Bed Linen Market size was valued at USD 452.29 Bn. in 2022 and the total Bed Linen Market revenue is expected to grow by 7.8 % from 2023 to 2029, reaching nearly USD 765.15 Bn.Bed Linen Market Overview

The Bed Linen Market is an Application that produces and supplies various Products of bed linens, such as sheets, duvet covers, pillowcases, blankets, and quilts, for both residential and commercial purposes. These products serve the dual purpose of enhancing comfort and aesthetics while contributing to hygiene and cleanliness. The Bed Linen market has experienced significant growth due to various factors, including trends in the real estate and hotel sectors, rising consumer spending on home furnishings, and a focus on quality sleep and self-care. The bed linen market is driven by factors such as increased residential construction, rising disposable incomes, health awareness, evolving home decor trends, sustainability concerns, and the growth of the hospitality Application. Manufacturers are capitalizing on these drivers by innovating in materials and design, focusing on premium quality, sustainability, and customization, and expanding their reach through online retail and partnerships. Consumers' willingness to spend on home furnishings, driven by higher per capita earnings and a variety of design options, is also contributing to the bed linen market growth.To know about the Research Methodology :- Request Free Sample Report

Bed Linen Market Dynamics:

Bed Linen Market Drivers: Rising Demand for Household Items, Residential Construction, and Disposable Incomes Drive the Bed Linen Market. The increase in residential construction projects leads to a higher demand for bedding materials, including bed linens. As more homes are being built, the need for quality bedding products rises. Growing disposable incomes enable individuals to invest in home furnishings, including a wide variety of bed linen options. This increased affordability drives higher consumption of bed linens with diverse designs, textures, and fabrics. The Increasing demand for quality products has been rising due to various factors. People spend money on comfort products that are durable as well as sustainable in nature. Bed Linen Market is a necessary product that gives comfort while sleeping and is sustainable. The rise in the real estate sector and increased consumer spending on home furnishings are driving demand for bedroom linen. Technological advancements, such as breathable and anti-microbial bed linen, are encouraging healthy sleeping habits, these aspects help to drive the bed linen market. Health Awareness Shift in Home Décor Drive the Bed Linen Market Awareness of the positive impact of better sleeping practices on mental and physical health is encouraging more consumers to prioritize the quality of their bedding materials. This awareness drives the adoption of premium and comfortable bed linens. Changing lifestyles and evolving home decor trends lead to increased purchases of items that enhance personal comfort, including high-quality bed linens. Consumers are looking for products that complement their interior design choices. This trend boosts overall consumption in the market. Consumer preference for organic and environmentally friendly bed linens is impacting the market positively. Luxurious and premium bed linens are in demand, both in residential and commercial settings, ontributing to bed linen market expansion. The e-commerce sector's growth and heightened awareness of the importance of sleep are driving innovation in textile technology, these aspects help to drive the bed linen market. Bed Linen Market Challenges: Lack of Ability to Tackle the Growing Demand for Cotton is Hampering the Growth of the Bed Linen Market Availability of substitutes in developed nations, followed by a lack of ability to tackle the growing demand for cotton-made products. Furthermore, the availability of disposable bed sets and consumers opting for the same owing to their busy schedules are encouraging them to shift toward disposable products. All these aspects which create an impact on Supply chain disruptions hampered the overall bed linen market growth. Bed Linen Market Opportunities: Innovation in Materials & Design, Premium Quality, Health, and Wellness Focus Creates More Opportunities for the Growing Bed Linen Market. Manufacturers grab opportunities to innovate and differentiate their products by developing unique bed linen materials, designs, textures, and color combinations that provide to changing consumer preferences. The growing demand for premium quality bed linens presents an opportunity for manufacturers to introduce high-end, luxury products that target consumers seeking top-tier comfort and style. Highlighting the health benefits of using high-quality bed linens attracts health-conscious consumers. Manufacturers develop bed linens made from organic or environmentally friendly materials to tap into this growing market segment, such factors boost the bed linen market. Online Retail E-commerce, Collaborations, and Partnerships Build market opportunities for Bed Linen Market Offering customization options such as personalized designs, monograms, or sizing is attract consumers looking for unique and tailored bedding solutions. As the hospitality Application expands, supplying bed linens to hotels, resorts, and other accommodation businesses presents a significant growth opportunity for manufacturers. Capitalizing on the trend of online shopping, manufacturers establish a strong online presence and offer convenient purchasing options for consumers seeking high-quality bed linens. Expanding into international markets provides new avenues for growth, especially in regions with increasing disposable incomes and a focus on home improvement. Collaborating with interior designers, home furnishing stores, and other relevant partners helps manufacturers reach a wider consumer base and enhance brand visibility, such factors boost the bed linen market.Bed Linen Market Competitive Landscape:

The Bed Linen market is dominated by a few leading market players in terms of market share. However, demand is primarily driven by consumers' income. While big players compete through the breadth of products, volume purchasing, and effective marketing and merchandising, small players focus on product superiority and customer service. Serta Simmons Bedding LLC, in June 2022, launched a limited-edition sleep collection designed by Nate Berkus. This collection features exclusive design prints along with a waterproof mattress protector. The material used is upcycled recovered plastic from the ocean In May 2021, Temper Sealy International, Inc. announced its acquisition of Dreams, a specialty bed retailer in the U.K. This move will help Temper Sealy grow in the European region and leverage the popularity and reach of Dreams Brooklinen launched a Luxe Core Sheet set featuring clever tabs label long side and short side on the fitted sheet. Slumber Cloud launched a stratus sheet set, the fabric technology that helps to maintain a comfortable body temperature all through the night. Beaumont & Brown Ltd launched the linen bedding collection for the bedroom and bathroom along with the launch of 'later Cross Border' bedding sets. Acton & Acton Ltd. introduced its new set of fitted, flat valance, and semi-fitted sheets along with their advanced-designed bedspreads. From pure cotton to 50% cotton - 50% polyester, the company covers each Product.Bed Linen Market Segment Analysis:

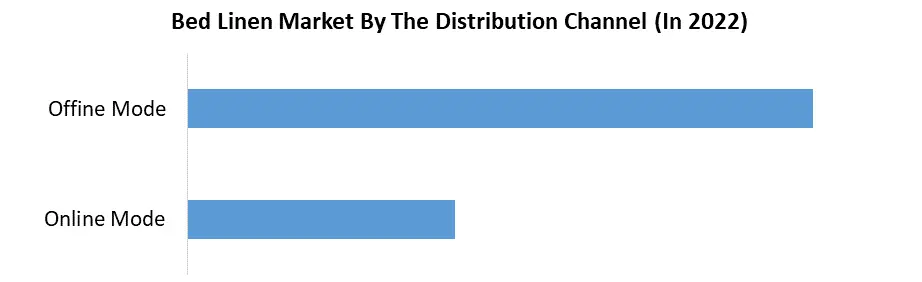

Based on Application, the market is segmented into Residential, Commercial. The Residential segment dominated the market in the year 2022 and is expected to continue its dominance during the forecast period. The increased adoption of pillowcases and bed sheets, as well as growing urbanization and consumer awareness of good home aesthetics. One of the key factors driving the market size is the growing population and construction Application in several emerging nations. Overall, in the work-from-home culture, consumer expectations are moving toward more durable, sustainable, resilient, and healthier products in the bed linen market.Based on Distribution Channel, the market is segmented into Offline, Online. The Offline segment dominated the market in the year 2022 and is expected to continue its dominance during the forecast period. Despite the growing popularity of e-commerce, a majority of consumers still prefer shopping for bedroom linens through offline channels. This reluctance to shop online is attributed to various factors, such as concerns over product quality, the desire to see and feel the linens before purchasing, and a lack of trust in online retailers. As a result, offline channels continue to play a dominant role, accounting for over 70% of revenue in the bed linen market. Furthermore, the online segment is expected to grow fastly during the forecast period. The bedroom linen market is experiencing a significant shift towards online shopping. The online channel has already contributed 30% of total revenue in 2022, and this figure is expected to exceed 35% by 2029. To encourage more consumers to adopt online shopping, businesses implement strategies that address these concerns. Offering high-quality product images, detailed product descriptions, and customer reviews helps build trust and provide a better understanding of the product. Additionally, providing easy return policies and reliable customer support further alleviate any hesitations related to online shopping. By addressing these issues, businesses are capitalizing on the growing trend of e-commerce and reaching a wider customer base.

Bed Linen Market Regional Insights:

In 2022, the revenue of the Asia Pacific region dominated the global market with a 40% share and is expected to continue its dominance during the forecast period. This region's rapidly expanding hospitality and housing Application is the primary driver of market expansion. According to the most recent CBRE survey, money was invested in hotels in this region. This sector will continue expanding due to the growing hospitality and housing Application, the anticipation around the performance of this area and operational profits that are virtually back to pre-pandemic levels, which will favorably impact the bed linen market. Furthermore, The North American region is expected to grow fastly during the forecast period. The growth is owing to increasing Consumers' awareness concerning good night's sleep and proper bedding material. Hence the region held a market share of 25% in 2022. Surging residential construction activities, especially in the US, are held regional bed linen market revenue. Additionally, strong growth in the hospitality Application is expected to enhance the market. According to the consumer trends in the US, around 75% of individuals prefer cotton and cotton blend materials, these aspects boosting the demand for the bed linen market in the region.Global Bed Linen Market Scope: Inquire before buying

Global Bed Linen Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 452.29 Bn. Forecast Period 2023 to 2029 CAGR: 7.8% Market Size in 2029: US $ 765.15 Bn. Segments Covered: by Product Sheets & Mattress Covers Blankets Pillowcases & Covers Others by Application Residential Commercial by Material Cotton Polyester Linen Silk Others by Distribution Channel Offline Online Bed Linen Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Bed Linen Market Key players

1. Serta Simmons Bedding, LLC 2. Bed Bath & Beyond Inc. 3. Tempur Sealy International, Inc. 4. Pacific Coast Feather Company 5. Acton & Acton Ltd. 6. Beaumont & Brown Ltd. 7. Boll & Branch LLC 8. Crane and Canopy Inc. 9. American Textile Co. 10. Trident Ltd. 11. Inter Ikea Group 12. Welspun India Ltd. 13. Frette 14. Springs Global 15. William Sanoma, Inc. 16. Penney Company, Inc. 17. Beltrami Linen Srl. 18. Cuddledown Marketing LLC 19. Dunelm Group plc 20. Hollander Sleep Products 21. I Love Linen 22. Paradise Pillow, Inc. 23. Peacock Alley 24. Sanderson 25. Sleep Number Corp. 26. The Bombay Dyeing & Mfg. Co. Ltd. 27. The Victoria Linen Co. Ltd. 28. Welspun India Ltd 29. Brooklinen 30. Slumber Cloud Frequently Asked Questions: 1] What is the CAGR for Bed Linen Market? Ans. The CAGR for Market is 7.8%. 2] What is the expected Application size of the bed linen market? Ans. The global market size is expected to reach USD 765.15 billion by 2029. 3] Who are the top market players in the market? Ans. Key players in the bedroom linen market are Beaumont & Brown, Bed Bath & Beyond, Tempur Sealy International, American Textile, Acton & Acton, Serta Simmons Bedding, and Welspun India. 4] What are the dominant product Products in the market? Ans. The major dominant product Products can be divided into divided into sheets, pillowcases, and duvet covers, among others. 5] What are the leading distribution channels of bed linen in the market? Ans. The leading distribution channels through majorly by offline market and another is the online market.

Table of Content: 1. Bed Linen Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Bed Linen Market: Dynamics 2.1. Bed Linen Market Trends by Region 2.1.1. Global Bed Linen Market Trends 2.1.2. North America Bed Linen Market Trends 2.1.3. Europe Bed Linen Market Trends 2.1.4. Asia Pacific Bed Linen Market Trends 2.1.5. Middle East and Africa Bed Linen Market Trends 2.1.6. South America Bed Linen Market Trends 2.2. Bed Linen Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Bed Linen Market Drivers 2.2.1.2. North America Bed Linen MarketRestraints 2.2.1.3. North America Bed Linen MarketOpportunities 2.2.1.4. North America Bed Linen MarketChallenges 2.2.2. Europe 2.2.2.1. Europe Bed Linen Market Drivers 2.2.2.2. Europe Bed Linen MarketRestraints 2.2.2.3. Europe Bed Linen MarketOpportunities 2.2.2.4. Europe Bed Linen MarketChallenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Bed Linen Market Drivers 2.2.3.2. Asia Pacific Bed Linen MarketRestraints 2.2.3.3. Asia Pacific Bed Linen MarketOpportunities 2.2.3.4. Asia Pacific Bed Linen MarketChallenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Bed Linen Market Drivers 2.2.4.2. Middle East and Africa Bed Linen MarketRestraints 2.2.4.3. Middle East and Africa Bed Linen MarketOpportunities 2.2.4.4. Middle East and Africa Bed Linen MarketChallenges 2.2.5. South America 2.2.5.1. South America Bed Linen Market Drivers 2.2.5.2. South America Bed Linen MarketRestraints 2.2.5.3. South America Bed Linen MarketOpportunities 2.2.5.4. South America Bed Linen MarketChallenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Supply Chain Analysis 2.7. Regulatory Landscape by Region 2.7.1. Global 2.7.2. North America 2.7.3. Europe 2.7.4. Asia Pacific 2.7.5. Middle East and Africa 2.7.6. South America 2.8. Analysis of Government Schemes and Initiatives For Homewares Industry 2.9. The Global Pandemic Impact on Bed Linen Market 2.10. Homewares Price Trend Analysis (2021-22) 2.11. Global Bed Linen Market Trade Analysis (2017-2022) 2.11.1. Global Import of Homewares 2.11.1.1. Ten Largest Importer 2.11.2. Global Export of Homewares 2.11.3. Ten Largest Exporter 2.12. Production Capacity Analysis 2.12.1. Chapter Overview 2.12.2. Key Assumptions and Methodology 2.12.3. Homewares Manufacturers: Global Installed Capacity 2.12.3.1. Analysis by Size of Manufacturer 2.12.3.2. Analysis by Scale of Operation 2.12.4. Analysis by Location of Manufacturing Facility 2.13. Demand and Supply Analysis 3. Bed Linen Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) (2022-2029) 3.1. Bed Linen Market Size and Forecast, by Product (2022-2029) 3.1.1. Sheets & Mattress Covers 3.1.2. Blankets 3.1.3. Pillowcases & Covers 3.1.4. Others 3.2. Bed Linen Market Size and Forecast, by Application (2022-2029) 3.2.1. Residential 3.2.2. Commercial 3.3. Bed Linen Market Size and Forecast, by Material (2022-2029) 3.3.1. Cotton 3.3.2. Polyester 3.3.3. Linen 3.3.4. Silk 3.3.5. Others 3.4. Bed Linen Market Size and Forecast, by Distribution Channel (2022-2029) 3.4.1. Offline 3.4.2. Online 3.5. Bed Linen Market Size and Forecast, by Region (2022-2029) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Bed Linen Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 4.1. North AmericaBed Linen Market Size and Forecast, by Product (2022-2029) 4.1.1. Sheets & Mattress Covers 4.1.2. Blankets 4.1.3. Pillowcases & Covers 4.1.4. Others 4.2. North AmericaBed Linen Market Size and Forecast, by Application (2022-2029) 4.2.1. Residential 4.2.2. Commercial 4.3. North AmericaBed Linen Market Size and Forecast, by Material (2022-2029) 4.3.1. Cotton 4.3.2. Polyester 4.3.3. Linen 4.3.4. Silk 4.3.5. Others 4.4. North AmericaBed Linen Market Size and Forecast, by Distribution Channel (2022-2029) 4.4.1. Offline 4.4.2. Online 4.5. Bed Linen Market Size and Forecast, by Country (2022-2029) 4.5.1. United States 4.5.1.1. United States Bed Linen Market Size and Forecast, by Product (2022-2029) 4.5.1.1.1. Sheets & Mattress Covers 4.5.1.1.2. Blankets 4.5.1.1.3. Pillowcases & Covers 4.5.1.1.4. Others 4.5.1.2. United States Bed Linen Market Size and Forecast, by Application (2022-2029) 4.5.1.2.1. Residential 4.5.1.2.2. Commercial 4.5.1.3. United States Bed Linen Market Size and Forecast, by Material (2022-2029) 4.5.1.3.1. Cotton 4.5.1.3.2. Polyester 4.5.1.3.3. Linen 4.5.1.3.4. Silk 4.5.1.3.5. Others 4.5.1.4. United States Bed Linen Market Size and Forecast, by Distribution Channel (2022-2029) 4.5.1.4.1. Offline 4.5.1.4.2. Online 4.5.2. Canada 4.5.2.1. Canada Bed Linen Market Size and Forecast, by Product (2022-2029) 4.5.2.1.1. Sheets & Mattress Covers 4.5.2.1.2. Blankets 4.5.2.1.3. Pillowcases & Covers 4.5.2.1.4. Others 4.5.2.2. Canada Bed Linen Market Size and Forecast, by Application (2022-2029) 4.5.2.2.1. Residential 4.5.2.2.2. Commercial 4.5.2.3. Canada Bed Linen Market Size and Forecast, by Material (2022-2029) 4.5.2.3.1. Cotton 4.5.2.3.2. Polyester 4.5.2.3.3. Linen 4.5.2.3.4. Silk 4.5.2.3.5. Others 4.5.2.4. Canada Bed Linen Market Size and Forecast, by Distribution Channel (2022-2029) 4.5.2.4.1. Offline 4.5.2.4.2. Online 4.5.3. Mexico 4.5.3.1. Mexico Bed Linen Market Size and Forecast, by Product (2022-2029) 4.5.3.1.1. Sheets & Mattress Covers 4.5.3.1.2. Blankets 4.5.3.1.3. Pillowcases & Covers 4.5.3.1.4. Others 4.5.3.2. Mexico Bed Linen Market Size and Forecast, by Application (2022-2029) 4.5.3.2.1. Residential 4.5.3.2.2. Commercial 4.5.3.3. Mexico Bed Linen Market Size and Forecast, by Material (2022-2029) 4.5.3.3.1. Cotton 4.5.3.3.2. Polyester 4.5.3.3.3. Linen 4.5.3.3.4. Silk 4.5.3.3.5. Others 4.5.3.4. Mexico Bed Linen Market Size and Forecast, by Distribution Channel (2022-2029) 4.5.3.4.1. Offline 4.5.3.4.2. Online 5. Europe Bed Linen Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 5.1. Europe Bed Linen Market Size and Forecast, by Product (2022-2029) 5.2. Europe Bed Linen Market Size and Forecast, by Application (2022-2029) 5.3. Europe Bed Linen Market Size and Forecast, by Material (2022-2029) 5.4. Europe Bed Linen Market Size and Forecast, by Distribution Channel (2022-2029) 5.5. Europe Bed Linen Market Size and Forecast, by Country (2022-2029) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Bed Linen Market Size and Forecast, by Product (2022-2029) 5.5.1.2. United Kingdom Bed Linen Market Size and Forecast, by Application (2022-2029) 5.5.1.3. United Kingdom Bed Linen Market Size and Forecast, by Material (2022-2029) 5.5.1.4. United KingdomBed Linen Market Size and Forecast, by Distribution Channel (2022-2029) 5.5.2. France 5.5.2.1. France Bed Linen Market Size and Forecast, by Product (2022-2029) 5.5.2.2. France Bed Linen Market Size and Forecast, by Application (2022-2029) 5.5.2.3. France Bed Linen Market Size and Forecast, by Material (2022-2029) 5.5.2.4. France Bed Linen Market Size and Forecast, by Distribution Channel (2022-2029) 5.5.3. Germany 5.5.3.1. Germany Bed Linen Market Size and Forecast, by Product (2022-2029) 5.5.3.2. Germany Bed Linen Market Size and Forecast, by Application (2022-2029) 5.5.3.3. Germany Bed Linen Market Size and Forecast, by Material (2022-2029) 5.5.3.4. Germany Bed Linen Market Size and Forecast, by Distribution Channel (2022-2029) 5.5.4. Italy 5.5.4.1. Italy Bed Linen Market Size and Forecast, by Product (2022-2029) 5.5.4.2. Italy Bed Linen Market Size and Forecast, by Application (2022-2029) 5.5.4.3. Italy Bed Linen Market Size and Forecast, by Material (2022-2029) 5.5.4.4. Italy Bed Linen Market Size and Forecast, by Distribution Channel (2022-2029) 5.5.5. Spain 5.5.5.1. Spain Bed Linen Market Size and Forecast, by Product (2022-2029) 5.5.5.2. Spain Bed Linen Market Size and Forecast, by Application (2022-2029) 5.5.5.3. Spain Bed Linen Market Size and Forecast, by Material (2022-2029) 5.5.5.4. Spain Bed Linen Market Size and Forecast, by Distribution Channel (2022-2029) 5.5.6. Sweden 5.5.6.1. Sweden Bed Linen Market Size and Forecast, by Product (2022-2029) 5.5.6.2. Sweden Bed Linen Market Size and Forecast, by Application (2022-2029) 5.5.6.3. Sweden Bed Linen Market Size and Forecast, by Material (2022-2029) 5.5.6.4. Sweden Bed Linen Market Size and Forecast, by Distribution Channel (2022-2029) 5.5.7. Austria 5.5.7.1. Austria Bed Linen Market Size and Forecast, by Product (2022-2029) 5.5.7.2. Austria Bed Linen Market Size and Forecast, by Application (2022-2029) 5.5.7.3. Austria Bed Linen Market Size and Forecast, by Material (2022-2029) 5.5.7.4. Austria Bed Linen Market Size and Forecast, by Distribution Channel (2022-2029) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Bed Linen Market Size and Forecast, by Product (2022-2029) 5.5.8.2. Rest of Europe Bed Linen Market Size and Forecast, by Application (2022-2029) 5.5.8.3. Rest of Europe Bed Linen Market Size and Forecast, by Material (2022-2029) 5.5.8.4. Rest of Europe Bed Linen Market Size and Forecast, by Distribution Channel (2022-2029) 6. Asia Pacific Bed Linen Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 6.1. Asia Pacific Bed Linen Market Size and Forecast, by Product (2022-2029) 6.2. Asia Pacific Bed Linen Market Size and Forecast, by Application (2022-2029) 6.3. Asia Pacific Bed Linen Market Size and Forecast, by Material (2022-2029) 6.4. Asia Pacific Linen Market Size and Forecast, by Distribution Channel (2022-2029) 6.5. Asia Pacific Bed Linen Market Size and Forecast, by Country (2022-2029) 6.5.1. China 6.5.1.1. China Bed Linen Market Size and Forecast, by Product (2022-2029) 6.5.1.2. China Bed Linen Market Size and Forecast, by Application (2022-2029) 6.5.1.3. China Bed Linen Market Size and Forecast, by Material (2022-2029) 6.5.1.4. China Bed Linen Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.2. S Korea 6.5.2.1. S Korea Bed Linen Market Size and Forecast, by Product (2022-2029) 6.5.2.2. S Korea Bed Linen Market Size and Forecast, by Application (2022-2029) 6.5.2.3. S Korea Bed Linen Market Size and Forecast, by Material (2022-2029) 6.5.2.4. S Korea Bed Linen Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.3. Japan 6.5.3.1. Japan Bed Linen Market Size and Forecast, by Product (2022-2029) 6.5.3.2. Japan Bed Linen Market Size and Forecast, by Application (2022-2029) 6.5.3.3. Japan Bed Linen Market Size and Forecast, by Material (2022-2029) 6.5.3.4. Japan Bed Linen Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.4. India 6.5.4.1. India Bed Linen Market Size and Forecast, by Product (2022-2029) 6.5.4.2. India Bed Linen Market Size and Forecast, by Application (2022-2029) 6.5.4.3. India Bed Linen Market Size and Forecast, by Material (2022-2029) 6.5.4.4. India Bed Linen Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.5. Australia 6.5.5.1. Australia Bed Linen Market Size and Forecast, by Product (2022-2029) 6.5.5.2. Australia Bed Linen Market Size and Forecast, by Application (2022-2029) 6.5.5.3. Australia Bed Linen Market Size and Forecast, by Material (2022-2029) 6.5.5.4. Australia Bed Linen Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.6. Indonesia 6.5.6.1. Indonesia Bed Linen Market Size and Forecast, by Product (2022-2029) 6.5.6.2. Indonesia Bed Linen Market Size and Forecast, by Application (2022-2029) 6.5.6.3. Indonesia Bed Linen Market Size and Forecast, by Material (2022-2029) 6.5.6.4. Indonesia Bed Linen Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.7. Malaysia 6.5.7.1. Malaysia Bed Linen Market Size and Forecast, by Product (2022-2029) 6.5.7.2. Malaysia Bed Linen Market Size and Forecast, by Application (2022-2029) 6.5.7.3. Malaysia Bed Linen Market Size and Forecast, by Material (2022-2029) 6.5.7.4. Malaysia Bed Linen Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.8. Vietnam 6.5.8.1. Vietnam Bed Linen Market Size and Forecast, by Product (2022-2029) 6.5.8.2. Vietnam Bed Linen Market Size and Forecast, by Application (2022-2029) 6.5.8.3. Vietnam Bed Linen Market Size and Forecast, by Material (2022-2029) 6.5.8.4. Vietnam Bed Linen Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.9. Taiwan 6.5.9.1. Taiwan Bed Linen Market Size and Forecast, by Product (2022-2029) 6.5.9.2. Taiwan Bed Linen Market Size and Forecast, by Application (2022-2029) 6.5.9.3. Taiwan Bed Linen Market Size and Forecast, by Material (2022-2029) 6.5.9.4. Taiwan Bed Linen Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Bed Linen Market Size and Forecast, by Product (2022-2029) 6.5.10.2. Rest of Asia Pacific Bed Linen Market Size and Forecast, by Application (2022-2029) 6.5.10.3. Rest of Asia Pacific Bed Linen Market Size and Forecast, by Material (2022-2029) 6.5.10.4. Rest of Asia Pacific Bed Linen Market Size and Forecast, by Distribution Channel (2022-2029) 7. Middle East and Africa Bed Linen Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029 7.1. Middle East and Africa Bed Linen Market Size and Forecast, by Product (2022-2029) 7.2. Middle East and Africa Bed Linen Market Size and Forecast, by Application (2022-2029) 7.3. Middle East and Africa Bed Linen Market Size and Forecast, by Material (2022-2029) 7.4. Middle East and Africa Bed Linen Market Size and Forecast, by Distribution Channel (2022-2029) 7.5. Middle East and Africa Bed Linen Market Size and Forecast, by Country (2022-2029) 7.5.1. South Africa 7.5.1.1. South Africa Bed Linen Market Size and Forecast, by Product (2022-2029) 7.5.1.2. South Africa Bed Linen Market Size and Forecast, by Application (2022-2029) 7.5.1.3. South Africa Bed Linen Market Size and Forecast, by Material (2022-2029) 7.5.1.4. South Africa n Bed Linen Market Size and Forecast, by Distribution Channel (2022-2029) 7.5.2. GCC 7.5.2.1. GCC Bed Linen Market Size and Forecast, by Product (2022-2029) 7.5.2.2. GCC Bed Linen Market Size and Forecast, by Application (2022-2029) 7.5.2.3. GCC Bed Linen Market Size and Forecast, by Material (2022-2029) 7.5.2.4. GCC Bed Linen Market Size and Forecast, by Distribution Channel (2022-2029) 7.5.3. Nigeria 7.5.3.1. Nigeria Bed Linen Market Size and Forecast, by Product (2022-2029) 7.5.3.2. Nigeria Bed Linen Market Size and Forecast, by Application (2022-2029) 7.5.3.3. Nigeria Bed Linen Market Size and Forecast, by Material (2022-2029) 7.5.3.4. Nigeria Bed Linen Market Size and Forecast, by Distribution Channel (2022-2029) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Bed Linen Market Size and Forecast, by Product (2022-2029) 7.5.4.2. Rest of ME&A Bed Linen Market Size and Forecast, by Application (2022-2029) 7.5.4.3. Rest of ME&A Bed Linen Market Size and Forecast, by Material (2022-2029) 7.5.4.4. Rest of ME&A Bed Linen Market Size and Forecast, by Distribution Channel (2022-2029) 8. South America Bed Linen Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029 8.1. South America Bed Linen Market Size and Forecast, by Product (2022-2029) 8.2. South America Bed Linen Market Size and Forecast, by Application (2022-2029) 8.3. South America Bed Linen Market Size and Forecast, by Material (2022-2029) 8.4. South America Bed Linen Market Size and Forecast, by Distribution Channel (2022-2029) 8.5. South AmericaBed Linen Market Size and Forecast, by Country (2022-2029) 8.5.1. Brazil 8.5.1.1. Brazil Bed Linen Market Size and Forecast, by Product (2022-2029) 8.5.1.2. Brazil Bed Linen Market Size and Forecast, by Application (2022-2029) 8.5.1.3. Brazil Bed Linen Market Size and Forecast, by Material (2022-2029) 8.5.1.4. Brazil Bed Linen Market Size and Forecast, by Distribution Channel (2022-2029) 8.5.2. Argentina 8.5.2.1. Argentina Bed Linen Market Size and Forecast, by Product (2022-2029) 8.5.2.2. Argentina Bed Linen Market Size and Forecast, by Application (2022-2029) 8.5.2.3. Argentina Bed Linen Market Size and Forecast, by Material (2022-2029) 8.5.2.4. Argentina Bed Linen Market Size and Forecast, by Distribution Channel (2022-2029) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Bed Linen Market Size and Forecast, by Product (2022-2029) 8.5.3.2. Rest Of South America Bed Linen Market Size and Forecast, by Application (2022-2029) 8.5.3.3. Rest Of South AmericaBed LinenMarket Size and Forecast, by Material (2022-2029) 8.5.3.4. Rest Of South America Bed Linen Market Size and Forecast, by Distribution Channel (2022-2029) 9. Global Bed Linen Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.3.6. SKU Details 9.3.7. Production Capacity 9.3.8. Production for 2022 9.3.9. No. of Stores 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Bed Linen Market Companies, by market capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Serta Simmons Bedding, LLC. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Bed Bath & Beyond Inc. 10.3. Tempur Sealy International, Inc. 10.4. Pacific Coast Feather Company 10.5. Acton & Acton Ltd. 10.6. Beaumont & Brown Ltd. 10.7. Boll & Branch LLC 10.8. Crane and Canopy Inc. 10.9. American Textile Co. 10.10. Trident Ltd. 10.11. Inter Ikea Group 10.12. Welspun India Ltd. 10.13. Frette 10.14. Springs Global 10.15. William Sanoma, Inc. 10.16. Penney Company, Inc. 10.17. Beltrami Linen Srl. 10.18. Cuddledown Marketing LLC 10.19. Dunelm Group plc 10.20. Hollander Sleep Products 10.21. I Love Linen 10.22. Paradise Pillow, Inc. 10.23. Peacock Alley 10.24. Sanderson 10.25. Sleep Number Corp. 10.26. The Bombay Dyeing & Mfg. Co. Ltd. 10.27. The Victoria Linen Co. Ltd. 10.28. Welspun India Ltd 10.29. Brooklinen 10.30. Slumber Cloud 11. Key Findings 12. Industry Recommendations 13. Bed Linen Market: Research Methodology 14. Terms and Glossary