The Global Automotive Retail Market size was valued at USD 3.66 trillion in 2023 and the total Global Automotive Retail revenue is expected to grow at a CAGR of 7.15 % from 2024 to 2030, reaching nearly USD 6.22 trillion.Automotive Retail Market Overview

Automotive retailing is the business of buying and selling vehicles which mainly involves two and three wheelers, passenger vehicles, LCV (Light commercial vehicles), HCV (Heavy commercial vehicles), to the consumers. Retailing involves the entire process of buying and selling vehicles from initial interaction with potential buyers to the final transaction and delivery. This whole process includes various tasks which involves providing test drives to interested consumers, Trade-ins which allows customers to exchange their existing vehicles as partial payment towards the purchase of a new or used vehicle. Arranging loans or lease agreements for customers through partnerships with banks, credit unions, or other financial institutions plays an important role in overall automotive retail business. As the automotive industry is experiencing a transition towards electric vehicles, driven by increased environmental awareness and government incentives, the automotive retailers have started to increase their offerings to include a wider range of EVs to meet the growing demand. The Automotive Retail Market includes both offline retail (traditional dealerships) and online retail channels. The rapid growth in digitalization has impacted the automotive retail sector as well, which has led the retailers to provide digital platforms and online marketplaces which has gained traction, allowing consumers to browse, compare, and purchase vehicles online. The scope includes technological advancements in the automotive retail sector, including innovations in electric vehicles (EVs), ADAS (Advanced drivers assistance systems), connectivity options, and safety features .In short, to thrive in this rapidly evolving digital Automotive Retail Market, automotive retailers must prioritize digitalization as a main ingredient in the business to deliver a consumer-friendly experience.To know about the Research Methodology :- Request Free Sample Report

Automotive Retail Market Dynamics

Technological Advancement and Change in Consumer Preferences Innovations in automotive technology influence consumer preferences and buying decisions. Advancements in electric vehicles (EVs), autonomous driving features, connectivity options, and safety features create shifts in the Automotive Retail market. Changes in lifestyle, demographics, and urbanization lead to shifts in preferences for smaller, more fuel-efficient vehicles, or larger SUVs and trucks. Additionally, changing consumer preferences for vehicle ownership models, such as ride-sharing and subscription services, influence the Automotive Retail industry. Competition drives companies to differentiate their products and services, providing accessibility to auto financing and interest rates which significantly impact consumer purchasing behaviour. Regulation impact on automotive retail sector Governments around the world are implementing emissions standards and offering incentives for electric and hybrid vehicles. These regulations influence automakers' strategies and consumer choices, impacting the Automotive Retail Market product mix. The regulation impact on Low-interest rates make car loans more affordable, stimulating demand, while high-interest rates discourage potential buyers. The role of automotive retailers in future landscape The traditional Automotive Retail Market dealerships remain crucial in the customer decision journey is to satisfy customers’ need. Overall, an average of 80 percent of customers prefer at least one test-drive as part of their buying process. Despite their preference for the online channel for many phases of the purchasing process, even younger customers still want to physically feel and experience the car of their choice before making a final decision. Another crucial role in the customer decision journey is to satisfy customers’ need for expert advice. Over 35 percent of customers rank product expertise as the most important element of a dealer consultation. As customers increasingly collect general information online, dealers are more being viewed as an advanced “second-level support” for questions and doubts. Economic recession and slowdowns to restrain the automotive retail market growth Economic recessions and slowdowns significantly impact consumer spending on big-ticket items like cars. During periods of economic uncertainty, consumers postpone purchasing new vehicles, leading to reduced demand and sales for the automotive retail market. Global trade tensions and fluctuations in tariffs impact the cost of raw materials, components, and finished vehicles. Trade disputes disrupt supply chains and add complexity to automakers' operations, potentially affecting vehicle pricing and availability. High levels of consumer debt limit purchasing power and make it more challenging for potential buyers to finance new vehicles. As consumer debt increases, the demand for automotive retail decrease.Trends in Automotive Retail Market

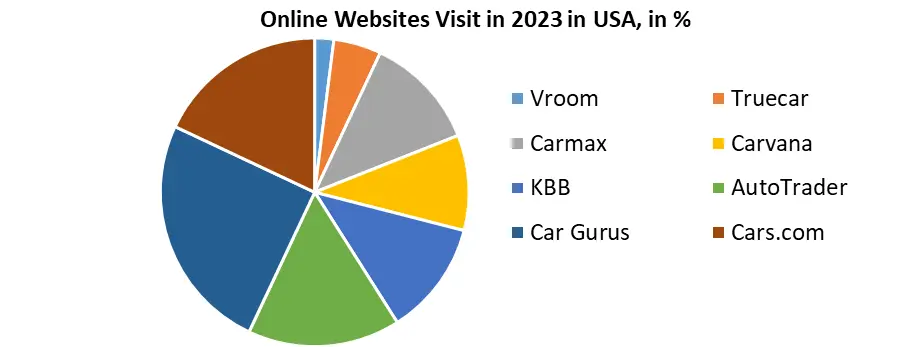

The subscription model, once considered a niche concept, has evolved into a prevalent business model globally, especially in the West in U.S. and Europe Automotive Retail Market, where notable success stories include UK-based Ontos and Germany-based Finn as well as more established players such as MeinAuto and Fleetpool. And while most car-subscription providers are still relatively new and modest in scale, a clearer picture is emerging of what it takes to win. Nearly 50 % consumers indicate that established retailers are their most trusted providers for vehicle subscriptions across the premium and volume brand segments. Consumers interested to try vehicle subscriptions signal a willingness to pay approximately 10-12 percent more for the access flexibility compared with their current mobility expenditures. The used-car Automotive Retail Market is another trend which the automotive retail market has witnessed. With the help of online sites which brought access to customers in a single touch, elements like cost-effectiveness accessibility of pre-owned vehicles, increased demand for individual transportation, and the emergence of diverse online platforms facilitating the market have collectively contributed to the growth of Automotive Retail Market. Companies like CarMax, Cars24 are one of the leadings in the used car retailing services. For instance, European countries such as Germany, the U.K., Spain, and Austria have witnessed significant volume sales of petrol, EVs, and hybrid vehicles. Auto dealers use their websites as a sales and marketing generation channel to direct buyers to the showroom floor, where they complete the purchase. Consumers are now looking for e-commerce options for their entire purchases. The number of digital sellers, such as Vroom, Carvana Inc., eBay Motors, and Shift Technologies Inc., that specifically cater to online vehicle buyers is increasing, increasing market competitiveness.The automotive retailers offers a spectrum of easily accessible financing options, along with comprehensive loan and lease services which enables consumers to take advantage of these facilities. With various digital payment options available and with the further use of technologies like block chain, creating online banking apps by using machine learning and artificial intelligence makes it easier for the retailers to perform the lending , leasing procedure and consumer benefits from these easily accessible technologies.

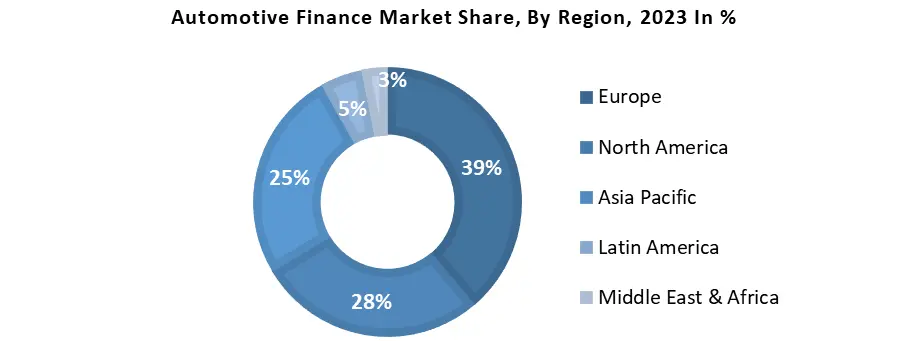

Automotive Retail Market Regional Insight

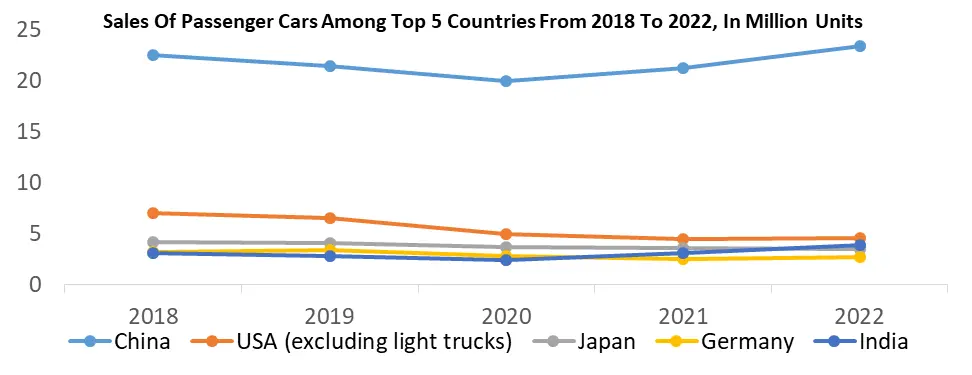

North America dominated the market in 2023 and is expected to hold the largest Automotive Retail Market share over the forecast period. In North America US, Canada, and Mexico are the countries with diverse consumer preferences and technological advancement in the Automotive Retail Market. To diversify business and improve market share, several established automotive dealerships are engaging in M&A deals. The primary target of the dealers are the distressed assets that easily integrated into their existing operations. For example, Houston-based IndiGO Auto Group, a dealer that specializes in selling luxury and performance vehicles bought three dealerships from Peter Sonnen to grow their footprint in North California, USA. M&A deals like these enable dealers to grow their brand portfolio and geographic reach, which help them to improve their market share and drive the growth of global automotive retail market. In Asia specific Automotive Retail Market, China is the biggest player with companies like Zhongsheng group, Bayan County playing a crucial role. The automotive players in China are planning to launch 2-3 vehicles every day. With an intention to captivate the tech-savvy Chinese car buyers, digital giants like Baidu, Alibaba, and Tencent are seeking to establish themselves as the go-to-resource for used and new car purchases. Around 65% of the consumers in China start their automotive journey buying online and around 70% buyers gather quotes from various dealers of the identical brand to secure the most favourable price.

Automotive Retail Market Segment Analysis

Based on Type, the Automotive Retail Market is segmented into Offline Retail, and Online Retail. Online retail segment is expected to hold the largest Automotive Retail Market share over the forecast period. Automotive manufacturers, dealerships, and third-party platforms have developed interactive and user-friendly websites where consumers browse through a wide selection of vehicles. These digital showrooms often provide detailed vehicle information, specifications, images, and pricing. Some online platforms offer virtual tours and 360-degree views of vehicles, allowing customers to explore both the interior and exterior of the cars from the comfort of their homes, which is expected to boost the Automotive Retail Market growth. Online platforms offer financing options, allowing customers to apply for car loans and get pre-approved digitally. This streamlines the financing process and saves time for customers. To enhance convenience and safety, some online automotive retailers offer contactless sales, where the entire transaction are conducted online, and the vehicle is delivered to the customer's doorstep. Nearly 40% of consumers admit they make purchases through an online channel to get a better price, and 25% do so because of how easily and quickly they complete a purchase.Based on Vehicle Type, the market is segmented into Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles. Passenger Cars segment held the largest automotive retail market share in 2023 and is expected to dominate the Automotive Retail Market over the forecast period. Passenger cars typically have seating capacity for two to five occupants, depending on the body type and configuration. Passenger cars are known for their comfort, convenience features, and amenities. They often offer air conditioning, advanced infotainment systems, power windows, and other modern technologies, and is expected to boost the segment growth in Automotive Retail market segment. Sedans are the most common passenger car body type, featuring four doors and a separate trunk compartment. When it comes to the LCV motor vehicle, they are with minimum of four wheels that are used to transport products. There carrying limit ranges between 3.5 and 7 tons, which is determined by national and professional criteria. The notable advancement in the Asian market’s commerce and transportation infrastructure resulted in a surge in sales for LCVs. The estimation of profitable changes in the Automotive Retail Market due to inclusion of Electric transmission in LCVs play a major role in the near future.

Adoption of innovative technologies and Government investments in research and development has positively skewed the growth of Heavy commercial vehicles as it plays crucial role in transportation of heavy goods with the country and with neighbouring countries as well. Growing emphasis on sustainability ensures fast growth in the HCV sales market.

Automotive Retail Market Competitive Landscape

Digital retail platforms, such as Carvana, AutoTrader, and TrueCar, have gained traction in recent years. These platforms allow consumers to browse, compare, and purchase vehicles online, offering convenience and transparency. Some platforms offer home delivery of vehicles and contactless buying options. Various third-party service providers contribute to the automotive retail market. These include automotive financing institutions, insurance companies, extended warranty providers, and vehicle valuation services. Providing an exceptional customer experience is crucial for gaining a competitive edge. Personalized services, transparent pricing, efficient after-sales support, and innovative buying options are essential for attracting and retaining customers.Digital marketing and advertising strategies are important for automakers and dealerships to reach and engage with potential customers and helps to increase Automotive Retail Market penetration. Social media, search engine optimization, and targeted online campaigns play a significant role in attracting consumers to their platforms. AutoNation has launched a new digital customer experience platform that offers customers a seamless and straightforward omnichannels automobile shopping sand purchasing experience. Powered by our 9 million Customers' real-time insights, AutoNation has created a highly personalized digital experience online and in-store.

Automotive Retail Market Report Scope: Inquire Before Buying

Global Automotive Retail Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2022 Market Size in 2023: US $ 3.66 Tn. Forecast Period 2024 to 2030 CAGR: 7.15% Market Size in 2030: US $ 6.22 Tn. Segments Covered: by Type Offline Retail Online Retail by Vehicle Type Passenger Cars Light Commercial Vehicles Heavy Commercial Vehicles by Sales Channel OEM Aftermarket Automotive Retail Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and the Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Automotive Retail Key Players

North America: 1. Sonic Automotive (North Carolina, USA) 2. AutoNation (Florida, USA) 3. CarMax (Virginia, USA) 4. Penske Automotive Group (Michigan, USA) 5. Lithia Motors (USA) 6. Asbury Automotive Group(US) 7. Hendrick Automotive Group 8. O'Reilly Auto Parts 9. Canadian Tire Corporation (Canada) Europe: 10. AutoZone (Brazil) 11. Advance Auto Parts 12. LKQ Corporation 13. Monro, Inc. 14. AutoZone Asia Pacific: 15. Toyota Motor Corporation (Tokyo, Japan) 16. Isuzu Motors Limit(Tokyo, Japan Global: 17. Roland Berger GmbH 18. Group 1 Automotive 19. Genuine Parts CompanyFrequently Asked Questions:

1. What are the growth drivers for the Automotive Retail Market? Ans. Technological Advancement and Change in Consumer Preferences and is expected to be the major driver for the Automotive Retail Market. 2. What is the major restraint for the Automotive Retail Market growth? Ans. Economic recession and slowdowns in the automotive retail market growth is expected to be the major restrain in the Automotive Retail Market. 3. Which region is expected to lead the global Automotive Retail Market during the forecast period? Ans. The Asia Pacific is expected to lead the Automotive Retail Market during the forecast period. 4. What is the projected market size and growth rate of the Automotive Retail Market? Ans. The Global Automotive Retail Market size was valued at USD 3.66 trillion in 2023 and the total Global Automotive Retail revenue is expected to grow at a CAGR of 7.15 % from 2024 to 2030, reaching nearly USD 6.22 trillion. 5. What segments are covered in the Automotive Retail Market report? Ans. The segments covered in the Automotive Retail Market report are by Product Type, Component, End-Users and Region.

1. Automotive Retail Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Automotive Retail Market: Dynamics 2.1. Automotive Retail Market Trends by Region 2.1.1. North America Automotive Retail Market Trends 2.1.2. Europe Automotive Retail Market Trends 2.1.3. Asia Pacific Automotive Retail Market Trends 2.1.4. Middle East and Africa Automotive Retail Market Trends 2.1.5. South America Automotive Retail Market Trends 2.2. Automotive Retail Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Automotive Retail Market Drivers 2.2.1.2. North America Automotive Retail Market Restraints 2.2.1.3. North America Automotive Retail Market Opportunities 2.2.1.4. North America Automotive Retail Market Challenges 2.2.2. Europe 2.2.2.1. Europe Automotive Retail Market Drivers 2.2.2.2. Europe Automotive Retail Market Restraints 2.2.2.3. Europe Automotive Retail Market Opportunities 2.2.2.4. Europe Automotive Retail Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Automotive Retail Market Drivers 2.2.3.2. Asia Pacific Automotive Retail Market Restraints 2.2.3.3. Asia Pacific Automotive Retail Market Opportunities 2.2.3.4. Asia Pacific Automotive Retail Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Automotive Retail Market Drivers 2.2.4.2. Middle East and Africa Automotive Retail Market Restraints 2.2.4.3. Middle East and Africa Automotive Retail Market Opportunities 2.2.4.4. Middle East and Africa Automotive Retail Market Challenges 2.2.5. South America 2.2.5.1. South America Automotive Retail Market Drivers 2.2.5.2. South America Automotive Retail Market Restraints 2.2.5.3. South America Automotive Retail Market Opportunities 2.2.5.4. South America Automotive Retail Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Regulatory Landscape by Region 2.6.1. Global 2.6.2. North America 2.6.3. Europe 2.6.4. Asia Pacific 2.6.5. Middle East and Africa 2.6.6. South America 2.7. Key Opinion Leader Analysis For Automotive Retail Industry 2.8. Analysis of Government Schemes and Initiatives For Automotive Retail Industry 2.9. The Global Pandemic Impact on Automotive Retail Market 3. Automotive Retail Market: Global Market Size and Forecast by Segmentation (by Value) (2023-2030) 3.1. Automotive Retail Market Size and Forecast, by Type (2023-2030) 3.1.1. Offline Retail 3.1.2. Online Retail 3.2. Automotive Retail Market Size and Forecast, by Vehicle Type (2023-2030) 3.2.1. Passenger Cars 3.2.2. Light Commercial Vehicle 3.2.3. Heavy Commercial Vehicles 3.3. Automotive Retail Market Size and Forecast, by Sales Channel (2023-2030) 3.3.1. OEM 3.3.2. Aftermarket 3.4. Automotive Retail Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Automotive Retail Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. North America Automotive Retail Market Size and Forecast, by Type (2023-2030) 4.1.1. Offline Retail 4.1.2. Online Retail 4.2. North America Automotive Retail Market Size and Forecast, by Vehicle Type (2023-2030) 4.2.1. Passenger Cars 4.2.2. Light Commercial Vehicle 4.2.3. Heavy Commercial Vehicles 4.3. North America Automotive Retail Market Size and Forecast, by Sales Channel (2023-2030) 4.3.1. OEM 4.3.2. Aftermarket 4.4. Automotive Retail Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Automotive Retail Market Size and Forecast, by Type (2023-2030) 4.4.1.1.1. Offline Retail 4.4.1.1.2. Online Retail 4.4.1.2. United States Automotive Retail Market Size and Forecast, by Vehicle Type (2023-2030) 4.4.1.2.1. Passenger Cars 4.4.1.2.2. Light Commercial Vehicle 4.4.1.2.3. Heavy Commercial Vehicles 4.4.1.3. United States Automotive Retail Market Size and Forecast, by Sales Channel (2023-2030) 4.4.1.3.1. OEM 4.4.1.3.2. Aftermarket 4.4.2. Canada 4.4.2.1. Canada Automotive Retail Market Size and Forecast, by Type (2023-2030) 4.4.2.1.1. Offline Retail 4.4.2.1.2. Online Retail 4.4.2.2. Canada Automotive Retail Market Size and Forecast, by Vehicle Type (2023-2030) 4.4.2.2.1. Passenger Cars 4.4.2.2.2. Light Commercial Vehicle 4.4.2.2.3. Heavy Commercial Vehicles 4.4.2.3. Canada Automotive Retail Market Size and Forecast, by Sales Channel (2023-2030) 4.4.2.3.1. OEM 4.4.2.3.2. Aftermarket 4.4.3. Mexico 4.4.3.1. Mexico Automotive Retail Market Size and Forecast, by Type (2023-2030) 4.4.3.1.1. Offline Retail 4.4.3.1.2. Online Retail 4.4.3.2. Mexico Automotive Retail Market Size and Forecast, by Vehicle Type (2023-2030) 4.4.3.2.1. Passenger Cars 4.4.3.2.2. Light Commercial Vehicle 4.4.3.2.3. Heavy Commercial Vehicles 4.4.3.3. Mexico Automotive Retail Market Size and Forecast, by Sales Channel (2023-2030) 4.4.3.3.1. OEM 4.4.3.3.2. Aftermarket 5. Europe Automotive Retail Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. Europe Automotive Retail Market Size and Forecast, by Type (2023-2030) 5.2. Europe Automotive Retail Market Size and Forecast, by Vehicle Type (2023-2030) 5.3. Europe Automotive Retail Market Size and Forecast, by Sales Channel (2023-2030) 5.4. Europe Automotive Retail Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Automotive Retail Market Size and Forecast, by Type (2023-2030) 5.4.1.2. United Kingdom Automotive Retail Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.1.3. United Kingdom Automotive Retail Market Size and Forecast, by Sales Channel (2023-2030) 5.4.2. France 5.4.2.1. France Automotive Retail Market Size and Forecast, by Type (2023-2030) 5.4.2.2. France Automotive Retail Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.2.3. France Automotive Retail Market Size and Forecast, by Sales Channel (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Automotive Retail Market Size and Forecast, by Type (2023-2030) 5.4.3.2. Germany Automotive Retail Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.3.3. Germany Automotive Retail Market Size and Forecast, by Sales Channel (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Automotive Retail Market Size and Forecast, by Type (2023-2030) 5.4.4.2. Italy Automotive Retail Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.4.3. Italy Automotive Retail Market Size and Forecast, by Sales Channel (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Automotive Retail Market Size and Forecast, by Type (2023-2030) 5.4.5.2. Spain Automotive Retail Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.5.3. Spain Automotive Retail Market Size and Forecast, by Sales Channel (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Automotive Retail Market Size and Forecast, by Type (2023-2030) 5.4.6.2. Sweden Automotive Retail Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.6.3. Sweden Automotive Retail Market Size and Forecast, by Sales Channel (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Automotive Retail Market Size and Forecast, by Type (2023-2030) 5.4.7.2. Austria Automotive Retail Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.7.3. Austria Automotive Retail Market Size and Forecast, by Sales Channel (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Automotive Retail Market Size and Forecast, by Type (2023-2030) 5.4.8.2. Rest of Europe Automotive Retail Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.8.3. Rest of Europe Automotive Retail Market Size and Forecast, by Sales Channel (2023-2030) 6. Asia Pacific Automotive Retail Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Asia Pacific Automotive Retail Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Automotive Retail Market Size and Forecast, by Vehicle Type (2023-2030) 6.3. Asia Pacific Automotive Retail Market Size and Forecast, by Sales Channel (2023-2030) 6.4. Asia Pacific Automotive Retail Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Automotive Retail Market Size and Forecast, by Type (2023-2030) 6.4.1.2. China Automotive Retail Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.1.3. China Automotive Retail Market Size and Forecast, by Sales Channel (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Automotive Retail Market Size and Forecast, by Type (2023-2030) 6.4.2.2. S Korea Automotive Retail Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.2.3. S Korea Automotive Retail Market Size and Forecast, by Sales Channel (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Automotive Retail Market Size and Forecast, by Type (2023-2030) 6.4.3.2. Japan Automotive Retail Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.3.3. Japan Automotive Retail Market Size and Forecast, by Sales Channel (2023-2030) 6.4.4. India 6.4.4.1. India Automotive Retail Market Size and Forecast, by Type (2023-2030) 6.4.4.2. India Automotive Retail Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.4.3. India Automotive Retail Market Size and Forecast, by Sales Channel (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Automotive Retail Market Size and Forecast, by Type (2023-2030) 6.4.5.2. Australia Automotive Retail Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.5.3. Australia Automotive Retail Market Size and Forecast, by Sales Channel (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Automotive Retail Market Size and Forecast, by Type (2023-2030) 6.4.6.2. Indonesia Automotive Retail Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.6.3. Indonesia Automotive Retail Market Size and Forecast, by Sales Channel (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Automotive Retail Market Size and Forecast, by Type (2023-2030) 6.4.7.2. Malaysia Automotive Retail Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.7.3. Malaysia Automotive Retail Market Size and Forecast, by Sales Channel (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Automotive Retail Market Size and Forecast, by Type (2023-2030) 6.4.8.2. Vietnam Automotive Retail Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.8.3. Vietnam Automotive Retail Market Size and Forecast, by Sales Channel (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Automotive Retail Market Size and Forecast, by Type (2023-2030) 6.4.9.2. Taiwan Automotive Retail Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.9.3. Taiwan Automotive Retail Market Size and Forecast, by Sales Channel (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Automotive Retail Market Size and Forecast, by Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Automotive Retail Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.10.3. Rest of Asia Pacific Automotive Retail Market Size and Forecast, by Sales Channel (2023-2030) 7. Middle East and Africa Automotive Retail Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030 7.1. Middle East and Africa Automotive Retail Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Automotive Retail Market Size and Forecast, by Vehicle Type (2023-2030) 7.3. Middle East and Africa Automotive Retail Market Size and Forecast, by Sales Channel (2023-2030) 7.4. Middle East and Africa Automotive Retail Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Automotive Retail Market Size and Forecast, by Type (2023-2030) 7.4.1.2. South Africa Automotive Retail Market Size and Forecast, by Vehicle Type (2023-2030) 7.4.1.3. South Africa Automotive Retail Market Size and Forecast, by Sales Channel (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Automotive Retail Market Size and Forecast, by Type (2023-2030) 7.4.2.2. GCC Automotive Retail Market Size and Forecast, by Vehicle Type (2023-2030) 7.4.2.3. GCC Automotive Retail Market Size and Forecast, by Sales Channel (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Automotive Retail Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Nigeria Automotive Retail Market Size and Forecast, by Vehicle Type (2023-2030) 7.4.3.3. Nigeria Automotive Retail Market Size and Forecast, by Sales Channel (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Automotive Retail Market Size and Forecast, by Type (2023-2030) 7.4.4.2. Rest of ME&A Automotive Retail Market Size and Forecast, by Vehicle Type (2023-2030) 7.4.4.3. Rest of ME&A Automotive Retail Market Size and Forecast, by Sales Channel (2023-2030) 8. South America Automotive Retail Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. South America Automotive Retail Market Size and Forecast, by Type (2023-2030) 8.2. Middle East and Africa Automotive Retail Market Size and Forecast, by Vehicle Type (2023-2030) 8.3. Middle East and Africa Automotive Retail Market Size and Forecast, by Sales Channel (2023-2030) 8.4. Middle East and Africa Automotive Retail Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Automotive Retail Market Size and Forecast, by Type (2023-2030) 8.4.1.2. Brazil Automotive Retail Market Size and Forecast, by Vehicle Type (2023-2030) 8.4.1.3. Brazil Automotive Retail Market Size and Forecast, by Sales Channel (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Automotive Retail Market Size and Forecast, by Type (2023-2030) 8.4.2.2. Argentina Automotive Retail Market Size and Forecast, by Vehicle Type (2023-2030) 8.4.2.3. Argentina Automotive Retail Market Size and Forecast, by Sales Channel (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Automotive Retail Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Rest Of South America Automotive Retail Market Size and Forecast, by Vehicle Type (2023-2030) 8.4.3.3. Rest Of South America Automotive Retail Market Size and Forecast, by Sales Channel (2023-2030) 9. Global Automotive Retail Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.3.6. SKU Details 9.3.7. Production Capacity 9.3.8. Production for 2023 9.3.9. No. of Stores 9.4. Leading Automotive Retail Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Sonic Automotive (North Carolina, USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. AutoNation (Florida, USA) 10.3. CarMax (Virginia, USA) 10.4. Penske Automotive Group (Michigan, USA) 10.5. Lithia Motors (USA) 10.6. Asbury Automotive Group(US) 10.7. Hendrick Automotive Group 10.8. O'Reilly Auto Parts 10.9. Canadian Tire Corporation (Canada) 10.10. AutoZone (Brazil) 10.11. Advance Auto Parts 10.12. LKQ Corporation 10.13. Monro, Inc. 10.14. AutoZone 10.15. Asia Pacific: 10.16. Toyota Motor Corporation (Tokyo, Japan) 10.17. Isuzu Motors Limit(Tokyo, Japan 10.18. Roland Berger GmbH 10.19. Group 1 Automotive 10.20. Genuine Parts Company 11. Key Findings 12. Industry Recommendations 13. Automotive Retail Market: Research Methodology 14. Terms and Glossary