Global Automotive Tire Market size was valued at USD 19.60 Bn in 2023 and Automotive Tire market revenue is expected to reach USD 22.82 Bn by 2030, at a CAGR of 2.2 % over the forecast period.Automotive Tire Market Overview

Automotive tires are complex structures designed for specific purposes, conditions, and vehicle types. The automotive tire industry continually experiences technological advancements, including innovations in tire materials, design, tread patterns, and manufacturing processes. Run-flat tires, self-sealing tires, and smart tire monitoring systems are examples of recent innovations. Sustainability and environmental considerations have gained importance in the automotive tire market. Tire manufacturers are working to develop eco-friendly tires that are more fuel-efficient and have longer lifespans. Recycling and responsible disposal of tires are also key focus areas. Safety is a paramount concern in the tire market. Governments around the world have established strict regulations and standards to ensure tire safety, durability, and performance. Regulations may cover aspects such as tire labelling, wet grip, and noise levels.To know about the Research Methodology :- Request Free Sample Report

Automotive Tire Market Dynamics

Growth in vehicle Production and Sales to boost the Automotive Tire Market growth Due to increased OEM demand, the aftermarket or replacement tire market is influenced by vehicle production and sales. As vehicles age or experience wear and tear, the need for replacement tires arises. Consumers who purchase new or used vehicles contribute to the aftermarket segment, either by replacing tires due to wear or by customizing their vehicles with different tire types. The original equipment manufacturers (OEMs) play a pivotal role in the tire market. When automakers produce vehicles, they often equip them with tires as part of the original equipment. This OEM demand for tires directly depends on vehicle production. Tire manufacturers work closely with OEMs to develop tires that meet the specific requirements of particular vehicle models, ensuring safety and performance. Economic factors drive not only vehicle sales but also the aftermarket or replacement tire market. Aging tires, wear and tear, punctures, and seasonal variations contribute to the continuous demand for replacement tires. Consumers in the aftermarket segment are influenced by factors like tire longevity, performance, and cost-effectiveness, contributing to the market's dynamics. The automotive tire market is also significantly shaped by original equipment manufacturers (OEMs) and their demands. Automotive Tire manufacturers often collaborate closely with OEMs to develop specialized tires that meet the specific requirements of particular vehicle models, ensuring a harmonious balance of safety, performance, and efficiency. Competition is inherent in the tire industry. Numerous global and regional players compete vigorously, driving innovation, cost-efficiency, and product differentiation. Intense competition encourages tire manufacturers to focus on product quality and branding to gain a competitive edge and capture the Automotive Tire market share. The rise of digital platforms and e-commerce has transformed how consumers research and purchase tires. Online reviews, comparisons, and the ability to order tires online have altered consumer behaviour and marketing strategies in the tire industry, making digitalization and e-commerce influential drivers in the market. Economic Fluctuations and Raw Material Price Volatility to limit the Automotive Tire Market growth Economic downturns, such as recessions or financial crises, can significantly impact the automotive tire market. During tough economic times, consumers often delay or reduce spending on non-essential items, including new tires. This lead to decreased demand for replacement tires and force tire manufacturers to cut production or offer discounts, impacting their profitability. The tire industry is highly sensitive to fluctuations in the prices of raw materials, particularly rubber, steel, and petrochemical-based compounds. Sudden spikes in the cost of these materials put pressure on tire manufacturers, leading to increased production costs. In turn, this results in higher tire prices or reduced profit margins. Environmental regulations aimed at reducing emissions and conserving resources also pose challenges for the tire market. Such regulations can require the development of eco-friendly tires, which may be costlier to produce. Additionally, tire disposal and recycling regulations may add to operational costs for tire manufacturers. Disruptions in the global supply chain, including natural disasters, geopolitical tensions, or pandemics, can severely impact the automotive tire market. These disruptions affect the availability of raw materials, transportation logistics, and manufacturing capabilities, leading to production delays and shortages. In some cases, the automotive tire market experience oversupply and overcapacity issues. This occurs when there is excessive production capacity, leading to intense competition and lower profit margins for manufacturers. Oversupply IS driven by factors like increased production or reduced demand, impacting the market's overall condition. Rapid changes in consumer preferences is restraint for the tire market. For example, the growing demand for electric vehicles (EVs) has led to a shift in tire requirements. EVs need specialized tires to accommodate their unique performance and efficiency needs, necessitating adjustments from tire manufacturers. While technological advancements drive innovation, they also present challenges in terms of adaptation. Developing and manufacturing advanced tire technologies is costly, and not all manufacturers have the capabilities to keep pace with these innovations, potentially leading to market restraints.Automotive Tire Market Segment Analysis

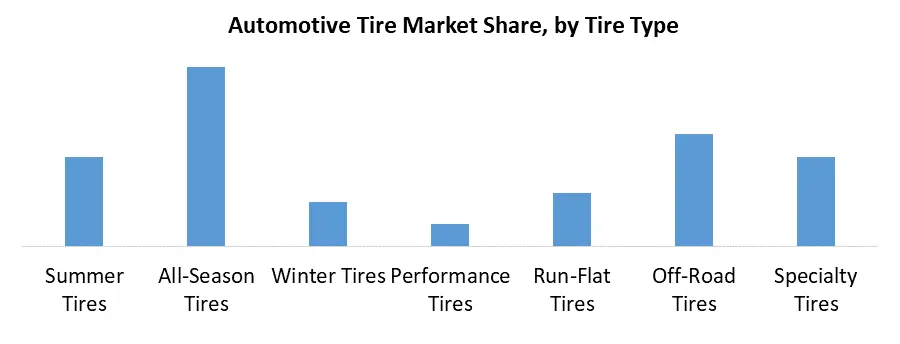

Based on Vehicle Type, the market is segmented into Passenger Cars, Light Trucks and SUVs, Commercial Vehicles, and Two-Wheelers. Light Trucks and SUVs segment dominated the market in 2023 and is expected to hold the largest Automotive Tire Market share over the forecast period. Consumers choose SUVs and light trucks for their versatility, cargo capacity, and off-road capabilities. As a result, they seek tires that can complement these vehicle features. Many SUV owners and light truck users appreciate the option to go off-road. Some tires in this segment are designed with off-road capabilities, featuring deeper treads and rugged construction. Tires for SUVs and light trucks need to be durable and capable of withstanding the additional weight and load-bearing requirements of these vehicles. This durability is essential for both safety and longevity. Types of tires in this segment are engineered to provide all-season performance, which is expected to boost the Automotive Tires Market growth. They need to deliver good traction and control on both dry and wet roads, as well as in light snow.Based on Tire Type, the market is segmented into Summer Tires, All-Season Tires, Winter Tires, Performance Tires, Run-Flat Tires, Off-Road Tires, and Specialty Tires. All-Season Tires segment held the largest Automotive Tire Market share in 2023 and is expected to dominate the market over the forecast period. All-season tires are designed to perform adequately in different weather conditions, including dry, wet, and light snow. They strike a balance between various performance attributes, making them suitable for a wide range of driving scenarios and seasons. The tread pattern of All-Season Tires typically features a mix of tread blocks and grooves. This design allows for efficient water evacuation to reduce the risk of hydroplaning on wet roads while also providing decent traction on dry surfaces, which is expected to boost the Automotive Tire Market growth. These tires are designed for longer tread life compared to more specialized tire types, making them a cost-effective choice for many consumers. All-Season Tires are competitively priced and represent a good value for those looking for a tire that can handle a variety of driving conditions without the added cost of multiple tire sets.

Automotive Tire Market Regional Analysis

Expanding Middle Class population to boost the Asia Pacific Automotive Tire Market growth The rising middle-class population in many Asia-Pacific countries has translated into higher vehicle ownership rates. A larger middle class afford personal vehicles, which has a direct impact on tire sales. These consumers often seek reliable and long-lasting tires, creating demand for both original equipment manufacturers (OEM) and replacement tires. Government investments in infrastructure, including road construction and improvement, have spurred vehicle usage. The Asia-Pacific region has become a global automotive manufacturing hub, with numerous automakers establishing production facilities in countries like China, Japan, South Korea, and India. The presence of these manufacturing centers generates substantial demand for OEM tires, which are installed on new vehicles at the factory. The Asia-Pacific region serves as a significant source of tire exports to other parts of the world. This is particularly evident in countries like China, which exports tires to various international markets. The competitive production costs in the region make it an attractive location for tire manufacturing and export. Consumer preferences and brand awareness play a vital role in the Asia-Pacific tire market. As consumers become more brand-conscious and quality-focused, they tend to choose recognized and reputable tire brands. This preference for branded tires often drives innovation and competition among tire manufacturers. The Asia-Pacific tire market benefits from ongoing technological advancements. These innovations include the development of tires with improved traction, reduced rolling resistance, and longer lifespan. Moreover, innovations in manufacturing processes, such as automated production and smart tire monitoring systems, enhance the competitiveness of the market. Tire manufacturers in India are investing in research and development to produce more fuel-efficient and environmentally friendly tires. They are also developing tires suited to specific Indian road and climate conditions. The market has seen innovations in tire technology, including run-flat tires, self-sealing tires, and smart tire monitoring systems. Indian consumers are becoming more brand-conscious and quality-focused. Recognized and reputable tire brands are preferred, pushing manufacturers to focus on brand building and product quality, which is expected to boost the Automotive Tire Market growth. In North America, Canada's automotive tire market shares similarities with the United States and has unique regional conditions and regulatory considerations. The market is influenced by Canada's diverse climate, with significant demand for winter tires in colder regions. The growth in the number of vehicles on the road and the need for replacement tires drive the market. Major automotive tire manufacturers in Canada such as Michelin, Bridgestone, and Continental operate in the Canadian market, providing a range of tires suitable for both winter and all-season use. Mexico's automotive tire market benefits from a growing middle class and a surge in vehicle production. As an important manufacturing hub for global automakers, Mexico has a substantial demand for OEM tires.Automotive Tire Market Competitive Landscape

Established Automotive Tire manufacturers with well-known brands often have a competitive advantage. Consumers often have brand preferences based on factors like trust, reputation, and past experiences. The reach and effectiveness of a company's distribution and retail networks impact its competitiveness. Strong relationships with dealers and retailers lead to increased market penetration. The competitive landscape varies by region, depending on local preferences, climate conditions, and regulatory requirements. Some regions favor specific tire types, such as winter tires in colder climates.Automotive Tire Market Scope: Inquiry Before Buying

Automotive Tire Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 19.60 Bn. Forecast Period 2024 to 2030 CAGR: 2.2% Market Size in 2030: US $ 22.82 Bn. Segments Covered: by Vehicle Type Passenger Cars Light Trucks and SUVs Commercial Vehicles Two-Wheelers by Tire Type Summer Tires All-Season Tires Winter Tires Performance Tires Run-Flat Tires Off-Road Tires Specialty Tires by End-Use OEM (Original Equipment Manufacturer) Aftermarket Automotive Tire Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Automotive Tire Key Players Include

1. Bridgestone Corporation 2. Michelin 3. Goodyear Tire & Rubber Company 4. Continental AG 5. Pirelli & C. S.p.A. 6. Sumitomo Rubber Industries 7. Hankook Tire Co. Ltd. 8. Cooper Tire & Rubber Company 9. Yokohama Rubber Co., Ltd. 10. Toyo Tire Corporation 11. Kumho Tire Co., Inc. 12. Nokian Tyres plc 13. MRF Ltd. 14. CEAT Ltd. 15. Apollo Tyres Ltd. 16. Nexen Tire Corporation 17. Hankook Tire America Corp. 18. Maxxis International 19. Giti Tire Group 20. Falken Tires Frequently Asked Questions: 1. What are the different types of automotive tires available in the market? Ans: The automotive tire market offers various types, including Summer Tires, All-Season Tires, Winter Tires, Performance Tires, Run-Flat Tires, Off-Road Tires, and Specialty Tires. Each type is designed for specific conditions and performance requirements. 2. Which factors are expected to drive the Global Automotive Tire Market growth by 2030? Ans. Growth in vehicle Production and Sales is expected to drive the Medical Device Testing Market growth over the forecast period. 3. What is the growth rate of the Global Automotive Tire Market? Ans. The Global Automotive Tire Market is growing at a significant rate of 2.2% over the forecast period. 4. Which region is expected to dominate the Global Automotive Tire Market? Ans. Asia Pacific region is expected to dominate the Automotive Tire Market over the forecast period.

1. Automotive Tire Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Automotive Tire Market: Dynamics 2.1. Automotive Tire Market Trends by Region 2.1.1. Global Automotive Tire Market Trends 2.1.2. North America Automotive Tire Market Trends 2.1.3. Europe Automotive Tire Market Trends 2.1.4. Asia Pacific Automotive Tire Market Trends 2.1.5. Middle East and Africa Automotive Tire Market Trends 2.1.6. South America Automotive Tire Market Trends 2.2. Automotive Tire Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Automotive Tire Market Drivers 2.2.1.2. North America Automotive Tire Market Restraints 2.2.1.3. North America Automotive Tire Market Opportunities 2.2.1.4. North America Automotive Tire Market Challenges 2.2.2. Europe 2.2.2.1. Europe Automotive Tire Market Drivers 2.2.2.2. Europe Automotive Tire Market Restraints 2.2.2.3. Europe Automotive Tire Market Opportunities 2.2.2.4. Europe Automotive Tire Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Automotive Tire Market Drivers 2.2.3.2. Asia Pacific Automotive Tire Market Restraints 2.2.3.3. Asia Pacific Automotive Tire Market Opportunities 2.2.3.4. Asia Pacific Automotive Tire Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Automotive Tire Market Drivers 2.2.4.2. Middle East and Africa Automotive Tire Market Restraints 2.2.4.3. Middle East and Africa Automotive Tire Market Opportunities 2.2.4.4. Middle East and Africa Automotive Tire Market Challenges 2.2.5. South America 2.2.5.1. South America Automotive Tire Market Drivers 2.2.5.2. South America Automotive Tire Market Restraints 2.2.5.3. South America Automotive Tire Market Opportunities 2.2.5.4. South America Automotive Tire Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Regulatory Landscape by Region 2.6.1. Global 2.6.2. North America 2.6.3. Europe 2.6.4. Asia Pacific 2.6.5. Middle East and Africa 2.6.6. South America 2.7. Key Opinion Leader Analysis For Automotive Tire Industry 2.8. Analysis of Government Schemes and Initiatives For Automotive Tire Industry 2.9. The Global Pandemic Impact on Automotive Tire Market 2.10. Automotive Tire Price Trend Analysis (2023-24) 2.11. Global Automotive Tire Market Trade Analysis (2018-2023) 2.11.1. Global Import of Automotive Tire 2.11.1.1. Ten Largest Importer 2.11.2. Global Export of Automotive Tire 2.11.3. Ten Largest Exporter 2.12. Production Capacity Analysis 2.12.1. Chapter Overview 2.12.2. Key Assumptions and Methodology 2.12.3. Automotive Tire Manufacturers: Global Installed Capacity 3. Automotive Tire Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) (2023-2030) 3.1. Automotive Tire Market Size and Forecast, by Vehicle Type (2023-2030) 3.1.1. Passenger Cars 3.1.2. Light Trucks and SUVs 3.1.3. Commercial Vehicles 3.1.4. Two-Wheelers 3.2. Automotive Tire Market Size and Forecast, by Tire Type (2023-2030) 3.2.1. Summer Tires 3.2.2. All-Season Tires 3.2.3. Winter Tires 3.2.4. Performance Tires 3.2.5. Run-Flat Tires 3.2.6. Off-Road Tires 3.2.7. Specialty Tires 3.3. Automotive Tire Market Size and Forecast, by End Use Industry (2023-2030) 3.3.1. OEM (Original Equipment Manufacturer) 3.3.2. Aftermarket 3.4. Automotive Tire Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Automotive Tire Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 4.1. North America Automotive Tire Market Size and Forecast, by Vehicle Type (2023-2030) 4.1.1. Passenger Cars 4.1.2. Light Trucks and SUVs 4.1.3. Commercial Vehicles 4.1.4. Two-Wheelers 4.2. North America Tire Market Size and Forecast, by Tire Type (2023-2030) 4.2.1. Summer Tires 4.2.2. All-Season Tires 4.2.3. Winter Tires 4.2.4. Performance Tires 4.2.5. Run-Flat Tires 4.2.6. Off-Road Tires 4.2.7. Specialty Tires 4.3. North America Automotive Tire Market Size and Forecast, by End Use (2023-2030) 4.3.1. OEM (Original Equipment Manufacturer) 4.3.2. Aftermarket 4.4. North America Automotive Tire Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Automotive Tire Market Size and Forecast, by Vehicle Type (2023-2030) 4.4.1.1.1. Passenger Cars 4.4.1.1.2. Light Trucks and SUVs 4.4.1.1.3. Commercial Vehicles 4.4.1.1.4. Two-Wheelers 4.4.1.2. United States Automotive Tire Market Size and Forecast, by Tire Type (2023-2030) 4.4.1.2.1. Summer Tires 4.4.1.2.2. All-Season Tires 4.4.1.2.3. Winter Tires 4.4.1.2.4. Performance Tires 4.4.1.2.5. Run-Flat Tires 4.4.1.2.6. Off-Road Tires 4.4.1.2.7. Specialty Tires 4.4.1.3. United States Automotive Tire Market Size and Forecast, by End Use (2023-2030) 4.4.1.3.1. OEM (Original Equipment Manufacturer) 4.4.1.3.2. Aftermarket 4.4.2. Canada 4.4.2.1. Canada Automotive Tire Market Size and Forecast, by Vehicle Type (2023-2030) 4.4.2.1.1. Passenger Cars 4.4.2.1.2. Light Trucks and SUVs 4.4.2.1.3. Commercial Vehicles 4.4.2.1.4. Two-Wheelers 4.4.2.2. Canada Automotive Tire Market Size and Forecast, by Tire Type (2023-2030) 4.4.2.2.1. Summer Tires 4.4.2.2.2. All-Season Tires 4.4.2.2.3. Winter Tires 4.4.2.2.4. Performance Tires 4.4.2.2.5. Run-Flat Tires 4.4.2.2.6. Off-Road Tires 4.4.2.2.7. Specialty Tires 4.4.2.3. Canada Automotive Tire Market Size and Forecast, by End Use (2023-2030) 4.4.2.3.1. OEM (Original Equipment Manufacturer) 4.4.2.3.2. Aftermarket 4.4.3. Mexico 4.4.3.1. Mexico Automotive Tire Market Size and Forecast, by Vehicle Type (2023-2030) 4.4.3.1.1. Passenger Cars 4.4.3.1.2. Light Trucks and SUVs 4.4.3.1.3. Commercial Vehicles 4.4.3.1.4. Two-Wheelers 4.4.3.2. Mexico Automotive Tire Market Size and Forecast, by Tire Type (2023-2030) 4.4.3.2.1. Summer Tires 4.4.3.2.2. All-Season Tires 4.4.3.2.3. Winter Tires 4.4.3.2.4. Performance Tires 4.4.3.2.5. Run-Flat Tires 4.4.3.2.6. Off-Road Tires 4.4.3.2.7. Specialty Tires 4.4.3.3. Mexico Automotive Tire Market Size and Forecast, by End Use (2023-2030) 4.4.3.3.1. OEM (Original Equipment Manufacturer) 4.4.3.3.2. Aftermarket 5. Europe Automotive Tire Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 5.1. Europe Automotive Tire Market Size and Forecast, by Vehicle Type (2023-2030) 5.2. Europe Automotive Tire Market Size and Forecast, by Tire Type (2023-2030) 5.3. Europe Automotive Tire Market Size and Forecast, by End Use (2023-2030) 5.4. Europe Automotive Tire Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Automotive Tire Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.1.2. United Kingdom Automotive Tire Market Size and Forecast, by Tire Type (2023-2030) 5.4.1.3. United Kingdom Automotive Tire Market Size and Forecast, by End Use (2023-2030) 5.4.2. France 5.4.2.1. France Automotive Tire Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.2.2. France Automotive Tire Market Size and Forecast, by Tire Type (2023-2030) 5.4.2.3. France Automotive Tire Market Size and Forecast, by End Use (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Automotive Tire Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.3.2. Germany Automotive Tire Market Size and Forecast, by Tire Type (2023-2030) 5.4.3.3. Germany Automotive Tire Market Size and Forecast, by End Use (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Automotive Tire Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.4.2. Italy Automotive Tire Market Size and Forecast, by Tire Type (2023-2030) 5.4.4.3. Italy Automotive Tire Market Size and Forecast, by End Use (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Automotive Tire Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.5.2. Spain Automotive Tire Market Size and Forecast, by Tire Type (2023-2030) 5.4.5.3. Spain Automotive Tire Market Size and Forecast, by End Use (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Automotive Tire Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.6.2. Sweden Automotive Tire Market Size and Forecast, by Tire Type (2023-2030) 5.4.6.3. Sweden Automotive Tire Market Size and Forecast, by End Use (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Automotive Tire Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.7.2. Austria Automotive Tire Market Size and Forecast, by Tire Type (2023-2030) 5.4.7.3. Austria Automotive Tire Market Size and Forecast, by End Use (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Automotive Tire Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.8.2. Rest of Europe Automotive Tire Market Size and Forecast, by Tire Type (2023-2030) 5.4.8.3. Rest of Europe Automotive Tire Market Size and Forecast, by End Use (2023-2030) 6. Asia Pacific Automotive Tire Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 6.1. Asia Pacific Automotive Tire Market Size and Forecast, by Vehicle Type (2023-2030) 6.2. Asia Pacific Automotive Tire Market Size and Forecast, by Tire Type (2023-2030) 6.3. Asia Pacific Automotive Tire Market Size and Forecast, by End Use (2023-2030) 6.4. Asia Pacific Automotive Tire Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Automotive Tire Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.1.2. China Automotive Tire Market Size and Forecast, by Tire Type (2023-2030) 6.4.1.3. China Automotive Tire Market Size and Forecast, by End Use (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Automotive Tire Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.2.2. S Korea Automotive Tire Market Size and Forecast, by Tire Type (2023-2030) 6.4.2.3. S Korea Automotive Tire Market Size and Forecast, by End Use (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Automotive Tire Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.3.2. Japan Automotive Tire Market Size and Forecast, by Tire Type (2023-2030) 6.4.3.3. Japan Automotive Tire Market Size and Forecast, by End Use (2023-2030) 6.4.4. India 6.4.4.1. India Automotive Tire Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.4.2. India Automotive Tire Market Size and Forecast, by Tire Type (2023-2030) 6.4.4.3. India Automotive Tire Market Size and Forecast, by End Use (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Automotive Tire Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.5.2. Australia Automotive Tire Market Size and Forecast, by Tire Type (2023-2030) 6.4.5.3. Australia Automotive Tire Market Size and Forecast, by End Use (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Automotive Tire Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.6.2. Indonesia Automotive Tire Market Size and Forecast, by Tire Type (2023-2030) 6.4.6.3. Indonesia Automotive Tire Market Size and Forecast, by End Use (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Automotive Tire Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.7.2. Malaysia Automotive Tire Market Size and Forecast, by Tire Type (2023-2030) 6.4.7.3. Malaysia Automotive Tire Market Size and Forecast, by End Use (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Automotive Tire Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.8.2. Vietnam Automotive Tire Market Size and Forecast, by Tire Type (2023-2030) 6.4.8.3. Vietnam Automotive Tire Market Size and Forecast, by End Use (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Automotive Tire Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.9.2. Taiwan Automotive Tire Market Size and Forecast, by Tire Type (2023-2030) 6.4.9.3. Taiwan Automotive Tire Market Size and Forecast, by End Use (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Automotive Tire Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Automotive Tire Market Size and Forecast, by Tire Type (2023-2030) 6.4.10.3. Rest of Asia Pacific Automotive Tire Market Size and Forecast, by End Use (2023-2030) 7. Middle East and Africa Automotive Tire Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030 7.1. Middle East and Africa Automotive Tire Market Size and Forecast, by Vehicle Type (2023-2030) 7.2. Middle East and Africa Automotive Tire Market Size and Forecast, by Tire Type (2023-2030) 7.3. Middle East and Africa Automotive Tire Market Size and Forecast, by End Use (2023-2030) 7.4. Middle East and Africa Automotive Tire Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Automotive Tire Market Size and Forecast, by Vehicle Type (2023-2030) 7.4.1.2. South Africa Automotive Tire Market Size and Forecast, by Tire Type (2023-2030) 7.4.1.3. South Africa Automotive Tire Market Size and Forecast, by End Use (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Automotive Tire Market Size and Forecast, by Vehicle Type (2023-2030) 7.4.2.2. GCC Automotive Tire Market Size and Forecast, by Tire Type (2023-2030) 7.4.2.3. GCC Automotive Tire Market Size and Forecast, by End Use (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Automotive Tire Market Size and Forecast, by Vehicle Type (2023-2030) 7.4.3.2. Nigeria Automotive Tire Market Size and Forecast, by Tire Type (2023-2030) 7.4.3.3. Nigeria Automotive Tire Market Size and Forecast, by End Use (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Automotive Tire Market Size and Forecast, by Vehicle Type (2023-2030) 7.4.4.2. Rest of ME&A Automotive Tire Market Size and Forecast, by Tire Type (2023-2030) 7.4.4.3. Rest of ME&A Automotive Tire Market Size and Forecast, by End Use (2023-2030) 8. South America Automotive Tire Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030 8.1. South America Automotive Tire Market Size and Forecast, by Vehicle Type (2023-2030) 8.2. Rest of ME&A Automotive Tire Market Size and Forecast, by Tire Type (2023-2030) 8.3. South America Automotive Tire Market Size and Forecast, by End Use (2023-2030) 8.4. South America Automotive Tire Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Automotive Tire Market Size and Forecast, by Vehicle Type (2023-2030) 8.4.1.2. Brazil Automotive Tire Market Size and Forecast, by Tire Type (2023-2030) 8.4.1.3. Brazil Automotive Tire Market Size and Forecast, by End Use (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Automotive Tire Market Size and Forecast, by Vehicle Type (2023-2030) 8.4.2.2. Argentina Automotive Tire Market Size and Forecast, by Tire Type (2023-2030) 8.4.2.3. Argentina Automotive Tire Market Size and Forecast, by End Use (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Automotive Tire Market Size and Forecast, by Vehicle Type (2023-2030) 8.4.3.2. Rest Of South America Automotive Tire Market Size and Forecast, by Tire Type (2023-2030) 8.4.3.3. Rest Of South America Automotive Tire Market Size and Forecast, by End Use (2023-2030) 9. Global Automotive Tire Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Leading Automotive Tire Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Caterpillar Inc. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Komatsu Ltd. 10.3. Hitachi Construction Machinery Co., Ltd. 10.4. Volvo Construction Equipment 10.5. Liebherr Group 10.6. Doosan Infracore 10.7. JCB 10.8. Kobelco Construction Machinery Co., Ltd. 10.9. SANY Group 10.10. Hyundai Construction Equipment Co., Ltd. 10.11. XCMG Group 10.12. Terex Corporation 10.13. Case Construction Equipment 10.14. Bobcat Company 10.15. Kubota Corporation 10.16. Takeuchi Manufacturing Co., Ltd. 10.17. Yanmar Co., Ltd. 10.18. LiuGong Machinery Corp. 10.19. New Holland Construction 10.20. Wacker Neuson Group 10.21. Deere & Company 10.22. Bell Equipment 10.23. CNH Industrial N.V. 11. Key Findings 12. Industry Recommendations 13. Automotive Tire Market: Research Methodology 14. Terms and Glossary