The Global Automotive Tinting Film Market size was valued at USD 6.65 Bn. in 2022 and the total Packaging revenue is expected to grow by 4.6 % from 2023 to 2029, reaching nearly USD 9.53 Bn.Automotive Tinting Film Market Overview:

Automotive tinting films are self-adhesive polyester films that are installed on the exterior or interior of window surfaces in automotive. The automotive tinting film market is expected to grow due to the different benefits they provide, such as UV protection, glare reduction, heat control, and privacy. The advantages of automotive tinting films are multifaceted and contribute to their popularity and sustained market growth.The rising sales of vehicles globally will create a favorable environment for the expansion of the worldwide automotive tinting film industry. The surging demand for glare reduction films, UV protection films, and safety films across the automotive sector will boost the market. Several manufacturers in the market are undertaking initiatives, such as mergers & acquisitions, and strategies, such as acquiring the division of other competitors, to expand their vehicle type portfolio. 3m company,4 AX Ltd, and many others are focused on developing new vehicle types, thereby increasing their market penetration. In the Automotive Tinting Films Market technological advancements, such as the introduction of bio-based polyester films, combined with rising consumer purchasing power, are expected to drive vehicle demand. Changes in consumer preferences, regulations related to window tinting, and overall trends in the automotive industry are other factors that will drive market growth.The automotive tinting film market is expected to continue to grow due to the benefits it offers and the initiatives taken by manufacturers. The market is anticipated to be grown by the rising sales of vehicles globally, technological advancements, and changes in consumer preferences.Lowering fuel consumption is a top concern for both automakers and consumers, particularly as the demand for energy-efficient vehicles continues to rise. Automotive tinting films provide a practical means to achieve this by decreasing the need for energy-consuming systems.To know about the Research Methodology :- Request Free Sample Report

Automotive Tinting Film Market Dynamics:

Automotive Tinting Film Market Driver Automotive Tinting Films Improve Energy Efficiency, Comfort, and Privacy for Drivers and Passengers Automotive Tinting Films Market demand for automotive tinting films is driven by the growing need for enhanced driving experience and privacy. The films reduce glare and heat inside vehicles, significantly improving passenger comfort. By blocking sunlight, tinting films regulate the vehicle's temperature and create a private environment, shielding passengers from prying eyes. As people spend more time in their vehicles, the need for increased comfort and enjoyment has led to a rise in demand for tinting films. The films alleviate discomfort caused by excessive heat and glare, making the driving experience more enjoyable. Automotive tinting films also offer protection against harmful UV rays by blocking up to 99% of UV radiation, effectively safeguarding passengers from potential skin damage and the risk of skin cancer. Automotive Tinting Films Improve Energy Efficiency, Comfort, and Privacy for Drivers and Passengers Automotive Tinting Films Market awareness of these benefits continues to spread, and the popularity of these films is expected to increase further.Energy efficiency is another critical aspect of the automotive industry, and automotive tinting films contribute to this goal.By reducing heat and glare, these films decrease the reliance on air conditioning systems, resulting in lower fuel consumption and improved energy efficiency. This makes them a cost-effective solution for reducing overall fuel consumption in vehicles. Lowering fuel consumption is a top concern for both automakers and consumers, particularly as the demand for energy-efficient vehicles continues to rise. Automotive tinting films provide a practical means to achieve this by decreasing the need for energy-consuming systems. Automotive tinting films contribute to reducing the carbon footprint of vehicles and promoting a green environment. Technological advancements, such as the introduction of bio-based polyester films, combined with rising consumer purchasing power, are expected to drive vehicle demand. Automotive Tinting Film drives green solutions for a sustainable future in the Automotive Industry In Automotive Tinting Films Market,a capital-intensive & technology-driven industry, has been playing an important role in socioeconomic development, car accessories such as window films improve the safety of the vehicle up to a substantial extent. End users are ramping up the safety level of the interior with improved aesthetics of their cars with automotive window films. Further by applying window films on the window, the window glass becomes harder to breach.In the case of accidents, window glass contracts to one place with lesser damage occurring to the passenger, thus this film also improves security. Additionally, window films improve the strength of the window glass which requires more force to break down the window. The increasing focus on vehicle safety and security of vehicles by end users is procuring traction for the sales and consumption of automotive window films. Automotive Tinting Film Market Restraints Advanced Glazing Technologies and Price Sensitivity Among Consumers Pose Challenges for the Automotive Tinting Film Market In Automotive Tinting Films Market Competition from alternative technologies, specifically self-tinting or smart glass windows, poses a significant challenge to the automotive tinting film market.The new advanced glazing solutions utilize mechanisms like electrochromic, photochromic, or thermochromic technologies to automatically adjust their tint level based on external conditions. As a result, they provide similar benefits to traditional tinting films and attract customers away from using them. Another factor hindering the widespread adoption of tinting films is price sensitivity. While tinting films offer numerous advantages such as enhanced privacy, heat reduction, and UV protection, their cost, including the purchase and installation expenses, acts as a deterrent for many potential consumers.High-quality tinting films and professional installation services are typically priced higher, making them less accessible to individuals who prioritize cost considerations. During price-sensitive markets or economic downturns, consumers tend to prioritize essential expenses over optional enhancements. As tinting films are perceived as discretionary purchases, they are often deferred in favor of more immediate needs, such as vehicle maintenance or necessary repairs.When consumers compare the cost of tinting films with other aftermarket accessories or modifications available for vehicles, their decision-making can be influenced. This will further impact the adoption of tinting films in the market. Automotive Tinting Film Market Opportunities Automotive Tinting Film Market Boosts Opportunity in the Era of Electric Vehicle In the Automotive Tinting Films Market manufacturers of tinting film products which are used in automotive vehicles have a significant opportunity to cater specifically to the growing demand for window films in electric vehicles (EVs).As EVs continue to rise in popularity, EV owners prioritize energy efficiency and sustainability, making window films a crucial element in enhancing these aspects. Window films excel in reducing interior heat buildup caused by sunlight, which is particularly important in electric vehicles with their large windows and panoramic roofs. These features contribute to increased solar heat gain, resulting in an uncomfortable driving experience, and added strain on the vehicle's air conditioning system. Manufacturers can capitalize on this opportunity by developing tinting films with exceptional heat-rejection properties, providing EV owners with a solution to mitigate heat buildup, improve energy efficiency, and enhance driving comfort. In addition to heat reduction, automotive tinting films offer other benefits to electric vehicle owners. They provide protection against harmful UV radiation, safeguarding occupants and preventing interior fading and damage to sensitive electronic components. They also reduce glare, improve visibility for the driver, and enhance overall safety. To seize the growing demand for window films in electric vehicles, manufacturers should focus on developing specialized tinting film solutions tailored to the unique characteristics and needs of EVs. This may involve creating films to seize the growing demand for window films in electric vehicles, manufacturers should focus on developing specialized tinting film solutions tailored to the unique characteristics and needs of EVs. This may involve creating films with higher levels of heat rejection to address the increased solar heat gain associated with large glass surfaces in electric vehicles. On the other hand, manufacturers can explore integrating advanced technologies like infrared-reflective coatings or smart films that dynamically adjust their tint based on external conditions or occupant preferences.Automotive Tinting Film Market Segment Analysis:

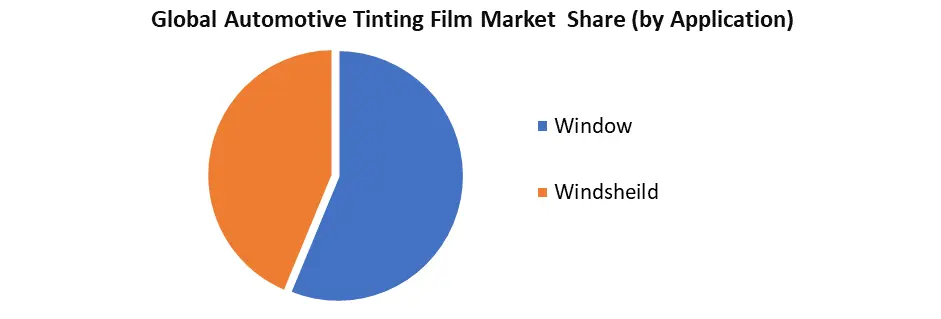

Based on vehicle type, the LCV segment dominated the market in the year 2022 and is expected to continue its dominance during the forecast period. The market segment for LCVs is anticipated to grow at the fastest rate. The demand for light commercial vehicles is anticipated to increase during the forecast period due to the significant improvement in global trade and transportation. Since the drivers of LCVs who transport goods spend more time behind the wheel. In and are subjected to harmful sunlight, tinting films are used on the windshields of these vehicles to reduce glare and block UV rays. There was a sizable market share for passenger cars. To shield interior occupants from UV rays and Charmful sunlight, tinting films are used on the windows and windshields of passenger cars. Films with tinting reduce heat and glare while also providing UV protection. The production and sales of passenger and light commercial vehicles are anticipated to rise globally during the forecast period due to rising disposable income and changing lifestyles which are then anticipated to fuel the overall demand for the product. Based on application, By application, the market is categorized into Windows and Windshields. Windshields held the largest share of the market and are expected to continue their domination during the forecast period. Applying tinting films to windshields prevents the direct impact of the sun's heat and ultraviolet rays on passengers. The product helps the vehicle's driver see clearly and safely while reducing glare. Most automakers use tinting films to reduce glare, improve driving comfort, and offer protection. Since CV and HV drivers frequently cover large distances at once because these vehicles were primarily created for moving goods from one location to another. The sun's harmful rays can make driving uncomfortable and make driving challenging for an extended period when they enter the car through the windshield. This effect is lessened by the product, which also improves driving comfort. Over the forecast period, the Windows application segment is anticipated to grow significantly. These windows film serve as protection from harmful UV rays exposure. During the forecast period, demand is anticipated to be driven by the rising need for products that reduce interior vehicle temperatures, shield interiors from UV rays, and give passengers a comfortable driving experience.

Automotive Tinting Film Regional Insights:

North America dominated the market in the year 2022 with a market share of 23% and is expected to continue its dominance during the forecast period. The regions analyzed for the market include North America, Asia Pacific, Latin America,America, Asia Pacific, the Middle East, and Africa. North America arose as the largest market for the global metaverse market with a 34.5% share of the market revenue in 2021.The growth of the technical solution is anticipated to be the highest in North America compared to other regions. Being technologically sound and developed, North America is the leading market by region in developing advanced technologies used in automobiles. The increasing expenditure of companies and individuals on digital solutions and cutting-edge technologies also boosts market growth.Automotive Tinting Film Market Scope: Inquire before buying

Global Automotive Tinting Film Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 6.65 Bn. Forecast Period 2023 to 2029 CAGR: 4.6 % Market Size in 2029: US $ 9.53 Bn. Segments Covered: by Vehicle type Heavy commercial vehicle Light commercial vehicle Passenger cars by Application Window Windshield Automotive Tinting Film Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Automotive Tinting Film Market Key players

1. 3M Company 2. Eastman Chemical Company 3. Saint-Gobain S.A. 4. Avery Dennison Corporation 5. Johnson Window Films 6. Madico Inc. 7. Solar Gard 8. Garware Suncontrol 9. Hanita Coatings and LLP Frequently Asked Questions: 1] What segments are covered in the Global Automotive Tinting Film Market report? Ans. The segments covered in the Automotive Tinting Film Market report are based on Material Type, Product Type, Application, End-Use, and Region. 2] Which region is expected to hold the highest share of the Global Automotive Tinting Film Market? Ans. The North American region is expected to hold the highest share of the Automotive Tinting Film Market. 3] What is the market size of the Global Automotive Tinting Film Market by 2029? Ans. The market size of the Automotive Tinting Film Market by 2029 is expected to reach US$ 9.53 Bn. 4] What is the forecast period for the Global Automotive Tinting Film Market? Ans. The forecast period for the Automotive Tinting Film Market is 2023-2029. 5] What was the market size of the Global Automotive Tinting Film Market in 2022? Ans. The market size of the Automotive Tinting Film Market in 2022 was valued at US$ 6.65 Bn.

Table of Content 1. Automotive Tinting Film Market: Research Methodology 2. Automotive Tinting Film Market: Executive Summary 3. Automotive Tinting Film Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Automotive Tinting Film Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Automotive Tinting Film Market: Segmentation (by Value USD and Volume Units) 5.1. Automotive Tinting Film Market, By Vehicle Type(2022-2029) 5.1.1. Heavy commercial vehicle 5.1.2. Light commercial vehicle 5.1.3. Passenger cars 5.2. Automotive Tinting Film Market, by Application (2022-2029) 5.2.1. Window 5.2.2. Windshield 5.3. Automotive Tinting Film Market, by region (2022-2029) 5.3.1. North America 5.3.2. Europe 5.3.3. Asia Pacific 5.3.4. Middle East and Africa 5.3.5. South America 6. North America Automotive Tinting Film Market (by Value USD and Volume Units) 6.1. North America Automotive Tinting Film Market, by vehicle type-2029) 6.1.1. Heavy commercial vehicle 6.1.2. Light commercial vehicle 6.1.3. Passenger cars Polyethylene 6.1.4. Others 6.2. North America Automotive Tinting Film Market, by Application (2022-2029) 6.2.1. Window 6.2.2. Windshield 6.3. North America Automotive Tinting Film Market, by Country (2022-2029) 6.3.1. United States 6.3.2. Canada 6.3.3. Mexico 7. Europe Automotive Tinting Film Market (by Value USD and Volume Units) 7.1. Europe Automotive Tinting Film Market, by vehicle type(2022-2029) 7.2. Heavy commercial vehicle 7.3. Light commercial vehicle 7.4. Passenger cars 7.5. Europe Automotive Tinting Film Market, by Application (2022-2029) 7.6. Electronics & Telecommunication 7.7. Textile 7.8. Aerospace & Defense 7.9. Construction & Building 7.10. Automotive 7.11. Sporting Goods 7.12. Others 7.13. Europe Automotive Tinting Film Market, by Country (2022-2029) 7.13.1. UK 7.13.2. France 7.13.3. Germany 7.13.4. Italy 7.13.5. Spain 7.13.6. Sweden 7.13.7. Austria 7.13.8. Rest of Europe 8. Asia Pacific Automotive Tinting Film Market (by Value USD and Volume Units) 8.1. Asia Pacific Automotive Tinting Film Market, by vehicle type(2022-2029) 8.2. Heavy commercial vehicle 8.3. Light commercial vehicle 8.4. Passenger cars 8.5. Asia Pacific Automotive Tinting Film Market, by Application (2022-2029) 8.6. Window 8.7. Windshield 8.8. Asia Pacific Automotive Tinting Film Market, by Country (2022-2029) 8.8.1. China 8.8.2. S Korea 8.8.3. Japan 8.8.4. India 8.8.5. Australia 8.8.6. Indonesia 8.8.7. Malaysia 8.8.8. Vietnam 8.8.9. Taiwan 8.8.10. Bangladesh 8.8.11. Pakistan 8.8.12. Rest of Asia Pacific 9. Middle East and Africa Automotive Tinting Film Market (by Value USD and Volume Units) 9.1. Heavy commercial vehicle 9.2. Light commercial vehicle 9.3. Passenger 9.4. Middle East and Africa Automotive Tinting Film Market, by Application (2022-2029) 9.5. Window 9.6. Windshield 9.7. Middle East and Africa Automotive Tinting Film Market, by Country (2022-2029) 9.7.1. South Africa 9.7.2. GCC 9.7.3. Egypt 9.7.4. Nigeria 9.7.5. Rest of ME&A 10. South America Automotive Tinting Film Market (by Value USD and Volume Units) 10.1. South America Automotive Tinting Film Marketby vehicle type (2022-2029) 10.2. Heavy commercial vehicle 10.3. Light commercial vehicle 10.4. Passenger cars 10.5. South America Automotive Tinting Film Market, by Application (2022-2029) 10.6. Window 10.7. Windshield 10.8. South America Automotive Tinting Film Market, by Country (2022-2029) 10.8.1. Brazil 10.8.2. Argentina 10.8.3. Rest of South America 11. Company Profile: Key players 11.1.1. 3M Company 11.1.2. Company Overview 11.1.3. Financial Overview 11.1.4. Business Portfolio 11.1.5. SWOT Analysis 11.1.6. Business Strategy 11.1.7. Recent Developments 11.2. Eastman Chemical Company 11.3. Saint-Gobain S.A. 11.4. Avery Dennison Corporation 11.5. Johnson Window Films 11.6. Madico Inc. 11.7. Solar Gard 11.8. Garware Suncontrol 11.9. Hanita Coatings and LLP 12. Key Findings 13. Industry Recommendation