The Carbon Steel Piping Spools Market size was valued at USD 5.48 Billion in 2025 and the total Carbon Steel Piping Spools revenue is expected to grow at a CAGR of 6.8% from 2026 to 2032, reaching nearly USD 8.68 Billion by 2032.Carbon Steel Piping Spools Market Overview:

Carbon Steel is one of the suitable materials to make Pipe Spools. Carbon Steel is a mixture of Iron and Carbon which has many qualities such as hardness, strength of elasticity, and flexibility. The maximum contains Carbon to make this material harder and more durable. With the increasing demand for reliable and cost-effective piping solutions in various industries, carbon steel piping spools have gained prominence. Crafted from premium-grade carbon steel, these spools provide exceptional durability, corrosion resistance, and remarkable tensile strength, rendering them apt for an extensive array of applications. The trends include a rising emphasis on energy-efficient and sustainable infrastructure, driving the adoption of carbon steel piping spools in HVAC, oil and gas, water treatment, and industrial processes. The market is also witnessing increased investments in infrastructure development projects, particularly in emerging economies. The market landscape is still being shaped by technological developments and competition from substitute materials, as advances have an effect on both product quality and installation effectiveness. While the market is cyclical and subject to general economic trends, the demand for carbon steel piping spools is anticipated to be supported by the continued industrialization and infrastructural development of the world.To know about the Research Methodology :- Request Free Sample Report

Carbon Steel Piping Spools Market Dynamics

Drivers Rising industrialization boosts the Carbon Steel Piping Spools Market The rising industrialization has significantly boosted the Carbon Steel Piping Spools market growth in several ways. The rising industrialization and expansion of infrastructure projects have led to an escalating need for dependable and sturdy piping systems to facilitate the conveyance of fluids like water, oil, and gas. Carbon steel piping spools have become the preferred choice in industrial settings due to their exceptional durability, cost-efficiency, and resistance to corrosion. They serve as indispensable elements for the efficient transportation of fluids within industrial processes. The expansion of manufacturing, construction, and energy sectors necessitates extensive piping networks, which, in turn, drive the demand for carbon steel piping spools. These spools are integral in constructing pipelines, power plants, refineries, and petrochemical facilities, as they offer high structural integrity and withstand harsh operating conditions. The increased industrialization leads to a greater need for carbon steel piping spools, as they play a vital role in ensuring the efficient and safe transport of fluids within the expanding industrial landscape, thus fueling market growth. Restrains Increasing Emphasis on Environmental Sustainability limits the Market Growth One significant restraining factor for the Carbon Steel Piping Spools market is the increasing emphasis on environmental sustainability. Despite its renowned strength and affordability, carbon steel is vulnerable to corrosion, particularly when it encounters corrosive substances. This susceptibility to corrosion can result in the development of leaks and environmental contamination, which, in turn, presents a significant risk to ecosystems and public health. As environmental regulations become more stringent worldwide, industries are under pressure to adopt more corrosion-resistant and eco-friendly materials, which limit the demand for carbon steel piping spools. The emphasis on decreasing carbon emissions and attaining carbon neutrality objectives has triggered a transition towards materials that leave a smaller carbon footprint. The production of carbon steel is known for its energy-intensive nature and its associated contribution to greenhouse gas emissions. Consequently, in a world increasingly alarmed by climate change, carbon steel is losing favor as an environmentally friendly material. These environmental considerations have prompted industries to explore alternative materials that are more sustainable and environmentally friendly, which impede the growth of the carbon steel piping spools market. Opportunity Renewable Energy Projects Create Lucrative Growth Opportunities for the Market Growth Renewable energy projects are significantly bolstering the Carbon Steel Piping Spools market's growth. These projects, which harness energy from naturally replenishing sources like solar, wind, hydro, and geothermal power, require a robust and cost-effective infrastructure for the transportation of energy sources. Carbon steel piping spools, known for their durability and affordability, are a preferred choice for constructing intricate piping systems vital in renewable energy facilities. In solar and wind farms, carbon steel piping spools are essential for connecting vast arrays of photovoltaic panels and wind turbines, offering structural support and transmitting generated energy. The increasing deployment of solar and wind farms worldwide amplifies the demand for piping spools. Similarly, in hydropower projects, where water must be channeled through turbines to generate electricity, carbon steel piping spools play a crucial role, contributing to market expansion. Geothermal energy projects and biomass/biogas facilities also rely on carbon steel piping spools due to their ability to withstand high temperatures, and high pressures, and their cost-effectiveness in transporting hot water, steam, and organic materials. The growing emphasis on sustainable energy solutions further propels the market, making it an integral part of the renewable energy transition. Carbon Steel Piping Spools Market Trend: In the Carbon Steel Piping Spools market, a trend is the relentless pursuit of enhanced quality and innovation among leading players. These market giants are introducing improved finished materials, which not only benefit the industry but also the wider community. They are taking strategic steps to enhance the accuracy and overall functionality of their products, aligning with the demand for precision and reliability in industrial applications. An example of this trend is Metal Forge India, which is leveraging new technologies to offer carbon steel piping spools with various ASTM grades. They are expanding their capabilities through in-house chemical and mechanical facilities, reflecting a commitment to advanced manufacturing practices. Competitors in the piping industry are actively adopting acquisition as a key developmental strategy to strengthen their global market presence. Cogbill's RedLine IPS Composite Wear Pad System is a testament to this approach, providing exceptional corrosion protection for industrial piping systems. By using specially formulated vinyl ester resin, they ensure UV stability and robust performance, especially in harsh and corrosive environments. Another trend is the growing emphasis on efficiency and optimization in the production of pipe spools, a critical phase in the piping process. PEMA solutions, for instance, are proactively addressing common challenges in pipe spool production, contributing to the growth of the piping industry by streamlining operations and enhancing productivity. This trend highlights the industry's commitment to innovation and improving the manufacturing process for increased efficiency and cost-effectiveness.Carbon Steel Piping Spools Market Segment Analysis:

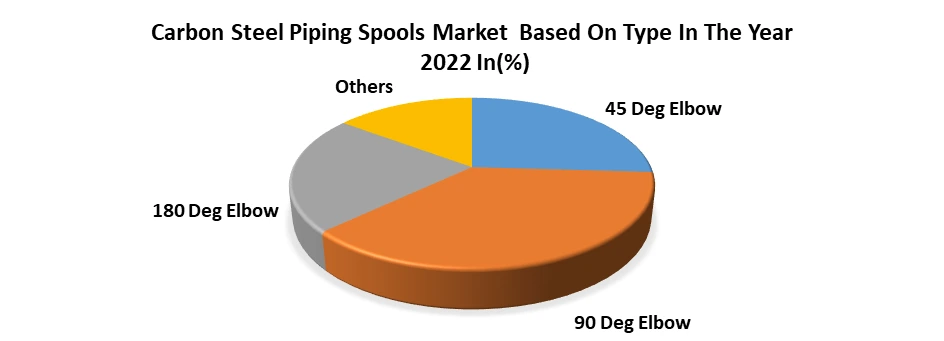

Based on Type, the 90 Deg Elbow segment dominates the type segment of the Carbon Steel Piping Spools Market. The 90-degree elbow is a critical component in piping systems, and it holds a prominent position due to its widespread usage. This type of elbow is extensively used for changing the direction of fluid flow in pipelines, providing a right-angle turn. Its versatility makes it suitable for a wide range of applications, from water supply and sewage systems to industrial processes and power generation. The 90-degree elbow offers a balanced compromise between flexibility and control in fluid conveyance. It allows for efficient changes in direction while maintaining a smooth flow, reducing turbulence, and pressure drop. This makes it an ideal choice for optimizing fluid transport in various industries. Many industrial processes and applications necessitate precise turning angles, and the 90-degree elbow provides this accuracy. Its standard design simplifies installation and maintenance, making it a practical choice for engineers and operators. While other segments such as the 45-degree and 180-degree elbows have specific applications, the 90-degree elbow's versatility and broad utility across industries position it as the dominant segment in the Carbon Steel Piping Spools market.

Regional Insight

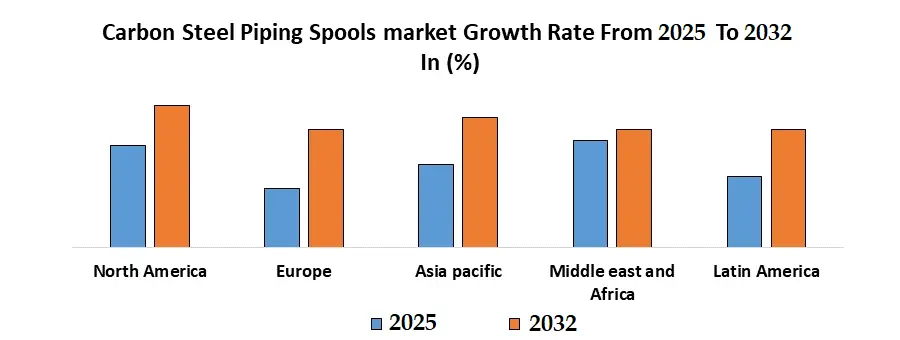

North America's Carbon Steel Piping Spools market thrives on the well-established industrial bases of the United States and Canada. These regions fuel demand, especially in the oil and gas sector, particularly in areas such as Texas and Alberta. The shale gas boom has further amplified the need for piping spools. Stringent environmental standards and corrosion management requirements drive the use of resilient materials like carbon steel. Infrastructure development, including power plants and water treatment facilities, supports market growth, aligning with the promotion of renewable energy sources. The market for carbon steel piping spools remains robust, driven by environmentally conscious practices and renewable energy initiatives. The recyclability of carbon steel carbon steel pipe material specification and aligns with the region's sustainability goals. Offshore oil and gas projects depend on corrosion-resistant materials, further increasing demand. The Asia-Pacific region is the fastest-growing market for carbon steel piping spools due to rapid industrialization in countries Such as China and India. Considerable investments in infrastructure, manufacturing, and energy contribute to the growing need for piping systems. The oil and gas industry, particularly in Malaysia and Australia, exerts significant influence. Emerging Southeast Asian nations, including Vietnam and Indonesia, further boost demand, driven by water treatment and power production facilities needed for urbanization and economic development.

Competitive Landscape:

The Competitive Landscape of the Carbon Steel Piping Spools Market covers the number of key companies, company size, strengths, weaknesses, barriers, and threats. It also focuses on the power of the company’s competitive rivals, potential, new cancer drug companies, customers, suppliers, carbon steel pipe distributors, and substitute products that drive the profitability of the companies in the pipe carbon steel industry. The global Carbon Steel Piping Spools Market includes several market players at the country, regional, and global levels. Some of the Market Segment companies are National Oilwell Varco, McJunkin Red Man Corporation (MRC Global), Sumitomo Corporation, TechnipFMC, ArcelorMittal and Vallourec. Many carbon steel pipe manufacturers have conducted research and development activities to fulfill consumer demand and increase their portfolio. The company focuses on strategic partnerships mergers and acquisitions to expand the global reach and maintain the brand name.Global Carbon Steel Piping Spools Market Scope: Inquire before buying

Global Carbon Steel Piping Spools Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: US $ 5.48 Bn. Forecast Period 2026 to 2032 CAGR: 6.8% Market Size in 2032: US $ 8.68 Bn. Segments Covered: by Type 45 Deg Elbow 90 Deg Elbow 180 Deg Elbow Others by Application Power Plant Petroleum Refineries Aerospace Food Processing Others Carbon Steel Piping Spools Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Carbon Steel Piping Spools Market Key Players

1. National Oilwell Varco 2. McJunkin Red Man Corporation (MRC Global) 3. Sumitomo Corporation 4. TechnipFMC 5. ArcelorMittal 6. Vallourec 7. Tenaris 8. TMK Group 9. Zekelman Industries 10. Sandvik Group 11. Jindal SAW Ltd. 12. American Piping Products 13. Welspun Corp Ltd. 14. Schulz Group 15. Edgen Murray 16. Northwest Pipe Company 17. Tata Steel 18. Centric Pipe 19. Marubeni-Itochu Steel 20. Cimtas Pipe Frequently Asked Questions: 1] What segments are covered in the Global Carbon Steel Piping Spools Market report? Ans. The segments covered in the Market report are based on Type, Application Regions. 2] Which region is expected to hold the highest share in the Global Carbon Steel Piping Spools Market? Ans. The North American region is expected to hold the highest share of the Market. 3] What was the market size of the Global Market by 2025? Ans. The market size of the Market by 2025 is expected to reach US$ 6.8 Bn. 4] What is the forecast period for the Global Market? Ans. The forecast period for the Market is 2026-2032. 5] What is the market size of the Global Market in 2032? Ans. The market size of the Market in 2032 is valued at US$ 8.68 Bn.

1. Carbon Steel Piping Spools Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Carbon Steel Piping Spools Market: Dynamics 2.1. Carbon Steel Piping Spools Market Trends by Region 2.1.1. North America Carbon Steel Piping Spools Market Trends 2.1.2. Europe Carbon Steel Piping Spools Market Trends 2.1.3. Asia Pacific Carbon Steel Piping Spools Market Trends 2.1.4. Middle East and Africa Carbon Steel Piping Spools Market Trends 2.1.5. South America Carbon Steel Piping Spools Market Trends 2.2. Carbon Steel Piping Spools Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Carbon Steel Piping Spools Market Drivers 2.2.1.2. North America Carbon Steel Piping Spools Market Restraints 2.2.1.3. North America Carbon Steel Piping Spools Market Opportunities 2.2.1.4. North America Carbon Steel Piping Spools Market Challenges 2.2.2. Europe 2.2.2.1. Europe Carbon Steel Piping Spools Market Drivers 2.2.2.2. Europe Carbon Steel Piping Spools Market Restraints 2.2.2.3. Europe Carbon Steel Piping Spools Market Opportunities 2.2.2.4. Europe Carbon Steel Piping Spools Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Carbon Steel Piping Spools Market Drivers 2.2.3.2. Asia Pacific Carbon Steel Piping Spools Market Restraints 2.2.3.3. Asia Pacific Carbon Steel Piping Spools Market Opportunities 2.2.3.4. Asia Pacific Carbon Steel Piping Spools Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Carbon Steel Piping Spools Market Drivers 2.2.4.2. Middle East and Africa Carbon Steel Piping Spools Market Restraints 2.2.4.3. Middle East and Africa Carbon Steel Piping Spools Market Opportunities 2.2.4.4. Middle East and Africa Carbon Steel Piping Spools Market Challenges 2.2.5. South America 2.2.5.1. South America Carbon Steel Piping Spools Market Drivers 2.2.5.2. South America Carbon Steel Piping Spools Market Restraints 2.2.5.3. South America Carbon Steel Piping Spools Market Opportunities 2.2.5.4. South America Carbon Steel Piping Spools Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Regulatory Landscape by Region 2.6.1. Global 2.6.2. North America 2.6.3. Europe 2.6.4. Asia Pacific 2.6.5. Middle East and Africa 2.6.6. South America 2.7. Key Opinion Leader Analysis For Allogeneic Cell Therapy Industry 2.8. Analysis of Government Schemes and Initiatives For Carbon Steel Piping Spools Industry 2.9. The Global Pandemic Impact on Carbon Steel Piping Spools Market 2.10. Carbon Steel Piping Spools Price Trend Analysis (2025-2032) 2.11. Global Carbon Steel Piping Spools Market Trade Analysis (2025-2032) 3. Carbon Steel Piping Spools Market: Global Market Size and Forecast by Segmentation (by Value Million Units) (2025-2032) 3.1. Carbon Steel Piping Spools Market Size and Forecast, by Type (2025-2032) 3.1.1. 45 Deg Elbow 3.1.2. 90 Deg Elbow 3.1.3. 180 Deg Elbow 3.1.4. Others 3.2. Carbon Steel Piping Spools Market Size and Forecast, by Application (2025-2032) 3.2.1. Power Plant 3.2.2. Petroleum Refineries 3.2.3. Aerospace 3.2.4. Food Processing 3.2.5. Others 3.3. Carbon Steel Piping Spools Market Size and Forecast, by Region (2025-2032) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Carbon Steel Piping Spools Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 4.1. North America Carbon Steel Piping Spools Market Size and Forecast, by Type (2025-2032) 4.1.1. 45 Deg Elbow 4.1.2. 90 Deg Elbow 4.1.3. 180 Deg Elbow 4.1.4. Others 4.2. North America Carbon Steel Piping Spools Market Size and Forecast, by Application (2025-2032) 4.2.1. Power Plant 4.2.2. Petroleum Refineries 4.2.3. Aerospace 4.2.4. Food Processing 4.2.5. Others 4.3. North America Cabinet Market Size and Forecast, by Country (2025-2032) 4.3.1. United States 4.3.1.1. United States Carbon Steel Piping Spools Market Size and Forecast, by Type (2025-2032) 4.3.1.1.1. 45 Deg Elbow 4.3.1.1.2. 90 Deg Elbow 4.3.1.1.3. 180 Deg Elbow 4.3.1.1.4. Others 4.3.1.2. United States Carbon Steel Piping Spools Market Size and Forecast, by Application (2025-2032) 4.3.1.2.1. Power Plant 4.3.1.2.2. Petroleum Refineries 4.3.1.2.3. Aerospace 4.3.1.2.4. Food Processing 4.3.1.2.5. Others 4.3.2. Canada 4.3.2.1. Canada Carbon Steel Piping Spools Market Size and Forecast, by Type (2025-2032) 4.3.2.1.1. 45 Deg Elbow 4.3.2.1.2. 90 Deg Elbow 4.3.2.1.3. 180 Deg Elbow 4.3.2.1.4. Others 4.3.2.2. Canada Carbon Steel Piping Spools Market Size and Forecast, by Application (2025-2032) 4.3.2.2.1. Power Plant 4.3.2.2.2. Petroleum Refineries 4.3.2.2.3. Aerospace 4.3.2.2.4. Food Processing 4.3.2.2.5. Others 4.3.3. Mexico 4.3.3.1. Mexico Carbon Steel Piping Spools Market Size and Forecast, by Type (2025-2032) 4.3.3.1.1. 45 Deg Elbow 4.3.3.1.2. 90 Deg Elbow 4.3.3.1.3. 180 Deg Elbow 4.3.3.1.4. Others 4.3.3.2. Mexico Carbon Steel Piping Spools Market Size and Forecast, by Application (2025-2032) 4.3.3.2.1. Power Plant 4.3.3.2.2. Petroleum Refineries 4.3.3.2.3. Aerospace 4.3.3.2.4. Food Processing 4.3.3.2.5. Others 5. Europe Carbon Steel Piping Spools Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2025-2032) 5.1. Europe Carbon Steel Piping Spools Market Size and Forecast, by Type (2025-2032) 5.2. Europe Carbon Steel Piping Spools Market Size and Forecast, by Application (2025-2032) 5.3. Europe Carbon Steel Piping Spools Market Size and Forecast, by Country (2025-2032) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Carbon Steel Piping Spools Market Size and Forecast, by Type (2025-2032) 5.3.1.2. United Kingdom Carbon Steel Piping Spools Market Size and Forecast, by Application (2025-2032) 5.3.2. France 5.3.2.1. France Carbon Steel Piping Spools Market Size and Forecast, by Type (2025-2032) 5.3.2.2. France Carbon Steel Piping Spools Market Size and Forecast, by Application (2025-2032) 5.3.3. Germany 5.3.3.1. Germany Carbon Steel Piping Spools Market Size and Forecast, by Type (2025-2032) 5.3.3.2. Germany Carbon Steel Piping Spools Market Size and Forecast, by Application (2025-2032) 5.3.4. Italy 5.3.4.1. Italy Carbon Steel Piping Spools Market Size and Forecast, by Type (2025-2032) 5.3.4.2. Italy Carbon Steel Piping Spools Market Size and Forecast, by Application (2025-2032) 5.3.5. Spain 5.3.5.1. Spain Carbon Steel Piping Spools Market Size and Forecast, by Type (2025-2032) 5.3.5.2. Spain Carbon Steel Piping Spools Market Size and Forecast, by Application (2025-2032) 5.3.6. Sweden 5.3.6.1. Sweden Carbon Steel Piping Spools Market Size and Forecast, by Type (2025-2032) 5.3.6.2. Sweden Carbon Steel Piping Spools Market Size and Forecast, by Application (2025-2032) 5.3.7. Austria 5.3.7.1. Austria Carbon Steel Piping Spools Market Size and Forecast, by Type (2025-2032) 5.3.7.2. Austria Carbon Steel Piping Spools Market Size and Forecast, by Application (2025-2032) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Carbon Steel Piping Spools Market Size and Forecast, by Type (2025-2032) 5.3.8.2. Rest of Europe Carbon Steel Piping Spools Market Size and Forecast, by Application (2025-2032) 6. Asia Pacific Carbon Steel Piping Spools Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 6.1. Asia Pacific Carbon Steel Piping Spools Market Size and Forecast, by Type (2025-2032) 6.2. Asia Pacific Carbon Steel Piping Spools Market Size and Forecast, by Application (2025-2032) 6.3. Asia Pacific Carbon Steel Piping Spools Market Size and Forecast, by Country (2025-2032) 6.3.1. China 6.3.1.1. China Carbon Steel Piping Spools Market Size and Forecast, by Type (2025-2032) 6.3.1.2. China Carbon Steel Piping Spools Market Size and Forecast, by Application (2025-2032) 6.3.2. S Korea 6.3.2.1. S Korea Carbon Steel Piping Spools Market Size and Forecast, by Type (2025-2032) 6.3.2.2. S Korea Carbon Steel Piping Spools Market Size and Forecast, by Application (2025-2032) 6.3.3. Japan 6.3.3.1. Japan Carbon Steel Piping Spools Market Size and Forecast, by Type (2025-2032) 6.3.3.2. Japan Carbon Steel Piping Spools Market Size and Forecast, by Application (2025-2032) 6.3.4. India 6.3.4.1. India Carbon Steel Piping Spools Market Size and Forecast, by Type (2025-2032) 6.3.4.2. India Carbon Steel Piping Spools Market Size and Forecast, by Application (2025-2032) 6.3.5. Australia 6.3.5.1. Australia Carbon Steel Piping Spools Market Size and Forecast, by Type (2025-2032) 6.3.5.2. Australia Carbon Steel Piping Spools Market Size and Forecast, by Application (2025-2032) 6.3.6. Indonesia 6.3.6.1. Indonesia Carbon Steel Piping Spools Market Size and Forecast, by Type (2025-2032) 6.3.6.2. Indonesia Carbon Steel Piping Spools Market Size and Forecast, by Application (2025-2032) 6.3.7. Malaysia 6.3.7.1. Malaysia Carbon Steel Piping Spools Market Size and Forecast, by Type (2025-2032) 6.3.7.2. Malaysia Carbon Steel Piping Spools Market Size and Forecast, by Application (2025-2032) 6.3.8. Vietnam 6.3.8.1. Vietnam Carbon Steel Piping Spools Market Size and Forecast, by Type (2025-2032) 6.3.8.2. Vietnam Carbon Steel Piping Spools Market Size and Forecast, by Application (2025-2032) 6.3.9. Taiwan 6.3.9.1. Taiwan Carbon Steel Piping Spools Market Size and Forecast, by Type (2025-2032) 6.3.9.2. Taiwan Carbon Steel Piping Spools Market Size and Forecast, by Application (2025-2032) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Carbon Steel Piping Spools Market Size and Forecast, by Type (2025-2032) 6.3.10.2. Rest of Asia Pacific Carbon Steel Piping Spools Market Size and Forecast, by Application (2025-2032) 7. Middle East and Africa Carbon Steel Piping Spools Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 7.1. Middle East and Africa Carbon Steel Piping Spools Market Size and Forecast, by Type (2025-2032) 7.2. Middle East and Africa Carbon Steel Piping Spools Market Size and Forecast, by Application (2025-2032) 7.3. Middle East and Africa Carbon Steel Piping Spools Market Size and Forecast, by Country (2025-2032) 7.3.1. South Africa 7.3.1.1. South Africa Carbon Steel Piping Spools Market Size and Forecast, by Type (2025-2032) 7.3.1.2. South Africa Carbon Steel Piping Spools Market Size and Forecast, by Application (2025-2032) 7.3.2. GCC 7.3.2.1. GCC Carbon Steel Piping Spools Market Size and Forecast, by Type (2025-2032) 7.3.2.2. GCC Carbon Steel Piping Spools Market Size and Forecast, by Application (2025-2032) 7.3.3. Nigeria 7.3.3.1. Nigeria Carbon Steel Piping Spools Market Size and Forecast, by Type (2025-2032) 7.3.3.2. Nigeria Carbon Steel Piping Spools Market Size and Forecast, by Application (2025-2032) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Carbon Steel Piping Spools Market Size and Forecast, by Type (2025-2032) 7.3.4.2. Rest of ME&A Carbon Steel Piping Spools Market Size and Forecast, by Application (2025-2032) 8. South America Carbon Steel Piping Spools Market Size and Forecast by Segmentation (by Value in USD Million) (2025-2032) 8.1. South America Carbon Steel Piping Spools Market Size and Forecast, by Type (2025-2032) 8.2. South America Carbon Steel Piping Spools Market Size and Forecast, by Application (2025-2032) 8.3. South America Carbon Steel Piping Spools Market Size and Forecast, by Country (2025-2032) 8.3.1. Brazil 8.3.1.1. Brazil Carbon Steel Piping Spools Market Size and Forecast, by Type (2025-2032) 8.3.1.2. Brazil Carbon Steel Piping Spools Market Size and Forecast, by Application (2025-2032) 8.3.2. Argentina 8.3.2.1. Argentina Carbon Steel Piping Spools Market Size and Forecast, by Type (2025-2032) 8.3.2.2. Argentina Carbon Steel Piping Spools Market Size and Forecast, by Application (2025-2032) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Carbon Steel Piping Spools Market Size and Forecast, by Type (2025-2032) 8.3.3.2. Rest Of South America Carbon Steel Piping Spools Market Size and Forecast, by Application (2025-2032) 9. Global Carbon Steel Piping Spools Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2025) 9.3.5. Company Locations 9.4. Leading Carbon Steel Piping Spools Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. National Oilwell Varco 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. McJunkin Red Man Corporation (MRC Global) 10.3. Sumitomo Corporation 10.4. TechnipFMC 10.5. ArcelorMittal 10.6. Vallourec 10.7. Tenaris 10.8. TMK Group 10.9. Zekelman Industries 10.10. Sandvik Group 10.11. Jindal SAW Ltd. 10.12. American Piping Products 10.13. Welspun Corp Ltd. 10.14. Schulz Group 10.15. Edgen Murray 10.16. Northwest Pipe Company 10.17. Tata Steel 10.18. Centric Pipe 10.19. Marubeni-Itochu Steel 10.20. Cimtas Pipe 11. Key Findings 12. Industry Recommendations 13. Carbon Steel Piping Spools Market: Research Methodology 14. Terms and Glossary