The Polymer Concrete Market size was valued at USD 0.51 Billion in 2023 and the total Polymer Concrete revenue is expected to grow at a CAGR of 7.9 % from 2024 to 2030, reaching nearly USD 0.87 Billion by 2030. Polymer concrete, alternatively termed Epoxy Granite, is a concrete variant employing a polymer to substitute lime-based cements as a binding agent. Occasionally, this polymer is integrated with Portland cement to create Polymer Cement Concrete (PCC) or Polymer Modified Concrete (PMC). The Polymer Concrete Market is growing rapidly driven by several key factors. As of the current scenario, the market is witnessing increasing demand primarily due to its superior properties such as high strength, chemical resistance, and durability, making it suitable for various applications in construction, infrastructure, and industrial sectors. The growing emphasis on sustainable construction materials, coupled with the rising investments in infrastructure development globally, further propels market growth. The rising need for corrosion-resistant and low-maintenance materials in harsh environments, such as wastewater treatment plants and chemical processing industries, is augmenting the adoption of polymer concrete. Polymer Concrete Market Key players in the are actively engaged in strategic initiatives to strengthen their market presence and enhance product offerings. Recent developments include collaborations, partnerships, mergers, and acquisitions aimed at expanding product portfolios and geographical reach. Continuous research and development efforts are focused on innovating advanced polymer concrete formulations to meet evolving customer requirements and regulatory standards, fostering market expansion and technological advancement. Some prominent market players contributing to the industry's development include BASF SE, Sika AG, Wacker Chemie AG, Fosroc International Limited, and MAPEI Corporation, among others. With favorable market dynamics and ongoing advancements, the Polymer Concrete Market is poised for substantial growth in the foreseeable future, offering lucrative opportunities for stakeholders across the value chain.To know about the Research Methodology :- Request Free Sample Report

Polymer Concrete Market Dynamics:

Urbanization And Population Growth Driving Polymer Concrete Market Growth The increased emphasis on infrastructure development globally has led to a rising demand for durable and high-performance materials like polymer concrete driving the growth of Polymer Concrete Market. Its superior strength and resistance to corrosion make it an ideal choice for construction projects such as bridges, highways, and industrial structures. Industries requiring chemical and corrosion-resistant solutions, such as chemical processing, wastewater treatment, and oil & gas, are driving the adoption of polymer concrete for applications like chemical storage tanks and industrial flooring. Technological advancements in construction techniques and materials play a crucial role in driving market growth, with innovations like precast polymer concrete panels offering enhanced durability and aesthetic appeal in building facades. The industry's focus on sustainable construction practices has boosted the demand for eco-friendly building materials, including polymer concrete, which often contains recycled materials. As urbanization and population growth accelerate, the demand for infrastructure and construction activities continues to rise, further boosting the need for durable and long-lasting materials like polymer concrete in urban development projects. Stringent regulations mandating the use of corrosion-resistant and environmentally friendly materials in infrastructure projects also contribute to market expansion. For instance, regulations requiring corrosion-resistant materials in wastewater infrastructure drive the adoption of polymer concrete pipes and structures. Furthermore, the rehabilitation and repair of aging infrastructure, coupled with the expansion of the industrial manufacturing sector, stimulate demand for polymer concrete solutions for flooring, machine bases, and chemical containment areas. The demand for lightweight yet high-strength materials in construction applications drives the adoption of polymer concrete, particularly in composite bridges and structures where weight savings and ease of installation are critical. Ongoing technological innovations and product development efforts, such as self-healing polymer concrete and ultra-high-performance polymer concrete, offer new opportunities for applications in demanding environments, further stimulating market growth. Overall, the polymer concrete market is poised for continued expansion as it continues to address the evolving needs of the construction industry for durable, high-performance materials. High initial investment Hinders the Polymer Concrete Market Growth The high initial cost of polymer concrete materials and installation acts as a significant barrier, deterring potential buyers from investing in this innovative technology and hindering the growth of Polymer Concrete Market. Despite offering superior performance and durability compared to traditional concrete, the upfront investment required for polymer concrete applications, such as pavements and bridge overlays, often exceeds budget constraints, limiting its adoption in infrastructure projects. Limited awareness and education among contractors, engineers, and other stakeholders about the benefits and applications of polymer concrete impede Polymer Concrete Market growth. Insufficient understanding of the advantages, such as corrosion resistance and reduced maintenance, results in underutilization in critical sectors like wastewater treatment plants and industrial flooring. Resistance from traditionalists within the construction industry further slows market acceptance and adoption of polymer concrete. Stakeholders accustomed to conventional concrete methods exhibit skepticism or reluctance to embrace polymer concrete technology due to perceived risks, unfamiliarity, or loyalty to established practices. Perceptions regarding the durability of polymer concrete compared to traditional materials also pose challenges. Despite its proven performance, concerns about long-term reliability and structural integrity deter stakeholders, particularly in critical applications such as bridge construction, where safety and reliability are paramount. Supply chain issues, including material availability and fluctuations in raw material prices, can disrupt project timelines and increase costs, impacting the feasibility and competitiveness of polymer concrete solutions. Uncertainties in the availability of resin and aggregate components due to supply chain disruptions hinder the production and delivery of polymer concrete products. Compliance with stringent building codes, standards, and regulatory requirements presents another obstacle for polymer concrete manufacturers and contractors. Adherence to regulatory standards for fire resistance, load-bearing capacity, and environmental sustainability requires extensive testing, certification, and documentation, adding complexity and costs to projects. The absence of standardized testing methods and specifications for polymer concrete products complicates quality assurance, comparison with traditional materials, and regulatory compliance. Limited industry-wide standards for polymer concrete materials and installation techniques hinder market growth, particularly in applications such as underground infrastructure and building construction. Environmental concerns surrounding the sustainability and lifecycle impact of polymer concrete production and disposal also influence market dynamics. Debates over the environmental footprint of polymer concrete compared to traditional materials raise questions about its suitability for green building projects and sustainable development initiatives. Additionally, the complex installation process of polymer concrete, requiring specialized knowledge, equipment, and techniques, can pose challenges for contractors, further increasing project costs and timelines. Complexity in applying polymer concrete linings in industrial facilities and wastewater treatment plants deter adoption despite its superior performance attributes.Polymer Concrete Market Segment Analysis:

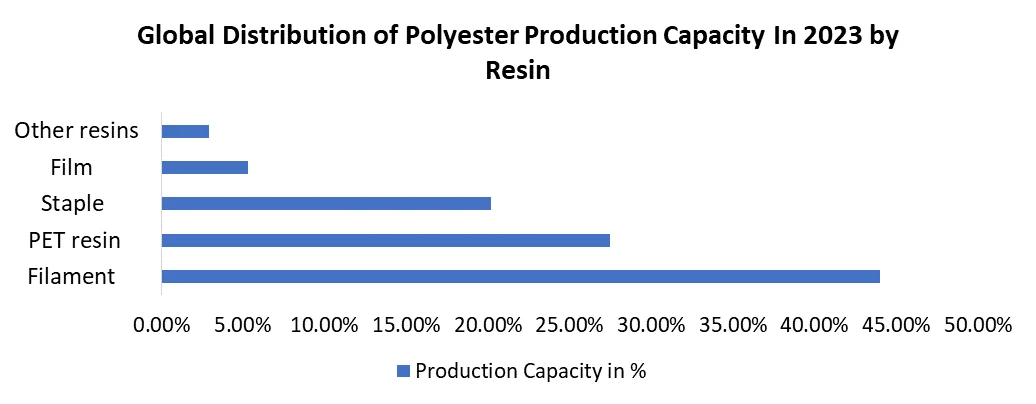

Based on Application, the market is segmented into Asphalt Pavement, Pump Bases, Waste Containers, Flooring Blocks, Trench Drains, and Others. Asphalt Pavement application segment is expected to hold the largest market share by 2030. Roads, parking lots, airports, and dams are frequently surfaced with asphalt concrete. Polymers are added to asphalt cement to change its viscoelastic behaviour as a result of developments in the construction sector. The growing road network primarily uses polymer modified hot mix asphalt cement. Increased rutting resistance is the main advantage of utilizing these high-performance asphalts, while reduced thermal (cold-temperature) cracking and improved mixture durability are the side advantages. Additionally, certain modified binders offer enhanced resistance to stripping (moisture damage). The two most widely utilised varieties are plastomers (plastics) and elastomers (rubbers or elastics). Commonly used elastomers include styrene-butadiene rubber (SBR) and styrene-butadiene-styrene (SBS). According to the International Energy Agency's (IEA) review of infrastructure needs, the length of the world's road network has risen by around 12 million lane kilometres since 2000. Globally, more than half of the new paved lanes were built in China and India. 53% of the total global road lane kilometres in recent years were paved lanes. The percentage of paved roads is expected to rise in the upcoming years, which will raise the need for polymer concrete in applications for asphalt pavement due to rising traffic. Furthermore, by 2050, it is expected that the world's annual vehicle kilometres will nearly treble to 43 trillion. In addition, with annual capital costs rising to 1.1 trillion USD over the next 20 years, global road capital construction, reconstruction, and operations and maintenance costs for 2050 are by far the largest infrastructure spending. This is because developing countries want to speed up roadway construction to meet the demand for travel. By 2050, it is expected that annual global road reconstruction will reach 700 USD billion. The demand for polymer concrete is therefore estimated to rise during the forecast period for asphalt pavements as a result of the developments indicated above. Based on the Material, the Polymer Concrete Market is segmented into Polyester, Vinyl Ester, Epoxy Based, and Others. Polyester material segment is expected to grow rapidly during the forecast period 2023-2030. Due to its convenient processing properties and affordable pricing, polyester resin is one type of thermosetting polymer that is frequently utilised in a variety of applications, including automotive parts, composite materials, and construction. In the present work, polymer concrete was created using polyester resin as a binder. Vinyl ester resins are utilized in demanding applications like pultruded profiles and corrosion-resistant industrial tanks and pipes. Vinyl esters are also frequently employed in vital parts of marine and automobile vehicles. The bonding substance is a vinyl ester resin rather than polyester or epoxy. This causes a chemical reaction within the mixture that affects the physical characteristics of the concrete, enabling use in corrosive and high-temperature environments.

Polymer Concrete Market Regional Insights:

North America Dominance in the Polymer Concrete Market The North American region is expected to dominate the Polymer Concrete Market during the forecast period. The US economy benefits hugely from the construction sector. The sector employs more than 7 million people, has more than 680,000 employers, and annually produces structures valued close to USD 1.3 trillion. It is one of the biggest consumers of mining, manufacturing, and a range of other services. Growing construction activities, new bridges in Clinton, Beaver, Clearfield, etc., and increasing road building activities are the main drivers of the market growth in this region. When comparing January 2021 to December 2020 in the region, industrial construction climbed by about 4.7 percent, followed by healthcare construction at 1.1 percent. The region's healthcare construction is expected to increase by about 5%. Commercial construction is estimated to grow by 2%, with office construction leading the way at about 6% growth, followed by retail construction at 1%. Additionally, in the US, the states of Florida, Georgia, North Carolina, Washington, Utah, Tennessee, Ohio, California, Idaho, and South Carolina had an increase in single-family home development. Geographically, the South of the nation is expected to increase at a rate of over 6%, followed by the West, the Midwest, and the Northeast. The demand for polymer concrete in the region is estimated to rise during the forecast period as a result of the aforementioned factors.Polymer Concrete Market Scope: Inquire before buying

Global Polymer Concrete Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 0.51 Bn. Forecast Period 2024 to 2030 CAGR: 7.9% Market Size in 2030: US $ 0.87 Bn. Segments Covered: by Material Polyester Vinyl Ester Epoxy Based Others by Binding Agent Natural Resin Synthetic Resin by Application Asphalt Pavement Pump Bases Waste Containers Flooring Blocks Trench Drains Others by End-User Industrial Residential and Municipal Commercial Polymer Concrete Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Polymer Concrete Market, Key Players:

The polymer concrete market is characterized by a diverse range of key players involved in various aspects of production, application, and innovation. These top polymer concrete manufacturers employ a variety of growth strategies, including strategic mergers and acquisitions, significant investments in research and development, and the expansion of their product offerings to meet evolving industry demands. To enhance their market presence, leading polymer concrete manufacturers in the polymer concrete sector engage in collaborations, partnerships, and joint ventures that allow them to leverage shared expertise and resources. Additionally, they focus on expanding into new geographical regions to tap into emerging markets and expand their customer base. Major Contributors in the Polymer Concrete Industry in North America: 1. Forte Composites Inc. - South Bend, Indiana, USA 2. ErgonArmor - Jackson, Mississippi, USA 3. Sauereisen Inc. - Pittsburgh, Pennsylvania, USA 4. Dudick Inc. - Twinsburg, Ohio, USA 5. Interplastic Corporation - St. Paul, Minnesota, USA Leading Figures in the European Polymer Concrete Sector: 1. BASF SE - Ludwigshafen, Germany 2. Sika AG - Baar, Switzerland 3. Wacker Chemie AG - Munich, Germany 4. MAPEI Corporation - Milan, Italy 5. ACO Group - Rendsburg, Germany Key players driving the Asia-Pacific Polymer Concrete Market: 1. Cipy Polyurethanes Pvt. Ltd. - Mumbai, India 2. Dubond Products (India) Pvt. Ltd. - Ahmedabad, India 3. Sumitomo Chemical Co., Ltd. - Tokyo, Japan 4. Asahi Kasei Corporation - Tokyo, Japan 5. Jiangsu Runtai Chemical Co., Ltd. - Jiangsu Province, China FAQs: 1] What Major Key players in the Global Polymer Concrete Market report? Ans. The Major Key players covered in the Polymer Concrete Market report are Navenio,Huq Industries Limited,Cambium Networks Ltd,Purple,OpenSignal,Relayr,Briteyellow,WiCastr 2] Which region is expected to hold the highest share in the Global Polymer Concrete Market? Ans. Asia Pacific region is expected to hold the highest share in the Polymer Concrete Market. The market size of the Polymer Concrete Market by 2030 is expected to reach US$ 0.87 Billion. 3] What is the market size of the Global Polymer Concrete Market by 2030? Ans. The market size of the Polymer Concrete Market by 2030 is expected to reach US$ 0.87 Billion. 4] What is the forecast period for the Global Polymer Concrete Market? Ans. The forecast period for the Polymer Concrete Market is 2024-2030. 5] What was the market size of the Global Polymer Concrete Market in 2023? Ans. The market size of the Polymer Concrete Market in 2023 was valued at US$ 0.51 Billion.

1. Polymer Concrete Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Polymer Concrete Market: Dynamics 2.1. Market Trends by Region 2.1.1. North America 2.1.2. Europe 2.1.3. Asia Pacific 2.1.4. Middle East and Africa 2.1.5. South America 2.2. Market Dynamics by Region 2.2.1. North America 2.2.1.1. Drivers 2.2.1.2. Restraints 2.2.1.3. Opportunities 2.2.1.4. Challenges 2.2.2. Europe 2.2.2.1. Drivers 2.2.2.2. Restraints 2.2.2.3. Opportunities 2.2.2.4. Challenges 2.2.3. Asia Pacific 2.2.3.1. Drivers 2.2.3.2. Restraints 2.2.3.3. Opportunities 2.2.3.4. Challenges 2.2.4. Middle East and Africa 2.2.4.1. Drivers 2.2.4.2. Restraints 2.2.4.3. Opportunities 2.2.4.4. Challenges 2.2.5. South America 2.2.5.1. Drivers 2.2.5.2. Restraints 2.2.5.3. Opportunities 2.2.5.4. Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Technological Roadmap 2.7. Regulatory Landscape by Region 2.7.1. North America 2.7.2. Europe 2.7.3. Asia Pacific 2.7.4. Middle East and Africa 2.7.5. South America 2.8. Analysis of Government Schemes and Initiatives For Polymer Concrete Industry 2.9. Key Opinion Leader Analysis 2.10. The Global Pandemic Impact on Polymer Concrete Market 3. Polymer Concrete Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 3.1. Polymer Concrete Market Size and Forecast, By Material (2023-2030) 3.1.1. Polyester 3.1.2. Vinyl Ester 3.1.3. Epoxy Based 3.1.4. Others 3.2. Polymer Concrete Market Size and Forecast, By Binding Agent (2023-2030) 3.2.1. Natural Resin 3.2.2. Synthetic Resin 3.3. Polymer Concrete Market Size and Forecast, By Application (2023-2030) 3.3.1. Asphalt Pavement 3.3.2. Pump Bases 3.3.3. Waste Containers 3.3.4. Flooring Blocks 3.3.5. Trench Drains 3.3.6. Others 3.4. Polymer Concrete Market Size and Forecast, By End-User (2023-2030) 3.4.1. Industrial 3.4.2. Residential and Municipal 3.4.3. Commercial 3.5. Polymer Concrete Market Size and Forecast, By Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Polymer Concrete Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. North America Polymer Concrete Market Size and Forecast, By Material (2023-2030) 4.1.1. Polyester 4.1.2. Vinyl Ester 4.1.3. Epoxy Based 4.1.4. Others 4.2. North America Polymer Concrete Market Size and Forecast, By Binding Agent (2023-2030) 4.2.1. Natural Resin 4.2.2. Synthetic Resin 4.3. North America Polymer Concrete Market Size and Forecast, By Application (2023-2030) 4.3.1. Asphalt Pavement 4.3.2. Pump Bases 4.3.3. Waste Containers 4.3.4. Flooring Blocks 4.3.5. Trench Drains 4.3.6. Others 4.4. North America Polymer Concrete Market Size and Forecast, By End-User (2023-2030) 4.4.1. Industrial 4.4.2. Residential and Municipal 4.4.3. Commercial 4.5. North America Polymer Concrete Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Polymer Concrete Market Size and Forecast, By Material (2023-2030) 4.5.1.1.1. Polyester 4.5.1.1.2. Vinyl Ester 4.5.1.1.3. Epoxy Based 4.5.1.1.4. Others 4.5.1.2. United States Polymer Concrete Market Size and Forecast, By Binding Agent (2023-2030) 4.5.1.2.1. Natural Resin 4.5.1.2.2. Synthetic Resin 4.5.1.3. United States Polymer Concrete Market Size and Forecast, By Application (2023-2030) 4.5.1.3.1. Asphalt Pavement 4.5.1.3.2. Pump Bases 4.5.1.3.3. Waste Containers 4.5.1.3.4. Flooring Blocks 4.5.1.3.5. Trench Drains 4.5.1.3.6. Others 4.5.1.4. United States Polymer Concrete Market Size and Forecast, By End-User (2023-2030) 4.5.1.4.1. Industrial 4.5.1.4.2. Residential and Municipal 4.5.1.4.3. Commercial 4.5.2. Canada 4.5.2.1. Canada Polymer Concrete Market Size and Forecast, By Material (2023-2030) 4.5.2.1.1. Polyester 4.5.2.1.2. Vinyl Ester 4.5.2.1.3. Epoxy Based 4.5.2.1.4. Others 4.5.2.2. Canada Polymer Concrete Market Size and Forecast, By Binding Agent (2023-2030) 4.5.2.2.1. Natural Resin 4.5.2.2.2. Synthetic Resin 4.5.2.3. Canada Polymer Concrete Market Size and Forecast, By Application (2023-2030) 4.5.2.3.1. Asphalt Pavement 4.5.2.3.2. Pump Bases 4.5.2.3.3. Waste Containers 4.5.2.3.4. Flooring Blocks 4.5.2.3.5. Trench Drains 4.5.2.3.6. Others 4.5.2.4. Canada Polymer Concrete Market Size and Forecast, By End-User (2023-2030) 4.5.2.4.1. Industrial 4.5.2.4.2. Residential and Municipal 4.5.2.4.3. Commercial 4.5.3. Mexico 4.5.3.1. Mexico Polymer Concrete Market Size and Forecast, By Material (2023-2030) 4.5.3.1.1. Polyester 4.5.3.1.2. Vinyl Ester 4.5.3.1.3. Epoxy Based 4.5.3.1.4. Others 4.5.3.2. Mexico Polymer Concrete Market Size and Forecast, By Binding Agent (2023-2030) 4.5.3.2.1. Natural Resin 4.5.3.2.2. Synthetic Resin 4.5.3.3. Mexico Polymer Concrete Market Size and Forecast, By Application (2023-2030) 4.5.3.3.1. Asphalt Pavement 4.5.3.3.2. Pump Bases 4.5.3.3.3. Waste Containers 4.5.3.3.4. Flooring Blocks 4.5.3.3.5. Trench Drains 4.5.3.3.6. Others 4.5.3.4. Mexico Polymer Concrete Market Size and Forecast, By End-User (2023-2030) 4.5.3.4.1. Industrial 4.5.3.4.2. Residential and Municipal 4.5.3.4.3. Commercial 5. Europe Polymer Concrete Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 5.1. Europe Polymer Concrete Market Size and Forecast, By Material (2023-2030) 5.2. Europe Polymer Concrete Market Size and Forecast, By Binding Agent (2023-2030) 5.3. Europe Polymer Concrete Market Size and Forecast, By Application (2023-2030) 5.4. Europe Polymer Concrete Market Size and Forecast, By End-User (2023-2030) 5.5. Europe Polymer Concrete Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Polymer Concrete Market Size and Forecast, By Material (2023-2030) 5.5.1.2. United Kingdom Polymer Concrete Market Size and Forecast, By Binding Agent (2023-2030) 5.5.1.3. United Kingdom Polymer Concrete Market Size and Forecast, By Application (2023-2030) 5.5.1.4. United Kingdom Polymer Concrete Market Size and Forecast, By End-User (2023-2030) 5.5.2. France 5.5.2.1. France Polymer Concrete Market Size and Forecast, By Material (2023-2030) 5.5.2.2. France Polymer Concrete Market Size and Forecast, By Binding Agent (2023-2030) 5.5.2.3. France Polymer Concrete Market Size and Forecast, By Application (2023-2030) 5.5.2.4. France Polymer Concrete Market Size and Forecast, By End-User (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Polymer Concrete Market Size and Forecast, By Material (2023-2030) 5.5.3.2. Germany Polymer Concrete Market Size and Forecast, By Binding Agent (2023-2030) 5.5.3.3. Germany Polymer Concrete Market Size and Forecast, By Application (2023-2030) 5.5.3.4. Germany Polymer Concrete Market Size and Forecast, By End-User (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Polymer Concrete Market Size and Forecast, By Material (2023-2030) 5.5.4.2. Italy Polymer Concrete Market Size and Forecast, By Binding Agent (2023-2030) 5.5.4.3. Italy Polymer Concrete Market Size and Forecast, By Application (2023-2030) 5.5.4.4. Italy Polymer Concrete Market Size and Forecast, By End-User (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Polymer Concrete Market Size and Forecast, By Material (2023-2030) 5.5.5.2. Spain Polymer Concrete Market Size and Forecast, By Binding Agent (2023-2030) 5.5.5.3. Spain Polymer Concrete Market Size and Forecast, By Application (2023-2030) 5.5.5.4. Spain Polymer Concrete Market Size and Forecast, By End-User (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Polymer Concrete Market Size and Forecast, By Material (2023-2030) 5.5.6.2. Sweden Polymer Concrete Market Size and Forecast, By Binding Agent (2023-2030) 5.5.6.3. Sweden Polymer Concrete Market Size and Forecast, By Application (2023-2030) 5.5.6.4. Sweden Polymer Concrete Market Size and Forecast, By End-User (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Polymer Concrete Market Size and Forecast, By Material (2023-2030) 5.5.7.2. Austria Polymer Concrete Market Size and Forecast, By Binding Agent (2023-2030) 5.5.7.3. Austria Polymer Concrete Market Size and Forecast, By Application (2023-2030) 5.5.7.4. Austria Polymer Concrete Market Size and Forecast, By End-User (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Polymer Concrete Market Size and Forecast, By Material (2023-2030) 5.5.8.2. Rest of Europe Polymer Concrete Market Size and Forecast, By Binding Agent (2023-2030) 5.5.8.3. Rest of Europe Polymer Concrete Market Size and Forecast, By Application (2023-2030) 5.5.8.4. Rest of Europe Polymer Concrete Market Size and Forecast, By End-User (2023-2030) 6. Asia Pacific Polymer Concrete Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 6.1. Asia Pacific Polymer Concrete Market Size and Forecast, By Material (2023-2030) 6.2. Asia Pacific Polymer Concrete Market Size and Forecast, By Binding Agent (2023-2030) 6.3. Asia Pacific Polymer Concrete Market Size and Forecast, By Application (2023-2030) 6.4. Asia Pacific Polymer Concrete Market Size and Forecast, By End-User (2023-2030) 6.5. Asia Pacific Polymer Concrete Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Polymer Concrete Market Size and Forecast, By Material (2023-2030) 6.5.1.2. China Polymer Concrete Market Size and Forecast, By Binding Agent (2023-2030) 6.5.1.3. China Polymer Concrete Market Size and Forecast, By Application (2023-2030) 6.5.1.4. China Polymer Concrete Market Size and Forecast, By End-User (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Polymer Concrete Market Size and Forecast, By Material (2023-2030) 6.5.2.2. S Korea Polymer Concrete Market Size and Forecast, By Binding Agent (2023-2030) 6.5.2.3. S Korea Polymer Concrete Market Size and Forecast, By Application (2023-2030) 6.5.2.4. S Korea Polymer Concrete Market Size and Forecast, By End-User (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Polymer Concrete Market Size and Forecast, By Material (2023-2030) 6.5.3.2. Japan Polymer Concrete Market Size and Forecast, By Binding Agent (2023-2030) 6.5.3.3. Japan Polymer Concrete Market Size and Forecast, By Application (2023-2030) 6.5.3.4. Japan Polymer Concrete Market Size and Forecast, By End-User (2023-2030) 6.5.4. India 6.5.4.1. India Polymer Concrete Market Size and Forecast, By Material (2023-2030) 6.5.4.2. India Polymer Concrete Market Size and Forecast, By Binding Agent (2023-2030) 6.5.4.3. India Polymer Concrete Market Size and Forecast, By Application (2023-2030) 6.5.4.4. India Polymer Concrete Market Size and Forecast, By End-User (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Polymer Concrete Market Size and Forecast, By Material (2023-2030) 6.5.5.2. Australia Polymer Concrete Market Size and Forecast, By Binding Agent (2023-2030) 6.5.5.3. Australia Polymer Concrete Market Size and Forecast, By Application (2023-2030) 6.5.5.4. Australia Polymer Concrete Market Size and Forecast, By End-User (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Polymer Concrete Market Size and Forecast, By Material (2023-2030) 6.5.6.2. Indonesia Polymer Concrete Market Size and Forecast, By Binding Agent (2023-2030) 6.5.6.3. Indonesia Polymer Concrete Market Size and Forecast, By Application (2023-2030) 6.5.6.4. Indonesia Polymer Concrete Market Size and Forecast, By End-User (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Polymer Concrete Market Size and Forecast, By Material (2023-2030) 6.5.7.2. Malaysia Polymer Concrete Market Size and Forecast, By Binding Agent (2023-2030) 6.5.7.3. Malaysia Polymer Concrete Market Size and Forecast, By Application (2023-2030) 6.5.7.4. Malaysia Polymer Concrete Market Size and Forecast, By End-User (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Polymer Concrete Market Size and Forecast, By Material (2023-2030) 6.5.8.2. Vietnam Polymer Concrete Market Size and Forecast, By Binding Agent (2023-2030) 6.5.8.3. Vietnam Polymer Concrete Market Size and Forecast, By Application (2023-2030) 6.5.8.4. Vietnam Polymer Concrete Market Size and Forecast, By End-User (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Polymer Concrete Market Size and Forecast, By Material (2023-2030) 6.5.9.2. Taiwan Polymer Concrete Market Size and Forecast, By Binding Agent (2023-2030) 6.5.9.3. Taiwan Polymer Concrete Market Size and Forecast, By Application (2023-2030) 6.5.9.4. Taiwan Polymer Concrete Market Size and Forecast, By End-User (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Polymer Concrete Market Size and Forecast, By Material (2023-2030) 6.5.10.2. Rest of Asia Pacific Polymer Concrete Market Size and Forecast, By Binding Agent (2023-2030) 6.5.10.3. Rest of Asia Pacific Polymer Concrete Market Size and Forecast, By Application (2023-2030) 6.5.10.4. Rest of Asia Pacific Polymer Concrete Market Size and Forecast, By End-User (2023-2030) 7. Middle East and Africa Polymer Concrete Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030 7.1. Middle East and Africa Polymer Concrete Market Size and Forecast, By Material (2023-2030) 7.2. Middle East and Africa Polymer Concrete Market Size and Forecast, By Binding Agent (2023-2030) 7.3. Middle East and Africa Polymer Concrete Market Size and Forecast, By Application (2023-2030) 7.4. Middle East and Africa Polymer Concrete Market Size and Forecast, By End-User (2023-2030) 7.5. Middle East and Africa Polymer Concrete Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Polymer Concrete Market Size and Forecast, By Material (2023-2030) 7.5.1.2. South Africa Polymer Concrete Market Size and Forecast, By Binding Agent (2023-2030) 7.5.1.3. South Africa Polymer Concrete Market Size and Forecast, By Application (2023-2030) 7.5.1.4. South Africa Polymer Concrete Market Size and Forecast, By End-User (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Polymer Concrete Market Size and Forecast, By Material (2023-2030) 7.5.2.2. GCC Polymer Concrete Market Size and Forecast, By Binding Agent (2023-2030) 7.5.2.3. GCC Polymer Concrete Market Size and Forecast, By Application (2023-2030) 7.5.2.4. GCC Polymer Concrete Market Size and Forecast, By End-User (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Polymer Concrete Market Size and Forecast, By Material (2023-2030) 7.5.3.2. Nigeria Polymer Concrete Market Size and Forecast, By Binding Agent (2023-2030) 7.5.3.3. Nigeria Polymer Concrete Market Size and Forecast, By Application (2023-2030) 7.5.3.4. Nigeria Polymer Concrete Market Size and Forecast, By End-User (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Polymer Concrete Market Size and Forecast, By Material (2023-2030) 7.5.4.2. Rest of ME&A Polymer Concrete Market Size and Forecast, By Binding Agent (2023-2030) 7.5.4.3. Rest of ME&A Polymer Concrete Market Size and Forecast, By Application (2023-2030) 7.5.4.4. Rest of ME&A Polymer Concrete Market Size and Forecast, By End-User (2023-2030) 8. South America Polymer Concrete Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 8.1. South America Polymer Concrete Market Size and Forecast, By Material (2023-2030) 8.2. South America Polymer Concrete Market Size and Forecast, By Binding Agent (2023-2030) 8.3. South America Polymer Concrete Market Size and Forecast, By Application (2023-2030) 8.4. South America Polymer Concrete Market Size and Forecast, By End-User (2023-2030) 8.5. South America Polymer Concrete Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Polymer Concrete Market Size and Forecast, By Material (2023-2030) 8.5.1.2. Brazil Polymer Concrete Market Size and Forecast, By Binding Agent (2023-2030) 8.5.1.3. Brazil Polymer Concrete Market Size and Forecast, By Application (2023-2030) 8.5.1.4. Brazil Polymer Concrete Market Size and Forecast, By End-User (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Polymer Concrete Market Size and Forecast, By Material (2023-2030) 8.5.2.2. Argentina Polymer Concrete Market Size and Forecast, By Binding Agent (2023-2030) 8.5.2.3. Argentina Polymer Concrete Market Size and Forecast, By Application (2023-2030) 8.5.2.4. Argentina Polymer Concrete Market Size and Forecast, By End-User (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Polymer Concrete Market Size and Forecast, By Material (2023-2030) 8.5.3.2. Rest Of South America Polymer Concrete Market Size and Forecast, By Binding Agent (2023-2030) 8.5.3.3. Rest Of South America Polymer Concrete Market Size and Forecast, By Application (2023-2030) 8.5.3.4. Rest Of South America Polymer Concrete Market Size and Forecast, By End-User (2023-2030) 9. Global Polymer Concrete Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Service Segment 9.3.3. End Use Segment 9.3.4. Revenue (2022) 9.3.5. Manufacturing Locations 9.4. Leading Polymer Concrete Market Companies, by Market Capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. BASF SE - Ludwigshafen, Germany 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Sika AG - Baar, Switzerland 10.3. Wacker Chemie AG - Munich, Germany 10.4. MAPEI Corporation - Milan, Italy 10.5. ACO Group - Rendsburg, Germany 10.6. Forte Composites Inc. - South Bend, Indiana, USA 10.7. ErgonArmor - Jackson, Mississippi, USA 10.8. Sauereisen Inc. - Pittsburgh, Pennsylvania, USA 10.9. Dudick Inc. - Twinsburg, Ohio, USA 10.10. Interplastic Corporation - St. Paul, Minnesota, USA 10.11. Cipy Polyurethanes Pvt. Ltd. - Mumbai, India 10.12. Dubond Products (India) Pvt. Ltd. - Ahmedabad, India 10.13. Sumitomo Chemical Co., Ltd. - Tokyo, Japan 10.14. Asahi Kasei Corporation - Tokyo, Japan 10.15. Jiangsu Runtai Chemical Co., Ltd. - Jiangsu Province, China 11. Key Findings 12. Industry Recommendations 13. Polymer Concrete Market: Research Methodology