The Global Busway-Bus Duct Market was Valued at USD 12.2 billion. In 2023, the revenue of the Busway-Bus Duct Market is expected to increase by 5.5% from 2024 to 2030, reaching an approximate sum of USD 17.75 billion.Overview:

Busways-bus ducts are used in various industrial, commercial, and institutional settings for electrical power distribution. Busways-bus ducts designed for efficient electricity transmission from one point to another, these systems serve as an alternative to traditional cable and conduit systems. They provide advantages, including flexibility, scalability, ease of installation, and improved power management. The Busway-Bus Duct market is experiencing steady growth due to increased demand for efficient and flexible electrical power distribution solutions. This market is driven by factors such as rising industrialization, infrastructure development, and the need for reliable energy transmission. The industry is continuously innovating to provide customizable, cost-effective, and environmentally friendly busway and bus duct systems. These solutions are being widely adopted in commercial, industrial, and data center applications to meet power distribution needs.To know about the Research Methodology :- Request Free Sample Report

Busway-Bus Duct Market Dynamics:

Driver Rapid urbanization and infrastructure development to boost market growth Rapid urbanization and infrastructure development represent a significant driving force in various industries, including construction and the Busway-Bus Duct market. As the world's population continues to shift from rural to urban areas, cities are expanding at an unprecedented rate. This urban growth necessitates the development of infrastructure such as residential buildings, commercial complexes, transportation systems, and utilities. Urban areas require substantial electrical power to support their infrastructure. Busway-bus duct systems are crucial for efficiently distributing electricity in densely populated urban environments. Quickly install and expand these systems to meet the growing power demands of newly developed urban areas. Busway-bus ducts provide a space-efficient solution for power distribution, a crucial consideration in urban settings where space is limited. Install them overhead or under the floor to save valuable real estate in crowded urban environments. Rapid urbanization demands reliable power distribution to support essential services, from hospitals to transportation. Busway-bus ducts ensure a stable power supply and are easily adapted to accommodate changes in infrastructure and load requirements.Increasing industrialization to drive the Busway-Bus Duct Market growth Increasing industrialization is an essential driver of the Busway-Bus Duct market, as industries all across the world, require strong and efficient electrical power distribution solutions to support their operations. Industrial facilities have substantial energy requirements for manufacturing, processing, and automation. Busway-bus duct systems offer a dependable and scalable means to meet these power needs while minimizing energy losses. Industries often have diverse power distribution requirements, ranging from heavy machinery to sensitive electronics. Busway-bus ducts provide the flexibility provide to various load types and adapt to changing industrial processes. In industrial settings, downtime is costly. Busway-bus ducts are preferred for their reliability and ease of maintenance, reducing the risk of production interruptions. As industrial regulations become stricter, busway-bus ducts with advanced safety features are crucial for compliance, reducing the risk of electrical accidents and ensuring worker safety. As industries grow and expand, busway-bus ducts are easily extended or reconfigured to accommodate changing facility layouts and increased power demands.

Restrain Limitations of the busway and bus duct systems hamper the Busway-Bus Duct market growth Busway-bus duct systems, while efficient, come with inherent limitations. Their rigid layout poses significant restraints, impacting adaptability to changing needs. After installation, making alterations to the configuration and capacity of these systems becomes a laborious and time-consuming task, causing operational disruptions. The flexibility afforded by traditional cable-based systems is particularly lacking in Busway-Bus Duct setups. Maintenance and repair present additional challenges, demanding specialized knowledge and trained personnel. Despite their advantages, careful consideration of these restraints is essential when implementing Busway-Bus Duct systems in industrial settings. The Busway-Bus Duct market encounters challenges related to system adaptability and maintenance complexities, highlighting the need for strategic planning to mitigate operational disruptions and ensure long-term efficiency. Opportunity Urbanization projects' power solutions create lucrative growth opportunities for market growth. The adaptability of the busway and bus duct systems allows for tailored solutions provided to diverse customer needs. Companies that provide customizable and modular options, with flexibility for expansion and modification, establish a competitive edge. This approach enables them to address specific industry requirements and adapt to evolving technological demands. Many existing buildings and facilities require electrical system upgrades to enhance efficiency, safety, and reliability. Retrofitting older power distribution systems with modern bus ducts is a promising avenue for businesses seeking to improve the functionality of aging infrastructure. This market allows for sustainable growth through system upgrades. Emerging markets with substantial infrastructure development projects present lucrative opportunities. Manufacturers explore these regions by adapting their products to meet local regulations and standards. Being responsive to the unique needs of emerging markets enables companies to establish a strong presence and build long-term success. Challenges: Bus duct installation is complex, often requiring specialized knowledge and skilled personnel. Incorrect installation leads to operational issues, posing a challenge for businesses. Bus duct systems, including cast resin and aluminium bus ducts, demand regular maintenance to ensure they function correctly. Finding qualified personnel to perform this maintenance is challenging. The bus duct market, particularly with key players like Schneider Electric, is highly competitive. Companies need to differentiate themselves to gain market share. Compliance with evolving safety and environmental regulations is a significant challenge. Staying updated and adapting products to meet new standards is vital. Customers often seek cost-effective power distribution solutions. Balancing quality, efficiency, and affordability is a constant challenge in the busway and bus duct market. Trends: The integration of smart technology into bus duct systems is a prominent trend. These systems offer real-time monitoring, predictive maintenance, and energy efficiency, which align with the Industry 4.0 revolution. The trend toward customizable and modular bus duct solutions allows businesses to cater to specific industry needs and provide options for expansion and modification. The use of eco-friendly materials in bus ducts, such as recyclable components and reduced environmental impact during manufacturing, is gaining traction. The trend of retrofitting older buildings and facilities with modern bus duct systems to enhance energy efficiency and safety continues to grow. As infrastructure development expands in emerging markets, bus duct manufacturers, including Schneider Electric, are looking to expand their presence by adapting products to local regulations and standards. Increasing urbanization, including the development of metro systems and airports, fuels the demand for efficient and safe power distribution solutions, making bus ducts a key player in such projects.

Busway-Bus Duct Market Segment Analysis:

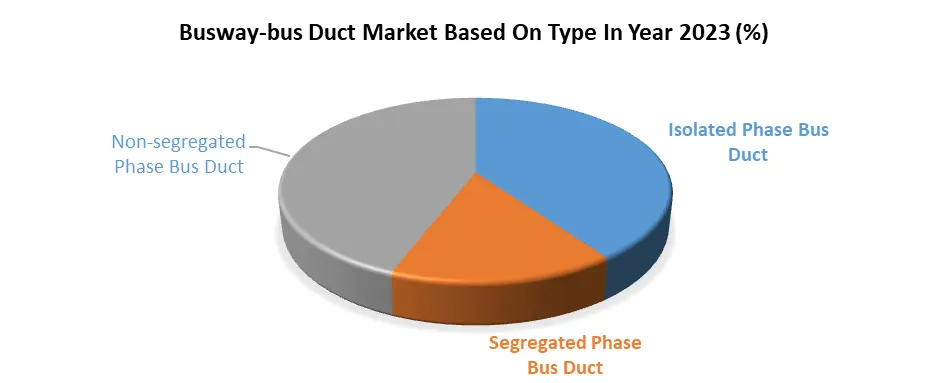

Based on Type, non-segregated phase buses dominated the Busway-Bus Duct Market in the year 2023. Non-segregated phase bus ducts are the most economical and versatile type of busway-bus duct system. A non-segregated phase bus (NSPB) is a type of busway that does not have any barriers separating the phase conductors. This makes it the most economical and versatile type of busway, as it is relatively easy to install and maintain. Typically, commercial and industrial facilities use NSPB in low-voltage applications. They are also relatively easy to install and maintain. This makes them a popular choice for a wide range of applications, including commercial, industrial, and utility facilities. Their design, allowing phases to be nearby, often leads to the use of these systems in less critical applications. This design is cost-effective but has limitations in terms of safety and fault tolerance.

Busway-Bus Duct Market Regional Insight:

North America dominated the Busway-Bus Duct Market in the year 2023. Busway-Bus Duct systems gained prominence in the United States and Canada due to strong industrial activities, commercial growth, and an increased emphasis on energy efficiency. The U.S. stood out as a substantial market for these systems. The Asia-Pacific region, especially, China and India, emerged as dominant forces in the Busway-Bus Duct market, experiencing rapid growth. The surge in demand was propelled by swift industrialization, urbanization, and extensive infrastructure development in these nations. Asia-Pacific, overall, became the fastest-growing market for Busway-Bus Duct systems. This trend underscored the region's increasing need for efficient power distribution solutions. As China and India continued to drive market expansion, the global Busway-Bus Duct industry witnessed a significant shift in focus towards the dynamic growth opportunities in the Asia-Pacific region. Competitive Landscape: The global Busway-Bus Duct market is highly competitive. The report provides a comprehensive analysis of the key players in the Global Busway-Bus Duct Market. The Major players in the market are focusing on mergers and acquisitions to innovate the products and maintain sustainability. Also, the key players rising focus on partnerships and investment to expand the product portfolio. As the Busway-Bus Duct market evolves, players are increasingly focusing on non-contact measurement methods, Industry 4.0 integration, and expanding into emerging markets. To boom in a competitive area, commitment to innovation, adherence to regulations, and adaptability to changing markets are crucial. Extensive R&D investments keep leaders ahead in technology. Pricing strategies, marketing efforts, and customer support help in their competitiveness. Moreover, strategic partnerships and acquisitions contribute to their growth and diversification.Busway-Bus Duct Market Scope Table : Inquire Before Buying

Global Busway-Bus Duct Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2022 Market Size in 2023: US $ 12.2 Bn. Forecast Period 2024 to 2030 CAGR: 5.5% Market Size in 2030: US $ 17.75 Bn. Segments Covered: by Type Isolated Phase Bus Duct Segregated Phase Bus Duct Non-segregated Phase Bus Duct by Voltage High-voltage Medium-voltage Low-voltage by End User Industry Residential Commercial Industrial Busway-Bus Duct Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Busway-Bus Duct Market Key Players

1. C&S Electric Limited (India) 2. Powell Industries Inc (USA) 3. Siemens AG (Germany) 4. Taian-Ecobar Technology (China) 5. General Electric Company (USA) 6. LS Cable & System Ltd.(S. Korea) 7. Huapeng Group Company, Ltd.( China) 8. Godrej and Boyce Company Limited (India) 9. L&T Electrical & Automation (India) 10. Tricolite Electrical Industries (India) 11. ABB (Switzerland) 12. Accu-Panels Energy Pvt Ltd(India) 13. Eaton Corporation PLC (Ireland)) 14. Schneider Electric 15. Vidhyut Control India Pvt. Ltd Frequently Asked Questions: 1] What segments are covered in the Global Busway-Bus Duct Market report? Ans. The segments covered in the Busway-Bus Duct Market report are based on Type, Voltage, End-User Industry, and Regions. 2] Which region is expected to hold the highest share in the Global Busway-Bus Duct Market? Ans. The North American region is expected to hold the highest share of the Busway-Bus Duct Market. 3] What was the market size of the Global Busway-Bus Duct Market by 2023? Ans. The market size of the Busway-Bus Duct Market by 2023 is expected to reach US$ 12.2Bn. 4] What is the forecast period for the Global Busway-Bus Duct Market? Ans. The forecast period for the Busway-Bus Duct Market is 2024-2030. 5] What is the market size of the Global Busway-Bus Duct Market in 2030? Ans. The market size of the Busway-Bus Duct Market in 2030 is valued at US$ 17.75 Bn.

1. Busway-Bus Duct Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Busway-Bus Duct Market: Dynamics 2.1. Busway-Bus Duct Market Trends by Region 2.1.1. North America Busway-Bus Duct Market Trends 2.1.2. Europe Busway-Bus Duct Market Trends 2.1.3. Asia Pacific Busway-Bus Duct Market Trends 2.1.4. Middle East and Africa Busway-Bus Duct Market Trends 2.1.5. South America Busway-Bus Duct Market Trends 2.1.6. Preference Analysis 2.2. Busway-Bus Duct Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Busway-Bus Duct Market Drivers 2.2.1.2. North America Busway-Bus Duct Market Restraints 2.2.1.3. North America Busway-Bus Duct Market Opportunities 2.2.1.4. North America Busway-Bus Duct Market Challenges 2.2.2. Europe 2.2.2.1. Europe Busway-Bus Duct Market Drivers 2.2.2.2. Europe Busway-Bus Duct Market Restraints 2.2.2.3. Europe Busway-Bus Duct Market Opportunities 2.2.2.4. Europe Busway-Bus Duct Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Busway-Bus Duct Market Drivers 2.2.3.2. Asia Pacific Busway-Bus Duct Market Restraints 2.2.3.3. Asia Pacific Busway-Bus Duct Market Opportunities 2.2.3.4. Asia Pacific Busway-Bus Duct Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Busway-Bus Duct Market Drivers 2.2.4.2. Middle East and Africa Busway-Bus Duct Market Restraints 2.2.4.3. Middle East and Africa Busway-Bus Duct Market Opportunities 2.2.4.4. Middle East and Africa Busway-Bus Duct Market Challenges 2.2.5. South America 2.2.5.1. South America Busway-Bus Duct Market Drivers 2.2.5.2. South America Busway-Bus Duct Market Restraints 2.2.5.3. South America Busway-Bus Duct Market Opportunities 2.2.5.4. South America Busway-Bus Duct Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For the Busway-Bus Duct Industry 2.8. Analysis of Government Schemes and Initiatives For the Busway-Bus Duct Industry 2.9. The Global Pandemic Impact on Busway-Bus Duct Market 3. Busway-Bus Duct Market: Global Market Size and Forecast by Segmentation (by Value) (2023-2030) 3.1. Busway-Bus Duct Market Size and Forecast, Type (2023-2030) 3.1.1. Isolated Phase Bus Duct 3.1.2. Segregated Phase Bus Duct 3.1.3. Non-segregated Phase Bus Duct 3.2. Busway-Bus Duct Market Size and Forecast, Voltage (2023-2030) 3.2.1. High-voltage 3.2.2. Medium-voltage 3.2.3. Low-voltage 3.3. Busway-Bus Duct Market Size and Forecast, by End User Industry (2023-2030) 3.3.1. Residential 3.3.2. Commercial 3.3.3. Industrial 3.4. Busway-Bus Duct Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Busway-Bus Duct Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. North America Busway-Bus Duct Market Size and Forecast, Type (2023-2030) 4.1.1. Isolated Phase Bus Duct 4.1.2. Segregated Phase Bus Duct 4.1.3. Non-segregated Phase Bus Duct 4.2. North America Busway-Bus Duct Market Size and Forecast, Voltage (2023-2030) 4.2.1. High-voltage 4.2.2. Medium-voltage 4.2.3. Low-voltage 4.3. North America Busway-Bus Duct Market Size and Forecast, by End User Industry (2023-2030) 4.3.1. Residential 4.3.2. Commercial 4.3.3. Industrial 4.4. North America Busway-Bus Duct Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Busway-Bus Duct Market Size and Forecast, Type (2023-2030) 4.4.1.1.1. Isolated Phase Bus Duct 4.4.1.1.2. Segregated Phase Bus Duct 4.4.1.1.3. Non-segregated Phase Bus Duct 4.4.1.2. United States Busway-Bus Duct Market Size and Forecast, Voltage (2023-2030) 4.4.1.2.1. High-voltage 4.4.1.2.2. Medium-voltage 4.4.1.2.3. Low-voltage 4.4.1.3. United States Busway-Bus Duct Market Size and Forecast, by End User Industry (2023-2030) 4.4.1.3.1. Residential 4.4.1.3.2. Commercial 4.4.1.3.3. Industrial 4.4.2. Canada 4.4.2.1. Canada Busway-Bus Duct Market Size and Forecast, Type (2023-2030) 4.4.2.1.1. Isolated Phase Bus Duct 4.4.2.1.2. Segregated Phase Bus Duct 4.4.2.1.3. Non-segregated Phase Bus Duct 4.4.2.2. Canada Busway-Bus Duct Market Size and Forecast, Voltage (2023-2030) 4.4.2.2.1. High-voltage 4.4.2.2.2. Medium-voltage 4.4.2.2.3. Low-voltage 4.4.2.3. Canada Busway-Bus Duct Market Size and Forecast, by End User Industry (2023-2030) 4.4.2.3.1. Residential 4.4.2.3.2. Commercial 4.4.2.3.3. Industrial 4.4.3. Mexico 4.4.3.1. Mexico Busway-Bus Duct Market Size and Forecast, Type (2023-2030) 4.4.3.1.1. Isolated Phase Bus Duct 4.4.3.1.2. Segregated Phase Bus Duct 4.4.3.1.3. Non-segregated Phase Bus Duct 4.4.3.2. Mexico Busway-Bus Duct Market Size and Forecast, Voltage (2023-2030) 4.4.3.2.1. High-voltage 4.4.3.2.2. Medium-voltage 4.4.3.2.3. Low-voltage 4.4.3.3. Mexico Busway-Bus Duct Market Size and Forecast, by End User Industry (2023-2030) 4.4.3.3.1. Residential 4.4.3.3.2. Commercial 4.4.3.3.3. Industrial 5. Europe Busway-Bus Duct Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. Europe Busway-Bus Duct Market Size and Forecast, Type (2023-2030) 5.2. Europe Busway-Bus Duct Market Size and Forecast, Voltage (2023-2030) 5.3. Europe Busway-Bus Duct Market Size and Forecast, by End User Industry (2023-2030) 5.4. Europe Busway-Bus Duct Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Busway-Bus Duct Market Size and Forecast, Type (2023-2030) 5.4.1.2. United Kingdom Busway-Bus Duct Market Size and Forecast, Voltage (2023-2030) 5.4.1.3. United Kingdom Busway-Bus Duct Market Size and Forecast, by End User Industry (2023-2030) 5.4.2. France 5.4.2.1. France Busway-Bus Duct Market Size and Forecast, Type (2023-2030) 5.4.2.2. France Busway-Bus Duct Market Size and Forecast, Voltage (2023-2030) 5.4.2.3. France Busway-Bus Duct Market Size and Forecast, by End User Industry (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Busway-Bus Duct Market Size and Forecast, Type (2023-2030) 5.4.3.2. Germany Busway-Bus Duct Market Size and Forecast, Voltage (2023-2030) 5.4.3.3. Germany Busway-Bus Duct Market Size and Forecast, by End User Industry (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Busway-Bus Duct Market Size and Forecast, Type (2023-2030) 5.4.4.2. Italy Busway-Bus Duct Market Size and Forecast, Voltage (2023-2030) 5.4.4.3. Italy Busway-Bus Duct Market Size and Forecast, by End User Industry (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Busway-Bus Duct Market Size and Forecast, Type (2023-2030) 5.4.5.2. Spain Busway-Bus Duct Market Size and Forecast, Voltage (2023-2030) 5.4.5.3. Spain Busway-Bus Duct Market Size and Forecast, by End User Industry (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Busway-Bus Duct Market Size and Forecast, Type (2023-2030) 5.4.6.2. Sweden Busway-Bus Duct Market Size and Forecast, Voltage (2023-2030) 5.4.6.3. Sweden Busway-Bus Duct Market Size and Forecast, by End User Industry (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Busway-Bus Duct Market Size and Forecast, Type (2023-2030) 5.4.7.2. Austria Busway-Bus Duct Market Size and Forecast, Voltage (2023-2030) 5.4.7.3. Austria Busway-Bus Duct Market Size and Forecast, by End User Industry (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Busway-Bus Duct Market Size and Forecast, Type (2023-2030) 5.4.8.2. Rest of Europe Busway-Bus Duct Market Size and Forecast, Voltage (2023-2030) 5.4.8.3. Rest of Europe Busway-Bus Duct Market Size and Forecast, by End User Industry (2023-2030) 6. Asia Pacific Busway-Bus Duct Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Asia Pacific Busway-Bus Duct Market Size and Forecast, Type (2023-2030) 6.2. Asia Pacific Busway-Bus Duct Market Size and Forecast, Voltage (2023-2030) 6.3. Asia Pacific Busway-Bus Duct Market Size and Forecast, by End User Industry (2023-2030) 6.4. Asia Pacific Busway-Bus Duct Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Busway-Bus Duct Market Size and Forecast, Type (2023-2030) 6.4.1.2. China Busway-Bus Duct Market Size and Forecast, Voltage (2023-2030) 6.4.1.3. China Busway-Bus Duct Market Size and Forecast, by End User Industry (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Busway-Bus Duct Market Size and Forecast, Type (2023-2030) 6.4.2.2. S Korea Busway-Bus Duct Market Size and Forecast, Voltage (2023-2030) 6.4.2.3. S Korea Busway-Bus Duct Market Size and Forecast, by End User Industry (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Busway-Bus Duct Market Size and Forecast, Type (2023-2030) 6.4.3.2. Japan Busway-Bus Duct Market Size and Forecast, Voltage (2023-2030) 6.4.3.3. Japan Busway-Bus Duct Market Size and Forecast, by End User Industry (2023-2030) 6.4.4. India 6.4.4.1. India Busway-Bus Duct Market Size and Forecast, Type (2023-2030) 6.4.4.2. India Busway-Bus Duct Market Size and Forecast, Voltage (2023-2030) 6.4.4.3. India Busway-Bus Duct Market Size and Forecast, by End User Industry (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Busway-Bus Duct Market Size and Forecast, Type (2023-2030) 6.4.5.2. Australia Busway-Bus Duct Market Size and Forecast, Voltage (2023-2030) 6.4.5.3. Australia Busway-Bus Duct Market Size and Forecast, by End User Industry (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Busway-Bus Duct Market Size and Forecast, Type (2023-2030) 6.4.6.2. Indonesia Busway-Bus Duct Market Size and Forecast, Voltage (2023-2030) 6.4.6.3. Indonesia Busway-Bus Duct Market Size and Forecast, by End User Industry (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Busway-Bus Duct Market Size and Forecast, Type (2023-2030) 6.4.7.2. Malaysia Busway-Bus Duct Market Size and Forecast, Voltage (2023-2030) 6.4.7.3. Malaysia Busway-Bus Duct Market Size and Forecast, by End User Industry (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Busway-Bus Duct Market Size and Forecast, Type (2023-2030) 6.4.8.2. Vietnam Busway-Bus Duct Market Size and Forecast, Voltage (2023-2030) 6.4.8.3. Vietnam Busway-Bus Duct Market Size and Forecast, by End User Industry (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Busway-Bus Duct Market Size and Forecast, Type (2023-2030) 6.4.9.2. Taiwan Busway-Bus Duct Market Size and Forecast, Voltage (2023-2030) 6.4.9.3. Taiwan Busway-Bus Duct Market Size and Forecast, by End User Industry (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Busway-Bus Duct Market Size and Forecast, Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Busway-Bus Duct Market Size and Forecast, Voltage (2023-2030) 6.4.10.3. Rest of Asia Pacific Busway-Bus Duct Market Size and Forecast, by End User Industry (2023-2030) 7. Middle East and Africa Busway-Bus Duct Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 7.1. Middle East and Africa Busway-Bus Duct Market Size and Forecast, Type (2023-2030) 7.2. Middle East and Africa Busway-Bus Duct Market Size and Forecast, Voltage (2023-2030) 7.3. Middle East and Africa Busway-Bus Duct Market Size and Forecast, by End User Industry (2023-2030) 7.4. Middle East and Africa Busway-Bus Duct Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Busway-Bus Duct Market Size and Forecast, Type (2023-2030) 7.4.1.2. South Africa Busway-Bus Duct Market Size and Forecast, Voltage (2023-2030) 7.4.1.3. South Africa Busway-Bus Duct Market Size and Forecast, by End User Industry (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Busway-Bus Duct Market Size and Forecast, Type (2023-2030) 7.4.2.2. GCC Busway-Bus Duct Market Size and Forecast, Voltage (2023-2030) 7.4.2.3. GCC Busway-Bus Duct Market Size and Forecast, by End User Industry (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Busway-Bus Duct Market Size and Forecast, Type (2023-2030) 7.4.3.2. Nigeria Busway-Bus Duct Market Size and Forecast, Voltage (2023-2030) 7.4.3.3. Nigeria Busway-Bus Duct Market Size and Forecast, by End User Industry (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Busway-Bus Duct Market Size and Forecast, Type (2023-2030) 7.4.4.2. Rest of ME&A Busway-Bus Duct Market Size and Forecast, Voltage (2023-2030) 7.4.4.3. Rest of ME&A Busway-Bus Duct Market Size and Forecast, by End User Industry (2023-2030) 8. South America Busway-Bus Duct Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 8.1. South America Busway-Bus Duct Market Size and Forecast, Type (2023-2030) 8.2. South America Busway-Bus Duct Market Size and Forecast, Voltage (2023-2030) 8.3. South America Busway-Bus Duct Market Size and Forecast, by End User Industry (2023-2030) 8.4. South America Busway-Bus Duct Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Busway-Bus Duct Market Size and Forecast, Type (2023-2030) 8.4.1.2. Brazil Busway-Bus Duct Market Size and Forecast, Voltage (2023-2030) 8.4.1.3. Brazil Busway-Bus Duct Market Size and Forecast, by End User Industry (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Busway-Bus Duct Market Size and Forecast, Type (2023-2030) 8.4.2.2. Argentina Busway-Bus Duct Market Size and Forecast, Voltage (2023-2030) 8.4.2.3. Argentina Busway-Bus Duct Market Size and Forecast, by End User Industry (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Busway-Bus Duct Market Size and Forecast, Type (2023-2030) 8.4.3.2. Rest Of South America Busway-Bus Duct Market Size and Forecast, Voltage (2023-2030) 8.4.3.3. Rest Of South America Busway-Bus Duct Market Size and Forecast, by End User Industry (2023-2030) 9. Global Busway-Bus Duct Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.4. Leading Busway-Bus Duct Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. C&S Electric Limited 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Details on Partnership 10.1.7. Recent Developments 10.2. Powell Industries Inc 10.3. Siemens AG 10.4. Taian-Ecobar Technology 10.5. General Electric Company 10.6. LS Cable & System Ltd. 10.7. Huapeng Group Company, Ltd., 10.8. Godrej and Boyce Company Limited 10.9. L&T Electrical & Automation 10.10. Tricolite Electrical Industries 10.11. ABB 10.12. Accu-Panels Energy Pvt Ltd 10.13. Eaton Corporation PLC 10.14. Schneider Electric 11. Key Findings 12. Industry Recommendations 13. Busway-Bus Duct Market: Research Methodology