Global Cattle Healthcare Market expected to hit USD 75.49 Bn by 2029 from USD 48.9 Bn in 2022 at a CAGR of 6.4% during the forecast periodCattle Healthcare Market Overview

Cattle is a plural term for all cows, bulls, calves, heifers and steers. A regular cattle health routine can reduce the risk of cattle diseases such as tuberculosis, anthrax, brucellosis, rabies, lumpy and others. The growing trend of animal farming across the world and increased awareness about cattle health are expected to drive the Cattle Healthcare Market over the period. Also, cattle have a large demand in the global meat industry to fulfill the need for the hunger of growing population.To know about the Research Methodology :- Request Free Sample Report

Cattle Healthcare Market Dynamics

Market Drivers Scientists developed devices such as smart health trackers powered by the kinetic energy of the animal’s movements that monitors their health, reproductive readiness and location. It also helps to collect information of cattle that includes the amount of exercise the animal gets, disease and the oxygen concentration in their body, air temperature, humidity and milk production. This helps in ensuring Cattle’s good health and improves natural breeding productivity. These factors are expected to drive the growth of the Cattle Healthcare Market over the forecast period. Usually, one or two cows calve every week and this requires a regular or scheduled monthly visit for the examination and treatment of individual animals. This allows veterinaries to monitor the outcome of treatment and modify treatment protocols accordingly. The growing awareness regarding cattle healthcare and the growth in professional cattle farming are expected to drive the Cattle Healthcare Market. This creates a lucrative opportunity for the major Cattle Healthcare Key Players to increase their Cattle Healthcare Market Share in the Cattle Healthcare Industry. The Cattle Healthcare Market growth is also supported by the high demand for livestock products to meet the need of a large population of hunger and provide them with a diet that includes protein and minerals. To fulfill all these needs cattle health is a major factor. Cattle Healthcare Companies such as Elanco and Zoetis are among the global leaders in the market since cattle health and well-being are their priorities. The Cattle Healthcare Companies are focusing on the human-cattle relationship not just through innovative dairy health products but with professional expertise and services that are expected to impact the Cattle Healthcare Market positively through improvement in cattle performance. Trends Complementary Feeds including Special Ingredients Complementary feeds are not complete food with major nutrients for the animal. Instead, it supports cattle health by including special ingredients such as amino acids and enzymes, medium chain fatty acids, oligo or polyphenolic acids, which promote intestinal function, metabolism and immune system and improve overall cattle health. The demand for complementary feeds in Cattle Healthcare Market has increased significantly since it reduces the need for antibiotics used on animal farms. The amino acids such as phenylalanine, valine, threonine, tryptophane, isoleucine, methionine, histidine, arginine, leucine and lysine are resistless in feeding cattle and are expected to increase milk production to a great extent. These factors are expected to propel the growth of the Cattle Healthcare Market directly. Monitoring Food Protein Quality to Avoid Reduction of Phosphorous and Nitrogen Protein requirements for cattle can be balanced by monitoring the protein quality through targeted feed processing, supplementation of free amino acids and through enzymes. Sometimes, due to the high protein requirements of animals and protein supplementation often exceeds the nutritional-necessary levels and is immediately excreted. The optimizing compound feeds so that it cannot exceed the limit of nitrogen and phosphorus in the cattle. These are some of the major factors and trends that are expected to drive the Cattle Healthcare Market. Growing Use of Alternative Protein Sources Some countries stopped using imported soybean meal as a protein for cattle health since it does not guarantee the material is from non-genetically modified plants. This increases the demand for alternative protein sources in cattle feeding and ultimately drives the Cattle Healthcare Market. The alternative protein products for cattle feeding are non-genetically modified rapeseed meal, field beans, peas, lupins and sunflower meal. The non-GMO improves cattle health, feed intake and efficiency and taste characteristics of the cattle products. Research on Protein Intake from Insect to drive market growth The world’s population is growing and so is the challenge of feeding everyone. As per the MMR report, global food demand is expected to increase by 57 percent to 89 percent above current levels. This is expected to increase the demand for high-quality protein foods such as meat and dairy products. Global research by scientists said that feeding insects to cattle is expected to make meat and milk production more sustainable. This has been driving not only the Cattle Healthcare Industry but Insect Farming Industry also. Producers are growing insects for animal feed because of their nutritional profile and ability to grow quickly. Data also suggest that feeding insects to livestock has a smaller environmental footprint than conventional feed crops such as soybean meal. Quality of Roughage Coarse feeds such as grass account for a major part of the ruminant feed but their quality is expected to be varied. Maximizing feed quality increasingly begins with focusing on technically well-founded cultivation planning, as well as on achieving optimal harvesting characteristics by cutting and gathering the crop at its most nutritious stage. Cattle Healthcare Market is not only about just about vaccines and medicines but about the feed products for cattle, Cattle Healthcare Devices and Cattle Healthcare Products also. To safeguard the quality of forage, additional silage additives can be used that make a significant contribution to improving the fermentation process. Feed Additives for the Cattle Healthcare Feed additives are widely used in livestock diets in the European Union only when it approved through comprehensive and complex processes to show that they are safe for cattle health. This is introducing new ways of improving product qualities from cattle in the Cattle Healthcare Market. The use of enzymes to improve the digestibility of certain ingredients such as protein, phosphorus or carbohydrates is widely used. Also, numerous probiotics and other products are used to stabilize gut flora and health. Market Restraints: The uncertain regulations in major geographic regions such as North America, Asia Pacific, Europe, Middle East and Africa and South America. Different regions possess different dietary habits. This is expected to constrain the Cattle Healthcare Market during the forecast period (2023-2029). The Cattle Healthcare Industry report includes growth drivers, restraints, opportunities and Cattle Healthcare Market Competitive Landscape. The high cost associated with veterinary services and cattle testing. The research for any drug can take years to evaluate and requires millions of dollars. These factors are expected to impede the growth of the Cattle Healthcare Market.Cattle Healthcare Market Regional Insights

North America dominated the Cattle Healthcare Market with the largest revenue share of 30 percent in 2022. The major Cattle Healthcare Key Companies are present in the region and they are using the latest technologies such as machine learning and artificial intelligence, which has reshaped the Cattle Healthcare Industry with improvements in products from cattle such as meat, hamburger, steak or even leather also. Also, the region’s increasing focus on higher production of quality products and the need to resist the increasing rate of diseases such as lumpy, flu, Bovine Tuberculosis, Foot and Mouth disease and others. This is expected to increase the growth of the Cattle Healthcare Market. The Cattle Healthcare Key Players are continuously working on developing new vaccines and medicines to prevent any type of diseases that are expected to affect cattle health. Some Cattle Healthcare Industry Leaders launched vaccines that are effective for these diseases. In coming years, Asia Pacific is expected to dominate the Cattle Healthcare Market. The region has the highest population density and the two most populous countries China and India belong to this region. The growing need to fulfill the demand of the hunger of large population requires high-quality protein and healthcare facilities and services. Smart agriculture and smart animal farming trend are now emerging in Asia Pacific countries such as India, China and the Philippines and others, which are creating a lucrative opportunity for Cattle Healthcare Market Leaders in the Asia Pacific market. Europe’s Cattle Healthcare Market is expected to grow at a CAGR of 4.2 percent during the forecast period. The region is home to 42 percent of the world’s top 100 universities for life sciences and computer sciences. These research institutes have been working on reducing the methane excretion from cattle by monitoring their feed intakes with the help of a skilled professional. These factors are expected to drive the region’s Cattle Healthcare Industry.

Cattle Healthcare Market Competitive Landscape

The report includes the Cattle Healthcare Market’s Competitive Benchmarking based on Key Player’s Cattle Healthcare Market Size, Cattle Healthcare Market Share and Cattle Healthcare Market Revenue. The report provides data regarding mergers and acquisitions and investment by Cattle Healthcare Key Companies in the Cattle Healthcare Industry. Recently, on March 1, 2023, Zoetis secured USD 15.3 billion dollar grant from Bill and Melinda Gates Foundation to develop and integrate innovative solutions to advance veterinary care and diagnostic services that will ultimately improve livestock health and productivity in Sub-Saharan Africa. The grant will help Zoetis to expand its original African Livestock Productivity and Health Advancement (A.L.P.H.A.) initiative to include aquaculture in addition to cattle, poultry, and swine in an additional seven countries in Sub-Saharan Africa. Intas Pharmaceuticals Ltd., Merck Animal Health, Bayer AG, Sanofi S.A. (MERIAL Limited), Elanco (Eli Lilly and Company), Zydus Animal Health and Zoetis Inc. are major key companies in the Cattle Healthcare Market.Cattle Healthcare Market Segment Analysis

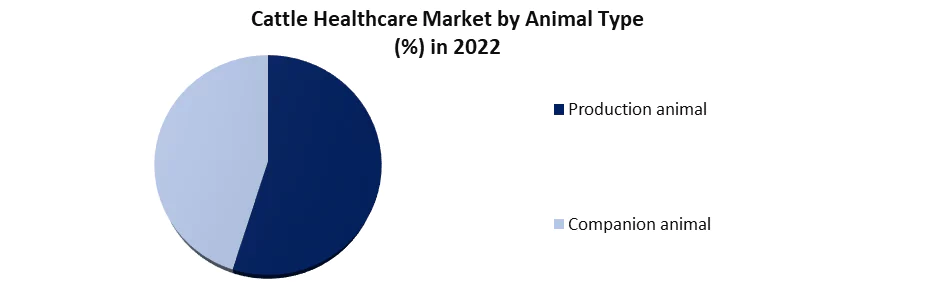

Based on Animal Type The production animal segment held the largest revenue share of the market in 2022 and is expected to dominate the market throughout the forecast period. Production animals such as poultry, cattle, swine, fish and sheep & goats are mostly used as dietary options in the form of milk and meat. Large population across the world prefers meat in their diet for protein intake. So, high-quality products have large demand all over the world, which is expected to drive the production animal segment in Cattle Healthcare Industry. Companion animals are nothing but pet animals such as dogs, horses, cats, and others. Based on Food Type This is divided into two sub-segments: Genetically modified feed and non-genetically modified feed type. Among these, the non-genetically modified segment is expected to hold the largest revenue share in the Cattle Healthcare Market. The use of non-genetically modified food in cattle improves the efficiency and taste characteristics of cattle products. Based on the End User Veterinary Hospitals & Clinics segment is expected to dominate the market throughout the forecast period. Along with it, reference laboratories are also expected to grow due to continuous research in the field of cattle healthcare. Veterinary hospitals & clinics are equipped with skilled professionals and the latest vaccines, pharmaceuticals and medicines from government quota in less price. People mostly prefer to visit veterinary hospitals & clinics in their region and they are largely penetrated across the world. These factors are expected to drive the segment in the market.Cattle Healthcare Market Scope: Inquire before buying

Cattle Healthcare Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: USD 48.9 Bn. Forecast Period 2023 to 2029 CAGR: 6.4% Market Size in 2029: USD 75.49 Bn. Segments Covered: by Animal Type 1.Production animal 2.Companion animal by Product 1.Vaccines 1.Pharmaceutical 1.Diagnostics 1.Feed Additives by Food Type 1.Genetically Modified 1.1.Corn 1.2.Canola 1.3.Cottonseed 1.4.Soybean 1.5.Potato 2.Non-Genetically Modified 2.1.Rapeseed Meal 2.2.Field Beans 2.3.Peas 2.4.Lupins or Sunflower Meal by Distribution Channel 1.Retail 2.Veterinary Hospitals & Clinics 3.E-commerce by End User 1.Reference Laboratories 2.Veterinary Hospitals & Clinics 3.Point-of-care Testing/In-house Testing 4.Others Cattle Healthcare Market, by Region:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Cattle Healthcare Key Players include:

1. Intas Pharmaceuticals Ltd. 2.Merck Animal Health 3. Bayer AG 4. Sanofi S.A. (MERIAL Limited) 5. Elanco (Eli Lilly and Company) 6.Zydus Animal Health 7. Zoetis Inc. 8.Vetoquinol 9.Ceva Santé Animale 10.Virbac Group 11.Boehringer Ingelheim GmbH 12.Dechra Pharmaceuticals plc 13.IDEXX Laboratories, Inc. 14.Phibro Animal Health Corporation 15. Norbrook Laboratories, Inc. 16.Alivira Animal Health Limited 17.Hester Biosciences Ltd. 18. SeQuent Scientific Ltd. 19. Orion 20.KRKA 21. AnimalCare 22.Eco Animal Health 23. Ouro Fino Saude Animal 24. Heska 25. Neogen 26. Covetrus Frequently Asked Questions: 1] What is the growth rate of the Cattle Healthcare Market? Ans. The Cattle Healthcare Market is growing at a CAGR of 6.4% during the forecast period. 2] Which region is expected to dominate the Cattle Healthcare Market? Ans. North America is expected to dominate the Cattle Healthcare Market during the forecast period from 2023 to 2029. 3] What is the expected Cattle Healthcare Market size by 2029? Ans. The size of the Cattle Healthcare Market by 2029 is expected to reach USD 75.49 Bn. 4] Who are the top players in the Cattle Healthcare Market? Ans. The major key players in the Cattle Healthcare Market are Intas Pharmaceuticals Ltd., Merck Animal Health, Bayer AG and Sanofi S.A. (MERIAL Limited) 5] Which factors contributed to the growth of the Cattle Healthcare Market in 2022? Ans. The Cattle Healthcare Market is expected to grow due to the rising trend of professional cattle farming.

1. Global Cattle Healthcare Market: Research Methodology 2. Global Cattle Healthcare Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Cattle Healthcare Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Cattle Healthcare Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Cattle Healthcare Market Segmentation (by Value USD and Volume Units) 4.1 Global Cattle Healthcare Market, by Animal Type (2022-2029) • Production animal • Companion animal 4.2 Global Cattle Healthcare Market, by Product (2022-2029) • Vaccines • Pharmaceutical • Diagnostics • Feed Additives 4.3 Global Cattle Healthcare Market, by Food Type (2022-2029) • Genetically Modified o Corn o Canola o Cottonseed o Soybean o Potato • Non-Genetically Modified o Rapeseed Meal o Field Beans o Peas o Lupins or Sunflower Meal 4.4 Global Cattle Healthcare Market, by Distribution Channel (2022-2029) • Retail • Veterinary Hospitals & Clinics • E-commerce 4.5 Global Cattle Healthcare Market, by End User (2022-2029) • Reference Laboratories • Veterinary Hospitals & Clinics • Point-of-care Testing/In-house Testing • Others 5. North America Cattle Healthcare Market (2022-2029) (by Value USD and Volume Units) 5.1 North America Cattle Healthcare Market, by Animal Type (2022-2029) • Production animal • Companion animal 5.2 North America Cattle Healthcare Market, by Product (2022-2029) • Vaccines • Pharmaceutical • Diagnostics • Feed Additives 5.3 North America Cattle Healthcare Market, by Food Type (2022-2029) • Genetically Modified o Corn o Canola o Cottonseed o Soybean o Potato • Non-Genetically Modified o Rapeseed Meal o Field Beans o Peas o Lupins or Sunflower Meal 5.4 North America Cattle Healthcare Market, by Distribution channel (2022-2029) • Retail • Veterinary Hospitals & Clinics • E-commerce 5.5 North America Cattle Healthcare Market, by End User (2022-2029) • Reference Laboratories • Veterinary Hospitals & Clinics • Point-of-care Testing/In-house Testing • Others 5.6 North America Cattle Healthcare Market, by Country (2022-2029) • United States • Canada • Mexico 6. Europe Cattle Healthcare Market (2022-2029) (by Value USD and Volume Units) 6.1. European Cattle Healthcare Market, by Animal Type (2022-2029) 6.2. European Cattle Healthcare Market, by Product (2022-2029) 6.3. European Cattle Healthcare Market, by Food Type (2022-2029) 6.4. European Cattle Healthcare Market, by Distribution Channel (2022-2029) 6.5. European Cattle Healthcare Market, by End User (2022-2029) 6.6. European Cattle Healthcare Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Cattle Healthcare Market (2022-2029) (by Value USD and Volume Units) 7.1. Asia Pacific Cattle Healthcare Market, by Animal Type (2022-2029) 7.2. Asia Pacific Cattle Healthcare Market, by Product (2022-2029) 7.3. Asia Pacific Cattle Healthcare Market, by Food Type (2022-2029) 7.4. Asia Pacific Cattle Healthcare Market, by Distribution Channel (2022-2029) 7.5. Asia Pacific Cattle Healthcare Market, by End User (2022-2029) 7.6. Asia Pacific Cattle Healthcare Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Cattle Healthcare Market (2022-2029) (by Value USD and Volume Units) 8.1 Middle East and Africa Cattle Healthcare Market, by Animal Type (2022-2029) 8.2. Middle East and Africa Cattle Healthcare Market, by Product (2022-2029) 8.3. Middle East and Africa Cattle Healthcare Market, by Food Type (2022-2029) 8.4. Middle East and Africa Cattle Healthcare Market, by Distribution Channel (2022-2029) 8.5. Middle East and Africa Cattle Healthcare Market, by End User (2022-2029) 8.6. Middle East and Africa Cattle Healthcare Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Cattle Healthcare Market (2022-2029) (by Value USD and Volume Units) 9.1. South America Cattle Healthcare Market, by Animal Type (2022-2029) 9.2. South America Cattle Healthcare Market, by Product (2022-2029) 9.3. South America Cattle Healthcare Market, by Food Type (2022-2029) 9.4. South America Cattle Healthcare Market, by Distribution Channel (2022-2029) 9.5. South America Cattle Healthcare Market, by End User (2022-2029) 9.6. South America Cattle Healthcare Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. Intas Pharmaceuticals Ltd. 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Merck Animal Health 10.3. Bayer AG 10.4. Sanofi S.A. (MERIAL Limited) 10.5. Elanco (Eli Lilly and Company) 10.6. Zydus Animal Health 10.7. Zoetis Inc. 10.8. Vetoquinol 10.9. Ceva Santé Animale 10.10. Virbac Group 10.11. Boehringer Ingelheim GmbH 10.12. Dechra Pharmaceuticals plc 10.13. IDEXX Laboratories, Inc. 10.14. Phibro Animal Health Corporation 10.15. Norbrook Laboratories, Inc. 10.16. Alivira Animal Health Limited 10.17. Hester Biosciences Ltd. 10.18. SeQuent Scientific Ltd. 10.19. Orion 10.20. KRKA 10.21. AnimalCare 10.22. Eco Animal Health 10.23. Ouro Fino Saude Animal 10.24. Heska 10.25. Neogen 10.26. Covetrus