Automotive Advanced Driver Assistance Systems Market size was valued at USD 31.52 Bn. in 2022 and the total revenue is expected to grow at 12.2% of CAGR through 2023 to 2029, reaching USD 70.57 Bn.Automotive Advanced Driver Assistance Systems Market Overview:

ADAS (Advanced Driver Assistance Systems) are passive and active safety systems designed to eliminate human error in operating vehicles. ADAS system is to assist drivers through its advanced technologies to perceive the environment and system around vehicle to enable driver to take necessary actions. European Union and United States have made it mandatory for all vehicles to be fitted with self driving capabilities, emergency systems and anti-collision systems. Car buyers are also becoming more aware and interested in in ADAS for comfort and economy of the system to assist parking and to monitor blind spots while driving. Since total market globally is increasing, the growth of the market is even and is different by region. Compliance with upcoming safety mandates and increasing demand for semi-autonomous driving systems are expected to drive the ADAS market. Market dynamics by region, by models and by key automakers have made this report more comprehensive and will help user to understand the who will be market leader in next seven years in ADAS and the market structure with market leaders, followers and new entrants who have potential to disrupt the market in next seven years.To know about the Research Methodology :- Request Free Sample Report

Report Scope:

The Automotive Advanced Driver Assistance Systems Market report provides an evaluation of the market till forecast period. The report comprises various segments as well as an analysis of the driving factors and restraints that expected to play a substantial role in the market. The primary and secondary data has been collected from the internal database, paid sources, annual reports of businesses, news releases from the government, and price databases & many more sources. Secondary research has been conducted into various segments, to derive total market size, market forecast, and growth rate. Detailed research methodology will be shared on request.Automotive Advanced Driver Assistance Systems Market Dynamics:

Advancements in safety and security Increasing awareness of vehicle safety ratings and lower component costs as a result of the widespread use of cameras and radars are expected to driver the growth of ADAS market. Major automakers are embracing ADAS solutions in order to achieve higher safety ratings and thus attract more customers. As a result, leading OEMs are offering either standardize safety systems across models or offer them as options. Outcome of customized solution are ultimately increasing penetration of advanced driver assistance system features. Thanks to demand for ADAS, demand for components such as cameras, radar sensors, ultrasonic sensors, and LiDAR are also expected to increase during the forecast period. Advancement of self-driving cars The introduction of self-driving cars is expected to transform commuting. With features such as lane monitoring, emergency braking, stability controls, and others, ADAS technologies have significantly reduced the complexity of driving. Advance autonomous vehicle use LiDAR, radar, ultrasound sensors, and high definition cameras to collect the data and guide the automation. Onboard smart autonomous driving system analyzes data collected by different systems to safely move the vehicle. Tesla, Volkswagen, Ford, GM, and Waymo all intend to release fully autonomous vehicles in the coming years. Nissan announced in March 2020 that ProPILOT would be available in 20 models by 2022. With a greater emphasis on autonomous driving systems, OEMs will be able to include more cruise control features and advanced safety systems for semi-autonomous vehicles. The report has covered the upcoming autonomous vehicles and their impact on the ADAS market. Market Restraint: Restrictions on the environment and security risks The majority of ADAS safety features use a variety of sensors, including radar, LiDAR, ultrasonic, cameras, infrared, and various actuators. The vehicle, driver, passengers, and pedestrians are all kept secure by these sensors and actuators, which continuously scan fields in all directions. The system's operation is influenced by a number of variables, including the weather and traffic. Inaccurate fail-safe techniques could endanger occupant safety. Advanced driver assistance systems must operate safely and with the ideal balance of automation and manual override. ADAS needs to be useful, but it also needs to be protected from malevolent hackers. The car could be taken over by a hacker who infiltrates the system. Numerous research has demonstrated that Bluetooth, Wi-Fi, or even GPS can be used to operate vehicles. System manufacturers and OEMs have serious difficulty as a result of these security concerns. The absence of necessary infrastructure in underdeveloped markets To function properly, ADAS require basic infrastructures such as well-organized roads, lane marking, and GPS availability. Poor infrastructure outside of urban areas, cost considerations, and insufficient driving training or discipline limit the growth of the ADAS market in developing countries. Furthermore, the ongoing COVID-19 pandemic will cause financial crises, further delaying the development of modern infrastructure for intelligent transportation.Automotive Advanced Driver Assistance Systems Market Segment Analysis

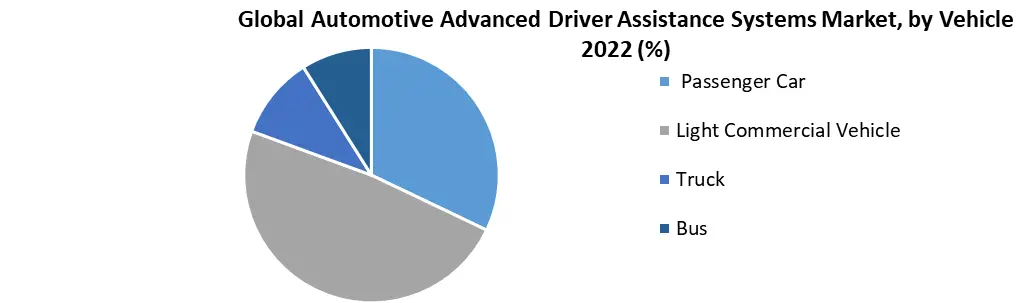

Based on the system, The market for night vision systems is anticipated to grow thanks to rise in demand for advanced safety systems like ADAS in automobiles. The increase in vehicle production and the rise in demand for improved night vision in vehicles to aid driver visibility are also anticipated to drive the night vision system market. The car's inappropriate visual complexity is significantly reduced by the night vision technology, which also improves safety and lessens night-time vehicle collisions. During the forecast period, it is also expected that the advantages described above would increase demand for vehicle night vision systems. Growth factors are captured at micro level in each country by each auto player. The manufacturers' focus on integrating the two systems has led to an increase in visibility range as a result of the adaptive front lighting system, which has increased the effectiveness of the vehicle safety system. Based on the component, Important OEMs are implementing ADAS technologies to increase safety ratings and draw in more customers. As a result, they either standardize safety systems across models or offer them as options. Growing safety awareness and an increase in accidents are the primary drivers of the ADAS market, which has resulted in increased demand for radar sensors in countries such as China, the United States, and major European countries. The US Federal Communications Commission (FCC) and the European Telecommunications Standards Institute (ETSI) have imposed restrictions on the use of 24 GHz radar in the 5 GHz bandwidth. Beyond 2022, the 24 GHz frequency range won't be accessible in ultrawideband (UWB). For greater dependability and regulatory compliance, major OEMs and Tier 1 auto component manufacturers are switching to long-range 77 GHz radars. This is anticipated to fuel the ADAS market's demand for radar sensors. The need for radar sensors is also anticipated to increase during the projected period as collision avoidance systems in semi-autonomous driving systems receive more attention. Robert Bosch (Germany), Continental AG (Germany), ZF Friedrichshafen (Germany), Denso (Japan), Aptiv (UK), Valeo (France), and Magna International are a few of the top producers and suppliers of advanced driver assistance systems (Canada). Depending on the unique demands of OEMs, these Tier 1 suppliers have created new safety and driver aid systems. Additionally, these players have increased their regional footprint through collaborations, joint ventures, and opening new locations in areas with rapid economic development. Key competitors have consolidated their position in the global ADAS market thanks to a broad product range and a strong regional presence.Based on the vehicle, The market for ADAS is significantly impacted by the passenger car industry. Increasing road safety regulations, supportive legislation, and consumer awareness are all factors that have contributed to the rise in demand for safety systems in emerging economies. In addition, a number of nations in Europe, North America, and the Asia Pacific have passed laws requiring the use of various ADAS in the passenger automobile market. As an illustration, the European Union has outlined Vision Zero, a program to reduce traffic fatalities to zero by 2050. By 2030, the authority hopes to have cut injuries and fatalities by 50%. The strategic strategy calls for requiring important safety features such as automatic emergency braking, lane departure warning, and tiredness & attentiveness monitoring in new cars by 2022.

Automotive Advanced Driver Assistance Systems Market Regional Insights:

Asia Pacific ADAS market is dominated by China in 2022. South Korea and Japan at the second and third position respectively. The high vehicle production and rising use of cutting-edge electronics in China, South Korea, and Japan are responsible for the market expansion in the Asia Pacific region. The governments of these nations have taken various actions to entice major OEMs to enter their domestic markets as a result of realizing the automotive industry's growth potential. Several European and American automakers have relocated their manufacturing facilities to developing nations, including Volkswagen (Germany), Mercedes-Benz (Germany), and General Motors (US). Major ADAS solution providers with production sites throughout the region include Robert Bosch (Germany), Continental (Germany), and Denso (Japan). Despite the COVID-19 pandemic-related slowdown in car sales, current safety regulations will undoubtedly increase the adoption of ADAS technologies in forthcoming vehicles. For instance, starting in 2022, vehicles in China must have TPMS. During the predicted time, the nation is also debating requiring automatic emergency braking. The Chinese government also announced a number of initiatives to stimulate the development of new energy vehicles, stabilizing domestic demand and other monetary and fiscal policies. As a result, it is anticipated that the auto sector would significantly improve in the second quarter of 2020. The need for ADAS in the nation would be driven by economic support, impending mandates, and the expansion of Chinese OEMs. In the Asia Pacific, Japan is a significant market for cutting-edge electrical and electronic components. All new passenger cars will be required to have AEB by November 2022, according to plans released by the Ministry of Land, Infrastructure, Transport, and Tourism (MLITT). By December 2025, all current models will have this technology, while all imported cars must have AEB by June 2024. By 2022, the Indian Ministry of Road Transport and Highways intended to implement ADAS features. In the initial phase, features like electronic stability control and automatic emergency braking were taken into consideration. In India, Tier 1 producers like Continental are working with OEMs to facilitate the adoption by 2022–2023Automotive Advanced Driver Assistance Systems Market Scope: Inquire before Buying

Automotive Advanced Driver Assistance Systems Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 31.52 Bn. Forecast Period 2023 to 2029 CAGR: 12.2% Market Size in 2029: US $ 70.57 Bn. Segments Covered: by System 1.Adaptive Cruise Control (ACC) 2.Adaptive Front Light (AFL) 3.Automatic Emergency Braking (AEB) 4.Blind Spot Detection (BSD) 5.Cross Traffic Alert (CTA) 6.Driver Monitoring System (DMS) 7.Forward Collision Warning (FCW) 8.Intelligent Park Assist (IPA) 9.Lane Departure Warning (LDW) 10.Night Vision System (NVS) 11.Pedestrian Detection System (PDS) 12.Road Sign Recognition (RSR) 13.Tire Pressure Monitoring System (TPMS) 14.Traffic Jam Assist (TJA) by Component 1.Camera Unit 2.LiDAR 3.Radar Sensor 4.Ultrasonic Sensor 5. Infrared Sensor by Vehicle 1.Passenger Car 2.Light Commercial Vehicle 3. Truck 4.Bus Automotive Advanced Driver Assistance Systems Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden,Netherlands, Austria and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina and Rest of South America)Automotive Advanced Driver Assistance Systems Market, Key Players are:

1.Valeo(France) 2.Autoliv(Sweden) 3. Audi( Germany) 4.BMW(Germany) 5.Robert Bosch(Germany) 6. Continental AG(Germany) 7.Aptiv (Delphi Automotive)(Germany) 8.Intel (US) 9. Texas Instruments(US) 10. Aptiv (UK) 11. Delphi Automotive(UK) 12. NXP Semiconductor(Netherlands) 13.Panasonic Corporation(Japan) 14.Denso(Japan) 15. Renesas Electronics Corporation(Japan) 16.Magna International Inc.(Canada) Frequently Asked Questions: 1. What is the forecast period considered for the Automotive Advanced Driver Assistance Systems Market report? Ans. The forecast period for the Automotive Advanced Driver Assistance Systems Market is 2023-2029. 2. Which key factors are hindering the growth of the Automotive Advanced Driver Assistance Systems Market? Ans. Restrictions on the environment and security risks these key factors hindering market growth. 3. What is the compound annual growth rate (CAGR) of the Automotive Advanced Driver Assistance Systems Market for the forecast period? Ans. 12.2% of CAGR is the annual growth rate of the automotive advanced driver assistance system market. 4. What are the key factors driving the growth of the Automotive Advanced Driver Assistance Systems Market? Ans. Advancements in safety and security driving the growth of the automotive advanced driver assistance system market (ADAS) market. 5. Which are the worldwide major key players covered for the Automotive Advanced Driver Assistance Systems Market report? Ans. Valeo, Continental, Aptiv (Delphi Automotive), Denso, Autoliv, Audi, BMW, Robert Bosch are the major key players in ADAS market.

1. Global Automotive Advanced Driver Assistance Systems Market: Research Methodology 2. Global Automotive Advanced Driver Assistance Systems Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Automotive Advanced Driver Assistance Systems Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Automotive Advanced Driver Assistance Systems Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Automotive Advanced Driver Assistance Systems Market Segmentation 4.1 Global Automotive Advanced Driver Assistance Systems Market, by System (2022-2029) • Adaptive Cruise Control (ACC) • Adaptive Front Light (AFL) • Automatic Emergency Braking (AEB) • Blind Spot Detection (BSD) • Cross Traffic Alert (CTA) • Driver Monitoring System (DMS) • Forward Collision Warning (FCW) • Intelligent Park Assist (IPA) • Lane Departure Warning (LDW) • Night Vision System (NVS) • Pedestrian Detection System (PDS) • Road Sign Recognition (RSR) • Tire Pressure Monitoring System (TPMS) • Traffic Jam Assist (TJA) 4.2 Global Automotive Advanced Driver Assistance Systems Market, by Component (2022-2029) • Camera Unit • LiDAR • Radar Sensor • Ultrasonic Sensor • Infrared Sensor 4.3 Global Automotive Advanced Driver Assistance Systems Market, by Vehicle (2022-2029) • Passenger Car • Light Commercial Vehicle • Truck • Bus 5. North America Automotive Advanced Driver Assistance Systems Market (2022-2029) 5.1 North America Automotive Advanced Driver Assistance Systems Market, by System (2022-2029) • Adaptive Cruise Control (ACC) • Adaptive Front Light (AFL) • Automatic Emergency Braking (AEB) • Blind Spot Detection (BSD) • Cross Traffic Alert (CTA) • Driver Monitoring System (DMS) • Forward Collision Warning (FCW) • Intelligent Park Assist (IPA) • Lane Departure Warning (LDW) • Night Vision System (NVS) • Pedestrian Detection System (PDS) • Road Sign Recognition (RSR) • Tire Pressure Monitoring System (TPMS) • Traffic Jam Assist (TJA) 5.2 North America Automotive Advanced Driver Assistance Systems Market, by Component (2022-2029) • Camera Unit • LiDAR • Radar Sensor • Ultrasonic Sensor • Infrared Sensor 5.3 North America Automotive Advanced Driver Assistance Systems Market, by Vehicle (2022-2029) • Passenger Car • Light Commercial Vehicle • Truck • Bus 5.4 North America Automotive Advanced Driver Assistance Systems Market, by Country (2022-2029) • United States • Canada • Mexico 6. Europe Automotive Advanced Driver Assistance Systems Market (2022-2029) 6.1. European Automotive Advanced Driver Assistance Systems Market, by System (2022-2029) 6.2. European Automotive Advanced Driver Assistance Systems Market, by Component (2022-2029) 6.3. European Automotive Advanced Driver Assistance Systems Market, by Vehicle (2022-2029) 6.4. European Automotive Advanced Driver Assistance Systems Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Automotive Advanced Driver Assistance Systems Market (2022-2029) 7.1. Asia Pacific Automotive Advanced Driver Assistance Systems Market, by System (2022-2029) 7.2. Asia Pacific Automotive Advanced Driver Assistance Systems Market, by Component (2022-2029) 7.3. Asia Pacific Automotive Advanced Driver Assistance Systems Market, by Vehicle (2022-2029) 7.4. Asia Pacific Automotive Advanced Driver Assistance Systems Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Automotive Advanced Driver Assistance Systems Market (2022-2029) 8.1 Middle East and Africa Automotive Advanced Driver Assistance Systems Market, by System (2022-2029) 8.2. Middle East and Africa Automotive Advanced Driver Assistance Systems Market, by Component (2022-2029) 8.3. Middle East and Africa Automotive Advanced Driver Assistance Systems Market, by Vehicle (2022-2029) 8.4. Middle East and Africa Automotive Advanced Driver Assistance Systems Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Automotive Advanced Driver Assistance Systems Market (2022-2029) 9.1. South America Automotive Advanced Driver Assistance Systems Market, by System (2022-2029) 9.2. South America Automotive Advanced Driver Assistance Systems Market, by Component (2022-2029) 9.3. South America Automotive Advanced Driver Assistance Systems Market, by Vehicle (2022-2029) 9.4 South America Automotive Advanced Driver Assistance Systems Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 Valeo 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Continental,Aptiv (Delphi Automotive) 10.3 Denso 10.4 Autoliv 10.5 Audi 10.6 BMW 10.7 Robert Bosch 10.8 Delphi Automotive 10.9 Continental AG 10.10 Intel (US) 10.11 Aptiv (UK) 10.12 NXP Semiconductor 10.13 Texas Instruments 10.14 Panasonic Corporation 10.15 Magna International Inc. 10.16 Renesas Electronics Corporation