The Brain Mapping Instruments Market size was valued at USD 2.5 Bn in 2023 and market revenue is growing at a CAGR of 5.9 % from 2024 to 2030, reaching nearly USD 3.73 Bn by 2030.Brain Mapping Instruments Market Overview

Exploring brain structure and function, mapping tools help neuroscience in deciphering cognitive processes. The growing Brain Mapping Instruments Market is accelerated by heightened neuroscience research focus, increasing neurological disorders, and ongoing technological advancements. Rising investments and understanding of brain complexities drive demand for innovative diagnostic tools. For example, according to the MMR Study report dementia affects over 10 million individuals annually, with a projected 166% increase to 130.8 million cases by 2030, emphasizing the urgency. Therefore, the Continuous advancements in brain mapping technologies provide opportunities for precise, efficient, and user-friendly instruments, integrating artificial intelligence and machine learning for enhanced data analysis and deeper insights into brain function, crucial in mitigating brain-related diseases.To know about the Research Methodology :- Request Free Sample Report

Brain Mapping Instruments Market Dynamics:

Increasing prevalence of neurological diseases to drive the market growth Neurological disorders have increased therefore the focus on understanding the details of the human brain helps to boost demand for brain mapping instruments. The use of these instruments helps the diagnosis, treatment, and research of neurological conditions. The rise in diseases such as Alzheimer's, Parkinson's, epilepsy, and multiple sclerosis is linked to a growing elderly population, changing lifestyles, and environmental factors. Neurological diseases are increasing globally. Various brain mapping technologies, such as functional magnetic resonance imaging, electroencephalography, magnetoencephalography, and positron emission tomography, offer ways to understand and address these conditions through non-invasive imaging and measurement of brain structure and function. The global prevalence of these conditions is expanding, underscoring the importance of accurate and timely diagnostic tools. These advancements in brain mapping significantly contribute to grappling with the escalating burden of neurological diseases in our communities. According to the MMR study, in 2020, the global count of people living with dementia surpassed 55 million. It indicates that this number will nearly double every 20 years, and reaching 78 million by 2030. The majority of this increase is expected in developing countries. Currently, 60% of individuals with dementia reside in low and middle-income nations. The most rapid growth in the elderly population is occurring in countries such as China, India, and their South Asian and Western Pacific counterparts this factor is significantly responsible for the growth of the Brain Mapping Instruments Market.High cost of brain mapping instruments The high cost of brain mapping instruments hinders the growth of the brain mapping instruments market. Because of the advanced technologies involved, these instruments are often extremely costly, despite their importance to understanding the complexities of the brain. Therefore, smaller research institutions and clinics cannot access the technology due to financial barriers. Enhanced costs hinder the integration of brain mapping technologies into diagnostic and treatment procedures in clinical applications. The market itself likely lacks competitiveness because the initial investment and maintenance costs are high, which discourages new entrants. To counter these challenges, stakeholders should focus on technological advancements to create more cost-effective solutions. Collaborative efforts between academic institutions and industry players, supported by government initiatives, encourage shared resources and reduce financial burdens. Moreover, investments in education and training programs can cultivate a skilled workforce, fostering increased demand and utilization of brain mapping instruments. By addressing these challenges strategically, the brain mapping instrument market can overcome cost-related obstacles, promoting accessibility and growth. Technological Advancements in Brain Mapping Instruments Create Lucrative Growth Opportunities The integration of AI and ML in brain mapping instruments enhances data analysis and interpretation. These technologies enable the identification of subtle patterns and correlations, offering a deeper understanding of neurological conditions. Technological advancements in brain mapping instruments have created significant growth opportunities in the Brain Mapping Instruments Market. The integration of Innovative technologies has accelerated the development of more sophisticated and efficient tools for mapping the intricate neural pathways of the brain. Recent developments in brain mapping instruments extend beyond traditional imaging techniques. Advancements in optoacoustic imaging, a hybrid modality combining ultrasound and laser-induced optoacoustic signals, offer deep-tissue imaging with high spatial resolution. This technology allows researchers to visualize neurovascular and functional connectivity in unprecedented detail. The emergence of neurophotonics, which involves using light to study and manipulate neural activity, presents innovative possibilities. Techniques such as two-photon microscopy enable deep imaging within living brain tissue, facilitating longitudinal studies of neural processes. Furthermore, there's a growing emphasis on multimodal integration, combining various imaging modalities to capture complementary information. Integrating data from fMRI, EEG, and structural MRI enhances the understanding of both brain structure and function. These unique technologies underscore a dynamic landscape in brain mapping, showcasing the interdisciplinary nature of recent innovations and their potential to revolutionize our understanding of the brain these factors are significantly responsible for the growth of the Brain Mapping Instruments Market.

Government Initiatives for the Brain Mapping Instruments Market

Country Initiative Description United States BRAIN Initiative Launched in 2013, the BRAIN Initiative is a collaborative effort involving multiple federal agencies, including the National Institutes of Health (NIH), the National Science Foundation (NSF), and the Defense Advanced Research Projects Agency (DARPA). The initiative helps to speed up the progress and implementation of technologies for mapping the activity of individual neurons. European Union Human Brain Project The Human Brain Project, launched in 2013, is a large-scale collaborative project involving multiple European countries. The project focuses on developing advanced brain mapping techniques and high-performance computing tools. China Brain Science and Brain-Inspired Intelligence China has invested in various neuroscience and brain research initiatives. The Brain Science and Brain-Inspired Intelligence Project is one such example. The goal is to promote research on brain science, brain-inspired computing, and artificial intelligence. Canada Canadian Brain Research Strategy Canada has been involved in brain research through initiatives such as the Canadian Brain Research Strategy. This strategy aims to foster collaboration and coordination among researchers across the country, focusing on advancing understanding of the brain and its disorders. Japan Brain/MINDS Project The Brain Mapping by Integrated Neurotechnology for Disease Studies (Brain/MINDS) Project is a Japanese initiative that focuses on mapping the structure and function of the primate brain. It aims to contribute to the understanding of brain diseases. Brain Mapping Instruments Market Segment Analysis:

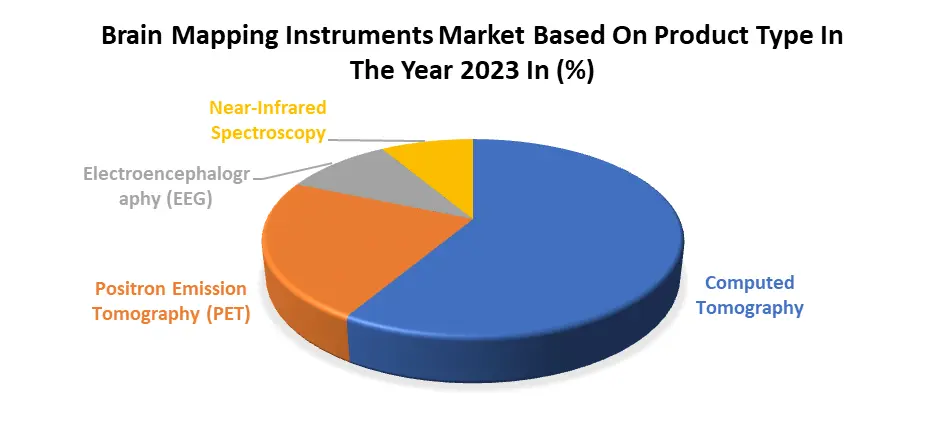

Based On Product Type: Computed Tomography segment dominated the Product Type segment of the Brain Mapping Instruments Market in the year 2023. Due to its high imaging capabilities and widespread clinical applications. CT scans provide detailed cross-sectional images of the brain, enabling precise visualization of anatomical structures and abnormalities. This diagnostic modality is crucial for identifying and assessing various neurological conditions, including tumors, hemorrhages, and vascular abnormalities. CT’s efficiency in capturing high-resolution images in a non-invasive manner makes it a preferred choice for quick and accurate diagnosis in emergencies. The advancements in CT technology, such as multi-detector CT and enhanced image reconstruction algorithms, have further strengthened its diagnostic accuracy. While other imaging modalities such as magnetic resonance imaging (MRI) offer complementary information, the speed, accessibility, and diagnostic versatility of CT have positioned it as a cornerstone in brain mapping instruments, driving its dominance in the product type segment of the market.

Brain Mapping Instruments Market Regional Analysis

North America region dominated the brain mapping instruments market in the year 2023. The dominance of North America is attributed to a region's leadership in healthcare, technology, and research. The presence of established key players such as GE Healthcare, Siemens Healthineers, and Philips Healthcare contributes significantly to the region's market stronghold. North America has a strong healthcare infrastructure, a high level of technological adoption, and substantial investment in research and development. For example, in 2022, there were around 17.3 billion U.S. dollars of healthcare venture capital invested in California. This illustrates leading U.S. states by total healthcare VC investment. California and Massachusetts, by far the leading life sciences hubs in the country, had also the largest amount of VC invested among all U.S. states.The region's advanced healthcare systems and favorable policies boost the demand for innovative brain mapping instruments. Also, North America's demographic trends, including an aging population susceptible to neurological disorders, amplify the necessity for sophisticated brain mapping technologies. As the region continues to pioneer advancements in neuroscience and medical imaging, its dominance in the Brain Mapping Instruments Market is poised to persist, offering a template for global best practices in neuroimaging and neurological healthcare. Brain Mapping Instruments Market Competitive Landscape: The competitive dynamics within the Brain Mapping Instruments sector are marked by the strategic maneuvers of major players, including Siemens Healthineers, Philips Healthcare, Hitachi Medical Systems, Canon Medical Systems Corporation, and Natus Medical Incorporated. These industry leaders predominantly concentrate on fostering market growth through strategic partnerships, mergers, and acquisitions. For instance, Murata Manufacturing actively seeks collaborative ventures to exploit the potential of its Brain NaviTM brainwave analysis platform, particularly in health management businesses. In a collaboration, Synaptive Medical and Panaxium have joined forces to integrate Synaptive's Modus V robotic exoscope technology with Panaxium's ultra-flexible intronic electrocorticography (ECoG), bringing high-resolution, real-time, AI-assisted cortical mapping to neurosurgeons. Meanwhile, companies like Mind Maps leverage brain mapping techniques not only for medical purposes but also in product development. They employ mind maps to organize customer requirements, facilitating conceptual product development by establishing relationships between requirements, resolving conflicts, and creating a cohesive vision for the final product. This competitive landscape underscores a strategic emphasis on innovation and collaborative ventures to propel advancements in Brain Mapping Instruments.

Brain Mapping Instruments Market Scope Table: Inquire Before Buying

Global Brain Mapping Instruments Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 2.5 Bn. Forecast Period 2024 to 2030 CAGR: 5.9% Market Size in 2030: US $ 3.73 Bn. Segments Covered: by Product Type Computed Tomography Positron Emission Tomography (PET) Electroencephalography (EEG) Near-Infrared Spectroscopy Magnetic Resonance Imaging (MRI) Others by End User Hospitals Ambulatory Centers Others Brain Mapping Instruments Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Brain Mapping Instruments Market key players

1. GE Healthcare 2. Siemens Healthineers 3. Philips Healthcare 4. Hitachi Medical Systems 5. Canon Medical Systems Corporation 6. Natus Medical Incorporated 7. Bio-Rad Laboratories 8. Nihon Kohden Corporation 9. Magstim Company Limited 10. Elekta AB 11. Neurosoft 12. Rogue Research Inc. 13. Cephasonics 14. Brainlab AG 15. Ricoh Company, Ltd. 16. Compumedics Limited 17. ANT Neuro 18. EB Neuro S.p.A. 19. Laureate Digital Securities Pvt. Ltd. 20. Brain Products GmbH FAQs: 1] What segments are covered in the Global Brain Mapping Instruments Market report? Ans. The segments covered in the Brain Mapping Instruments Market report are based on, Product Type, End User, and Regions. 2] Which region is expected to hold the highest share of the Global Brain Mapping Instruments Market? Ans. The North American region is expected to hold the highest share of the Brain Mapping Instruments Market. 3] What is the market size of the Global Brain Mapping Instruments Market by 2030? Ans. The market size of the Brain Mapping Instruments Market by 2030 is expected to reach US$ 3.73 Bn. 4] What was the market size of the Global Brain Mapping Instruments Market in 2023? Ans. The market size of the Brain Mapping Instruments Market in 2023 was valued at US$ 2.5 Bn. 5] Key players in the Global Brain Mapping Instruments Market. Ans. GE Healthcare, Siemens Healthineers, Philips Healthcare, Hitachi Medical Systems, Canon Medical Systems Corporation, Natus Medical Incorporated, Bio-Rad Laboratories, Nihon Kohden Corporation, Magstim Company Limited, Elekta AB

1. Brain Mapping Instruments Market: Research Methodology 2. Brain Mapping Instruments Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Brain Mapping Instruments Market: Dynamics 3.1. Brain Mapping Instruments Market Trends by Region 3.1.1. North America Brain Mapping Instruments Market Trends 3.1.2. Europe Brain Mapping Instruments Market Trends 3.1.3. Asia Pacific Brain Mapping Instruments Market Trends 3.1.4. Middle East and Africa Brain Mapping Instruments Market Trends 3.1.5. South America Brain Mapping Instruments Market Trends 3.2. Brain Mapping Instruments Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Brain Mapping Instruments Market Drivers 3.2.1.2. North America Brain Mapping Instruments Market Restraints 3.2.1.3. America Brain Mapping Instruments Market Opportunities 3.2.1.4. North America Brain Mapping Instruments Market Challenges 3.2.2. Europe 3.2.2.1. Europe Brain Mapping Instruments Market Drivers 3.2.2.2. Europe Brain Mapping Instruments Market Restraints 3.2.2.3. Europe Brain Mapping Instruments Market Opportunities 3.2.2.4. Europe Brain Mapping Instruments Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Brain Mapping Instruments Market Drivers 3.2.3.2. Asia Pacific Brain Mapping Instruments Market Restraints 3.2.3.3. Asia Pacific Brain Mapping Instruments Market Opportunities 3.2.3.4. Asia Pacific Brain Mapping Instruments Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Brain Mapping Instruments Market Drivers 3.2.4.2. Middle East and Africa Brain Mapping Instruments Market Restraints 3.2.4.3. Middle East and Africa Brain Mapping Instruments Market Opportunities 3.2.4.4. Middle East and Africa Brain Mapping Instruments Market Challenges 3.2.5. South America 3.2.5.1. South America Brain Mapping Instruments Market Drivers 3.2.5.2. South America Brain Mapping Instruments Market Restraints 3.2.5.3. South America Brain Mapping Instruments Market Opportunities 3.2.5.4. South America Brain Mapping Instruments Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis for Brain Mapping Instruments Market 3.8. Analysis of Government Schemes and Initiatives for the Brain Mapping Instruments Market 3.9. The Global Pandemic Impact on the Brain Mapping Instruments Market 4. Brain Mapping Instruments Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. Brain Mapping Instruments Market Size and Forecast, By Product Type (2023-2030) 4.1.1. Computed Tomography 4.1.2. Positron Emission Tomography (PET) 4.1.3. Electroencephalography (EEG) 4.1.4. Near-Infrared Spectroscopy 4.1.5. Magnetic Resonance Imaging (MRI) 4.1.6. Others 4.2. Brain Mapping Instruments Market Size and Forecast, By End User (2023-2030) 4.2.1. Hospitals 4.2.2. Ambulatory Centers 4.2.3. Others 4.3. Brain Mapping Instruments Market Size and Forecast, by Region (2023-2030) 4.3.1. North America 4.3.2. Europe 4.3.3. Asia Pacific 4.3.4. Middle East and Africa 4.3.5. South America 5. North America Brain Mapping Instruments Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America Brain Mapping Instruments Market Size and Forecast, By Product Type (2023-2030) 5.1.1. Computed Tomography 5.1.2. Positron Emission Tomography (PET) 5.1.3. Electroencephalography (EEG) 5.1.4. Near-Infrared Spectroscopy 5.1.5. Magnetic Resonance Imaging (MRI) 5.1.6. Others 5.2. North America Brain Mapping Instruments Market Size and Forecast, By End User (2023-2030) 5.2.1. Hospitals 5.2.2. Ambulatory Centers 5.2.3. Others 5.3. North America Brain Mapping Instruments Market Size and Forecast, by Country (2023-2030) 5.3.1. United States 5.3.1.1. United States Brain Mapping Instruments Market Size and Forecast, By Product Type (2023-2030) 5.3.1.1.1. Computed Tomography 5.3.1.1.2. Positron Emission Tomography (PET) 5.3.1.1.3. Electroencephalography (EEG) 5.3.1.1.4. Near-Infrared Spectroscopy 5.3.1.1.5. Magnetic Resonance Imaging (MRI) 5.3.1.1.6. Others 5.3.1.2. United States Brain Mapping Instruments Market Size and Forecast, By End User (2023-2030) 5.3.1.2.1. Hospitals 5.3.1.2.2. Ambulatory Centers 5.3.1.2.3. Others 5.3.2. Canada 5.3.2.1. Canada Brain Mapping Instruments Market Size and Forecast, By Product Type (2023-2030) 5.3.2.1.1. Computed Tomography 5.3.2.1.2. Positron Emission Tomography (PET) 5.3.2.1.3. Electroencephalography (EEG) 5.3.2.1.4. Near-Infrared Spectroscopy 5.3.2.1.5. Magnetic Resonance Imaging (MRI) 5.3.2.1.6. Others 5.3.2.2. Canada Brain Mapping Instruments Market Size and Forecast, By End User (2023-2030) 5.3.2.2.1. Hospitals 5.3.2.2.2. Ambulatory Centers 5.3.2.2.3. Others 5.3.3. Mexico 5.3.3.1. Mexico Brain Mapping Instruments Market Size and Forecast, By Product Type (2023-2030) 5.3.3.1.1. Computed Tomography 5.3.3.1.2. Positron Emission Tomography (PET) 5.3.3.1.3. Electroencephalography (EEG) 5.3.3.1.4. Near-Infrared Spectroscopy 5.3.3.1.5. Magnetic Resonance Imaging (MRI) 5.3.3.1.6. Others 5.3.3.2. Mexico Brain Mapping Instruments Market Size and Forecast, By End User (2023-2030) 5.3.3.2.1. Hospitals 5.3.3.2.2. Ambulatory Centers 5.3.3.2.3. Others 6. Europe Brain Mapping Instruments Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe Brain Mapping Instruments Market Size and Forecast, By Product Type (2023-2030) 6.2. Europe Brain Mapping Instruments Market Size and Forecast, By End User (2023-2030) 6.3. Europe Brain Mapping Instruments Market Size and Forecast, by Country (2023-2030) 6.3.1. United Kingdom 6.3.1.1. United Kingdom Brain Mapping Instruments Market Size and Forecast, By Product Type (2023-2030) 6.3.1.2. United Kingdom Brain Mapping Instruments Market Size and Forecast, By End User (2023-2030) 6.3.2. France 6.3.2.1. France Brain Mapping Instruments Market Size and Forecast, By Product Type (2023-2030) 6.3.2.2. France Brain Mapping Instruments Market Size and Forecast, By End User (2023-2030) 6.3.3. Germany 6.3.3.1. Germany Brain Mapping Instruments Market Size and Forecast, By Product Type (2023-2030) 6.3.3.2. Germany Brain Mapping Instruments Market Size and Forecast, By End User (2023-2030) 6.3.4. Italy 6.3.4.1. Italy Brain Mapping Instruments Market Size and Forecast, By Product Type (2023-2030) 6.3.4.2. Italy Brain Mapping Instruments Market Size and Forecast, By End User (2023-2030) 6.3.5. Spain 6.3.5.1. Spain Brain Mapping Instruments Market Size and Forecast, By Product Type (2023-2030) 6.3.5.2. Spain Brain Mapping Instruments Market Size and Forecast, By End User (2023-2030) 6.3.6. Sweden 6.3.6.1. Sweden Brain Mapping Instruments Market Size and Forecast, By Product Type (2023-2030) 6.3.6.2. Sweden Brain Mapping Instruments Market Size and Forecast, By End User (2023-2030) 6.3.7. Austria 6.3.7.1. Austria Brain Mapping Instruments Market Size and Forecast, By Product Type (2023-2030) 6.3.7.2. Austria Brain Mapping Instruments Market Size and Forecast, By End User (2023-2030) 6.3.8. Rest of Europe 6.3.8.1. Rest of Europe Brain Mapping Instruments Market Size and Forecast, By Product Type (2023-2030) 6.3.8.2. Rest of Europe Brain Mapping Instruments Market Size and Forecast, By End User (2023-2030) 7. Asia Pacific Brain Mapping Instruments Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Brain Mapping Instruments Market Size and Forecast, By Product Type (2023-2030) 7.2. Asia Pacific Brain Mapping Instruments Market Size and Forecast, By End User (2023-2030) 7.3. Asia Pacific Brain Mapping Instruments Market Size and Forecast, by Country (2023-2030) 7.3.1. China 7.3.1.1. China Brain Mapping Instruments Market Size and Forecast, By Product Type (2023-2030) 7.3.1.2. China Brain Mapping Instruments Market Size and Forecast, By End User (2023-2030) 7.3.2. S Korea 7.3.2.1. S Korea Brain Mapping Instruments Market Size and Forecast, By Product Type (2023-2030) 7.3.2.2. S Korea Brain Mapping Instruments Market Size and Forecast, By End User (2023-2030) 7.3.3. Japan 7.3.3.1. Japan Brain Mapping Instruments Market Size and Forecast, By Product Type (2023-2030) 7.3.3.2. Japan Brain Mapping Instruments Market Size and Forecast, By End User (2023-2030) 7.3.4. India 7.3.4.1. India Brain Mapping Instruments Market Size and Forecast, By Product Type (2023-2030) 7.3.4.2. India Brain Mapping Instruments Market Size and Forecast, By End User (2023-2030) 7.3.5. Australia 7.3.5.1. Australia Brain Mapping Instruments Market Size and Forecast, By Product Type (2023-2030) 7.3.5.2. Australia Brain Mapping Instruments Market Size and Forecast, By End User (2023-2030) 7.3.6. Indonesia 7.3.6.1. Indonesia Brain Mapping Instruments Market Size and Forecast, By Product Type (2023-2030) 7.3.6.2. Indonesia Brain Mapping Instruments Market Size and Forecast, By End User (2023-2030) 7.3.7. Malaysia 7.3.7.1. Malaysia Brain Mapping Instruments Market Size and Forecast, By Product Type (2023-2030) 7.3.7.2. Malaysia Brain Mapping Instruments Market Size and Forecast, By End User (2023-2030) 7.3.8. Vietnam 7.3.8.1. Vietnam Brain Mapping Instruments Market Size and Forecast, By Product Type (2023-2030) 7.3.8.2. Vietnam Brain Mapping Instruments Market Size and Forecast, By End User (2023-2030) 7.3.9. Taiwan 7.3.9.1. Taiwan Brain Mapping Instruments Market Size and Forecast, By Product Type (2023-2030) 7.3.9.2. Taiwan Brain Mapping Instruments Market Size and Forecast, By End User (2023-2030) 7.3.10. Rest of Asia Pacific 7.3.10.1. Rest of Asia Pacific Brain Mapping Instruments Market Size and Forecast, By Product Type (2023-2030) 7.3.10.2. Rest of Asia Pacific Brain Mapping Instruments Market Size and Forecast, By End User (2023-2030) 8. Middle East and Africa Brain Mapping Instruments Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. Middle East and Africa Brain Mapping Instruments Market Size and Forecast, By Product Type (2023-2030) 8.2. Middle East and Africa Brain Mapping Instruments Market Size and Forecast, By End User (2023-2030) 8.3. Middle East and Africa Brain Mapping Instruments Market Size and Forecast, by Country (2023-2030) 8.3.1. South Africa 8.3.1.1. South Africa Brain Mapping Instruments Market Size and Forecast, By Product Type (2023-2030) 8.3.1.2. South Africa Brain Mapping Instruments Market Size and Forecast, By End User (2023-2030) 8.3.2. GCC 8.3.2.1. GCC Brain Mapping Instruments Market Size and Forecast, By Product Type (2023-2030) 8.3.2.2. GCC Brain Mapping Instruments Market Size and Forecast, By End User (2023-2030) 8.3.3. Nigeria 8.3.3.1. Nigeria Brain Mapping Instruments Market Size and Forecast, By Product Type (2023-2030) 8.3.3.2. Nigeria Brain Mapping Instruments Market Size and Forecast, By End User (2023-2030) 8.3.4. Rest of ME&A 8.3.4.1. Rest of ME&A Brain Mapping Instruments Market Size and Forecast, By Product Type (2023-2030) 8.3.4.2. Rest of ME&A Brain Mapping Instruments Market Size and Forecast, By End User (2023-2030) 9. South America Brain Mapping Instruments Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 9.1. South America Brain Mapping Instruments Market Size and Forecast, By Product Type (2023-2030) 9.2. South America Brain Mapping Instruments Market Size and Forecast, By End User (2023-2030) 9.3. South America Brain Mapping Instruments Market Size and Forecast, by Country (2023-2030) 9.3.1. Brazil 9.3.1.1. Brazil Brain Mapping Instruments Market Size and Forecast, By Product Type (2023-2030) 9.3.1.2. Brazil Brain Mapping Instruments Market Size and Forecast, By End User (2023-2030) 9.3.2. Argentina 9.3.2.1. Argentina Brain Mapping Instruments Market Size and Forecast, By Product Type (2023-2030) 9.3.2.2. Argentina Brain Mapping Instruments Market Size and Forecast, By End User (2023-2030) 9.3.3. Rest Of South America 9.3.3.1. Rest Of South America Brain Mapping Instruments Market Size and Forecast, By Product Type (2023-2030) 9.3.3.2. Rest Of South America Brain Mapping Instruments Market Size and Forecast, By End User (2023-2030) 10. Global Brain Mapping Instruments Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2023) 10.3.5. Company Locations 10.4. Leading Brain Mapping Instruments Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. GE Healthcare 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Details on Partnership 11.1.7. Recent Developments 11.2. Siemens Healthineers 11.3. Philips Healthcare 11.4. Hitachi Medical Systems 11.5. Canon Medical Systems Corporation 11.6. Natus Medical Incorporated 11.7. Bio-Rad Laboratories 11.8. Nihon Kohden Corporation 11.9. Magstim Company Limited 11.10. Elekta AB 11.11. Microsoft 11.12. Rogue Research Inc. 11.13. Cephasonics 11.14. Brainlab AG 11.15. Ricoh Company, Ltd. 11.16. Compumedics Limited 11.17. ANT Neuro 11.18. EB Neuro S.p.A. 11.19. Laureate Digital Securities Pvt. Ltd. 11.20. Brain Products GmbH 12. Key Findings 13. Industry Recommendations