Automotive Ultracapacitor Market was valued at USD 2.43 Bn. in 2024 & is expected to reach USD 11.62 bn by 2032. The Automotive Ultracapacitor Market size is expected to grow at a CAGR of 21.6 % through the forecast period.Automotive Ultracapacitor Market Overview:

Ultracapacitors are electronic devices which are used in the automobile market for the storage of electric energy. They are sometimes called Supercapacitors, which are energy storage devices that offer high power density, fast charging, and discharging with long life. It is not a new technology, but it has reached a point where it can be implemented in various industries. Ultracapacitors are more efficient than batteries, however, they are used with batteries in cars to increase fuel efficiency.To know about the Research Methodology:-Request Free Sample Report Several new advancements in the field of EVs have been made recently. Newer technologies and developments have been adopted by EVs. To accomplish the stop function, automotive Ultracapacitors are installed on the vehicle. This feature saves fuel by turning off the vehicle's engine while it is stopped and restarting it when the brakes are released. Automotive ultracapacitors are mostly utilised in EVs and hybrid cars to store energy and provide it to the engine during peak demand. Automotive ultracapacitors are primarily used to improve vehicle performance by improving fuel efficiency and lowering hazardous emissions by extending vehicle life. They have a number of advantages, including increased fuel efficiency, longer battery life, and lower greenhouse gas emissions. The market share for the Automotive Ultracapacitors is constantly increasing with the adoption of modern technologies by electric vehicles, increasing demand for electric vehicles, and the various benefits offered by the Ultracapacitors. 2024 is considered as a base year to forecast the market from 2025 to 2032. 2024’s market size is estimated on real numbers and outputs of the key players and major players across the globe. The past five years' trends are considered while forecasting the market through 2032. 2024 is a year of exception and analysis, especially with the impact of lockdown by region.

Automotive Ultracapacitor Market Dynamics:

Drivers for the Automotive Ultracapacitor Market: 1. Increasing Demand for Fuel-Efficient Vehicles: Customers are looking for fuel-efficient vehicles as gasoline prices & restrictions rise. Electric vehicles (EVs) and hybrid electric vehicles (HEVs) are extremely fuel efficient, and they do not use fossil fuels or hurt the environment. EVs will undoubtedly dominate the market. Automobile manufacturers are increasingly adopting ultra-capacitors due to increased demand for fuel-efficient automobiles. During the anticipated period, the ultracapacitor industry will experience significant expansion. The global electric car market is growing at an annual rate of 18.2 %. During the anticipated period, the market will reach roughly 0.8 Bn dollars. 2. Adopting the deployment of Ultracapacitors in EVs & HEVs: With significant expansion in recent years, the worldwide electric car market is expected to reach 10 Mn vehicles on the road by 2024. The sale of electric vehicles increased by 43% in 2024. As the need for electric vehicles grows, so will the market for ultracapacitors. For the optimum alternative for petrol or diesel cars, the EV market is integrating current technology. Ultracapacitors are becoming more popular in EVs due to a variety of advantages such as improved fuel efficiency, energy storage, & battery longevity. EVs and HEVs benefit greatly from ultracapacitors. The usage of ultracapacitors in EVs & HEVs is driving market expansion because they allow vehicle makers to reduce vehicle weight, increase battery capacity, and reduce CO2 emissions. Constraints for the Automotive Ultracapacitor Market: EVs & HEVs are in high demand, but their higher pricing compared to conventional vehicles are a big barrier. EVs are not accessible in price ranges that any buyer can afford. EVs are about 2-2.5 times more expensive. Infrastructure is one of the primary obstacles for the EV market, & charging infrastructure is a critical component. It is impossible to grow an EV market without the right infrastructure; however, EV firms are working on it, and the required infrastructure is expected to be developed in the future years.Automotive Ultracapacitor Market Segment Analysis:

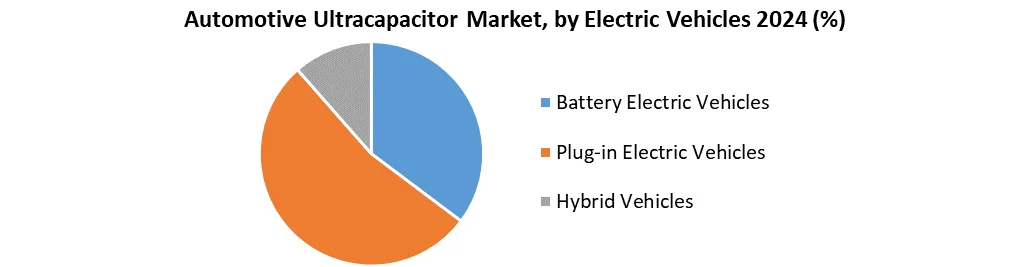

Based on Vehicle Type, the Automotive Ultracapacitor Market is divided into two categories: passenger cars & commercial cars. Hatchbacks, sedans, MPVs, & sport utility vehicles are the different types of passenger cars (SUVs). Due to increased SUV manufacturing, SUVs have a considerable market share in the passenger automobile class. SUVs are in more demand than other vehicle categories. SUV sales have increased in recent years, with a market share of roughly 45 % in passenger vehicles. It has a 53 % market share in India. There are two types of commercial vehicles: light commercial vehicles and large commercial vehicles. Based on the Application, Stop-start and regenerative braking systems (RBS), for example, are segments of the Automotive Ultracapacitor Market. The RBS is an energy recovery device that is built into the braking system of a vehicle and is designed to convert thermal energy into electrical energy. This electricity-generated energy is used to power the vehicle's many operations. This energy is stored in ultracapacitors, which then deliver it as needed. Heat is generated by friction between the brake pads and the wheels. The generated heat is converted into electrical energy by RBS using an engine generator. Ultracapacitors, which have a large capacity for energy storage, are used to store electrical energy. These solutions are popular in nations like Japan, India, & Australia because of their low resistance, low self-heating, and low maintenance requirements. During the anticipated time, RBS is expected to increase significantly. It has a CAGR of approximately 15.5 percent. Based on electric vehicles, Battery-powered electric vehicles, plug-in electric vehicles, & hybrid vehicles make up the automotive ultra-condenser industry. In-vehicle rechargeable energy storage systems, such as batteries & motors, are used in battery-powered electric cars. Internal combustion engines (ICs) & batteries are used in hybrid cars. When decelerating, however, the battery is fully charged using waste heat and energy from a conventional engine. During the anticipated period, the Electric Vehicle Market is expected to grow at a CAGR of 18.2 percent.

Automotive Ultracapacitor Market Regional Insights:

The APAC region dominated the market with a 40 % share in 2024. The APAC region is expected to witness significant growth at a CAGR of 21.5 % through the forecast period. The Asia Pacific region is dominating the ultracapacitor market. China is the leader in the Asia Pacific region with the highest sales of electric and hybrid vehicles. Increasing demand, developments in infrastructure, and governmental support for the EV market are boosting the sales of electric vehicles. China accounts for around the 53% share of the global passenger EV market. The sale of Plug-in electric vehicles in China is around 3 times that of the sale in the US. Double-digit growth is expected through Japan in the Ultracapacitor market as high demand for electric and hybrid vehicles. The EV market in India is expected a CAGR of 43.13% through the forecasted period. Europe is one of the largest markets for the Automotive Ultracapacitor Market followed by the US. There is high demand for hybrid and electric vehicles, however, the Automotive Ultracapacitor Market in Europe and US is relatively more mature than the other regions. The objective of the report is to present a comprehensive analysis of the global Automotive Ultracapacitor Market to the stakeholders in the industry. The past and status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Automotive Ultracapacitor Market dynamic, and structure by analyzing the market segments and projecting the Automotive Ultracapacitor Market size. Clear representation of competitive analysis of key players by Vehicle type, price, financial position, product portfolio, growth strategies, and regional presence in the Automotive Ultracapacitor Market make the report investor’s guide.Automotive Ultracapacitor Market Scope: Inquire before buying

Automotive Ultracapacitor Market Report Coverage Details Base Year: 2024 Forecast Period: 2024-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 2.43 Bn. Forecast Period 2025 to 2032 CAGR: 21.6% Market Size in 2032: USD 11.62 Bn. Segments Covered: by Vehicle Type Passenger Vehicle Hatchback MPV Sedan SUV Commercial Vehicle Lightweight Heavy by Application Start-Stop Operation Regenerative Breaking System Others by Electric Vehicles Battery Electric Vehicles Plug-in Electric Vehicles Hybrid Vehicles by Sales Channel OEM Aftermarket Automotive Ultracapacitor Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Automotive Ultracapacitor Key Players are:

1. Maxwell Technologies 2. Nesscap Ultracapacitors 3. Skeleton Technologies 4. ELNA America Inc. 5. Ioxus Inc 6. LS Mtron 7. Yunasko 8. Panasonic 9. Tesla 10. NAWA Technologies 11. SPEL Technologies 12. Nippon Chemi-Con 13. CAP-XX 14. NEC-Tokin 15. Kemet Corporation 16. Sumitomo Corporation Frequently Asked Questions: 1. Which region has the largest share in Global Automotive Ultracapacitor Market? Ans: Asia Pacific region held the highest share in 2024. 2. What is the growth rate of Global Automotive Ultracapacitor Market? Ans: The Global Automotive Ultracapacitor Market is growing at a CAGR of 21.6 % during forecasting period 2025-2032. 3. What is scope of the Global Automotive Ultracapacitor Market report? Ans: Global Automotive Ultracapacitor Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global Automotive Ultracapacitor Market? Ans: The important key players in the Global Automotive Ultracapacitor Market are – Maxwell Technologies, Nesscap Ultracapacitors, Skeleton Technologies, ELNA America Inc., Ioxus Inc, LS Mtron, Yunasko, Panasonic, Tesla, NAWA Technologies, SPEL Technologies, Nippon Chemi-Con, CAP-XX, NEC-Tokin, Kemet Corporation, Sumitomo Corporation 5. What is the study period of this Market? Ans: The Global Automotive Ultracapacitor Market is studied from 2024 to 2032.

1. Global Automotive Ultracapacitor Market Size: Research Methodology 2. Global Automotive Ultracapacitor Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Automotive Ultracapacitor Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Automotive Ultracapacitor Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region 3.12. COVID-19 Impact 4. Global Automotive Ultracapacitor Market Size Segmentation 4.1. Global Automotive Ultracapacitor Market Size, by Vehicle Type (2024-2032) 4.2. Global Automotive Ultracapacitor Market Size, by Application (2024-2032) 4.3. Global Automotive Ultracapacitor Market Size, by Electric Vehicle (2024-2032) 4.4. Global Automotive Ultracapacitor Market Size, by Sales Channel (2024-2032) 5. North America Automotive Ultracapacitor Market (2024-2032) 5.1. North America Automotive Ultracapacitor Market Size, by Vehicle Type (2024-2032 5.2. North America Automotive Ultracapacitor Market Size, by Application (2024-2032) 5.3. North America Automotive Ultracapacitor Market Size, by Electric Vehicle (2024-2032) 5.4. North America Automotive Ultracapacitor Market Size, by Sales Channel (2024-2032) 5.5. North America Automotive Ultracapacitor Market, by Country (2024-2032) 6. European Automotive Ultracapacitor Market (2024-2032) 6.1. European Automotive Ultracapacitor Market, by Vehicle Type (2024-2032) 6.2. European Automotive Ultracapacitor Market, by Application (2024-2032) 6.3. European Automotive Ultracapacitor Market, by Electric Vehicle (2024-2032) 6.4. European Automotive Ultracapacitor Market, by Sales Channel (2024-2032) 6.5. European Automotive Ultracapacitor Market, by Country (2024-2032) 7. Asia Pacific Automotive Ultracapacitor Market (2024-2032) 7.1. Asia Pacific Automotive Ultracapacitor Market, by Vehicle Type (2024-2032) 7.2. Asia Pacific Automotive Ultracapacitor Market, by Application (2024-2032) 7.3. Asia Pacific Automotive Ultracapacitor Market, by Electric Vehicle (2024-2032) 7.4. Asia Pacific Automotive Ultracapacitor Market, by Sales Channel (2024-2032) 7.5. Asia Pacific Automotive Ultracapacitor Market, by Country (2024-2032) 8. The Middle East and Africa Automotive Ultracapacitor Market (2024-2032) 8.1. The Middle East and Africa Automotive Ultracapacitor Market, by Vehicle Type (2024-2032) 8.2. The Middle East and Africa Automotive Ultracapacitor Market, by Application (2024-2032) 8.3. The Middle East and Africa Automotive Ultracapacitor Market, by Electric Vehicle (2024-2032) 8.4. The Middle East and Africa Automotive Ultracapacitor Market, by Sales Channel (2024-2032) 8.5. The Middle East and Africa Automotive Ultracapacitor Market, by Country (2024-2032) 9. South America Automotive Ultracapacitor Market (2024-2032) 9.1. South America Automotive Ultracapacitor Market, by Vehicle Type (2024-2032) 9.2. South America Automotive Ultracapacitor Market, by Application (2024-2032) 9.3. South America Automotive Ultracapacitor Market, by Electric Vehicle (2024-2032) 9.4. South America Automotive Ultracapacitor Market, by Sales Channel (2024-2032) 9.5. South America Automotive Ultracapacitor Market, by Country (2024-2032) 10. Company Profile: Key players 10.1. Maxwell Technologies 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Nesscap Ultracapacitors 10.3. Skeleton Technologies 10.4. ELNA America Inc. 10.5. Ioxus Inc 10.6. LS Mtron 10.7. Yunasko 10.8. SPEL Technologies 10.9. NAWA Technologies 10.10. Panasonic 10.11. Nippon Chemi-Con 10.12. CAP-XX 10.13. NEC-Tokin 10.14. Kemet Corporation 10.15. Sumitomo Corporation 10.16. Tesla