Bowel Management Systems Market size was valued at USD 2.8 Billion in 2024 and the total Global Bowel Management Systems Market revenue is expected to grow at a CAGR of 3.2% from 2025 to 2032, reaching nearly USD 3.6 Billion.Bowel Management Systems Market Overview

Bowel management systems are medical solutions designed to manage faecal incontinence, constipation and other bowel disorders. These systems include rectal catheters, irrigation equipment and neuromodulation technologies. They help patients to improve hygiene, dignity and quality of life, especially in clinical and homecare settings. Global Bowel Management Systems Market has been experiencing steady growth due to increasing cases of faecal incontinence, neurogenic bowel disorders and rising awareness about advanced bowel care solutions. The growing geriatric population rising adoption of minimally invasive treatments and the shift toward homecare solutions. Technological innovations such as digital integration and smart monitoring devices are further propelling the market. Emerging economies where access to healthcare is expanding particularly in Asia-Pacific along with growing demand for paediatric and low-cost bowel management solutions. The North America region dominates the global market due to high healthcare expenditure, strong product availability, and early adoption of advanced technologies. In terms of segments, the product category especially colostomy bags, hold the largest market share due to their widespread clinical and home use. Major key players in the Bowel Management Systems Market include Coloplast Corp., Convatec Inc., and Medtronic plc. Coloplast leads with its advanced irrigation systems, while Convatec is known for its Flexi-Seal™ system, and Medtronic dominates in neuromodulation solutions like InterStim™ Micro. These companies drive innovation, global reach, and market leadership. Demand is consistently high in hospitals long -term care centres and due to the patient's priority and convenience, there is a rapid demand in home settings.To know about the Research Methodology :- Request Free Sample Report

Bowel Management Systems Market Dynamics:

Safety Concerns and Innovations Reshape Growth to Drive the Market Rectal ulcer bleeding after using intestinal management system impacts sales The intestinal management system market is projected to reach approximately $ 3 billion by 2031. However, these systems are associated with complications such as rectal ampoules, rectal lacerations, and fatal bleeding from rectal trauma. As a result, healthcare professionals are becoming more aware of the long-term use of fecal management systems. Patients receiving anticoagulant therapy should be carefully monitored for signs of lower gastrointestinal bleeding. The need for continued use of this device should be assessed daily and a low threshold for removal should be used. ConvaTec Groupplc's FlexiSealTM stool management system, an Anglo-American medical product and Patient Type company, is an excellent alternative to traditional methods, but is checked for hemorrhagic rectal ulcers after use. Companies are becoming more aware of proper use and precautions to reduce patient morbidity. System with deodorant coating, heavy-duty collection bag features Manufacturers preferred in the bowel management market are expanding the production capacity of products that provide the ability to flash devices on demand and sample from sampling ports. Medical device manufacturer Primed Halberstadt Medizintechnik GmbH is known for its DIARFLEX® ADVANCED stool management system, which allows rectal administration via an irrigation port. Inspired by these innovations, Medtech companies are developing systems that offer special deodorant coatings. R&D Innovation and Non-Invasive Solutions to Boost Growth Market Companies are developing an intestinal management system with a collection bag function such as an additional activated carbon filter. Increasingly, the intestinal management system market is recognizing the importance of investing in R & D to enable us to offer dynamic and comprehensive products. For example, according to the American College of Gastroenterology in the United States, it is estimated that 10-15% of the adult population suffers from IBS symptoms. In addition, increased government R & D investment in the healthcare sector is driving the growth of the intestinal management system market. However, the lack of trained professionals and patient discomfort while using these devices is hampering market growth. On the contrary, the introduction of various new devices and the development of medical R & D facilities are expected to create favourable opportunities for the growth of the intestinal management system market. In addition, the development of the healthcare industry and increased R & D activity by major companies are expected to drive market growth over the forecast period. Currently, FI can be treated invasively (surgically) or non-invasively. Standard methods of surgical treatment include injecting biological material into the anal canal, high frequency treatment of the anal canal, and surgical repair of anal muscle damage, sacral nerve stimulation, artificial intestinal sphincter, and muscles to strengthen the anal sphincter. Includes transposition, and stoma creation. These often require long-term patient rehabilitation, are very uncomfortable and can even be very painful. As a result, preference for non-invasive approaches such as B. Disposable product use, medication, diet and lifestyle changes, exercise, biofeedback, intestinal training, transanal lavage, anterograde intestinal lavage, and Electrical stimulation. In addition, these alternative therapies are considered the front line of treatment by surgeons. Strong acceptance of non-invasive treatment options and patient preferences are expected to impede optimal growth of the intestinal management system market during the forecast period. Underreporting of Faecal Incontinence Impact of the Market It is one of the most common pathophysiological disorders in the elderly and females worldwide. Older women are at increased risk of FI due to damage to the anal sphincter during pregnancy and childbirth. However, most patients suffering from FI are hesitant to report their clinical status, primarily due to confusion. Medical professionals are also often not informed about FI because they are not fully informed about the latest FI treatment options.Bowel Management Systems Market Segment Analysis:

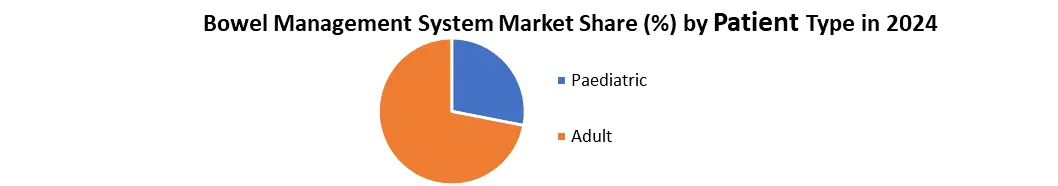

Colostomy Bags dominated the market in 2024: Based on the product, the market is categorized into artificial anal bags, irrigation systems, neural modulation devices, and others. Artificial anal bags gained the largest market share in 2024 due to increased awareness of their availability and benefits. In addition, the availability of well-structured artificial anal product reimbursement policies in developed regions is expected to drive the market during the forecast period. United Stomy Associations of America, Inc. And Colostomy U.K. It works to empower people suffering from tissue stoma such as. In addition, government agencies in developed regions have launched programs to support people with stoma by increasing access to clinically relevant and most appropriate stoma-related products. These factors are expected to further contribute to the growth of the artificial anal bag segment. Adult Patients: Key Growth Segment for the Market: Based on patient Product, the market has been bifurcated into adult and pediatric. The adult segment was the largest in 2024. It is expected to show significant growth over the forecast period. This growth can be attributed to the high prevalence of fecal incontinence among adults. It is a common condition among adults, affecting around 1 in 12 adults or 18 million people in the U.S. According to BMJ Publishing Group, fecal incontinence is very common and affects around 10.0% of the population. In addition, the increased availability of technologically advanced products has helped patients effectively treat fecal incontinence, which is estimated to help grow the overall intestinal management system market. In addition, increasing patient awareness initiatives for effective treatment of fecal incontinence continue to accelerate growth in this segment.

Bowel Management Systems Market Regional Insights:

North America accounted the majority of the market share in 2024, and this trend is expected to continue during the forecast period. This is due to the significant increase in the elderly population in the region. The United States dominated the North American market in 2024 and is expected to remain that way for the duration of the forecast. This is due to the increasing prevalence of irritable bowel syndrome in the region. According to the International Foundation of Gastrointestinal Disorders, IBS affects approximately 25 to 45 million people in the United States. In addition, the main trend in the North American bowel management system market is continuous research and development towards the development of innovative bowel management devices for fecal sludge management. The growing elderly population in the region is further contributing to the growth of the market. According to the Economics and Statistics Administration of the US Department of Commerce, the elderly population in the United States is currently growing at a slow pace. However, the Asia-Pacific region will be the most during the forecast period due to increased demand for healthcare infrastructure, increased hospital numbers in emerging markets, rapid development of the R & D sector, increased healthcare reforms and technological advances in healthcare. It is expected to grow at a fast growth rate. The objective of the report is to present a comprehensive analysis of the global Bowel Management Systems Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. Bowel Management Systems Market Competitive Landscape Major Key Players in Bowel Management Systems Market are Coloplast Corp. (USA), Convatec Inc. (USA), Medtronic plc (USA) Rising incidences of bowel dysfunction, growing awareness and technical advancements. The leading major key player, Coloplast Corp., held a dominant position with a projected 28–30% market share as of 2024. The company strong portfolio, including the Peristeen Plus system, along with its robust distribution network in North America. Contributed significantly to its leadership. Coloplast focuses on patient-centred resolutions and direct-to-consumer models, enhancing user accessibility and satisfaction. Convatec Inc. follows with a market share of 18–20%, backed by its widely adopted Flexi-Seal Fecal Management System and a strong presence in chronic care management. The company is focused on expanding its bowel care offerings through innovation and acquisitions. Medtronic plc holds a 10–12% share primarily through its advanced InterStim sacral neuromodulation system, targeting patients with neurogenic bowel disorders. Medtronic continues to invest in clinical research and hospital partnerships to promote acceptance of its neuromodulation therapies. These companies represent a competitive landscape of size by constant growing global access and increasing demand for minimum invasive and home-based bowel management solutions. Strategic participation and rising adoption in emerging markets are expected to increase the market. Bowel Management Systems Market TrendsBowel Management Systems Market Key Development • In 15 February 2024, Coloplast Corp. (North America) launched Peristeen Plus in the U.S., enhancing patient ease of use, safety, and access to home-based bowel management solutions. • In 10 May 2024, Medtronic plc (Europe) expanded InterStim™ Micro availability in Germany for neurogenic bowel care. • In 22 January 2024, Convatec Inc. (North America) acquired a digital health startup to enhance smart fecal management solutions. • In 18 March 2024, Qufora A/S (Europe) partnered with Nordic clinics to distribute advanced bowel irrigation products. • In 14 August 2023, Consure Medical (Asia Pacific) launched a low-cost bowel system targeting rural healthcare accessibility.

Trends Description Rising Adoption of Homecare Solutions Growing preference for at-home bowel management products to reduce hospital visits. Technological Advancements Innovation in bowel irrigation systems, neuromodulation, and digital tracking tools. Minimally Invasive Therapies Increased demand for less invasive solutions like sacral nerve stimulation. Bowel Management Systems Market Scope: Inquiry Before Buying

Bowel Management Systems Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 2.8 Bn. Forecast Period 2025 to 2032 CAGR: 3.2% Market Size in 2032: USD 3.6 Bn. Segments Covered: by Product Colostomy Bags Irrigation Systems Nerve Modulation Devices Other Products and Accessories by Patient Type Paediatric Adult by End-User Home Care Hospitals Ambulatory Surgery Centers Bowel Management Systems Market by Region

North America (United Patient Type Products, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Philippines, Malaysia, Vietnam, Thailand and Rest of APAC) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South AmericaBowel Management Systems Market Key Players

North America 1. Coloplast Corp. (USA) 2. Convatec Inc. (USA) 3. Medtronic plc (USA) 4. B. Braun Medical Inc. (USA) 5. Hollister Incorporated (USA) 6. Aquaflush Medical Ltd (USA) 7. Consure Medical (USA) Europe 8. Coloplast A/S (Denmark) 9. B. Braun Melsungen AG (Germany) 10. Wellspect HealthCare (Sweden) 11. MBH-International A/S (Denmark) 12. Qufora A/S (Denmark) 13. MacGregor Healthcare Ltd. (UK) 14. Aquaflush Medical Ltd (UK) 15. Norgine B.V. (Netherlands) 16. Teleflex Incorporated (Europe division) (Ireland/UK) Asia-Pacific 17. Consure Medical Pvt. Ltd. (India) 18. Welland Medical Ltd (part of CliniMed Group) (India/UK) 19. Kohler India Corporation Pvt. Ltd. (India) 20. Zhejiang Runqiang Medical Instruments Co., Ltd. (China) 21. Chongqing Jinshan Science & Patient Type (China) 22. Coloplast (China operations) (China) 23. 3M Healthcare (APAC Division) (Singapore) South America 24. Promedon S.A. (Argentina) 25. Bioclin (Quibasa) (Brazil) 26. Coloplast (Brazil division) (Brazil) 27. Medtronic Latin America (Brazil) Middle East & Africa 28. Surgitech Innovations (South Africa) 29. Medtronic Middle East (UAE/Saudi Arabia) 30. Coloplast MEA (UAE/South Africa)Frequently Asked Question

Q1. What was the market size of the Bowel Management Systems Market in 2024? Ans. Market size was valued at USD 2.8 Billion in 2024. Q2. Which product segment dominates the market? Ans. Colostomy (artificial anal) bags dominate the market. Q3. Who are the leading players in the market? Ans. Coloplast Corp., Convatec Inc., and Medtronic plc. are leading players in the market. Q4. Which region held the largest market share in 2024? Ans. North America dominated the bowel management systems market. Q5. What is a key trend driving the market? Ans. Rising adoption of homecare bowel management solutions.

1. Bowel Management Systems Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Bowel Management Systems Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. Patient Type Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Bowel Management Systems Market: Dynamics 3.1. Region wise Trends of Bowel Management Systems Market 3.1.1. North America Bowel Management Systems Market Trends 3.1.2. Europe Bowel Management Systems Market Trends 3.1.3. Asia Pacific Bowel Management Systems Market Trends 3.1.4. Middle East and Africa Bowel Management Systems Market Trends 3.1.5. South America Bowel Management Systems Market Trends 3.2. Bowel Management Systems Market Dynamics 3.2.1. Global Bowel Management Systems Market Drivers 3.2.1.1. Growing Healthcare Awareness 3.2.1.2. Non-Invasive Treatment Demand 3.2.1.3. Rising FI Prevalence 3.2.2. Global Bowel Management Systems Market Restraints 3.2.3. Global Bowel Management Systems Market Opportunities 3.2.3.1. Emerging Market Expansion 3.2.3.2. Product Innovation Surge 3.2.4. Global Bowel Management Systems Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Rising Healthcare Expenditure 3.4.2. Healthcare Policy Support 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Bowel Management Systems Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. Bowel Management Systems Market Size and Forecast, By Product (2024-2032) 4.1.1. Colostomy Bags 4.1.2. Irrigation Systems 4.1.3. Nerve Modulation Devices 4.1.4. Other Products and Accessories 4.2. Bowel Management Systems Market Size and Forecast, By Patient Type (2024-2032) 4.2.1. Paediatric 4.2.2. Adult 4.3. Bowel Management Systems Market Size and Forecast, By End-User (2024-2032) 4.3.1. Home Care 4.3.2. Hospitals 4.3.3. Ambulatory Surgery Centers 4.4. Bowel Management Systems Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Bowel Management Systems Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America Bowel Management Systems Market Size and Forecast, By Product (2024-2032) 5.1.1. Colostomy Bags 5.1.2. Irrigation Systems 5.1.3. Nerve Modulation Devices 5.1.4. Other Products and Accessories 5.2. North America Bowel Management Systems Market Size and Forecast, By Patient Type (2024-2032) 5.2.1. Paediatrics 5.2.2. Adult 5.3. North America Bowel Management Systems Market Size and Forecast, By End-User (2024-2032) 5.3.1. Home Care 5.3.2. Hospitals 5.3.3. Ambulatory Surgery Centers 5.4. North America Bowel Management Systems Market Size and Forecast, by Country (2024-2032) 5.4.1. Unite Stateses 5.4.1.1. United States Bowel Management Systems Market Size and Forecast, By Product (2024-2032) 5.4.1.1.1. Colostomy Bags 5.4.1.1.2. Irrigation Systems 5.4.1.1.3. Nerve Modulation Devices 5.4.1.1.4. Other Products and Accessories 5.4.1.2. United States Bowel Management Systems Market Size and Forecast, By Patient Type (2024-2032) 5.4.1.2.1. Paediatrics 5.4.1.2.2. Adult 5.4.1.3. United States Bowel Management Systems Market Size and Forecast, By End-User (2024-2032) 5.4.1.3.1. Home Care 5.4.1.3.2. Hospitals 5.4.1.3.3. Ambulatory Surgery Centers 5.4.2. Canada 5.4.2.1. Canada Bowel Management Systems Market Size and Forecast, By Product (2024-2032) 5.4.2.1.1. Colostomy Bags 5.4.2.1.2. Irrigation Systems 5.4.2.1.3. Nerve Modulation Devices 5.4.2.1.4. Other Products and Accessories 5.4.2.2. Canada Bowel Management Systems Market Size and Forecast, By Patient Type (2024-2032) 5.4.2.2.1. Paediatrics 5.4.2.2.2. Adult 5.4.2.3. Canada Bowel Management Systems Market Size and Forecast, By End-User (2024-2032) 5.4.2.3.1. Home Care 5.4.2.3.2. Hospitals 5.4.2.3.3. Ambulatory Surgery Centres 5.4.2.4. Mexico Bowel Management Systems Market Size and Forecast, By Product (2024-2032) 5.4.2.4.1. Colostomy Bags 5.4.2.4.2. Irrigation Systems 5.4.2.4.3. Nerve Modulation Devices 5.4.2.4.4. Other Products and Accessories 5.4.2.5. Mexico Bowel Management Systems Market Size and Forecast, By Patient Type (2024-2032) 5.4.2.5.1. Paediatrics 5.4.2.5.2. Adult 5.4.2.6. Mexico Bowel Management Systems Market Size and Forecast, By End-User (2024-2032) 5.4.2.6.1. Home Care 5.4.2.6.2. Hospitals 5.4.2.6.3. Ambulatory Surgery Centers 6. Europe Bowel Management Systems Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe Bowel Management Systems Market Size and Forecast, By Product (2024-2032) 6.2. Europe Bowel Management Systems Market Size and Forecast, By Patient Type (2024-2032) 6.3. Europe Bowel Management Systems Market Size and Forecast, By End-User (2024-2032) 6.4. Europe Bowel Management Systems Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Bowel Management Systems Market Size and Forecast, By Product (2024-2032) 6.4.1.2. United Kingdom Bowel Management Systems Market Size and Forecast, By Patient Type (2024-2032) 6.4.1.3. United Kingdom Bowel Management Systems Market Size and Forecast, By End-User (2024-2032) 6.4.2. France 6.4.2.1. France Bowel Management Systems Market Size and Forecast, By Product (2024-2032) 6.4.2.2. France Bowel Management Systems Market Size and Forecast, By Patient Type (2024-2032) 6.4.2.3. France Bowel Management Systems Market Size and Forecast, By End-User (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Bowel Management Systems Market Size and Forecast, By Product (2024-2032) 6.4.3.2. Germany Bowel Management Systems Market Size and Forecast, By Patient Type (2024-2032) 6.4.3.3. Germany Bowel Management Systems Market Size and Forecast, By End-User (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Bowel Management Systems Market Size and Forecast, By Product (2024-2032) 6.4.4.2. Italy Bowel Management Systems Market Size and Forecast, By Patient Type (2024-2032) 6.4.4.3. Italy Bowel Management Systems Market Size and Forecast, By End-User (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Bowel Management Systems Market Size and Forecast, By Product (2024-2032) 6.4.5.2. Spain Bowel Management Systems Market Size and Forecast, By Patient Type (2024-2032) 6.4.5.3. Spain Bowel Management Systems Market Size and Forecast, By End-User (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Bowel Management Systems Market Size and Forecast, By Product (2024-2032) 6.4.6.2. Sweden Bowel Management Systems Market Size and Forecast, By Patient Type (2024-2032) 6.4.6.3. Sweden Bowel Management Systems Market Size and Forecast, By End-User (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Bowel Management Systems Market Size and Forecast, By Product (2024-2032) 6.4.7.2. Austria Bowel Management Systems Market Size and Forecast, By Patient Type (2024-2032) 6.4.7.3. Austria Bowel Management Systems Market Size and Forecast, By End-User (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Bowel Management Systems Market Size and Forecast, By Product (2024-2032) 6.4.8.2. Rest of Europe Bowel Management Systems Market Size and Forecast, By Patient Type (2024-2032) 6.4.8.3. Rest of Europe Bowel Management Systems Market Size and Forecast, By End-User (2024-2032) 7. Asia Pacific Bowel Management Systems Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific Bowel Management Systems Market Size and Forecast, By Product (2024-2032) 7.2. Asia Pacific Bowel Management Systems Market Size and Forecast, By Patient Type (2024-2032) 7.3. Asia Pacific Bowel Management Systems Market Size and Forecast, By End-User (2024-2032) 7.4. Asia Pacific Bowel Management Systems Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Bowel Management Systems Market Size and Forecast, By Product (2024-2032) 7.4.1.2. China Bowel Management Systems Market Size and Forecast, By Patient Type (2024-2032) 7.4.1.3. China Bowel Management Systems Market Size and Forecast, By End-User (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Bowel Management Systems Market Size and Forecast, By Product (2024-2032) 7.4.2.2. S Korea Bowel Management Systems Market Size and Forecast, By Patient Type (2024-2032) 7.4.2.3. S Korea Bowel Management Systems Market Size and Forecast, By End-User (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Bowel Management Systems Market Size and Forecast, By Product (2024-2032) 7.4.3.2. Japan Bowel Management Systems Market Size and Forecast, By Patient Type (2024-2032) 7.4.3.3. Japan Bowel Management Systems Market Size and Forecast, By End-User (2024-2032) 7.4.4. India 7.4.4.1. India Bowel Management Systems Market Size and Forecast, By Product (2024-2032) 7.4.4.2. India Bowel Management Systems Market Size and Forecast, By Patient Type (2024-2032) 7.4.4.3. India Bowel Management Systems Market Size and Forecast, By End-User (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Bowel Management Systems Market Size and Forecast, By Product (2024-2032) 7.4.5.2. Australia Bowel Management Systems Market Size and Forecast, By Patient Type (2024-2032) 7.4.5.3. Australia Bowel Management Systems Market Size and Forecast, By End-User (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Bowel Management Systems Market Size and Forecast, By Product (2024-2032) 7.4.6.2. Indonesia Bowel Management Systems Market Size and Forecast, By Patient Type (2024-2032) 7.4.6.3. Indonesia Bowel Management Systems Market Size and Forecast, By End-User (2024-2032) 7.4.7. Philippines 7.4.7.1. Philippines Bowel Management Systems Market Size and Forecast, By Product (2024-2032) 7.4.7.2. Philippines Bowel Management Systems Market Size and Forecast, By Patient Type (2024-2032) 7.4.7.3. Philippines Bowel Management Systems Market Size and Forecast, By End-User (2024-2032) 7.4.8. Malaysia 7.4.8.1. Malaysia Bowel Management Systems Market Size and Forecast, By Product (2024-2032) 7.4.8.2. Malaysia Bowel Management Systems Market Size and Forecast, By Patient Type (2024-2032) 7.4.8.3. Malaysia Bowel Management Systems Market Size and Forecast, By End-User (2024-2032) 7.4.9. Vietnam 7.4.9.1. Vietnam Bowel Management Systems Market Size and Forecast, By Product (2024-2032) 7.4.9.2. Vietnam Bowel Management Systems Market Size and Forecast, By Patient Type (2024-2032) 7.4.9.3. Vietnam Bowel Management Systems Market Size and Forecast, By End-User (2024-2032) 7.4.10. Thailand 7.4.10.1. Thailand Bowel Management Systems Market Size and Forecast, By Product (2024-2032) 7.4.10.2. Thailand Bowel Management Systems Market Size and Forecast, By Patient Type (2024-2032) 7.4.10.3. Thailand Bowel Management Systems Market Size and Forecast, By End-User (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Bowel Management Systems Market Size and Forecast, By Product (2024-2032) 7.4.11.2. Rest of Asia Pacific Bowel Management Systems Market Size and Forecast, By Patient Type (2024-2032) 7.4.11.3. Rest of Asia Pacific Bowel Management Systems Market Size and Forecast, By End-User (2024-2032) 8. Middle East and Africa Bowel Management Systems Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 8.1. Middle East and Africa Bowel Management Systems Market Size and Forecast, By Product (2024-2032) 8.2. Middle East and Africa Bowel Management Systems Market Size and Forecast, By Patient Type (2024-2032) 8.3. Middle East and Africa Bowel Management Systems Market Size and Forecast, By End-User (2024-2032) 8.4. Middle East and Africa Bowel Management Systems Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Bowel Management Systems Market Size and Forecast, By Product (2024-2032) 8.4.1.2. South Africa Bowel Management Systems Market Size and Forecast, By Patient Type (2024-2032) 8.4.1.3. South Africa Bowel Management Systems Market Size and Forecast, By End-User (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Bowel Management Systems Market Size and Forecast, By Product (2024-2032) 8.4.2.2. GCC Bowel Management Systems Market Size and Forecast, By Patient Type (2024-2032) 8.4.2.3. GCC Bowel Management Systems Market Size and Forecast, By End-User (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Bowel Management Systems Market Size and Forecast, By Product (2024-2032) 8.4.3.2. Nigeria Bowel Management Systems Market Size and Forecast, By Patient Type (2024-2032) 8.4.3.3. Nigeria Bowel Management Systems Market Size and Forecast, By End-User (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Bowel Management Systems Market Size and Forecast, By Product (2024-2032) 8.4.4.2. Rest of ME&A Bowel Management Systems Market Size and Forecast, By Patient Type (2024-2032) 8.4.4.3. Rest of ME&A Bowel Management Systems Market Size and Forecast, By End-User (2024-2032) 9. South America Bowel Management Systems Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 9.1. South America Bowel Management Systems Market Size and Forecast, By Product (2024-2032) 9.2. South America Bowel Management Systems Market Size and Forecast, By Patient Type (2024-2032) 9.3. South America Bowel Management Systems Market Size and Forecast, By End-User (2024-2032) 9.4. South America Bowel Management Systems Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Bowel Management Systems Market Size and Forecast, By Product (2024-2032) 9.4.1.2. Brazil Bowel Management Systems Market Size and Forecast, By Patient Type (2024-2032) 9.4.1.3. Brazil Bowel Management Systems Market Size and Forecast, By End-User (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Bowel Management Systems Market Size and Forecast, By Product (2024-2032) 9.4.2.2. Argentina Bowel Management Systems Market Size and Forecast, By Patient Type (2024-2032) 9.4.2.3. Argentina Bowel Management Systems Market Size and Forecast, By End-User (2024-2032) 9.4.3. Rest of South America 9.4.3.1. Rest of South America Bowel Management Systems Market Size and Forecast, By Product (2024-2032) 9.4.3.2. Rest of South America Bowel Management Systems Market Size and Forecast, By Patient Type (2024-2032) 9.4.3.3. Rest of South America Bowel Management Systems Market Size and Forecast, By End-User (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Industry Players) 10.1. Coloplast Corp. (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Convatec Inc. (USA) 10.3. Medtronic plc (USA) 10.4. B. Braun Medical Inc. (USA) 10.5. Hollister Incorporated (USA) 10.6. Aquaflush Medical Ltd (USA) 10.7. Consure Medical (USA/India) 10.8. Coloplast A/S (Denmark) 10.9. B. Braun Melsungen AG (Germany) 10.10. Wellspect HealthCare (Sweden) 10.11. MBH-International A/S (Denmark) 10.12. Qufora A/S (Denmark) 10.13. MacGregor Healthcare Ltd. (UK) 10.14. Aquaflush Medical Ltd (UK) 10.15. Norgine B.V. (Netherlands) 10.16. Teleflex Incorporated (Europe division) (Ireland/UK) 10.17. Consure Medical Pvt. Ltd. (India) 10.18. Welland Medical Ltd (part of CliniMed Group) (India/UK) 10.19. Kohler India Corporation Pvt. Ltd. (India) 10.20. Zhejiang Runqiang Medical Instruments Co., Ltd. (China) 10.21. Chongqing Jinshan Science & Patient Type (China) 10.22. Coloplast (China operations) (China) 10.23. 3M Healthcare (APAC Division) (Singapore/Global) 10.24. Promedon S.A. (Argentina) 10.25. Bioclin (Quibasa) (Brazil) 10.26. Coloplast (Brazil division) (Brazil) 10.27. Medtronic Latin America (Mexico/Brazil) 10.28. Surgitech Innovations (South Africa) 10.29. Medtronic Middle East (UAE/Saudi Arabia) 10.30. Coloplast MEA (UAE/South Africa) 11. Key Findings 12. Analyst Recommendations 13. Bowel Management Systems Market: Research Methodology