The Busway-Bus Duct Market size was valued at USD 13.57 Billion in 2025 and the total Busway-Bus Duct revenue is expected to grow at a CAGR of 5.5% from 2026 to 2032, reaching nearly USD 19.75 Billion by 2032. Busways-bus ducts are used in various industrial, commercial, and institutional settings for electrical power distribution. Busways-bus ducts designed for efficient electricity transmission from one point to another, these systems serve as an alternative to traditional cable and conduit systems. They provide advantages, including flexibility, scalability, ease of installation, and improved power management. The Busway-Bus Duct market is experiencing steady growth due to increased demand for efficient and flexible electrical power distribution solutions. This market is driven by factors such as rising industrialization, infrastructure development, and the need for reliable energy transmission. The industry is continuously innovating to provide customizable, cost-effective, and environmentally friendly busway and bus duct systems. These solutions are being widely adopted in commercial, industrial, and data center applications to meet power distribution needs.To know about the Research Methodology :- Request Free Sample Report

Busway-Bus Duct Market Dynamics:

Rapid urbanization and infrastructure development to boost market growth Rapid urbanization and infrastructure development represent a significant driving force in various industries, including construction and the Busway-Bus Duct market. As the world's population continues to shift from rural to urban areas, cities are expanding at an unprecedented rate. This urban growth necessitates the development of infrastructure such as residential buildings, commercial complexes, transportation systems, and utilities. Urban areas require substantial electrical power to support their infrastructure. Busway-bus duct systems are crucial for efficiently distributing electricity in densely populated urban environments. Quickly install and expand these systems to meet the growing power demands of newly developed urban areas. Busway-bus ducts provide a space-efficient solution for power distribution, a crucial consideration in urban settings where space is limited. Install them overhead or under the floor to save valuable real estate in crowded urban environments. Rapid urbanization demands reliable power distribution to support essential services, from hospitals to transportation. Busway-bus ducts ensure a stable power supply and are easily adapted to accommodate changes in infrastructure and load requirements.Increasing industrialization to drive the Busway-Bus Duct Market growth Increasing industrialization is an essential driver of the Busway-Bus Duct market, as industries all across the world, require strong and efficient electrical power distribution solutions to support their operations. Industrial facilities have substantial energy requirements for manufacturing, processing, and automation. Busway-bus duct systems offer a dependable and scalable means to meet these power needs while minimizing energy losses. Industries often have diverse power distribution requirements, ranging from heavy machinery to sensitive electronics. Busway-bus ducts provide the flexibility provide to various load types and adapt to changing industrial processes. In industrial settings, downtime is costly. Busway-bus ducts are preferred for their reliability and ease of maintenance, reducing the risk of production interruptions. As industrial regulations become stricter, busway-bus ducts with advanced safety features are crucial for compliance, reducing the risk of electrical accidents and ensuring worker safety. As industries grow and expand, busway-bus ducts are easily extended or reconfigured to accommodate changing facility layouts and increased power demands.

Limitations of the busway and bus duct systems hamper the Busway-Bus Duct market growth Busway-bus duct systems, while efficient, come with inherent limitations. Their rigid layout poses significant restraints, impacting adaptability to changing needs. After installation, making alterations to the configuration and capacity of these systems becomes a laborious and time-consuming task, causing operational disruptions. The flexibility afforded by traditional cable-based systems is particularly lacking in Busway-Bus Duct setups. Maintenance and repair present additional challenges, demanding specialized knowledge and trained personnel. Despite their advantages, careful consideration of these restraints is essential when implementing Busway-Bus Duct systems in industrial settings. The Busway-Bus Duct market encounters challenges related to system adaptability and maintenance complexities, highlighting the need for strategic planning to mitigate operational disruptions and ensure long-term efficiency.

Busway-Bus Duct Market Growth Opportunity

Urbanization projects' power solutions create lucrative growth opportunities for market growth. The adaptability of the busway and bus duct systems allows for tailored solutions provided to diverse customer needs. Companies that provide customizable and modular options, with flexibility for expansion and modification, establish a competitive edge. This approach enables them to address specific industry requirements and adapt to evolving technological demands. Many existing buildings and facilities require electrical system upgrades to enhance efficiency, safety, and reliability. Retrofitting older power distribution systems with modern bus ducts is a promising avenue for businesses seeking to improve the functionality of aging infrastructure. This market allows for sustainable growth through system upgrades. Emerging markets with substantial infrastructure development projects present lucrative opportunities. Manufacturers explore these regions by adapting their products to meet local regulations and standards. Being responsive to the unique needs of emerging markets enables companies to establish a strong presence and build long-term success.Market Growth Challenges:

Bus duct installation is complex, often requiring specialized knowledge and skilled personnel. Incorrect installation leads to operational issues, posing a challenge for businesses. Bus duct systems, including cast resin and aluminium bus ducts, demand regular maintenance to ensure they function correctly. Finding qualified personnel to perform this maintenance is challenging. The bus duct market, particularly with key players like Schneider Electric, is highly competitive. Companies need to differentiate themselves to gain market share. Compliance with evolving safety and environmental regulations is a significant challenge. Staying updated and adapting products to meet new standards is vital. Customers often seek cost-effective power distribution solutions. Balancing quality, efficiency, and affordability is a constant challenge in the busway and bus duct market.Trends:

The integration of smart technology into bus duct systems is a prominent trend. These systems offer real-time monitoring, predictive maintenance, and energy efficiency, which align with the Industry 4.0 revolution. The trend toward customizable and modular bus duct solutions allows businesses to cater to specific industry needs and provide options for expansion and modification. The use of eco-friendly materials in bus ducts, such as recyclable components and reduced environmental impact during manufacturing, is gaining traction. The trend of retrofitting older buildings and facilities with modern bus duct systems to enhance energy efficiency and safety continues to grow. As infrastructure development expands in emerging markets, bus duct manufacturers, including Schneider Electric, are looking to expand their presence by adapting products to local regulations and standards. Increasing urbanization, including the development of metro systems and airports, fuels the demand for efficient and safe power distribution solutions, making bus ducts a key player in such projects.Busway-Bus Duct Market Segment Analysis:

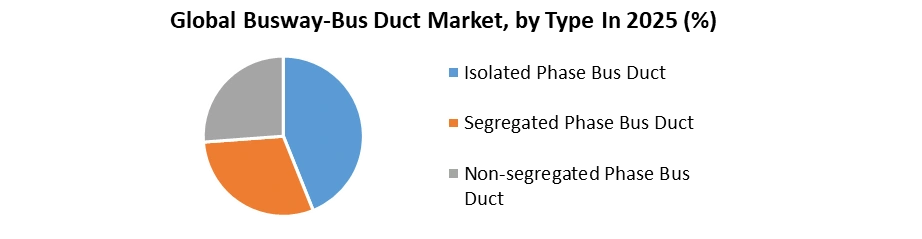

Based on Type, non-segregated phase buses dominated the Busway-Bus Duct Market in the year 2025. Non-segregated phase bus ducts are the most economical and versatile type of busway-bus duct system. A non-segregated phase bus (NSPB) is a type of busway that does not have any barriers separating the phase conductors. This makes it the most economical and versatile type of busway, as it is relatively easy to install and maintain. Typically, commercial and industrial facilities use NSPB in low-voltage applications. They are also relatively easy to install and maintain. This makes them a popular choice for a wide range of applications, including commercial, industrial, and utility facilities. Their design, allowing phases to be nearby, often leads to the use of these systems in less critical applications. This design is cost-effective but has limitations in terms of safety and fault tolerance.

Busway-Bus Duct Market Regional Insight:

North America dominated the Busway-Bus Duct Market in the year 2025. Busway-Bus Duct systems gained prominence in the United States and Canada due to strong industrial activities, commercial growth, and an increased emphasis on energy efficiency. The U.S. stood out as a substantial market for these systems. The Asia-Pacific region, especially, China and India, emerged as dominant forces in the Busway-Bus Duct market, experiencing rapid growth. The surge in demand was propelled by swift industrialization, urbanization, and extensive infrastructure development in these nations. Asia-Pacific, overall, became the fastest-growing market for Busway-Bus Duct systems. This trend underscored the region's increasing need for efficient power distribution solutions. As China and India continued to drive market expansion, the global Busway-Bus Duct industry witnessed a significant shift in focus towards the dynamic growth opportunities in the Asia-Pacific region.Competitive Landscape:

The global Busway-Bus Duct market is highly competitive. The report provides a comprehensive analysis of the key players in the Global Busway-Bus Duct Market. The Major players in the market are focusing on mergers and acquisitions to innovate the products and maintain sustainability. Also, the key players rising focus on partnerships and investment to expand the product portfolio. As the Busway-Bus Duct market evolves, players are increasingly focusing on non-contact measurement methods, Industry 4.0 integration, and expanding into emerging markets. To boom in a competitive area, commitment to innovation, adherence to regulations, and adaptability to changing markets are crucial. Extensive R&D investments keep leaders ahead in technology. Pricing strategies, marketing efforts, and customer support help in their competitiveness. Moreover, strategic partnerships and acquisitions contribute to their growth and diversification.Busway-Bus Duct Market Scope Table : Inquire Before Buying

Global Busway-Bus Duct Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 13.57 Bn. Forecast Period 2026 to 2032 CAGR: 5.5% Market Size in 2032: USD 19.75 Bn. Segments Covered: by Type Isolated Phase Bus Duct Segregated Phase Bus Duct Non-segregated Phase Bus Duct by Voltage High-voltage Medium-voltage Low-voltage by End User Industry Residential Commercial Data Centers Office Buildings Others Industrial Busway-Bus Duct Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Busway-Bus Duct Market, Key Players

1. C&S Electric Limited (India) 2. Powell Industries Inc (USA) 3. Siemens AG (Germany) 4. Taian-Ecobar Technology (China) 5. General Electric Company (USA) 6. LS Cable & System Ltd.(S. Korea) 7. Huapeng Group Company, Ltd.( China) 8. Godrej and Boyce Company Limited (India) 9. L&T Electrical & Automation (India) 10. Tricolite Electrical Industries (India) 11. ABB (Switzerland) 12. Accu-Panels Energy Pvt Ltd(India) 13. Eaton Corporation PLC (Ireland)) 14. Schneider Electric 15. Vidhyut Control India Pvt. LtdFrequently Asked Questions:

1] What segments are covered in the Global Busway-Bus Duct Market report? Ans. The segments covered in the Busway-Bus Duct Market report are based on Type, Voltage, End-User Industry, and Regions. 2] Which region is expected to hold the highest share in the Global Busway-Bus Duct Market? Ans. The North American region is expected to hold the highest share of the Market. 3] What was the market size of the Global Busway-Bus Duct Market by 2025? Ans. The market size of the Busway-Bus Duct Market by 2025 is expected to reach USD 13.57 Bn. 4] What is the forecast period for the Global Busway-Bus Duct Market? Ans. The forecast period for the Busway-Bus Duct Market is 2026-2032. 5] What is the market size of the Global Busway-Bus Duct Market in 2032? Ans. The market size of the Busway-Bus Duct Market in 2032 is valued at USD 19.75 Bn.

1. Busway-Bus Duct Market: Executive Summary 1.1. Executive Summary 1.2. Market Size (2025) & Forecast (2025-2032) 1.3 Market Size (Value in USD Billion) and Market Share (%) - By Segments, Regions and Country 2. Busway-Bus Duct Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Positioning Of Key Players 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Business Portfolio 2.3.4. End-User 2.3.5. Revenue (2025) 2.3.6. Market Share (%) 2025 2.3.7. Market Expansion Strategies 2.3.8. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 2.6. Research and Development 3. Busway-Bus Duct Market: Market Dynamics 3.1. Busway-Bus Duct Market Trends 3.2. Busway-Bus Duct Market Dynamics 3.2.1.1. Drivers 3.2.1.2. Restraints 3.2.1.3. Opportunities 3.2.1.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Key Opinion Leader Analysis For the Global Industry 4. Industry Trends & Technological Advancements 4.1. Smart and Digital Busway-Bus Duct Systems 4.2. Increasing Use of IoT in Power Distribution Networks 4.3. Energy-Efficient and Sustainable Busway Solutions 4.4. Emerging Manufacturing Techniques and Materials 4.5. Future Market Trends (2025-2032) 5. Investment and Business Opportunities 5.1. Investment Landscape & Funding Trends 5.2. Market Entry Strategies for New Entrants 5.3. Joint Ventures and Collaborations 5.4. Expansion Opportunities in Emerging Markets 5.5. Risk Analysis and Mitigation Strategies 6. Supply Chain and Value Chain Analysis 6.1. Raw Material Procurement and Pricing Trends 6.2. Manufacturing Process Overview 6.3. Distribution and Sales Channels 6.4. End-User Purchasing Behavior 7. Regulatory Framework and Compliance 7.1. Industry Standards and Certifications 7.2. Government Policies Supporting Market Growth 7.3. Environmental and Safety Regulations 7.4. Compliance Challenges for Manufacturers 8. Busway-Bus Duct Market: Global Market Size and Forecast By Segmentation (Value in USD Billion) (2025-2032) 8.1. Busway-Bus Duct Market Size and Forecast, By Type (2025-2032) 8.1.1. Isolated Phase Bus Duct 8.1.2. Segregated Phase Bus Duct 8.1.3. Non-segregated Phase Bus Duct 8.2. Busway-Bus Duct Market Size and Forecast, By Voltage (2025-2032) 8.2.1. High-voltage 8.2.2. Medium-voltage 8.2.3. Low-voltage 8.3. Busway-Bus Duct Market Size and Forecast, By End User Industry (2025-2032) 8.3.1. Residential 8.3.2. Commercial 8.3.2.1. Data Centers 8.3.2.2. Office Buildings 8.3.2.3. Others 8.3.3. Industrial 8.4. Busway-Bus Duct Market Size and Forecast, By Region (2025-2032) 8.4.1. North America 8.4.2. Europe 8.4.3. Asia Pacific 8.4.4. South America 8.4.5. MEA 9. North America Busway-Bus Duct Market Size and Forecast By Segmentation (Value in USD Billion) (2025-2032) 9.1. North America Busway-Bus Duct Market Size and Forecast, By Type (2025-2032) 9.1.1. Isolated Phase Bus Duct 9.1.2. Segregated Phase Bus Duct 9.1.3. Non-segregated Phase Bus Duct 9.2. North America Busway-Bus Duct Market Size and Forecast, By Voltage (2025-2032) 9.2.1. High-voltage 9.2.2. Medium-voltage 9.2.3. Low-voltage 9.3. North America Busway-Bus Duct Market Size and Forecast, By End User Industry (2025-2032) 9.3.1. Residential 9.3.2. Commercial 9.3.2.1. Data Centers 9.3.2.2. Office Buildings 9.3.2.3. Others 9.3.3. Industrial 9.4. North America Busway-Bus Duct Market Size and Forecast, By Country (2025-2032) 9.4.1. United States 9.4.1.1. United States Busway-Bus Duct Market Size and Forecast, By Type (2025-2032) 9.4.1.2. United States Busway-Bus Duct Market Size and Forecast, By Voltage (2025-2032) 9.4.1.3. United States Busway-Bus Duct Market Size and Forecast, By End User Industry (2025-2032) 9.4.2. Canada 9.4.2.1. Canada Busway-Bus Duct Market Size and Forecast, By Type (2025-2032) 9.4.2.2. Canada Busway-Bus Duct Market Size and Forecast, By Voltage (2025-2032) 9.4.2.3. Canada Busway-Bus Duct Market Size and Forecast, By End User Industry (2025-2032) 9.4.3. Mexico 9.4.3.1. Mexico Busway-Bus Duct Market Size and Forecast, By Type (2025-2032) 9.4.3.2. Mexico Busway-Bus Duct Market Size and Forecast, By Voltage (2025-2032) 9.4.3.3. Mexico Busway-Bus Duct Market Size and Forecast, By End User Industry (2025-2032) 10. Europe Busway-Bus Duct Market Size and Forecast By Segmentation (Value in USD Billion) (2025-2032) 10.1. Europe Busway-Bus Duct Market Size and Forecast, By Type (2025-2032) 10.2. Europe Busway-Bus Duct Market Size and Forecast, By Voltage (2025-2032) 10.3. Europe Busway-Bus Duct Market Size and Forecast, By End User Industry (2025-2032) 10.4. Europe Busway-Bus Duct Market Size and Forecast, By Country (2025-2032) 10.4.1. United Kingdom 10.4.2. France 10.4.3. Germany 10.4.4. Italy 10.4.5. Spain 10.4.6. Sweden 10.4.7. Russia 10.4.8. Rest of Europe 11. Asia Pacific Busway-Bus Duct Market Size and Forecast By Segmentation (Value in USD Billion) (2025-2032) 11.1. Asia Pacific Busway-Bus Duct Market Size and Forecast, By Type (2025-2032) 11.2. Asia Pacific Busway-Bus Duct Market Size and Forecast, By Voltage (2025-2032) 11.3. Asia Pacific Busway-Bus Duct Market Size and Forecast, By End User Industry (2025-2032) 11.4. Asia Pacific Busway-Bus Duct Market Size and Forecast, By Country (2025-2032) 11.4.1. China 11.4.2. Japan 11.4.3. South Korea 11.4.4. India 11.4.5. Australia 11.4.6. Malaysia 11.4.7. Thailand 11.4.8. Vietnam 11.4.9. Indonesia 11.4.10. Philippines 11.4.11. Rest of Asia Pacific 12. Middle East and Africa Busway-Bus Duct Market Size and Forecast By Segmentation (Value in USD Billion) (2025-2032) 12.1. Middle East and Africa Busway-Bus Duct Market Size and Forecast, By Type (2025-2032) 12.2. Middle East and Africa Busway-Bus Duct Market Size and Forecast, By Voltage (2025-2032) 12.3. Middle East and Africa Busway-Bus Duct Market Size and Forecast, By End User Industry (2025-2032) 12.4. Middle East and Africa Busway-Bus Duct Market Size and Forecast, By Country (2025-2032) 12.4.1. South Africa 12.4.2. GCC 12.4.3. Nigeria 12.4.4. Egypt 12.4.5. Turkey 12.4.6. Rest of ME&A 13. South America Busway-Bus Duct Market Size and Forecast by Segmentation (by Value in USD ) (2023-2032) 13.1. South America Busway-Bus Duct Market Size and Forecast, By Type (2023-2032) 13.2. South America Busway-Bus Duct Market Size and Forecast, By Voltage (2023-2032) 13.3. South America Busway-Bus Duct Market Size and Forecast, By End User Industry (2025-2032) 13.4. South America Busway-Bus Duct Market Size and Forecast, by Country (2023-2032) 13.4.1. Brazil 13.4.2. Argentina 13.4.3. Colombia 13.4.4. Chile 13.4.5. Peru 13.4.6. Rest Of South America 14. Company Profile: Key Players 14.1. ABB 14.1.1. Company Overview 14.1.2. Business Portfolio 14.1.3. Financial Overview 14.1.4. SWOT Analysis 14.1.5. Strategic Analysis 14.1.6. Recent Developments 14.2. GE VERNOVA 14.3. Schneider Electric SE 14.4. Siemens AG 14.5. Eaton Corporation 14.6. MP Husky Corp. 14.7. RS Breakers and Controls 14.8. Power Bus Way Ltd. 14.9. Electrical Builders Inc. 14.10. Fuji Electric Co., Ltd. 14.11. Hitachi Energy Ltd 14.12. Starline 14.13. Zucchini 14.14. Brilltech Engineers Pvt. Ltd. 14.15. ZhenJiang Sunshine Electric Group Co., Ltd. 14.16. SMA Power Controls Pvt. Ltd. 14.17. Legrand 14.18. Mitsubishi Electric 14.19. Royce Cross Group 14.20. Godrej Enterprises 14.21. C&S Electric Limited 14.22. Powell Industries Inc 14.23. Taian-Ecobar Technology 14.24. LS Cable & System Ltd. 14.25. Tricolite Electrical Industries 14.26. Accu-Panels Energy Pvt Ltd 14.27. Vidhyut Control India Pvt. Ltd 14.28. Avail Infrastructure Solutions 14.29. Vertiv Group Corp 14.30. NOVOLECS 15. Key Findings 16. Analyst Recommendations 17. Busway-Bus Duct Market: Research Methodology