Canada Electric Car Market volume was 38576.27 thousand units in 2022 and is expected to reach 139,846.47 thousand units by 2029, exhibiting a CAGR of 20.2% during the forecast period (2023-2029)Canada Electric Car Market Overview

The market has experienced significant growth in the past few years and has gained popularity among consumers. Environmental concerns, better-charging infrastructure, technological advancements, government initiatives, high investments in R&D, lower maintenance costs, competitive fuel economy and increasing public awareness of electric cars are the factors contributing to the Canadian Electric Car market growth. The electric cars in the country are expected to be the major contributor to achieving the greenhouse gas emissions reduction target of 12 megatonnes of CO2 by 2030.To know about the Research Methodology :- Request Free Sample Report

Canada Electric Car Market Dynamics

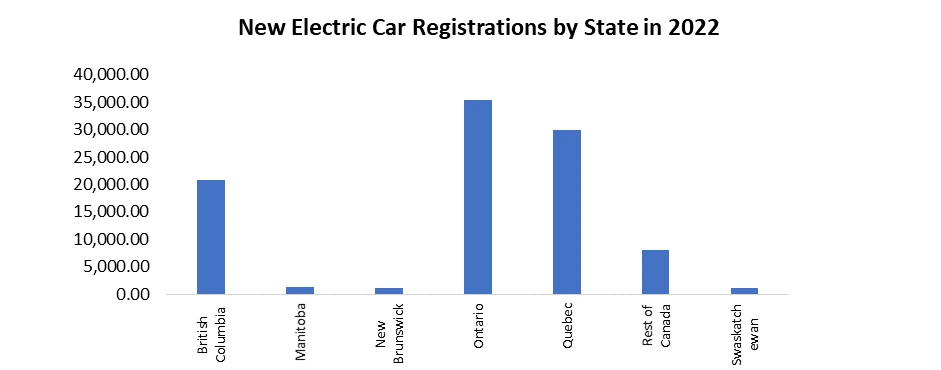

Sales of Electric Cars in Canada The switch to electric cars seems to be a little difficult in Canada than in other developed countries where shift is happening quicker, even though more and more people are choosing to go electric than ever before. In the first half of 2022, EV sales in the country went up by 30 percent. As per the study, one in fourteen new cars bought in the first half of 2022 were full electric vehicle or a plug-in hybrid, which is an improvement over a year prior when it was one for 20 cars. Under the new regulations Environment Minister Steven Guilbeault is proposing, one-fifth of all passenger cars, SUVs and trucks sold in Canada in 2026 will need to run on electricity. According to the federal government’s plan, the mandate is expected to hit 60 percent of all sales by 2030 and every passenger vehicle sold in Canada will need to be electric by 2030. These show opportunities for the Canada Electric Car Market growth in the future. Government Incentives to Increase the Adoption of Electric Cars in Canada The government of Canada has introduced incentives to encourage the acquisition of zero-emission vehicles such as electric cars, plug-in hybrids and hydrogen fuel cell vehicles, in order to receive greenhouse emissions in the country. The Zero-Emission Vehicles (iZEV) Program offers two types of incentives: 1.All battery electric vehicles, long-range plug-in hybrid electric vehicles and hydrogen fuel cell vehicles, with an electric range of 50 kilometers or more can receive USD 5000. 2.Plug-in hybrid vehicles (PHEVs) with an electric range of less than 50 kilometers can receive USD 2500. The iZEV Program is expected to continue until 31 March 2025, or until the available funds are exhausted. At the point of sale, the grant is applied directly by the car dealer. Availability of Charging Stations in Canada The availability of charging stations is one of the major hurdles for incentivizing car purchases across the world. The charging infrastructure in Canada has immensely improved in the past few years. Many public charging stations have been installed in urban areas, workplaces, shopping centers and along major highways, which makes it more convenient for electric car owners to charge their cars. As of February 2023, Canada has 8,726 charging stations and 20,423 charging ports, which is good but it’s unevenly distributed. Yukon has 15 charging stations and the Northwest territories have just two while more developed states Ontario and Quebec have 2538 and 3434 charging stations. For the construction of charging stations, Transport Canada has pledged millions of dollars. The country has planned to add 50,000 new EV chargers through USD 400 million in investments and another USD 500 million in financing via the Canada Infrastructure Bank. Canada Electric Car Market States Insights The Electric Car Market in Quebec dominated the Canada Electric Car Market in 2022 and is expected to retain its dominance during the forecast period. This is attributed to the incentives and a reduction in pricing for new and used electric vehicles offered by the state government. Quebec has implemented supportive policies for the adoption of electric vehicles and the reduction of greenhouse gas emissions. Residents of the province of the country can benefit from financial help that can go up to USD 7000 for the purchase or lease of a 100 percent electric vehicle or plug-in hybrid. Car-sharing and ride-sharing programs were conducted in some cities of the country that included electric cars. With the help of these programs, people got the opportunity to experience electric cars without owning one. The Electric Car Market in Ontario was the second largest market in the country in 2022. This is mainly attributed to the various incentives and rebates introduced by the Ontario government to encourage the purchase and use of electric vehicles. Ontario drivers are eligible to receive a grant of USD 1000 for the purchase of used all-electric cars. The state has been highly investing in its charging infrastructure to support the increasing number of electric vehicles. The state has a high concentration of electric cars compared to many other provinces in the country. Toronto, Hamilton and Ottawa have a high density of electric cars due to the availability of charging infrastructure and consumer awareness.

Canada Electric Car Segment Analysis

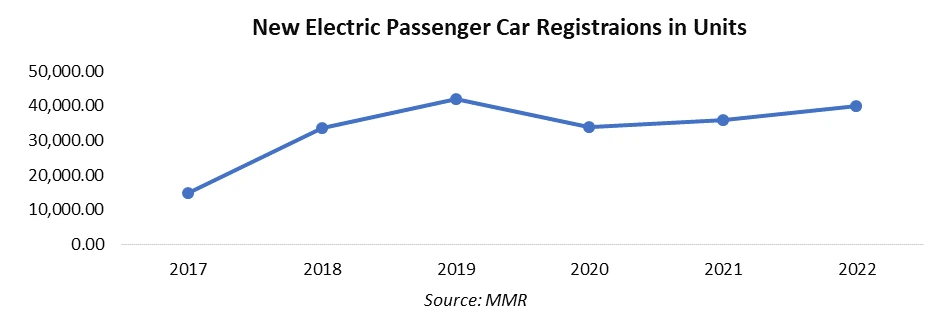

Based on Technology: The market is divided into BEV, PHEV and HEV. The BEV segment held the largest Canada Electric Car market share in 2022. The volume of BEV sales in Canada increased to around 85,000 units in 2022. It increased by nearly 44.1 percent compared with the previous year when around 59,000 units were first time registered in the country.Based on Battery Type: The Canada Electric Car Market is divided into Lithium-ion Batteries and Solid State Batteries. The Lithium-ion Batteries segment is expected to grow at a high rate during the forecast period. This is attributed to the advantages associated with it such as high energy density, relatively lightweight, and good overall performance, which is increasing its demand in the country. Lithium-ion Batteries have become the standard battery technology for electric vehicles. This segment is further sub-segmented into NMC (Nickel Manganese Cobalt) Batteries and LFP (Lithium Iron Phosphate) Batteries. NMC batteries are a popular choice for many electric car models. They are majorly known for their longer lifespan and high energy density. LFP batteries are commonly used in commercial electric vehicles and they are majorly known for their safety, stability, and lower cost. Based on Charging Point: The Canada Electric Car Market is divided into Normal Charging and Super Charging. The Normal Charging segment dominated the market with the largest Canada Electric Car market share in 2022. In the Canadian Electric Car Market, Normal represents the majority of the charging. Normal charging is slower than supercharging and is commonly used for overnight charging or during longer periods of parking. The demand for this charging is high because they are convenient for daily commuting and routine charging needs. Based on Car Type: The Canada Electric Car Market is divided into Passenger Cars, Commercial Cars and Shared Mobility. The Passenger Cars segment has grown immensely since 2017 and is expected to grow at a high rate during the forecast period. The Government in Canada is setting a mandatory target for all new passenger cars to be zero-emission by 2035, which is driving Canada’s previous goal of 100 percent of sales by 2040.

Canada Electric Car Market Competitive Landscape

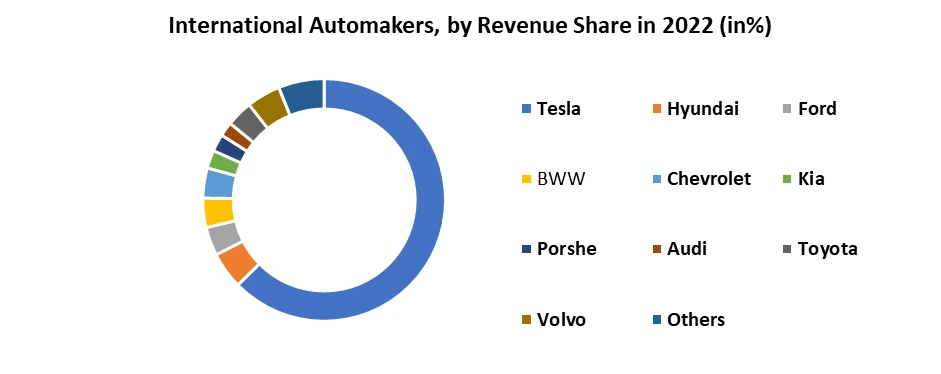

In Canada, new entrants are actively introducing electric car models Canada Electric Car Industry due to the increasing demand for clean and sustainable transportation. Electra Meccanica, Daymak, Briggs Automotive Company (BAC) and Campagna Motors are the Canadian Electric Car Manufacturers. Electric Car Manufacturers from other regions are also making efforts to increase their presence in Canadian electric car market. They include TESLA, Chevrolet, Hyundai, Volvo, Ford, BMW, Toyota, Kia, Porshe, Audi and others. The Electra Meccanica stopped making its flagship model “SOLO”, a three-wheeled, single-passenger electric vehicle, which was designed for urban computing. Instead, they started focusing on an electric car with four wheels. Recently, Daymak claimed to make the world’s fastest three-wheeled electric car. The company is crowdfunding a two-seater Electric vehicle called Spiritus, which features solar panels on the body for additional charging and a regeneration system alongside wireless charging. BAC’s adoption of Ultimaker 3D printing ecosystem has resulted in significant improvements in cost reduction, design iteration and overall manufacturing efficiency.

Global Canada Electric Car Market Scope: Inquire before buying

Global Canada Electric Car Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 38576.27 Units. Forecast Period 2023 to 2029 CAGR: 20.2% Market Size in 2029: US $ 139,846.47 Units. Segments Covered: by Technology BEV HEV PHEV by Battery Type Lithium-ion Batteries NMC (Nickel Manganese Cobalt) Batteries LFP (Lithium Iron Phosphate) Batteries Solid State Batteries by Product Sedans SUVs/Crossovers Hatchbacks Minivans Sports Cars Vans by Price Range Low-Priced Electric Cars Mid-Priced Electric Cars Luxury Electric Cars by Car Type Passenger Cars Commercial Cars Shared Mobility by Charging Point Normal Charging Super Charging by End User Personal Users Government Organizations Shared Mobility Provider Canada Electric Car Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Canada Electric Car Key Players

1. Electra Meccanica 2. Daymak 3. Briggs Automotive Company (BAC) 4. Campagna Motors 5. Tesla 6. Nissan 7. Chevrolet 8. BMW 9. Hyundai 10. Kia 11. Audi 12. Jaguar 13. Volvo 14. Toyota 15. Ford Frequently Asked Questions 1] What was the Canada Electric Car Market size in 2022? Ans. 38576.27 Units was Canada Electric Car Market size in 2022. 2] What is the expected Canada Electric Car Market size by 2029? Ans. 139,846.47 Units is the expected Canada Electric Car Market size by 2029. 3] What is the expected CAGR of the Canada Electric Car Market during the forecast period? Ans. During the forecast period, the Canada Electric Car Market is expected to grow at a CAGR of 20.2 percent. 4] What are the major Canada Electric Car Market segments? Ans. The market is divided by Technology, Battery Type, Product, Price Range, Car Type, Charging Point and End-User. 5] Which State is expected to hold the largest Canada Electric Car Market share during the forecast period? Ans. Quebec is expected to hold the largest share of the global market during the forecast period.

Table of Content for Canada Electric Car Market 1. Canada Electric Car Market: Research Methodology 2. Canada Electric Car Market: Executive Summary 3. Canada Electric Car Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Canada Electric Car Market: Dynamics 4.1. Market Trends by Country 4.1.1. India 4.2. Market Drivers by Country 4.2.1. India 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Country 4.9.1. India 5. Canada Electric Car Market Size and Forecast by Segments (by Value USD and Volume Units) 5.1. Canada Electric Car Market Size and Forecast, by Technology (2022-2029) 5.1.1. BEV 5.1.2. HEV 5.1.3. PHEV 5.2. Canada Electric Car Market Size and Forecast, by Battery (2022-2029) 5.2.1. LFP 5.2.2. Li-NMC 5.3. Canada Electric Car Market Size and Forecast, by Product (2022-2029) 5.3.1. Hatchback 5.3.2. Sedan 5.3.3. SUV 5.4. Canada Electric Car Market Size and Forecast, by End-User (2022-2029) 5.4.1. Personal Users 5.4.2. Government Organizations 5.4.3. Shared Mobility Provider 5.5. Canada Electric Car Market Size and Forecast, by States (2022-2029) 5.5.1. British Columbia 5.5.2. Quebec 5.5.3. Ontario 5.5.4. Manitoba 5.5.5. Saskatchewan 5.5.6. New Brunswick 5.5.7. Rest of Canada 6. Company Profile: Key players 6.1. Tesla 6.1.1. Company Overview 6.1.2. Financial Overview 6.1.3. Business Portfolio 6.1.4. SWOT Analysis 6.1.5. Business Strategy 6.1.6. Recent Developments 6.2. Nissan 6.3. Chevrolet 6.4. BMW 6.5. Hyundai 6.6. Kia 6.7. Audi 6.8. Jaguar 7. Key Findings 8. Industry Recommendation