Bonding Films Market size was valued at USD 1.171 Bn in 2024, and the total Bonding Films revenue is expected to grow at a CAGR of 8.04% from 2025 to 2032, reaching nearly USD 2.175 Bn.Bonding Films Market Overview

A high-strength, quick-bonding adhesive film for both metal and plastic bonds is referred to as a bonding film. It is a substance that adheres to surfaces to hold things together. Flexible, limited bond widths, minimal leaking, and controlled and uniform thickness are all traits of bonding films. Due to their wide range of uses, including high strength, quick bonding, high-temperature protection, etc., bonding films are widely utilized in a variety of industries. The bonding films are utilized for a variety of applications since they are economical. The use of bonding films has many advantages, including good adherence to a variety of surfaces, a layer of dielectric insulation, strong internal and structural linkages, and much more. Electrical, electronic, and automotive industries all require bonding films since they act as insulators. An important element driving the growth of the global bonding films market is the increasing need for these films in end-use industries, including electronics, transportation, and others. In addition, benefits provided by bonding films, including ease of handling, affordability, and effective performance across a range of temperatures and environmental conditions, are significant drivers of the market's growth in a variety of industries over the forecast period. The Asia-Pacific (APAC) region dominated the global bonding films market in 2024, fueled by massive electronics manufacturing in China, Japan, and South Korea, along with booming demand for EVs and semiconductors. Leading players driving innovation include Henkel AG & Co. KGaA (Germany) in AI chip packaging, DuPont (USA) in advanced semiconductor films, 3M (USA) in EV battery solutions, Toray Industries (Japan) in sustainable films, and Hitachi Chemical (Japan) in display technologies, collectively shaping the industry with cutting-edge and eco-friendly adhesive solutions.To know about the Research Methodology:-Request Free Sample Report The report provides a complete analysis of the global Bonding Films Market. This report estimates the Bonding Films Market, in terms of USD value, from 2024 to 2032. This report forecasts revenue growth at global, regional & country levels and provides a detailed analysis of the latest trends in each of the segments from 2024 to 2032. This market is thoroughly examined both qualitatively and quantitatively. Additionally includes a thorough analysis of the major market drivers, barriers, opportunities, challenges, and trends. The report addresses several key industry characteristics. The Bonding Films Market Research Report includes a value chain analysis, PESTLE analysis, Porter's Five Forces model, competitive landscape, benchmarking of key players (by product, price, investments, expansion plans, physical presence, and market presence), market dynamics, market forecasts in terms of value, and future trends. The market potential for growth in various geographies is examined in the Bonding Films Market Report. The regions of North America, Latin America, Asia-Pacific, Europe, the Middle East, and Africa are all covered in the report. The research also discusses the major growth prospects in various regional markets, on which businesses joining the Bonding Films market should concentrate to achieve success. In addition to examining the top players, the report also discusses the competitive landscape of the Bonding Films market and the investment prospects for current market participants and new entrants.

Bonding Films Market Dynamics

Increasing Demand for Advanced Packaging Solutions in the Electronics Industry to Drive the Bonding Films Market

The global bonding films market is experiencing significant growth, driven by the rising demand for advanced packaging solutions in the electronics industry. With the rapid expansion of consumer electronics, automotive electronics, and IoT devices, manufacturers are increasingly adopting bonding films for their superior adhesion, thermal conductivity, and electrical insulation properties. The miniaturization of electronic components and the shift toward high-density interconnects further amplify the need for high-performance bonding films. Additionally, the growing adoption of flexible and foldable displays in smartphones and wearable devices is fueling market demand. As industries prioritize lightweight, durable, and efficient packaging solutions, bonding films emerge as a critical enabler of next-generation electronic devices, propelling market growth at a steady pace.High Cost of Specialty Bonding Films to Restrain Bonding Films Market

The high cost of specialty bonding films, particularly those with advanced functionalities such as high thermal stability and ultra-thin profiles, poses a significant challenge to their widespread adoption. Price-sensitive industries may opt for cheaper alternatives, thereby limiting market expansion.Growth in Electric Vehicles (EVs) and Renewable Energy Sectors to Create Bonding Films Market

The surge in electric vehicle production and renewable energy installations presents a lucrative opportunity for the market. These films are essential for battery assembly, photovoltaic modules, and lightweight automotive components, driving demand in sustainable technology applications. As governments worldwide implement stricter emissions regulations and promote clean energy initiatives, the adoption of EVs and solar energy systems is accelerating rapidly. This trend positions bonding films as a critical material solution, offering manufacturers significant growth potential in these expanding sectors. The development of high-performance, durable bonding films tailored for energy storage and conversion applications further enhances this opportunity, creating new revenue streams for market players.Bonding Films Market Segment Analysis:

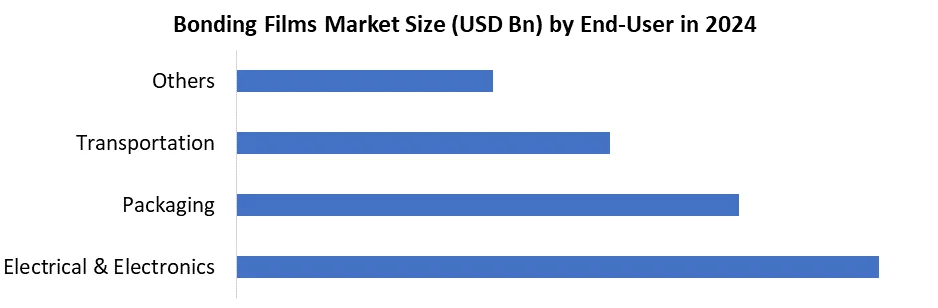

Based on the End-use Industry, Bonding Films Market is segmented into Electrical & Electronics, Packaging, Transportation, and Others. The Electrical & Electronics segment dominated the market in 2024 and is expected to hold the largest market share over the forecast period. Dominance is due to the spread of smartphones, IoT devices, and advanced semiconductor packaging. Bonding movies are important in PCB assembly, display panel (OLED/LCD), and chip stacking (3D ICS), where ultra-inges High-identical-conductivity adhesives ensure miniatures and heat dissipation. The motor vehicle/transport sector follows. Fuel is provided by an EV battery. Insulation and light have an overall relationship, while packaging depends on films. For flexible electronics and moisture-resistant seals. However, the electronics primary development engine remains with innovations like hybrid bonding 2.5D/3D ICS and foldable display disappointment demand. Asia-Pacific Leeds Consumption of semiconductors and consumer electronics manufacturing, while North America and Europe see a strong shift in high-ecology motor vehicles and aerospace apps. The dominance of the section is expected to continue with 5G, supported by AI hardware and wearable technical trends.

Bonding Films Market Regional Analysis

Asia Pacific held the largest market share in 2024. The presence of several major bonding film producers in the region, together with rising demand from a variety of end-use industries, including electrical & electronics and transportation in nations like China, South Korea, Japan, and Taiwan, is attributed to the industry's growth. Additionally, the region's easy access to raw materials has drawn several international businesses and investors to establish production facilities there, which has fueled the growth of the Asia Pacific bonding films market. In addition, a significant share of the market is accounted for by Europe and North America. Due to strict government rules against the use of harmful adhesives, the bonding film market in the region is expected to grow slowly.Bonding Films Market Competitive Landscape

The Bonding Films Market is dominated by two leading players: Henkel AG & Company KGaA and DuPont de Nemours, Inc. Henkel, a global leader in adhesive technologies, reported $ XX million in its adhesive technique (2024), operated by its adhesive technologies, operated in electronics (semiconductor packaging). Its Loctite and Technomelt brands are used widely in consumer electronics and industrial applications. Another industry giant, DuPont, produced $ XX billion (2024) from its electronics and industrial segment, further, and is required for advanced semiconductor packaging and 5G devices with Interra bonding films. Both companies invest heavily in durable, bio-based films in R&D-Hankel, and ultra-thin edges for AI and IOT applications, high-ingredients adhesives (DuPont). Their dominance stems from strategic acquisition, strong OEM participation (Apple, TSMC, Tesla), and regional manufacturing, especially in the Asia-Pacific.Bonding Films Market Recent Trends

1. Ultra-Thin Films Dominate Electronics The market is shifting toward sub-10µm films for advanced chip packaging, micro-LEDs, and AI hardware, driven by demand for precision adhesion and thermal management in next-gen devices. 2. Sustainable Films Gain Traction Bio-based, low-VOC bonding films are rising due to eco-regulations, with plant-based epoxies reducing petroleum use by 90% while maintaining performance in automotive and electronics. 3. Smart Films Enable New Applications Self-healing and conductive adhesives are transforming EVs and 5G tech, with microcapsule-based films repairing cracks and ECAs replacing solder in high-frequency mm Wave devices.Bonding Films Market Recent Development

Date Company Headquarters Recent Development 12 March 2024 Henkel AG & Co. KGaA Düsseldorf, Germany Launched Loctite ABLESTIK NCA 2000 for AI chip packaging 22 February 2024 DuPont de Nemours Wilmington, USA Released Interra HK 2945 for advanced semiconductor packaging 5 January 2024 3M Company Minnesota, USA Introduced flame-retardant bonding film for EV batteries 18 April 2024 Toray Industries Tokyo, Japan Unveiled bio-based bonding film with 30% plant-derived materials 9 May 2024 Hitachi Chemical Tokyo, Japan Expanded ACF production for foldable OLED displays Bonding Films Market Scope: Inquire before buying

Global Bonding Films Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 1.171 Bn. Forecast Period 2025 to 2032 CAGR: 8.04% Market Size in 2032: USD 2.175 Bn. Segments Covered: by Type Epoxy Polyurethane Acrylic Others by Technology Thermally Cured Pressure Cured Others by End User Industry Electrical & Electronics Packaging Transportation Others Bonding Films Market, by Region

North America (United States, Canada and Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Russia, Rest of Europe) Asia Pacific (China, Japan, South Korea, India, Australia, Malaysia, Thailand, Vietnam, Indonesia, Philippines, Rest of APAC) Middle East and Africa (South Africa, GCC, Nigeria, Egypt, Turkey, Rest of MEA) South America (Brazil, Argentina, Colombia, Chile, Peru, Rest of South America)Bonding Films Key Players are:

North America 1. DuPont de Nemours, Inc. - United States 2. 3M Company - United States 3. Henkel Corporation (US Operations) - United States 4. Avery Dennison Corporation - United States 5. Dow Inc. - United States 6. H.B. Fuller Company - United States Europe 1. Henkel AG & Co. KGaA - Germany 2. Sika AG - Switzerland 3. Arkema (Bostik SA) - France 4. BASF SE - Germany 5. Solvay SA - Belgium 6. Tesa SE (a Beiersdorf company) - Germany Asia Pacific 1. Toray Industries, Inc. - Japan 2. Hitachi Chemical Co., Ltd. (Showa Denko Materials) - Japan 3. Nitto Denko Corporation - Japan 4. Lintec Corporation - Japan 5. Sekisui Chemical Co., Ltd. - Japan Middle East and Africa 1. Sika AG (MEA Operations) – UAE (Dubai) 2. Henkel Middle East (Henkel AG Subsidiary) – UAE (Dubai) 3. Al Muqarram Group – Saudi Arabia (Riyadh) South America 1. Adexus (formerly BASF Chile) – Chile 2. Pegatec Adesivos – BrazilFrequently Asked Questions:

1. What is the study period of the market? Ans. The Global market is studied from 2024-2032 2. What is the growth rate of the Bonding Films Market? Ans. The Bonding Films Market is growing at a CAGR of 8.04% over the forecast period. 3. What is the market size of the Bonding Films Market by 2032? Ans. The market size of the Bonding Films Market by 2032 is expected to reach USD 2.175 Bn. 4. What is the forecast period for the Bonding Films Market? Ans. The forecast period for the Bonding Films Market is 2025-2032 5. What was the market size of the Bonding Films Market in 2024? Ans. The market size of the Bonding Films Market in 2024 was valued at USD 1.171 Bn.

1. Global Bonding Films Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Bonding Films Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Headquarter 2.4.3. Business Segment 2.4.4. End-user Segment 2.4.5. Revenue (2024) 2.4.6. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Global Bonding Films Market: Dynamics 3.1. Global Bonding Films Market Trends by Region 3.1.1. North America Global Bonding Films Market Trends 3.1.2. Europe Global Bonding Films Market Trends 3.1.3. Asia Pacific Global Bonding Films Market Trends 3.1.4. Middle East and Africa Global Bonding Films Market Trends 3.1.5. South America Global Bonding Films Market Trends 3.2. Global Bonding Films Market Dynamics 3.2.1. Global Bonding Films Market Drivers 3.2.1.1.1. Cost-Effectiveness 3.2.2. Global Bonding Films Market Restraints 3.2.3. Global Bonding Films Market Opportunities 3.2.3.1.1. Eco-Friendly Formulations 3.2.3.1.2. Automotive Electrification 3.2.4. Global Bonding Films Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.4.1.1. Bans Drive Bio-Shift 3.4.1.2. Gen Z’s Eco-Pressure 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 3.6. Key Opinion Leader Analysis for Minimally Invasive Glaucoma Surgery Devices Industry 4. Global Bonding Films Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 4.1. Global Bonding Films Market Size and Forecast, By Type (2024-2032) 4.1.1. Epoxy 4.1.2. Polyurethane 4.1.3. Acrylic 4.1.4. Others 4.2. Global Bonding Films Market Size and Forecast, By Application (2024-2032) 4.2.1. Thermally Cured 4.2.2. Pressure Cured 4.2.3. Others 4.3. Global Bonding Films Market Size and Forecast, By End-Users (2024-2032) 4.3.1. Electrical & Electronics 4.3.2. Packaging 4.3.3. Transportation 4.3.4. Others 4.4. Global Bonding Films Market Size and Forecast, By Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Global Bonding Films Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 5.1. North America Global Bonding Films Market Size and Forecast, By Type (2024-2032) 5.1.1. Epoxy 5.1.2. Polyurethane 5.1.3. Acrylic 5.1.4. Others 5.2. North America Global Bonding Films Market Size and Forecast, By Application (2024-2032) 5.2.1. Thermally Cured 5.2.2. Pressure Cured 5.2.3. Others 5.3. North America Global Bonding Films Market Size and Forecast, By End-Users (2024-2032) 5.3.1. Electrical & Electronics 5.3.2. Packaging 5.3.3. Transportation 5.3.4. Others 5.4. North America Global Bonding Films Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Global Bonding Films Market Size and Forecast, By Type (2024-2032) 5.4.1.1.1. Epoxy 5.4.1.1.2. Polyurethane 5.4.1.1.3. Acrylic 5.4.1.1.4. Others 5.4.1.2. United States Global Bonding Films Market Size and Forecast, By Application (2024-2032) 5.4.1.2.1. Thermally Cured 5.4.1.2.2. Pressure Cured 5.4.1.2.3. Others 5.4.1.3. United States Global Bonding Films Market Size and Forecast, By End-Users (2024-2032) 5.4.1.3.1. Electrical & Electronics 5.4.1.3.2. Packaging 5.4.1.3.3. Transportation 5.4.1.3.4. Others 5.4.2. Canada 5.4.2.1. Canada Global Bonding Films Market Size and Forecast, By Type (2024-2032) 5.4.2.1.1. Epoxy 5.4.2.1.2. Polyurethane 5.4.2.1.3. Acrylic 5.4.2.1.4. Others 5.4.2.2. Canada Global Bonding Films Market Size and Forecast, By Application (2024-2032) 5.4.2.2.1. Thermally Cured 5.4.2.2.2. Pressure Cured 5.4.2.2.3. Others 5.4.3. Canada Global Bonding Films Market Size and Forecast, By End-Users Industry (2024-2032) 5.4.3.1.1. Electrical & Electronics 5.4.3.1.2. Packaging 5.4.3.1.3. Transportation 5.4.3.1.4. Others 5.4.4. Mexico 5.4.4.1. Mexico Global Bonding Films Market Size and Forecast, By Type (2024-2032) 5.4.4.1.1. Epoxy 5.4.4.1.2. Polyurethane 5.4.4.1.3. Acrylic 5.4.4.1.4. Others 5.4.4.2. Mexico Global Bonding Films Market Size and Forecast, By Application (2024-2032) 5.4.4.2.1. Thermally Cured 5.4.4.2.2. Pressure Cured 5.4.4.2.3. Others 5.4.4.3. Mexico Global Bonding Films Market Size and Forecast, By End-Users (2024-2032) 5.4.4.3.1. Electrical & Electronics 5.4.4.3.2. Packaging 5.4.4.3.3. Transportation 5.4.4.3.4. Others 6. Europe Global Bonding Films Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 6.1. Europe Global Bonding Films Market Size and Forecast, By Type (2024-2032) 6.2. Europe Global Bonding Films Market Size and Forecast, By Application (2024-2032) 6.3. Europe Global Bonding Films Market Size and Forecast, By End-Users (2024-2032) 6.4. Europe Global Bonding Films Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Global Bonding Films Market Size and Forecast, By Type (2024-2032) 6.4.1.2. United Kingdom Global Bonding Films Market Size and Forecast, By Application (2024-2032) 6.4.1.3. United Kingdom Global Bonding Films Market Size and Forecast, By End-Users (2024-2032) 6.4.2. France 6.4.2.1. France Global Bonding Films Market Size and Forecast, By Type (2024-2032) 6.4.2.2. France Global Bonding Films Market Size and Forecast, By Application (2024-2032) 6.4.2.3. France Global Bonding Films Market Size and Forecast, By End-Users (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Global Bonding Films Market Size and Forecast, By Type (2024-2032) 6.4.3.2. Germany Global Bonding Films Market Size and Forecast, By Application (2024-2032) 6.4.3.3. Germany Global Bonding Films Market Size and Forecast, By End-Users (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Global Bonding Films Market Size and Forecast, By Type (2024-2032) 6.4.4.2. Italy Global Bonding Films Market Size and Forecast, By Application (2024-2032) 6.4.4.3. Italy Global Bonding Films Market Size and Forecast, By End-Users (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Global Bonding Films Market Size and Forecast, By Type (2024-2032) 6.4.5.2. Spain Global Bonding Films Market Size and Forecast, By Application (2024-2032) 6.4.5.3. Spain Global Bonding Films Market Size and Forecast, By End-Users (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Global Bonding Films Market Size and Forecast, By Type (2024-2032) 6.4.6.2. Sweden Global Bonding Films Market Size and Forecast, By Application (2024-2032) 6.4.6.3. Sweden Global Bonding Films Market Size and Forecast, By End-Users (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Global Bonding Films Market Size and Forecast, By Type (2024-2032) 6.4.7.2. Austria Global Bonding Films Market Size and Forecast, By Application (2024-2032) 6.4.7.3. Austria Global Bonding Films Market Size and Forecast, By End-Users (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Global Bonding Films Market Size and Forecast, By Type (2024-2032) 6.4.8.2. Rest of Europe Global Bonding Films Market Size and Forecast, By Application (2024-2032) 6.4.8.3. Rest of Europe Global Bonding Films Market Size and Forecast, By End-Users (2024-2032) 7. Asia Pacific Global Bonding Films Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 7.1. Asia Pacific Global Bonding Films Market Size and Forecast, By Type (2024-2032) 7.2. Asia Pacific Global Bonding Films Market Size and Forecast, By Application (2024-2032) 7.3. Asia Pacific Global Bonding Films Market Size and Forecast, By End-Users (2024-2032) 7.4. Asia Pacific Global Bonding Films Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Global Bonding Films Market Size and Forecast, By Type (2024-2032) 7.4.1.2. China Global Bonding Films Market Size and Forecast, By Application (2024-2032) 7.4.1.3. China Global Bonding Films Market Size and Forecast, By End-Users (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Global Bonding Films Market Size and Forecast, By Type (2024-2032) 7.4.2.2. S Korea Global Bonding Films Market Size and Forecast, By Application (2024-2032) 7.4.2.3. S Korea Global Bonding Films Market Size and Forecast, By End-Users (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Global Bonding Films Market Size and Forecast, By Type (2024-2032) 7.4.3.2. Japan Global Bonding Films Market Size and Forecast, By Application (2024-2032) 7.4.3.3. Japan Global Bonding Films Market Size and Forecast, By End-Users (2024-2032) 7.4.4. India 7.4.4.1. India Global Bonding Films Market Size and Forecast, By Type (2024-2032) 7.4.4.2. India Global Bonding Films Market Size and Forecast, By Application (2024-2032) 7.4.4.3. India Global Bonding Films Market Size and Forecast, By End-Users (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Global Bonding Films Market Size and Forecast, By Type (2024-2032) 7.4.5.2. Australia Global Bonding Films Market Size and Forecast, By Application (2024-2032) 7.4.5.3. Australia Global Bonding Films Market Size and Forecast, By End-Users (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Global Bonding Films Market Size and Forecast, By Type (2024-2032) 7.4.6.2. Indonesia Global Bonding Films Market Size and Forecast, By Application (2024-2032) 7.4.6.3. Indonesia Global Bonding Films Market Size and Forecast, By End-Users (2024-2032) 7.4.7. Philippines 7.4.7.1. Philippines Global Bonding Films Market Size and Forecast, By Type (2024-2032) 7.4.7.2. Philippines Global Bonding Films Market Size and Forecast, By Application (2024-2032) 7.4.7.3. Philippines Global Bonding Films Market Size and Forecast, By End-Users (2024-2032) 7.4.8. Malaysia 7.4.8.1. Malaysia Global Bonding Films Market Size and Forecast, By Type (2024-2032) 7.4.8.2. Malaysia Global Bonding Films Market Size and Forecast, By Application (2024-2032) 7.4.8.3. Malaysia Global Bonding Films Market Size and Forecast, By End-Users (2024-2032) 7.4.9. Vietnam 7.4.9.1. Vietnam Global Bonding Films Market Size and Forecast, By Type (2024-2032) 7.4.9.2. Vietnam Global Bonding Films Market Size and Forecast, By Application (2024-2032) 7.4.9.3. Vietnam Global Bonding Films Market Size and Forecast, By End-Users (2024-2032) 7.4.10. Thailand 7.4.10.1. Thailand Global Bonding Films Market Size and Forecast, By Type (2024-2032) 7.4.10.2. Thailand Global Bonding Films Market Size and Forecast, By Application (2024-2032) 7.4.10.3. Thailand Global Bonding Films Market Size and Forecast, By End-Users (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Global Bonding Films Market Size and Forecast, By Type (2024-2032) 7.4.11.2. Rest of Asia Pacific Global Bonding Films Market Size and Forecast, By Application (2024-2032) 7.4.11.3. Rest of Asia Pacific Global Bonding Films Market Size and Forecast, By End-Users (2024-2032) 8. Middle East and Africa Global Bonding Films Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 8.1. Middle East and Africa Global Bonding Films Market Size and Forecast, By Type (2024-2032) 8.2. Middle East and Africa Global Bonding Films Market Size and Forecast, By Application (2024-2032) 8.3. Middle East and Africa Global Bonding Films Market Size and Forecast, By End-Users (2024-2032) 8.4. Middle East and Africa Global Bonding Films Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Global Bonding Films Market Size and Forecast, By Type (2024-2032) 8.4.1.2. South Africa Global Bonding Films Market Size and Forecast, By Application (2024-2032) 8.4.1.3. South Africa Global Bonding Films Market Size and Forecast, By End-Users (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Global Bonding Films Market Size and Forecast, By Type (2024-2032) 8.4.2.2. GCC Global Bonding Films Market Size and Forecast, By Application (2024-2032) 8.4.2.3. GCC Global Bonding Films Market Size and Forecast, By End-Users (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Global Bonding Films Market Size and Forecast, By Type (2024-2032) 8.4.3.2. Nigeria Global Bonding Films Market Size and Forecast, By Application (2024-2032) 8.4.3.3. Nigeria Global Bonding Films Market Size and Forecast, By End-Users (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Global Bonding Films Market Size and Forecast, By Type (2024-2032) 8.4.4.2. Rest of ME&A Global Bonding Films Market Size and Forecast, By Application (2024-2032) 8.4.4.3. Rest of ME&A Global Bonding Films Market Size and Forecast, By End-Users (2024-2032) 9. South America Global Bonding Films Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 9.1. South America Global Bonding Films Market Size and Forecast, By Type (2024-2032) 9.2. South America Global Bonding Films Market Size and Forecast, By Application (2024-2032) 9.3. South America Global Bonding Films Market Size and Forecast, By End-Users (2024-2032) 9.4. South America Global Bonding Films Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Global Bonding Films Market Size and Forecast, By Type (2024-2032) 9.4.1.2. Brazil Global Bonding Films Market Size and Forecast, By Application (2024-2032) 9.4.1.3. Brazil Global Bonding Films Market Size and Forecast, By End-Users (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Global Bonding Films Market Size and Forecast, By Type (2024-2032) 9.4.2.2. Argentina Global Bonding Films Market Size and Forecast, By Application (2024-2032) 9.4.2.3. Argentina Global Bonding Films Market Size and Forecast, By End-Users (2024-2032) 9.4.3. Rest of South America 9.4.3.1. Rest of South America Global Bonding Films Market Size and Forecast, By Type (2024-2032) 9.4.3.2. Rest of South America Global Bonding Films Market Size and Forecast, By Application (2024-2032) 9.4.3.3. Rest of South America Global Bonding Films Market Size and Forecast, By End-Users (2024-2032) 10. Company Profile: Key Players 10.1. DuPont de Nemours, Inc. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. 3M Company 10.3. Henkel Corporation (US Operations) 10.4. Avery Dennison Corporation 10.5. Dow Inc. 10.6. H.B. Fuller Company 10.7. Henkel AG & Co. KGaA 10.8. Sika AG 10.9. Arkema (Bostik SA) 10.10. BASF SE 10.11. Solvay 10.12. Tesa SE (a Beiersdorf company) 10.13. Toray Industries, Inc. 10.14. Hitachi Chemical Co., Ltd. (Showa Denko Materials) 10.15. Nitto Denko Corporation 10.16. Lintec Corporation 10.17. Sekisui Chemical Co., Ltd. 10.18. Sika AG (MEA Operations) 10.19. Henkel Middle East (Henkel AG Subsidiary) 10.20. Al Muqarram Group 10.21. Adexus (formerly BASF Chile) 10.22. Pegatec Adesivos 11. Key Findings 12. Analyst Recommendations 13. Global Bonding Films Market: Research Methodology