Bolt Heaters Market size was valued at USD 195.3 Mn. in 2022 and the total Bolt Heaters revenue is expected to grow by 4.8 % from 2022 to 2029, reaching nearly USD 271.2 Mn.Bolt Heaters Market Overview:

The bolt heaters market refers to the industry that deals with the production and sale of devices used to heat bolts for easier removal or installation. These devices use an electric current to heat the bolt, causing it to grow and loosen, making it easier to remove or install. The market is increasing industrialization with the growth of various industries such as manufacturing, automotive, and aerospace, the demand for bolt heaters has increased significantly, as they are essential for efficient maintenance and repair processes. Another primary driver of the bolt heaters market is the demand for efficient bolt removal and installation. Bolt heaters are an effective and efficient way of removing or installing bolts, particularly in challenging environments or when the bolts are rusted or corroded. As a result, they are becoming increasingly popular in various industries, including oil and gas, power generation, and construction. Rising investments in oil and gas and power generation sectors are also driving the bolt heaters market. As these industries continue to grow, there is an increasing need for efficient maintenance and repair processes, which has led to a higher demand for bolt heaters. Despite the positive growth prospects for the bolt heaters market, there are some factors that act as a restraint for its growth. One of the primary restraints for the market is the high cost associated with bolt heaters. The cost of these devices can be relatively high, particularly for high-end models, which may deter some potential customers from purchasing them. The bolt heaters market presents several opportunities for growth. One of the most significant opportunities is the adoption of renewable energy sources. With the increasing focus on sustainability and reducing carbon emissions, there is a growing demand for renewable energy sources such as wind and solar power. The installation and maintenance of these energy sources require bolt heaters, which presents an opportunity for the market.To know about the Research Methodology :- Request Free Sample Report

Market Dynamics:

Bolt Heaters Market Trends Increasing Adoption of Induction Bolt Heaters in Various Industries Induction bolt heaters use electromagnetic induction to heat the bolt, rather than an electric current. This method is more efficient and faster than traditional methods, as it heats only the bolt, rather than the surrounding area. The adoption of induction bolt heaters has increased in various industries such as oil and gas, power generation, and manufacturing. This is due to the significant advantages that induction bolt heaters offer, such as reducing the risk of damaging the bolt, reducing the time required to heat the bolt, and improving safety by eliminating open flames or hot surfaces. Moreover, induction bolt heaters offer more precise heating control than traditional methods, which is essential when working with specific alloys or materials that require precise heating temperatures. This makes them an ideal solution for industries that require high precision in their maintenance and repair processes. Moreover, the increasing adoption of induction bolt heaters in various industries is a significant trend in the bolt heaters market. As industries continue to adopt these devices, their demand is expected to increase, which will drive the growth of the bolt heaters market in the forecast period. Bolt Heaters Market Drivers Rising Demand for Bolt Heaters in Maintenance and Repair Operations Bolt heaters are essential tools used in various industries for maintenance and repair activities, such as removing or tightening bolts. As the global manufacturing and construction industries continue to grow, the demand for bolt heaters is expected to rise, as they are critical tools in these industries. In addition, the increasing need for maintenance and repair operations in various industries, such as oil and gas, automotive, and aerospace, is driving the demand for bolt heaters. Moreover, bolt heaters are increasingly being adopted by industries that require precision heating to avoid damage to bolts or equipment. These industries include pharmaceuticals, food processing, and electronics. This is because bolt heaters provide a precise and controlled method of heating, which reduces the risk of damage to the surrounding equipment. Furthermore, the rising demand for bolt heaters in maintenance and repair operations is a significant driver of the bolt heaters market. As the demand for these devices continues to increase, manufacturers are expected to introduce innovative bolt heaters with advanced features and improved efficiency, which will further drive the growth of the market. Bolt Heaters Market Restraint High Initial Cost of Bolt Heaters Hindering Market Growth Bolt heaters are relatively expensive compared to traditional methods of heating bolts, such as using open flames or hot surfaces. This high initial cost deter some businesses from investing in bolt heaters, especially small and medium-sized enterprises (SMEs). Moreover, some businesses may be hesitant to invest in bolt heaters if they do not have a regular need for maintenance and repair activities that require these devices. This limited usage may make it difficult for businesses to justify the high cost of purchasing a bolt heater. In addition, the high cost of bolt heaters can also pose a challenge for manufacturers, as they need to price their products competitively to remain profitable. This can result in lower profit margins, which slow down the growth of the market. Additionally, the high initial cost of bolt heaters is a significant restraint of the market. Manufacturers are expected to introduce cost-effective solutions to address this challenge, such as offering financing options or leasing programs, which makes it more accessible for SMEs and businesses with limited usage to invest in these devices. Bolt Heaters Market Opportunity Growing Demand for Energy-Efficient Bolt Heaters Presents Lucrative Opportunities Energy efficiency has become a critical factor for businesses across various industries, as they look to reduce their energy consumption and carbon footprint while maintaining their operational efficiency. Manufacturers in the bolt heaters market are responding to this demand by introducing energy-efficient bolt heaters that consume less power and offer improved performance. These devices use advanced technologies such as induction heating and infrared heating, which are more energy-efficient than traditional methods. Moreover, the demand for energy-efficient bolt heaters is also being driven by various government regulations and initiatives aimed at reducing energy consumption and promoting sustainability. For instance, the U.S. Environmental Protection Agency's Energy Star program promotes energy-efficient products and provides guidelines and standards for manufacturers to follow. Additionally, the growing demand for energy-efficient bolt heaters presents a lucrative opportunity for manufacturers in the market. By investing in research and development to create more energy-efficient solutions, manufacturers meet the growing demand for sustainable and efficient products, which drives the growth of the market.Bolt Heaters Market Segment Analysis:

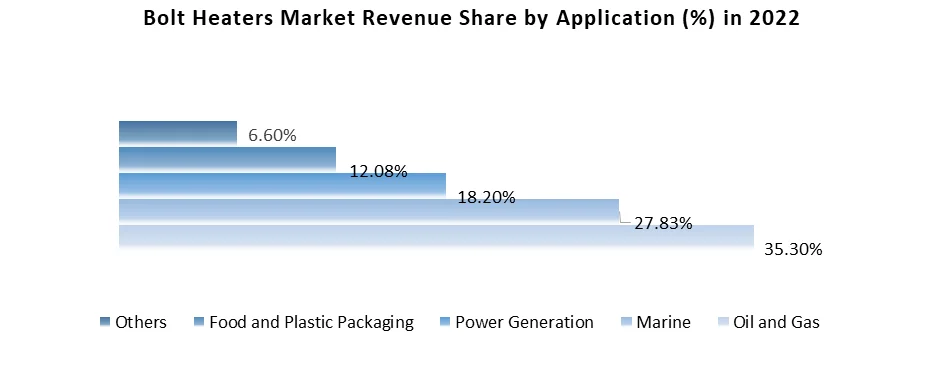

Based on Type, the electric bolt heaters segment was reported to be the largest segment in the bolt heaters market, according to a previous report by MMR. The electric bolt heaters are widely used in various industries, such as construction, manufacturing, and automotive, due to their ease of use, availability of power sources, and safety features. They are also preferred for their consistent and precise heating of bolts, which is crucial in several industrial applications. The report attributes the growth of the electric bolt heaters segment to the increasing demand for energy-efficient and cost-effective heating solutions in various industrial applications. Furthermore, the report states that the flexible bolt heaters segment is also expected to grow at a significant rate during the forecast period, driven by their ability to heat bolts in tight or hard-to-reach spaces. The report also highlights the growing demand for gas bolt heaters thanks to their high heating power and suitability for heavy-duty industrial applications.Based on the Price Point, the oil and gas segment dominates the bolt heaters market and is expected to do the same during the forecast period. While the oil and gas industry is one of the major users of bolt heaters thanks to its need for heavy-duty equipment and machinery, the usage of bolt heaters is not limited to this industry alone. Bolt heaters are also used in various other industries, such as construction, manufacturing, and automotive, among others. Furthermore, the dominance of a particular segment can vary depending on several factors such as the region, application, and prevailing industry trends. It's important to note that market trends can change, and the actual dominance of a particular segment may vary depending on these factors.

Bolt Heaters Market Regional Insights:

North America dominated the global bolt heaters market with a market share of over 35%. The region's dominance can be attributed to the presence of a large number of major manufacturers, such as Chromalox, Enerpac, and Industrial Heater Corporation, who have a strong foothold in the region. Additionally, the region has a mature oil and gas industry, which is one of the major end-users of bolt heaters. For example, in the United States, the shale gas industry is rapidly growing, and bolt heaters are used extensively in the production and transportation of shale gas. Moreover, the region is witnessing an increase in the number of infrastructure projects, such as pipelines, power plants, and refineries, which require bolt heaters for maintenance and repair purposes. Furthermore, the region's strong focus on research and development, coupled with favorable government initiatives, is also driving the growth of the bolt heaters market. For instance, the US government has launched several initiatives to promote the use of renewable energy sources, which has increased the demand for bolt heaters in the renewable energy sector. Moreover, North America's dominance in the bolt heaters market is expected to continue over the forecast period, owing to its strong manufacturing capabilities, established end-user industries, and favorable government policies. Europe bolt heaters market is expected to grow at a CAGR of 3.7% during the forecast period. The growth can be attributed to the increasing demand for energy, growth in the manufacturing sector, and the need for maintenance and repair of aging infrastructure. Europe is home to several major manufacturers of bolt heaters, including Sicom Testing, EFD Induction, and Turbolader Berlin. These manufacturers have a strong presence in the region and cater to various end-users such as the oil and gas, chemical, and manufacturing industries. In Europe, the oil and gas industry is one of the major end-users of bolt heaters. The region has a mature oil and gas industry, and the need for maintenance and repair of aging infrastructure drives the demand for bolt heaters. Additionally, the region has been focusing on the development of renewable energy sources, which is expected to further increase the demand for bolt heaters. Europe is also witnessing an increase in the number of infrastructure projects, such as power plants, refineries, and pipelines. These projects require bolt heaters for maintenance and repair purposes. Furthermore, the region's favorable government policies and initiatives to promote the use of renewable energy sources are expected to drive the growth of the bolt heaters market in the region over the forecast period. Moreover, the bolt heaters market in Europe is expected to grow steadily over the next few years, driven by factors such as increasing demand for energy, growth in the manufacturing sector, and the need for maintenance and repair of aging infrastructure.Global Market Scope: Inquire before buying

Global Bolt Heaters Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 195.3 Mn Forecast Period 2023 to 2029 CAGR: 4.8% Market Size in 2029: US $ 271.2 Mn. Segments Covered: by Type Flexible Bolt Heaters Gas Bolt Heaters Electric Bolt Heaters by End User Oil and Gas Marine Power Generation Food and Plastic Packaging Others Bolt Heaters Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Bolt Heaters Market Manufacturers

1. Chromalox 2. Enerpac 3. Hydraquip 4. Park Thermal International 5. Flex-C-Therm Corporation 6. Advanced Design Technology (ADT) 7. Industrial Heater Corporation 8. Kampa 9. KH Heating Solutions 10.MSI Viking 11.NPT 12.Powerblanket 13.Sigma Thermal 14.Stargas 15.Thermal Hire Ltd 16.Titan Products Inc 17.Valin Thermal Solutions & Automation 18.Wattco 19.Yash Systems Manufacturing Co Pvt. Ltd. 20.Zoppas Industries Frequently Asked Questions: 1] What segments are covered in the Global Bolt Heaters Market report? Ans. The segments covered in the Bolt Heaters Market report are based on Type, End Use, and Region. 2] Which region is expected to hold the highest share in the Global Bolt Heaters Market? Ans. The North America region is expected to hold the highest share of the Bolt Heaters Market. 3] What is the market size of the Global Bolt Heaters Market by 2029? Ans. The market size of the Bolt Heaters Market by 2029 is expected to reach US$ 271.2 Mn. 4] What is the forecast period for the Global Bolt Heaters Market? Ans. The forecast period for the Bolt Heaters Market is 2023-2029. 5] What was the market size of the Global Bolt Heaters Market in 2021? Ans. The market size of the Bolt Heaters Market in 2022 was valued at US$ 195.3 Mn.

Table of Content 1. Bolt Heaters Market: Research Methodology 2. Bolt Heaters Market: Executive Summary 3. Bolt Heaters Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Bolt Heaters Market: Dynamics 4.1. Market Trends by region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Bolt Heaters Market: Segmentation (by Value USD and Volume Units) 5.1. Bolt Heaters Market, by Type (2023-2029) 5.1.1. Flexible Bolt Heaters 5.1.2. Gas Bolt Heaters 5.1.3. Electric Bolt Heaters 5.2. Bolt Heaters Market, by End Use (2023-2029) 5.2.1. Oil and Gas 5.2.2. Marine 5.2.3. Power Generation 5.2.4. Food and Plastic Packaging 5.2.5. Others 5.3. Bolt Heaters Market, by Region (2023-2029) 5.3.1. North America 5.3.2. Europe 5.3.3. Asia Pacific 5.3.4. Middle East and Africa 5.3.5. South America 6. North America Bolt Heaters Market (by Value USD and Volume Units) 6.1. North America Bolt Heaters Market, by Type (2023-2029) 6.1.1. Flexible Bolt Heaters 6.1.2. Gas Bolt Heaters 6.1.3. Electric Bolt Heaters 6.2. North America Bolt Heaters Market, by End Use (2023-2029) 6.2.1. Oil and Gas 6.2.2. Marine 6.2.3. Power Generation 6.2.4. Food and Plastic Packaging 6.2.5. Others 6.3. North America Bolt Heaters Market, by Country (2023-2029) 6.3.1. United States 6.3.2. Canada 6.3.3. Mexico 7. Europe Bolt Heaters Market (by Value USD and Volume Units) 7.1. Europe Bolt Heaters Market, by Type (2023-2029) 7.2. Europe Bolt Heaters Market, by End Use (2023-2029) 7.3. Europe Bolt Heaters Market, by Country (2023-2029) 7.3.1. UK 7.3.2. France 7.3.3. Germany 7.3.4. Italy 7.3.5. Spain 7.3.6. Sweden 7.3.7. Austria 7.3.8. Rest of Europe 8. Asia Pacific Bolt Heaters Market (by Value USD and Volume Units) 8.1. Asia Pacific Bolt Heaters Market, by Type (2023-2029) 8.2. Asia Pacific Bolt Heaters Market, by End Use (2023-2029) 8.3. Asia Pacific Bolt Heaters Market, by Country (2023-2029) 8.3.1. China 8.3.2. S Korea 8.3.3. Japan 8.3.4. India 8.3.5. Australia 8.3.6. Indonesia 8.3.7. Malaysia 8.3.8. Vietnam 8.3.9. Taiwan 8.3.10. Bangladesh 8.3.11. Pakistan 8.3.12. Rest of Asia Pacific 9. Middle East and Africa Bolt Heaters Market (by Value USD and Volume Units) 9.1. Middle East and Africa Bolt Heaters Market, by Type (2023-2029) 9.2. Middle East and Africa Bolt Heaters Market, by End Use (2023-2029) 9.3. Middle East and Africa Bolt Heaters Market, by Country (2023-2029) 9.3.1. South Africa 9.3.2. GCC 9.3.3. Egypt 9.3.4. Nigeria 9.3.5. Rest of ME&A 10. South America Bolt Heaters Market (by Value USD and Volume Units) 10.1. South America Bolt Heaters Market, by Type (2023-2029) 10.2. South America Bolt Heaters Market, by End Use (2023-2029) 10.3. South America Bolt Heaters Market, by Country (2023-2029) 10.3.1. Brazil 10.3.2. Argentina 10.3.3. Rest of South America 11. Company Profile: Key players 11.1. Chromalox 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Enerpac 11.3. Hydraquip 11.4. Park Thermal International 11.5. Flex-C-Therm Corporation 11.6. Advanced Design Technology (ADT) 11.7. Industrial Heater Corporation 11.8. Kampa 11.9. KH Heating Solutions 11.10. MSI Viking 11.11. NPT 11.12. Powerblanket 11.13. Sigma Thermal 11.14. Stargas 11.15. Thermal Hire Ltd 11.16. Titan Products Inc 11.17. Valin Thermal Solutions & Automation 11.18. Wattco 11.19. Yash Systems Manufacturing Co Pvt. Ltd. 11.20. Zoppas Industries 12. Key Findings 13. Industry Recommendation