The Global Car Subscription Market size was valued at USD 4.72 Billion in 2022 and the total Car Subscription revenue is expected to grow at a CAGR of 35.8% from 2023 to 2029, reaching nearly USD 40.2 Billion by 2029.Car Subscription Market Overview:

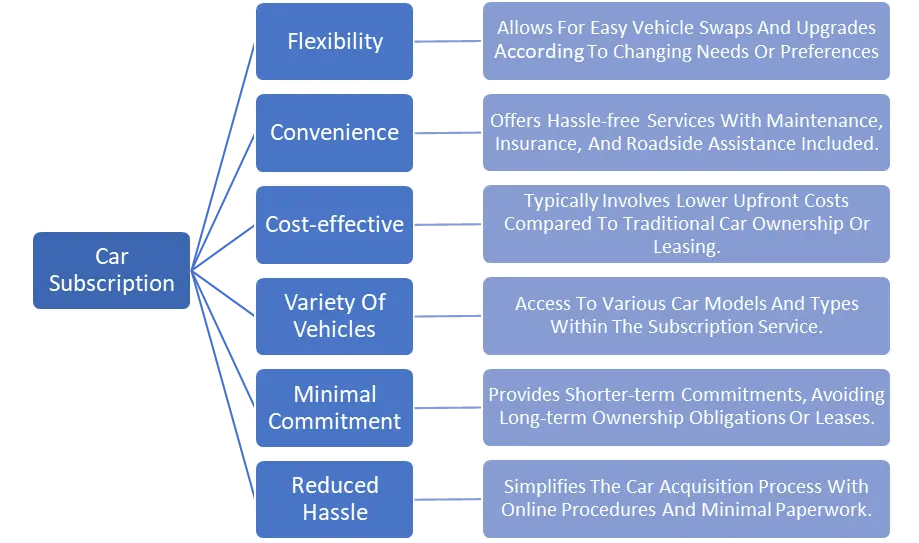

Car subscription is an evolving model that offers individuals access to vehicles through a flexible, subscription-based approach rather than traditional ownership. It provides a convenient alternative by enabling users to pay a periodic fee to use a vehicle of their choice for a specified duration, often covering maintenance, insurance, and other related costs. The demand for car subscriptions has surged rapidly all across the world, due to shifting consumer preferences favoring flexibility, convenience, and cost-effective mobility solutions. This model particularly appeals to individuals seeking hassle-free access to vehicles without the financial commitment and long-term obligations associated with ownership. Countries like the United States, Germany, and India have witnessed significant demand for car subscriptions. In the US, the demand is attributed to the appeal of flexibility and varied subscription options, while in Germany, the concept's traction is driven by an inclination toward alternative mobility solutions. In India, the rising demand is influenced by the desire for financial flexibility and the convenience of accessing vehicles without the burden of upfront expenses, resonating well with the evolving consumer preferences seeking more adaptable and accessible transportation solutions. The car subscription market is experiencing substantial growth globally, driven by evolving consumer preferences and the need for flexible, hassle-free mobility solutions. In addition, the increasing preference for access over ownership, rising urbanization, and a shift towards more sustainable transportation options are expected to be the major factors driving the car subscription market growth. As consumers seek convenience and cost-effectiveness, the car subscription industry is witnessing a surge in demand for subscription-based car services across various demographics. Key players in the industry are adopting strategic measures to gain a maximum market share. They're focusing on diversifying their offerings to cater to diverse consumer needs, enhancing digital platforms for seamless user experiences, and collaborating with automakers to expand their vehicle fleets. For instance, companies like SIXT and FINN in the US are amassing fleets and offering subscriptions through user-friendly apps and websites. Similarly, Autonomy and Ferry are concentrating on electric vehicle subscriptions, while GO is exploring long-term subscription models, thereby capturing different market segments and driving car subscription market penetration. These strategies align with the growing demand for varied subscription models, catering to different lifestyles and preferences. The focus remains on customer-centric approaches, technological advancements, and partnership expansions to solidify their positions in this rapidly increasing car subscription market.To know about the Research Methodology :- Request Free Sample Report

Car Subscription Market Dynamics:

Car Subscription Model: A new era for OEMs The emergence of in-car subscription services signifies a pivotal shift in the automotive landscape, offering lucrative growth opportunities for the car subscription market players, as customers increasingly opt for flexibility and choice over traditional ownership models. This trend towards subscription-based mobility solutions presents a twofold opportunity for automotive businesses, captured by the widespread adoption of vehicle subscription models and the nascent development of in-car subscriptions. The concept of in-car subscriptions enables users to activate and pay for specific functionalities or services within their vehicles on a weekly, monthly, or yearly basis. Departing from conventional pre-installed features, this model aligns with evolving consumer preferences, offering heightened flexibility and reduced commitment. With a focus on customer-centricity akin to leading retailers, this approach empowers drivers to tailor their vehicle's features based on immediate needs, activating or canceling services at their discretion. Automotive companies, leveraging data-driven technologies, are exploring variations of in-car subscription models that facilitate over-the-air activation of services and accessories. These add-ons range from enhancing battery range before a road trip to integrating automated voice control technology for destination information or navigation commands. This dynamic approach enhances the value proposition for drivers, aligning with contemporary expectations of on-demand, customizable experiences. The transition to agency models marks a pivotal evolution in the automotive industry's profit landscape, steering away from solely relying on parts and service revenue towards establishing long-term, innovative financial relationships with customers. While aftersales services remain integral, the emphasis shifts towards over-the-air delivery of technology upgrades, system updates, and fault patches. Agent training focuses on selling these additional services, amplifying the revenue potential beyond traditional avenues.Advantages Of Car Subscriptions

Although in-car subscriptions aren't entirely novel, they pose a paradigm shift for traditional OEMs accustomed to selling accessories upfront. This approach enables OEMs to offer additional functionalities that continually add value to drivers throughout the vehicle lifecycle, breaking away from the constraints of one-time purchases at the outset. This paradigm shift mirrors the success of subscription-based services like Netflix and Spotify, underscoring the growing consumer inclination towards subscription models that prioritize flexibility, convenience, and choice. General Motors' success in this arena, with approximately a quarter of its on-road vehicles in the US and Canada utilizing subscription services, highlights the potential revenue streams akin to streaming giant Netflix by the end of the forecast period. The flexibility inherent in in-car subscriptions allows for tailored, timely enhancements, catering to specific needs at opportune moments. For instance, drivers seeking high performance for weekend racing can temporarily access additional horsepower, while families embarking on long journeys can opt for temporary Wi-Fi connectivity for entertainment purposes. This flexibility and adaptability embedded in in-car subscriptions are poised to drive significant growth in the car subscription market. The allure of personalized, pay-as-you-go features not only attracts customers but also promises lucrative revenue streams for OEMs, amplifying market growth through enhanced customer experiences and evolving mobility preferences. Increasing Car Subscription Startups all across the world The car subscription market is witnessing a surge in startups globally, revolutionizing the way consumers access vehicles. This trend primarily involves third-party companies leveraging apps and online platforms to offer flexible subscription services, a departure from traditional automaker-led models. Various startups, like FINN, Autonomy, Ferry, and GO, are making significant strides, targeting different niches such as imported vehicles, electric cars, and long-term subscription models. Although these startups operate on a smaller scale and in select markets currently, their strategies cater to evolving consumer preferences for flexible and hassle-free mobility solutions.Name Of The Startups In Car Subscription Industry All Across The World

For instance, Autonomy recently ordered a substantial fleet of EVs, signaling a potential shift in the market. While these startups have a relatively modest subscriber base presently, they offer an array of options that resonate with consumers seeking the freedom to switch vehicles regularly or adapt their rides to upcoming life events. FINN, for example, boasts about 18,000 subscribers in Germany and is aspiring to replicate or surpass these numbers in the American market. This rise of startups is redefining car subscription dynamics, aligning with consumer demands for convenience, variety, and adaptability in their transportation choices. As a result, the increasing number of start-ups is expected to be the key factor driving the car subscription market growth. More digital nomads, more car subscriptions The evolving lifestyle preferences and time constraints of modern consumers play a significant role in reshaping the car subscription market. Increasingly, people seek hassle-free, quick solutions that align with their busy schedules and desire for convenience. The ability to order a car online within minutes, bypassing lengthy paperwork and credit checks, while also facilitating home delivery, appeals to a broad demographic. Moreover, evolving lifestyles, characterized by mobility and flexibility, contribute to the rising demand for short-term, flexible car subscriptions. The emergence of a nomadic consumer base—individuals living across multiple cities or those frequently on the move due to work, education, or personal reasons—fuels the demand for adaptable mobility solutions. Whether it's college students, professionals navigating multiple job locations, or those with familial ties in different cities, the need for agility in transportation choices becomes paramount.

Company Name Headquarter Founded Total Funding (Million Euros) Finn Germany 2019 844 Onto United Kingdom 2017 330 Carvolution Switzerland 2018 89 Autonomy United States 2020 83 Imove Norway 2018 15 ViveLaCar Germany 2018 5 Ferry United States 2021 5 While debates persist about the extent of disruption caused by car subscription models, it's evident that these services are gaining traction. As startup companies amass larger vehicle fleets and expand their market reach, more consumers, particularly Americans, will have access to and consider car subscriptions. The blurring of boundaries between subscribing, renting, and leasing, as highlighted by industry experts, signifies a dynamic shift in consumer preferences towards more adaptable and transient mobility solutions. This evolving landscape is poised to drive growth in the car subscription market during the forecast period. India: Lucrative Region For The Car Subscription Industry Players The rapid surge in the car subscription model in India is attributed to the paradigm shift it offers from traditional long-term car ownership. Unlike conventional methods demanding significant upfront payments or extensive loans for vehicle acquisition, subscriptions introduce flexibility, convenience, and automation into the vehicle ownership experience. For instance, individuals eyeing a car worth Rs. 10 lakhs need not possess the entire amount in savings or secure a substantial loan. Instead, committing to a monthly payment of Rs. 20,000 for at least 6 months suffices, presenting a more manageable option.

Moreover, the appeal of car subscriptions extends beyond financial flexibility. Subscriptions come with added convenience, eliminating additional costs for insurance and maintenance, which is a stark contrast to conventional ownership. The streamlined process of booking, seamless delivery, and the consolidation of the entire customer journey onto a single platform enhance the attractiveness of this model to consumers seeking simplicity and ease. This incorporation of financial flexibility, convenience, and a simplified customer journey forms the core attraction of car subscriptions in the Indian market.

Car Subscription Market Regional Insights:

Europe led the global car subscription market with the highest market share of 46.8% in 2022 and is expected to grow at a significant CAGR during the forecast period. According to the analysis, the estimated increase in annual new subscription contracts from 210,000-230,000 in 2022 to an expected 4 million by 2029 illuminates the burgeoning popularity of this service across the region. An increasing number of individuals, particularly non-car owners, gravitating towards Vehicle-as-a-Service (VaaS) models are expected to be the major factor driving the European car subscription market growth. According to the MMR estimates, 13% of non-car users in Germany, approximately 1.3 million people, expressed interest in VaaS, underscoring the potential car subscription industry growth. The evolving consumer landscape is reshaping preferences, with current subscription customers averaging seven to eight years younger than traditional car buyers. A shift in mindset is evident as convenience and flexibility eclipse the desire for car ownership among these demographics. This demand pivot is fueled by the attraction of immediate access to vehicles from existing fleets, starkly contrasting the prolonged delivery timelines associated with purchased cars, often hampered by supply chain issues like chip shortages. Significantly, the attraction of car subscription services lies in their ability to offer short-term commitments, with minimal contractual obligations compared to long-term credit or leasing agreements. The allure of a seamless digital experience aligned with the ease of online ordering without the necessity of direct dealer engagement is a significant draw for consumers accustomed to the seamless transactions offered by industry giants like Amazon, Zalando, and Netflix. The intensifying competition within the European car subscription market is indicative of its burgeoning potential, with automotive titans such as Volvo and VW pushing for market share alongside innovative startups and established rental agencies. Amidst this proliferation of offerings, differentiation emerges as a crucial challenge for stakeholders, necessitating a focus on delivering a superlative, fully digitized customer experience coupled with an attractive vehicle lineup and competitive pricing. In addition, European car subscription market players are adopting various strategies to further increase their market share. For instance,October 2021: ALD is set to acquire Fleetpool, a major German car subscription company with 10,000 vehicles. This move enables ALD's rapid development of digital car subscription services for partners and individuals across Europe. Fleetpool's online platform for multi-brand subscriptions and seamless contract management aligns with ALD's aim to diversify mobility solutions. The acquisition, subject to competition authority approval, signifies ALD's strategic growth plan, targeting value-driven expansions in the mobility sector.

Asia Pacific is expected to grow at a rapid CAGR and offer lucrative growth opportunities for the Asia Pacific car subscription market players during the forecast period. The growth is attributed to the strategic moves from key players like Myles Automotive and Maruti Suzuki India Ltd. Myles Automotive's introduction of a one-month car subscription plan across major cities like Delhi, the NCR region, Mumbai, and Bangalore is transforming consumer access by offering flexibility to change cars monthly. For instance,In October 2022, Myles Automotive, a prominent player in car subscriptions, debuted a monthly plan for Delhi, NCR, Mumbai, and Bangalore, enabling monthly car changes. Offering roadside assistance, maintenance, and insurance, this launch is set to escalate India's car subscription market growth.

Maruti Suzuki India Ltd., an automotive giant, unveiled a car subscription platform across Nagpur, Chandigarh, Lucknow, Vishakhapatnam, and Ludhiana, during the late 2022 quarter, boosting India's car subscription market.

Their inclusive services include roadside assistance, maintenance, and insurance, catering to evolving consumer needs. These initiatives are set to invigorate the car subscription business in India, reflecting a broader trend across the Asia-Pacific region. The moves emphasize the growing significance of adaptable and hassle-free mobility solutions, positioning the region for substantial growth in the car subscription market. This shift aligns with evolving consumer preferences for flexible and comprehensive mobility options, reflecting a promising trajectory for the Asia-Pacific car subscription market's growth.Car Subscription Market Competitive Landscape:

As more companies enter the car subscription market, competition is intensifying. Traditional automobile dealerships and rental agencies have launched their subscription-based services, and several new companies have entered the market. Porsche Passport, Care by Volvo, and Book by Cadillac are subscription services for luxury automobiles offered by some of the market leaders in auto subscriptions. Other companies, such as Fair and Canvas, offer more affordable membership plans that include a variety of vehicles. Hertz and Enterprise, among others, have introduced their subscription programs to remain competitive in the industry. High competitiveness in the industry has forced companies to differentiate themselves by offering supplementary services such as smartphone applications, concierge services, and integration with other modes of transportation such as ride-sharing and public transportation. In addition, Automakers like BMW, Volvo, and Mercedes-Benz lead the charge, offering subscription services like "Access by BMW," "Care by Volvo," and "Mercedes-Benz Collection," enabling subscribers to access a range of models with added perks like insurance and maintenance. Third-party providers such as Fair and Canvas (acquired by Fair from Ford) have gained traction with their flexible, dealership-partnered subscription offerings, while Clutch Technologies, under Cox Automotive, brings dealership-centric subscription services into play. Rental giants in the car subscription market, including Enterprise and Hertz have ventured into subscriptions, while startups like Borrow and Cinch carve niches with short-term EV rentals and flexible subscription models. Technology integrators like Uber and Lyft explore subscription-like services melding ride-hailing and car access. As these entities navigate regional and global markets, they emphasize flexibility, diverse vehicle options, and user-centric experiences to captivate and retain subscribers, leveraging partnerships, technological advancements, and EV integration to stay competitive.Car Subscription Market Scope: Inquiry Before Buying

Car Subscription Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 4.72 Bn. Forecast Period 2023 to 2029 CAGR: 35.8% Market Size in 2029: US $ 40.2 Bn. Segments Covered: by Vehicle type 1.Luxury 2.Sports 3.Sedans 4.SUVs 5.Electric 6.Affordable 7.Others by Subscription duration 1.Short term 2.Long term by Service level 1.Basic 2.Premium by Payment structure 1.Monthly 2.Quarterly 3.Yearly 4.Pay per use by Age of vehicles 1.New 2.Old by Additional services 1.Concierge service 2.Mobile apps 3.Integration with other mobility options by Service provider 1.OEM 2.Independent third-party providers Car Subscription Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Company Profile: Car subscription market key players

North America: 1.Book by Cadillac (USA) 2.Care by Volvo (Sweden, USA) 3.Canvas (USA) 4.Fair (USA) 5.Clutch Technologies (USA) 6.Flexdrive (USA) 7.Drive Flow (USA) 8.Hertz My Car (USA) 9.Enterprise Car Club (USA) Europe: 1.Drover (UK) 2.ViveLaCar (Germany) 3.Carvolution (Switzerland) 4.LeasePlan (Netherlands) 5.ALD Automotive (France) 6.Sixt Flat (Germany) 7. NÜWIEL (Germany) 8.finn.auto (Germany) Asia-Pacific: 1.Carro (Singapore) 2.Flux (Malaysia) 3.Orix Car Rentals (Japan) 4.Maruti Suzuki Subscribe (India) 5.MyTukar (Malaysia) 6.Zoomcar Subscription (India) Middle East & Africa: 1.Invygo (UAE) 2.ekar (UAE) 3.Udrive (UAE) 4.Masar (Saudi Arabia) 5.CTC (Egypt) South America: 1.Unidas Livre (Brazil) 2. Localiza (Brazil) 3. Movida (Brazil) 4.Wappa (Brazil) FAQs Q: What is a car subscription, and how does it differ from traditional car ownership or leasing? A car subscription model allows one to rent a car on a monthly basis. Unlike traditional car ownership, car subscriptions offer greater flexibility and convenience with the ability to switch vehicles frequently without being locked into long-term contracts. Q: What are some of the advantages of using a car subscription service? car subscription service include convenience, flexibility, access to a variety of vehicles, and lower overall costs compared to traditional ownership. Q: Which companies are currently offering car subscription services, and what are some of the key differences between them? Key players in the car subscription market include Book by Cadillac, Care by Volvo, Porsche Passport, Fair, and Canvas. Differences between them may include the types of vehicles offered, pricing, payment structures, and additional services. Q: How do pricing and payment structures typically work for car subscription services? Pricing and payment structures for car subscription services vary by company but may include monthly subscriptions, pay-per-use models, or other payment options. Q: What are some of the key factors that are driving growth in the car subscription market? Key drivers of growth in the car subscription market include changing consumer preferences, increasing demand for flexible transportation options, and advancements in digital technology. Q: How can consumers compare different car subscription services to determine which one is right for them? Consumers can compare different car subscription services by considering factors such as pricing, vehicle selection, service levels, and additional features like mobile apps and concierge services. Online reviews and customer feedback can also be helpful in determining which service is right for a particular individual.

1. Car subscription market: Research Methodology 2. Car subscription market: Executive Summary 3. Car subscription market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Car subscription market Dynamics 4.1. Market Trends by region 4.1.1. North America 4.1.2. South America 4.1.3. Europe 4.1.4. Asia 4.1.5. Middle East & Africa 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. South America 4.2.3. Europe 4.2.4. Asia 4.2.5. Middle East & Africa 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. South America 4.9.3. Europe 4.9.4. Asia 4.9.5. Middle East & Africa 5. Car subscription market: Segmentation (by Value USD and Volume Units) 5.1. Car subscription market, by Vehicle type (2022-2029) 5.1.1. Luxury 5.1.2. Sports 5.1.3. Electric 5.1.4. Affordable 5.1.5. Sedans 5.1.6. SUVs 5.1.7. Others 5.2. Car subscription market, by Subscription duration (2022-2029) 5.2.1. Short terma 5.2.2. Long term 5.3. Car subscription market, by Service level (2022-2029) 5.3.1. Basic 5.3.2. Premium 5.4. Car subscription market, by Age of vehicles: (2022-2029) 5.4.1. New 5.4.2. Old 5.5. Car subscription market, by Additional services: (2022-2029) 5.5.1. Concierge service 5.5.2. Mobile apps 5.5.3. Integration with other mobility options 5.6. Car subscription market, by Service provider: (2022-2029) 5.6.1. OEM 5.6.2. Independent third-party providers 5.7. Car subscription market, by region (2022-2029) 5.7.1. North America 5.7.2. South America 5.7.3. Europe 5.7.4. Asia 5.7.5. Middle East & Africa 6. North America Car subscription market (by Value USD and Volume Units) 6.1. North America Car subscription market, by Vehicle type (2022-2029) 6.1.1. Luxury 6.1.2. Sports 6.1.3. Electric 6.1.4. Affordable Car 6.1.5. Others 6.2. North America subscription market, by Subscription duration (2022-2029) 6.2.1. Short term 6.2.2. Long term 6.3. North America Car subscription market, by Service level (2022-2029) 6.3.1. Basic 6.3.2. Premium 6.4. North America Car subscription market, by Age of vehicles: (2022-2029) 6.4.1. New 6.4.2. Old 6.5. North America Car subscription market, by Additional services: (2022-2029) 6.5.1. Concierge service 6.5.2. Mobile apps 6.5.3. Integration with other mobility options 6.6. North America Car subscription market, by Service provider: (2022-2029) 6.6.1. OEM 6.6.2. Independent third-party providers 7. Europe Car subscription market (by Value USD and Volume Units) 7.1. Europe Car subscription market by vehicle type (2022-2029) 7.2. Europe Car subscription market, by subscription duration (2022-2029) 7.3. Europe Car subscription market, by service level (2022-2029) 7.4. Europe Car subscription market, by age of vehicle (2022-2029) 7.5. Europe Car subscription market, by additional services (2022-2029) 7.6. Europe Car subscription market, by service provider (2022-2029) 7.7. Europe Car subscription market, by Country (2022-2029) 7.7.1. UK 7.7.2. France 7.7.3. Germany 7.7.4. Italy 7.7.5. Spain 7.7.6. Sweden 7.7.7. Austria 7.7.8. Rest of Europe 8. Asia Pacific Car subscription market by Vehicle type (2022-2029) 8.1. Asia Pacific Car subscription market, by subscription duration (2022-2029) 8.2. Asia Pacific Car subscription market, by service level (2022-2029) 8.3. Asia Pacific Car subscription market, by age of vehicle (2022-2029) 8.4. Asia Pacific Car subscription market, by additional services (2022-2029) 8.5. Asia Pacific Car subscription market, by service provider (2022-2029) 8.6. Asia Pacific Car subscription market, by Country (2022-2029) 8.6.1. China 8.6.2. S Korea 8.6.3. Japan 8.6.4. India 8.6.5. Australia 8.6.6. Indonesia 8.6.7. Malaysia 8.6.8. Vietnam 8.6.9. Taiwan 8.6.10. Bangladesh 8.6.11. Rest of Asia Pacific 9. Middle East & Africa Car subscription market (by Value USD and Volume Units) 9.1. Middle East & Africa Car subscription market by Vehicle type (2022-2029) 9.2. Middle East & Africa Car subscription market, by subscription duration (2022-2029) 9.3. Middle East & Africa Car subscription market, by service level (2022-2029) 9.4. Middle East & Africa Car subscription market, by age of vehicle (2022-2029) 9.5. Middle East & Africa Car subscription market, by additional services (2022-2029) 9.6. Middle East & Africa Car subscription market, by service provider (2022-2029) 9.7. Middle East & Africa Car subscription market, by Country (2022-2029) 9.7.1. South Africa 9.7.2. GCC 9.7.3. Egypt 9.7.4. Nigeria 9.7.5. Rest of ME&A 10. South America Car subscription market (by Value USD and Volume Units) 10.1. South America Car subscription market, by Service type (2022-2029) 10.2. South America Car subscription market, by Vehicle Type (2022-2029) 10.3. South America Car subscription market, by Level of autonomy (2022-2029) 10.4. South America Car subscription market, by End User 10.5. South America Car subscription market, by Country (2022-2029) 10.5.1. Brazil 10.5.2. Argentina 10.5.3. Rest of South America 11. Company Profile: Key players 11.1. Book by Cadillac (USA) 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Care by Volvo (Sweden, USA) 11.3. Canvas (USA) 11.4. Fair (USA) 11.5. Clutch Technologies (USA) 11.6. Flexdrive (USA) 11.7. Drive Flow (USA) 11.8. Hertz My Car (USA) 11.9. Enterprise Car Club (USA) 11.10. Drover (UK) 11.11. ViveLaCar (Germany) 11.12. Carvolution (Switzerland) 11.13. LeasePlan (Netherlands) 11.14. ALD Automotive (France) 11.15. Sixt Flat (Germany) 11.16. NÜWIEL (Germany) 11.17. finn.auto (Germany) 11.18. Carro (Singapore) 11.19. Flux (Malaysia) 11.20. Orix Car Rentals (Japan) 11.21. Maruti Suzuki Subscribe (India) 11.22. MyTukar (Malaysia) 11.23. Zoomcar Subscription (India) 11.24. Invygo (UAE) 11.25. ekar (UAE) 11.26. Udrive (UAE) 11.27. Masar (Saudi Arabia) 11.28. CTC (Egypt) 11.29. Unidas Livre (Brazil) 11.30. Localiza (Brazil) 11.31. Movida (Brazil) 11.32. Wappa (Brazil) 12. Key Findings 13. Industry Recommendation