, Wall tiles are designed for vertical surfaces and are widely used for interior and exterior wall coverings. They come in various sizes, colours, and patterns, allowing for creative and decorative applications. Wall tiles are preferred for their ease of maintenance, water resistance, and ability to enhance the aesthetic appeal of spaces.Ceramic Tiles Market Regional Insights:

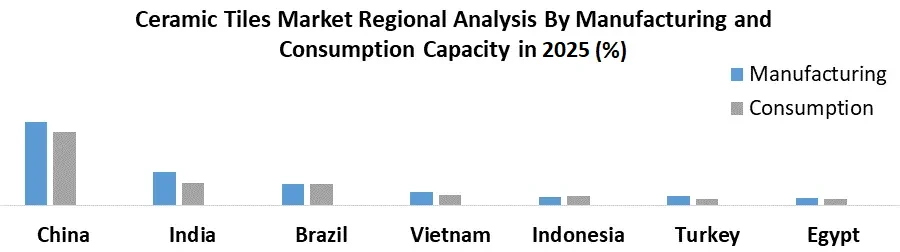

Asia Pacific dominated the Ceramic Tiles Market in 2025, with xx% of global production. China contributes nearly xx% in the manufacturing of ceramic tiles and exports around 24-25% to other regions. The region is expected to maintain its dominance during the forecast period due to high demand from residential and non-residential construction segments, especially in emerging economies like China and India. North Americas ceramic tiles market is expected a significant growth during the forecast period, fueled by rising construction activities in residential and commercial sectors. Italian tile manufacturers are capitalizing on the region's availability of raw materials and untapped market potential, leading to expansions of their production bases. North America stands as the largest region for ceramic tiles imports, with the USA alone accounting for xx% of ceramic tile imports, according to ICCTAS's latest industry report. Europe is a fast-growing region in the ceramic tiles market, with notable manufacturers like Mohawk Industries and Grupo Pamesa, exporting around xx% of global ceramic tiles to other regions. South America and the Middle East Africa are expected to experience rapid growth in the ceramic market as well.

Competitive Landscape:

The ceramic tiles market's competitive landscape is characterized by dynamic competition among key players, each vying for market share through product innovation, quality, and customer satisfaction. Notable companies such as Porcelanosa Group, Mohawk Industries, RAK Ceramics, Siam Cement Group, Kajaria Ceramics Limited, Lamosa Grupo, Grupo Cedasa, SCG Ceramics, Roca Sanitario, and China Ceramics Co., Ltd. lead the industry. These manufacturers operate globally and offer diverse ranges of high-quality and innovative ceramic tiles for various residential, commercial, and industrial applications. With a strong emphasis on sustainability, technology-driven manufacturing, and wide distribution networks, these players continuously contribute to the market's competitiveness and growth.Mohawk Industries stands as a market leader with over 25 ceramic tiles manufacturing plants, of which 23 are located in the USA. The company's growth is further evidenced by 32 acquisitions made since 2013. Group Lamosa is another significant player in the ceramic tiles market, boasting 16 manufacturing plants in South America. SGC Ceramics, with 28 ceramic tiles manufacturing plants worldwide, holds a 12% global share in exporting ceramic tiles. Ceramica Carmelo Fior commands a 32% global export share in the ceramic tiles market. These prominent players' manufacturing capacities and market shares reflect their influential positions in the industry.

Ceramic Tiles Industry Ecosystem

Ceramic Tiles Market Scope: Inquire before buying

Ceramic Tiles Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 391.23 Billion Forecast Period 2026 to 2032 CAGR: 7.1 % Market Size in 2032: USD 632.36 Billion. Segments Covered: by Type Glazed ceramic tile Porcelain tiles Scratch-free ceramic tiles Others by Finish Matt Gloss by Construction Type New Construction Renovation and Replacement by Application Wall tiles Floor tiles Other by End User Residential Commercial Ceramic Tiles Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Ceramic Tiles Market Key Players

1. Arwana Citramulia Tbk 2. ATLAS CONCORDE S.P.A. 3. Avalon Flooring 4. Ceramic Industries Group 5. Cerâmica Carmelo Fior 6. Cersanit Group 7. China Ceramics Co., Ltd. 8. Crossville Inc. 9. Dynasty Ceramic Public Company Limited 10. Elizabeth Group 11. Florim Ceramiche S.p.A. 12. Grupo Cedasa 13. Grupo Celima Trebol 14. Grupo Lamosa 15. Guangdong Newpearl Ceramics Group Co., Ltd. 16. Kajaria Ceramics Limited 17. Kaleseramik 18. Lamsoa Group 19. LASSELSBERGER Group 20. MOHAWK INDUSTRIES INC. 21. PAMESA CERÁMICA SL 22. Porcelanosa Group 23. RAK CERAMICS 24. Ricchetti Group 25. SCG CERAMICS 26. Siam Cement Group 27. Somany Ceramics 28. STN Cerámica 29. Vitromex USA, Inc. 30. White Horse CeramicFrequently Asked Questions:

1] What segments are covered in the Global Ceramic Tiles Market report? Ans. The segments covered in the Ceramic Tiles Market report are based on Type, Finish, Construction Type, Application, End-User and Region. 2] Which region is expected to hold the highest share of the Global Ceramic Tiles Market? Ans. The Asia Pacific region is expected to hold the highest share of the Ceramic Tiles Market. 3] What is the market size of the Global Ceramic Tiles Market by 2032? Ans. The market size of the Ceramic Tiles Market by 2032 is expected to reach USD 632.36 Billion. 4] What is the forecast period for the Global Ceramic Tiles Market? Ans. The forecast period for the Ceramic Tiles Market is 2026-2032. 5] What was the Global Ceramic Tiles Market size in 2025? Ans: The Global Ceramic Tiles Market size was USD 391.23 Billion in 2025.

1. Ceramic Tiles Market Introduction 1.1. Study Assumption and Market Definition 1.1.1. Inclusion and Exclusion 1.2. Scope of the Study 1.2.1. Ceramic Tiles: Market Segmentation 1.2.2. Region Covered 1.3. Executive Summary 2. Global Ceramic Tiles Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Market share analysis of major players 2.4. Products specific analysis 2.5. Key Players Benchmarking 2.5.1. Company Name 2.5.2. Product Segment 2.5.3. End-user Segment 2.5.4. Revenue (2025) 2.5.5. Key Development 2.5.6. Market Share 2.6. Industry Ecosystem 2.6.1. Key players in the Ceramic Tiles ecosystem 2.6.2. Role of companies in the Ceramic Tiles ecosystem 2.7. Upcoming Technological and Advancement Initiatives by Key Players 2.8. Market Structure 2.8.1. Market Leaders 2.8.2. Market Followers 2.8.3. Emerging Players 2.9. Consolidation of the Market 2.9.1. Strategic Initiatives and Developments 2.9.2. Mergers and Acquisitions 2.9.3. Collaborations and Partnerships 2.9.4. Product Launches and Innovations 2.10. Pricing Analysis: Average Selling Price of Ceramic Tiles Offered by Key Players in the Market 3. Ceramic Tiles Market: Dynamics 3.1. Ceramic Tiles Market Trends by Region 3.1.1. North America Ceramic Tiles Market Trends 3.1.2. Europe Ceramic Tiles Market Trends 3.1.3. Asia Pacific Ceramic Tiles Market Trends 3.1.4. South America Ceramic Tiles Market Trends 3.1.5. Middle East & Africa (MEA) Ceramic Tiles Market Trends 3.2. Ceramic Tiles Market Dynamics 3.2.1.1. Drivers 3.2.1.2. Restraints 3.2.1.3. Opportunities 3.2.1.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.3.1. Threat of New Entrants 3.3.2. Threat of Substitutes 3.3.3. Bargaining Power of Suppliers 3.3.4. Bargaining Power of Buyers 3.3.5. Intensity of Competitive Rivalry 3.4. Value/Supply Chain Analysis 3.4.1. Ceramic Tiles Market: Value Chain Analysis 3.4.2. Ceramic Tiles Market: Supply Chain Analysis 3.5. Impact of Trends and Disruption on manufacturer 3.6. Technological Analysis 3.6.1. Key Technological 3.6.2. Complementary Technologies 3.7. Key Stakeholder and Buying Criteria 3.7.1. Influence of Stakeholders on the Buying Process for the Top Applications 3.7.2. Key Buying Criteria for Top Applications 3.8. Regulatory Landscape 3.8.1. Regulation by Region 3.8.2. Tariff and Taxes 3.8.3. Regulatory Bodies, Government agencies, and other organization by Region 3.9. Patent Analysis 3.9.1. Top 10 Patent Holders 3.9.2. Top 10 Companies with Highest Number of Patents 3.9.3. Patent Registration Analysis 3.9.4. Number of Patents Granted Still 2024 4. Trade Data Analysis: 4.1.1. Import/ Export of Ceramic Tiles 4.1.2. Import Data on Ceramic Tiles 4.1.3. Export Data on Ceramic Tiles 5. Ceramic Tiles Market: Global Market Size and Forecast by Segmentation (by Value USD Bn) (2025-2032) 5.1. Global Ceramic Tiles Market Size and Forecast, by Type (2025-2032) 5.1.1. Glazed ceramic tile 5.1.2. Porcelain tiles 5.1.3. Scratch-free ceramic tiles 5.1.4. Others 5.2. Global Ceramic Tiles Market Size and Forecast, by Finish (2025-2032) 5.2.1. Matt 5.2.2. Gloss 5.3. Global Ceramic Tiles Market Size and Forecast, by Construction Type (2025-2032) 5.3.1. New Construction 5.3.2. Renovation and Replacement 5.4. Global Ceramic Tiles Market Size and Forecast, by Application (2025-2032) 5.4.1. Wall tiles 5.4.2. Floor tiles 5.4.3. Other 5.5. Global Ceramic Tiles Market Size and Forecast, by End User (2025-2032) 5.5.1. Residential 5.5.2. Commercial 5.6. Global Ceramic Tiles Market Size and Forecast, by Region (2025-2032) 5.6.1. North America 5.6.2. Europe 5.6.3. Asia Pacific 5.6.4. South America 5.6.5. MEA 6. North America Ceramic Tiles Market Size and Forecast by Segmentation (by Value USD Bn) (2025-2032) 6.1. North America Ceramic Tiles Market Size and Forecast, by Type (2025-2032) 6.1.1. Glazed ceramic tile 6.1.2. Porcelain tiles 6.1.3. Scratch-free ceramic tiles 6.1.4. Others 6.2. North America Ceramic Tiles Market Size and Forecast, by Finish (2025-2032) 6.2.1. Matt 6.2.2. Gloss 6.3. North America Ceramic Tiles Market Size and Forecast, by Construction Type (2025-2032) 6.3.1. New Construction 6.3.2. Renovation and Replacement 6.4. North America Ceramic Tiles Market Size and Forecast, by Application (2025-2032) 6.4.1. Wall tiles 6.4.2. Floor tiles 6.4.3. Other 6.5. North America Ceramic Tiles Market Size and Forecast, by End User (2025-2032) 6.5.1. Residential 6.5.2. Commercial 6.6. North America Ceramic Tiles Market Size and Forecast, by Country (2025-2032) 6.6.1. United States 6.6.1.1. United States Ceramic Tiles Market Size and Forecast, by Type (2025-2032) 6.6.1.1.1. Glazed ceramic tile 6.6.1.1.2. Porcelain tiles 6.6.1.1.3. Scratch-free ceramic tiles 6.6.1.1.4. Others 6.6.1.2. United States Ceramic Tiles Market Size and Forecast, by Finish (2025-2032) 6.6.1.2.1. Matt 6.6.1.2.2. Gloss 6.6.1.3. United States Ceramic Tiles Market Size and Forecast, by Construction Type (2025-2032) 6.6.1.3.1. New Construction 6.6.1.3.2. Renovation and Replacement 6.6.1.4. United States Ceramic Tiles Market Size and Forecast, by Application (2025-2032) 6.6.1.4.1. Wall tiles 6.6.1.4.2. Floor tiles 6.6.1.4.3. Other 6.6.1.5. United States Ceramic Tiles Market Size and Forecast, by End User (2025-2032) 6.6.1.5.1. Residential 6.6.1.5.2. Commercial 6.6.2. Canada 6.6.2.1. Canada Ceramic Tiles Market Size and Forecast, by Type (2025-2032) 6.6.2.1.1. Glazed ceramic tile 6.6.2.1.2. Porcelain tiles 6.6.2.1.3. Scratch-free ceramic tiles 6.6.2.1.4. Others 6.6.2.2. Canada Ceramic Tiles Market Size and Forecast, by Finish (2025-2032) 6.6.2.2.1. Matt 6.6.2.2.2. Gloss 6.6.2.3. Canada Ceramic Tiles Market Size and Forecast, by Construction Type (2025-2032) 6.6.2.4. New Construction 6.6.2.5. Renovation and Replacement 6.6.2.6. Canada Ceramic Tiles Market Size and Forecast, by Application (2025-2032) 6.6.2.6.1. Wall tiles 6.6.2.6.2. Floor tiles 6.6.2.6.3. Other 6.6.2.7. Canada Ceramic Tiles Market Size and Forecast, by End User (2025-2032) 6.6.2.7.1. Residential 6.6.2.7.2. Commercial 6.6.3. Mexico 6.6.3.1. Mexico Ceramic Tiles Market Size and Forecast, by Type (2025-2032) 6.6.3.1.1. Glazed ceramic tile 6.6.3.1.2. Porcelain tiles 6.6.3.1.3. Scratch-free ceramic tiles 6.6.3.1.4. Others 6.6.3.2. Mexico Ceramic Tiles Market Size and Forecast, by Finish (2025-2032) 6.6.3.2.1. Matt 6.6.3.2.2. Gloss 6.6.3.3. Mexico Ceramic Tiles Market Size and Forecast, by Construction Type (2025-2032) 6.6.3.3.1. New Construction 6.6.3.3.2. Renovation and Replacement 6.6.3.4. Mexico Ceramic Tiles Market Size and Forecast, by Application (2025-2032) 6.6.3.4.1. Wall tiles 6.6.3.4.2. Floor tiles 6.6.3.4.3. Other 6.6.3.5. Mexico Ceramic Tiles Market Size and Forecast, by End User (2025-2032) 6.6.3.5.1. Residential 6.6.3.5.2. Commercial 7. Europe Ceramic Tiles Market Size and Forecast by Segmentation (by Value USD Bn) (2025-2032) 7.1. Europe Ceramic Tiles Market Size and Forecast, by Type (2025-2032) 7.2. Europe Ceramic Tiles Market Size and Forecast, by Finish (2025-2032) 7.3. Europe Ceramic Tiles Market Size and Forecast, by Construction Type (2025-2032) 7.4. Europe Ceramic Tiles Market Size and Forecast, by Application (2025-2032) 7.5. Europe Ceramic Tiles Market Size and Forecast, by End User (2025-2032) 7.6. Europe Ceramic Tiles Market Size and Forecast, by Country (2025-2032) 7.6.1. United Kingdom 7.6.1.1. United Kingdom Ceramic Tiles Market Size and Forecast, by Type (2025-2032) 7.6.1.2. United Kingdom Ceramic Tiles Market Size and Forecast, by Finish (2025-2032) 7.6.1.3. United Kingdom Ceramic Tiles Market Size and Forecast, by Construction Type (2025-2032) 7.6.1.4. United Kingdom Ceramic Tiles Market Size and Forecast, by Application (2025-2032) 7.6.1.5. United Kingdom Ceramic Tiles Market Size and Forecast, by End User (2025-2032) 7.6.2. France 7.6.2.1. France Ceramic Tiles Market Size and Forecast, by Application (2025-2032) 7.6.2.2. France Ceramic Tiles Market Size and Forecast, by Finish (2025-2032) 7.6.2.3. France Ceramic Tiles Market Size and Forecast, by Type (2025-2032) 7.6.2.4. France Ceramic Tiles Market Size and Forecast, by Construction Type (2025-2032) 7.6.2.5. France Ceramic Tiles Market Size and Forecast, by End User (2025-2032) 7.6.3. Germany 7.6.3.1. Germany Ceramic Tiles Market Size and Forecast, by Type (2025-2032) 7.6.3.2. Germany Ceramic Tiles Market Size and Forecast, by Finish (2025-2032) 7.6.3.3. Germany Ceramic Tiles Market Size and Forecast, by Construction Type (2025-2032) 7.6.3.4. Germany Ceramic Tiles Market Size and Forecast, by Application (2025-2032) 7.6.3.5. Germany Ceramic Tiles Market Size and Forecast, by End User (2025-2032) 7.6.4. Italy 7.6.4.1. Italy Ceramic Tiles Market Size and Forecast, by Type (2025-2032) 7.6.4.2. Italy Ceramic Tiles Market Size and Forecast, by Finish (2025-2032) 7.6.4.3. Italy Ceramic Tiles Market Size and Forecast, by Construction Type (2025-2032) 7.6.4.4. Italy Ceramic Tiles Market Size and Forecast, by Application (2025-2032) 7.6.4.5. Italy Ceramic Tiles Market Size and Forecast, by End User (2025-2032) 7.6.5. Spain 7.6.5.1. Spain Ceramic Tiles Market Size and Forecast, by Type (2025-2032) 7.6.5.2. Spain Ceramic Tiles Market Size and Forecast, by Finish (2025-2032) 7.6.5.3. Spain Ceramic Tiles Market Size and Forecast, by Construction Type (2025-2032) 7.6.5.4. Spain Ceramic Tiles Market Size and Forecast, by Application (2025-2032) 7.6.5.5. Spain Ceramic Tiles Market Size and Forecast, by End User (2025-2032) 7.6.6. Sweden 7.6.6.1. Sweden Ceramic Tiles Market Size and Forecast, by Type (2025-2032) 7.6.6.2. Sweden Ceramic Tiles Market Size and Forecast, by Finish (2025-2032) 7.6.6.3. Sweden Ceramic Tiles Market Size and Forecast, by Construction Type (2025-2032) 7.6.6.4. Sweden Ceramic Tiles Market Size and Forecast, by Application (2025-2032) 7.6.6.5. Sweden Ceramic Tiles Market Size and Forecast, by End User (2025-2032) 7.6.7. Austria 7.6.7.1. Austria Ceramic Tiles Market Size and Forecast, by Type (2025-2032) 7.6.7.2. Austria Ceramic Tiles Market Size and Forecast, by Finish (2025-2032) 7.6.7.3. Austria Ceramic Tiles Market Size and Forecast, by Construction Type (2025-2032) 7.6.7.4. Austria Ceramic Tiles Market Size and Forecast, by Application (2025-2032) 7.6.7.5. Austria Ceramic Tiles Market Size and Forecast, by End User (2025-2032) 7.6.8. Rest of Europe 7.6.8.1. Rest of Europe Ceramic Tiles Market Size and Forecast, by Type (2025-2032) 7.6.8.2. Rest of Europe Ceramic Tiles Market Size and Forecast, by Finish (2025-2032) 7.6.8.3. Rest of Europe Ceramic Tiles Market Size and Forecast, by Construction Type (2025-2032) 7.6.8.4. Rest of Europe Ceramic Tiles Market Size and Forecast, by Application (2025-2032) 7.6.8.5. Rest of Europe Ceramic Tiles Market Size and Forecast, by End User (2025-2032) 8. Asia Pacific Ceramic Tiles Market Size and Forecast by Segmentation (by Value USD Bn) (2025-2032) 8.1. Asia Pacific Ceramic Tiles Market Size and Forecast, by Type (2025-2032) 8.2. Asia Ceramic Tiles Market Size and Forecast, by Finish (2025-2032) 8.3. Asia Pacific Ceramic Tiles Market Size and Forecast, by Construction Type (2025-2032) 8.4. Asia Pacific Ceramic Tiles Market Size and Forecast, by Application (2025-2032) 8.5. Asia Pacific Ceramic Tiles Market Size and Forecast, by End User (2025-2032) 8.6. Asia Pacific Ceramic Tiles Market Size and Forecast, by Country (2025-2032) 8.6.1. China 8.6.1.1. China Ceramic Tiles Market Size and Forecast, by Type (2025-2032) 8.6.1.2. China Ceramic Tiles Market Size and Forecast, by Construction Type (2025-2032) 8.6.1.3. China Ceramic Tiles Market Size and Forecast, by Application (2025-2032) 8.6.1.4. China Ceramic Tiles Market Size and Forecast, by End User (2025-2032) 8.6.2. S Korea 8.6.2.1. S Korea Ceramic Tiles Market Size and Forecast, by Type (2025-2032) 8.6.2.2. S Korea Ceramic Tiles Market Size and Forecast, by Construction Type (2025-2032) 8.6.2.3. S Korea Ceramic Tiles Market Size and Forecast, by Application (2025-2032) 8.6.2.4. S Korea Ceramic Tiles Market Size and Forecast, by End User (2025-2032) 8.6.3. Japan 8.6.3.1. Japan Ceramic Tiles Market Size and Forecast, by Type (2025-2032) 8.6.3.2. Japan Ceramic Tiles Market Size and Forecast, by Construction Type (2025-2032) 8.6.3.3. Japan Ceramic Tiles Market Size and Forecast, by Finish (2025-2032) 8.6.3.4. Japan Ceramic Tiles Market Size and Forecast, by Application (2025-2032) 8.6.3.5. Japan Ceramic Tiles Market Size and Forecast, by End User (2025-2032) 8.6.4. India 8.6.4.1. India Ceramic Tiles Market Size and Forecast, by Type (2025-2032) 8.6.4.2. India Ceramic Tiles Market Size and Forecast, by Finish (2025-2032) 8.6.4.3. India Ceramic Tiles Market Size and Forecast, by Construction Type (2025-2032) 8.6.4.4. 8.6.4.5. India Ceramic Tiles Market Size and Forecast, by Application (2025-2032) 8.6.4.6. India Ceramic Tiles Market Size and Forecast, by End User (2025-2032) 8.6.5. Australia 8.6.5.1. Australia Ceramic Tiles Market Size and Forecast, by Type (2025-2032) 8.6.5.2. Australia Ceramic Tiles Market Size and Forecast, by Finish (2025-2032) 8.6.5.3. Australia Ceramic Tiles Market Size and Forecast, by Construction Type (2025-2032) 8.6.5.4. Australia Ceramic Tiles Market Size and Forecast, by Application (2025-2032) 8.6.5.5. Australia Ceramic Tiles Market Size and Forecast, by End User (2025-2032) 8.6.6. ASEAN 8.6.6.1. ASEAN Ceramic Tiles Market Size and Forecast, by Type (2025-2032) 8.6.6.2. ASEAN Ceramic Tiles Market Size and Forecast, by Finish (2025-2032) 8.6.6.3. ASEAN Ceramic Tiles Market Size and Forecast, by Construction Type (2025-2032) 8.6.6.4. ASEAN Ceramic Tiles Market Size and Forecast, by Application (2025-2032) 8.6.6.5. ASEAN Ceramic Tiles Market Size and Forecast, by End User (2025-2032) 8.6.7. Rest of Asia Pacific 8.6.7.1. Rest of Asia Pacific Ceramic Tiles Market Size and Forecast, by Type (2025-2032) 8.6.7.2. Rest of Asia Pacific Ceramic Tiles Market Size and Forecast, by Finish (2025-2032) 8.6.7.3. Rest of Asia Pacific Ceramic Tiles Market Size and Forecast, by Construction Type (2025-2032) 8.6.7.4. Rest of Asia Pacific Ceramic Tiles Market Size and Forecast, by Application (2025-2032) 8.6.7.5. Rest of Asia Pacific Ceramic Tiles Market Size and Forecast, by End User (2025-2032) 9. South America Ceramic Tiles Market Size and Forecast by Segmentation (by Value USD Bn) (2025-2032) 9.1. South America Ceramic Tiles Market Size and Forecast, by Type (2025-2032) 9.2. South America Ceramic Tiles Market Size and Forecast, by Finish (2025-2032) 9.3. South America Ceramic Tiles Market Size and Forecast, by Construction Type (2025-2032) 9.4. South America Ceramic Tiles Market Size and Forecast, by Application (2025-2032) 9.5. South America Ceramic Tiles Market Size and Forecast, by End User (2025-2032) 9.6. South America Ceramic Tiles Market Size and Forecast, by Country (2025-2032) 9.6.1. Brazil 9.6.1.1. Brazil Ceramic Tiles Market Size and Forecast, by Type (2025-2032) 9.6.1.2. Brazil Ceramic Tiles Market Size and Forecast, by Finish (2025-2032) 9.6.1.3. Brazil Ceramic Tiles Market Size and Forecast, by Construction Type (2025-2032) 9.6.1.4. Brazil Ceramic Tiles Market Size and Forecast, by Application (2025-2032) 9.6.1.5. Brazil Ceramic Tiles Market Size and Forecast, by End User (2025-2032) 9.6.2. Argentina 9.6.2.1. Argentina Ceramic Tiles Market Size and Forecast, by Type (2025-2032) 9.6.2.2. Argentina Ceramic Tiles Market Size and Forecast, by Finish (2025-2032) 9.6.2.3. Argentina Ceramic Tiles Market Size and Forecast, by Construction Type (2025-2032) 9.6.2.4. Argentina Ceramic Tiles Market Size and Forecast, by Application (2025-2032) 9.6.2.5. Argentina Ceramic Tiles Market Size and Forecast, by End User (2025-2032) 9.6.3. Rest Of South America 9.6.3.1. Rest Of South America Ceramic Tiles Market Size and Forecast, by Type (2025-2032) 9.6.3.2. Rest of South America Ceramic Tiles Market Size and Forecast, by Finish (2025-2032) 9.6.3.3. Rest of South America Ceramic Tiles Market Size and Forecast, by Construction Type (2025-2032) 9.6.3.4. Rest Of South America Ceramic Tiles Market Size and Forecast, by Application (2025-2032) 9.6.3.5. Rest Of South America Ceramic Tiles Market Size and Forecast, by End User (2025-2032) 10. Middle East and Africa Ceramic Tiles Market Size and Forecast by Segmentation (by Value USD Bn) (2025-2032) 10.1. Middle East and Africa Ceramic Tiles Market Size and Forecast, by Type (2025-2032) 10.2. Middle East and Africa Ceramic Tiles Market Size and Forecast, by Finish (2025-2032) 10.3. Middle East and Africa Ceramic Tiles Market Size and Forecast, by Construction Type (2025-2032) 10.4. Middle East and Africa Ceramic Tiles Market Size and Forecast, by Application (2025-2032) 10.5. Middle East and Africa Ceramic Tiles Market Size and Forecast, by End User (2025-2032) 10.6. Middle East and Africa Ceramic Tiles Market Size and Forecast, by Country (2025-2032) 10.6.1. South Africa 10.6.1.1. South Africa Ceramic Tiles Market Size and Forecast, by Type (2025-2032) 10.6.1.2. South Africa Ceramic Tiles Market Size and Forecast, by Finish (2025-2032) 10.6.1.3. South Africa Ceramic Tiles Market Size and Forecast, by Construction Type (2025-2032) 10.6.1.4. South Africa Ceramic Tiles Market Size and Forecast, by Application (2025-2032) 10.6.1.5. South Africa Ceramic Tiles Market Size and Forecast, by End User (2025-2032) 10.6.2. GCC 10.6.2.1. GCC Ceramic Tiles Market Size and Forecast, by Type (2025-2032) 10.6.2.2. GCC Ceramic Tiles Market Size and Forecast, by Finish (2025-2032) 10.6.2.3. GCC Ceramic Tiles Market Size and Forecast, by Construction Type (2025-2032) 10.6.2.4. GCC Ceramic Tiles Market Size and Forecast, by Application (2025-2032) 10.6.2.5. GCC Ceramic Tiles Market Size and Forecast, by End User (2025-2032) 10.6.3. Rest Of MEA 10.6.3.1. Rest Of MEA Ceramic Tiles Market Size and Forecast, by Type (2025-2032) 10.6.3.2. Rest of MEA Ceramic Tiles Market Size and Forecast, by Finish (2025-2032) 10.6.3.3. Rest of MEA Ceramic Tiles Market Size and Forecast, by Construction Type (2025-2032) 10.6.3.4. Rest Of MEA Ceramic Tiles Market Size and Forecast, by Application (2025-2032) 10.6.3.5. Rest Of MEA Ceramic Tiles Market Size and Forecast, by End User (2025-2032) 11. Company Profile: Key Players 11.1. Avalon Flooring 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis (Technological strengths and weaknesses) 11.1.5. Strategic Analysis (Recent strategic moves) 11.1.6. Recent Developments 11.2. Arwana Citramulia Tbk 11.3. ATLAS CONCORDE S.P.A. 11.4. Avalon Flooring 11.5. Ceramic Industries Group 11.6. Cerâmica Carmelo Fior 11.7. Cersanit Group 11.8. China Ceramics Co., Ltd. 11.9. Crossville Inc. 11.10. Dynasty Ceramic Public Company Limited 11.11. Elizabeth Group 11.12. Florim Ceramiche S.p.A. 11.13. Grupo Cedasa 11.14. Grupo Celima Trebol 11.15. Grupo Lamosa 11.16. Guangdong Newpearl Ceramics Group Co., Ltd. 11.17. Kajaria Ceramics Limited 11.18. Kaleseramik 11.19. Lamsoa Group 11.20. LASSELSBERGER Group 11.21. MOHAWK INDUSTRIES INC. 11.22. PAMESA CERÁMICA SL 11.23. Porcelanosa Group 11.24. RAK CERAMICS 11.25. Ricchetti Group 11.26. SCG CERAMICS 11.27. Siam Cement Group 11.28. Somany Ceramics 11.29. STN Cerámica 11.30. Vitromex USA, Inc. 11.31. White Horse Ceramic 11.32. Others 12. Key Findings and Analyst Recommendations 12.1. Attractive Opportunities for Players in the Ceramic Tiles Market 13. Ceramic Tiles Market: Research Methodology 13.1. Market Size Estimation 13.1.1. Market Size Estimation: Bottom-Up Approach 13.1.2. Market Size Estimation: Top-Down Approach 13.2. Data Triangulation 13.2.1. Ceramic Tiles Market: Data Triangulation method 13.3. Growth Forecast