The Cell Therapy Market size was valued at USD 4.80 Bn in 2023. The Cell Therapy Market revenue is growing at a CAGR of 15.2% from 2023 to 2030, reaching nearly USD 12.92 Bn by 2030.Cell Therapy Market

The healthcare sector has shown significant interest in cell therapy, a therapeutic approach that involves introducing healthy cells into the body to replace dysfunctional ones and regulate specific functions. Continuous advancements in regenerative medicine, especially within the area of cell therapy, have unlocked novel possibilities for treating several medical conditions. The capacity to regenerate damaged tissues and organs through cell-based therapies has emerged as a driving force boosting research and investment, ultimately contributing to the strong growth of the Cell Therapy Market. Cell therapies have risen as an innovative solution for severe diseases such as cancer and rare genetic disorders. LUXTURNA, a significant example, stands as a treatment for an inherited retinal disease leading to blindness. This represents the transformative impact of cell therapies, solidifying their position as a groundbreaking solution in the evolving landscape of healthcare and the Cell Therapy Market Many other Cell therapies are now in development. According to MMR Study report more than 750 trials of CGTs in almost 30,000 patients were underway as of June 2020, and Cell and Gene Therapy products account for some 12 percent of the pharmaceutical industry’s clinical pipeline and at least 16 percent of its preclinical pipeline. All that activity reflects the hope that CGTs increase the still-limited treatment options available to many patients and transform the clinical paradigm. But the COVID-19 crisis has severely disrupted the sector.To know about the Research Methodology :- Request Free Sample Report

Cell Therapy Market Dynamics:

Driver Increased Prevalence Of Chronic Diseases Drives Market Growth The growth of the cell therapy market is being driven by the increasing prevalence of chronic diseases. As the population ages and lifestyles change, there has been a significant rise in the incidence of chronic conditions such as cancer, cardiovascular diseases, and autoimmune disorders. The conventional treatments for these ailments often have limitations, which has led to a shift toward innovative therapeutic approaches such as cell therapy. Cell therapies have the potential to address the root causes of diseases at a cellular level, offering promising avenues for effective and personalized treatment. The rising burden of chronic diseases across the globe highlights the urgent need for advanced medical solutions, making cell therapy a leading option in the evolving healthcare landscape. The market's response to this demand demonstrates a commitment to transformative solutions and the continuous pursuit of breakthroughs in medical science. For Instance, according to the MMR Study Report in Italy, 23.7 million individuals suffered from at least one chronic disease. A considerable number of people were even affected by two or more chronic conditions. Among them, hypertension, arthritis, and allergies were the most widespread.Restrain High Treatment Costs and Affordability Concerns limit the Cell Therapy Market The high costs associated with cell therapy treatments, encompassing research, development, and manufacturing expenses, pose a considerable challenge to affordability for patients and healthcare systems alike. This financial obstacle is particularly pronounced due to the intricate and personalized nature of cell therapies, contributing to elevated production costs. Consequently, a broader patient population finds it difficult to access these advanced treatments, hindering the widespread adoption of cell therapies. This affordability challenge is especially impactful in regions with limited resources where reimbursement policies are insufficient. To ensure the equitable distribution and adoption of cell therapies in healthcare systems globally, it is imperative to address these cost-related challenges. Efforts aimed at optimizing production processes and establishing sustainable pricing models are crucial in overcoming this hindrance and fostering the growth of the Cell Therapy Market. Recognizing the importance of cost considerations contributes to making cell therapies more accessible and inclusive in diverse healthcare settings. Opportunity Increasing therapeutic applications and the development of innovative treatments create lucrative growth opportunities for the market growth There is a growing and dynamic opportunity to explore new indications beyond the current focus areas of the cell therapy market, particularly in oncology. Cell therapies demonstrate the potential to address a diverse range of medical conditions, including neurological disorders, genetic diseases, and degenerative conditions. The emergence of gene-editing technologies, notably CRISPR-Cas9, brings an exciting prospect to enhance the precision and effectiveness of cell therapies. This breakthrough opens avenues for the development of next-generation, genetically modified cell therapies specifically targeting disease mechanisms. Collaborations between academic institutions, biotechnology companies, and pharmaceutical firms present another promising opportunity for advancing cell therapy research and development. By pooling expertise and resources, these collaborations accelerate the translation of scientific discoveries into clinically viable cell-based treatments, contributing to the overall growth of the cell therapy market. The establishment of regulatory frameworks that facilitate a streamlined approval process for cell therapies represents a crucial opportunity. Clear regulatory pathways expedite market entry, fostering innovation and encouraging investment in the development of novel cell therapies. These regulatory advancements play a pivotal role in shaping the future landscape of the cell therapy market by creating an environment conducive to the efficient approval and commercialization of Innovative treatments.

Cell Therapy Market Segment Analysis:

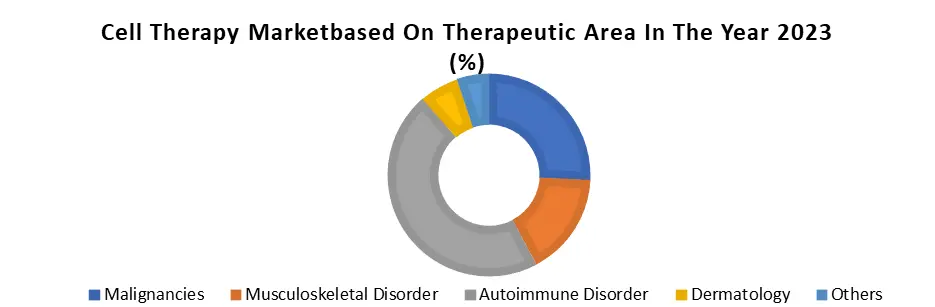

Based on Therapy Type, the autologous treatment segment dominated the cell therapy market in the year 2023. The segment is expected to maintain its dominance over the forecast period. This can be due to several benefits associated with autologous transplantation, such as B. Easy to obtain, no need to identify HLA-matched donors, low risk of life-threatening complications, no risk of GvHD, and no need for immunosuppressive therapy. In addition, autologous therapies are more affordable compared to allogeneic therapies, which is further due to segment growth. Due to the high cost and relatively low recurrence rate associated with allogeneic transplantation, the growth of cell banking and the relocation of companies to the development of allogeneic therapeutic products are driving the Cell Therapy Market.Based on the Therapeutic Area, Autoimmune Disorders dominate the Global Cell Therapy Market in the year 2023. Currently, cell therapy is a potential treatment for cancer, autoimmune disorders disease, and other infectious diseases with more than 40% of the application in given treatments. Hematopoietic stem cell transplant is the most frequent cell therapy opted in many Asians as well as in North America. Potential applications of cell therapies include treating cancers, autoimmune diseases, urinary problems, and infectious diseases, rebuilding damaged cartilage in joints, repairing spinal cord injuries, improving a weakened immune system, and helping patients with neurological disorders. This application in such treatment boosted the growth in the Global Cell Therapy Market.

Regional Analysis: Cell Therapy Market

North America dominated the cell therapy market in the year 2023. This commanding presence is primarily attributed to collaborative research endeavors involving research institutes and pharmaceutical giants in the region. The collaborative landscape saw significant advancements, exemplified by the partnership between Immatics and Bristol Myers Squibb in June 2022. The collaboration aimed to develop Gamma Delta Allogeneic Cell Therapy Programs, with Bristol Myers Squibb holding two initial programs and both entities having the option to develop up to four additional programs each. Asia Pacific is expected to witness the fastest growth in the Cell therapy market. The region's accelerated growth is boosted by rising demand for cell therapy, bolstered by factors such as heightened awareness of novel therapies, increased investments, and anticipated favorable government policies. A case in point is Tessa Therapeutics Ltd., which, in June 2022, secured USD 126 million in series funding to expedite the development of next-generation cancer therapy. This dynamic regional landscape underscores the global trajectory of cell therapy, with North America leading in 2022 and Asia Pacific poised for significant growth in the forecast period. According to MMR Study Report, The FDA anticipates that each year they receive more than 200 investigational new drug applications for CGTs and expects to approve 10 to 20 new cell and gene therapies per year. In 2024 alone, up to 21 cell therapy launches and as many as 31 gene therapy launches are expected. Because of this expected increase in workload, the FDA has elevated and reorganized its Office of Tissues and Advanced Therapies (OTAT) to a ‘Super Office’ within the Center of Biologics Research and Evaluation (CBER) to meet its growing cell and gene therapy workload. Proposed structural changes improve functional alignment, increase review capabilities, and enhance expertise on new cell and gene therapies Cell and Gene Therapy LandscapeCell Therapy Market: Competitive Landscape Cell Therapy Market, key players are strategically positioning themselves for growth and innovation. Leading companies are actively growing their customer base by targeting surgeons for transplantation procedures. Significantly initiatives include 2seventy Bio and Regeneron's collaborative efforts to develop new cell therapy-based combinations for solid tumors, announced in January 2023. Adaptimmune Therapeutics plc's collaboration with Genentech in September 2021 focuses on the development and marketing of allogeneic therapies for multiple oncology indications. These market players are focusing on collaborations and employing various strategies such as new product launches, partnerships, mergers, and acquisitions to reinforce their market presence. As the cell therapy landscape continues to advance, these initiatives reflect a commitment to innovation and a proactive approach to addressing the diverse needs of the healthcare industry. Noteworthy companies in this competitive space include 2seventy Bio, Regeneron, and Adaptimmune Therapeutics plc.

North America Europe Asia Pacific Other Region Developers 686 244 492 35 Clinical Trials 964 403 848 139 Investment $10.8 B $3.2 B $2.2 B $3.6 B Cell Therapy Market Scope: Inquire before buying

Global Cell Therapy Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 4.80 Bn. Forecast Period 2024 to 2030 CAGR: 15.2% Market Size in 2030: US $ 12.92 Bn. Segments Covered: by Cell Type Stem Cell Non-Stem Cell by Therapy Type Autologous Allogeneic by Therapeutic Area Malignancies Musculoskeletal Disorder Autoimmune Disorder Dermatology Others Cell Therapy Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Cell Therapy Market Key Players

North America 1. Gilead Sciences, Inc. (United States) 2. Kite Pharma (a Gilead Company) (United States) 3. Johnson & Johnson (United States) 4. Bluebird bio (United States) 5. Celgene Corporation (a Bristol Myers Squibb Company) (United States) 6. Regeneron Pharmaceuticals, Inc. (United States) 7. Fate Therapeutics (United States) 8. Vericel Corporation (United States) 9. Rubius Therapeutics (United States) 10. Magenta Therapeutics (United States) 11. Precision BioSciences (United States) 12. Allogene Therapeutics (United States) Europe 1.Novartis AG (Switzerland) 2.Adaptimmune Therapeutics plc (United Kingdom) 3.Celyad –(Belgium) 4.Orchard Therapeutics (United Kingdom) Asia Pacific 1.Gamida Cell Ltd. (Israel) 2.Celltrion Healthcare (South Korea) 3.Cynata Therapeutics (Australia) Frequently Asked Questions: 1] What segments are covered in the Global Cell Therapy Market report? Ans. The segments covered in the Cell Therapy Market report are based on Cell Type, Therapy Type, Therapeutic Area, and Regions. 2] Which region is expected to hold the highest share in the Global Cell Therapy Market? Ans. The North America region is expected to hold the largest share of the Cell Therapy Market. 3] What is the market size of the Global Cell Therapy Market by 2030? Ans. The market size of the Cell Therapy Market by 2030 is expected to reach US$ 12.92 Bn. 4] What is the forecast period for the Global Cell Therapy Market? Ans. The forecast period for the Cell Therapy Market is 2024-2030. 5] What was the market size of the Global Cell Therapy Market in 2023? Ans. The market size of the Cell Therapy Market in 2023 was valued at US$ 4.80 Bn.

1. Cell Therapy Market: Research Methodology 2. Cell Therapy Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Cell Therapy Market: Dynamics 3.1. Cell Therapy Market Trends by Region 3.1.1. North America Cell Therapy Market Trends 3.1.2. Europe Cell Therapy Market Trends 3.1.3. Asia Pacific Cell Therapy Market Trends 3.1.4. Middle East and Africa Cell Therapy Market Trends 3.1.5. South America Cell Therapy Market Trends 3.2. Cell Therapy Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Cell Therapy Market Drivers 3.2.1.2. North America Cell Therapy Market Restraints 3.2.1.3. North America Cell Therapy Market Opportunities 3.2.1.4. North America Cell Therapy Market Challenges 3.2.2. Europe 3.2.2.1. Europe Cell Therapy Market Drivers 3.2.2.2. Europe Cell Therapy Market Restraints 3.2.2.3. Europe Cell Therapy Market Opportunities 3.2.2.4. Europe Cell Therapy Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Cell Therapy Market Drivers 3.2.3.2. Asia Pacific Cell Therapy Market Restraints 3.2.3.3. Asia Pacific Cell Therapy Market Opportunities 3.2.3.4. Asia Pacific Cell Therapy Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Cell Therapy Market Drivers 3.2.4.2. Middle East and Africa Cell Therapy Market Restraints 3.2.4.3. Middle East and Africa Cell Therapy Market Opportunities 3.2.4.4. Middle East and Africa Cell Therapy Market Challenges 3.2.5. South America 3.2.5.1. South America Cell Therapy Market Drivers 3.2.5.2. South America Cell Therapy Market Restraints 3.2.5.3. South America Cell Therapy Market Opportunities 3.2.5.4. South America Cell Therapy Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Cell Therapy Market 3.8. Analysis of Government Schemes and Initiatives For Cell Therapy Market 3.9. The Global Pandemic Impact on Cell Therapy Market 4. Cell Therapy Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. Cell Therapy Market Size and Forecast, by Cell Type (2023-2030) 4.1.1. Stem Cell 4.1.2. Non-Stem Cell 4.2. Cell Therapy Market Size and Forecast, by Therapy Type (2023-2030) 4.2.1. Autologous 4.2.2. Allogeneic 4.3. Cell Therapy Market Size and Forecast, by Therapeutic Area (2023-2030) 4.3.1. Malignancies 4.3.2. Musculoskeletal Disorder 4.3.3. Autoimmune Disorder 4.3.4. Dermatology 4.3.5. Others 4.4. Cell Therapy Market Size and Forecast, by Region (2023-2030) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Cell Therapy Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America Cell Therapy Market Size and Forecast, by Cell Type (2023-2030) 5.1.1. Stem Cell 5.1.2. Non-Stem Cell 5.2. North America Cell Therapy Market Size and Forecast, by Therapy Type (2023-2030) 5.2.1. Autologous 5.2.2. Allogeneic 5.3. North America Cell Therapy Market Size and Forecast, by Therapeutic Area (2023-2030) 5.3.1. Malignancies 5.3.2. Musculoskeletal Disorder 5.3.3. Autoimmune Disorder 5.3.4. Dermatology 5.3.5. Others 5.4. North America Cell Therapy Market Size and Forecast, by Country (2023-2030) 5.4.1. United States 5.4.1.1. United States Cell Therapy Market Size and Forecast, by Cell Type (2023-2030) 5.4.1.1.1. Stem Cell 5.4.1.1.2. Non-Stem Cell 5.4.1.2. United States Cell Therapy Market Size and Forecast, by Therapy Type (2023-2030) 5.4.1.2.1. Autologous 5.4.1.2.2. Allogeneic 5.4.1.3. United States Cell Therapy Market Size and Forecast, by Therapeutic Area (2023-2030) 5.4.1.3.1. Malignancies 5.4.1.3.2. Musculoskeletal Disorder 5.4.1.3.3. Autoimmune Disorder 5.4.1.3.4. Dermatology 5.4.1.3.5. Others 5.4.2. Canada 5.4.2.1. Canada Cell Therapy Market Size and Forecast, by Cell Type (2023-2030) 5.4.2.1.1. Stem Cell 5.4.2.1.2. Non-Stem Cell 5.4.2.2. Canada Cell Therapy Market Size and Forecast, by Therapy Type (2023-2030) 5.4.2.2.1. Autologous 5.4.2.2.2. Allogeneic 5.4.2.3. Canada Cell Therapy Market Size and Forecast, by Therapeutic Area (2023-2030) 5.4.2.3.1. Malignancies 5.4.2.3.2. Musculoskeletal Disorder 5.4.2.3.3. Autoimmune Disorder 5.4.2.3.4. Dermatology 5.4.2.3.5. Others 5.4.3. Mexico 5.4.3.1. Mexico Cell Therapy Market Size and Forecast, by Cell Type (2023-2030) 5.4.3.1.1. Stem Cell 5.4.3.1.2. Non-Stem Cell 5.4.3.2. Mexico Cell Therapy Market Size and Forecast, by Therapy Type (2023-2030) 5.4.3.2.1. Autologous 5.4.3.2.2. Allogeneic 5.4.3.3. Mexico Cell Therapy Market Size and Forecast, by Therapeutic Area (2023-2030) 5.4.3.3.1. Malignancies 5.4.3.3.2. Musculoskeletal Disorder 5.4.3.3.3. Autoimmune Disorder 5.4.3.3.4. Dermatology 5.4.3.3.5. Others 6. Europe Cell Therapy Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe Cell Therapy Market Size and Forecast, by Cell Type (2023-2030) 6.2. Europe Cell Therapy Market Size and Forecast, by Therapy Type (2023-2030) 6.3. Europe Cell Therapy Market Size and Forecast, by Therapeutic Area (2023-2030) 6.4. Europe Cell Therapy Market Size and Forecast, by Country (2023-2030) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Cell Therapy Market Size and Forecast, by Cell Type (2023-2030) 6.4.1.2. United Kingdom Cell Therapy Market Size and Forecast, by Therapy Type (2023-2030) 6.4.1.3. United Kingdom Cell Therapy Market Size and Forecast, by Therapeutic Area (2023-2030) 6.4.2. France 6.4.2.1. France Cell Therapy Market Size and Forecast, by Cell Type (2023-2030) 6.4.2.2. France Cell Therapy Market Size and Forecast, by Therapy Type (2023-2030) 6.4.2.3. France Cell Therapy Market Size and Forecast, by Therapeutic Area (2023-2030) 6.4.3. Germany 6.4.3.1. Germany Cell Therapy Market Size and Forecast, by Cell Type (2023-2030) 6.4.3.2. Germany Cell Therapy Market Size and Forecast, by Therapy Type (2023-2030) 6.4.3.3. Germany Cell Therapy Market Size and Forecast, by Therapeutic Area (2023-2030) 6.4.4. Italy 6.4.4.1. Italy Cell Therapy Market Size and Forecast, by Cell Type (2023-2030) 6.4.4.2. Italy Cell Therapy Market Size and Forecast, by Therapy Type (2023-2030) 6.4.4.3. Italy Cell Therapy Market Size and Forecast, by Therapeutic Area (2023-2030) 6.4.5. Spain 6.4.5.1. Spain Cell Therapy Market Size and Forecast, by Cell Type (2023-2030) 6.4.5.2. Spain Cell Therapy Market Size and Forecast, by Therapy Type (2023-2030) 6.4.5.3. Spain Cell Therapy Market Size and Forecast, by Therapeutic Area (2023-2030) 6.4.6. Sweden 6.4.6.1. Sweden Cell Therapy Market Size and Forecast, by Cell Type (2023-2030) 6.4.6.2. Sweden Cell Therapy Market Size and Forecast, by Therapy Type (2023-2030) 6.4.6.3. Sweden Cell Therapy Market Size and Forecast, by Therapeutic Area (2023-2030) 6.4.7. Austria 6.4.7.1. Austria Cell Therapy Market Size and Forecast, by Cell Type (2023-2030) 6.4.7.2. Austria Cell Therapy Market Size and Forecast, by Therapy Type (2023-2030) 6.4.7.3. Austria Cell Therapy Market Size and Forecast, by Therapeutic Area (2023-2030) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Cell Therapy Market Size and Forecast, by Cell Type (2023-2030) 6.4.8.2. Rest of Europe Cell Therapy Market Size and Forecast, by Therapy Type (2023-2030) 6.4.8.3. Rest of Europe Cell Therapy Market Size and Forecast, by Therapeutic Area (2023-2030) 7. Asia Pacific Cell Therapy Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Cell Therapy Market Size and Forecast, by Cell Type (2023-2030) 7.2. Asia Pacific Cell Therapy Market Size and Forecast, by Therapy Type (2023-2030) 7.3. Asia Pacific Cell Therapy Market Size and Forecast, by Therapeutic Area (2023-2030) 7.4. Asia Pacific Cell Therapy Market Size and Forecast, by Country (2023-2030) 7.4.1. China 7.4.1.1. China Cell Therapy Market Size and Forecast, by Cell Type (2023-2030) 7.4.1.2. China Cell Therapy Market Size and Forecast, by Therapy Type (2023-2030) 7.4.1.3. China Cell Therapy Market Size and Forecast, by Therapeutic Area (2023-2030) 7.4.2. S Korea 7.4.2.1. S Korea Cell Therapy Market Size and Forecast, by Cell Type (2023-2030) 7.4.2.2. S Korea Cell Therapy Market Size and Forecast, by Therapy Type (2023-2030) 7.4.2.3. S Korea Cell Therapy Market Size and Forecast, by Therapeutic Area (2023-2030) 7.4.3. Japan 7.4.3.1. Japan Cell Therapy Market Size and Forecast, by Cell Type (2023-2030) 7.4.3.2. Japan Cell Therapy Market Size and Forecast, by Therapy Type (2023-2030) 7.4.3.3. Japan Cell Therapy Market Size and Forecast, by Therapeutic Area (2023-2030) 7.4.4. India 7.4.4.1. India Cell Therapy Market Size and Forecast, by Cell Type (2023-2030) 7.4.4.2. India Cell Therapy Market Size and Forecast, by Therapy Type (2023-2030) 7.4.4.3. India Cell Therapy Market Size and Forecast, by Therapeutic Area (2023-2030) 7.4.5. Australia 7.4.5.1. Australia Cell Therapy Market Size and Forecast, by Cell Type (2023-2030) 7.4.5.2. Australia Cell Therapy Market Size and Forecast, by Therapy Type (2023-2030) 7.4.5.3. Australia Cell Therapy Market Size and Forecast, by Therapeutic Area (2023-2030) 7.4.6. Indonesia 7.4.6.1. Indonesia Cell Therapy Market Size and Forecast, by Cell Type (2023-2030) 7.4.6.2. Indonesia Cell Therapy Market Size and Forecast, by Therapy Type (2023-2030) 7.4.6.3. Indonesia Cell Therapy Market Size and Forecast, by Therapeutic Area (2023-2030) 7.4.7. Malaysia 7.4.7.1. Malaysia Cell Therapy Market Size and Forecast, by Cell Type (2023-2030) 7.4.7.2. Malaysia Cell Therapy Market Size and Forecast, by Therapy Type (2023-2030) 7.4.7.3. Malaysia Cell Therapy Market Size and Forecast, by Therapeutic Area (2023-2030) 7.4.8. Vietnam 7.4.8.1. Vietnam Cell Therapy Market Size and Forecast, by Cell Type (2023-2030) 7.4.8.2. Vietnam Cell Therapy Market Size and Forecast, by Therapy Type (2023-2030) 7.4.8.3. Vietnam Cell Therapy Market Size and Forecast, by Therapeutic Area (2023-2030) 7.4.9. Taiwan 7.4.9.1. Taiwan Cell Therapy Market Size and Forecast, by Cell Type (2023-2030) 7.4.9.2. Taiwan Cell Therapy Market Size and Forecast, by Therapy Type (2023-2030) 7.4.9.3. Taiwan Cell Therapy Market Size and Forecast, by Therapeutic Area (2023-2030) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Cell Therapy Market Size and Forecast, by Cell Type (2023-2030) 7.4.10.2. Rest of Asia Pacific Cell Therapy Market Size and Forecast, by Therapy Type (2023-2030) 7.4.10.3. Rest of Asia Pacific Cell Therapy Market Size and Forecast, by Therapeutic Area (2023-2030) 8. Middle East and Africa Cell Therapy Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2030) 8.1. Middle East and Africa Cell Therapy Market Size and Forecast, by Cell Type (2023-2030) 8.2. Middle East and Africa Cell Therapy Market Size and Forecast, by Therapy Type (2023-2030) 8.3. Middle East and Africa Cell Therapy Market Size and Forecast, by Therapeutic Area (2023-2030) 8.4. Middle East and Africa Cell Therapy Market Size and Forecast, by Country (2023-2030) 8.4.1. South Africa 8.4.1.1. South Africa Cell Therapy Market Size and Forecast, by Cell Type (2023-2030) 8.4.1.2. South Africa Cell Therapy Market Size and Forecast, by Therapy Type (2023-2030) 8.4.1.3. South Africa Cell Therapy Market Size and Forecast, by Therapeutic Area (2023-2030) 8.4.2. GCC 8.4.2.1. GCC Cell Therapy Market Size and Forecast, by Cell Type (2023-2030) 8.4.2.2. GCC Cell Therapy Market Size and Forecast, by Therapy Type (2023-2030) 8.4.2.3. GCC Cell Therapy Market Size and Forecast, by Therapeutic Area (2023-2030) 8.4.3. Nigeria 8.4.3.1. Nigeria Cell Therapy Market Size and Forecast, by Cell Type (2023-2030) 8.4.3.2. Nigeria Cell Therapy Market Size and Forecast, by Therapy Type (2023-2030) 8.4.3.3. Nigeria Cell Therapy Market Size and Forecast, by Therapeutic Area (2023-2030) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Cell Therapy Market Size and Forecast, by Cell Type (2023-2030) 8.4.4.2. Rest of ME&A Cell Therapy Market Size and Forecast, by Therapy Type (2023-2030) 8.4.4.3. Rest of ME&A Cell Therapy Market Size and Forecast, by Therapeutic Area (2023-2030) 9. South America Cell Therapy Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2030) 9.1. South America Cell Therapy Market Size and Forecast, by Cell Type (2023-2030) 9.2. South America Cell Therapy Market Size and Forecast, by Therapy Type (2023-2030) 9.3. South America Cell Therapy Market Size and Forecast, by Therapeutic Area (2023-2030) 9.4. South America Cell Therapy Market Size and Forecast, by Country (2023-2030) 9.4.1. Brazil 9.4.1.1. Brazil Cell Therapy Market Size and Forecast, by Cell Type (2023-2030) 9.4.1.2. Brazil Cell Therapy Market Size and Forecast, by Therapy Type (2023-2030) 9.4.1.3. Brazil Cell Therapy Market Size and Forecast, by Therapeutic Area (2023-2030) 9.4.2. Argentina 9.4.2.1. Argentina Cell Therapy Market Size and Forecast, by Cell Type (2023-2030) 9.4.2.2. Argentina Cell Therapy Market Size and Forecast, by Therapy Type (2023-2030) 9.4.2.3. Argentina Cell Therapy Market Size and Forecast, by Therapeutic Area (2023-2030) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Cell Therapy Market Size and Forecast, by Cell Type (2023-2030) 9.4.3.2. Rest Of South America Cell Therapy Market Size and Forecast, by Therapy Type (2023-2030) 9.4.3.3. Rest Of South America Cell Therapy Market Size and Forecast, by Therapeutic Area (2023-2030) 10. Global Cell Therapy Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2022) 10.3.5. Company Locations 10.4. Leading Cell Therapy Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Gilead Sciences, Inc. (United States) 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Details on Partnership 11.1.7. Recent Developments 11.2. Kite Pharma (a Gilead Company) (United States) 11.3. Johnson & Johnson (United States) 11.4. Bluebird bio (United States) 11.5. Celgene Corporation (a Bristol Myers Squibb Company) (United States) 11.6. Regeneron Pharmaceuticals, Inc. (United States) 11.7. Fate Therapeutics (United States) 11.8. Vericel Corporation (United States) 11.9. Rubius Therapeutics (United States) 11.10. Magenta Therapeutics (United States) 11.11. Precision BioSciences (United States) 11.12. Allogene Therapeutics (United States) 11.13. Europe 11.14. Novartis AG (Switzerland) 11.15. Adaptimmune Therapeutics plc (United Kingdom) 11.16. Celyad –(Belgium) 11.17. Orchard Therapeutics (United Kingdom) 11.18. Asia Pacific 11.19. Gamida Cell Ltd. (Israel) 11.20. Celltrion Healthcare (South Korea) 11.21. Cynata Therapeutics (Australia) 12. Key Findings 13. Industry Recommendations