Brazil Electric Car Market size was valued at USD 766.6 Billion in 2023 and the Brazil Electric Car Market revenue is expected to reach USD 1657.5 Billion by 2030, at a CAGR of 17.2% over the forecast period.Brazil Electric Car Market Overview

An electric vehicle (EV) is a vehicle that uses an electric motor powered by a rechargeable battery and can be charged from an external source. EVs are more efficient and cheaper to charge than vehicles that use fossil fuels like petrol or diesel. They also have several advantages over conventional vehicles, including; Energy efficiency: EVs convert over 77% of the electrical energy from the grid to power at the wheels. Environmentally friendly: EVs emit no tailpipe pollutants.To know about the Research Methodology :- Request Free Sample Report The Brazil EV Market is streamlined with some of the largest players, having major influence in the market. This ecosystem comprises EV manufacturers, charging infrastructure providers, battery manufacturing companies, and technology/software firms Battery advancements impact vehicle design, charging infrastructure requirements influence vehicle usage patterns, and software solutions enhance the overall EV experience. Government incentives and policies further shape the ecosystem, influencing investments, market adoption, and regulatory frameworks. Brazil Electric Car is not limited to a specific geographical region. The Brazil Electric Car Market has a global presence, with consumers across different continents interested in these supplements. This Brazil Electric Car Market Report offers a specific and detailed market overview with statistical as well as pre-sized trendy data. This Brazil Electric Car Market report showcases the Brazil Electric Car market situation with Dynamics, Market Segment, Regional Analysis, and Top Competitor's Market Position.

Brazil Electric Car Market Dynamics

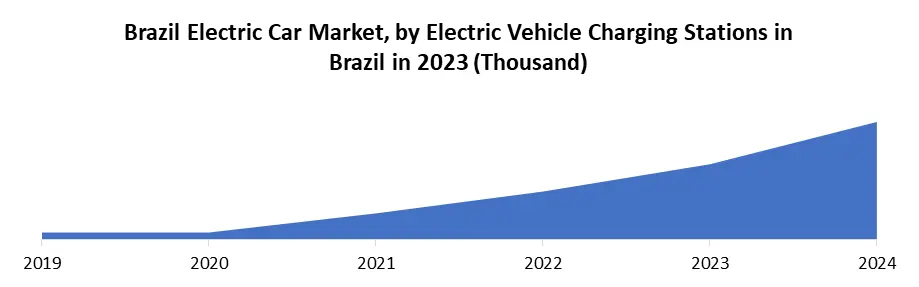

Increasing Environmental Concerns and a Push Toward Reducing Carbon Emissions Driving the Brazil Electric Car Market The Brazil electric car market is primarily driven by several factors. Firstly, increasing environmental concerns and a push towards reducing carbon emissions have led to a growing interest in electric vehicles (EVs) as a cleaner alternative to traditional gasoline-powered cars. Government incentives and policies aimed at promoting electric mobility, such as tax breaks, subsidies, and investment in charging infrastructure, have further fueled the adoption of electric cars in Brazil. Additionally, rising fuel prices and the volatility of oil markets have made electric vehicles more economically attractive over the long term, driving consumer interest in EVs. Technological advancements in battery technology, leading to improvements in range and charging times, have also contributed to the growth of the electric car market in Brazil. The Development of a Robust Charging Infrastructure Network Across the Country Boosting Opportunities in The Brazil Electric Car Market The Brazil electric car market presents several opportunities for growth and expansion. One significant opportunity lies in the development of a robust charging infrastructure network across the country. Investments in charging stations, both public and private, will be essential to address range anxiety and facilitate the widespread adoption of electric vehicles. Furthermore, there is potential for collaboration between the government, private sector, and automotive industry to incentivize domestic production of electric vehicles and components, thereby creating jobs and stimulating economic growth. As consumer awareness and acceptance of electric vehicles continue to increase, there is a growing market for innovative electric car models tailored to the preferences and needs of Brazilian consumers. Expanding the availability of financing options and subsidies for electric vehicle purchases can also help make EVs more accessible to a broader range of consumers, further driving market growth.

Brazil Electric Car Market Segment Analysis

On Type of Vehicle, the Passenger vehicle is the dominant segment in 2023 in the Brazil Electric Car Market because of their broader consumer base, daily commuting suitability, and increasing environmental awareness. Consumers opt for EVs as personal transportation, driven by lower emissions, cost savings, and urban mobility advantages. Government incentives often target passenger EVs, further boosting adoption. These factors collectively position passenger EVs as the preferred choice for individuals seeking sustainable and efficient mobility solutions. The Brazil Electric Car market is segmented by Distribution Channels into Banks, NBFCs and OEMs. OEMs sector dominate the market in 2023. Due to their manufacturing expertise, brand recognition, diverse product range, research investment and global partnership. These factors enable them to produce high-quality EVs, offer various models, innovate in technology, and ensure reliable after-sales support, making them key drivers in shaping the industry's growth and consumer adoption.

Brazil Electric Car Market Regional Analysis

The most dominant region for electric vehicle (EV) adoption in Brazil is the South region, characterized by its higher population density compared to other regions. This increased population density not only reflects a larger market potential but also signifies a greater demand for transportation solutions, including electric vehicles. Urban centers within the South region, such as São Paulo, boast a substantial concentration of potential EV consumers, further accentuating the region's prominence in the electric car market. The availability of charging infrastructure plays a pivotal role in facilitating EV adoption, and the South region has made significant investments in building a robust charging network. This extensive charging infrastructure contributes immensely to the region's market share, fostering a conducive environment for the widespread adoption and growth of electric vehicles. Brazil Electric Car Market Competitive Landscape The competitive landscape of the Brazilian electric vehicle (EV) market is characterized by a diverse array of players spanning various segments. Established global automotive giants such as Tesla, Nissan, and Chevrolet have a significant presence, offering a range of EV models that cater to different consumer preferences. These companies drive innovation in EV technology, design, and performance, setting industry benchmarks. Battery manufacturing companies such as Samsung SDI and local producers contribute to technological advancements, enhancing the efficiency and capabilities of EV batteries. Charging infrastructure companies play a crucial role, with international names like EVgo and Electrify America making their mark alongside local entities like EDP and Green Mobility. Their expanding charging networks address the critical concern of charging accessibility, facilitating widespread EV adoption. Volkswagen aims to make significant gains in South America, and Brazil with a major product. By 2027, the company plans to grow by 40% in Brazil, with the region’s largest EV market. i.e., 15 new electric and flex-fuel vehicle models are expected to be launched by 2025 alone. Volkswagen in 2021 announced the creation of a research and development center in Brazil to explore expanding the applications of ethanol and other biofuels in emerging markets, and nearly every carmaker operating in Brazil plans to keep ethanol it its lineup in some form going forward. That will further boost the EV market in the future. Moreover, companies like General Motors, are skeptical that ethanol cars have a future in Brazil. The company has laid out goals to be carbon neutral by 2040 and wants to replicate locally its global focus on EVs. EXEED’s launch of new energy vehicles in Brazil in 2023 is a significant step towards promoting sustainability and reducing carbon emissions in the country. The company’s investment of around 100 billion yuan in research and development and commitment to infrastructure development will contribute to the growth of the electric vehicle market in Brazil, providing consumers with more sustainable options for transportation.

Brazil Electric Car Market Scope: Inquire Before Buying

Brazil Electric Car Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 766.6 Mn. Forecast Period 2024 to 2030 CAGR: 17.2% Market Size in 2030: US $ 1657.5 Mn. Segments Covered: by Vehicle Type of Vehicles Passenger Commercial by Distribution Channels OEMs Banks NBFCs Leading Brazil Electric Car Key Players Include

1. Tesla 2. BYD Company Limited 3. Nissan Motor Corporation 4. BMW Group 5. Volkswagen Group 6. Renault Group 7. General Motors (Chevrolet) 8. Ford Motor Company 9. Hyundai Motor Company 10. Audi AG 11. Jaguar Land Rover 12. Kia Motors Corporation 13. Mercedes-Benz (Daimler AG) 14. Mitsubishi Motors Corporation 15. Toyota Motor Corporation 16. Volvo Cars 17. Honda Motor Co., Ltd. 18. Peugeot Citroën (Groupe PSA) 19. Fiat Chrysler Automobiles (FCA) 20. Chery Automobile Co., Ltd. Frequently Asked Questions and Answers in the Brazil Electric Car Market: 1. How many electric cars are operating in Brazil? Ans: As per the Brazilian Electric Vehicle Association, or ABVE, sales of electrified automobiles, which include electrics, plug-in hybrids, and hybrid models, totalled 49,245 vehicles in 2023. 2. what is the market size of Brazil's electric vehicle market? Ans: The market value of the Brazilian electric vehicle market was valued at USD 766.6 Mn in 2023. 3. What is the future market size of Brazil's electric vehicle market? Ans: The Brazil electric vehicle market is anticipated to reach a market value of USD 1657 Mn by the end of 2030. 4. Who are the major players in the Brazil Electric Car market? Ans: Major players in the Brazil Electric Car market include Volkswagen Group and Renault among others. 5. How many EV charging stations are there in Brazil?? Ans: Brazil has 401 registered charging stations across the nation as of July 2023, Brazil had the most electric vehicle charging stations in all of Latin America. East and Chile came next, with 340 and 316 stations, respectively.

1. Brazil Electric Car Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Brazil Electric Car Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Product Segment 2.3.3. End-user Segment 2.3.4. Revenue (2023) 2.3.5. Company Locations 2.4. Brazil Electric Car Market Companies Share 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Brazil Electric Car Market: Dynamics 3.1. Brazil Electric Car Market Trends 3.2. Brazil Electric Car Market Dynamics 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Value Chain Analysis 3.6. Technological Roadmap 3.7. Regulatory Landscape 4. Brazil Electric Car Market: Global Market Size and Forecast by Segmentation (by Value) (2023-2030) 4.1. Brazil Electric Car Market Size and Forecast, By Vehicle Type (2023-2030) 4.1.1. Passenger 4.1.2. Commercial 4.2. Brazil Electric Car Market Size and Forecast, By Distribution Channel (2023-2030) 4.2.1. OEMs 4.2.2. Banks 4.2.3. NBFCs 5. Company Profile: Key Players 5.1. Tesla 5.1.1. Company Overview 5.1.2. Business Portfolio 5.1.3. Financial Overview 5.1.4. SWOT Analysis 5.1.5. Strategic Analysis 5.1.6. Recent Developments 5.2. BYD Company Limited 5.3. Nissan Motor Corporation 5.4. BMW Group 5.5. Volkswagen Group 5.6. Renault Group 5.7. General Motors (Chevrolet) 5.8. Ford Motor Company 5.9. Hyundai Motor Company 5.10. Audi AG 5.11. Jaguar Land Rover 5.12. Kia Motors Corporation 5.13. Mercedes-Benz (Daimler AG) 5.14. Mitsubishi Motors Corporation 5.15. Toyota Motor Corporation 5.16. Volvo Cars 5.17. Honda Motor Co., Ltd. 5.18. Peugeot Citroën (Groupe PSA) 5.19. Fiat Chrysler Automobiles (FCA) 5.20. Chery Automobile Co., Ltd. 6. Key Findings and Analyst Recommendations 7. Brazil Electric Car Market: Research Methodology