The Bike Camera Market size was valued at USD 1.88 Billion in 2022 and the total Bike Camera Market revenue is expected to grow at a CAGR of 7.8% from 2023 to 2029, reaching nearly USD 3.18 Billion Bike cameras are cameras that cyclists use while cycling to capture or film the surroundings. Bike cameras have grown in popularity and now offer a wide range of functions in addition to being tiny, waterproof, and crash-proof cameras that can be mounted to anything. Bike cameras are compact, well-designed cameras that can record HD video without making it challenging. Depending on the type, they can also serve as a safety feature, allowing for the capturing of near passes and other poor driving behaviors. Garmin and Cycliq products, for example, could be considered among the best bike lights and cameras. Bike cameras are classified into three types: action cameras, helmet cameras, and handlebar cameras. The most common sort of bike camera is an action camera. They're compact, light, and simple to install on a bike. In addition, action cameras are usually less expensive than other types of bike cameras. Action cameras are the best cameras for cyclists, and are tested in a variety of real-world and controlled shooting circumstances to see how well they function which drives bike camera market. Helmet cameras are attached to the helmet and provide a clear view of the road ahead. Major Areas Helmet cameras cost more than action cameras, but they are less likely to be damaged in a collision. Handlebar cameras, which are mounted on handlebars, provide a wide-angle view of the road. Bike cameras are used for personal or commercial use. The bike Camera market is continue expanding in the future. Bike Camera Market Scope and Research Methodology: The bike camera market report provides a wide-ranging analysis of the global market in the consumer and goods industry. It covers various aspects such as type, application, sales channel, and region. It also gives knowledge about the growth drivers, upcoming challenges, trends, and opportunities. The research methodology involves analysing industry press releases, annual reports, and other relevant documents of key industry participants. The report highlights the product’s competitive position and focuses on technological advancements to establish dominance in the global bike camera market. Key players are also strengthening their market positions by implementing market strategies such as product launches, R&D development, joint venture, and mergers & acquisitions. Overall, the report aims to offer valuable insights and an analytical depiction of the global bike camera industry to assist investors in making decisions and understanding market dynamics related to the consumer and goods industryTo know about the Research Methodology :- Request Free Sample Report

Bike Camera Market Dynamics:

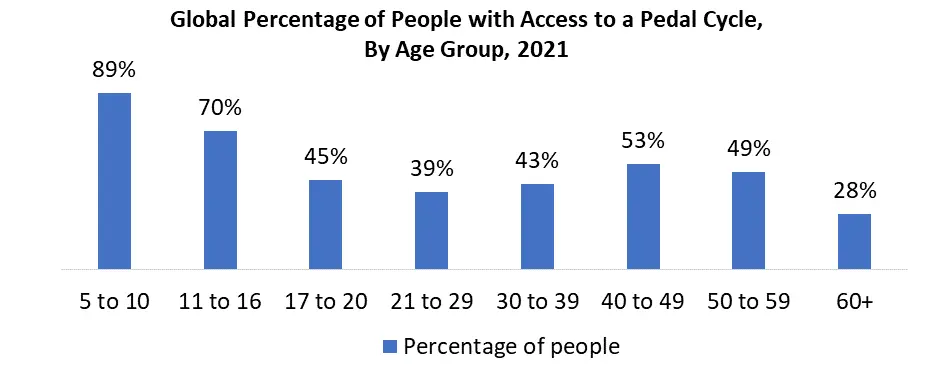

Growing Acceptance of Bike Cameras by Professional Cyclists to Surge the Market Growth In recent times, the number of cyclists grows, increasing the frequency of accidents involving them. Many of these incidents are caused by other road users' irresponsibility, such as drivers who fail to detect bicycles when turning or changing lanes. Having a camera installed on the bike can assist in capturing film of these instances, which can then be used as evidence to support the case if need to file a claim. The rising cost of fuel is another aspect fuelling the growth of the bike camera industry. As the cost of fuel and diesel continues to rise, an increasing number of individuals are looking for other modes of transportation that are less expensive to operate. Cycling is a natural choice for many individuals, and having a camera mounted on the bike can assist in safeguarding people. Another major driver of the bike camera industry is increased environmental awareness. People are increasingly seeking for solutions to lower their carbon footprint as the consequences of climate change become more evident. Cycling is an excellent method to accomplish this, and having a camera mounted on the bike can assist in documenting any cases of pollution or environmental damage that encounter on tour. The bike camera market demand is projected to expand in the future years as more individuals use them for a variety of purposes. High Cost of Bike Camera Setups Restrains the Growth of the Global Bike Camera Market The expense of a front and rear bike camera setup, which can exceed $500, presents a significant financial barrier for potential customers. Additionally, the unmanageable process of mounting, positioning, and charging the cameras before each ride can be seen as time-consuming and inconvenient. Ensuring proper camera positioning to capture license plates and maintaining clean lenses free from dirt and water droplets requires technical knowledge and ongoing maintenance. This complexity may discourage some customers who prefer a simpler and more user-friendly solution. For cyclists who have experienced accidents or close calls with vehicles, the use of bike cameras with the sole purpose of capturing potential crashes can trigger post-traumatic stress disorder (PTSD) and heighten anxiety about traffic situations. This emotional aspect may cause them to avoid using the cameras altogether. Moreover, bike cameras are susceptible to vibrations during rides, leading to frequent repositioning, which may disrupt the cycling experience and diminish the joy riders seek from their journeys. The use of bike cameras may raise legal and privacy concerns, as different jurisdictions may have varying laws and regulations regarding the recording of public spaces. This uncertainty could demotivate some potential customers from investing in the technology. These factors hampered the growth of the bike camera market. According to statistics released by the National Police Agency in Japan, in 2022, cyclists were involved in 23.3 percent of all traffic accidents the highest rate on record. Bike Camera Creates Enormous Opportunities for Exposing Adventure and Safety Solutions Bike cameras offer a revolutionary approach to video shooting, boasting remarkable stabilization and the ability to capture comprehensive surroundings simultaneously. For cycling and motorcycling enthusiasts, these cameras present an exceptional opportunity to produce compelling and captivating videos. Even for everyday commuters, the 360-degree cameras guarantee no detail is missed throughout the entire recording duration. Originally marketed as accessories for recreational riders, bike cameras have evolved into powerful tools for editing and creating captivating films of journeys. Their true potential emerged when cyclists began utilizing them to document collisions, near-misses, and dangerous driving incidents, sharing these videos on popular platforms like YouTube. Beyond cycling and motorcycling, the versatility of action cameras extends to various adventures, including family vacations, action sports, ski holidays, beach getaways, diving, hiking, and skating. An action camera, particularly the highly regarded GoPro Hero10 Black, emerges as the top choice for most individuals. With its outstanding video quality, integrated mount, and incredibly effective image stabilization, the Hero10 Black delivers exceptional performance, ranking among the best in its class. Additionally, its user-friendly design ensures ease of use for all levels of expertise. While the Hero11 Black offers an upgraded image sensor as the premium option, the majority of users are unlikely to discern a noticeable difference between the two models. For seeking opportunities in the bike camera market, it is evident that these innovative devices cater to a wide range of consumers. Their potential applications extend from recreational use to documenting safety incidents, making them valuable tools for both enthusiasts and safety-conscious individuals. As the demand for action cameras continues to grow, businesses explore collaborations with manufacturers, marketing strategies to target adventure enthusiasts, and partnerships with content creators who showcase the cameras' capabilities through videos.Bike Camera Market Segment Analysis:

Based on type, the market has been divided into 4K and 1080 P. Among these, the 4K sub-segment is projected to generate the maximum revenue. The 4K sub-segment witnessed the highest market share in the global bike camera market in 2022.4K resolution captures far more detail and information than 1080p. This detail is plainly seen in the video storage sizes. Five 4K cameras will demand significantly more storage than five 1080p cameras. With 4K resolution, the image is clear, and 4K is the best option for capturing writing or other minute components in the recording. Higher resolution sensors can affect detail in 4K cameras. Light, the most important factor in producing an aesthetic image, might have a greater impact on the recordings. Because 4K Ultra HD collects more data, it is now a market leader in the consumer electronics sector, and it promises great image quality and details in video surveillance. These factors are anticipated to boost the growth of the 4K sub-segment during the forecast timeframe.Based on application, the market has been divided into personal and commercial. Among these, the personal sub-segment is projected to generate the maximum revenue. The personal sub-segment witnessed the highest revenue in 2022. This market increase can be linked to the personal use of bike cameras to collect footage while riding. It is useful for documenting pleasing roads, accidents, and close calls. The camera also captures the rider's performance, which may help in skill improvement. Furthermore, it records videos and images of the surrounding locations, which might be used as evidence if an accident occurs. This may due to an increase in sports tourism as well as an increase in the number of sports enthusiasts who want to capture high-quality images and films of their sports and adventure activities such as surfing, scuba diving, riding, and skydiving. This is due to the increasing popularity of social media. Many amateurs and professionals have begun uploading and posting films of their exploits and life experiences is expected to enhance demand for the sub-segment and bike camera market analysis. Based on sales channels, the market has been divided into online and offline. Among these, the online sub-segment is projected to generate the maximum revenue. The online sub-segment of the bike camera market witnessed the highest market share in 2022 due to the vast range of product availability. The advancements in these stores provide customers with an easier shopping experience. Customers are also attracted by the deals and discounts made available by online sales channels. The fact that consumers find it extremely convenient to purchase online has led to the expansion of the bike camera market trend. Furthermore, the extensive availability of all types of products on apps with significant price discounts and plans entices the majority of the public to buy online. This is because suppliers provide good after-sales services at a low cost. Due to the increasing adoption of the Internet and e-commerce sites for purchasing action cameras, the online segment is projected to acquire quick growth over the forecast period. The Internet stores provide enormous discounts and quick brand comparisons, as well as simple return and payment choices which are likely to drive the growth of the bike camera market demand during the forecast period.

Bike Camera Market Regional Insights:

North America region dominated the market in the year 2022, and is expected to continue its dominance during the forecast period. The bike camera market in North America has witnessed notable trends that are shaping the industry landscape. In recent years, there has been a growing emphasis on safety and the adoption of advanced technologies among cyclists in the North American region. As more people turn to cycling for transportation and recreation, concerns regarding road safety have become dominant. This has led to an increased demand for bike cameras, as cyclists seek a proactive solution to capture incidents and ensure accountability on the road. Advancements in camera technology have improved the quality and functionality of bike cameras, making them more appealing to consumers. High-definition video capture, better image stabilization, and enhanced battery life have addressed some of the previous limitations and bolstered the overall performance of these devices. Furthermore, the integration of bike cameras with smartphones and other smart devices has opened up new possibilities for data sharing, social networking, and community engagement. Cyclists can now easily share footage of near-misses or road hazards, promoting a culture of safety and awareness among fellow riders. This connectivity also enables bike camera manufacturers to offer cloud storage and online services, providing added value to their products. Businesses operating in the bike camera market have recognized the importance of user-friendly interfaces and seamless integration with existing cycling equipment. Streamlined mounting systems, easy-to-use controls, and wireless connectivity are key features that appeal to consumers seeking hassle-free experiences. Moreover, the rise of e-commerce platforms and direct-to-consumer marketing has facilitated broader access to bike cameras, allowing smaller companies to compete with more established players. The market has become increasingly competitive, leading to price adjustments and product differentiation to cater to diverse customer segments. The growing food service industry is expected to propel the bike camera market growth in the forecast years.Competitive Landscape

The growing interest in cycling safety and the rise of cycling as a popular activity have attracted tech startups to the bike camera market. These startups often bring innovative features and technology, attempting to disrupt the established players by using the strategies such as product launches, joint ventures, R&D development, and mergers & acquisitions are common strategies followed by major market key players. Established cycling brands may incorporate bike cameras into their product offerings, either through partnerships or in-house development. These brands leverage their reputation in the cycling community to attract customers. Companies that offer excellent customer service, warranty coverage, and software updates tend to build stronger customer loyalty and satisfaction. For instance, in April 2023, GoPro declared its fifth Million Dollar Challenge. This thrilling challenge revolves around a 100% user-generated highlight reel, showcasing videos captured solely on GoPro's latest flagship models, the HERO11 Black and HERO11 Black Mini cameras. The challenge attracted the creative efforts of 55 talented content creators from 21 countries worldwide. GoPro's Million Dollar Challenge was an exciting opportunity for users to showcase their skills and creativity in capturing extraordinary moments with the cutting-edge capabilities of the HERO11 Black and HERO11 Black Mini cameras. The challenge emphasizes the outstanding features of these flagship devices, which have been designed to deliver exceptional video quality and stunning performance in a compact form. Each selected creator was rewarded with a substantial prize of $18,181.81 for their exceptional contribution. This initiative not only celebrates the passion and talent of GoPro users but also serves as a platform to showcase the versatility and capabilities of the latest HERO11 Black and HERO11 Black Mini cameras. The global participation from creators across diverse regions underscores the widespread popularity and influence of GoPro's innovative camera technology in the world of content creation.Bike Camera Market Scope: Inquire before buying

Bike Camera Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 1.88 Bn. Forecast Period 2023 to 2029 CAGR: 7.8% Market Size in 2029: US $ 3.18 Bn. Segments Covered: by Type 4K 1080 P by Sales Channel Online Offline by Application Personal Commercial Bike Camera Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Bike Camera Market Key Players:

1. Garmin 2. Gopro Inc. 3. Polaroid 4. YI Technology 5. RevZilla 6. Drift Innovation 7. Contour 8. Coleman 9. SJCAM 10. PowerLead 11. Sound Around 12. Cycliq 13. MOHOC 14. Sena 15. Sony Corporation 16. Nikon Corporation FAQs: 1. What are the growth drivers for the Bike Camera market? Ans. The growing acceptance of bike cameras by professional cyclists is the key factor driving the growth of the bike camera market. 2. What is the major restraint on the Bike Camera market growth? Ans. The high cost of the bike camera is expected to be the major restraining factor for the bike camera market growth. 3. Which region is expected to lead the global bike camera market during the forecast period? Ans. North America is expected to lead the global bike camera market during the forecast period. 4. What is the projected market size & growth rate of the Bike Camera market? Ans. The bike camera market size was valued at USD 1.88in 2022 and the total bike camera market revenue is expected to grow at a CAGR of 7.8% from 2022 to 2029, reaching nearly USD 3.18 Billion. 5. What segments are covered in the Bike Camera market report? Ans. The segments covered in the bike Camera market report are type, application, sales channel, and region.

TOC 1. Bike Camera Market: Research Methodology 2. Bike Camera Market: Executive Summary 3. Bike Camera Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Bike Camera Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Bike Camera Market: Segmentation (by Value USD and Volume Units) 5.1. Bike Camera Market, by Type(2022-2029) 5.1.1. 4K 5.1.2. 1080 P 5.2. Bike CameraMarket, by Application (2022-2029) 5.2.1. Personal 5.2.2. Commercial 5.3. Bike CameraMarket, by Sales Channel (2022-2029) 5.3.1. Online 5.3.2. Offline 5.4. Bike CameraMarket, by Region (2022-2029) 5.4.1. North America 5.4.2. Europe 5.4.3. Asia Pacific 5.4.4. Middle East and Africa 5.4.5. South America 6. North America Bike Camera Market (by Value USD and Volume Units) 6.1. North America Bike Camera Market, by Type (2022-2029) 6.1.1. 4K 6.1.2. 1080 P 6.2. North America Bike CameraMarket, by Application (2022-2029) 6.2.1. Personal 6.2.2. Commercial 6.3. North America Bike CameraMarket, by Sales Channel (2022-2029) 6.3.1. Online 6.3.2. Offline 6.4. North America Bike CameraMarket, by Country (2022-2029) 6.4.1. United States 6.4.2. Canada 6.4.3. Mexico 7. Europe Bike CameraMarket (by Value USD and Volume Units) 7.1. Europe Bike CameraMarket, by Type (2022-2029) 7.2. Europe Bike CameraMarket, by Application (2022-2029) 7.3. Europe Bike CameraMarket, by Sales Channel (2022-2029) 7.4. Europe Bike CameraMarket, by Country (2022-2029) 7.4.1. UK 7.4.2. France 7.4.3. Germany 7.4.4. Italy 7.4.5. Spain 7.4.6. Sweden 7.4.7. Austria 7.4.8. Rest of Europe 8. Asia Pacific Bike Camera Market (by Value USD and Volume Units) 8.1. Asia Pacific Bike CameraMarket, by Type (2022-2029) 8.2. Asia Pacific Bike CameraMarket, by Application (2022-2029) 8.3. Asia Pacific Bike CameraMarket, by Sales Channel (2022-2029) 8.4. Asia Pacific Bike CameraMarket, by Country (2022-2029) 8.4.1. China 8.4.2. S Korea 8.4.3. Japan 8.4.4. India 8.4.5. Australia 8.4.6. Indonesia 8.4.7. Malaysia 8.4.8. Vietnam 8.4.9. Taiwan 8.4.10. Bangladesh 8.4.11. Pakistan 8.4.12. Rest of Asia Pacific 9. Middle East and Africa Bike Camera Market (by Value USD and Volume Units) 9.1. Middle East and Africa Bike Camera Market, by Type (2022-2029) 9.2. Middle East and Africa Bike Camera Market, by Application (2022-2029) 9.3. Middle East and Africa Bike Camera Market, by Sales Channel (2022-2029) 9.4. Middle East and Africa Bike Camera Market, by Country (2022-2029) 9.4.1. South Africa 9.4.2. GCC 9.4.3. Egypt 9.4.4. Nigeria 9.4.5. Rest of ME&A 10. South America Bike CameraMarket (by Value USD and Volume Units) 10.1. South America Bike CameraMarket, by Type (2022-2029) 10.2. South America Bike CameraMarket, by Application (2022-2029) 10.3. South America Bike CameraMarket, by Sales Channel (2022-2029) 10.4. South America Bike CameraMarket, by Country (2022-2029) 10.4.1. Brazil 10.4.2. Argentina 10.4.3. Rest of South America 11. Company Profile: Key players 11.1. Garmin 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Gopro Inc. 11.3. Polaroid 11.4. YI Technology 11.5. RevZilla 11.6. Drift Innovation 11.7. Contour 11.8. Coleman 11.9. SJCAM 11.10. PowerLead 11.11. Sound Around 11.12. Cycliq 11.13. MOHOC 11.14. Sena 11.15. Sony Corporation 11.16. Nikon Corporation 12. Key Findings 13. Industry Recommendation