Global Carob Market size was valued at USD 223.6 Million in 2022 and Carob Market revenue is expected to reach USD 319.2 Million by 2029, at a CAGR of 5.3 % over the forecast period (2023-2029)Carob Market Overview

Carob is used as a natural sweetener and as a cocoa substitute, it comes from seed pods and carob tree, and carob holds a unique position as a natural and nutritious alternative to traditional chocolate-based products. The increasing global emphasis on health influences this market and wellness has led consumers to seek healthier indulgence options, propelling the demand for carob due to its low-fat content, absence of caffeine, and natural sweetness. The rise of plant-based diets and heightened awareness of allergen-free alternatives has positioned carob as an appealing choice, being both vegan-friendly and free from common allergens like gluten and dairy. The carob tree requires less water and pesticides than other crops, resonating with environmentally conscious consumers. The market gains momentum as manufacturers innovate and introduce carob-infused products, such as carob powder, chips, and syrups. Carob has also been shown to have a positive effect on digestive health. It helps regulate bowel movements and reduce the symptoms of irritable bowel syndrome (IBS). Carob also contains polyphenols, which have been shown to have anti-inflammatory and anti-cancer properties. Carob growing has been performed in the Mediterranean region for about 4000 years. The world's annual carob production is expected at 3, 10,000 from approximately 200,000. In Turkey, annual carob production is approximately 13,500. Its numerous health benefits make it an excellent addition to any diet, and its natural sweetness and chocolate-like flavor make it a delicious alternative to traditional sweeteners and chocolates.To know about the Research Methodology :- Request Free Sample Report Increasing demand for healthy and natural food products The demand for healthy and natural food products is rapidly escalating, fueled by heightened consumer awareness regarding the pivotal role of a nutritious diet. Carob market growth is propelled by several interconnected factors. The surge in chronic diseases like obesity, heart ailments, and diabetes, often associated with poor dietary choices, prompts consumers to actively seek foods with disease-preventive potential. Concurrently, the ascent of plant-based diets gains momentum, spurred by environmental consciousness and the recognized health benefits of plant-derived nourishment. Convenience stands as a pivotal driver as well. Consumers are actively pursuing healthy and natural food options that seamlessly integrate into their fast-paced lives. This translates to a burgeoning demand for pre-packaged wholesome meals, nutrient-rich snacks, and convenient smoothies that embody health-consciousness. Social media's pervasive influence further accentuates the trend, with platforms acting as catalysts for discovering novel healthy food alternatives and fostering communities of like-minded individuals. This escalating demand is catalysing significant shifts in the food industry. In 2021, the United States witnessed significant growth in various food sectors: a notable 15% increase in organic food sales, a remarkable 25% surge in plant-based milk purchases, and an impressive 20% rise in gluten-free product sales. This uptick reflects a consumer shift towards prioritizing health and sustainability, indicating a rising demand for readily available, natural, and nourishing food choices. Food manufacturers are adeptly responding to these evolving preferences by offering convenient, affordable, and delectable healthy products are poised to thrive in this growing Carob Market landscape. Carob powder usage as dietary Supplement Carob powder is increasingly utilized as a dietary supplement due to its rich nutritional profile. Packed with dietary fiber, essential minerals such as calcium, and antioxidants, carob powder offers a natural and healthful addition to diets. Its low-fat content and natural sweetness make it an appealing alternative to traditional supplements. Its use as a dietary supplement aligns with the growing demand for functional foods that offer both nutritional benefits and culinary versatility. The growing popularity of carob as a vegan and gluten-free ingredient The surging popularity of carob as a vegan and gluten-free ingredient stands as a paramount catalyst propelling the carob market's growth. With its innate attributes of being both naturally vegan and gluten-free, carob has secured its niche as a sought-after natural sweetener. Renowned for its richness in fiber, calcium, and other essential nutrients, it has emerged as an attractive choice for health-conscious consumers seeking alternatives to sugary treats and chocolate. The Carob Market’s trajectory is underpinned by escalating demand for vegan and gluten-free products and the expanding popularity of carob across culinary realms including confectionery, bakery, and diverse food and beverage applications. Carob powder sales in the United States escalated by 20% in 2022. Also, Carob-based snack sales in the United Kingdom experienced a robust 15% growth in 2022. Carob-based dessert sales in France surged remarkably by 25% in the same year. These instances underscore the growing resonance of carob as a vegan and gluten-free ingredient. This upward trajectory is anticipated to continue as health-consciousness gains further traction and the call for convenient, natural, and sustainable food alternatives intensifies. Beyond its dietary attributes, carob boasts versatility in its applications. Serving as a sweetener, thickener, or flavor enhancer, its potential extends even to the cosmetics and personal care sector. This growing popularity of carob not only aligns with the needs of a discerning consumer base but also ushers in novel opportunities for forward-looking food manufacturers. Trends in Carob Market Rising Demand for Plant-Based Alternatives Plant-based alternatives stems from a rising consumer inclination towards sustainable, ethical, and health-oriented food preferences. Foods such as carob are in high demand among individuals adopting vegan or vegetarian diets, and also by those seeking dairy-free and cruelty-free options while prioritizing balanced and eco-friendly nutrition. Gluten-Free and Allergen-Free Appeal The gluten-free and allergen-free appeal of carob stems from its inherent properties that cater to dietary restrictions and sensitivities. Carob's natural composition devoid of gluten and common allergens offers a safe and nutritious option for individuals with celiac disease, gluten sensitivity, or other allergies, aligning with their health-conscious dietary needs. Carob Market Restraints The carob market faces several significant restraints. The high cost of production, driven by the slow growth and warm climate requirements of carob trees, poses a challenge that could hinder market growth, as companies might be hesitant to invest in costly production processes. Additionally, limited consumer awareness about carob and its health benefits presents a hurdle, potentially dissuading companies from substantial marketing efforts if demand remains low. Intense competition from alternative sweeteners like sugar, stevia, and monk fruit, which are often cheaper and more familiar to consumers, further impedes growth prospects. Furthermore, stringent government regulations impacting carob production and sale could deter market growth, potentially creating barriers for companies trying to navigate regulatory complexities. These combined restraints necessitate strategic efforts to raise awareness, mitigate production costs, differentiate from competitors, and navigate regulatory landscapes to foster the carob market's growth.

Carob Market Regional Analysis

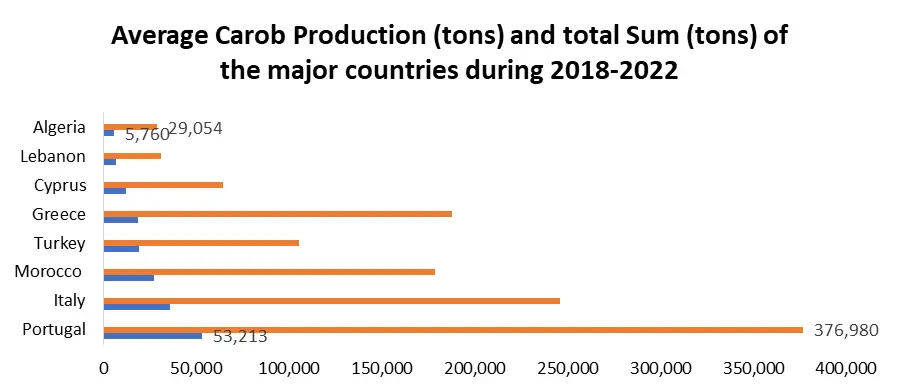

The study provides market insights into North America, Europe, Asia Pacific, and the rest of the world. The North American carob market dominates this market. The WHO and health influencers are raising awareness of the negative effects of excessive sugar intake influencing consumers' preference for healthier meals. The major carob-producing countries, as shown in the table In 2022, Europe is anticipated to dominate the Carob Market share, with notable countries such as Italy, Spain, and Portugal emerging as primary revenue generators. Particularly, Portugal stands out as a leading carob producer. In the year 2018, Portugal recorded the highest carob consumption at 38,000 tonnes. The escalating demand for carob, driven by its incorporation into bakery items, confectioneries, and dairy products, and the pursuit of natural additives within the European region, serves as a catalyst for market growth. According to the data provided by the 2018 FAO research, Italy and Spain have respectively production of 23.8% and 20.4% respectively of the total amount produced. The production of carob in Italy has changed over time. The evolution of the production of carob in Italy, particularly in Sicily is highlighted. The average carob production per plant varies depending on the soil composition and the individual production stations. Furthermore, the surge in requests for carob in animal feed and pet food applications contributes to the market's growth. This upswing in demand extends to carob powder, which finds increased utilization in confectionery and baking products, significantly bolstering the global carob market's revenue trajectory throughout the projected period. Embracing health-conscious alternatives such as products containing carob powder further propels market advancement. Prominent industry players are actively striving to establish a formidable foothold in the broader food and beverages sector through the introduction of innovative carob-based products.Average Carob Production (tons) and total Sum (tons) of the major countries during 2018-2022

Producing Country Average (tons) Sum(tons) 1 51,342 368,800 2 Portugal 53,213 376,980 3 Italy 36,096 246,143 4 Morocco 27,213 178,545 5 Turkey 19,324 105,239 6 Greece 18,712 187,901 7 Cyprus 12,418 64,380 8 Lebanon 6,650 31,124 9 Algeria 5,760 29,054

Carob Market Segment Analysis

Based on Type, The carob powder segment dominates the market with over 50% share in 2022, driven by its demand as a natural sweetener and thickener in various food and beverage items. Health-conscious consumers prefer carob powder due to its fiber and calcium content. Carob chips, bars, syrup, and snacks segments are growing, albeit slower, being niche products with limited usage. Carob powder's versatility as a sugar and cocoa substitute, coupled with its health benefits, fuels its market prominence among diverse products.Based on Application, The bakery and confectionery sector hold a dominant position in the carob market, capturing a share exceeding 40% in 2022. The surge is attributed to the escalating demand for carob as a natural sweetener and thickener in various delectable treats, including cakes, cookies, and chocolates. Carob's rich fiber and calcium content ads allure for health-conscious consumers. Other segments like nutrition, supplements, dairy, and pharmaceuticals are experiencing growth, albeit slower. The mild, chocolatey taste of carob, coupled with its role as a sugar and cocoa substitute, renders it a fevered choice among bakers and confectioners, driving its supremacy in this segment.

Carob Market Competitive Landscape The carob market's competitive landscape is marked by a mix of established players and emerging entrants striving to tap into the growing demand for health-conscious and sustainable alternatives. Key industry participants are actively engaged in product innovation, diversification, and strategic partnerships to gain a competitive edge. Companies are developing an array of carob-based products such as powder, snacks, beverages, and confectionery to cater to varying consumer preferences. Notable players are also focusing on expanding their distribution networks and enhancing brand visibility through marketing efforts. As the market experiences increasing demand for vegan, gluten-free, and natural offerings, the competitive arena is expected to intensify, promoting further innovation and development of carob-infused solutions that align with evolving consumer trends.

Carob Market Scope : Inquire Before Buying

Global Carob Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 223.6 Mn. Forecast Period 2023 to 2029 CAGR: 5.3% Market Size in 2029: US $ 319.2 Mn. Segments Covered: by Type Carob Powder Carob Chips Carob Bars Carob Syrup Carob Snacks by Application Bakery and Confectionary Nutrition and supplements Dairy Products Pharmaceuticals Other by Distribution Channel Online Retail Retail Stores Supermarkets Specialty Stores Other Carob Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Carob Market key players include

1. Carab Co ( Australia ) 2. Stavros Parpis Foods Ltd. - (Cyprus) 3. Savvy Carob Co. Ltd. - (United Kingdom) 4. AEP Colloids - (United States) 5. Tic Gums Inc. - (United States) 6. Altrafine Gums - (India) 7. Australian Carobs Pty Ltd. - (Australia) 8. Pedro Perez - (United States) 9. Carob S.A. - (Greece) 10. DuPont - (United States) 11. Tate & Lyle plc - (United Kingdom) 12. Auroduna Americas - (United States) 13. CyberColloids - (Ireland) 14. The Hain Celestial Group - (United States) 15. Savvy Foods - (United Kingdom) 16. Carobs Australia - (Australia) 17. Creta Carob - (Greece) 18. Lewis Confectionery - (United States) 19. Frontier Co-op - (United States) Frequently Asked Questions: 1] What is the growth rate of the Global Carob Market? Ans. The Global Carob Market is growing at a significant rate of 5.3% over the forecast period. 2] Which region is expected to dominate the Global Carob Market? Ans. Europe region is expected to dominate the Carob Market over the forecast period. 3] What is the expected Global Carob Market size by 2029? Ans. The market size of the Carob Market is expected to reach USD 319.2 Mn by 2029. 4] Who are the top players in the Global Carob Industry? Ans. The major key players in the Global Carob Market are Carabou, Stavros parpis foods ltd., savvy carob co. Ltd, aep colloids, tic gums inc, altrafine gums 5] What was the market size of Global Carob Market in 2022? Ans. The market size of Global Carob Market in 2022 was USD 223.6 Mn.

1. Carob Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Carob Market: Dynamics 2.1. Carob Market Trends by Region 2.1.1. Global Carob Market Trends 2.1.2. North America Carob Market Trends 2.1.3. Europe Carob Market Trends 2.1.4. Asia Pacific Carob Market Trends 2.1.5. Middle East and Africa Carob Market Trends 2.1.6. South America Carob Market Trends 2.2. Carob Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Carob Market Drivers 2.2.1.2. North America Carob Market Restraints 2.2.1.3. North America Carob Market Opportunities 2.2.1.4. North America Carob Market Challenges 2.2.2. Europe 2.2.2.1. Europe Carob Market Drivers 2.2.2.2. Europe Carob Market Restraints 2.2.2.3. Europe Carob Market Opportunities 2.2.2.4. Europe Carob Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Carob Market Drivers 2.2.3.2. Asia Pacific Carob Market Restraints 2.2.3.3. Asia Pacific Carob Market Opportunities 2.2.3.4. Asia Pacific Carob Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Carob Market Drivers 2.2.4.2. Middle East and Africa Carob Market Restraints 2.2.4.3. Middle East and Africa Carob Market Opportunities 2.2.4.4. Middle East and Africa Carob Market Challenges 2.2.5. South America 2.2.5.1. South America Carob Market Drivers 2.2.5.2. South America Carob Market Restraints 2.2.5.3. South America Carob Market Opportunities 2.2.5.4. South America Carob Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Supply Chain Analysis 2.7. Regulatory Landscape by Region 2.7.1. Global 2.7.2. North America 2.7.3. Europe 2.7.4. Asia Pacific 2.7.5. Middle East and Africa 2.7.6. South America 2.8. Analysis of Government Schemes and Initiatives For Homewares Industry 2.9. The Global Pandemic Impact on Carob Market 2.10. Homewares Price Trend Analysis (2021-22) 2.11. Global Carob Market Trade Analysis (2017-2022) 2.11.1. Global Import of Homewares 2.11.1.1. Ten Largest Importer 2.11.2. Global Export of Homewares 2.11.3. Ten Largest Exporter 2.12. Production Capacity Analysis 2.12.1. Chapter Overview 2.12.2. Key Assumptions and Methodology 2.12.3. Homewares Manufacturers: Global Installed Capacity 2.12.3.1. Analysis by Size of Manufacturer 2.12.3.2. Analysis by Scale of Operation 2.12.4. Analysis by Location of Manufacturing Facility 2.13. Demand and Supply Analysis 3. Carob Market: Global Market Size and Forecast (by Value and Volume) (2022-2029) 3.1. Carob Market Size and Forecast, by Type (2022-2029) 3.1.1. Carob Powder 3.1.2. Carob Chips 3.1.3. Carob Bars 3.1.4. Carob Syrup 3.1.5. Carob Snacks 3.2. Carob Market Size and Forecast, by Application (2022-2029) 3.2.1. Bakery and Confectionary 3.2.2. Nutrition and supplements 3.2.3. Dairy Products 3.2.4. Pharmaceuticals 3.2.5. Other 3.3. Carob Market Size and Forecast, by Distribution Channel (2022-2029) 3.3.1. Online Retail 3.3.2. Retail Stores 3.3.3. Supermarkets 3.3.4. Specialty Stores 3.3.5. Other 3.4. Carob Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Carob Market Size and Forecast (by Value in USD Billion) (2022-2029) 4.1. North America Carob Market Size and Forecast, by Type (2022-2029) 4.1.1. Carob Powder 4.1.2. Carob Chips 4.1.3. Carob Bars 4.1.4. Carob Syrup 4.1.5. Carob Snacks 4.2. North America Carob Market Size and Forecast, by Application (2022-2029) 4.2.1. Bakery and Confectionary 4.2.2. Nutrition and supplements 4.2.3. Dairy Products 4.2.4. Pharmaceuticals 4.2.5. Other 4.3. North America Carob Market Size and Forecast, by Distribution Channel (2022-2029) 4.3.1. Online Retail 4.3.2. Retail Stores 4.3.3. Supermarkets 4.3.4. Specialty Stores 4.3.5. Other 4.4. Carob Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Carob Market Size and Forecast, by Type (2022-2029) 4.4.1.1.1. Carob Powder 4.4.1.1.2. Carob Chips 4.4.1.1.3. Carob Bars 4.4.1.1.4. Carob Syrup 4.4.1.1.5. Carob Snacks 4.4.1.2. United States Carob Market Size and Forecast, by Application (2022-2029) 4.4.1.2.1. Bakery and Confectionary 4.4.1.2.2. Nutrition and supplements 4.4.1.2.3. Dairy Products 4.4.1.2.4. Pharmaceuticals 4.4.1.2.5. Other 4.4.1.3. United States Carob Market Size and Forecast, by Distribution Channel (2022-2029) 4.4.1.4. Online Retail 4.4.1.5. Retail Stores 4.4.1.6. Supermarkets 4.4.1.7. Specialty Stores 4.4.1.8. Other 4.4.2. Canada 4.4.2.1. Canada Carob Market Size and Forecast, by Type (2022-2029) 4.4.2.1.1. Carob Powder 4.4.2.1.2. Carob Chips 4.4.2.1.3. Carob Bars 4.4.2.1.4. Carob Syrup 4.4.2.1.5. Carob Snacks 4.4.2.2. Canada Carob Market Size and Forecast, by Application (2022-2029) 4.4.2.2.1. Bakery and Confectionary 4.4.2.2.2. Nutrition and supplements 4.4.2.2.3. Dairy Products 4.4.2.2.4. Pharmaceuticals 4.4.2.2.5. Other 4.4.2.3. Canada Carob Market Size and Forecast, by Distribution Channel (2022-2029) 4.4.2.3.1. Online Retail 4.4.2.3.2. Retail Stores 4.4.2.3.3. Supermarkets 4.4.2.3.4. Specialty Stores 4.4.2.3.5. Other 4.4.3. Mexico 4.4.3.1. Mexico Carob Market Size and Forecast, by Type (2022-2029) 4.4.3.1.1. Carob Powder 4.4.3.1.2. Carob Chips 4.4.3.1.3. Carob Bars 4.4.3.1.4. Carob Syrup 4.4.3.1.5. Carob Snacks 4.4.3.2. Mexico Carob Market Size and Forecast, by Application (2022-2029) 4.4.3.2.1. Bakery and Confectionary 4.4.3.2.2. Nutrition and supplements 4.4.3.2.3. Dairy Products 4.4.3.2.4. Pharmaceuticals 4.4.3.2.5. Other 4.4.3.3. Mexico Carob Market Size and Forecast, by Distribution Channel (2022-2029) 4.4.3.3.1. Online Retail 4.4.3.3.2. Retail Stores 4.4.3.3.3. Supermarkets 4.4.3.3.4. Specialty Stores 4.4.3.3.5. Other 5. Europe Carob Market Size and Forecast (by Value in USD Billion) (2022-2029) 5.1. Europe Carob Market Size and Forecast, by Type (2022-2029) 5.2. Europe Carob Market Size and Forecast, by Application (2022-2029) 5.3. Europe Carob Market Size and Forecast, by Distribution Channel (2022-2029) 5.4. Europe Carob Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Carob Market Size and Forecast, by Type (2022-2029) 5.4.1.2. United Kingdom Carob Market Size and Forecast, by Application (2022-2029) 5.4.1.3. United Kingdom Carob Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.2. France 5.4.2.1. France Carob Market Size and Forecast, by Type (2022-2029) 5.4.2.2. France Carob Market Size and Forecast, by Application (2022-2029) 5.4.2.3. France Carob Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.3. Germany 5.4.3.1. Germany Carob Market Size and Forecast, by Type (2022-2029) 5.4.3.2. Germany Carob Market Size and Forecast, by Application (2022-2029) 5.4.3.3. Germany Carob Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Carob Market Size and Forecast, by Type (2022-2029) 5.4.4.2. Italy Carob Market Size and Forecast, by Application (2022-2029) 5.4.4.3. Italy Carob Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.5. Spain 5.4.5.1. Spain Carob Market Size and Forecast, by Type (2022-2029) 5.4.5.2. Spain Carob Market Size and Forecast, by Application (2022-2029) 5.4.5.3. Spain Carob Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Carob Market Size and Forecast, by Type (2022-2029) 5.4.6.2. Sweden Carob Market Size and Forecast, by Application (2022-2029) 5.4.6.3. Sweden Carob Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Carob Market Size and Forecast, by Type (2022-2029) 5.4.7.2. Austria Carob Market Size and Forecast, by Application (2022-2029) 5.4.7.3. Austria Carob Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Carob Market Size and Forecast, by Type (2022-2029) 5.4.8.2. Rest of Europe Carob Market Size and Forecast, by Application (2022-2029) 5.4.8.3. Rest of Europe Carob Market Size and Forecast, by Distribution Channel (2022-2029) 6. Asia Pacific Carob Market Size and Forecast (by Value in USD Billion) (2022-2029) 6.1. Asia Pacific Carob Market Size and Forecast, by Type (2022-2029) 6.2. Asia Pacific Carob Market Size and Forecast, by Application (2022-2029) 6.3. Asia Pacific Carob Market Size and Forecast, by Distribution Channel (2022-2029) 6.4. Asia Pacific Carob Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Carob Market Size and Forecast, by Type (2022-2029) 6.4.1.2. China Carob Market Size and Forecast, by Application (2022-2029) 6.4.1.3. China Carob Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Carob Market Size and Forecast, by Type (2022-2029) 6.4.2.2. S Korea Carob Market Size and Forecast, by Application (2022-2029) 6.4.2.3. S Korea Carob Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Carob Market Size and Forecast, by Type (2022-2029) 6.4.3.2. Japan Carob Market Size and Forecast, by Application (2022-2029) 6.4.3.3. Japan Carob Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.4. India 6.4.4.1. India Carob Market Size and Forecast, by Type (2022-2029) 6.4.4.2. India Carob Market Size and Forecast, by Application (2022-2029) 6.4.4.3. India Carob Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Carob Market Size and Forecast, by Type (2022-2029) 6.4.5.2. Australia Carob Market Size and Forecast, by Application (2022-2029) 6.4.5.3. Asia Pacific Carob Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Carob Market Size and Forecast, by Type (2022-2029) 6.4.6.2. Indonesia Carob Market Size and Forecast, by Application (2022-2029) 6.4.6.3. Indonesia Carob Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Carob Market Size and Forecast, by Type (2022-2029) 6.4.7.2. Malaysia Carob Market Size and Forecast, by Application (2022-2029) 6.4.7.3. Malaysia Carob Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Carob Market Size and Forecast, by Type (2022-2029) 6.4.8.2. Vietnam Carob Market Size and Forecast, by Application (2022-2029) 6.4.8.3. Vietnam Carob Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Carob Market Size and Forecast, by Type (2022-2029) 6.4.9.2. Taiwan Carob Market Size and Forecast, by Application (2022-2029) 6.4.9.3. Taiwan Carob Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Carob Market Size and Forecast, by Type (2022-2029) 6.4.10.2. Rest of Asia Pacific Carob Market Size and Forecast, by Application (2022-2029) 6.4.10.3. Rest of Asia Pacific Carob Market Size and Forecast, by Distribution Channel (2022-2029) 7. Middle East and Africa Carob Market Size and Forecast (by Value in USD Billion) (2022-2029) 7.1. Middle East and Africa Carob Market Size and Forecast, by Type (2022-2029) 7.2. Middle East and Africa Carob Market Size and Forecast, by Application (2022-2029) 7.3. Middle East and Africa Carob Market Size and Forecast, by Distribution Channel (2022-2029) 7.4. Middle East and Africa Carob Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Carob Market Size and Forecast, by Type (2022-2029) 7.4.1.2. South Africa Carob Market Size and Forecast, by Application (2022-2029) 7.4.1.3. South Africa Carob Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Carob Market Size and Forecast, by Type (2022-2029) 7.4.2.2. GCC Carob Market Size and Forecast, by Application (2022-2029) 7.4.2.3. GCC Carob Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Carob Market Size and Forecast, by Type (2022-2029) 7.4.3.2. Nigeria Carob Market Size and Forecast, by Application (2022-2029) 7.4.3.3. Nigeria Carob Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Carob Market Size and Forecast, by Type (2022-2029) 7.4.4.2. Rest of ME&A Carob Market Size and Forecast, by Application (2022-2029) 7.4.4.3. Rest of ME&A Carob Market Size and Forecast, by Distribution Channel (2022-2029) 8. South America Carob Market Size and Forecast (by Value in USD Billion) (2022-2029) 8.1. South America Carob Market Size and Forecast, by Type (2022-2029) 8.2. South America Carob Market Size and Forecast, by Application (2022-2029) 8.3. South America Carob Market Size and Forecast, by Distribution Channel (2022-2029) 8.4. South America Carob Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Carob Market Size and Forecast, by Type (2022-2029) 8.4.1.2. Brazil Carob Market Size and Forecast, by Application (2022-2029) 8.4.1.3. Brazil Carob Market Size and Forecast, by Distribution Channel (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Carob Market Size and Forecast, by Type (2022-2029) 8.4.2.2. Argentina Carob Market Size and Forecast, by Application (2022-2029) 8.4.2.3. Argentina Carob Market Size and Forecast, by Distribution Channel (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Carob Market Size and Forecast, by Type (2022-2029) 8.4.3.2. Rest Of South America Carob Market Size and Forecast, by Application (2022-2029) 8.4.3.3. Rest Of South America Carob Market Size and Forecast, by Distribution Channel (2022-2029) 9. Global Carob Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.3.6. SKU Details 9.3.7. Production Capacity 9.3.8. Production for 2022 9.3.9. No. of Stores 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Carob Market Companies, by market capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Carab co 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Stavros parpis foods ltd. 10.3. savvy carob co. Ltd. 10.4. aep colloids 10.5. tic gums inc. 10.6. altrafine gums 10.7. australian carobs pty ltd. 10.8. pedro perez 10.9. carob s.a. 10.10. dupont 10.11. tate & lyle plc 10.12. Australian Carobs ptd 10.13. Auroduna Americas 10.14. CyberColloids 10.15. The Hain Celestial Group 10.16. Savvy Foods 10.17. Carobs Austrilia 10.18. Creta Carob 10.19. Lewis Confectionery 10.20. Frontier Co-op 10.21. Oak Haven 11. Key Findings 12. Industry Recommendations 13. Carob Market: Research Methodology 14. Terms and Glossary